Global Security and Vulnerability Management Market Size, Decision-Making Report By Component (Software (Vulnerability, Scanners, Patch Management, Security Incident & Event Management, Risk Assessment, Threat Intelligence, and Others), and Services (Professional Services (Consulting & Deployment, Pen Testing, Vulnerability Assessment, Incident Response, and Support & Maintenance) and Managed Services), By Security Type (Endpoint Security, Cloud Security, Network Security, and Application Security), By Target (Content Management Vulnerabilities, IoT Vulnerabilities, API Vulnerabilities, and Others), By Deployment ( Cloud, and On-premises), By Enterprise Size (Large Enterprises, and SMEs), By Vertical (BFSI, Healthcare, Defense/Government, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 154714

- Number of Pages: 324

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts’ Viewpoint

- Role of AI

- U.S. Market Size

- Component Analysis

- Security Type Analysis

- Target Analysis

- Deployment Analysis

- Enterprise Size Analysis

- Vertical Segment Analysis

- Growth Factors

- Emerging Trends

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

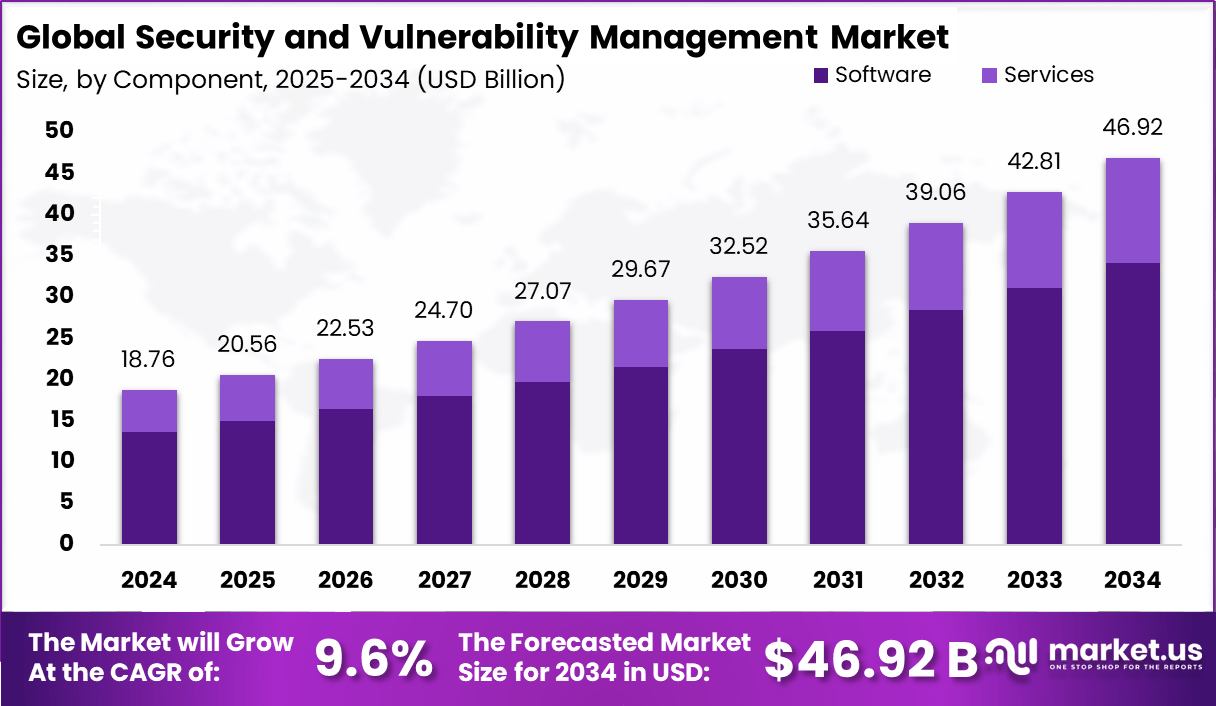

The global Security and Vulnerability Management market size accounted for USD 18.76 billion in 2024 and is predicted to increase from USD 20.56 billion in 2025 to approximately USD 46.92 billion by 2034, expanding at a CAGR of 9.60% from 2025 to 2034.

The Security and Vulnerability Management Market can be described as the continuous and structured set of practices, tools, and services employed by organizations to detect, assess, prioritise, and remediate weaknesses in digital systems. These processes include vulnerability scanning, risk assessments, threat intelligence, patching and compliance validation.

The market supports the proactive governance of cyber‑risk by integrating real‑time diagnostics and automated workflows to close exposure gaps and maintain operational integrity. It has gained prominence due to widespread digital transformation and escalating cyber threats. The growth of the security and vulnerability management industry is mainly driven by the increasing number of cyber-attacks, creating a greater need for proactive security solutions.

