Saudi Arabia Hajj Tourism Market Size, Share, Growth Analysis By Tour Type (International, Domestic), By Tourist Type (Tour Group, Independent Traveler, Package Traveler), By Age Group (26 to 35 Years, 36 to 45 Years, 46 to 55 Years), By Consumer Orientation (Men, Women), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 167687

- Number of Pages: 362

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Saudi Arabia Hajj Tourism Market size is expected to be worth around USD 358.8 Billion by 2034, from USD 172.5 Billion in 2024, growing at a CAGR of 7.6% during the forecast period from 2025 to 2034.

Saudi Arabia Hajj tourism refers to the organized travel and hospitality ecosystem that serves millions of Muslims performing the spiritual pilgrimage to Makkah. It includes accommodation, transportation, food services, crowd management, digital booking solutions, and religious tourism infrastructure aligned with Vision 2030 expansion goals for sustainable pilgrimage experiences.

Saudi Arabia Hajj Tourism reflects strong policy-led growth supported by mega-infrastructure investments and rising travel demand from Muslim-majority countries. Moreover, the ecosystem continues to diversify through smart services, dynamic visa management, and enhanced logistics capacity, reinforcing its stature as the world’s most strategic spiritual tourism hub.

The commercial landscape demonstrates high revenue potential driven by long-term government funding, service digitalization, and expansion of hospitality supply. Additionally, increasing public-private partnerships and year-round Umrah services create scalable business opportunities across transport, hotels, and pilgrimage technology segments.

The market’s growth trajectory is strengthened by ongoing improvements in airports, rail networks, and on-ground mobility systems that minimize crowd pressure. Furthermore, sustained investment in safety standards, health services, and smart monitoring drives enhanced pilgrim satisfaction, supporting strong repeat demand and encouraging new entrants across the Saudi religious tourism value chain.

Government initiatives, including Vision 2030 programs, actively stimulate market expansion by boosting accommodation capacity and enabling flexible Hajj quotas. Subsequently, digital platforms for booking, e-visa approvals, and real-time guidance represent promising opportunities for tech players. Rising disposable income in Muslim markets is also expected to increase future inbound traffic.

Regulatory enhancements continue to modernize the sector through structured service approvals, price transparency, and efficient crowd control frameworks. As a result, service providers can optimize operations while pilgrims benefit from safer and more seamless journeys. This regulatory clarity further strengthens investor confidence across hospitality, transportation, and pilgrimage support sectors.

According to an industry report, in 1445H (2024) Saudi Arabia recorded 1,833,164 total Hajj pilgrims, including 1,611,310 from abroad and 221,854 domestically, demonstrating 87.9% international participation. Additionally, the same source highlights a balanced gender distribution of 52.3% males (958,137) and 47.7% females (875,027), reinforcing inclusive market demand driven by regulated and expanding Hajj tourism services.

Key Takeaways

- The Saudi Arabia Hajj Tourism Market is projected to reach USD 358.8 Billion by 2034, up from USD 172.5 Billion in 2024, with a CAGR of 7.6% (2025–2034).

- The International Tour Type segment dominated with a 76.3% share in 2024, driven by global pilgrim influx and expanded visa facilities.

- The Tour Group segment led the market by Tourist Type with a 54.7% share in 2024, reflecting preference for organized travel.

- The 36 to 45 Years age group held the largest share at 42.9% in 2024, driven by financial stability and structured travel demand.

