Global Self-Storage and Moving Services Market Size, Share, Growth Analysis By Service Type (Self-Storage, Moving Services, Packing Services, Truck Rental), By Storage Type (Indoor Storage, Outdoor Storage, Climate-Controlled Storage, Vehicle Storage), By End-User (Residential, Commercial, Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 139188

- Number of Pages: 327

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

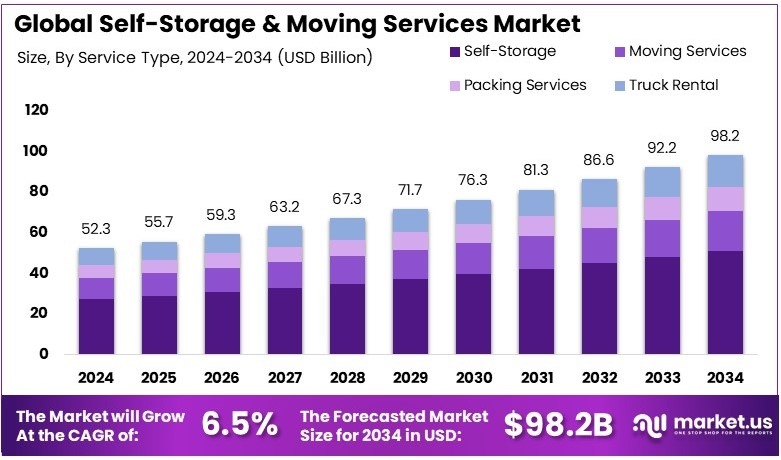

The Global Self-Storage and Moving Services Market size is expected to be worth around USD 98.2 Billion by 2034, from USD 52.3 Billion in 2024, growing at a CAGR of 6.5% during the forecast period from 2025 to 2034.

Self-storage and moving services offer individuals and businesses solutions for storing and relocating goods. Self-storage provides a safe, rented space for personal or commercial use. Moving services assist with the transportation of belongings, often including packing, loading, and unloading. These services make relocating or downsizing easier.

The self-storage and moving services market includes businesses that offer storage space rentals and moving assistance. It consists of companies providing short-term and long-term storage, as well as moving services like packing and transportation. The market serves individuals, families, and businesses looking for storage and relocation solutions.

The self-storage and moving services market is growing rapidly. In the U.S., there are 52,301 self-storage facilities, and 14.5 million households use these services. This growing number of facilities reflects the increasing demand for storage solutions. Similarly, in the UK, 38% of Americans are using self-storage, indicating strong demand.

Self-storage is driven by increased urbanization, lifestyle changes, and downsizing trends. As more people move into smaller apartments, the need for extra storage grows. The market offers significant opportunities for businesses providing flexible storage solutions, from personal use to business storage. Companies that offer moving services alongside storage solutions benefit from this trend.

The market is moderately saturated, with several established brands, especially in large cities. However, there is still room for growth in underserved regions and innovative service offerings. For instance, offering climate-controlled storage or advanced security systems could differentiate new businesses and give them a competitive edge in the market.

At a local level, self-storage facilities can significantly impact small communities by offering convenient storage options. On a broader scale, the growth of self-storage facilities is linked to greater mobility and changing housing patterns. The industry helps facilitate smoother relocations and downsizing, supporting broader trends in urban development.

Key Takeaways

- Self-Storage and Moving Services Market was valued at USD 52.3 Billion in 2024, and is expected to reach USD 98.2 Billion by 2034, with a CAGR of 6.50%.

- In 2024, Self-Storage dominates the service type segment with 52.3%, driven by increased demand for personal and business storage.

