Global Satellite Reconnaissance Market Size, Share, Industry Analysis Report By Platform (Earth Observation Satellites, Reconnaissance Drones), By Orbit Type (Low Earth Orbit (LEO), Geosynchronous Earth Orbit (GEO), Medium Earth Orbit (MEO), Others), By Application (Intelligence, Surveillance, and Reconnaissance (ISR), Earth Observation & Mapping, Signal Intelligence (SIGINT), Electronic Intelligence (ELINT), Communications Intelligence (COMINT), Others), By End-User (Defense & Intelligence Agencies, Government & Civil Agencies, Commercial Enterprises), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 165157

- Number of Pages: 354

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Role of Generative AI

- Investment and Business Benefits

- U.S. Market Size

- Platform Analysis

- Orbit Type Analysis

- Application Analysis

- End-User Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

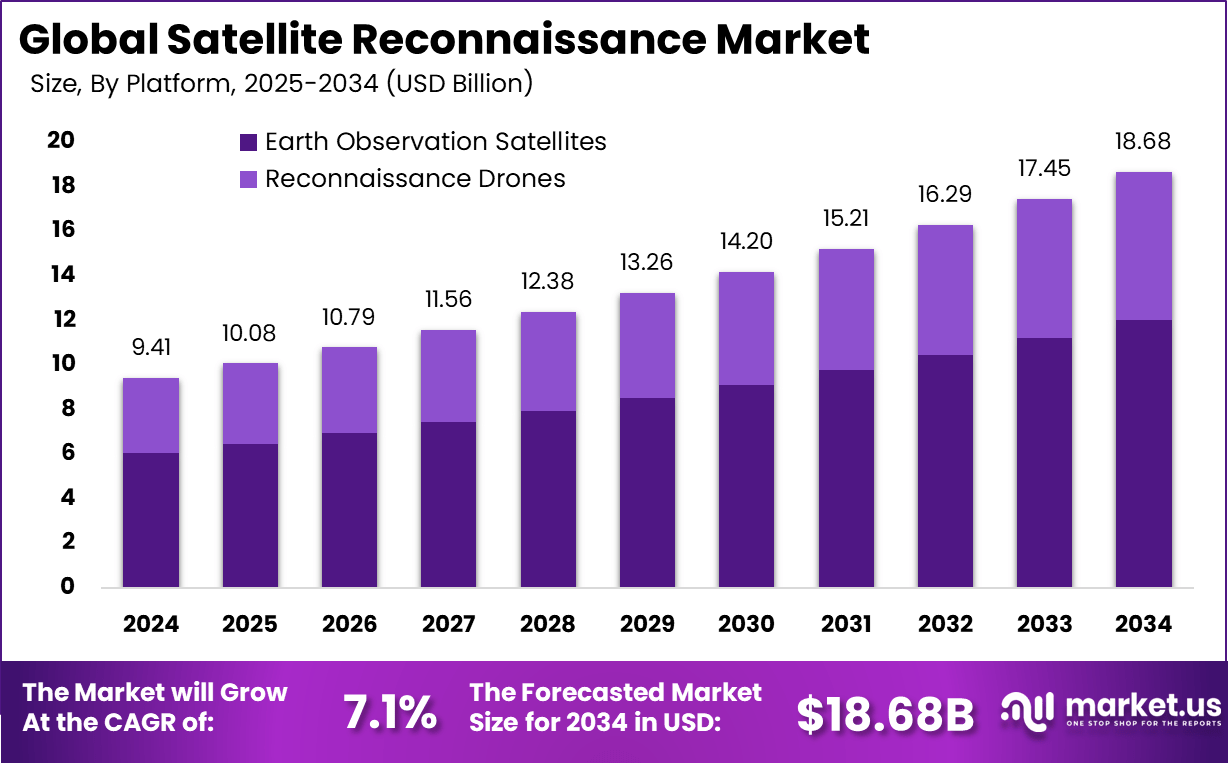

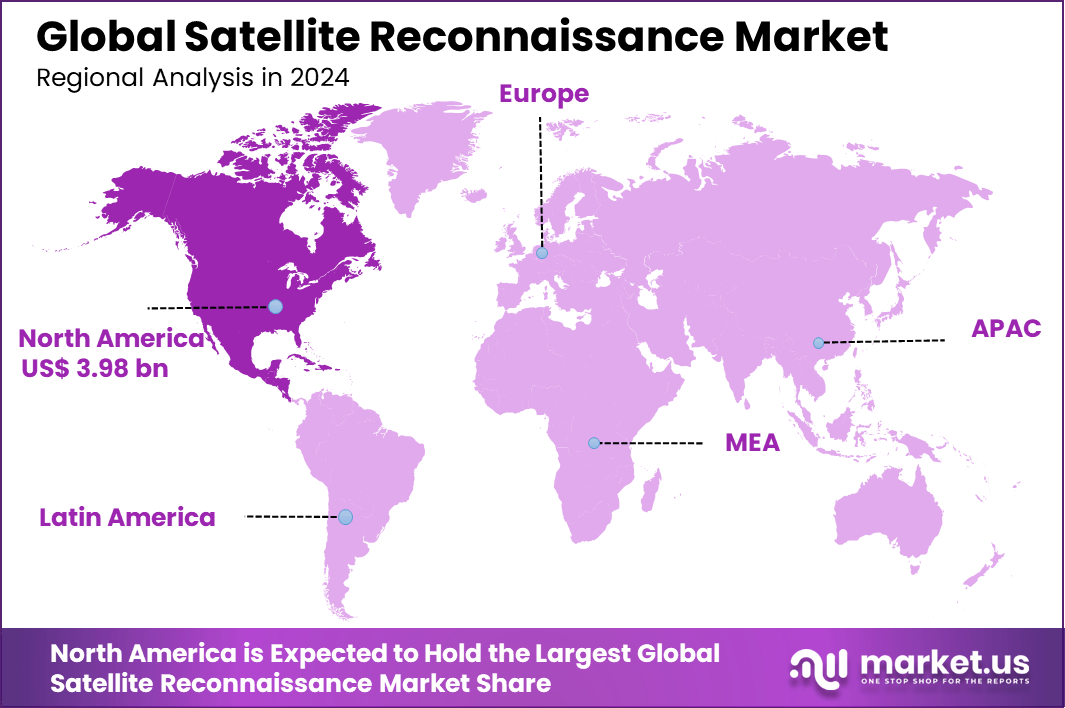

The Global Satellite Reconnaissance Market size is expected to be worth around USD 18.68 billion by 2034, from USD 9.41 billion in 2024, growing at a CAGR of 7.1% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 42.3% share, holding USD 3.98 billion in revenue.

The Satellite Reconnaissance Market revolves around the use of satellites designed to capture high-resolution imagery and data from Earth for military, environmental, and commercial surveillance purposes. These satellites are crucial for intelligence gathering, national security, disaster relief, and monitoring environmental changes. Their capacity to provide real-time, global coverage makes them indispensable tools for both defense and civilian sectors.

The market’s growth is aided by technological advancements that improve satellite imaging and sensor capabilities, enabling enhanced data accuracy and faster decision-making. Top driving factors include an increasing investment in military expenditures, which rose by around 6.8% recently, enhancing demand for advanced reconnaissance technologies. Additionally, the low cost of manufacturing and deploying satellites has driven collaborations and partnerships, boosting production volume.

The market for Satellite Reconnaissance is driven by increasing global investments in defense and national security. Governments are dedicating substantial funds to enhance surveillance capabilities using advanced satellites that offer real-time intelligence and high-resolution imagery. This rise in military spending fuels the adoption of sophisticated reconnaissance technologies that enable monitoring of threats and critical decision-making across defense sectors.

