Global Screenless Laptop Market Size, Share and Analysis Report By Type (Standard Screenless Laptops, Hybrid/Convertible Screenless Devices, Wearable/Integrated Screenless Interfaces), By Technology / Interface (Projection-Based Interfaces, Holographic Display Systems, Retinal / Direct-Eye Output, Voice & Gesture Interaction Systems), By Application (Personal & Home Use, Professional / Enterprise Use, Gaming & Entertainment, Development & Programming, Industrial & Field Operations, Healthcare, Government, Others), By Distribution Channel (Online Sales, Offline Retail), By Price (Entry-Level / Budget Screenless Laptops, Mid-Range Screenless Devices, Premium & High-Performance Devices), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 172249

- Number of Pages: 313

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Increasing Adoption Technologies

- By Type

- By Technology and Interface

- By Application

- By Distribution Channel

- By Price

- By Region

- Emerging Trends Analysis

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

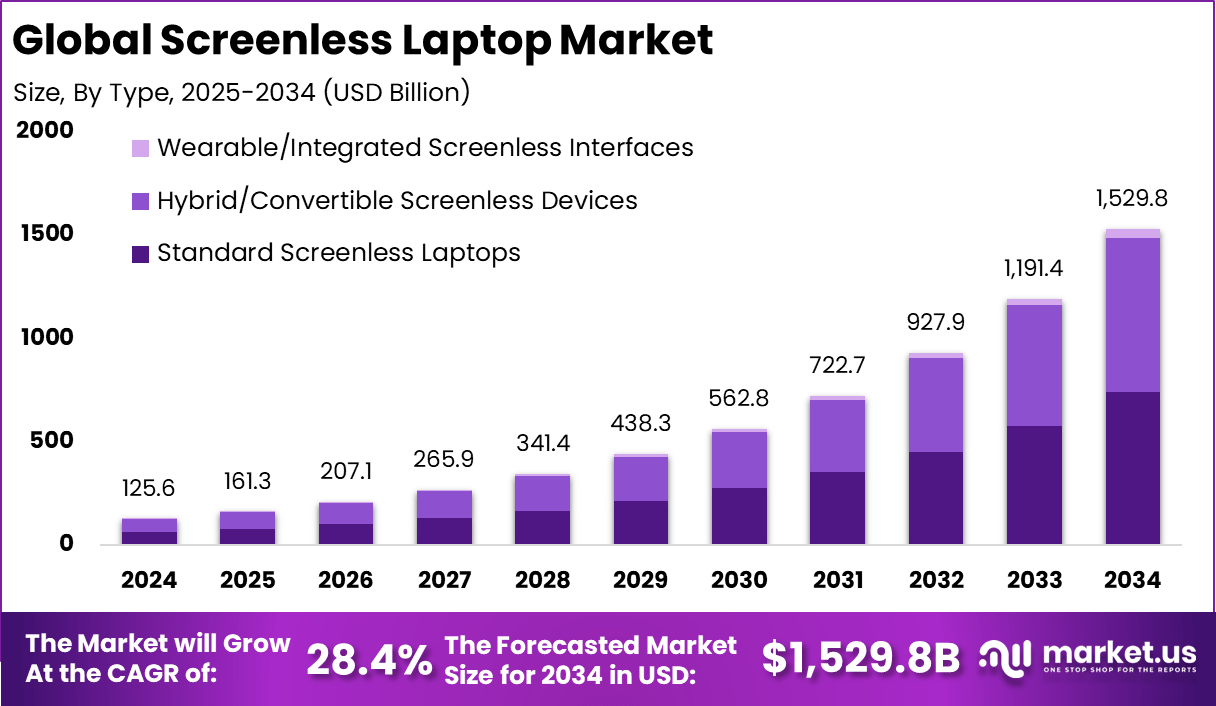

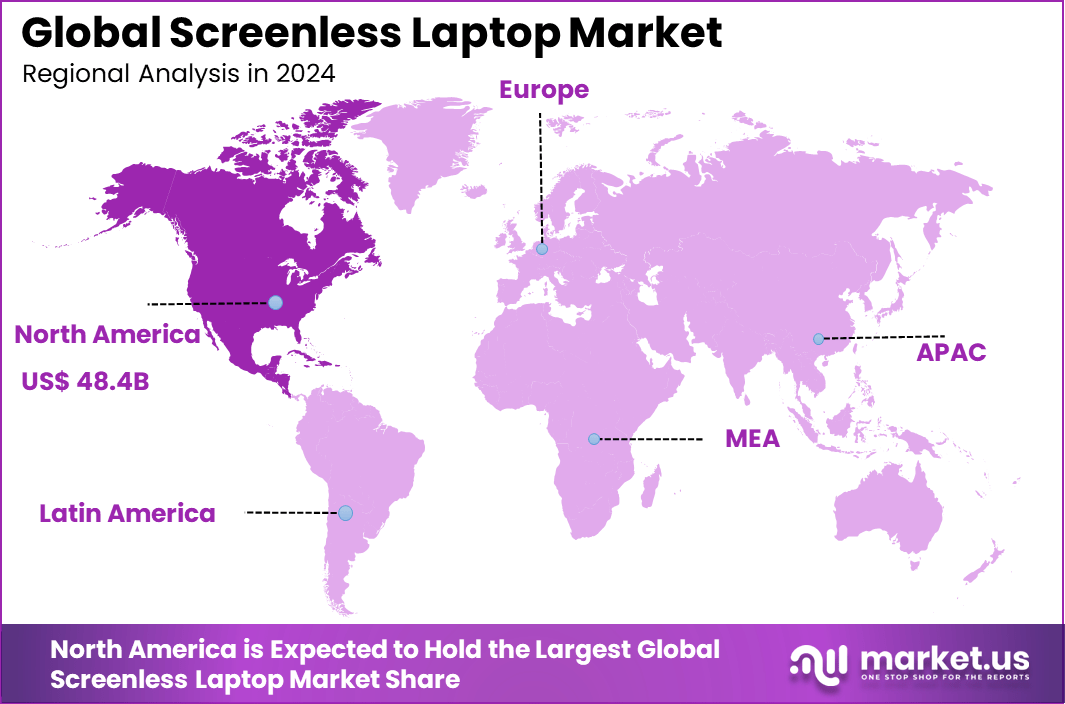

The Global Screenless Laptop Market size is expected to be worth around USD 1,529.8 Billion By 2034, from USD 161.3 billion in 2025, growing at a CAGR of 28.4% during the forecast period from 2025 to 2034. In 2024, North America held a dominan Market position, capturing more than a 38.6% share, holding USD 48.4 Billion revenue.

The Screenless Laptop Market refers to innovative computing devices that eliminate traditional physical displays, relying instead on technologies like augmented reality (AR) glasses, holographic projections, or external interfaces for visual output. These laptops prioritize extreme portability by housing powerful processors, keyboards, and input systems in compact, lightweight chassis without the bulk of screens.

This market emerges from advancements in AR and spatial computing, addressing limitations of conventional laptops such as screen size constraints and visibility issues in public spaces. Devices like the Spacetop G1 exemplify this shift, pairing hardware with AR eyewear to deliver private, scalable desktops up to 100 inches wide. Early adoption focuses on productivity tools for remote workers, with growth driven by demands for flexibility in dynamic environments.

Top Market Takeaways

- Standard screenless laptops led by type with a 48.5% share, reflecting early adoption of familiar form factors without integrated displays.

- Projection-based interfaces accounted for 40.6%, driven by demand for flexible, portable display experiences across personal and professional settings.

- Personal and home use represented 36.5%, as consumers explored screenless devices for minimal setups, space efficiency, and privacy-focused computing.

- Online sales dominated distribution with 58.4%, supported by direct-to-consumer channels, wider product availability, and competitive pricing.

