Global Satellite NTN Market Size, Share, Industry Analysis Report By Component (Hardware, Software), By Frequency (L-Band, S-Band, C-Band, KU-Band, Ka-Band, HF/VHF/UHF-Bands), By Orbit (LEO, GEO, MEO), By Sector (Commercial, Defense, Government), By Technology (NR NTN, IOT NTN)), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 157711

- Number of Pages: 366

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Role of Generative AI

- U.S. Satellite NTN Market Size

- Growth Factors in Satellite NTN

- Emerging Trends in Satellite NTN

- Component Analysis

- Frequency Analysis

- Orbit Analysis

- Sector Analysis

- Technology Analysis

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

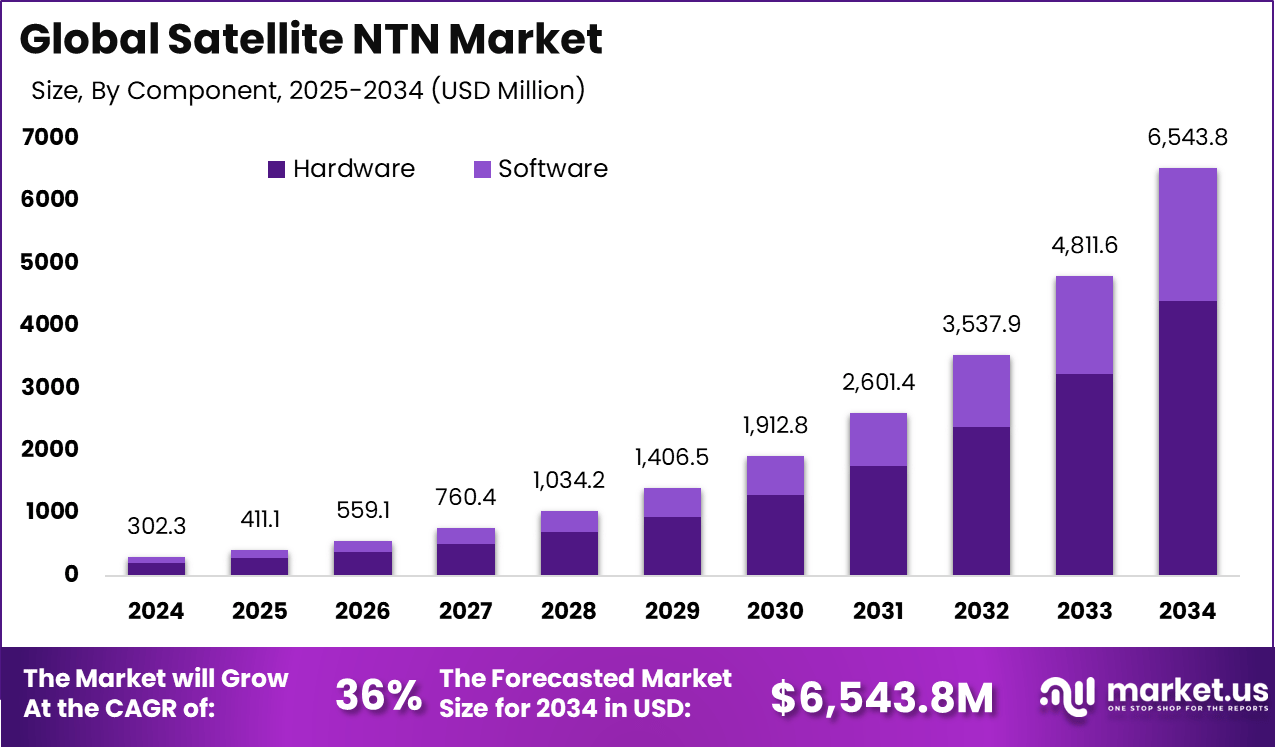

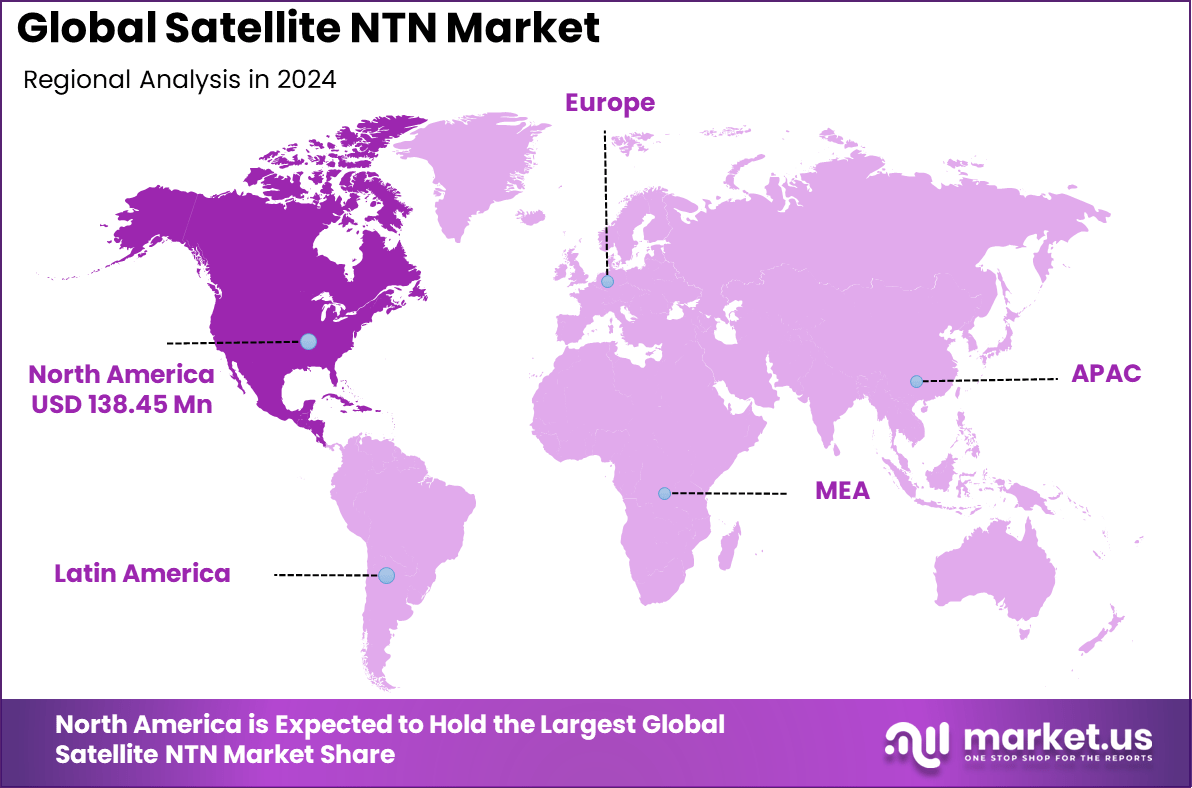

The Global Satellite NTN Market size is expected to be worth around USD 6,543.8 million by 2034, from USD 302.3 million in 2024, growing at a CAGR of 36% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 45.8% share, holding USD 138.45 million in revenue.

The Satellite Non-Terrestrial Network (NTN) market refers to communication systems that use satellites operating above the Earth’s surface in orbits such as Low Earth Orbit (LEO), Medium Earth Orbit (MEO), and Geostationary Orbit (GEO). These systems extend wireless connectivity beyond the reach of traditional terrestrial networks, providing seamless internet access and communication services to remote, underserved, and mobile areas like ships, aircraft, and vehicles.

One of the main drivers of this market is the growing demand for global connectivity, especially in rural and hard-to-reach areas where terrestrial infrastructure is limited or absent. The increasing use of Internet of Things (IoT) devices, expansion of smart city projects, and the rise in remote work are creating new demand for reliable and consistent communication coverage.

For instance, in August 2024, Lockheed Martin announced the acquisition of satellite products manufacturer Terran Orbital for $450 million. This strategic acquisition enhances Lockheed’s capabilities in satellite technology, particularly in the growing Satellite Non-Terrestrial Network (NTN) market. By integrating Terran’s advanced satellite buses and systems, Lockheed aims to strengthen its position in the rapidly expanding space communications sector.

Demand for satellite NTN services is expanding in sectors that require real-time data transmission and global coverage. Industries such as maritime logistics, aviation, disaster recovery, and national defense rely on NTNs for secure and continuous communication. In emerging markets, governments and telecom providers are using satellite connectivity to bridge the digital divide and enable internet access in rural regions.

