Global Self Storage Service Market Size, Share, Statistics Analysis Report By Unit Size (Small, Medium, Large), By End-User (Commercial, Industrial, Residential), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: November 2024

- Report ID: 133453

- Number of Pages: 285

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

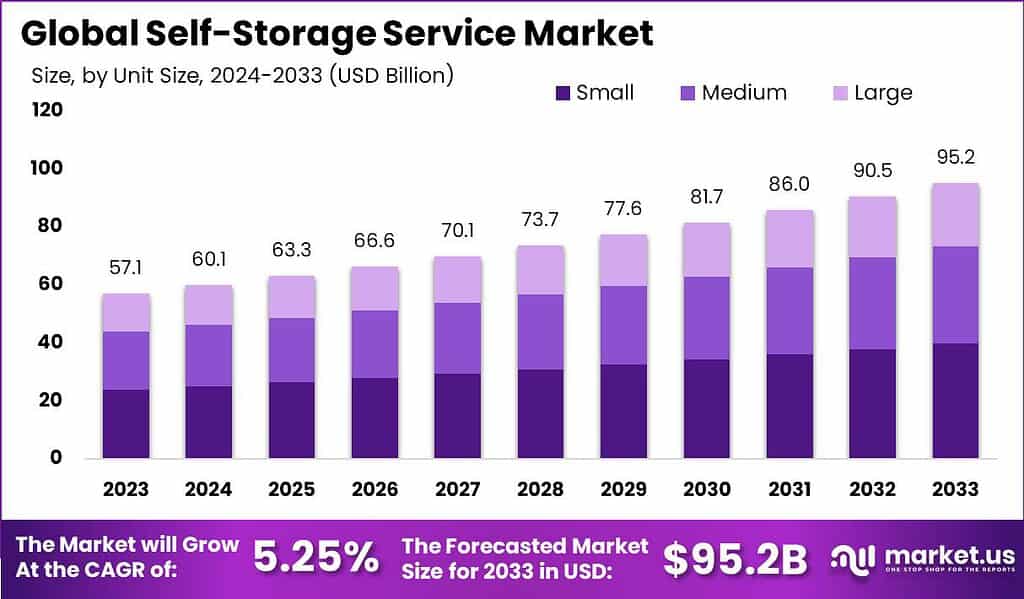

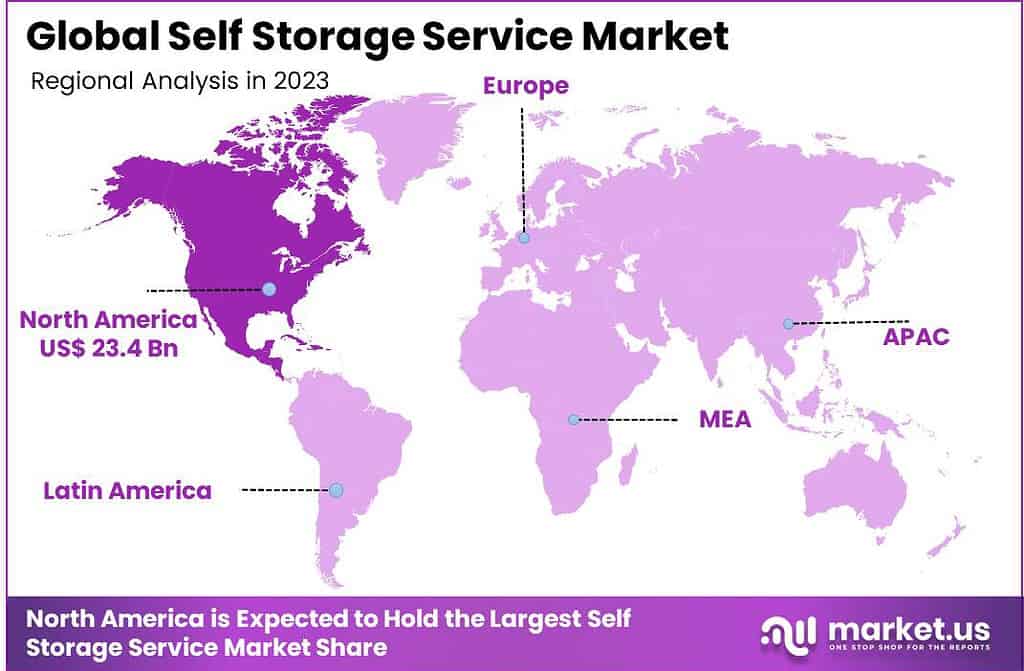

The Global Self Storage Service Market size is expected to be worth around USD 95.2 Billion By 2033, from USD 57.12 Billion in 2023, growing at a CAGR of 5.25% during the forecast period from 2024 to 2033. In 2023, North America dominated the self-storage service market, accounting for over 41% of the market share, with a revenue of USD 23.4 billion.