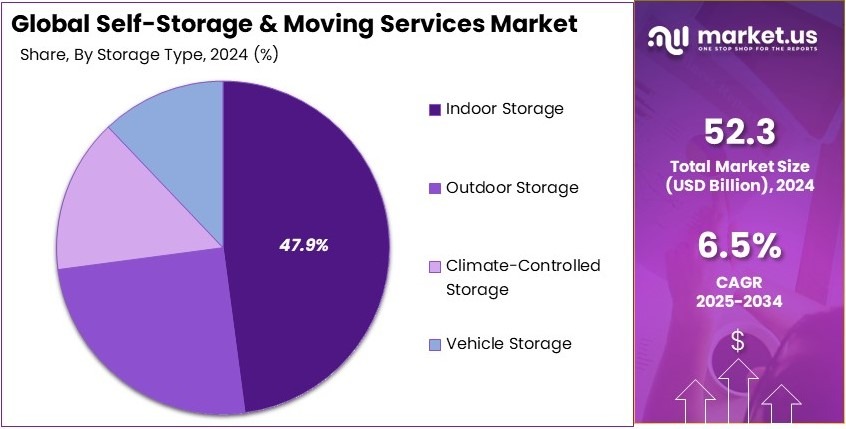

- In 2024, Indoor Storage dominates the storage type segment with 47.9%, highlighting its preference for climate-sensitive goods.

- In 2024, Residential leads the end-user segment with 62.7%, indicating the growing need for self-storage among homeowners.

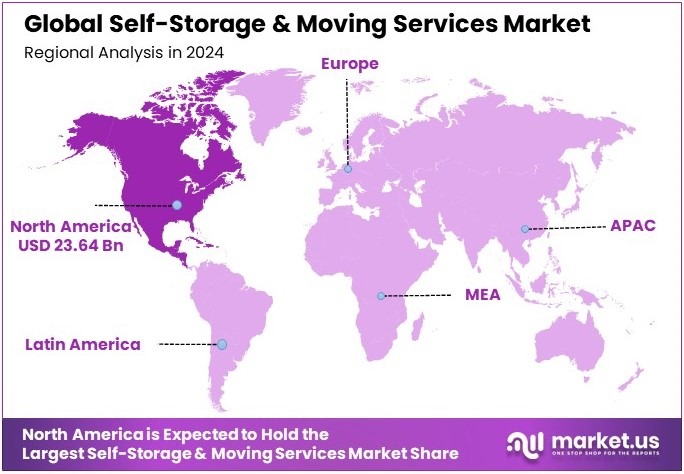

- In 2024, North America dominates the market with 45.2% and is valued at USD 23.64 Billion, driven by a robust demand for self-storage and moving services.

- In 2024, North America is the dominant region, representing the largest share in the self-storage and moving services market.

Service Type Analysis

Self-Storage dominates with 52.3% due to increasing urbanization, demand for flexible storage solutions, and convenience.

In the Self-Storage and Moving Services Market, the self-storage service type leads with 52.3% of the market share. This dominance is mainly driven by the growing need for flexible storage solutions in urban environments. With more people living in apartments and smaller homes, the demand for extra space has increased.

Self-storage offers a cost-effective way for individuals and businesses to store their belongings without having to rent additional or larger properties. This service is highly convenient, providing 24/7 access, and allows customers to rent space for as long or as short a period as they need.

Moving Services, accounting for 31.4% of the market share, is the second-largest sub-segment. This service helps individuals and businesses transport their goods to new locations. Moving services include packing, loading, transportation, and unloading, making the process smoother for customers.

Packing Services hold a smaller share of 9.2%. This service involves packing items securely for transport or storage, often working in tandem with moving services. As people become more aware of the potential risks of damage during moves, packing services have seen increased demand.

Truck Rental, holding 7.1% of the market, is primarily used by individuals or businesses who want to manage their move on their own. Truck rental services provide the necessary vehicles for transporting goods but require customers to do the packing and driving themselves. Although this option is more affordable, it may not be as convenient or secure as full-service moving options.

Storage Type Analysis

Indoor Storage dominates with 47.9% due to its high security, privacy, and preference for non-weather-sensitive items.

Indoor Storage takes the lead in the Self-Storage and Moving Services Market, holding a 47.9% share. This dominance stems from its high-security features and the privacy it provides to customers. Indoor storage units are often climate-controlled, making them ideal for storing valuable items, sensitive documents, and personal belongings that need protection from harsh weather.