According to Market.us, In 2024, the global Small Satellites Market was valued at USD 4.43 billion and is projected to reach around USD 14.08 billion by 2033. The market is expected to expand at a strong CAGR of 13.7% during 2024–2033, reflecting rising adoption of small satellites for communication, earth observation, navigation, and defense applications.

Key Takeaway

- In 2024, the Hardware segment led the market, holding 67.3% share.

- By frequency, the Ku-Band segment dominated with 28.6% share.

- By orbit, the GEO segment was the leader, accounting for 46.5% share.

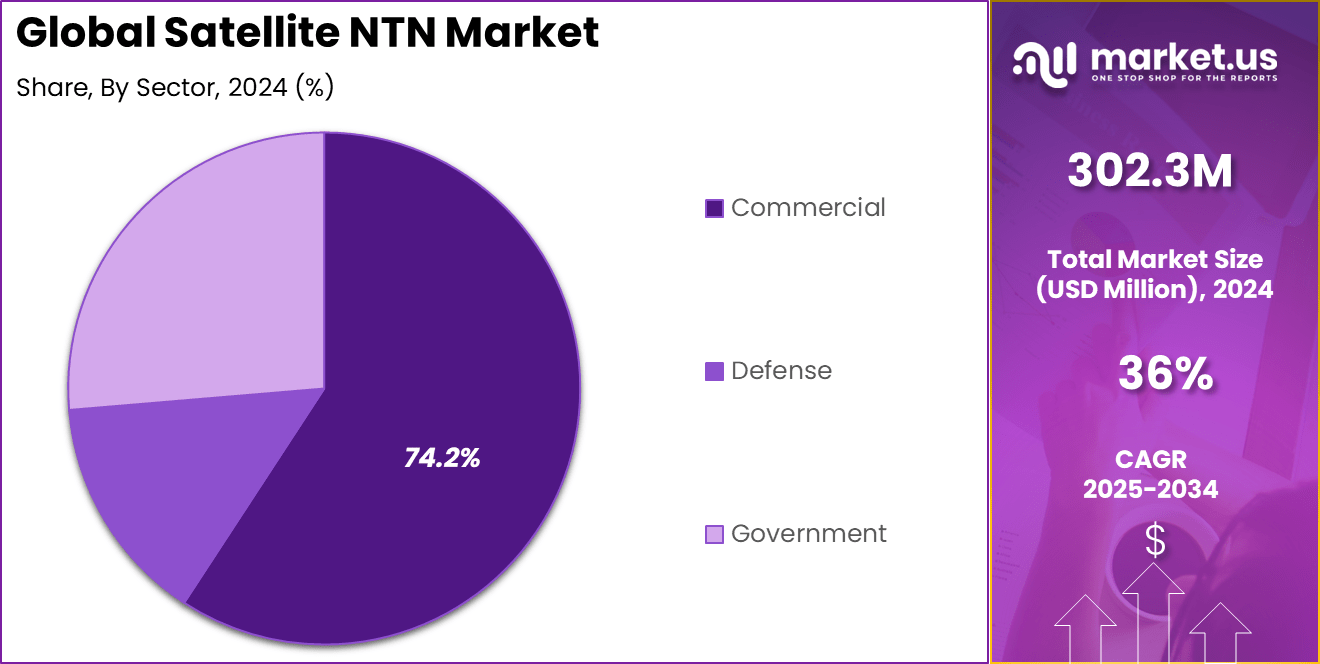

- The Commercial segment held the top position, securing 74.2% share in 2024.

- By application, IoT NTN dominated strongly with 78.3% share.