Demand analysis points to a rising need for real-time intelligence where satellites provide immediate, continuous data feeds that enhance situational awareness on the battlefield or in complex environments. The ability of these satellites to deliver up-to-date imagery significantly speeds up military and government response times, improving precision in target identification and threat detection.

For instance, in October 2025, Airbus Defence and Space revealed a new restructuring effort, including a plan to reduce around 2,043 positions, mainly in management roles. The goal is to improve agility and reduce costs, supporting the company’s focus on resilient space and defense operations amid geopolitical tensions.

Key Takeaway

- In 2024, the Earth Observation Satellites segment led the market with a 64.3% share, reflecting their critical role in real-time monitoring, mapping, and defense intelligence operations.

- The Low Earth Orbit (LEO) segment accounted for 42.3%, driven by growing adoption of LEO constellations for faster data transmission and cost-effective surveillance coverage.

- The Intelligence, Surveillance, and Reconnaissance (ISR) segment captured 38.1%, emphasizing its importance in supporting national defense, strategic planning, and situational awareness.

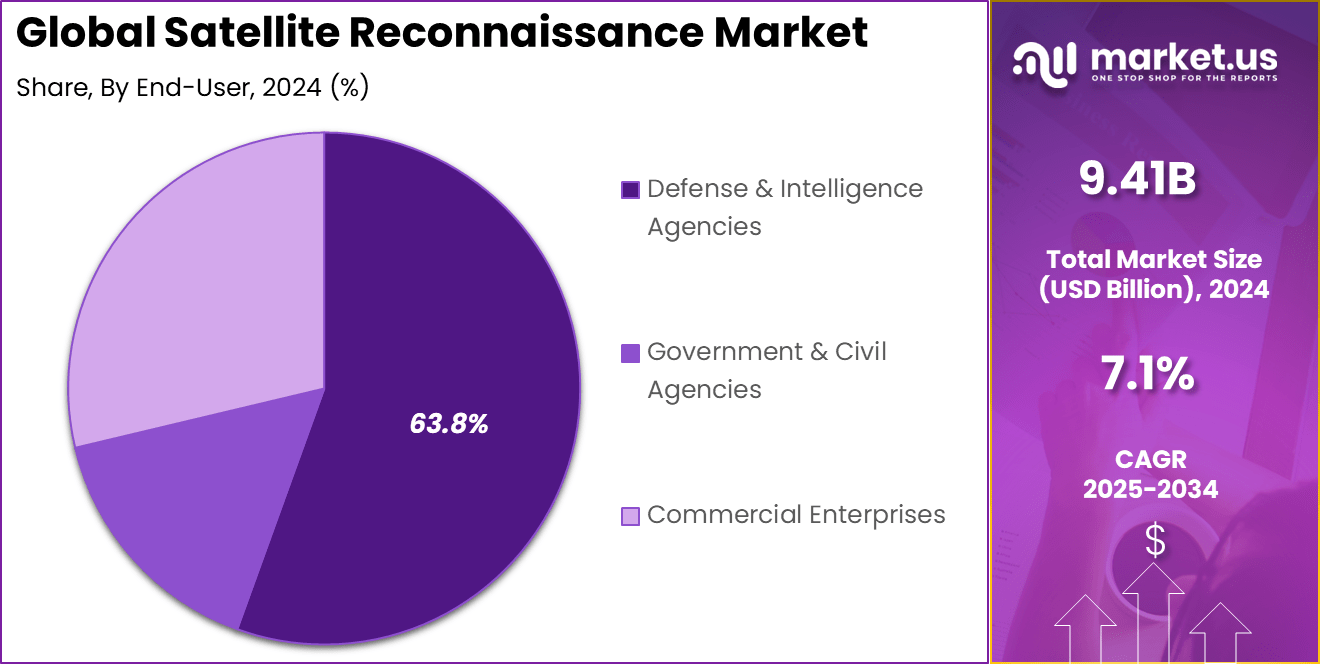

- The Defense & Intelligence Agencies segment dominated with 63.8%, underlining strong investments in satellite-based reconnaissance and space defense capabilities.