The added layer of security, often including surveillance cameras, gated access, and on-site personnel, further boosts the popularity of indoor storage. Customers prefer these storage units when they have valuable or sentimental items that they want to keep in a secure and controlled environment.

Outdoor Storage follows with 29.1%, offering a more economical and flexible option for customers who don’t require climate-controlled conditions. These storage units are typically larger, making them ideal for storing vehicles, large equipment, or less sensitive items.

Climate-Controlled Storage accounts for 16.5% of the market. This specialized storage type maintains a steady temperature and humidity level, making it ideal for items that are sensitive to changes in climate, such as antiques, artwork, electronics, or documents.

Vehicle Storage makes up 6.5%, offering designated spaces for storing vehicles such as cars, boats, and RVs. This type of storage is highly sought after by people who may not have enough room at home or live in areas with strict parking regulations.

End-User Analysis

Residential end-users dominate with 62.7% due to the need for extra space during relocations, downsizing, and storage of personal items.

Residential end-users account for the largest share of the market, making up 62.7%. This dominance is largely due to individuals and families needing extra storage space for a variety of reasons. Many people turn to self-storage when they are in between moves, downsizing their homes, or simply need additional space to store seasonal items, furniture, or personal belongings.

The growing trend of urbanization, where people move to cities with smaller living spaces, has contributed significantly to the rise in demand for self-storage. People often use self-storage as a temporary solution while they adjust to new living arrangements or before they find permanent housing.

Commercial end-users hold 27.2% of the market share. Businesses often need storage space for inventory, supplies, or equipment that they don’t need on a daily basis but still need to store securely. Commercial users are also more likely to use truck rental services for moving goods between locations.

Small businesses, in particular, benefit from self-storage options, as they are a cost-effective way to store excess stock or seasonal items without having to rent large warehouse spaces. Industrial end-users represent 10.1% of the market. This segment includes industries that need to store large machinery, parts, or equipment that may not be in use at all times.

While industrial storage requirements tend to be more specialized, such as for vehicles or heavy machinery, it still plays a crucial role in the broader self-storage market. As industrial operations become more flexible and dynamic, the need for specialized storage options in this sector is expected to grow.

Key Market Segments

By Service Type

- Self-Storage

- Moving Services

- Packing Services

- Truck Rental

By Storage Type

- Indoor Storage

- Outdoor Storage

- Climate-Controlled Storage

- Vehicle Storage

By End-User

- Residential

- Commercial

- Industrial

Driving Factors

Urbanization and Demand for Convenience Drive Market Growth

The self-storage and moving services market is experiencing significant growth due to increasing urbanization. As more people move to cities, there is a growing need for temporary storage solutions. Urban areas often have limited space, making self-storage units an attractive option for individuals and businesses seeking a place to store personal belongings or inventory.

Additionally, the rising popularity of DIY moving and relocation services is another driving factor. Many people prefer to handle their own moves to save on costs, which has led to a surge in demand for rental moving trucks, storage units, and other moving-related services.

The growth of e-commerce is also contributing to the expansion of the self-storage market. As online shopping continues to rise, consumers need more home storage solutions for their products. The need for efficient space management at home is increasing, and self-storage units offer a simple solution.

Finally, the rise in disposable income is enabling consumers to spend more on convenience services, such as self-storage and moving services. People are willing to pay for the ease and flexibility these services offer, further driving market growth.

Restraining Factors

High Costs and Security Concerns Restrain Market Growth

Despite the growth in the self-storage and moving services market, several factors are limiting its full potential. One significant barrier is the high cost of self-storage units and moving services. Renting a storage unit or hiring a moving company can be expensive, especially for consumers with limited budgets, restricting market access to higher-income groups.

Another challenge is the limited availability of self-storage facilities in certain areas, particularly in smaller towns or rural regions. While urban centers often have a high concentration of storage options, people in less populated areas may not have easy access to these services.