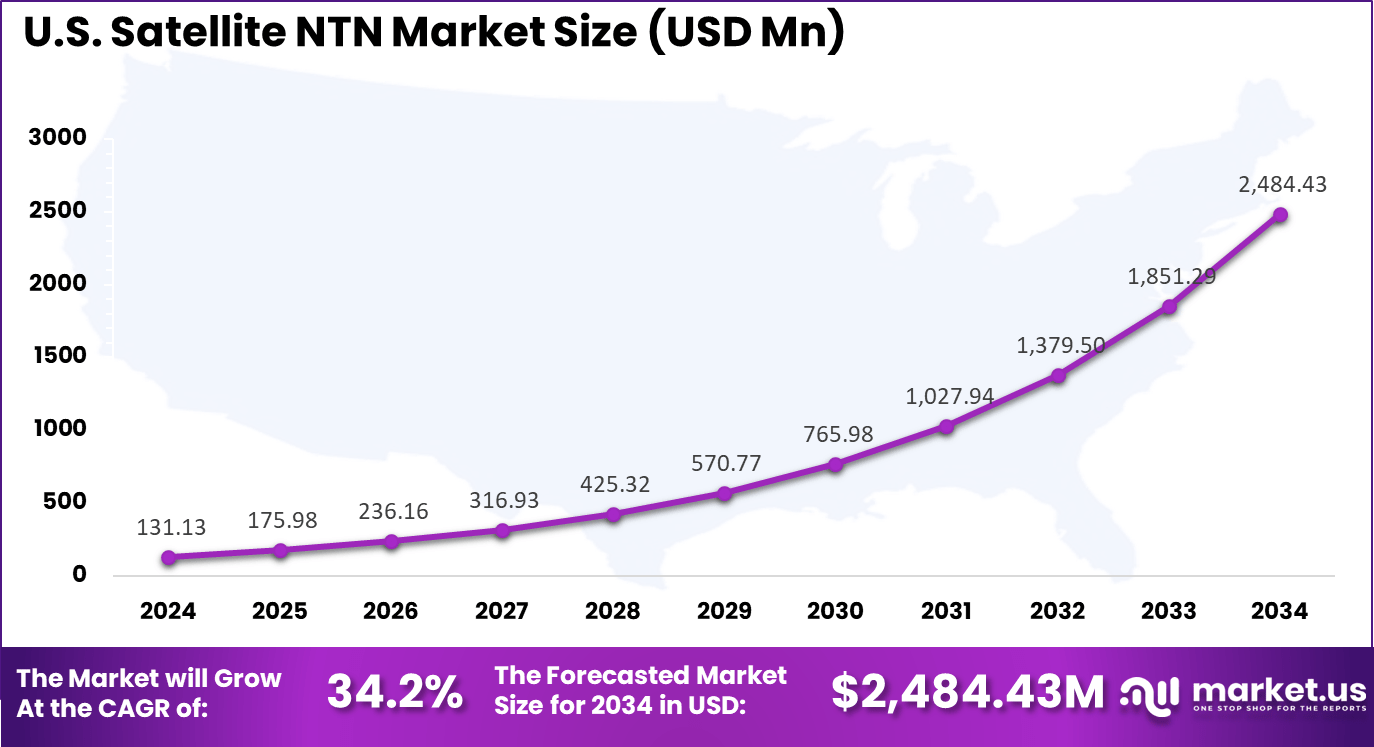

- The U.S. market was valued at USD 131.13 Million in 2024, growing at a rapid 34.2% CAGR.

- North America led globally, capturing 45.8% share of the market in 2024.

Role of Generative AI

Key Points Description Realistic Data Synthesis Generative AI generates missing sensor or wireless channel data, improving network resilience and seamless connectivity for Satellite NTNs. Semantic Compression It compresses user intent and data into compact messages, enabling low-latency communication and efficient use of satellite bandwidth. Predictive Resource Allocation GenAI predicts dynamic network states for proactive resource allocation, increasing responsiveness of NTN infrastructure. Digital Twin Management It powers digital twin updates for NTN systems, supporting privacy-preserving simulation and operational planning for satellites. Intelligent Channel Shaping GenAI supports adaptive channel formation with intelligent surfaces, optimizing link quality and preventing blockage in NTN environments. U.S. Satellite NTN Market Size

The market for Satellite NTN within the U.S. is growing tremendously and is currently valued at USD 131.13 million, the market has a projected CAGR of 34.2%. The market is growing due to the increasing need for reliable, high-speed connectivity in rural and underserved areas. As traditional terrestrial networks struggle to provide coverage in remote regions, satellite NTNs offer an effective solution.

Additionally, the U.S. government’s support for space infrastructure, alongside advancements in 5G and 6G technologies, is driving innovation and investment. The demand for global connectivity and enhanced communication capabilities for industries like defense, IoT, and autonomous vehicles has further fueled the growth.

For instance, in August 2025, the U.S. Space Force successfully launched the NTS-3 satellite, built by L3Harris Technologies. This launch reinforces the U.S.’s dominance in Satellite Non-Terrestrial Networks (NTN), marking a significant milestone in advancing military and commercial satellite communications. The NTS-3 satellite is designed to enhance next-generation communication capabilities, supporting 5G and future 6G networks.

