Global Robotics Retrofit Services Market By Service Type (Hardware Retrofit, Software Retrofit, Control System Upgrade, Integration Services, Others), By Robot Type (Industrial Robots, Collaborative Robots, Mobile Robots, Others), By End-User (Automotive, Electronics, Aerospace, Food & Beverage, Healthcare, Logistics, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 170287

- Number of Pages: 302

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

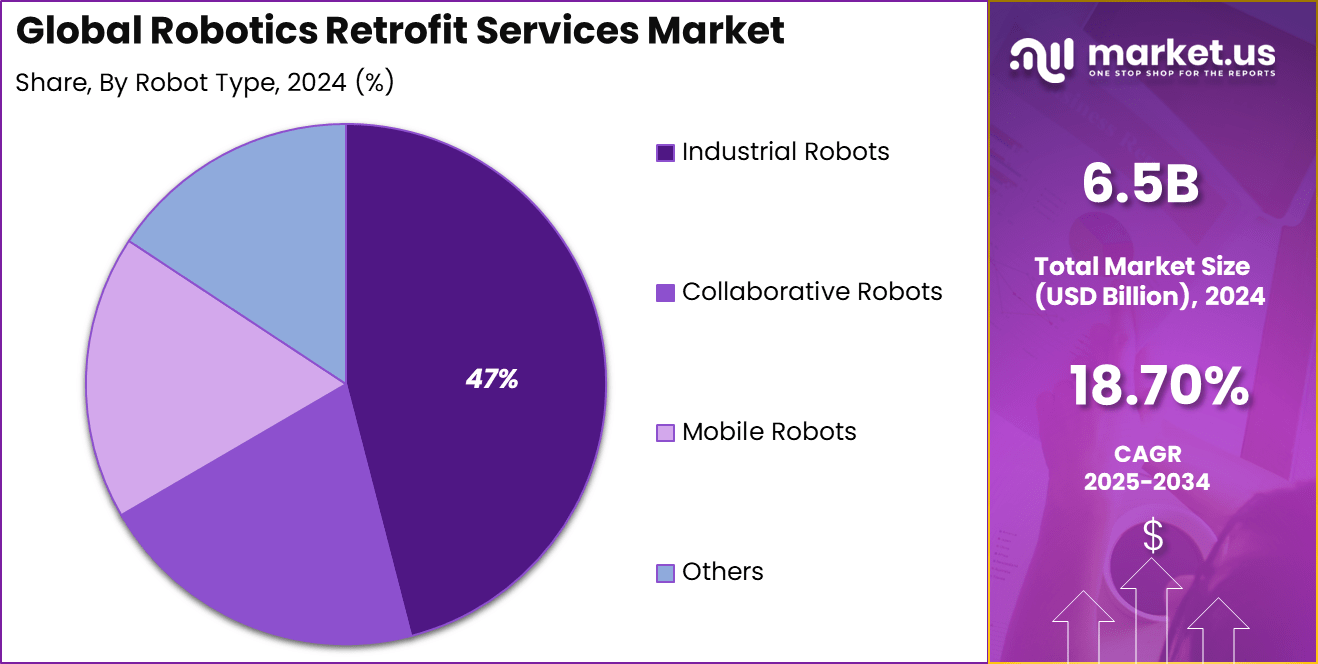

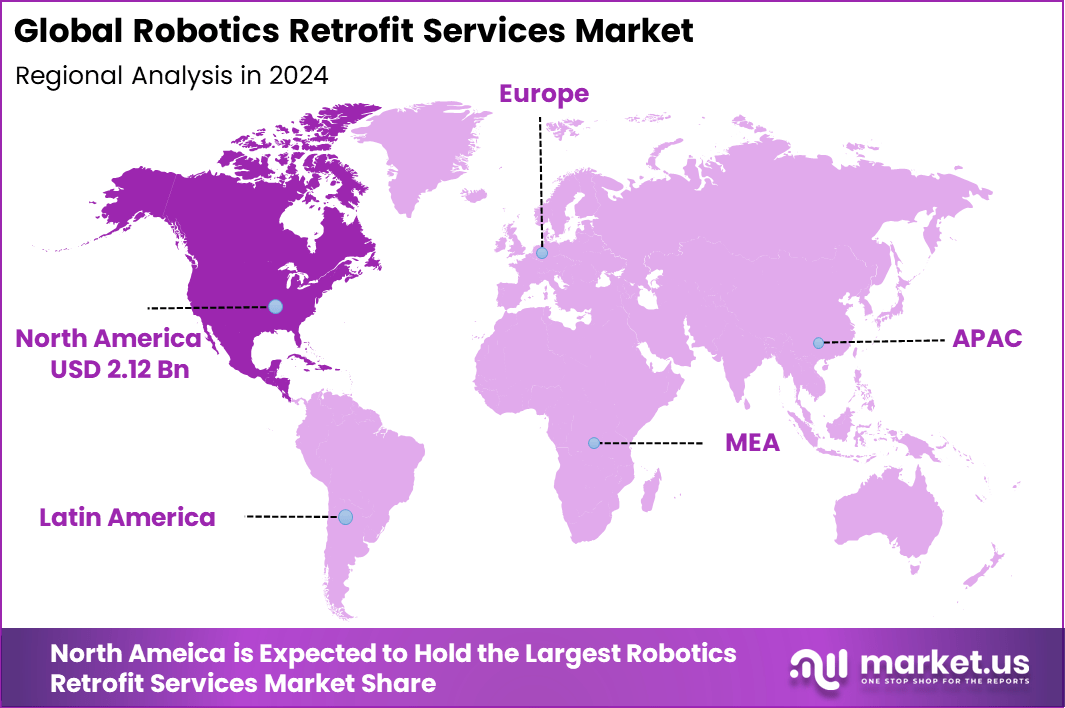

The Global Robotics Retrofit Services Market generated USD 6.5 billion in 2024 and is predicted to register growth from USD 7.7 billion in 2025 to about USD 36.1 billion by 2034, recording a CAGR of 18.60% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 32.7% share, holding USD 2.12 Billion revenue.

The robotics retrofit services market refers to the provision of upgrades, modernization, and integration services for existing robotic systems. These services extend the operational life of installed robots by improving performance, adding new capabilities, and ensuring compatibility with current automation technologies. Retrofit services include hardware replacement, software updates, sensor integration, connectivity enhancement, and safety improvements.

The main drivers of this market include the high cost of purchasing new robots and the growing need to extend the usable life of existing automation assets. Many manufacturers are choosing retrofit services to achieve productivity improvements while avoiding long shutdown periods.

Increasing demand for flexible production and frequent product changes is also encouraging upgrades to older robotic systems. In addition, stricter safety standards and efficiency requirements are pushing companies to update legacy robots to meet current operational and regulatory expectations.

Demand for robotics retrofit services is rising steadily, particularly among small and mid sized manufacturers seeking cost effective automation improvements. Facilities operating aging robotic systems are showing strong interest in upgrades that enhance accuracy, speed, and system reliability.

The market is also supported by the need to reduce unplanned downtime and improve return on existing investments. As manufacturers focus on gradual automation upgrades rather than full replacements, demand for retrofit services is expected to remain stable across industrial sectors.

Top Market Takeaways

- By service type, hardware retrofit accounted for 40.6% of the robotics retrofit services market, reflecting strong demand for upgrading drives, controllers, and end-of-arm tooling instead of full robot replacement.

- By robot type, industrial robots held 46.8% share, supported by extensive installed bases in manufacturing that require modernization to meet Industry 4.0 and connectivity requirements.

- By end-user, automotive contributed 38.9% of the market, as carmakers retrofit existing robotic lines to handle EV platforms, new materials, and flexible body and final assembly operations.