Concerns over the security and safety of stored goods also restrain market growth. Consumers are often worried about the protection of their belongings while in storage, especially when they are storing valuable or sensitive items. Without adequate security measures, such as surveillance cameras, alarms, and climate controls, potential customers may be hesitant to use these services.

Lastly, seasonal demand fluctuations can affect business stability. The need for self-storage and moving services tends to rise during certain times of the year, like summer or holiday seasons, and drop during off-peak times, making it difficult for businesses to maintain a steady revenue stream.

Growth Opportunities

Expansion and Technology Integration Provide Market Opportunities

There are several growth opportunities in the self-storage and moving services market, particularly through expansion and technology integration. The expansion of self-storage solutions into emerging markets presents a significant opportunity. As cities in developing countries continue to grow, the need for storage facilities and moving services is also increasing, making these regions prime targets for expansion.

The integration of smart technology and automation in storage facilities offers another opportunity for growth. By incorporating features like remote access, smart locks, and climate controls, storage companies can provide enhanced convenience and security for customers, further attracting tech-savvy consumers.

Offering value-added services like packing and unpacking assistance presents a chance for businesses to stand out in a competitive market. By providing a complete moving experience, companies can increase customer satisfaction and build loyalty.

Furthermore, the development of mobile self-storage units is a growing opportunity. Mobile units provide customers with greater flexibility, allowing them to access their stored items without visiting a physical storage facility. These units can be delivered to a location and picked up when no longer needed, making them more convenient for customers.

Emerging Trends

Climate Control and Digital Platforms Are Latest Trends

Several trends are shaping the future of the self-storage and moving services market. One of the most significant is the increased demand for climate-controlled storage units. Consumers are becoming more conscious of the need to protect sensitive items, such as electronics, documents, and antiques, from extreme temperatures or humidity. Climate-controlled units offer a solution to this concern, which is driving their popularity.

Another notable trend is the adoption of subscription-based storage and moving services. Subscription models allow customers to pay for storage or moving services on a recurring basis, often with added perks and flexibility. This model is gaining traction as consumers prefer predictable costs and convenience.

The growth of digital platforms for easy booking and management of services is also shaping the market. Consumers now expect to book and manage storage or moving services online, through apps or websites, for greater convenience and efficiency.

Finally, the rising popularity of sustainable and eco-friendly moving solutions is influencing market trends. More customers are seeking environmentally conscious moving options, such as reusable packing materials or electric moving trucks, to reduce their carbon footprint. This trend is pushing companies to adopt greener practices in their offerings.

Regional Analysis

North America Dominates with 45.2% Market Share

North America leads the Self-Storage and Moving Services Market with a dominant 45.2% market share, valued at approximately USD 23.64 billion. The region’s high market share is attributed to its strong infrastructure, increasing urbanization, and demand for flexible storage solutions, especially from businesses and individual consumers. The presence of major service providers further consolidates its dominance.

Key factors driving North America’s high market share include a well-established self-storage infrastructure, a large consumer base, and consistent demand for moving services, particularly in urban areas. The growing number of households, combined with frequent relocations for work or lifestyle choices, fuels the need for self-storage and moving services. Additionally, high disposable income levels and a culture of convenience make it easier for people to invest in storage solutions.

Market dynamics in North America are heavily influenced by urbanization, changing lifestyles, and e-commerce growth. With the rise in e-commerce, both businesses and consumers need temporary storage options for goods, fueling growth in the sector.

Regional Mentions:

- Europe: Europe is a growing player in the self-storage and moving services market, benefiting from an increasing need for storage space in dense urban areas. Countries like the UK and Germany have seen steady growth in demand for these services, especially driven by the rising trend of apartment living and high mobility among professionals.

- Asia Pacific: Asia Pacific is experiencing rapid expansion in the self-storage market, driven by rising disposable incomes, urbanization, and growing demand from small businesses. Countries like China, India, and Japan are adopting self-storage solutions as the middle class expands and people increasingly seek flexible storage options for their homes and businesses.