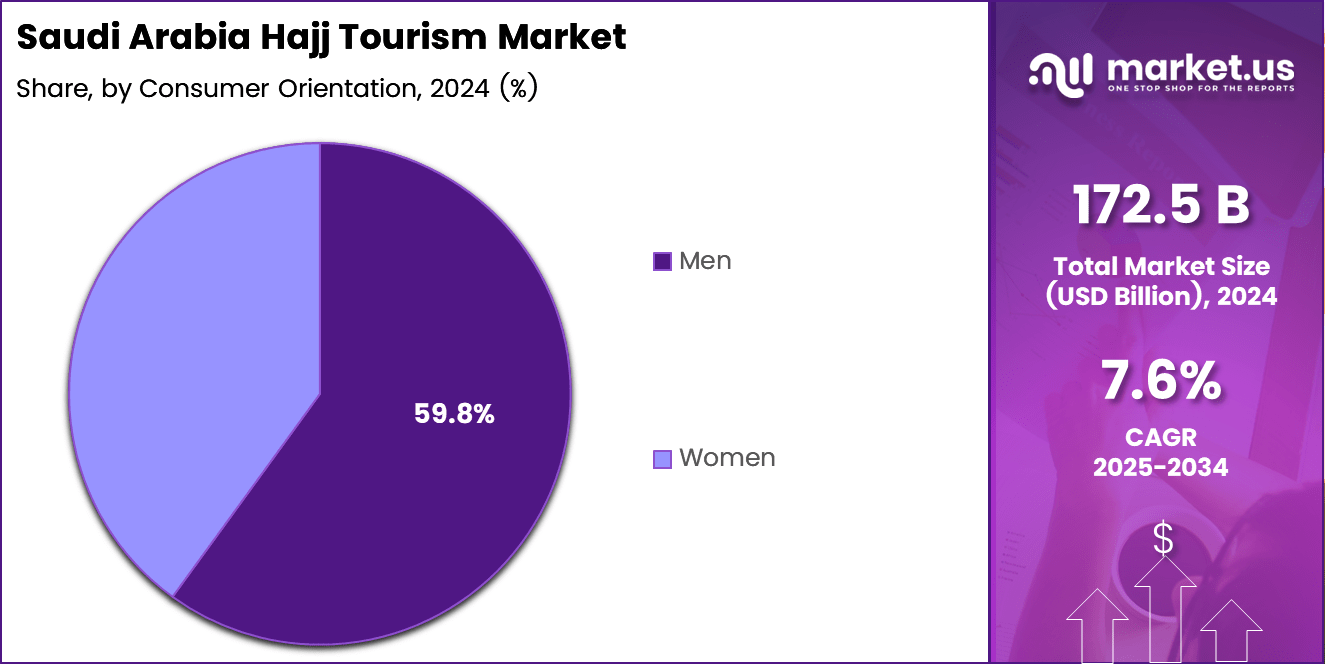

- The Men segment led by Consumer Orientation with a 59.8% share in 2024, supported by higher male participation in Hajj.

- The Asia Pacific region dominated with a 32.8% market share, valued at USD 56.5 Billion, due to a large Muslim population and outbound travel growth.

By Tour Type Analysis

In 2024, International held a dominant market position in the By Tour Type Analysis segment of the Saudi Arabia Hajj Tourism Market, with a 76.3% share.

The International tour type dominated due to the large influx of pilgrims arriving from different countries for Hajj. With a share of 76.3%, this segment continued to grow as global Muslim populations increasingly prioritized spiritual travel, supported by expanding Saudi visa facilities and enhanced pilgrimage support services.

The Domestic tour type also contributed significantly, driven by residents of Saudi Arabia performing Hajj with greater convenience and reduced travel costs. This segment is expanding gradually as improved transportation and accommodation infrastructure encourage more local pilgrims to choose structured domestic tour options.

By Tourist Type Analysis

In 2024, Tour Group held a dominant market position in the By Tourist Type Analysis segment of the Saudi Arabia Hajj Tourism Market, with a 54.7% share.

The Tour Group segment led with 54.7% as most pilgrims preferred organized arrangements that ensure safety, logistics assistance, and guided support throughout the Hajj journey. Group travel simplifies coordination and service delivery, making it an attractive option for first-time and elderly pilgrims.

The Independent Traveler segment is increasing steadily as tech-savvy pilgrims seek flexible itineraries and personalized services. Digital booking platforms and customizable travel plans are encouraging growth in this segment among younger travelers comfortable managing their own arrangements.

The Package Traveler segment also plays a strong role, driven by all-inclusive offerings covering accommodation, transport, meals, and rituals support. Pilgrims choose package services for convenience and reduced planning stress during Hajj, contributing to sustained demand.

By Age Group Analysis

In 2024, 36 to 45 Years held a dominant market position in the By Age Group Analysis segment of the Saudi Arabia Hajj Tourism Market, with a 42.9% share.

The 26 to 35 Years segment reflects increasing interest from younger adults who prioritize religious travel along with cultural exploration. More affordable tour packages and digital travel planning tools have encouraged participation within this age group.

The 36 to 45 Years age group dominated with 42.9%, driven by financial stability and a greater ability to invest in structured Hajj services. This demographic often prefers comfortable travel packages with reliable accommodation and logistical support.

