Global Rooftop Solar PV Market Size, Share, And Business Benefits By Deployment (Terrace Mounted, Pole Mounted), By Technology (Thin Film, Crystalline Silicon), By Grid Type (Off-Grid, Grid Connected), By End-Use (Residential, Commercial, Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 154882

- Number of Pages: 331

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

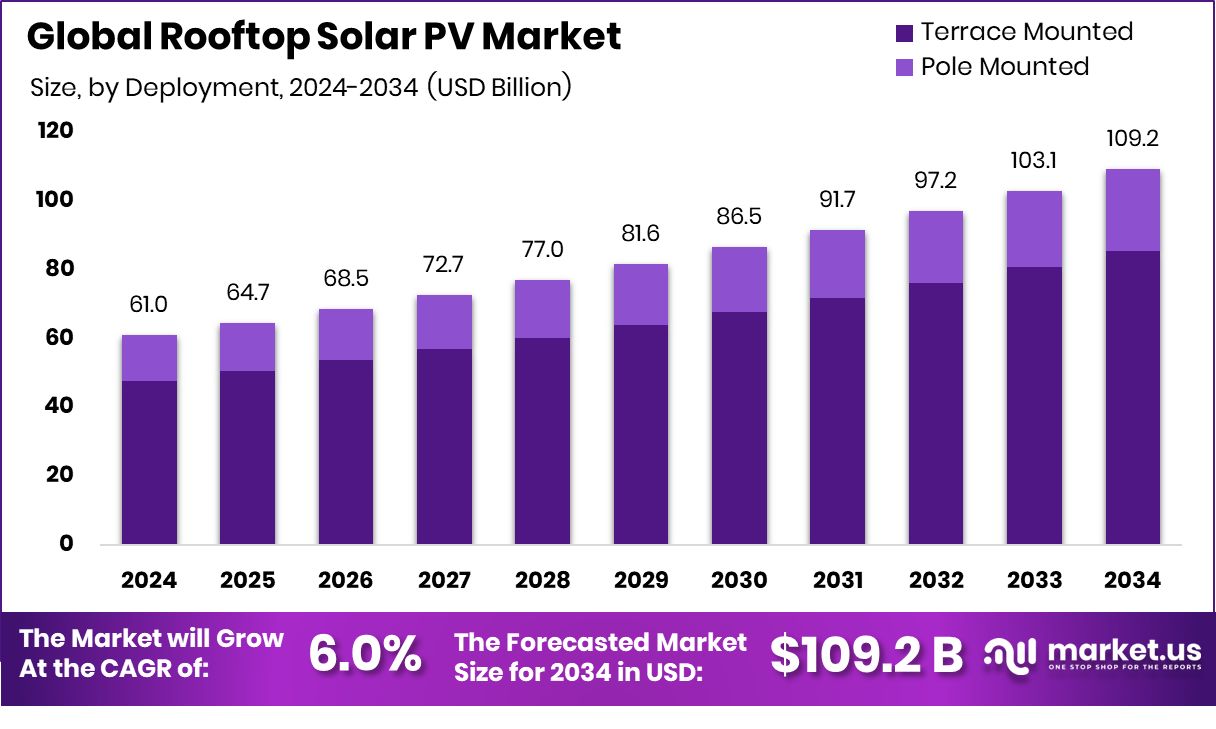

The Global Rooftop Solar PV Market is expected to be worth around USD 109.2 billion by 2034, up from USD 61.0 billion in 2024, and is projected to grow at a CAGR of 6.0% from 2025 to 2034. Strong policy support and high solar potential drove Asia Pacific’s USD 21.2 Bn growth.

Rooftop Solar Photovoltaic (PV) refers to solar power systems installed on the rooftops of residential, commercial, or industrial buildings. These systems convert sunlight directly into electricity using solar panels mounted on the roof surface. The generated electricity can either be consumed on-site, stored in batteries, or fed back into the grid, depending on the system configuration and local energy policies.