Self storage refers to a service that provides individuals and businesses with secure and accessible spaces to store their belongings, inventory, or equipment. These storage units, which can range from small lockers to large rooms or containers, are typically rented on a monthly basis and located within a larger facility. Users have exclusive access to their rented units, ensuring privacy and security for their stored items.

The self storage market has seen significant growth, driven by increasing urbanization and the subsequent demand for additional storage space. This sector appeals to a broad demographic, including individuals undergoing life transitions such as moving or downsizing, as well as businesses needing space for excess inventory or documents. In the U.S. alone, there are over 54,000 self-storage facilities, indicating a robust and expanding market.

Several factors are propelling the growth of the self storage service market. Urbanization is a primary driver, as increasing city populations and smaller living spaces lead individuals to seek additional storage solutions. Additionally, lifestyle transitions such as marriages, divorces, and downsizing contribute to the demand for temporary and long-term storage.

The rise of e-commerce has also played a significant role, with small businesses and online retailers using self storage spaces as a cost-effective solution for inventory management. The growing trend of decluttering and minimalism in residential living encourages more people to use self storage facilities to keep their less frequently used possessions.

Demand in the self-storage service market is driven by rising number of apartment dwellers, especially in metropolitan areas, often face space constraints, making self-storage an attractive option. Also, lifestyle transitions such as moving, marriage, or retirement frequently necessitate temporary storage solutions. Businesses, too, contribute to the growing demand as they require space to store documents, equipment, or surplus inventory.

The popularity of self-storage services has surged due to their convenience and flexibility. Many providers offer 24/7 access, enhancing the appeal to individuals who need to retrieve their possessions outside of typical business hours. The market’s adaptability, offering various unit sizes and rental terms, also adds to its popularity, accommodating a wide range of customer needs from seasonal decorations storage to large-scale business logistics.

Opportunities within the self-storage service market are vast and varied. Innovations such as climate-controlled units are becoming more common, appealing to customers who need to store sensitive items like electronics or antiques. The integration of technology,like digital surveillance and smart locks, offers enhanced security features, attracting customer base. The growing trend of converting unused urban spaces into storage facilities is creating opportunities for market expansion in densely populated cities.

The expansion of the self-storage market is evident in its growing footprint in both urban and suburban landscapes. New facilities are frequently being developed to meet the increasing demand, with a focus on more accessible and user-friendly designs. The market is also seeing a shift towards more sustainable practices, such as using energy-efficient lighting and solar panels, broadening its appeal to environmentally conscious consumers.

Key Takeaways

- The Global Self Storage Service Market size is expected to reach USD 95.2 billion by 2033, up from USD 57.12 billion in 2023, growing at a CAGR of 5.25% during the forecast period from 2024 to 2033.

- In 2023, the Small Units segment dominated the market, holding more than 42% share in the self-storage service sector.

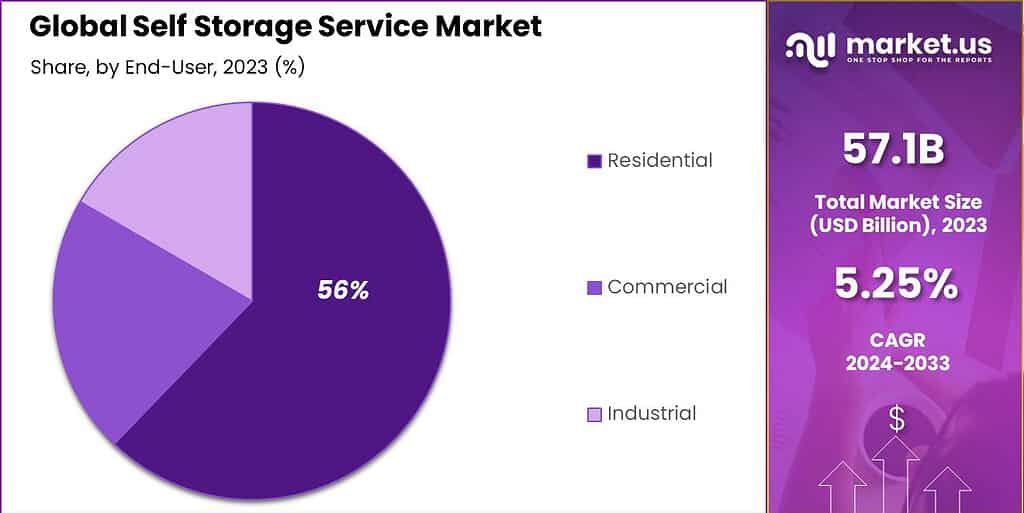

- In 2023, the Residential segment led the market with more than 56% share, driven by changing housing dynamics and the increasing mobility of the general population.