The 46 to 55 Years segment remains strong as higher spiritual commitment and life readiness motivate more middle-aged adults to embark on the pilgrimage. Travel operators increasingly tailor packages to meet their comfort and wellness needs.

By Consumer Orientation Analysis

In 2024, Men held a dominant market position in the By Consumer Orientation Analysis segment of the Saudi Arabia Hajj Tourism Market, with a 59.8% share.

The Men segment dominated with 59.8% as male pilgrims often travel more frequently for Hajj, supported by cultural responsibilities and higher participation in organized religious journeys. Tour providers continue enhancing specialized service offerings to cater to this majority segment.

The Women segment is witnessing strong development due to improved travel safety, better accommodation facilities, and supportive regulations for female pilgrims. Growing awareness and rising income levels are encouraging more women to travel for Hajj independently or with tour groups.

Key Market Segments

By Tour Type

- International

- Domestic

By Tourist Type

- Tour Group

- Independent Traveler

- Package Traveler

By Age Group

- 26 to 35 Years

- 36 to 45 Years

- 46 to 55 Years

By Consumer Orientation

- Men

- Women

Drivers

Rising Muslim Population and Global Demand for Spiritual Pilgrimage Drives Market Growth

The Saudi Arabia Hajj tourism market is steadily expanding as the global Muslim population continues to grow. Millions of Muslims from around the world aspire to perform Hajj at least once in their lifetime, creating sustained demand for spiritual travel to the Kingdom. This rising faith-driven motivation is a strong force behind the market’s long-term expansion.

To support the increasing number of pilgrims, large-scale infrastructure development projects have been initiated in Mecca and Medina. The expansion of the Grand Mosque, improvement of transport facilities, and new accommodations help the country manage higher visitor volumes more efficiently.

Government initiatives are also helping accelerate market growth. The introduction of digital platforms for visa issuance and bookings has simplified the entire travel process, making pilgrimage more accessible and reducing administrative barriers for international travelers.

Additionally, significant investments continue to flow into transportation, hospitality, and religious tourism services. New hotels, improved road networks, and modern airport systems are enhancing overall pilgrim experience. These developments collectively contribute to positioning Saudi Arabia as a global hub for religious tourism and reinforce the upward momentum of the Hajj tourism market.

Restraints

Capacity Limitations and Crowd Management Challenges During Peak Pilgrimage Season

Despite strong growth prospects, the Saudi Arabia Hajj tourism market faces notable restraints due to capacity limitations. The annual Hajj pilgrimage attracts millions of visitors within a short time frame, making crowd management a major challenge. Ensuring safety and smooth movement of pilgrims during rituals is difficult, and logistical pressure can reduce service quality.

Another challenge is the high cost of travel and accommodation for pilgrims. Air travel fares, hotel bookings near holy sites, and package costs have increased significantly, making Hajj less affordable for low-income Muslims. The high price barrier limits the market’s reach, preventing many willing pilgrims from participating.

The rigid timeframe in which Hajj must be completed also intensifies pressure on infrastructure. Since pilgrims must arrive and depart around the same period, transportation, lodging, and food facilities experience extreme demand spikes.

These challenges highlight the need for continued investments and operational improvements. Without addressing these issues, the Saudi Arabia Hajj tourism market may struggle to accommodate future growth and fully meet global pilgrimage demand.

Growth Factors

Development of Premium and Personalized Pilgrimage Travel Packages Drives Market Expansion

The Saudi Arabia Hajj tourism market presents strong growth opportunities through the development of premium and personalized travel packages. Many pilgrims are seeking comfortable and highly organized journeys that offer better transport, guided rituals, and tailored experiences, creating demand for premium services.

Expanding digital services also offers huge potential. Multilingual digital guidance and virtual assistance platforms can support pilgrims with navigation, ritual instructions, and real-time information, improving convenience and confidence for international visitors.

Collaboration between Saudi tourism authorities and global travel agencies can further open new market channels. Such partnerships can improve accessibility, simplify travel arrangements, and support marketing efforts in key Muslim-majority and minority regions.

Moreover, the introduction of year-round religious tourism experiences beyond the Hajj season represents another major opportunity. Umrah, historical Islamic tours, and cultural learning programs can attract visitors throughout the year, helping stabilize revenue generation for local businesses and service providers.

