Global Semiconductor Tape Market Size, Share, Industry Analysis Report By Tape Type (Dicing Tapes, Back Grinding Tapes, Protective Tapes, Specialty Tapes, Others), By End-Use Application (Wafer Processing, Packaging & Assembly, Testing & Prototyping), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 157223

- Number of Pages: 384

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

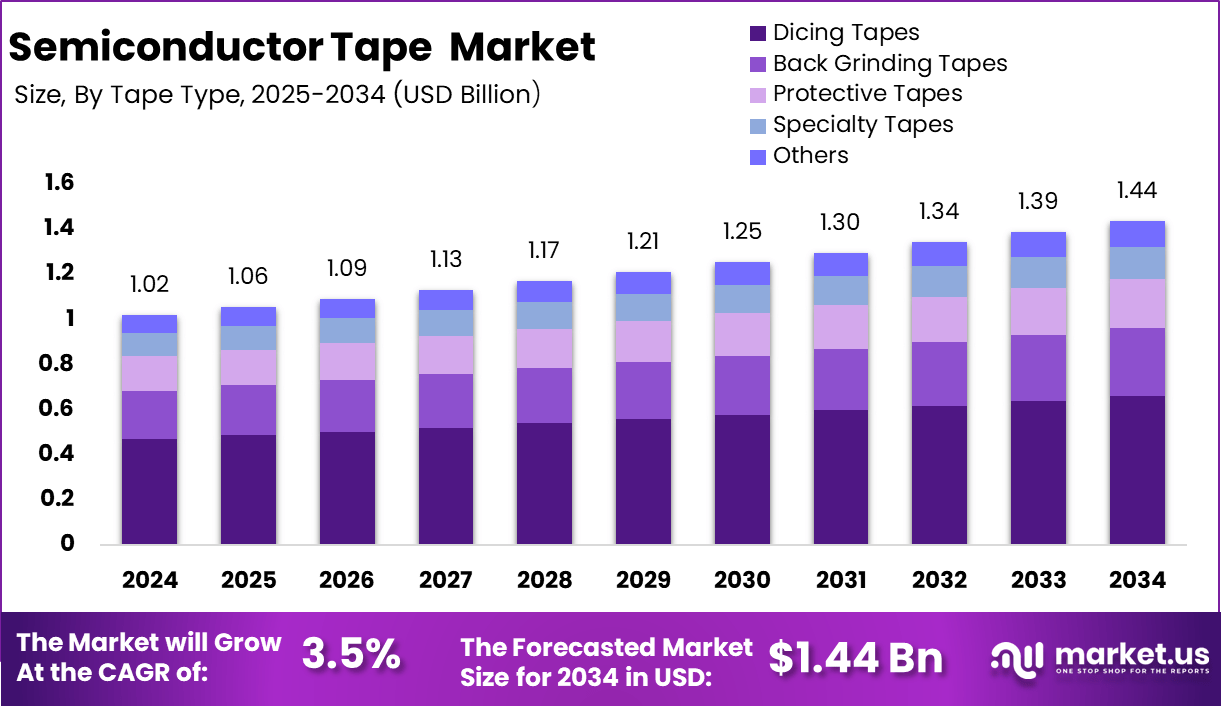

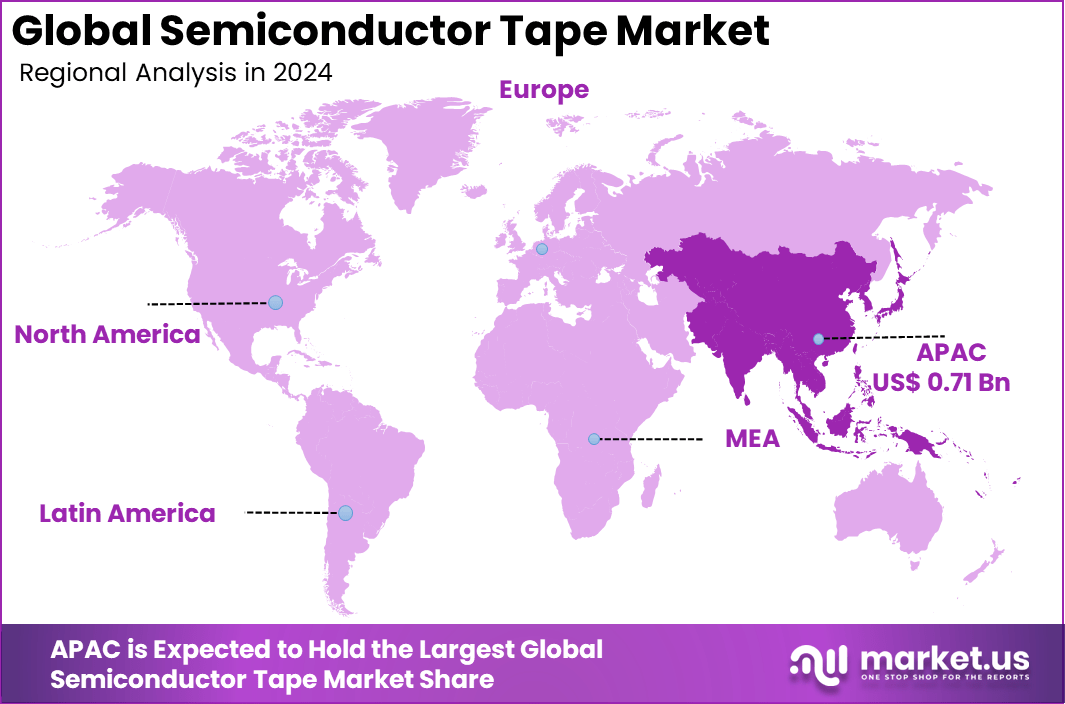

The Global Semiconductor Tape Market size is expected to be worth around USD 1.44 Billion By 2034, from USD 1.02billion in 2024, growing at a CAGR of 3.5% during the forecast period from 2025 to 2034. In 2024, Asia-pacific held a dominan market position, capturing more than a 70% share, holding USD 0.71 Billion revenue.

The semiconductor tape market is gaining more importance in the global electronics value chain, as it offers essential adhesive and protective functions during the fabrication and packaging of semiconductor components. These specialized tapes help keep delicate wafers and microchips secure during critical processing stages such as dicing and back grinding, minimizing risks of contamination and physical damage.

A top driving factor for the growth of the semiconductor tape market is the accelerating demand for sophisticated consumer electronics and automotive applications using advanced materials. The surge in high-performance computing, internet of things, and 5G networks has also contributed to the market’s steady upward trajectory.

According to Market.us, The global semiconductor market continues to expand at a strong pace, driven by rising demand for advanced electronics, AI-driven devices, and next-generation connectivity solutions. The market size was valued at approximately USD 840.60 bn in 2024 and is expected to grow from USD 917.94 bn in 2025 to nearly USD 2,026.82 bn by 2034, registering a CAGR of 9.20% between 2025 and 2034.

Key Insight Summary

- In 2024, the Dicing Tapes segment held a dominant market position, capturing an 46.0% share of the Semiconductor Tape Market.