In 2024, North America held a dominant market position in the Global Satellite NTN Market, capturing more than a 45.8% share, holding USD 138.45 million in revenue. The dominance is due to its strong technological infrastructure, government support, and rapid adoption of 5G and emerging 6G technologies.

The region’s focus on improving connectivity in rural and remote areas, coupled with substantial investments in space-based communications, has driven growth. Additionally, North America’s leadership in satellite manufacturing, innovative startups, and strategic partnerships among telecom providers and satellite companies further solidifies its market dominance in the NTN sector.

For instance, in September 2024, Telesat secured $2.54 billion in funding from the Canadian government to support its Lightspeed LEO satellite constellation project. This significant investment strengthens North America’s dominance in the Satellite Non-Terrestrial Network (NTN) market. The Lightspeed constellation will enhance global connectivity, especially in remote and underserved regions, by providing high-speed, low-latency communication.

Growth Factors in Satellite NTN

Key Factors Description Demand for Global Connectivity Need for high-speed internet in remote, rural, and underserved areas drives adoption of Satellite NTN solutions. LEO Deployment Acceleration Increased deployment of LEO satellites provides enhanced coverage and lower latency compared to traditional geostationary systems. Telco-Satellite Partnerships Strategic alliances between satellite operators and mobile carriers accelerate rollout and mainstream integration of NTNs. 5G NTN Backhaul Demand for reliable, high-capacity 5G backhaul in challenging geographies increases the role of NTN. Cost Innovation Advances such as reusable launch systems and optimized hardware reduce overall costs and increase commercial viability. Emerging Trends in Satellite NTN

Key Trends Description LEO Megaconstellations Deployment of extensive LEO satellite constellations delivers low-latency, high-speed broadband globally. 5G Integration NTN and terrestrial 5G network convergence enables hybrid connectivity and seamless user experiences in underserved regions. Miniaturized Hardware Advancements in compact, energy-efficient satellite payloads reduce deployment costs and expand deployment flexibility. High-Throughput Satellites Adoption of Ka-/Ku-band high-throughput satellites increases data speeds and supports bandwidth-intensive enterprise and consumer services. NTN-as-a-Service Models Service-oriented business models allow enterprises in remote or critical sectors to access NTN capacity as scalable, managed offerings. Component Analysis

In 2024, The Hardware segment held a dominant market position, capturing a 67.3% share of the Global Satellite NTN Market. The dominance is due to the growing need for advanced satellite communication equipment, including antennas, transceivers, and ground infrastructure, essential for NTN deployment.

The rapid rollout of LEO, MEO, and GEO satellite constellations has increased demand for compact, energy-efficient, and high-performance hardware. As satellite networks play a bigger role in enabling 5G and future 6G, the need for reliable, scalable hardware solutions continues to grow, prompting increased investment and innovation in this segment.

For Instance, in April 2025, Vicinity and EnSilica announced a collaboration on a €10 million project to accelerate the development of next-generation satellite user terminals, specifically targeting the hardware needs of Satellite Non-Terrestrial Networks (NTN). The partnership aims to create advanced, high-performance terminals that will enable faster, more reliable satellite communications, supporting the growing demand for NTN services.

Frequency Analysis

In 2024, the Ku-Band segment held a dominant market position, capturing a 28.6% share of the Global Satellite NTN Market. This dominance is due to the Ku-band’s ability to offer a balanced combination of bandwidth, capacity, and coverage, making it ideal for high-throughput satellite communications.

Its suitability for both commercial and government applications, along with its cost-effectiveness and efficient use of spectrum, has driven its widespread adoption in NTN networks, especially for broadband services, 5G integration, and remote connectivity solutions.

For instance, in June 2025, Kymeta unveiled a groundbreaking dual-band antenna designed for multi-orbit satellite connectivity, significantly advancing the use of Ku-Band frequency in Satellite Non-Terrestrial Networks (NTN). This innovative antenna enables seamless communication across different satellite constellations, including Low Earth Orbit (LEO), Medium Earth Orbit (MEO), and Geostationary Orbit (GEO) satellites.

Orbit Analysis

In 2024, The GEO segment held a dominant market position, capturing a 46.5% share of the Global Satellite NTN Market. This dominance is due to their ability to provide broad, consistent coverage over large areas with minimal latency, making them ideal for communication services.