The rooftop solar PV market is growing as more individuals, businesses, and institutions seek cost-effective and cleaner alternatives to grid power. The market includes panel manufacturers, system installers, storage integrators, and utility partners. It has witnessed steady expansion due to the falling cost of solar modules, supportive government incentives, and the rising cost of conventional electricity.

Rooftop PV is particularly attractive in regions with high solar irradiation and unstable grid power, where energy independence and savings are strong motivators for adoption. Recent developments, such as the Trump-era EPA seeking to recover $7 billion allocated for rooftop solar grants and the MNRE offering ₹20 million in funding to selected startups for rooftop solar innovation, further underline the critical role of public funding and regulatory decisions in shaping the market’s direction.

One of the key growth factors is the global shift toward renewable energy and the increasing pressure to reduce greenhouse gas emissions. Rooftop PV enables consumers to generate clean power at the point of use, avoiding transmission losses and contributing to climate targets.

Additionally, technological improvements in panel efficiency and energy storage have made rooftop systems more viable and productive over time. In line with these efforts, Great British Energy has allocated £10 million to support expanded rooftop solar deployment, encouraging broader access to clean energy in the UK market.

Demand is also being driven by rising electricity bills and energy insecurity in both developing and developed regions. Households and commercial buildings are turning to solar rooftops not only for economic benefits but also to enhance energy reliability. Urbanization and the spread of smart city initiatives further strengthen this demand by integrating rooftop solar with modern infrastructure.

Financial activity is also increasing, with Dugar Finance, a rooftop solar-focused NBFC, securing $3 million through debt funding to support installations and services in key markets. Additionally, regional governments are scaling up deployments, as seen in Telangana’s recent tender for the development of 81 MW rooftop solar capacity, signaling the growing institutional push toward decentralized solar adoption.

Key Takeaways

- The Global Rooftop Solar PV Market is expected to be worth around USD 109.2 billion by 2034, up from USD 61.0 billion in 2024, and is projected to grow at a CAGR of 6.0% from 2025 to 2034.

- In the Rooftop Solar PV Market, terrace-mounted systems dominate with a 78.3% deployment share in 2024.

- Crystalline silicon technology leads the Rooftop Solar PV Market, capturing a strong 83.9% share globally.

- Grid-connected systems account for 69.2% of the Rooftop Solar PV Market, reflecting growing utility integration trends.