Top driving factors for this market include the increasing frequency and sophistication of cyber‑attacks, intensified cloud and remote‑work adoption, and expanded use of IoT and API‑driven technologies. The enlargement of attack surfaces has necessitated advanced scanning, risk‑based prioritisation, and remediation capabilities. Strict regulations in finance, healthcare, and infrastructure drive the adoption of vulnerability management for compliance and risk control.

Market Size and Growth

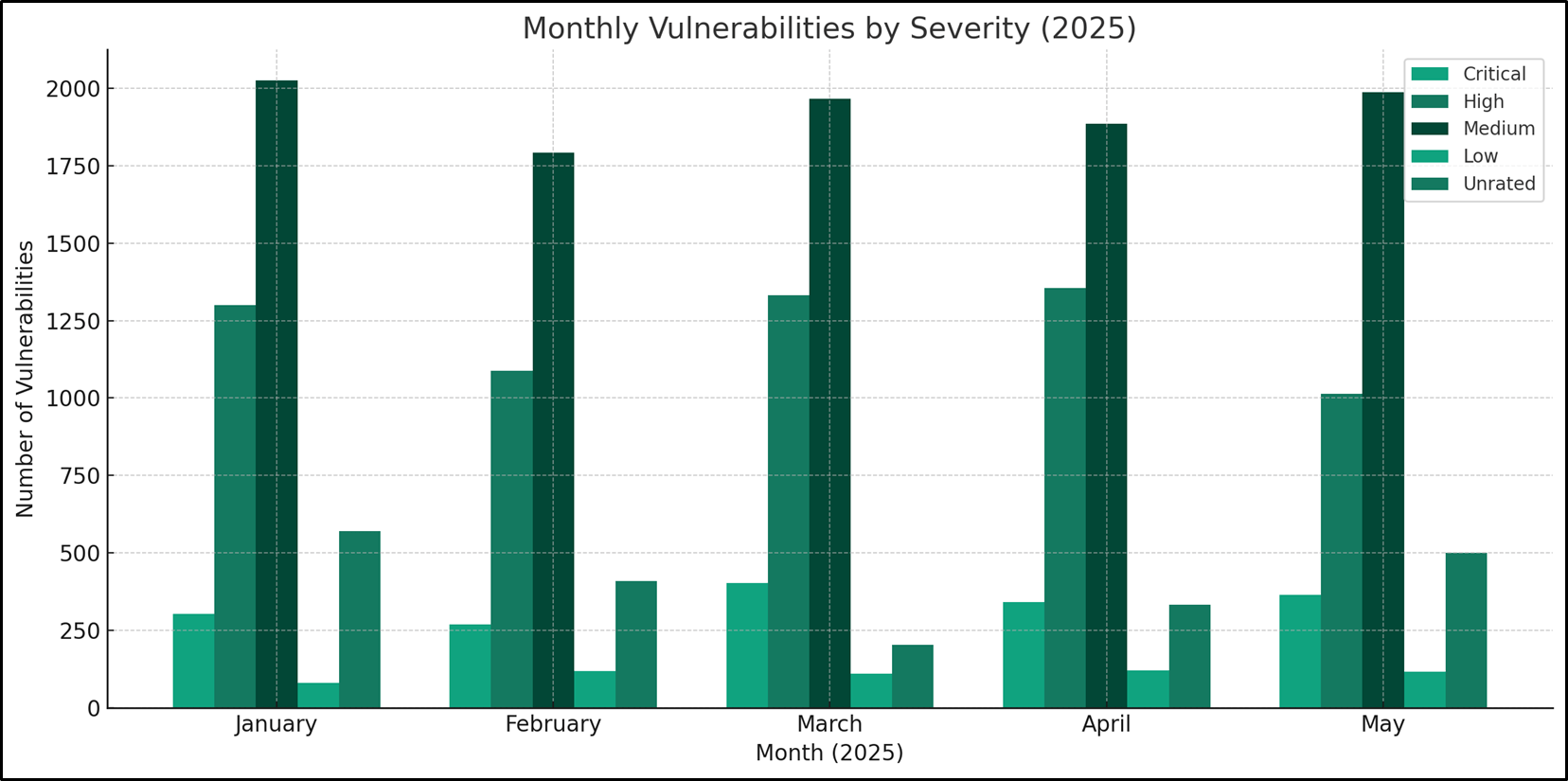

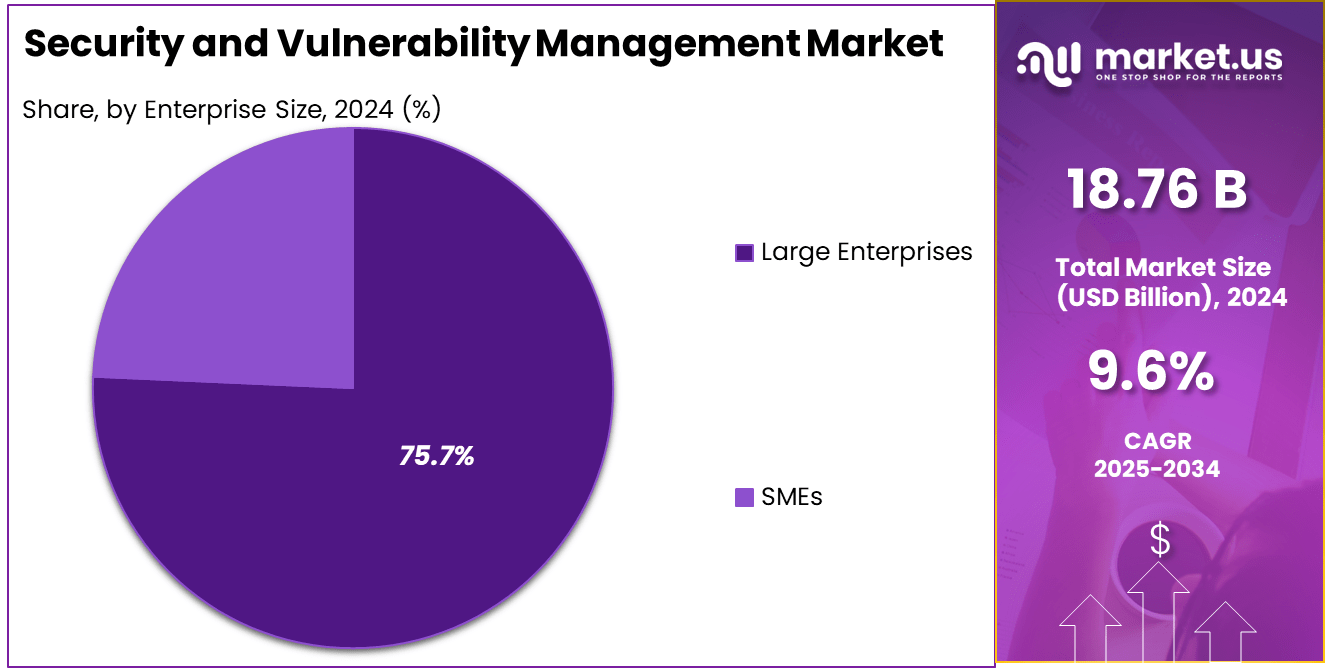

Metric Statistic / Value Market Value (2024) USD 18.76 Bn Forecast Revenue (2034) USD 46.92 Bn CAGR(2025-2034) 9.6% Leading Segment Large Enterprises: 75.7% Region with Largest Share North America [35.6% Market Share] Largest Country U.S. [USD 5.67 Bn Market Revenue], CAGR: 6.7% Based on data from zero threat, As of June 2025, a total of 21,528 vulnerabilities have been published, reflecting an 18% year-over-year increase, with +3,285 more vulnerabilities compared to the same period in 2024. On average, 133 vulnerabilities are reported per day.

Notably, over 38% of these are categorized as critical or high severity, underscoring the urgent need for prompt risk mitigation. January 2025 alone accounted for the highest monthly count, with 4,278 CVE vulnerabilities disclosed, signaling an alarming start to the year.

Key Takeaways

- The Software segment led the global market with a 72.8% share, driven by widespread adoption of automated platforms for threat detection, patch management, and security analytics.

- Endpoint Security dominated the solution type, holding 45.6%, as organizations prioritized protection for remote devices and distributed work environments.

- Content Management Vulnerabilities captured 45.6%, highlighting the increasing risk associated with CMS platforms, plugins, and misconfigured access controls.

- Large Enterprises accounted for 75.7% of the market, reflecting their complex infrastructure, higher exposure to cyber threats, and greater compliance requirements.

- The BFSI sector emerged as the leading end-user, securing 34.6%, due to heightened regulatory scrutiny, sensitive customer data, and critical need for zero-trust frameworks.