Their established infrastructure and long operational lifespans also contribute to their continued market leadership. GEO satellites are especially valuable for broadcast, broadband, and critical communication services, ensuring reliable connectivity in both urban and remote regions.

For Instance, in February 2025, the European Space Agency (ESA) and the Seamless Air Alliance partnered to advance 5G Non-Terrestrial Network (NTN) connectivity for aviation. This collaboration focuses on enhancing in-flight communication by integrating satellite networks, including Geostationary Earth Orbit (GEO) satellites, to provide reliable, high-speed connectivity.

Sector Analysis

In 2024, The Commercial segment held a dominant market position, capturing a 74.2% share of the Global Satellite NTN Market. This dominance is due to the increasing demand for satellite-based services across industries such as telecommunications, broadband, and media.

Commercial applications benefit from the scalability, reliability, and global reach of satellite networks, which are essential for providing connectivity in remote areas. Additionally, the growth of 5G services and IoT solutions further drives the adoption of satellite NTNs in commercial sectors, fostering continued market growth.

For Instance, in February 2025, Eutelsat, MediaTek, and Airbus announced the world’s first 5G Non-Terrestrial Network (NTN) connection, leveraging OneWeb’s Low Earth Orbit (LEO) satellites. This collaboration marks a significant milestone in the commercial sector, enabling global, high-speed 5G connectivity, especially in remote and underserved regions.

Technology Analysis

In 2024, The IoT NTN segment held a dominant market position, capturing a 78.3% share of the Global Satellite NTN Market. This dominance is due to the rapid growth of the Internet of Things (IoT) and the increasing need for reliable, low-latency connectivity in remote and rural areas.

Satellite NTNs offer the ideal solution for connecting IoT devices across vast geographical areas, including regions where traditional terrestrial networks are unavailable. The expansion of smart cities, industrial IoT, and agriculture further drives the demand for satellite-based IoT networks.

For Instance, in March 2025, General Dynamics (GD) announced a partnership with Skylo to offer satellite-cellular Internet of Things (IoT) coverage. This collaboration focuses on expanding IoT NTN (Non-Terrestrial Network) capabilities by integrating satellite connectivity with cellular networks, providing global coverage for IoT devices in remote and underserved areas.

Key Market Segments

By Component

- Hardware

- RF Front End

- Antenna

- Onboard Processor Unit

- Others

- Software

By Frequency

- L-Band

- S-Band

- C-Band

- KU- Band

- Ka-Band

- HF/VHF/UHF-Bands

By Orbit

- LEO

- GEO

- MEO

By Sector

- Commercial

- Defense

- Government

By Technology

- NR NTN

- IOT NTN

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Demand for Connectivity in Remote Regions

Satellite NTNs offer a critical solution for providing connectivity in remote areas where traditional terrestrial networks struggle. These regions, including rural, mountainous, and isolated islands, often face challenges like difficult terrain or economic barriers.

Satellite technology can bypass these constraints, delivering reliable internet access and bridging the digital divide, thereby enabling communication, economic development, and access to education and healthcare in underserved areas.

For instance, in August 2025, Anritsu enhanced its 5G testing capabilities with the integration of satellite network support, addressing the growing demand for connectivity in remote regions. This development enables the testing of satellite Non-Terrestrial Networks (NTN) alongside traditional 5G networks, ensuring reliable connectivity even in underserved and difficult-to-reach areas.

Restraint

High Infrastructure and Launch Costs

Establishing satellite constellations requires significant financial investment, covering satellite launches, ground infrastructure, and operational maintenance. The high costs can be a hindrance to small businesses or new companies in their growth. These expenses also pose a challenge for scaling operations or achieving profitability in the early stages, limiting the pace at which satellite NTNs can be deployed globally.

For instance, in September 2025, a French startup secured €31 million in funding for its Satellite Non-Terrestrial Network (NTN) 5G project. This investment will help address the high infrastructure and launch costs associated with satellite constellations. By focusing on NTN integration with 5G networks, the startup aims to enhance global connectivity, particularly in underserved regions.

Opportunities

Advancements in Satellite Technology

Recent advancements in satellite design, including miniaturization and more cost-efficient propulsion systems, are significantly enhancing the feasibility of satellite NTNs. Smaller and lighter satellites reduce launch and operational costs, making them more accessible for a range of organizations.