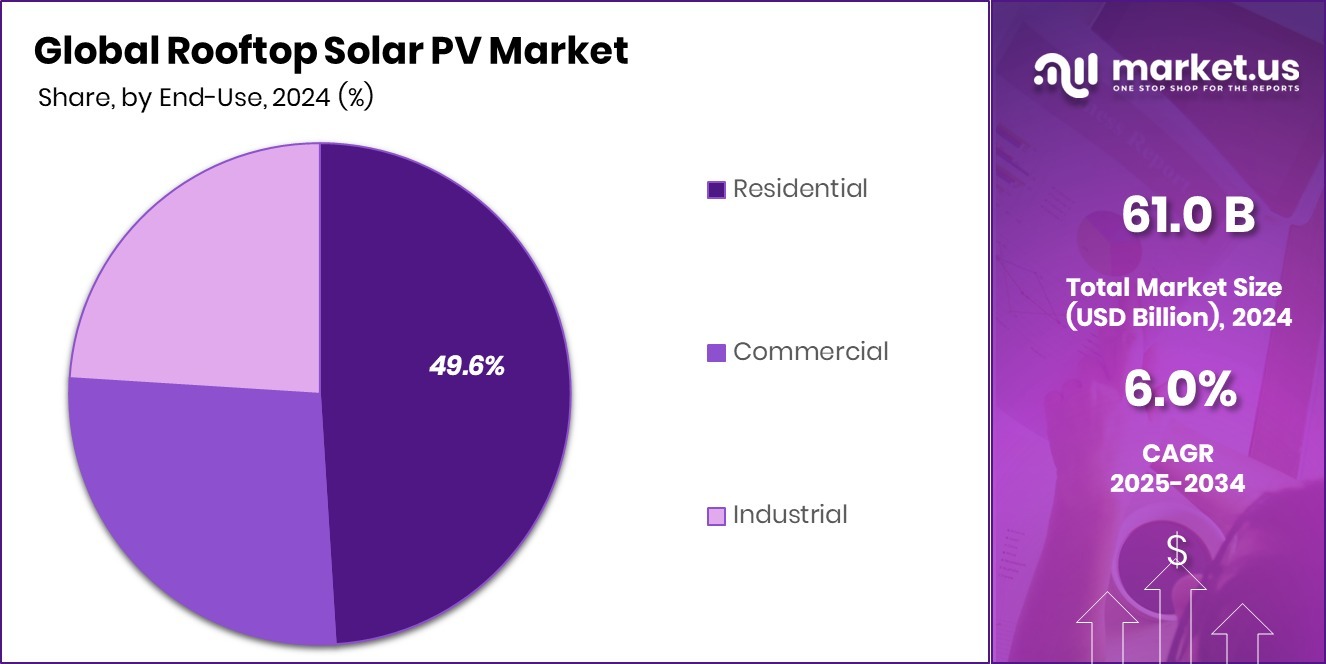

- The residential segment holds 49.6% in the Rooftop Solar PV Market, driven by rising household solar adoption.

- The Asia Pacific market value reached approximately USD 21.2 billion during the same year.

By Deployment Analysis

Terrace-mounted systems dominate the rooftop solar PV market with 78.3%.

In 2024, Terrace Mounted held a dominant market position in the By Deployment segment of the Rooftop Solar PV Market, with a 78.3% share. This high share reflects the strong preference for terrace installations, especially in urban and semi-urban areas where open rooftop spaces are more readily available than sloped or tiled roofs.

Terrace mounted systems offer flexibility in orientation and tilt angle, allowing users to maximize solar energy generation throughout the year. The installation process is comparatively straightforward and cost-effective, especially for flat concrete roofs common in residential and commercial buildings.

The dominance of terrace-mounted systems can also be linked to their adaptability for various building types, including individual homes, apartment complexes, schools, and commercial establishments. These systems enable better access for maintenance and cleaning, which helps sustain long-term performance and efficiency. Additionally, terrace installations often face fewer structural limitations and are less obstructed by shading, further supporting their widespread adoption.

The availability of net metering policies and rooftop-specific subsidies in several regions has also played a role in boosting the demand for terrace-mounted configurations. As rooftop solar continues to expand, terrace-mounted systems are expected to remain the preferred deployment type due to their practical advantages and alignment with user expectations.

By Technology Analysis

Crystalline silicon leads the rooftop solar PV market technology at 83.9%.

In 2024, Crystalline Silicon held a dominant market position in the By Technology segment of the Rooftop Solar PV Market, with an 83.9% share. This leading position was driven by the widespread use of crystalline silicon panels due to their high efficiency, long lifespan, and proven performance across varied climatic conditions.

Crystalline silicon technology, which includes both monocrystalline and multicrystalline variants, has become the preferred choice for rooftop installations, particularly where space optimization and power output are critical considerations.

The dominance of crystalline silicon also reflects its strong manufacturing base and established supply chain, which have contributed to consistent cost reductions over recent years. These panels are known for their higher energy conversion rates, making them suitable for rooftop applications where limited space must deliver maximum output. Their durability and resistance to environmental wear have further reinforced consumer trust, especially in residential and commercial deployments.

In addition, supportive government policies and financing models have enabled mass adoption of crystalline silicon systems, particularly in markets where rooftop solar is promoted as a decentralized energy solution. The 83.9% share highlights the continued reliance on crystalline silicon as the foundation technology for rooftop solar PV installations globally in 2024.

By Grid Type Analysis

Grid-connected systems drive 69.2% of the rooftop solar PV market.