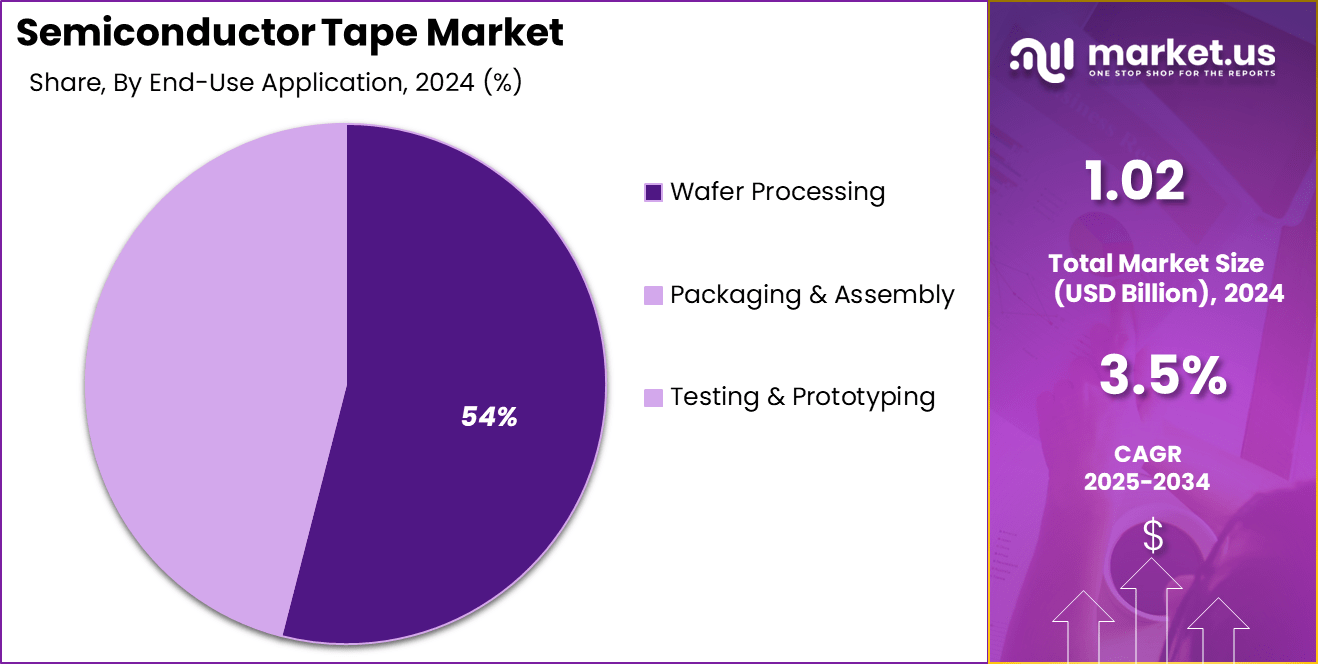

- In 2024, the Wafer Processing segment held a dominant market position, capturing an 54.0% share of the Semiconductor Tape Market.

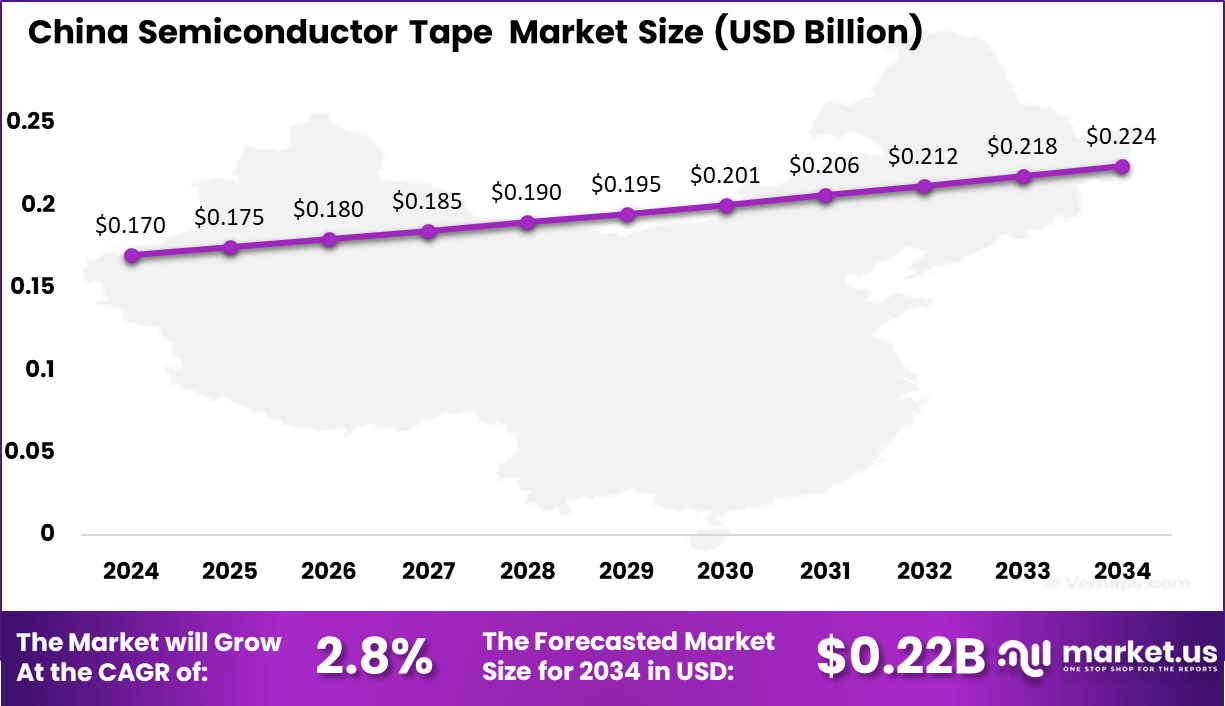

- The China Semiconductor Tape Market was valued at USD 0.17 Billion in 2024, with a robust CAGR of 2.8%.