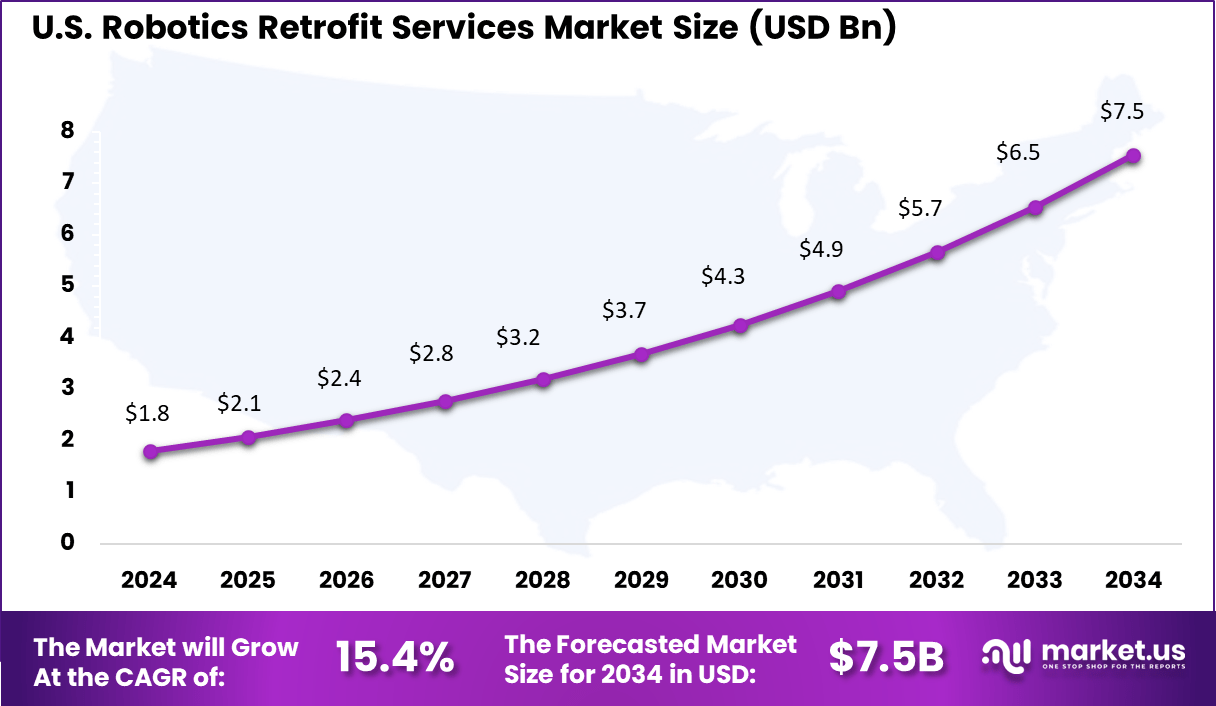

- North America represented 32.7% of global revenues, with the U.S. robotics retrofit services market estimated at USD 1.80 billion in 2025 and projected to grow at a CAGR of 15.4% on the back of factory modernization and reshoring initiatives.

Service Type Analysis

Hardware retrofit services lead with 40.6%, reflecting strong demand for upgrading existing robotic systems with new physical components. These upgrades often include sensors, controllers, actuators, and safety devices that improve performance and extend the usable life of robots.

Organizations prefer hardware retrofits as a cost effective alternative to full robot replacement. By enhancing existing equipment, companies can improve productivity, accuracy, and safety while avoiding large capital investments.

Robot Type Analysis

Industrial Robots dominate with a 46.8% portion, as factories retrofit these workhorses for heavier lifts and repeat tasks that define manufacturing floors. These machines, from welders to assemblers, get new joints and cables to handle tighter tolerances in electric vehicle builds or electronics packing.

Owners choose retrofits over scrap because frames last decades, and upgrades boost payloads for shifting product mixes without retooling whole cells. Service teams map out changes to avoid interference, testing runs before full go-live.

Demand spikes in auto and metalworking, pairing old arms with AI vision for adaptive grabs that cut rejects. Providers offer kits tested across models, easing installs in tight spaces. This type’s weight drives service growth, turning legacy investments into flexible assets that adapt to market swings.

End-User Analysis

The automotive sector holds 38.9%, reflecting its high dependence on robotic automation. Automotive manufacturers use retrofit services to modernize production lines and meet evolving quality and efficiency standards.

Frequent model changes and increasing vehicle complexity push manufacturers to update existing robotic assets. Retrofit services help automotive companies improve throughput while minimizing downtime and capital expenditure.