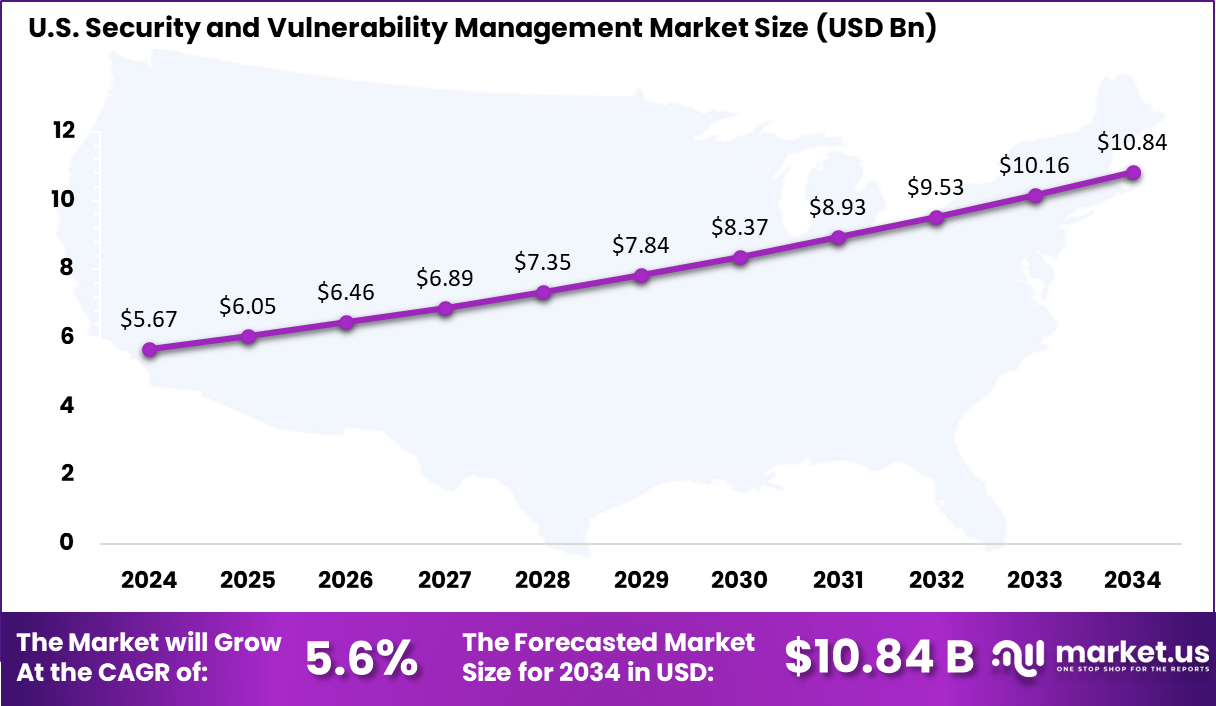

- The U.S. market was valued at USD 5.67 billion in 2024, with a solid CAGR of 6.7%, supported by aggressive investments in cybersecurity modernization and incident response.