- In 2024, Asia Pacific held a dominant market position in the Global Semiconductor Tape Market, capturing around a 70.0% share.

China Market Size

China’s semiconductor tape market is experiencing significant growth, driven by advancements in semiconductor packaging technologies and the increasing demand for consumer electronics. The Chinese government has been actively supporting the semiconductor industry through substantial investments and strategic initiatives.

In May 2024, China launched the third phase of its National Integrated Circuit Industry Investment Fund, raising approximately $47.5 billion to bolster domestic semiconductor capabilities, including packaging and materials sectors. This funding aims to reduce reliance on foreign technologies and enhance the competitiveness of Chinese semiconductor companies.

Additionally, the “Made in China 2025” initiative emphasizes the development of high-end manufacturing and the semiconductor industry, targeting a 70% domestic production rate by 2025. These government-backed efforts are expected to drive demand for semiconductor tapes used in advanced packaging processes. However, challenges such as high production costs and reliance on imported materials may hinder market growth.

Opportunities lie in the development of eco-friendly and cost-effective semiconductor tapes, aligning with global sustainability trends. The trend towards miniaturization and integration in electronic devices further propels the need for specialized semiconductor tapes. Overall, China’s strategic investments and initiatives position the semiconductor tape market for substantial growth in the coming years.

In 2024, Asia Pacific held a dominant market position in the Global Semiconductor Tape Market, capturing around a 70.0% share. The Asia Pacific region is a significant hub for the semiconductor tape market, driven by robust government investments and the increasing demand for advanced packaging solutions.

In May 2024, the Chinese government raised approximately $48 billion for the third phase of its National Integrated Circuit Industry Investment Fund, aimed at enhancing domestic semiconductor capabilities, including packaging and materials sectors. This funding is expected to bolster the demand for semiconductor tapes used in advanced packaging processes.

Similarly, in South Korea, the government announced a $19 billion support package for its chip businesses in May 2024, focusing on areas like chip design and contract manufacturing. This initiative is anticipated to drive the need for specialized materials, including semiconductor tapes, to support the expansion of the semiconductor industry.

However, the high initial investment and operational costs associated with semiconductor tape production remain a significant restraint. The complexity of manufacturing and the need for specialized materials contribute to elevated production costs, limiting the affordability and widespread adoption of advanced semiconductor tapes.

An opportunity lies in the development of eco-friendly semiconductor tapes, aligning with global sustainability trends and regulatory pressures. The trend towards miniaturization and integration in electronic devices further propels the need for specialized semiconductor tapes. Overall, the Asia Pacific region’s strategic investments and initiatives position the semiconductor tape market for substantial growth in the coming years.

Tape Type Analysis

In 2024, the Dicing Tapes segment dominate the global Semiconductor Tape Market, holding the highest market share of 46.0%, primarily due to their essential role in wafer dicing, which is a critical step in semiconductor manufacturing. Dicing tapes are used to secure semiconductor wafers during cutting and ensure the integrity of the individual dies after slicing.

In the U.S., government initiatives, such as the CHIPS Act, have allocated significant funds to boost domestic semiconductor production, indirectly supporting the demand for dicing tapes. The U.S. Department of Commerce allocated USD 52 billion in 2024 to strengthen the semiconductor supply chain, which includes investments in wafer processing technology and materials, including dicing tapes.

In Taiwan, Taiwan Semiconductor Manufacturing Company (TSMC), a global leader, continues to expand its wafer manufacturing capacity, further driving demand for dicing tapes. TSMC’s investments in its new fab facilities are expected to increase semiconductor production, indirectly boosting the use of dicing tapes in the region.

Additionally, Japan’s Ministry of Economy, Trade, and Industry (METI) has been promoting advanced manufacturing technologies that utilize precise dicing, further contributing to the growing demand for dicing tapes in wafer production. The efficiency, accuracy, and ability to maintain die integrity make dicing tapes the preferred choice in wafer processing.