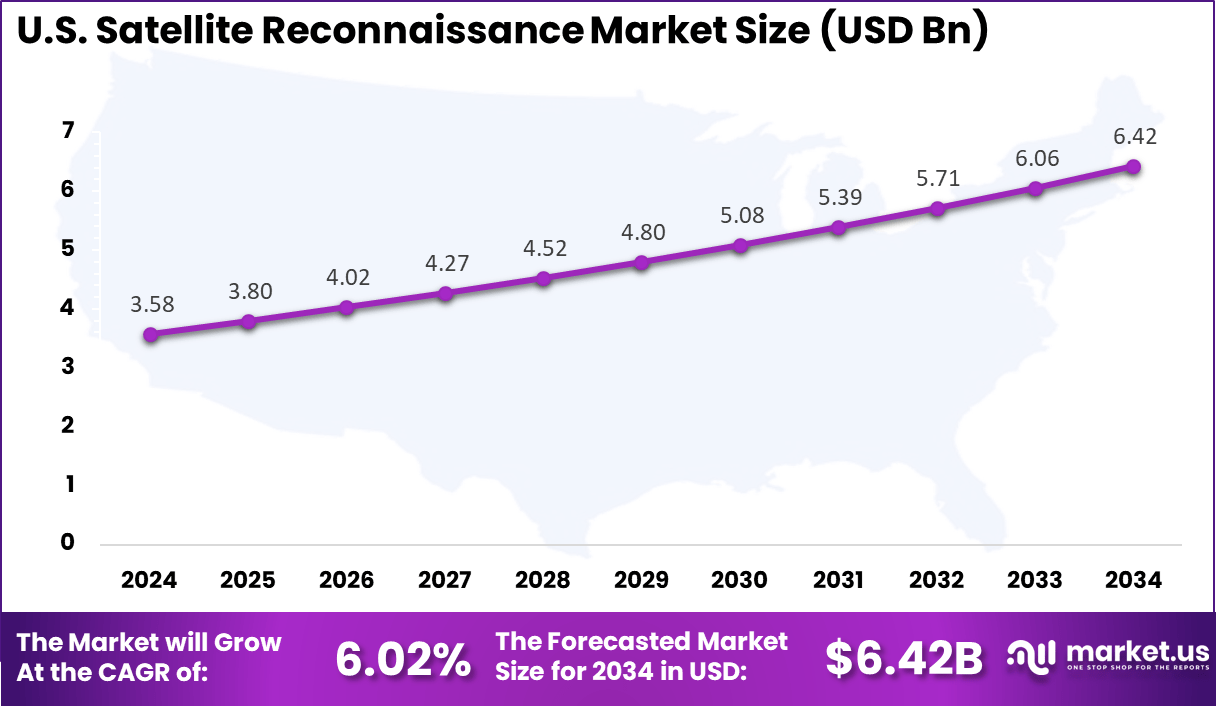

- The US market was valued at USD 3.58 billion in 2024 and is expanding at a healthy CAGR of 6.02%, supported by government programs and private partnerships in satellite technology.

- North America maintained leadership with over 42.3% share, attributed to advanced defense infrastructure, technological innovation, and continuous modernization of reconnaissance networks.

Role of Generative AI

Generative AI has become a key player in satellite reconnaissance, especially in data analysis. It can process and interpret vast amounts of satellite data faster and with fewer errors than traditional methods. This ability to deliver near real-time insights improves how surveillance and intelligence missions are conducted.

Around 54% growth has been observed in generative AI’s role within aerospace and defense, highlighting its practical impact. With the ability to operate autonomously, AI now supports satellites in identifying targets and adjusting operations without constant human control, which enhances decision speed and accuracy.