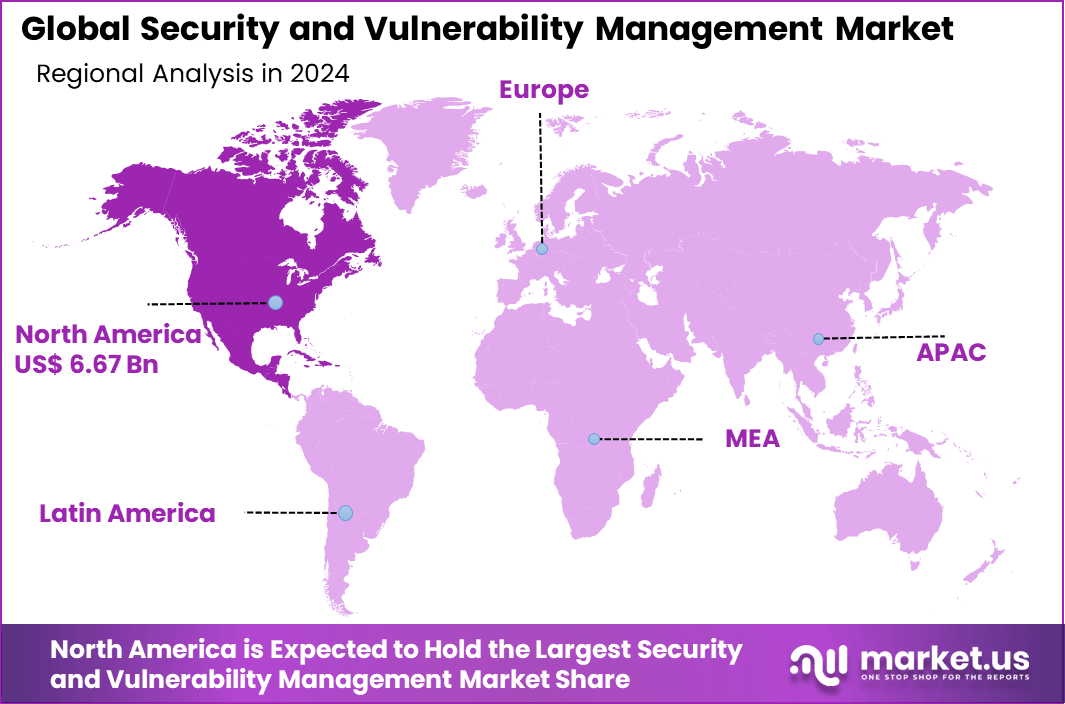

- North America remained the top region, contributing 35.6% of global revenue, backed by high awareness, mature IT infrastructure, and a proactive regulatory environment.

Analysts’ Viewpoint

Investment opportunities arise in RBVM platforms that provide predictive and semantic prioritisation, SaaS‑based vulnerability management tools with integrated patch orchestration, AI‑augmented threat intelligence modules, and services to bridge talent gaps through managed or professional offerings. Opportunities are also present in risk assessment, compliance modules, and threat‑intelligence integrations that address cloud and IoT‑driven vulnerabilities.

Business benefits include reduction in breach risk through early detection, consolidation of disparate tools into unified platforms, shortened remediation cycles, enhanced regulatory compliance, and governance transparency. The structured approach supports continuous auditing and stronger vendor and supply‑chain oversight in line with zero‑trust principles and audit readiness.

The regulatory environment has become more rigorous globally. In the European Union, directives such as NIS2, the Cybersecurity Act, the Digital Operational Resilience Act (DORA) and the Cyber Resilience Act impose vulnerability‑disclosure, incident‑reporting, and resilience standards on vendors and operators of essential services. In the US, new SEC cybersecurity disclosure rules, CISA frameworks and evolving public‑private programs mandate continuous assurance.

Role of AI

Role/Function Description Automated Threat Detection AI analyzes vast data sets (logs, network traffic, threat intel) for rapid anomaly detection and zero-days Risk-Based Prioritization AI uses context (asset value, exploitability, threat intel) to triage and prioritize vulnerabilities Automated Remediation AI triggers and coordinates patching, configuration updates, and responses without human delay Continuous Self-Learning AI models adapt to emerging threats and changing IT environments for ongoing improvement Efficiency & Cost Reduction Reduces false positives, lowers mean time to response, and enables teams to focus on high-value tasks U.S. Market Size

The US Security and Vulnerability Management Market was valued at USD 5.67 Billion in 2024, with a robust CAGR of 6.7%. The US Security and Vulnerability Management Market is projected to experience robust growth in 2024, driven by increasing cyber threats and regulatory requirements.

Organizations are focusing on vulnerability detection, risk mitigation, and compliance to protect against data breaches and attacks. Key factors influencing the market include the growing adoption of cloud-based security solutions, the integration of AI and machine learning for real-time threat analysis, and the escalating need for comprehensive risk management platforms.

Enterprises, particularly in finance, healthcare, and government sectors, are investing heavily in advanced vulnerability management tools to identify, prioritize, and remediate threats. The market is also witnessing significant demand for automation and orchestration to streamline security processes and ensure proactive threat mitigation.

For instance, In 2024, the FBI’s Internet Crime Complaint Center (IC3) reported over 21,000 ransomware attacks in the U.S., highlighting the urgent need for preemptive vulnerability scanning. This, along with growing emphasis on proactive asset management and continuous risk monitoring, is expected to drive market growth in the coming years.

In 2024, North America held a dominant market position in the global Security and Vulnerability Management Market, capturing more than a 35.6% share. This market is poised for consistent growth, driven by increasing cyber threats, rising instances of data breaches, and stricter regulatory requirements.

Key drivers include the adoption of cloud-based solutions, integration of AI-driven threat detection, and a focus on automation in security operations. Software solutions dominate the market, contributing to the largest share of revenue in 2024. As organizations continue to address vulnerabilities proactively, the market’s expansion is likely to accelerate in the coming years.

Component Analysis

In 2024, the Software segment held a dominant market position, capturing more than a 72.8% share of the Global Security and Vulnerability Management Market due to its pivotal role in vulnerability detection, assessment, and management.

Software solutions are expected to continue leading the market as enterprises prioritize advanced tools for real-time threat intelligence and automated vulnerability management. The increasing complexity of cyber-attacks, along with the growing demand for continuous monitoring, drives the adoption of software-based solutions for proactive risk management.