These technological innovations allow for larger satellite constellations, improving global coverage, network reliability, and scalability. The progress of satellite networks for telecommunications can lead to greater accessibility and coverage, particularly in remote and service-deficient areas.

For instance, in February 2025, the UK government announced a £16 million investment aimed at advancing satellite communications technology. This funding will support the development of innovative satellite systems to enhance connectivity, particularly in remote and underserved areas.

Challenges

Complexity of Integration and Interoperability

Despite strong enthusiasm for cross-sector growth, the satellite NTN market faces real challenges in integrating with diverse terrestrial network systems and industry applications. Different sectors, from shipping to agriculture and defense, have their own communication standards and operational protocols.

Achieving smooth interoperability between satellite NTNs and existing networks requires complex engineering, extensive testing, and close coordination with regulatory authorities. Even small issues in compatibility or hardware-software integration can disrupt service continuity and dampen user confidence.

Another layer of challenge comes from country-specific regulations governing spectrum use and orbital management, often resulting in fragmented rules and prolonged approval processes. Infrastructure costs remain high, and both operational and technical risks, like orbital congestion and potential spectrum interference, persist as more satellites crowd into popular orbits.

Key Players Analysis

Airbus, Thales Alenia Space, and NEC Corporation are leading players that focus on advanced payloads, broadband satellite connectivity, and strong ground-based systems. Their work supports global coverage and smooth integration of satellite non-terrestrial networks. These companies are shaping the foundation of high-capacity communication systems used in both commercial and defense sectors.

Kongsberg, Analog Devices, Lockheed Martin, and Safran strengthen the market with precision engineering and defense-grade solutions. Analog Devices delivers advanced semiconductor systems, while Lockheed Martin ensures secure satellite communication. Safran and Kongsberg provide critical subsystems that enhance reliability. Their combined expertise drives innovation and meets the growing need for resilient satellite networks.

Honeywell, L3Harris, Teledyne, and Smiths Interconnect add value through avionics and secure communication. Qorvo, Mercury Systems, Mini-Circuits, BAE Systems, and Filtronic contribute RF technologies and microwave systems. These firms improve data transmission speed, reduce latency, and expand application areas.

Top Key Players in the Market

- Airbus

- Thales Alenia Space

- NEC Corporation

- Kongsberg

- Analog Devices Inc.

- Lockheed Martin Corporation

- Safran

- Honeywell International Inc.

- L3Harris Technologies

- Teledyne Technologies

- Smiths Interconnect

- Qorvo Inc.

- Mercury Systems Inc.

- Mini-Circuits

- BAE Systems

- Filtronic PLC

- Others

Recent Developments

- In September 2025, Nokia made significant strides in advancing satellite-based 5G and 6G connectivity by working with the 3GPP to integrate Non-Terrestrial Networks (NTN) into global communications. This collaboration is focused on enabling seamless satellite communication across 6G networks, enhancing coverage, particularly in remote and rural areas.

- In December 2024, Honeywell was selected by MDA Space Ltd. to deliver satellite control systems, including Reaction Wheel Assemblies and Magnetometer Units. These components are essential for space-based communications, enhancing Honeywell’s role in satellite technology.

Report Scope

Report Features Description Market Value (2024) USD 302.3 Mn Forecast Revenue (2034) USD 6,543.8 Mn CAGR(2025-2034) 36% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software), By Frequency (L-Band, S-Band, C-Band, KU-Band, Ka-Band, HF/VHF/UHF-Bands), By Orbit (LEO, GEO, MEO), By Sector (Commercial, Defense, Government), By Technology (NR NTN, IOT NTN) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Airbus, Thales Alenia Space, NEC Corporation, Kongsberg, Analog Devices Inc., Lockheed Martin Corporation, Safran, Honeywell International Inc., L3Harris Technologies, Teledyne Technologies, Smiths Interconnect, Qorvo Inc., Mercury Systems Inc., Mini-Circuits, BAE Systems, Filtronic PLC, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Airbus

- Thales Alenia Space

- NEC Corporation

- Kongsberg

- Analog Devices Inc.

- Lockheed Martin Corporation

- Safran

- Honeywell International Inc.

- L3Harris Technologies

- Teledyne Technologies

- Smiths Interconnect

- Qorvo Inc.

- Mercury Systems Inc.

- Mini-Circuits

- BAE Systems

- Filtronic PLC

- Others