Generative AI is enabling predictive analysis and anomaly detection, critical in identifying unexpected activities or threats from space imagery. Approximately 45% of satellite data services use AI-driven analytics, mainly in regions like North America. This integration is changing how intelligence agencies approach reconnaissance, making processes more automated and less reliant on manual data handling.

Investment and Business Benefits

Investment opportunities in this sector are robust, driven by the growth of satellite data monetization and foundational infrastructure development. Investors are drawn to companies innovating with AI-powered analytics and direct-to-device satellite connectivity solutions that enable seamless data delivery to smartphones and IoT devices.

The infrastructure ecosystem, including reusable launch vehicles and satellite manufacturing, offers significant returns as demand for satellite networks expands. This space economy growth is considered a new frontier for strategic investment, focusing on data services and launch technology innovation. Businesses benefit from satellite reconnaissance by gaining enhanced national security, improved crisis response, and critical insights supporting strategic decision-making.

These satellites provide actionable intelligence that strengthens military operations and public safety efforts. Additionally, the commercial exploitation of satellite data allows businesses to optimize resources and operational planning across sectors such as agriculture, urban development, and environmental management.

U.S. Market Size

The market for Satellite Reconnaissance within the U.S. is growing tremendously and is currently valued at USD 3.58 billion, the market has a projected CAGR of 6.02%. The market is growing due to increasing defense budgets and advanced satellite technology. Rising geopolitical tensions have triggered greater demand for real-time intelligence, surveillance, and reconnaissance (ISR) capabilities.

Innovative satellite platforms, including high-resolution Earth Observation and Low Earth Orbit systems, offer enhanced accuracy and rapid data access. Additionally, supportive government policies and investments in space modernization programs, such as the U.S. Space Force initiatives, are accelerating technological advancements. Integration of AI and cloud computing further improves satellite data processing, enabling faster decision-making and more effective national security operations.

For instance, in September 2025, Lockheed Martin launched 21 advanced satellites as part of the Space Development Agency’s Tranche 1 Transport Layer. These satellites enhance the Proliferated Warfighter Space Architecture, significantly advancing space-based threat detection and secure military communications. The project embodies U.S. leadership in resilience and rapid innovation in defense space systems.

In 2024, North America held a dominant market position in the Global Satellite Reconnaissance Market, capturing more than a 42.3% share, holding USD 3.98 billion in revenue. This dominance is due to the region’s significant government and defense spending dedicated to advanced space and satellite technologies. Robust investments in next-generation intelligence, surveillance, and reconnaissance (ISR) satellite platforms underpin this market strength.

Additionally, North America benefits from a well-established aerospace and defense ecosystem, home to key contractors like Lockheed Martin, Northrop Grumman, and Raytheon Technologies. Their continuous innovation and collaboration with defense agencies, particularly the U.S. Space Force, drive advancements in satellite capabilities, ensuring superior operational effectiveness and reinforcing North America’s strategic dominance.

For instance, in October 2025, Northrop Grumman reinforced North America’s dominance in satellite reconnaissance by partnering with AI startup Luminary Cloud to develop Physics AI, a physics-based artificial intelligence model that accelerates spacecraft component design. Using NVIDIA’s PhysicsNeMo framework, this AI-driven model can generate detailed spacecraft designs within seconds, significantly reducing development time and improving efficiency.

Platform Analysis

In 2024, The Earth Observation Satellites segment held a dominant market position, capturing a 64.3% share of the Global Satellite Reconnaissance Market. These satellites specialize in capturing high-resolution images and data from the Earth’s surface. This capability makes them essential for various uses, including environmental monitoring, disaster management, and particularly defense-related intelligence gathering.

Their ability to provide timely and detailed imagery has solidified their position as the preferred platform in reconnaissance. As technology advances, these satellites become more sophisticated and cost-effective, encouraging wider deployment and enabling smarter decision-making based on accurate, real-world data.