Key drivers include the integration of AI and machine learning in security software, enabling better identification and mitigation of vulnerabilities. Software also plays a crucial role in compliance with regulatory requirements like GDPR, HIPAA, and others. As businesses continue to embrace digital transformation, the need for comprehensive and scalable security software solutions has amplified, making it a preferred choice over hardware alternatives.

Security Type Analysis

In 2024, the Endpoint Security segment held a dominant market position, capturing more than a 45.6% share of the Global Security and Vulnerability Management Market due to the increasing frequency and sophistication of cyber threats targeting end-user devices.

Endpoint security involves protecting devices such as desktops, laptops, mobile devices, and servers from vulnerabilities, malware, and unauthorized access. The growing trend of remote work, coupled with the BYOD (Bring Your Own Device) movement, has amplified the need for robust endpoint protection, making it a top priority for enterprises across industries.

According to Market.us report, Endpoint Security Market is projected to reach USD 36.5 billion by 2033, growing at a CAGR of 8.4% from 2024 to 2033. In 2023, the market was valued at USD 16.3 billion, reflecting consistent demand for robust security frameworks amid rising endpoint threats. With cyber-attacks becoming more advanced, endpoint security solutions are evolving to provide real-time monitoring, threat intelligence, and automated threat remediation.

As businesses strive to secure their IT infrastructures, the demand for comprehensive endpoint security solutions, such as antivirus software, firewalls, and mobile device management tools, continues to surge. This segment is key in ensuring compliance with regulatory standards and minimizing security risks associated with endpoints in corporate environments.

Target Analysis

In 2024, the Content Management Vulnerabilities segment held a dominant market position, capturing more than a 70.4% share of the Global Security and Vulnerability Management Market, due to the growing need to safeguard sensitive and critical business information.

As organizations increasingly rely on digital content management systems (CMS), vulnerabilities within these systems present significant risks, particularly in sectors dealing with confidential data, such as finance, healthcare, and government. Content management vulnerabilities often result from improper access control, outdated software, and poorly configured systems, leading to data breaches and unauthorized access.

This has prompted businesses to prioritize security management solutions that can identify, assess, and mitigate these vulnerabilities effectively. With the rise of cloud-based content storage and collaboration tools, the demand for robust vulnerability management in content systems is intensifying.

Deployment Analysis

In 2024, the On-premises segment held a dominant market position, capturing more than a 64.8% share of the Global Security and Vulnerability Management Market due to its ability to offer greater control and customization for enterprises. Organizations with stringent data security and privacy requirements prefer on-premises solutions as they provide direct oversight and management of their security infrastructure.

This deployment method is particularly popular among industries such as finance, healthcare, and government, where data sensitivity is a top priority. The ability to manage security policies, maintain control over sensitive data, and address compliance requirements are key advantages of on-premises deployment.

Additionally, businesses that already have robust IT infrastructure and resources to support on-premises solutions find this deployment model cost-effective in the long run. While cloud-based solutions are gaining traction, on-premises security remains a preferred choice for many enterprises, particularly in regions with high regulatory requirements and concerns over data sovereignty.

Enterprise Size Analysis

In 2024, the Large Enterprises segment held a dominant market position, capturing more than a 75.7% share of the Global Security and Vulnerability Management Market due to its high adoption of advanced cybersecurity frameworks and dedicated IT security teams. These organizations often manage vast volumes of sensitive data across complex infrastructures, making them prime targets for cyberattacks.

To address this, large enterprises prioritize investments in robust vulnerability assessment tools, real-time threat monitoring systems, and compliance management solutions. Their larger budgets enable the integration of cutting-edge technologies such as AI, machine learning, and automation into their security operations.

Moreover, stringent regulatory requirements and increasing focus on data privacy and risk management further drive demand for comprehensive vulnerability management strategies in this segment. The need for scalable and centralized platforms to secure distributed networks and cloud environments also contributes to the strong adoption rate among large enterprises.

Vertical Segment Analysis

In 2024, the BFSI segment held a dominant market position, capturing more than a 32.7% share of the Global Security and Vulnerability Management Market, driven by the increasing need for robust security systems to protect sensitive financial data and ensure compliance with stringent regulations.

With the rise in cyber threats targeting financial institutions, including fraud, phishing, and ransomware, BFSI companies are heavily investing in advanced vulnerability management tools to safeguard customer information and financial transactions. These solutions enable organizations to proactively identify, assess, and remediate security gaps, minimizing potential risks.

Additionally, regulatory requirements such as GDPR and PCI DSS mandate the implementation of comprehensive security measures, further pushing the adoption of vulnerability management solutions. As digital transformation continues in the BFSI sector, the demand for integrated security frameworks to protect both legacy systems and emerging technologies, like blockchain and mobile banking, remains strong.