Emerging Trends

Key Trend Description Add AI to Old Robots Smart AI upgrades help older robots learn, adapt, and perform tasks more efficiently. Link to Factory Internet Connecting legacy robots to IoT systems provides real-time monitoring, data access, and remote control. Easy Vision Upgrades New sensors and cameras improve accuracy, object detection, and picking performance in older robots. Control System Swap Replacing outdated controllers with modern ones enhances speed, reliability, and safety during operations. Work with Human Teams Upgraded robots are designed to collaborate safely with human workers on shared factory floors. Growth Factors

Key Factors Description Save Money Over New Buys Retrofitting extends robot life and reduces capital expenditure by avoiding costly new replacements. Need for Smart Factories Industry 4.0 adoption pushes factories to upgrade legacy robots so they can integrate with modern automation systems. Car and Tech Factories Grow Automotive and electronics manufacturing expansion increases demand for faster robot upgrades to support new production needs. Robots Spread Worldwide As more factories adopt robotics, the need to upgrade and maintain existing fleets rises steadily. Green and Safe Rules Stricter regulations encourage upgrades that improve energy efficiency, reduce waste, and enhance worker safety. Key Market Segments

By Service Type

- Hardware Retrofit

- Software Retrofit

- Control System Upgrade

- Integration Services

- Others

By Robot Type

- Industrial Robots

- Collaborative Robots

- Mobile Robots

- Others

By End-User

- Automotive

- Electronics

- Aerospace

- Food & Beverage

- Healthcare

- Logistics

- Others

Regional Analysis

North America holds 32.7% of the global Robotics Retrofit Services market. Factories and warehouses here upgrade old robots to handle new tasks like picking items and sorting packages, which saves money over buying new ones. Strong manufacturing in cars, food processing, and electronics drives demand, with services adding sensors and software for better speed and safety, matching a CAGR of 15.4%.

Tech hubs push AI and vision upgrades to old arms, helping firms meet labor shortages and green rules. Service providers offer quick installs with low downtime, supported by skilled workers and parts supply. This keeps North America ahead in making robots last longer and work smarter.

The U.S. Robotics Retrofit Services market reaches USD 1.80 billion, growing at 15.4% CAGR. Auto plants and logistics centers lead upgrades for flexible production lines that switch products fast. Government plans for smart factories fund retrofits, cutting energy use and boosting output.

Demand grows from e-commerce booms needing 24/7 operations without new hires. Local firms provide custom kits with safety features for older models from Fanuc and ABB. This focus on efficiency and jobs makes the U.S. the top spot in North America for robot upgrades.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Growth in the robotics retrofit services market is supported by rising pressure to reduce operational costs while maintaining productivity. Many firms operate robots purchased years ago, and replacing these systems with new units requires significant capital. Retrofit services allow these firms to update key components and extend the useful life of existing robots at a fraction of replacement cost. This cost advantage encourages adoption among companies with older robotic fleets.

Another driver is the increasing awareness of performance limitations in legacy robotic systems. Older robots may lack capabilities needed for current production demands, such as higher precision, faster motion, or improved safety features. By retrofitting these robots with modern components and software, manufacturers can achieve performance closer to modern standards without full replacement. This need to support evolving production specifications continues to drive demand for retrofit services.

Restraint Analysis

A key restraint on this market comes from technical complexity involved in upgrading older robots. Many legacy systems were built with proprietary parts, outdated interfaces, or limited documentation. Integrating new hardware and software into these systems can be difficult and may require specialist engineering. This complexity can increase implementation time, cost, and risk, making some operators hesitant to pursue retrofitting.

Another restraint is the limited availability of retrofit solutions for very old or obsolete robotic models. Some early generation robots may not support modern components or communication standards, making retrofit impractical or impossible. In such cases, operators may decide to replace the robots rather than invest in retrofit services, which slows market expansion.

Opportunity Analysis

There is a significant opportunity in providing standardized retrofit packages tailored to specific robot families or common production tasks. Many manufacturers operate similar types of robots across facilities, and retrofit service providers who offer tested upgrade kits can reduce engineering time and improve implementation efficiency. These solutions can appeal to a broader range of customers and support faster project execution.

Another opportunity lies in linking retrofit services with performance monitoring and predictive support. By updating robots not only with new components but also with sensors and monitoring software, service providers can help operators track performance and anticipate maintenance needs. This added value can strengthen customer relationships and encourage repeat engagements.

Challenge Analysis

A major challenge in this market is ensuring compatibility between old and new components. Technologies evolve quickly, and newer controllers or sensors may not align easily with legacy mechanical interfaces. Achieving seamless integration often requires custom engineering work, which increases project complexity.

Another challenge involves balancing cost and benefit for the operator. While retrofit services reduce capital expense relative to full replacement, they still represent a significant investment. Operators must weigh the expected performance gains and extended service life against the cost of retrofit. When expected benefits are marginal, operators may opt for full replacement, which reduces demand for retrofit services.