End-Use Application Analysis

In 2024, the Wafer Processing segment dominate the global Semiconductor Tape Market, holding the highest market share of 54.0%, driven by the increasing demand for semiconductor chips across industries like automotive, electronics, and telecommunications. The demand for wafer processing is high because semiconductor wafers are the foundational element for chip fabrication.

In South Korea, Samsung Electronics has significantly expanded its semiconductor fabrication capacity, with investments exceeding USD 17 billion in 2024, aimed at increasing its production of advanced semiconductor chips, directly driving the demand for wafer processing and related materials, including semiconductor tapes.

Similarly, in China, the government’s “Made in China 2025” initiative focuses on increasing domestic semiconductor production, with a particular emphasis on wafer processing. This initiative includes allocating billions in subsidies to enhance wafer fabrication plants, pushing up the demand for high-quality tapes used during the wafer slicing and processing stages.

In India, the government’s “National Policy on Electronics” aims to attract USD 10 billion in investments to boost semiconductor manufacturing by 2025, which will likely increase the need for wafer processing technologies. As wafer production ramps up across these regions, the demand for semiconductor tapes used in wafer processing applications continues to rise, cementing its dominance in the market.

Key Market Segments

By Tape Type

- Dicing Tapes

- Back Grinding Tapes

- Protective Tapes

- Specialty Tapes

- Others

By End-Use Application

- Wafer Processing

- Packaging & Assembly

- Testing & Prototyping

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Increasing Demand for Semiconductor Packaging Solutions

The escalating demand for advanced semiconductor packaging solutions is a significant driver in the semiconductor tape market. Governments worldwide are investing heavily to bolster their semiconductor industries. For instance, the U.S. Department of Commerce announced in November 2024 that it would invest up to $300 million in advanced packaging research projects in Georgia, California, and Arizona.

Similarly, in Japan, the Ministry of Economy, Trade and Industry allocated an additional ¥45 billion (approximately $320 million) in 2024 to the Leading-edge Semiconductor Technology Center to support research in advanced packaging and materials. These investments underscore the growing emphasis on advanced packaging solutions, driving the demand for specialized semiconductor tapes used in wafer processing and packaging applications.

Restraint

High Production Costs of Specialized Tapes

The high production costs associated with specialized semiconductor tapes pose a significant restraint in the market. Manufacturing these tapes requires advanced materials and precision processes, leading to elevated costs.

In South Korea, the government enacted the K-CHIPS Act in March 2023, offering tax credits of up to 25% for facility investments and up to 50% for research and development in the semiconductor sector. While these incentives aim to reduce overall production costs, the specialized nature of semiconductor tapes means that cost reductions are incremental. Additionally, the reliance on imported raw materials for tape production further exacerbates cost challenges.

In China, the National Integrated Circuit Industry Investment Fund, established in 2014, has been instrumental in funding domestic semiconductor companies. However, as of 2024, the fund’s third phase raised approximately $47.5 billion, focusing on large-scale manufacturing and equipment, which may not directly alleviate the high production costs of specialized tapes. These factors collectively contribute to the high production costs, limiting the affordability and widespread adoption of advanced semiconductor tapes.

Opportunities

Rising Focus on Miniaturization of Semiconductor Components

The industry’s increasing focus on miniaturization presents a significant opportunity for the semiconductor tape market. As electronic devices become smaller and more powerful, the demand for compact and efficient semiconductor components grows.

In India, the government approved ten semiconductor units under the India Semiconductor Mission in 2024, supported by subsidies from both central and state levels. These units aim to enhance domestic production capabilities, including wafer processing and packaging, aligning with the global trend towards miniaturization.

Additionally, in Japan, the Japan Advanced Semiconductor Manufacturing (JASM) joint venture, involving TSMC, Sony, Denso, and Toyota, is constructing a $23 billion semiconductor factory in Kumamoto. This facility focuses on producing semiconductors using advanced process technologies, catering to the miniaturization needs of automotive and consumer electronics industries.

Challenges

Maintaining Consistent Quality in Tape Manufacturing

Ensuring consistent quality in semiconductor tape manufacturing is a significant challenge. The precision required in tape production to meet the stringent standards of semiconductor applications necessitates advanced manufacturing processes and quality control measures.

In the United States, the CHIPS and Science Act allocated nearly $53 billion to support semiconductor manufacturing, research and development, and workforce development. While these investments aim to enhance domestic production capabilities, maintaining consistent quality across the supply chain remains a challenge.