Growth Factors

Growth Factor Description Evolving Cyber Threat Landscape Rising ransomware, phishing, and advanced persistent threats challenge all sectors Expansion of Cloud & IoT Rapid digital transformation and proliferation of IoT devices broaden the attack surface Regulatory & Compliance Pressures Mandates (GDPR, HIPAA, CCPA, CMMC, NIS2) demand robust, auditable vulnerability controls Remote Work & BYOD Adoption Hybrid work models increase endpoints and access points that need protection Skills Gap & Need for Automation Shortage of cybersecurity talent accelerates uptake of automated, AI-powered vulnerability management Emerging Trends

Trend/Innovation Description AI & ML-Driven Predictive Security Predictive analytics and self-learning tools for proactive threat identification and real-time response Integration with DevSecOps/CI-CD Embedding security into DevOps pipelines for continuous vulnerability monitoring and mitigation Cloud-Native and Agentless Solutions SaaS-based, scalable platforms with minimal management overhead for cloud, hybrid, and multicloud environments Risk-Based & Attack Surface Management Prioritization based on business impact and exposure, covering IT, OT, IoT, and supply chain vulnerabilities Platform Consolidation & Managed Services Increasing vendor consolidation, all-in-one platforms, and demand for managed vulnerability management services Key Market Segments

By Component

- Software

- Vulnerability Scanners

- Patch Management

- Security Incident & Event Management

- Risk Assessment

- Threat Intelligence

- Others

- Services

- Professional Services

- Consulting & Deployment

- Pen Testing

- Vulnerability Assessment

- Incident Response

- Support & Maintenance

- Managed Services

- Professional Services

By Security Type

- Endpoint Security

- Cloud Security

- Network Security

- Application Security

By Target

- Content Management Vulnerabilities

- IoT Vulnerabilities

- API Vulnerabilities

- Others

By Deployment

- Cloud

- On-premises

By Enterprise Size

- Large Enterprises

- SMEs

By Vertical

- BFSI

- Healthcare

- Defense/Government

- IT and Telecom

- Energy

- Retail

- Manufacturing

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Increase in Cybersecurity Threats and Data Breaches

The rise in cyberattacks and data breaches is one of the primary drivers for the Global Security and Vulnerability Management Market. As organizations across sectors become more digitized, the attack surface expands, making them more susceptible to various cyber threats, including ransomware, phishing, and DDoS attacks.

According to CISA, intrusions on critical infrastructure rose by 38% in 2024, driven by advanced tactics from state-sponsored actors and cybercriminal groups. The ENISA Threat Landscape 2024 also identified ransomware and supply chain attacks among the top five cybersecurity threats, noting a shift toward double extortion and stealth tactics, which have transformed ransomware into a more covert and damaging threat.

High-profile breaches have emphasized the need for comprehensive vulnerability management systems to identify, assess, and mitigate risks proactively. These systems help organizations detect vulnerabilities before attackers exploit them, safeguarding sensitive data and ensuring business continuity. As cybercriminals develop more sophisticated tactics, enterprises are compelled to invest in advanced solutions for real-time threat detection and incident response, driving market growth.

Restraint

High Cost of Implementation

The cost associated with deploying comprehensive security and vulnerability management solutions is a significant restraint, particularly for small and medium-sized enterprises (SMEs). Advanced solutions often require substantial upfront investments, including software licensing, hardware infrastructure, and skilled personnel for implementation and ongoing management.

Additionally, regular updates and maintenance can further elevate the cost. Many organizations in emerging markets or those with limited budgets may hesitate to adopt these solutions, limiting overall market growth.

Opportunities

Cloud Adoption and Integration

The growing shift toward cloud environments presents a significant opportunity for the Security and Vulnerability Management Market. As businesses increasingly migrate their operations and data to cloud platforms, they face heightened risks of cyberattacks, including data breaches and misconfigurations.

Vulnerability management solutions are crucial for identifying and mitigating these risks. As cloud services expand, the need for comprehensive security solutions that integrate seamlessly with cloud platforms (e.g., AWS, Azure, Google Cloud) will drive market growth. By leveraging cloud-native vulnerability management tools, companies can ensure their infrastructure remains secure and compliant with regulatory standards.

Key Players Analysis

In the Security and Vulnerability Management Market, established players such as IBM Corporation, Cisco Systems, Inc., and Microsoft continue to hold strong positions due to their comprehensive cybersecurity portfolios and integrated solutions. Their capabilities span threat detection, endpoint security, and advanced risk analytics. These firms benefit from their vast enterprise client base and long-standing trust in IT infrastructure.

