Global Robotic Waste Sorting Market Size, Share, Statistics Analysis Report By Sorting Type (Plastic Products Sorting, Metallic Waste Sorting, Wood and Bricks Sorting, Others), By Application (Waste Recovery, Waste Recycling), By End-users (Muncipal, Industrial, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: November 2024

- Report ID: 133384

- Number of Pages: 222

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

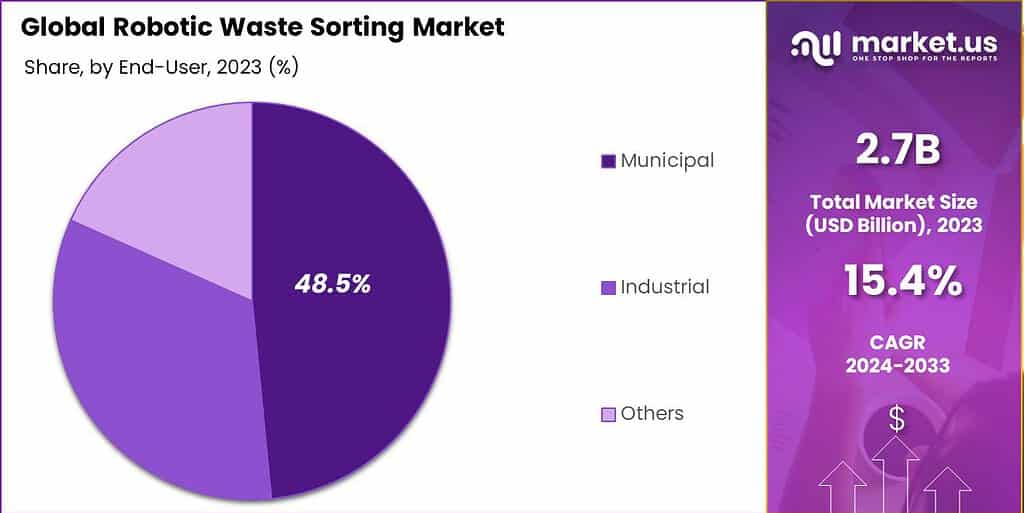

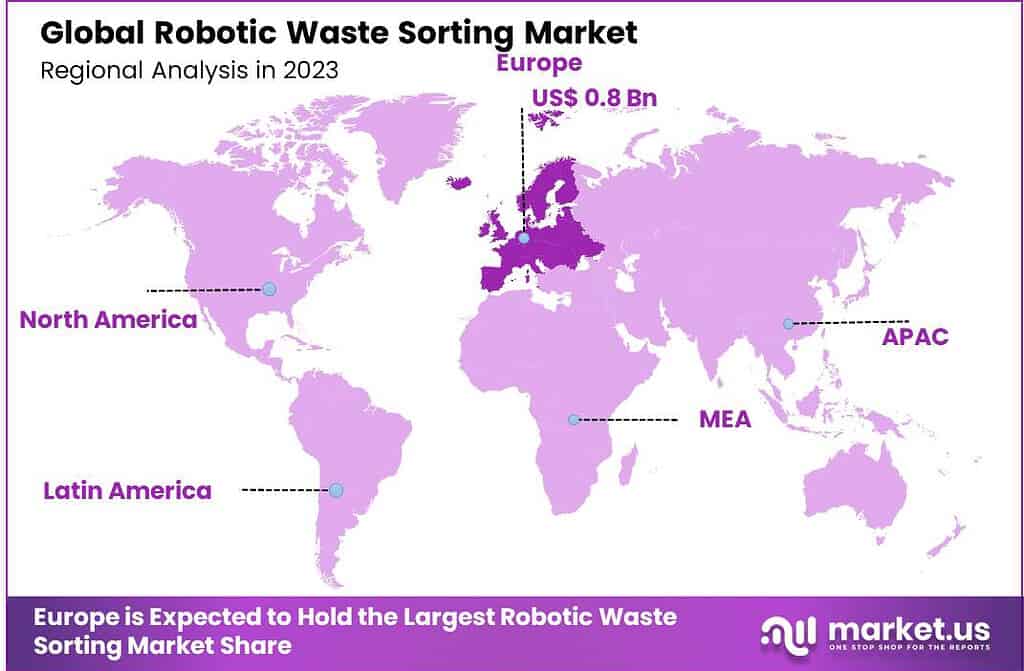

The Global Robotic Waste Sorting Market size is expected to be worth around USD 11.3 Billion By 2033, from USD 2.7 Billion in 2023, growing at a CAGR of 15.40% during the forecast period from 2024 to 2033. In 2023, Europe dominated the Robotic Waste Sorting Market, accounting for over 32.5% of the global market share, with revenue reaching USD 0.8 billion.