For Instance, in July 2024, Maxar Technologies released the first images from its next-generation WorldView Legion satellites. These satellites significantly boost Maxar’s Earth imaging capacity with high-resolution 30 cm-class imagery. This enhances their ability to provide near-real-time geospatial data critical for intelligence and environmental monitoring.

Orbit Type Analysis

In 2024, the Low Earth Orbit (LEO) segment held a dominant market position, capturing a 42.3% share of the Global Satellite Reconnaissance Market. Their proximity to Earth provides the advantage of higher resolution imaging and faster data transmission compared to satellites in higher orbits. This makes LEO satellites highly suitable for applications that require real-time or near-real-time information.

The growing adoption of small satellite constellations in LEO has contributed to improving global coverage and revisit times for surveillance purposes. As a result, LEO is the preferred orbit for many reconnaissance operations, especially those focused on intelligence and rapid response.

For instance, in September 2024, Northrop Grumman demonstrated hybrid satellite communications that included connectivity with LEO satellites, supporting resilient and rapid data flow for defense purposes. Their plans include launching over 130 satellites into LEO, which reflects the growing reliance on this orbit for comprehensive surveillance and communications.

Application Analysis

In 2024, the Intelligence, Surveillance, and Reconnaissance (ISR) segment held a dominant market position, capturing a 38.1% share of the Global Satellite Reconnaissance Market. ISR is essential for national security, offering real-time situational awareness, strategic observation, and battlefield intelligence. These applications enable defense agencies to detect threats early, monitor adversary movements, and support tactical decision-making.

ISR’s significant market share highlights its critical role in defense ecosystems worldwide. Ongoing investments in ISR satellite technologies reflect the escalating need for advanced intelligence gathering driven by rising geopolitical tensions.

For Instance, in December 2024, Lockheed Martin prepared to launch its TacSat, a tactical ISR satellite equipped with high-quality infrared sensors and advanced communication systems. TacSat is designed to enable integrated multi-domain military operations and advanced threat tracking.

End-User Analysis

In 2024, the Defense & Intelligence Agencies segment held a dominant market position, capturing a 63.8% share of the Global Satellite Reconnaissance Market. These users depend heavily on satellite reconnaissance for national security, border surveillance, and strategic operations. The sustained investments in defense space programs underscore the crucial role these agencies play in driving the demand for advanced reconnaissance satellites.

Their requirements for persistent and reliable satellite data support continuous upgrades in satellite technologies. This strong demand helps maintain a steady flow of innovations tailored to defense and intelligence needs, reinforcing their leading position in the market.

For Instance, in March 2025, L3Harris Technologies received a $90 million contract from the U.S. Space Force to advance space domain awareness tools critical for tracking satellites and debris, a key defense application supporting national security.

Emerging Trends

Emerging trends in satellite reconnaissance focus on smaller, more agile satellites deployed in large constellations. These small satellites, which now account for about 50% of new launches, offer a cost-effective and flexible approach. They provide better global coverage with lower latency, making satellite data more accessible for various applications such as earth observation and communication.

This shift from larger, single satellites to many smaller ones increases responsiveness and provides almost continuous monitoring capabilities. Another significant trend is the rise of advanced communication networks among satellites using laser crosslinks and intelligent routing. This development supports integrated satellite networks that can share data efficiently and resist disruptions.

Major investments are being made globally to build secure, high-speed satellite constellations, especially in Europe and North America. These networks improve the resilience and throughput of satellite-based reconnaissance, ensuring more reliable data delivery for critical operations.

Growth Factors

The growth of satellite reconnaissance is largely driven by security needs and an expanding range of commercial uses. The demand for timely intelligence in defense has increased sharply, with regional military developments serving as a catalyst.

At the same time, satellite technology supports environmental monitoring, disaster response, and agriculture, showing diverse practical uses outside defense. AI and machine learning amplify the value of satellite data by speeding up processing and improving accuracy, essential given the enormous data volumes generated.