Emerging innovators like CrowdStrike, Tenable, Inc., Rapid7, and Qualys, Inc. are gaining market share through their SaaS-first models and predictive vulnerability intelligence tools. These companies offer scalable, cloud-integrated platforms with real-time response features, making them attractive to SMEs and large enterprises alike. Their success is driven by constant innovation, threat hunting automation, and partnerships that extend reach across hybrid cloud environments.

For instance, in April 2025, Qualys, Inc., a leading provider of disruptive cloud-based IT, security and compliance solutions, announced major updates to its TotalAI solution to secure organizations’ complete MLOps pipeline from development to deployment. Other key participants such as Palo Alto Networks, Balbix, Inc., Wiz, Inc., and BlueVoyant are expanding through niche solutions and AI-powered security automation.

For instance, in July 2025, Palo Alto Networks announced agreement to acquire CyberArk, the identity security leader this strategic combination will mark Palo Alto Networks’ formal entry into Identity Security, establishing it as a core pillar of the company’s multi-platform strategy. Companies like Fortra, LLC, CybeReady, and RSI Security are also enhancing their presence by focusing on training, managed services, and advanced vulnerability remediation.

Top Key Players in the Market

- AT&T Intellectual Property.

- CrowdStrike

- Cisco Systems, Inc.

- Fortra, LLC

- IMB Corporation

- Microsoft

- Qualys, Inc.

- Rapid7

- RSI Security.

- Tenable, Inc.

- CrowdStrike

- CybeReady

- Balbix, Inc.

- Splunk LLC

- BlueVoyant

- Palo Alto Networks

- Wiz, Inc.

- Other Key Players

Recent Developments

- In April 2025, Black Kite introduced its Vulnerability Intelligence Briefs (VIB) to move beyond traditional CVE listings. This innovation empowers security teams with deeper insights into severity, exploitability, and vendor-specific exposure risks.

- Also in April 2025, N-able expanded its cybersecurity portfolio by embedding vulnerability management tools into its Unified Endpoint Management platforms, N-central and N-sight. The integration offers managed service providers a unified dashboard to monitor vulnerabilities across multiple operating systems.

- In January 2025, Absolute Software enhanced its Resilience Platform by integrating patch management, vulnerability scanning, remediation automation, and remote endpoint recovery. This consolidated approach reduces costs and strengthens endpoint resilience.

- In January 2025, Hackuity.io partnered with Wiz, Inc., integrating with the Wiz Integration Network (WIN). This collaboration prioritizes vulnerabilities using Hackuity.io’s True Risk Score (TRS), enabling more efficient risk-based management.

- In September 2024, CrowdStrike and Zscaler introduced AI and Zero Trust integrations, advancing real-time threat detection and vulnerability management to support faster response for security operations centers.

- By July 2024, Rapid7 had acquired Noetic Cyber to strengthen vulnerability insights, streamline exposure prioritization, and enhance operational productivity in security teams.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software (Vulnerability, Scanners, Patch Management, Security Incident & Event Management, Risk Assessment, Threat Intelligence, and Others), and Services (Professional Services (Consulting & Deployment, Pen Testing, Vulnerability Assessment, Incident Response, and Support & Maintenance) and Managed Services), By Security Type (Endpoint Security, Cloud Security, Network Security, and Application Security), By Target (Content Management Vulnerabilities, IoT Vulnerabilities, API Vulnerabilities, and Others), By Deployment ( Cloud, and On-premises), By Enterprise Size (Large Enterprises, and SMEs), By Vertical (BFSI, Healthcare, Defense/Government, IT and Telecom, Energy, Retail, Manufacturing, and Others), and Region Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AT&T Intellectual Property, CrowdStrike, Cisco Systems, Inc., Fortra, LLC, IMB Corporation, Microsoft, Qualys, Inc., Rapid7, RSI Security, Tenable, Inc., CrowdStrike, CybeReady, Balbix, Inc., Splunk LLC, BlueVoyant, Palo Alto Networks, Wiz, Inc., and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Security and Vulnerability Management MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Security and Vulnerability Management MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AT&T Intellectual Property.

- CrowdStrike

- Cisco Systems, Inc.

- Fortra, LLC

- IMB Corporation

- Microsoft

- Qualys, Inc.

- Rapid7

- RSI Security.

- Tenable, Inc.

- CrowdStrike

- CybeReady

- Balbix, Inc.

- Splunk LLC

- BlueVoyant

- Palo Alto Networks

- Wiz, Inc.

- Other Key Players