In 2024, Grid Connected held a dominant market position in the By Grid Type segment of the Rooftop Solar PV Market, with a 69.2% share. This significant share reflects the growing preference for grid-connected rooftop solar systems, particularly in urban and semi-urban areas where access to the electricity grid is well-established.

Grid-connected systems allow users to generate solar power for immediate use while feeding surplus electricity back into the grid, often benefiting from net metering mechanisms or feed-in tariffs. This setup offers an economical and efficient solution, reducing reliance on conventional electricity and lowering monthly power bills.

The adoption of grid-connected rooftop PV systems is further supported by government incentives and simplified interconnection processes, encouraging residential, commercial, and institutional users to invest in solar. These systems typically require less investment in energy storage infrastructure since the grid acts as a virtual battery, which enhances affordability and operational ease.

The 69.2% market share indicates that grid-tied solutions remain the preferred configuration due to their cost-effectiveness, ease of integration, and policy support in many countries. As power grids modernize and net metering programs expand, the dominance of grid-connected rooftop solar systems is expected to sustain momentum across key markets.

By End-Use Analysis

The residential sector holds 49.6% of the rooftop solar PV market.

In 2024, Residential held a dominant market position in the By End-Use segment of the Rooftop Solar PV Market, with a 49.6% share. This leading position highlights the strong adoption of rooftop solar systems among homeowners seeking to reduce electricity bills, enhance energy independence, and contribute to environmental sustainability. The growing awareness of clean energy benefits, coupled with rising electricity tariffs and supportive government policies such as subsidies and net metering, has significantly influenced residential rooftop installations.

The 49.6% market share also reflects the increasing affordability of rooftop solar systems for individual households. Improved financing options, lower system costs, and user-friendly installation services have made solar power more accessible to middle-income residential consumers. Moreover, residential rooftops offer suitable and often underutilized space for solar deployment, allowing homeowners to turn idle infrastructure into productive energy assets.

This trend has gained particular traction in regions with strong solar potential and reliable grid access. The dominance of the residential segment underlines the shifting energy preferences of households, where self-generation of electricity is becoming a practical and economically viable choice. As households continue to prioritize long-term energy savings and sustainability, the residential sector is expected to remain a key driver in the rooftop solar PV market.

Key Market Segments

By Deployment

- Terrace Mounted

- Pole Mounted

By Technology

- Thin Film

- Crystalline Silicon

By Grid Type

- Off-Grid

- Grid Connected

By End-Use

- Residential

- Commercial

- Industrial

Driving Factors

High Electricity Prices Drive Rooftop Solar Adoption

One of the biggest reasons people are choosing rooftop solar PV systems is the rising cost of electricity. In many regions, monthly power bills have become a financial burden for households and businesses. Rooftop solar helps reduce these costs by allowing users to generate their electricity from sunlight. Once installed, solar panels provide power for many years with very little maintenance and no fuel costs.

This makes them a smart long-term investment. Over time, users can recover the cost of installation through savings on their electricity bills. As energy prices continue to rise globally, more people are turning to rooftop solar as a practical and affordable solution to lower their energy expenses.

Restraining Factors

High Initial Installation Cost Limits Solar Growth

A major factor holding back the growth of the rooftop solar PV market is the high upfront cost of installation. Even though solar systems help save money in the long run, the initial investment required for purchasing panels, inverters, mounting equipment, and installation services can be expensive for many homeowners and small businesses. In some regions, financing options or subsidies are not easily available, which makes it harder for people to afford solar.

This financial barrier discourages potential users, especially in developing areas where income levels are lower. Without strong support from government programs or easy loan options, the high starting cost remains a key reason why many consumers hesitate to switch to rooftop solar power.

Growth Opportunity

Rising Demand in Rural Areas Creates Opportunity

One of the biggest growth opportunities for the rooftop solar PV market lies in rural and remote areas. Many of these regions still lack stable electricity connections or suffer from frequent power cuts. Rooftop solar systems can provide a reliable and independent power source for homes, schools, and small businesses in such locations. Since these systems do not depend on long-distance transmission lines, they are ideal for off-grid or weak-grid areas.