The complexity of semiconductor devices and the need for high-precision materials exacerbate this issue. Additionally, the global nature of the semiconductor supply chain introduces variability in material quality and manufacturing processes, further complicating efforts to ensure consistent tape quality. Addressing these challenges requires ongoing investment in advanced manufacturing technologies and stringent quality control protocols to meet the evolving demands of the semiconductor industry.

Latest Trends

Integration of Smart Manufacturing Technologies

The integration of smart manufacturing technologies is a notable trend in the semiconductor tape market. These technologies, including automation, artificial intelligence, and the Internet of Things (IoT), enhance the efficiency and precision of manufacturing processes.

In the United States, the CHIPS and Science Act allocated $1.6 billion for funding multiple awards across research and development areas, including smart manufacturing technologies. These investments aim to accelerate the development of cutting-edge technologies essential to the semiconductor industry.

Similarly, in South Korea, the government passed the K-CHIPS Act in March 2023, providing tax credits for facility investments and research and development in the semiconductor sector. These initiatives support the adoption of smart manufacturing technologies, driving efficiency and innovation in semiconductor production.

The integration of these technologies facilitates real-time monitoring, predictive maintenance, and optimized production processes, aligning with the industry’s move towards Industry 4.0 standards. As the semiconductor industry continues to evolve, the adoption of smart manufacturing technologies is expected to play a crucial role in enhancing the capabilities and competitiveness of semiconductor tape manufacturers.

Competitive Analysis

The global semiconductor tape market is characterized by a competitive landscape featuring established players and emerging innovators. Companies like Furukawa Electric, 3M, Nitto, and Mitsui Chemicals dominate the market, leveraging their extensive experience and technological advancements to maintain leadership positions.

Furukawa Electric, for instance, has been focusing on enhancing its semiconductor process tapes to meet the evolving demands of the industry. In 2024, the company launched products containing up to 11 disks, showcasing its commitment to innovation in the semiconductor sector.

Similarly, 3M has been actively introducing new products to cater to the semiconductor industry’s needs. In 2024, 3M unveiled a range of new products at CES 2024, highlighting its dedication to advancing semiconductor tape technologies. Nitto has also been making strides in the market, focusing on developing advanced semiconductor manufacturing process products.

Mitsui Chemicals has been aligning its product offerings with the semiconductor roadmap, introducing new technologies and solutions to meet the industry’s requirements. These companies are not only enhancing their product portfolios but are also expanding their global presence to cater to the growing demand in the semiconductor sector.

Top Key Players in the Market

- Furukawa Electric

- 3M

- Nitto

- Mitsui Chemicals

- UltraTape

- Semiconductor Equipment

- DaehyunST

- Lintec

- AMC

- Shin-Etsu

- Maxell Holdings

- Other Key Players

Recent Developments

- On January, 2025, Mitsui Chemicals ICT Materia announced the successful development of a water-based acrylic adhesive for surface protective tapes used in laser cutting processes. This innovation reduces VOC and CO₂ emissions during production, aligning with environmental sustainability goals.

- On April, 2024, Lintec introduced a new bump support film designed to improve the durability and reliability of semiconductor chips. This tape, integrated with back grinding tape, aims to enhance the board-level reliability of semiconductor components.

- On March, 2024, Furukawa Electric reported a decrease in demand for smartphone memory, impacting the sales of its semiconductor process tapes. The company is focusing on developing new markets and high-performance products to counteract this decline.

Report Scope

Report Features Description Market Value (2024) USD 1.02 Bn Forecast Revenue (2034) USD 1.4 Bn CAGR(2025-2034) 3.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Tape Type (Dicing Tapes, Back Grinding Tapes, Protective Tapes, Specialty Tapes, Others), By End-Use Application (Wafer Processing, Packaging & Assembly, Testing & Prototyping) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Furukawa Electric, 3M, Nitto, Mitsui Chemicals, UltraTape, Semiconductor Equipment, DaehyunST, Lintec, AMC, Shin-Etsu, Maxell Holdings, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Semiconductor Tape MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Semiconductor Tape MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Furukawa Electric

- 3M

- Nitto

- Mitsui Chemicals

- UltraTape

- Semiconductor Equipment

- DaehyunST

- Lintec

- AMC

- Shin-Etsu

- Maxell Holdings

- Other Key Players