Emerging Trends

Adoption of Smart Tracking Wearables and IoT Technologies Enhances Pilgrim Safety

Technology adoption is becoming one of the most significant trends shaping the Saudi Arabia Hajj tourism market. Smart wearables and IoT devices are increasingly used to track pilgrims, ensure safety, and help families remain connected during travel. These innovations also support authorities in locating individuals quickly during emergencies.

Sustainability is another trending factor as pilgrims show growing interest in eco-friendly accommodation. Hotels and service providers that introduce green energy systems, waste-reduction initiatives, and ethical tourism practices are expected to gain higher preference.

AI-powered crowd analytics is also gaining popularity, helping authorities predict movement patterns and manage high-density areas more efficiently. This enhances safety and decreases waiting times during rituals.

In addition, mobile pilgrimage apps are becoming widely used for booking, itinerary planning, navigation, and real-time updates. The convenience provided by all-in-one mobile platforms is transforming the traditional pilgrimage experience, making digital solutions a crucial component of future Hajj tourism strategies.

Regional Analysis

Asia Pacific Dominates the Saudi Arabia Hajj Tourism Market with a Market Share of 32.8%, Valued at USD 56.5 Billion

Asia Pacific leads the Saudi Arabia Hajj tourism market, holding 32.8% of the regional demand share and valued at a robust USD 56.5 Billion, reflecting the region’s large Muslim population base and strong outbound pilgrimage spending capacity. Countries across APAC demonstrate high travel frequency for Hajj due to improved aviation connectivity, expanding middle-income demographics, and government-supported pilgrimage quotas. Digital adoption for travel planning and preference for packaged services (including Sharia-compliant hospitality and guided group tours) further accelerates contribution from the region. This dominance is reinforced by consistent year-on-year growth in travel bookings destined for Saudi Arabia during peak Hajj seasons.

Middle East and Africa Hajj Tourism Market Outlook

The Middle East and Africa represent a major feeder region for Hajj travel, driven by geographic proximity, high religious travel propensity, and established cultural alignment. Strong participation is supported by lower travel duration, expanding regional airline investments, and structured group pilgrimage programs. Several countries exhibit rising demand for value-based Hajj tourism services, including short-haul charter flights and guided mobility solutions. Public-sector participation in pilgrimage organization contributes to stable travel flow and predictable seasonal demand patterns.

North America Hajj Tourism Market Growth Drivers

North America’s Hajj tourism segment is characterized by premiumization of services, higher per-traveler expenditure, and a strong preference for curated pilgrimage experiences. Demand is fueled by increased diaspora participation, long-haul direct flight expansion, and rising reservations for high-comfort mobility and accommodation packages. Travelers from the region typically seek bundled offerings with flexible travel support and comprehensive trip facilitation. Seasonality impacts travel planning with peak booking trends concentrated months ahead of the pilgrimage period.

Europe Hajj Tourism Market Dynamics

Europe contributes steadily to Saudi Arabia’s Hajj tourism market, driven by growing religious tourism participation and strong packaged travel demand among Muslim communities. The region shows rising interest in structured group travel, multi-city religious tours, and end-to-end pilgrimage facilitation services. Increasing long-haul connectivity and the presence of online travel intermediaries enhance booking accessibility and seasonal demand. Travelers also demonstrate a preference for service transparency, guided mobility assistance, and compliant hospitality ecosystems.

Latin America Hajj Tourism Market Trends

Latin America remains an emerging but fast-scaling segment, supported by rising awareness of international pilgrimage programs and gradual expansion of mosque-led group travel networks. Improved flight routing options and growing participation from Muslim diaspora communities strengthen seasonal demand. The region shows notable interest in fully guided pilgrimage packages that simplify long-distance travel logistics. Demand remains highly seasonal, while spending trends show upward momentum in structured Hajj tourism solutions.