With falling solar panel prices and growing awareness about clean energy, rural communities are now more open to adopting solar power. Governments and development agencies are also launching programs to support rural electrification through solar. This growing demand in rural regions offers strong potential for market expansion.

Latest Trends

Battery Storage Integration Gains Strong Market Attention

A major trend in the rooftop solar PV market is the growing use of battery storage systems. More homeowners and businesses are now installing batteries along with their solar panels to store extra electricity generated during the day. This stored energy can be used at night or during power outages, making the solar system more useful and reliable.

Battery prices have started to fall, and new technologies are making them safer and more efficient. This trend is especially helpful in areas with unstable electricity or high evening demand. By combining rooftop solar with battery storage, users can reduce dependence on the grid and make better use of their solar power. This integrated solution is gaining strong interest worldwide.

Regional Analysis

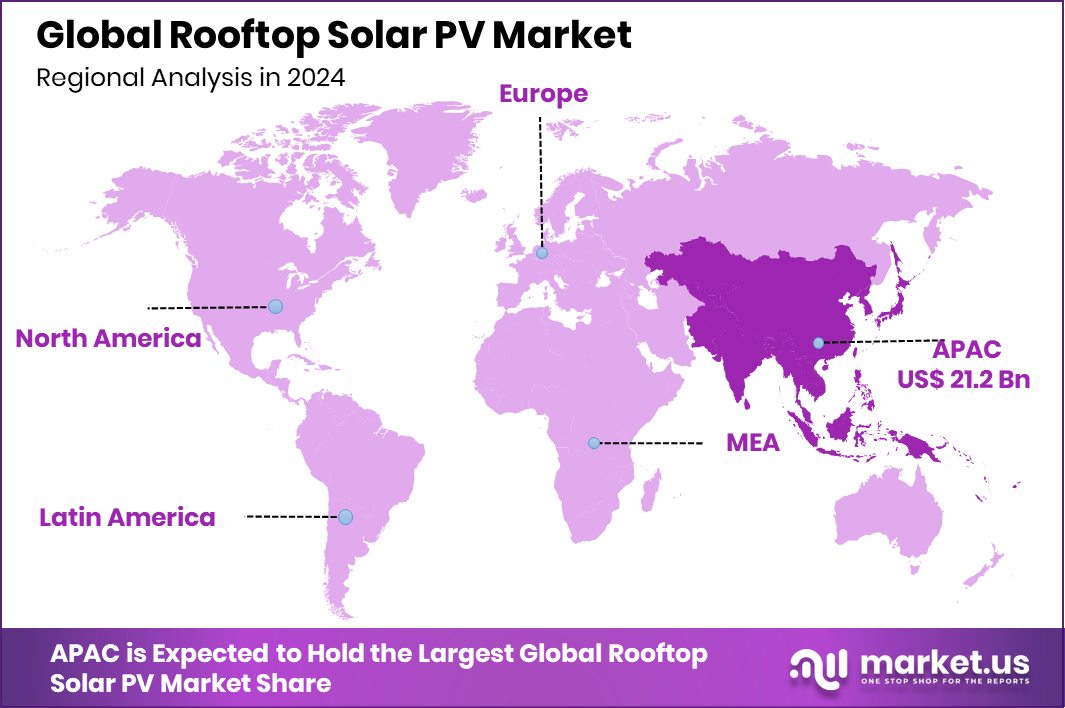

In 2024, the Asia Pacific dominated the Rooftop Solar PV Market with a 34.90% share.

In 2024, Asia Pacific held the dominant position in the global Rooftop Solar PV Market, accounting for 34.90% of the total share, which translated to a market value of USD 21.2 billion. This strong performance was driven by rising electricity demand, favorable government policies, and abundant solar resources across countries in the region.

The increasing focus on renewable energy transition and rooftop solar subsidies in markets such as China, India, Japan, and Australia further supported large-scale adoption. North America also witnessed notable progress, backed by growing residential solar installations and supportive net metering regulations, particularly in the United States.