- In 2023, North America held a leading market position, capturing over 41% share with a revenue of USD 23.4 billion.

Unit Size Analysis

In 2023, the Small Units segment held a dominant market position in the self storage service market, capturing more than a 42% share. This segment’s leadership is primarily attributed to the cost-effectiveness and practicality of small units, which meet the storage needs of the majority of individual consumers.

The preference for small units is further supported by the growing trend of urban living, where individuals and small families reside in compact apartments with limited storage space. As urban populations continue to rise, the demand for small storage units has surged, especially in metropolitan areas where space is at a premium.

For instance, According to The World Bank Group, the global urban population has grown significantly, from 52% in 2010 to 57% in 2023. This steady rise, combined with lifestyle shifts like frequent relocations, downsizing, retirement, and divorce, is fueling the demand for personal storage. As people move more often and adapt to changing living arrangements, the need for flexible storage solutions has become an essential part of modern life

Moreover, the rise of small online businesses and startups has significantly contributed to the popularity of small units. These enterprises require space to store inventory and supplies but often cannot commit to large warehouses due to budget constraints.

Small units segment benefits from lower construction and maintenance costs compared to larger units. This affordability allows service providers to offer competitive pricing, making small units more accessible to a broader range of customers. As a result, facility owners often report higher occupancy rates in small units, which sustains their lead in the market share.

End-User Analysis

In 2023, the residential segment held a dominant market position in the self-storage service market, capturing more than a 56% share. This segment leads primarily due to the changing dynamics of housing and the increased mobility of the general population.

As more individuals and families move between homes or downsize due to economic factors, the demand for residential self-storage solutions has significantly risen. These facilities provide a flexible and secure option for storing personal belongings during transitions.

The growth in the residential segment is also bolstered by the trend of reducing clutter within living spaces, a concept popularized by minimalism and more efficient living. Many homeowners and renters use self-storage services to keep seasonal items, heirlooms and other infrequently used possessions, thus freeing up valuable space in their homes.

Technological advancements have further supported the expansion of the residential segment. Innovations such as climate-controlled units protect sensitive items from damage, while enhanced security features like digital surveillance and personalized access codes ensure the safety of stored items. These features make self-storage an attractive option for residential users concerned with preservation of their possessions.

How is AI reshaping the self-storage industry?

Artificial Intelligence (AI) is significantly reshaping the self-storage market by enhancing operational efficiencies, improving customer service, and boosting security measures. The integration of AI in the self-storage industry is not just about upgrading technology but is also fundamentally altering how businesses operate, leading to substantial cost savings and improved customer experiences.

AI applications in the self-storage sector are diverse. Operators are employing AI to refine pricing strategies, which can potentially increase revenue by about 10%. This is achieved through dynamic pricing models that adjust storage unit rates in real-time based on demand and capacity.

Additionally, AI-powered chatbots are becoming a preferred method for customer interaction, with 72% of self-storage customers favoring AI-driven chatbots for making inquiries and receiving assistance. These chatbots are available 24/7, enhancing the customer service experience by providing instant responses and streamlining the booking process.

Moreover, AI is pivotal in boosting security at storage facilities. AI-driven surveillance systems can significantly decrease theft incidents by up to 40% by identifying and reacting to suspicious activities in real-time. Predictive maintenance powered by AI is another area where operators see substantial benefits, helping reduce energy costs by 25%, thus lowering overall operational expenses.

On the revenue management front, AI tools are employed to predict customer behavior, manage inventory, and enhance decision-making processes based on comprehensive data analysis. This not only ensures better resource utilization but also leads to more informed strategic decisions, further optimizing business operations.

For instance, In September 2024, Self Storage Manager (SSM) introduced the SSM Web Platform, a strategic enhancement aimed at revolutionizing the digital landscape for self-storage companies. Developed through a collaboration between Absolute’s technical team and Adverank, a specialist in digital marketing, this platform is tailored exclusively for users of SSM Cloud. It promises to deliver unparalleled control and innovation in website management.