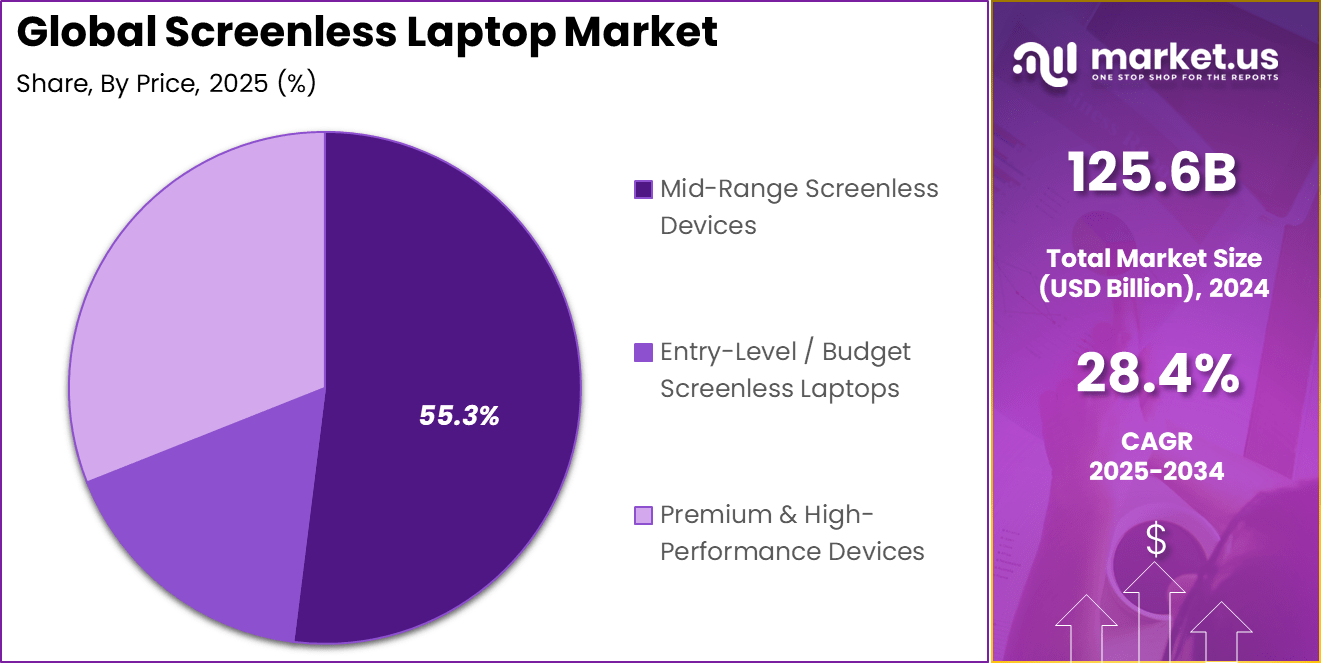

- Mid-range screenless devices captured 55.3%, indicating strong demand for balanced performance at accessible price points.

- North America held 38.6% share, backed by high consumer tech adoption and strong e-commerce penetration.