Robotic waste sorting involves the application of robotics technology, artificial intelligence (AI), and machine learning algorithms to enhance and automate the process of sorting waste materials. This modern technology aims to categorize different types of waste more efficiently for recycling or disposal. Robots equipped with AI and various sensors can identify, segregate, and manage waste materials, tackling tasks that traditionally required human intervention.

The market for robotic waste sorting is expanding as the demand for more efficient waste management solutions grows globally. As waste volumes increase and environmental sustainability becomes a priority, the use of robotics in waste sorting facilities has become increasingly significant. This technology not only streamlines operations but also improves the accuracy and efficiency of waste sorting, which is crucial for effective recycling and resource recovery.

The main drivers of the robotic waste sorting market include escalating waste volumes and the push for sustainability. These factors compel waste management facilities to adopt advanced technologies to enhance efficiency and reduce the environmental impact of waste. Additionally, labor shortages and the need to improve working conditions in waste management facilities further motivate the adoption of robotic sorting systems.

There is a strong market demand for robotic waste sorting solutions, driven by the need to improve recycling rates and manage waste more effectively. Facilities are increasingly implementing robotic systems to cope with high volumes of waste and the complex demands of sorting various materials. This technology helps facilities overcome challenges related to labor shortages and operational efficiency.

The robotic waste sorting sector offers substantial opportunities for growth and innovation. Advances in AI and machine learning can enhance the capabilities of robots to identify and sort a broader range of materials with higher precision. Furthermore, the expansion of recycling regulations globally presents additional opportunities for the deployment of robotic waste sorting technologies in new markets.

For instance, In January 2024, RGS Nordic, a major waste management company in Denmark, took a big step forward by investing in a new robotic sorting plant at its Copenhagen facility. The project, developed with Terex Recycling Systems and ZenRobotics, introduces advanced AI-driven robotic arms to sort waste more efficiently. This fully automated system highlights the company’s commitment to innovation and sustainability, aiming to improve recycling rates and reduce environmental impact.

Significant technological advancements are shaping the robotic waste sorting industry. Innovations in AI, such as machine learning and computer vision, have vastly improved the accuracy with which robots can identify and sort waste materials. These advancements allow robots to adapt to various types of waste streams and conditions, enhancing their effectiveness in real-world waste management scenarios

Key Takeaways

- The Global Robotic Waste Sorting Market is projected to reach USD 11.3 billion by 2033, growing from USD 2.7 billion in 2023, with a CAGR of 15.40% during the forecast period from 2024 to 2033.

- In 2023, the Plastic Products Sorting segment held a dominant market share, capturing more than 43.5% of the market.

- The Waste Recovery segment also held a leading position in 2023, accounting for more than 53.6% of the market share.

- In 2023, the Municipal segment dominated the market, securing over 48.5% of the total share.

- Europe held the largest market share in 2023, with a 32.5% share and total revenue of USD 0.8 billion.

Sorting Type Analysis

In 2023, the Plastic Products Sorting segment held a dominant market position in the robotic waste sorting market, capturing more than a 43.5% share. This leadership is primarily due to the high volume of plastic waste generated globally, coupled with increasing pressures to recycle plastics due to environmental concerns.

Plastics are a major focus for waste management protocols as they are less biodegradable and pose significant environmental risks, including ocean pollution and wildlife disruption. Additionally, advancements in sorting technology have made the separation and recycling of various types of plastics more feasible and cost-effective.

Robotic sorting systems are particularly adept at identifying and separating different plastic polymers, which are often required to be recycled separately to maintain the integrity of the recycled material. This technological proficiency boosts the efficiency of plastic recycling facilities and enhances the quality of the output, making the process more profitable.

Moreover, the push from governmental regulations demanding higher recycling rates and the public’s growing preference for sustainable products encourage companies to invest in advanced sorting technologies like robotics. These regulatory and consumer pressures have led to increased adoption of robotic sorting systems in the plastic recycling sector.