As AI continues to evolve, the self-storage industry is poised to experience further growth and transformation, driven by technological advancements and increased efficiency. This integration represents a significant competitive advantage for operators who adopt these innovative tools, setting the stage for a more profitable and customer-friendly future in the self-storage market.

Key Market Segments

By Unit Size

- Small

- Medium

- Large

By End-User

- Commercial

- Industrial

- Residential

Driver

Urbanization and Changing Lifestyles

The rapid pace of urbanization has significantly influenced the self-storage industry. As more individuals migrate to urban centers for employment and better living conditions, living spaces have become increasingly compact. This shift has led to a growing need for additional storage solutions.

In metropolitan areas, where residential units often lack sufficient storage, self-storage facilities offer a practical solution for residents to store belongings they cannot accommodate at home. Additionally, the rise of remote work and flexible living arrangements has contributed to a transient lifestyle, further driving the demand for accessible and secure storage options.

Restraint

Regulatory and Zoning Challenges

Despite the growing demand, the self-storage industry faces significant hurdles due to regulatory and zoning constraints. In many urban areas, stringent zoning laws categorize self-storage facilities under conditional use, subjecting them to rigorous approval processes. This classification often leads to delays and increased costs for developers seeking to establish new facilities.

Moreover, some municipalities impose moratoriums on new self-storage developments or restrict them to less desirable industrial zones, limiting expansion opportunities. These regulatory barriers not only hinder the growth of the industry but also affect the availability of storage solutions for consumers in high-demand areas.

Opportunity

Technological Advancements and Enhanced Customer Experience

The integration of technology presents a significant opportunity for the self-storage industry to enhance customer experience and operational efficiency. The adoption of user-friendly websites and online platforms allows customers to easily book and manage their storage units, reflecting a shift toward prioritizing seamless user experiences.

Additionally, the implementation of digital surveillance and access control systems enhances security, addressing customer concerns about the safety of their stored belongings. By embracing these technological advancements, self-storage operators can differentiate themselves in a competitive market and meet the evolving expectations of modern consumers.

Challenge

Market Saturation and Increased Competition

The self-storage industry is experiencing heightened competition, particularly in metropolitan areas where the number of facilities has surged. This increase in supply can lead to market saturation, making it challenging for new entrants to establish a foothold. In oversaturated markets, operators may engage in price wars to attract customers, potentially impacting profitability.

Additionally, the presence of large, well-established companies with extensive resources can make it difficult for smaller operators to compete. To navigate this competitive landscape, self-storage businesses must focus on differentiating their services, such as offering enhanced security features, flexible rental terms, and superior customer service, to attract and retain customers.

Latest Trends

The self-storage industry is evolving rapidly, embracing new trends to meet changing customer needs. One significant development is the integration of smart technology into storage units. Modern facilities now offer features like digital locks, climate control, and real-time monitoring accessible via smartphones, enhancing security and user convenience.

Another trend is the rise of on-demand storage services. Companies are offering pickup and delivery options, allowing customers to store belongings without visiting a facility. This service caters to urban dwellers with limited space and busy schedules, providing flexibility and ease.

Additionally, the industry is expanding into mixed-use developments. Storage facilities are being integrated into residential and commercial complexes, offering convenient access for tenants and optimizing urban space utilization. Sustainability is also becoming a focus. Operators are constructing eco-friendly buildings, utilizing solar panels, and implementing energy-efficient systems to reduce their environmental footprint.

Business Benefits

- Space Optimization: By storing seldom-used items offsite, companies can free up valuable office space for core activities, enhancing operational efficiency.

- Cost-Effective Expansion: Instead of investing in larger office spaces or warehouses, businesses can utilize self-storage units to accommodate excess inventory or equipment, leading to significant cost savings.

- Flexible Lease Terms: Month-to-month leasing options for storage facilities provide businesses with a high level of flexibility by eliminating the need for long-term contracts. This allows businesses to adjust their storage requirements as needed, without being locked into fixed rental periods.

- Improved Organization: Storing documents, equipment or inventory, helps businesses maintain a clutter-free environment, leading to better organization and productivity.

- Protection from Environmental Factors: Climate-controlled storage units help safeguard sensitive items from extreme temperatures and humidity, preserving the quality and longevity of business assets.

Regional Analysis

In 2023, North America held a dominant market position in the self storage service market, capturing more than a 41% share with a revenue of USD 23.4 billion. This leadership stems primarily from the high demand for storage solutions driven by significant consumer and business activities in the region.