- Middle East & Africa: The Middle East & Africa region is witnessing a surge in demand for self-storage services due to increasing urbanization and economic growth. Countries like the UAE and South Africa are leading the way, with high demand driven by real estate development, the expat workforce, and an increase in business activity requiring storage solutions.

- Latin America: Latin America is gradually embracing self-storage services, with countries like Brazil and Mexico experiencing increased demand. Economic growth, urbanization, and a shift toward smaller living spaces are driving the need for temporary storage solutions. However, the market remains in a developing phase compared to more established regions like North America.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Self-Storage and Moving Services Market is led by several large players that provide storage and moving solutions to both individuals and businesses. The top companies in this market include Public Storage, Extra Space Storage, U-Haul International, and CubeSmart.

Public Storage is one of the largest self-storage companies in the world. Known for its vast network of storage units, Public Storage offers flexible and affordable solutions to customers looking to store personal or business items. Their extensive locations and variety of storage options, including climate-controlled units, have made them a leader in the industry.

Extra Space Storage is another key player in the self-storage market, offering a wide range of storage solutions including personal, commercial, and vehicle storage. Their focus on security and customer convenience, with features like 24/7 access and video surveillance, has helped them build a large and loyal customer base. Extra Space Storage also has a strong presence in both urban and suburban areas, making their services widely accessible.

U-Haul International is a major player in both the moving and storage services sectors. Known primarily for its moving truck rentals, U-Haul also offers a variety of self-storage options. The company’s ability to combine moving and storage services gives it a unique advantage, particularly for customers looking for a one-stop solution for relocation and temporary storage.

CubeSmart offers self-storage services with a strong focus on customer satisfaction and innovative features like online reservation and bill payment. Their high-quality, well-maintained facilities and competitive pricing make CubeSmart a key player in the self-storage industry. The company also focuses on providing moving and packing supplies, making it a comprehensive service provider for storage and relocation.

These top companies lead the Self-Storage and Moving Services Market by offering a range of flexible, secure, and accessible services that meet the needs of both residential and commercial customers.

Major Companies in the Market

- Public Storage

- Extra Space Storage

- U-Haul International

- CubeSmart

- Life Storage

- Moving APT

- PODS Enterprises

- Bekins Van Lines

- Two Men and a Truck

- Rent-A-Space

- SpareFoot

- SmartStop Self Storage

Recent Developments

- Forum Asset Management and Make Space Inc.: On February 2024, Forum Asset Management acquired a 50% interest in Make Space Capital Partners, the investment arm of Make Space Inc., and launched the Forum Make Space Storage Fund, a $200 million private real estate investment trust. The fund will focus on acquiring and operating 28 self-storage facilities across five Canadian provinces, with plans for further expansion in major cities like Montreal, Toronto, and Vancouver.

- U-Haul Holding Company: On November 2024, U-Haul Holding Company (NYSE: UHAL) will attend Deutsche Bank’s 2024 “Gaming, Lodging, Leisure & Restaurants One-on-One Conference” in Miami Beach. The management team will hold meetings with institutional investors, but no webcast will be available for the event.

Report Scope

Report Features Description Market Value (2024) USD 52.3 Billion Forecast Revenue (2034) USD 98.2 Billion CAGR (2025-2034) 6.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service Type (Self-Storage, Moving Services, Packing Services, Truck Rental), By Storage Type (Indoor Storage, Outdoor Storage, Climate-Controlled Storage, Vehicle Storage), By End-User (Residential, Commercial, Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Public Storage, Extra Space Storage, U-Haul International, CubeSmart, Life Storage, Moving APT, PODS Enterprises, Bekins Van Lines, Two Men and a Truck, Rent-A-Space, SpareFoot, SmartStop Self Storage Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Self-Storage and Moving Services MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Self-Storage and Moving Services MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Public Storage

- Extra Space Storage

- U-Haul International

- CubeSmart

- Life Storage

- Moving APT

- PODS Enterprises

- Bekins Van Lines

- Two Men and a Truck

- Rent-A-Space

- SpareFoot

- SmartStop Self Storage