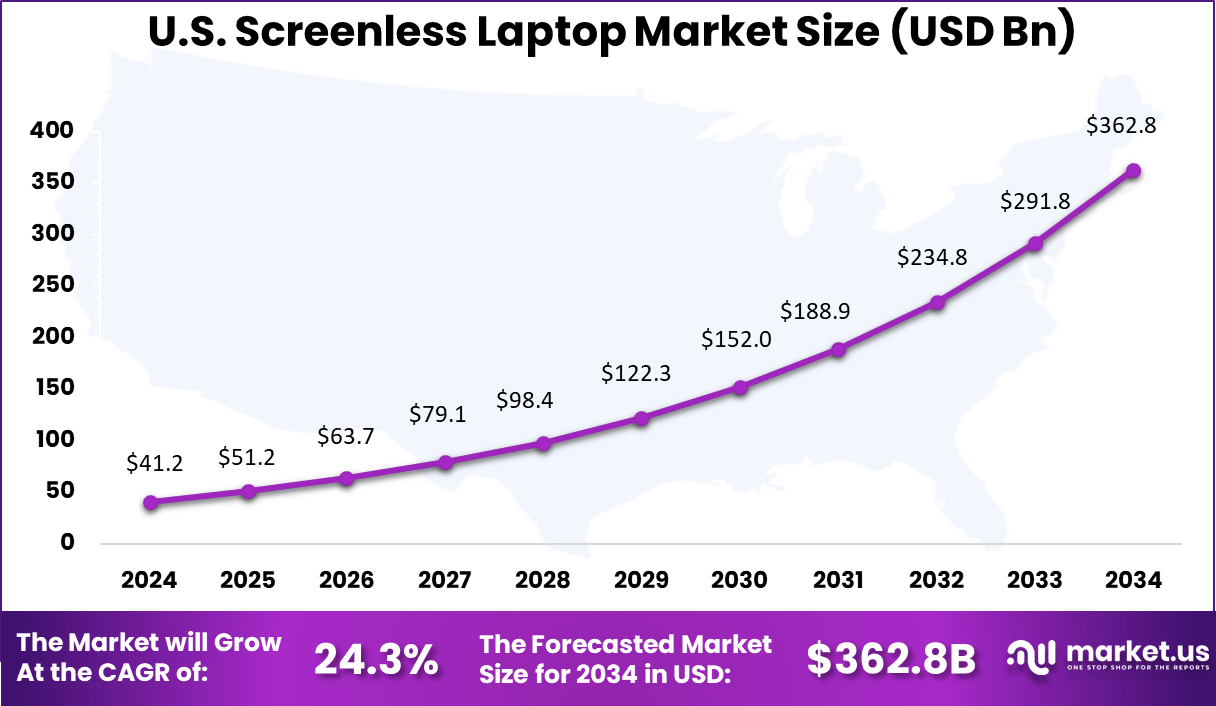

- The U.S. market reached USD 41.23 billion and is expanding at a 24.37% CAGR, driven by rapid innovation, early adopter interest, and rising demand for next-generation computing form factors.

Increasing Adoption Technologies

Augmented reality glasses lead adoption, integrating lightweight eyewear with laptop bases to project high-resolution interfaces into the user’s field of view. These systems, seen in products like Spacetop G1 paired with Xreal lenses, support gesture controls and voice commands for intuitive navigation. Holographic projectors complement this by casting interactive images onto surfaces or mid-air, enhancing versatility for collaborative tasks.

Spatial computing platforms further accelerate uptake by enabling cloud-synced virtual desktops that scale dynamically. Advances in low-latency processors, such as Qualcomm Snapdragon chips, ensure smooth performance for multitasking. Miniaturized sensors for eye-tracking and hand gestures refine user interaction, making these technologies feel natural and reducing reliance on physical inputs.Portability stands as a primary driver, with screenless designs slashing device weight and volume compared to standard laptops, ideal for frequent travelers. Extended battery life follows, as omitting power-hungry displays allows longer operation on single charges, supporting all-day workflows. Enhanced privacy ranks third, creating personal digital bubbles that shield content from prying eyes in shared spaces.

By Type

Standard screenless laptops account for 48.5%, indicating strong demand for basic screenless computing designs. These devices depend on external displays or projected visuals instead of built-in screens. Users prefer them for their lightweight structure and reduced hardware complexity. The absence of a fixed display helps improve portability. Standard models are suitable for general computing needs.

Adoption of standard screenless laptops is driven by demand for modular device usage. Users value the ability to connect with different display options as needed. These laptops also support longer battery life due to lower power consumption. Simpler hardware design reduces maintenance requirements. This supports steady adoption across user groups.

By Technology and Interface

Projection-based interfaces hold 40.6%, making them a key technology segment in the market. These systems project virtual keyboards and display surfaces onto physical areas. Users can interact with projected content using touch or gestures. This eliminates the need for physical screens. Such interfaces support flexible working environments.

Growth in this segment is driven by improvements in projection clarity and input accuracy. Users benefit from adaptable workspaces in compact areas. Projection-based systems support mobile and temporary setups. They reduce dependence on additional hardware. This makes them attractive for modern usage patterns.

By Application

Personal and home use represents 36.5%, showing rising consumer interest in screenless laptops. Users rely on these devices for browsing, communication, and basic productivity tasks. Compact design suits home environments with limited space. Easy setup encourages regular use. Screenless laptops align well with personal computing needs.