Application Analysis

In 2023, the Waste Recovery segment held a dominant market position in the Robotic Waste Sorting Market, capturing more than a 53.6% share. This segment’s leadership is primarily attributed to the growing emphasis on maximizing resource extraction from waste.

The prevalence of these systems in waste recovery operations is driven by the increasing need for sustainability in resource management. As natural resources become scarcer and the environmental impacts of mining and extraction become more apparent, the importance of recovering resources from waste has become a priority for many governments and organizations.

Furthermore, advancements in artificial intelligence and machine learning have propelled the Waste Recovery segment to the forefront. These technologies enable robots to sort waste with greater accuracy and speed than human sorters, leading to higher throughput and less contamination in recovered materials. This not only supports environmental goals but also reduces costs associated with waste processing, making robotic waste recovery an increasingly popular solution.

End-users Analysis

In 2023, the Municipal segment held a dominant market position in the Robotic Waste Sorting Market, capturing more than a 48.5% share. This leadership can be attributed primarily to the increasing adoption of automation technologies by municipal authorities aiming to enhance efficiency and reduce human involvement in waste sorting operations.

Municipal waste management programs are continually seeking to improve recycling rates and reduce landfill usage, aligning with broader environmental goals and regulations. Robotic waste sorting systems are highly effective in these settings because they can accurately separate different types of waste materials, such as plastics, metals, and organics, at a high throughput rate.

This capability not only improves the quality of the sorted materials, making them more valuable for recycling processes, but also minimizes the contamination levels in organic waste, which is crucial for composting and other bio-based applications.

The integration of advanced technologies such as AI and machine learning has empowered these systems to adapt and improve over time, enhancing their sorting accuracy and operational efficiency. This technological edge makes the municipal segment a significant adopter of robotic waste sorting systems, as city managers aim to meet stringent waste management standards and sustainability goals.

Key Market Segments

By Sorting Type

- Plastic Products Sorting

- Metallic Waste Sorting

- Wood and Bricks Sorting

- Others

By Application

- Waste Recovery

- Waste Recycling

By End-users

- Muncipal

- Industrial

- Others

Driver

Increasing Focus on Waste Management and Recycling

Governments and businesses worldwide are emphasizing efficient waste management systems to combat environmental degradation. Robotic waste sorting plays a critical role in meeting stringent recycling and waste reduction goals. Automation reduces human error and increases the sorting speed and accuracy, making it a vital tool in managing growing waste volumes.

Robots equipped with AI and machine learning can identify and separate different types of recyclable materials, enhancing efficiency compared to manual sorting. This approach aligns with global initiatives to promote sustainability and reduce landfill dependency. Additionally, labor shortages in waste management have amplified the demand for robotic solutions, making automation a reliable alternative.

Restraint

High Costs and Integration Complexities

While robotic waste sorting offers significant operational advantages, its adoption is hindered by high upfront costs. Advanced robots equipped with sensors, AI, and machine learning capabilities are expensive, making them less accessible for smaller waste management companies. Furthermore, integrating robotic systems into existing infrastructure requires significant investments in hardware, software, and training.

These systems also demand ongoing maintenance, which can add to operational costs over time. Another challenge lies in ensuring seamless integration with varied waste streams and local recycling practices, as not all systems are universally compatible. For many organizations, the cost-benefit ratio may seem unfavorable in the short term, delaying adoption.

Opportunity

Growing Demand for AI-Powered Recycling Solutions

The global push towards a circular economy creates immense opportunities for robotic waste sorting systems. As industries adopt sustainable practices, the demand for AI-powered waste sorting grows, especially in sectors like packaging, construction, and electronics.

Robotic systems equipped with vision technologies and real-time data analytics can improve material recovery rates, allowing businesses to achieve higher recycling targets. Innovations in AI algorithms are enabling robots to recognize a broader range of materials, including plastics, metals, and organic waste, with remarkable precision.

Emerging markets, particularly in Asia-Pacific and Latin America, present lucrative opportunities as governments invest in modern waste management systems. Moreover, partnerships between technology providers and waste management firms are accelerating the adoption of intelligent sorting systems.

Challenge

Handling Mixed and Contaminated Waste

One of the significant challenges for robotic waste sorting is dealing with mixed and contaminated waste streams. Robots rely on sensors and algorithms to identify materials, but contamination often reduces their accuracy. Many times food residue on recyclable plastics or incorrect disposal of hazardous materials can disrupt the sorting process, leading to inefficiencies.