In Europe, ongoing sustainability targets and high electricity prices encouraged rooftop solar deployment across both residential and commercial sectors. The Middle East & Africa showed gradual uptake, with rooftop solar gaining attention in urban areas and off-grid applications. Latin America, although smaller in comparison, continued to explore rooftop solar potential in countries like Brazil and Mexico through public and private sector initiatives.

However, Asia Pacific’s clear lead in market share and value underscores its central role in shaping the global rooftop solar PV landscape, reflecting the region’s large population base, rising urbanization, and active policy environment favoring decentralized solar energy solutions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, LONGi Group emerged as a pivotal force in the rooftop solar sector. The company’s focus on manufacturing high-efficiency photovoltaic wafers and modules was central to its influence. Its vertically integrated operations contributed to maintaining strong production continuity and reliable product quality. These attributes reinforced its standing among rooftop solar installers, particularly in markets demanding high performance in limited rooftop space.

SunPower Corporation continued to be recognized for its premium rooftop solar offerings in 2024. Its legacy in delivering high-efficiency, design-focused solar solutions, along with comprehensive customer service, sustained its appeal among residential and commercial users who sought both aesthetic integration and long-term performance reliability. The brand’s positioning rested on delivering complete system solutions that emphasized user experience, ease of installation, and after-sales support.

Trina Solar Co. Ltd. maintained robust engagement in the rooftop PV domain, helped by its broad product portfolio and global supply chain reach. Trina’s capability to cater to diverse market segments—from residential to commercial—positively influenced its adoption across varied geographies. Its approach balanced scale-driven production with consistent module quality, which continued to underpin its market relevance in 2024.

Indosolar Ltd. retained a focused presence in specific regional markets. Its commitment to localized manufacturing and regional distribution, combined with cost-competitive module offerings, provided a strategic advantage in cost-sensitive and emerging rooftop solar markets. The company’s market impact was derived from its grounded regional approach and price agility.

Top Key Players in the Market

- LONGi Group,

- SunPower Corporation

- Trina Solar Co. Ltd.

- Indosolar Ltd,

- First Solar, Inc.

- E-Ton Solar Tech Co., Ltd.

- Jinko Solar Holding Co. Ltd.

- JA Solar Holdings Co. Ltd.

- Hanwha Q-cells

- Canadian Solar Inc.

Recent Developments

- In June 2025, JinkoSolar introduced the new Tiger Neo 3.0 solar module series and the Sungiga G2Plus liquid-cooled energy storage system (520 kWh). These products enhance efficiency, performance, and safety, supporting integration of rooftop PV with energy storage.

- In May 2025, LONGi introduced a new back‑contact (HBC) module under the EcoLife brand at Intersolar in Munich. The module achieves 27.3 % cell efficiency and 25 % module efficiency, delivering up to 510 W of power—marking the first commercial use of heterojunction back‑contact technology in a residential module.

Report Scope

Report Features Description Market Value (2024) USD 61.0 Billion Forecast Revenue (2034) USD 109.2 Billion CAGR (2025-2034) 6.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Deployment (Terrace Mounted, Pole Mounted), By Technology (Thin Film, Crystalline Silicon), By Grid Type (Off-Grid, Grid Connected), By End-Use (Residential, Commercial, Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape LONGi Group, SunPower Corporation, Trina Solar Co. Ltd., Indosolar Ltd,, First Solar, Inc., E-Ton Solar Tech Co., Ltd., Jinko Solar Holding Co. Ltd., JA Solar Holdings Co. Ltd., Hanwha Q-cells, Canadian Solar Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- LONGi Group,

- SunPower Corporation

- Trina Solar Co. Ltd.

- Indosolar Ltd,

- First Solar, Inc.

- E-Ton Solar Tech Co., Ltd.

- Jinko Solar Holding Co. Ltd.

- JA Solar Holdings Co. Ltd.

- Hanwha Q-cells

- Canadian Solar Inc.