North America’s large geographic size combined with a highly mobile population who frequently move between states for work or personal reasons contributes to the continual need for temporary and long-term storage spaces. The region’s economic stability and high disposable income levels also support the growth of the self storage market.

In the United States and Canada, many households use self storage facilities to manage excess belongings, a trend amplified by the consumer culture of acquiring and storing goods. Moreover, the proliferation of housing and apartment downsizing, particularly among the baby boomer generation, has led to increased demand for additional storage space to safeguard cherished personal and family items.

North America is characterized by a robust entrepreneurial environment and a flourishing e-commerce sector. Small businesses and startups often require flexible and cost-effective storage solutions for inventory and supplies, which self storage units readily provide.

For instance, London’s population is projected to grow significantly in the coming years. By 2024, the city’s population is expected to reach 9.7 million and is forecasted to surpass the 10 million mark by 2030. This steady growth highlights London’s enduring appeal as a global hub, while also indicating increased demand for housing, infrastructure, and services.

In December 2023, VanWest announced an exciting development in Denver, Colorado. The project, under the management of its subsidiary ClearHome Self Storage, will introduce a 5-story, 93,000-square-foot facility. This Class A building will offer modern, climate-controlled self-storage units, addressing the growing demand for high-quality storage solutions in urban areas.

Furthermore, the high rate of urbanization in major North American cities has resulted in limited residential and commercial space, propelling the demand for offsite storage solutions. This urban density, combined with a strong real estate market, has driven the construction of new storage facilities and ensuring that the supply meets the growing demand.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

In the self storage service market, several key players stand out due to their significant market presence and innovative practices.

Aecom has established itself as a major player in the self storage sector through its involvement in the construction and design of state-of-the-art facilities. Aecom’s approach combines sustainability with efficiency, emphasizing eco-friendly materials and smart designs that maximize space utilization.

CubeSmart is recognized for its customer-centric services and extensive network of storage units across various regions. With a focus on accessibility and convenience, CubeSmart offers a wide range of storage options that cater to both individual and business needs. Their facilities are known for being exceptionally clean and well-maintained, which enhances user satisfaction and trust.

Life Storage Inc. specializes in providing high-quality self storage solutions with a strong emphasis on security and customer service. Their units are equipped with advanced security features like 24-hour surveillance cameras and coded access gates to ensure that customers’ belongings are safe. Life Storage Inc. also offers flexible rental terms, which is a significant advantage for customers who need storage for unpredictable durations.

Top Key Players in the Market

- Aecom

- CubeSmart

- Life Storage Inc.

- Metro Storage LLC (Find Local Storage)

- National Storage

- Public Storage

- Safestore

- Simply Self Storage

- StorageMart

- U-Haul International Inc. (AMERCO)

- Urban Self Storage

- World Class Capital Group LLC

- Other Key Players

Recent Developments

- Extra Space Storage and Life Storage Merger (July 2023): In July 2023, Extra Space Storage completed its acquisition of Life Storage, creating the largest self-storage operator in the U.S. with over 3,700 locations and two million customers.

- Public Storage Acquires Simply Self Storage (September 2023): Public Storage finalized the purchase of Simply Self Storage for $2.2 billion in September 2023, expanding its portfolio and market presence.

- National Storage’s Partnership with GIC (June 2024): National Storage REIT formed a partnership with Singapore’s sovereign wealth fund GIC in June 2024, creating the National Storage Ventures Fund to develop and manage self-storage centers across Australia.

- Go Store It and Snapbox Self Storage Merger (August 2024): In August 2024, Go Store It Self Storage and Snapbox Self Storage merged, forming one of the largest private self-storage operators in the U.S., overseeing more than 10 million square feet of storage space across 145 locations in 23 states.

Report Scope

Report Features Description Market Value (2023) USD 57.12 Bn Forecast Revenue (2033) USD 95.2 Bn CAGR (2024-2033) 5.25% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Unit Size (Small, Medium, Large), By End-User (Commercial, Industrial, Residential) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Aecom, CubeSmart, Life Storage Inc., Metro Storage LLC (Find Local Storage), National Storage, Public Storage, Safestore, Simply Self Storage, StorageMart, U-Haul International Inc. (AMERCO), Urban Self Storage, World Class Capital Group LLC, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Self Storage Service MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample

Self Storage Service MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Aecom

- CubeSmart

- Life Storage Inc.

- Metro Storage LLC (Find Local Storage)

- National Storage

- Public Storage

- Safestore

- Simply Self Storage

- StorageMart

- U-Haul International Inc. (AMERCO)

- Urban Self Storage

- World Class Capital Group LLC

- Other Key Players