U.S Hajj Tourism Market Participation Trends

The U.S forms a key sub-segment within North America’s Hajj tourism contribution, driven by high religious travel intent and above-average pilgrimage spending patterns. Demand is supported by increasing community-organized pilgrimage groups, higher adoption of digitally booked Hajj travel solutions, and long-haul packaged services with integrated facilitation. Travelers typically demand high-comfort mobility, structured pre-departure training, and compliant accommodation networks. Growth remains seasonal with forward bookings initiated well in advance of the Hajj period.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Saudi Arabia Hajj Tourism Company Insights

Fly Dubai Saudi Arabia is poised to leverage the 2024 Hajj season by expanding capacity on high-demand regional routes and optimizing connections into Jeddah and Madinah. Its low-cost model positions it well to capture price-sensitive pilgrims from emerging markets, while codeshares and schedule coordination with local ground operators strengthen its role in integrated Hajj packages. Yield management will be critical as regulatory caps and slot constraints tighten around peak days.

Al Tayyar Travel Group remains one of the most influential intermediaries in the Saudi Arabia Hajj Tourism Market in 2024, benefiting from scale, long-standing government links, and a deep B2B network. The firm is increasingly shifting from pure ticketing toward end-to-end pilgrimage solutions, bundling flights, accommodation, and transport with digital booking and tracking tools. Margin expansion will likely depend on how effectively it cross-sells value-added services such as guided experiences and premium tiers.

Avis Saudi Arabia plays a niche but growing role in Hajj logistics, especially for higher-income and corporate-sponsored pilgrims seeking flexible mobility beyond group buses. In 2024, its focus on fleet reliability, multilingual customer support, and strategic locations near airports and key pilgrimage hubs positions it to benefit from the gradual diversification of transport modes. However, cost pressures and congestion-related risks require tight operational planning and dynamic pricing.

Zahid Travel Group remains a strong mid-to-upper-tier player, leveraging relationships with airlines and hotels to design differentiated, quality-focused Hajj itineraries. Its reputation for service reliability and compliance with evolving Hajj regulations is a key competitive advantage as authorities tighten oversight on operators. In 2024, further investment in digital platforms and data-driven capacity planning could unlock better demand forecasting and enhance margins across both group and semi-customized packages.

Top Key Players in the Market

- Fly Dubai Saudi Arabia

- Al Tayyar Travel Group

- Avis Saudi Arabia

- Zahid Travel Group

- Boudl Hotels & Resorts

- Wyndham Hotel Group

- InterContinental Hotels Saudi Arabia

- Saudi Arabian Airlines

- EgyptAir Saudi Arabia

- Saddik & Mohammed Attar Company

Recent Developments

- In May 2024, Seera Group reported that its UK-based Portman Travel Group nearly doubled its booking value in 1Q 2024, driven largely by the integration of a major new acquisition that expanded its business travel portfolio and reinforced Seera’s broader ecosystem of brands, including its growing Hajj and Umrah verticals.

- In September 2024, Riyadh-based fintech startup UmrahCash secured a US$500,000 investment from Adaverse Venture Fund to scale its Hajj and Umrah payments platform, enabling pilgrims across Makkah, Madinah and Jeddah to access Saudi riyals more conveniently and supporting the company’s regional expansion ambitions.

- In February 2024, Saudi Arabia’s Ministry of Hajj and Umrah licensed Saudia Hajj and Umrah, a new Saudia Group subsidiary, authorising it to serve 10,000 Hajj pilgrims through integrated travel services that combine flights, ground logistics and on-site support to improve the overall pilgrimage experience.

Report Scope

Report Features Description Market Value (2024) USD 172.5 Billion Forecast Revenue (2034) USD 358.8 Billion CAGR (2025-2034) 7.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Tour Type (International, Domestic), By Tourist Type (Tour Group, Independent Traveler, Package Traveler), By Age Group (26 to 35 Years, 36 to 45 Years, 46 to 55 Years), By Consumer Orientation (Men, Women) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Fly Dubai Saudi Arabia, Al Tayyar Travel Group, Avis Saudi Arabia, Zahid Travel Group, Boudl Hotels & Resorts, Wyndham Hotel Group, InterContinental Hotels Saudi Arabia, Saudi Arabian Airlines, EgyptAir Saudi Arabia, Saddik & Mohammed Attar Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Saudi Arabia Hajj Tourism MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Saudi Arabia Hajj Tourism MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Fly Dubai Saudi Arabia

- Al Tayyar Travel Group

- Avis Saudi Arabia

- Zahid Travel Group

- Boudl Hotels & Resorts

- Wyndham Hotel Group

- InterContinental Hotels Saudi Arabia

- Saudi Arabian Airlines

- EgyptAir Saudi Arabia

- Saddik & Mohammed Attar Company