Demand in this segment is supported by remote work and home learning trends. Consumers seek portable and flexible computing solutions. Screenless laptops help create clutter-free setups. They also support occasional and casual usage. This drives steady demand from households.

By Distribution Channel

Online sales account for 58.4%, highlighting strong consumer preference for digital purchasing channels. Buyers use online platforms to review features and compare pricing. Home delivery improves convenience for consumers. Online channels offer broader product visibility. This supports higher purchase activity.

Growth in online sales is driven by expanding e-commerce adoption. Consumers value access to product reviews and specifications. Online platforms support easy ordering and returns. Digital promotions also influence buying decisions. This channel continues to dominate distribution.

By Price

Mid-range devices hold 55.3%, reflecting balanced demand between affordability and performance. These devices offer essential functionality without premium pricing. Users prefer cost-effective options that meet everyday needs. Mid-range pricing supports wider market reach. This segment attracts value-focused consumers.

Demand for mid-range devices is driven by budget considerations. Users seek reliable performance at reasonable cost levels. These products suit students and home users. Mid-range pricing reduces purchase hesitation. This supports consistent market demand.

By Region

North America accounts for 38.6%, supported by strong technology adoption and consumer awareness. Users in the region are open to experimenting with new device formats. High purchasing power supports early adoption. Strong online retail infrastructure aids distribution. The region remains a key market.

The United States reached USD 41.23 Billion with a CAGR of 24.37%, reflecting rapid expansion. Growth is driven by innovation and evolving consumer preferences. Screenless laptops appeal to users seeking flexibility and portability. Adoption is supported by rising digital lifestyles. The market shows strong growth momentum.

Emerging Trends Analysis

The screenless laptop market is seeing a growing focus on immersive interaction methods that replace physical screens with projected or wearable visual interfaces. These systems rely on voice input, gesture control, and spatial projection to display information in the user’s field of view. This trend is aligned with broader advances in augmented reality and compact optical components. As a result, computing is becoming more portable and less dependent on fixed display hardware.

Another notable trend is the emphasis on minimal hardware design combined with cloud based processing. Screenless laptops are increasingly designed to act as lightweight computing hubs rather than full display devices. Processing and visualization are shifted to connected wearables or external projection systems. This approach supports mobility while reducing device size and energy use.

Key Market Segments

By Type

- Standard Screenless Laptops

- Hybrid/Convertible Screenless Devices

- Wearable/Integrated Screenless Interfaces

By Technology / Interface

- Projection-Based Interfaces

- Holographic Display Systems

- Retinal / Direct-Eye Output

- Voice & Gesture Interaction Systems

By Application

- Personal & Home Use

- Professional / Enterprise Use

- Gaming & Entertainment

- Development & Programming

- Industrial & Field Operations

- Healthcare

- Government

- Others

By Distribution Channel

- Online Sales

- Offline Retail

By Price

- Mid-Range Screenless Devices

- Entry-Level / Budget Screenless Laptops

- Premium & High-Performance Devices

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Market growth is primarily driven by rising demand for highly portable and flexible computing devices. Professionals and technology focused users are seeking alternatives to traditional laptops that reduce physical strain and improve mobility. Screenless designs support this need by removing bulky displays while maintaining computing capability. This shift reflects changing work patterns that favor remote and mobile productivity.

Another key driver is progress in voice recognition, spatial computing, and low latency connectivity. These technologies make screenless interaction more practical and reliable for daily tasks. Improved accuracy in voice and gesture control has increased user confidence in non screen based systems. As these technologies mature, adoption barriers continue to decline.

Restraint Analysis

High development and adoption costs remain a major restraint for the screenless laptop market. Advanced optical systems, sensors, and projection technologies increase production complexity. These costs are often passed on to users, limiting adoption beyond early adopters and enterprises. Price sensitivity in consumer markets slows large scale deployment.

Usability concerns also restrict growth at this stage. Many users are accustomed to visual feedback from physical screens and keyboards. Screenless systems require behavioral adjustment and learning time. Without clear productivity advantages, some users may resist the transition.