Competitive Analysis

The Robotics Retrofit Services market is anchored by the big four industrial robot OEMs ABB, FANUC, KUKA, and Yaskawa, which leverage their huge installed bases in automotive, metals, and general industry to offer controller upgrades, reprogramming, retooling, and complete cell modernization as an alternative to new robot purchases.

ABB and FANUC typically emphasize lifecycle service contracts, performance optimization, and migration to new control platforms such as OmniCore and latest R-series controllers, while KUKA promotes structured refurbishment and retrofit programs that extend the life of KR and QUANTEC families, and Yaskawa focuses on welding, handling, and palletizing retrofits where existing mechanics can be reused with new drives and software.

Surrounding these leaders, Mitsubishi Electric, Kawasaki, Denso, Epson, Nachi-Fujikoshi, Comau, Staubli, Hyundai Robotics, and Universal Robots compete by bundling retrofits with application-specific improvements in painting, cleanroom, electronics assembly, and cobot deployments, often using simulation, offline programming, and safety upgrades to justify payback without full line replacement.

Top Key Players in the Market

- ABB Ltd.

- FANUC Corporation

- KUKA AG

- Yaskawa Electric Corporation

- Siemens AG

- Mitsubishi Electric Corporation

- Rockwell Automation, Inc.

- Omron Corporation

- Universal Robots A/S

- Kawasaki Heavy Industries, Ltd.

- Denso Corporation

- Staubli International AG

- Comau S.p.A.

- Epson Robots

- Nachi-Fujikoshi Corp.

- Bosch Rexroth AG

- Schneider Electric SE

- Panasonic Corporation

- Toshiba Machine Co., Ltd.

- Hyundai Robotics

Future Outlook

The Robotics Retrofit Services market stands ready for ongoing expansion as manufacturers seek to extend the life of existing robotic systems rather than replace them entirely. Factories and warehouses will lean more on retrofit experts to upgrade older arms with modern sensors, AI software, and collaborative features, helping them adapt to flexible production lines and human-robot teamwork without full overhauls.

Opportunities lie in

- Tailoring retrofit packages for legacy industrial robots to add vision systems and safety features for safer cobot deployments in shared workspaces.

- Offering subscription-based software updates and remote diagnostics as part of retrofit services to keep upgraded robots current with new automation standards.

- Expanding into emerging sectors like agriculture and logistics, where retrofits turn basic machines into smart, autonomous units for tasks like picking or sorting.

Recent Developments

- September, 2025, ABB showcased robotics future at CIIF including retrofit solutions for modern manufacturing.

- October, 2025, FANUC America promoted CNC retrofits to boost productivity on legacy machine tools.

Report Scope

Report Features Description Market Value (2024) USD 6.5 Bn Forecast Revenue (2034) USD 36.1 Bn CAGR(2025-2034) 18.60% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Service Type (Hardware Retrofit, Software Retrofit, Control System Upgrade, Integration Services, Others), By Robot Type (Industrial Robots, Collaborative Robots, Mobile Robots, Others), By End-User (Automotive, Electronics, Aerospace, Food & Beverage, Healthcare, Logistics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ABB Ltd., FANUC Corporation, KUKA AG, Yaskawa Electric Corporation, Siemens AG, Mitsubishi Electric Corporation, Rockwell Automation, Inc., Omron Corporation, Universal Robots A/S, Kawasaki Heavy Industries, Ltd., Denso Corporation, Staubli International AG, Comau S.p.A., Epson Robots, Nachi-Fujikoshi Corp., Bosch Rexroth AG, Schneider Electric SE, Panasonic Corporation, Toshiba Machine Co., Ltd., Hyundai Robotics Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Robotics Retrofit Services MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Robotics Retrofit Services MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB Ltd.

- FANUC Corporation

- KUKA AG

- Yaskawa Electric Corporation

- Siemens AG

- Mitsubishi Electric Corporation

- Rockwell Automation, Inc.

- Omron Corporation

- Universal Robots A/S

- Kawasaki Heavy Industries, Ltd.

- Denso Corporation

- Staubli International AG

- Comau S.p.A.

- Epson Robots

- Nachi-Fujikoshi Corp.

- Bosch Rexroth AG

- Schneider Electric SE

- Panasonic Corporation

- Toshiba Machine Co., Ltd.

- Hyundai Robotics