Furthermore, the continued launch of satellites for broadband and exploration fuels growth in this sector. Higher automation through AI in satellites also reduces operational costs and human workload. These technological advancements push the market forward, making satellite reconnaissance more efficient, widespread, and capable of meeting the growing expectations of both military and civilian customers.

Key Market Segments

By Platform

- Earth Observation Satellites

- Reconnaissance Drones

By Orbit Type

- Low Earth Orbit (LEO)

- Geosynchronous Earth Orbit (GEO)

- Medium Earth Orbit (MEO)

- Others

By Application

- Intelligence, Surveillance, and Reconnaissance (ISR)

- Earth Observation & Mapping

- Signal Intelligence (SIGINT)

- Electronic Intelligence (ELINT)

- Communications Intelligence (COMINT)

- Others

By End-User

- Defense & Intelligence Agencies

- Government & Civil Agencies

- Commercial Enterprises

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Rising Military Investments

The increasing focus on national security is a significant factor supporting growth in the satellite reconnaissance market. Governments around the world are expanding their defense budgets to improve their surveillance capabilities. This trend encourages the deployment of advanced satellites that can provide critical intelligence, surveillance, and reconnaissance data.

With more financial resources allocated to defense, countries are investing in the latest satellite technologies that deliver high-resolution images and real-time data. This surge in military spending directly boosts the demand for high-performance reconnaissance satellites, fostering a competitive and innovative market environment.

For instance, in October 2025, Maxar Technologies completed its rebranding into Vantor and Lanteris Space Systems, reflecting a renewed focus on supporting U.S. military and allied space operations. The company signed a contract with the U.S. Space Force to help manage satellite neighborhood awareness, illustrating how increased defense budgets drive investments into advanced satellite capabilities for national security.

Restraint

High Costs and Regulatory Barriers

Developing and launching reconnaissance satellites is an expensive process. The costs involved in manufacturing, testing, and deploying these sophisticated systems are significant, which limits wider adoption, especially among smaller players. Cost barriers prevent new entrants from quickly penetrating the market, maintaining a degree of industry concentration among established companies.

In addition, regulatory restrictions add complexity to satellite operations. Governments impose strict rules on satellite licensing, spectrum use, and data sharing, which can delay projects or increase operational costs. Navigating this legal landscape requires substantial effort and increases the risk for companies operating in the sector.

For instance, in February 2025, Airbus reported challenges linked to the high costs and long timelines involved in designing and building the Oberon SAR satellites for the UK Ministry of Defence. The need to comply with rigorous regulatory standards and protect sensitive data added complexity and expenses to the project.

Opportunities

Advancement in AI and Imaging Technologies

Emerging technologies like artificial intelligence and improved imaging sensors offer promising growth opportunities. AI enhances the processing of satellite data, transforming raw images into useful intelligence more quickly. It allows for better pattern recognition, object detection, and anomaly detection, which are critical for military and civilian applications.

Technological advancements like hyperspectral and synthetic aperture radar imaging expand reconnaissance capabilities in challenging environments. These innovations can be used for environmental monitoring, disaster response, and strategic planning, thereby widening the scope of commercial and government applications in satellite imagery.

For instance, in June 2025, Planet Labs secured a multiyear contract with the German government to provide satellite data enhanced by AI tools for maritime domain awareness. This deal underscores the industry’s opportunity to expand commercial and defense applications through integrating artificial intelligence with satellite imagery.

Challenges

Growing Competition and Market Fragmentation

The increasing number of private companies entering the satellite industry complicates market dynamics. Low-cost satellite launches by small and commercial providers lead to a more fragmented industry with numerous players. This intensifies competition as each tries to capture a share of the growing demand for satellite imagery and data.

Market fragmentation also raises concerns about data exclusivity, security, and service reliability. Companies must continuously innovate and reduce costs while maintaining high standards, which can be challenging in a rapidly changing environment. Keeping pace with technological and regulatory developments becomes essential for remaining competitive.