Opportunity Analysis

Strong opportunities exist in professional and specialized use environments where screens are impractical. Fields such as healthcare, engineering, logistics, and defense benefit from hands free and spatial computing. Screenless laptops can support real time data access without interrupting physical tasks. This creates value in safety critical and high precision work settings.

Another opportunity lies in integration with wearable ecosystems. Screenless laptops can function as processing cores connected to smart glasses or head mounted displays. This model supports modular computing and long term platform development. As wearable adoption increases, supporting devices are expected to gain relevance.

Challenge Analysis

A key challenge for the market is limited user awareness and understanding of practical use cases. Screenless laptops are still perceived as experimental rather than essential tools. Clear communication of productivity benefits is required to build trust. Without this, adoption remains limited to niche users.

Software compatibility is another critical challenge. Most applications are designed for traditional screen based interfaces. Adapting software for spatial and voice driven interaction requires time and investment. Until application support improves, user experience may remain inconsistent across use cases.

Competitive Analysis

Sightful, Lenovo, Microsoft, HP, and ASUS lead the screenless laptop market by developing computing devices that rely on augmented reality displays instead of physical screens. Their solutions combine lightweight head mounted displays with high performance laptops to enable private, portable, and immersive work environments. These companies focus on productivity use cases, ergonomic design, and seamless OS integration. Rising demand for mobile work setups and spatial computing continues to support their leadership.

XREAL, Qualcomm Technologies, and Wistron strengthen the market through AR display hardware, chipset platforms, and manufacturing expertise. Their technologies enable low latency visual rendering, efficient power management, and compact form factors required for screenless computing. These providers emphasize hardware software co design and scalability. Growing investment in AR ecosystems and edge computing expands their relevance in this emerging segment.

Other players contribute by exploring niche applications such as remote work, secure computing, and immersive collaboration. Their offerings focus on flexibility, privacy, and next generation user interfaces. These companies experiment with new interaction models and lightweight designs. Increasing acceptance of AR based productivity tools continues to drive early stage growth in the screenless laptop market.

Top Key Players in the Market

- Sightful

- Lenovo

- XREAL, Inc.

- Qualcomm Technologies, Inc.

- Microsoft Corporation

- ASUSTeK Computer Inc.

- HP Development Company, L.P.

- Wistron Corporation

- Others

Recent Developments

- January, 2025 – Sightful relaunched Spacetop at CES as software-only for Windows laptops, pairing with XREAL Air 2 Ultra AR glasses to deliver a private 100-inch virtual multi-monitor workspace, ditching the hardware laptop for broader adoption.

- March, 2025 – Lenovo previewed transparent laptop concepts and AI-driven displays at MWC, hinting at AR-enhanced productivity tools like adaptive screens that could evolve toward screenless experiences via spatial computing integrations.

Report Scope

Report Features Description Market Value (2024) USD 125.6 Bn Forecast Revenue (2034) USD 1,529.8 Bn CAGR(2025-2034) 28.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Standard Screenless Laptops, Hybrid/Convertible Screenless Devices, Wearable/Integrated Screenless Interfaces), By Technology / Interface (Projection-Based Interfaces, Holographic Display Systems, Retinal / Direct-Eye Output, Voice & Gesture Interaction Systems), By Application (Personal & Home Use, Professional / Enterprise Use, Gaming & Entertainment, Development & Programming, Industrial & Field Operations, Healthcare, Government, Others), By Distribution Channel (Online Sales, Offline Retail), By Price (Entry-Level / Budget Screenless Laptops, Mid-Range Screenless Devices, Premium & High-Performance Devices) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sightful, Lenovo, XREAL, Inc., Qualcomm Technologies, Inc., Microsoft Corporation, ASUSTeK Computer Inc., HP Development Company, L.P., Wistron Corporation, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Sightful

- Lenovo

- XREAL, Inc.

- Qualcomm Technologies, Inc.

- Microsoft Corporation

- ASUSTeK Computer Inc.

- HP Development Company, L.P.

- Wistron Corporation

- Others