For instance, in October 2025, Northrop Grumman partnered with a tech startup to accelerate AI-enabled spacecraft design, enabling faster and more cost-effective development of satellite constellations. This reflects the industry shift toward rapid deployment of smaller, more numerous satellites, increasing market competition, and fragmentation.

Key Players Analysis

Maxar Technologies and Airbus Defence and Space lead the satellite reconnaissance market with strong imaging and data delivery capabilities. Lockheed Martin, Northrop Grumman, L3Harris Technologies, and Raytheon Technologies focus on defense-grade satellites and secure communication systems to support global surveillance and intelligence missions. Their combined efforts strengthen real-time monitoring and national security operations worldwide.

Thales Alenia Space and SSTL enhance Europe’s reconnaissance strength with flexible, cost-efficient satellite systems. Planet Labs, BlackSky, ICEYE, and Capella Space are modernizing commercial observation with frequent imaging and radar-based monitoring. Their innovations improve accessibility and reliability in global intelligence data.

Government agencies such as the National Reconnaissance Office (NRO) and European Space Imaging remain central to strategic defense operations. Satellogic expands affordable imaging services for diverse sectors. Collaboration between public and private players is increasing, driving advancements in real-time monitoring and global reconnaissance capabilities.

Top Key Players in the Market

- Maxar Technologies

- Airbus Defence and Space

- Lockheed Martin

- Northrop Grumman

- L3Harris Technologies

- Raytheon Technologies

- Thales Alenia Space

- Planet Labs

- BlackSky

- ICEYE

- Capella Space

- National Reconnaissance Office (NRO)

- European Space Imaging

- Satellogic

- SSTL (Surrey Satellite Technology Ltd)

- Others

Recent Developments

- In June 2025, Airbus Defence and Space announced the completion of a major restructuring plan. The reorganization aims to strengthen its end-to-end responsibility and responsiveness, involving a substantial workforce reduction of up to 2,043 positions, primarily in management roles, to adapt to a challenging business environment and boost operational agility.

- In December 2024, Lockheed Martin’s latest innovation, the Tactical Satellite (TacSat), is prepped for launch aboard a Firefly Aerospace Alpha rocket. Set to deploy in 2025, TacSat is designed to provide high-resolution imagery, advanced sensing, and 5G.MIL connectivity, supporting space-based ISR missions and crisis response capabilities.

Report Scope

Report Features Description Market Value (2024) USD 9.41 Bn Forecast Revenue (2034) USD 18.6 Bn CAGR(2025-2034) 7.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Platform (Earth Observation Satellites, Reconnaissance Drones), By Orbit Type (Low Earth Orbit (LEO), Geosynchronous Earth Orbit (GEO), Medium Earth Orbit (MEO), Others), By Application (Intelligence, Surveillance, and Reconnaissance (ISR), Earth Observation & Mapping, Signal Intelligence (SIGINT), Electronic Intelligence (ELINT), Communications Intelligence (COMINT), Others), By End-User (Defense & Intelligence Agencies, Government & Civil Agencies, Commercial Enterprises) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Maxar Technologies, Airbus Defence and Space, Lockheed Martin, Northrop Grumman, L3Harris Technologies, Raytheon Technologies, Thales Alenia Space, Planet Labs, BlackSky, ICEYE, Capella Space, National Reconnaissance Office (NRO), European Space Imaging, Satellogic, SSTL (Surrey Satellite Technology Ltd), Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Satellite Reconnaissance MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

Satellite Reconnaissance MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Maxar Technologies

- Airbus Defence and Space

- Lockheed Martin

- Northrop Grumman

- L3Harris Technologies

- Raytheon Technologies

- Thales Alenia Space

- Planet Labs

- BlackSky

- ICEYE

- Capella Space

- National Reconnaissance Office (NRO)

- European Space Imaging

- Satellogic

- SSTL (Surrey Satellite Technology Ltd)

- Others