Mixed waste streams also increase wear and tear on robotic systems, requiring frequent maintenance and reducing operational efficiency. Training AI models to recognize diverse waste types in such conditions is a complex and ongoing challenge. Additionally, public awareness about proper waste segregation remains low in many regions, further complicating the sorting process for automated systems.

Emerging Trends

Robotic waste sorting is undergoing significant advancements, driven by the integration of artificial intelligence (AI) and machine learning. Modern robots are now equipped to identify and separate a wide array of materials with remarkable precision.

Another notable trend is the development of autonomous waste-sorting robots capable of operating continuously without human intervention. These robots utilize advanced sensors and AI algorithms to navigate complex environments, identifying and sorting materials with minimal supervision.

The integration of robotics in waste management is also addressing safety concerns. Robots can handle hazardous materials, reducing the risk to human workers. This capability is particularly beneficial in environments where exposure to harmful substances is a concern.

Business Benefits

Implementing robotic waste sorting systems offers numerous advantages for businesses. One of the primary benefits is increased efficiency. Robots can sort waste at a rate that far surpasses human capability, leading to faster processing times and higher throughput.

Another significant benefit is the reduction in operational expenses (OPEX). Automated systems decrease the reliance on manual labor, leading to lower recruitment and retention costs. Additionally, robots can operate continuously, reducing downtime and maximizing resource utilization.

Robotic systems also enhance the quality of sorted materials. With the ability to identify and separate materials with high precision, robots reduce contamination in recycling streams. This improvement in quality can lead to higher revenues from the sale of recycled materials, as cleaner recyclables are more valuable in the market.

Furthermore, adopting robotic waste sorting aligns with corporate sustainability goals. Efficient sorting leads to higher recycling rates, reducing the amount of waste sent to landfills. This commitment to sustainability can enhance a company’s reputation and meet regulatory requirements.

Regional Analysis

In 2023, Europe held a dominant market position in the Robotic Waste Sorting Market, capturing more than a 32.5% share with revenue totaling USD 0.8 billion. This leadership is largely attributed to Europe’s stringent environmental regulations and ambitious targets for waste management and recycling.

European nations have been pioneers in implementing policies that encourage the reduction of landfill use and promote the recycling of materials. This regulatory environment has fostered the adoption of advanced technologies, including robotic waste sorting systems, to meet compliance standards and improve waste handling efficiencies.

The market’s growth in Europe is also supported by significant investments in waste management infrastructure and technological innovations. Many European countries have integrated smart and automated systems into their waste management frameworks, which has increased the demand for robotic sorting solutions.

Moreover, the presence of several leading robotic waste sorting manufacturers in Europe who continually invest in research and development activities has propelled the region’s market forward. These companies are at the forefront of developing enhanced sorting technologies that feature cutting-edge artificial intelligence capabilities for better material recognition and sorting accuracy.

Europe’s commitment to innovation and strong environmental awareness, supported by both the public and government, reinforces its dominance in the global robotic waste sorting market. These factors not only secure its current leadership but also position the region to maintain its edge with ongoing technological advancements in waste sorting.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

The robotic waste sorting industry is rapidly evolving, with several key players at the forefront of developing innovative solutions to address global waste management challenges.

General Kinematics Corporation is a leading player in the robotic waste sorting market, renowned for its innovative solutions tailored to waste management and recycling industries. The company specializes in designing and manufacturing vibratory equipment that enhances sorting efficiency and accuracy.

AMP Robotics Corp. has rapidly ascended in the market rankings due to its cutting-edge artificial intelligence (AI) and machine learning technologies applied to waste sorting. AMP Robotics is known for its high-speed, highly accurate robotic systems that can identify and sort recyclable materials from mixed waste streams.

ABB Ltd. is another significant player in the robotic waste sorting market, leveraging its extensive expertise in automation and robotics. ABB offers a range of robotic solutions that are integrated into waste sorting facilities to improve both speed and precision in sorting operations. Their robots are equipped with sophisticated sensors and vision systems, enabling them to handle and sort various types of waste materials effectively.

Top Key Players in the Market

- General Kinematics Corporation

- AMP Robotics Corp.

- ABB Ltd.

- Clean Robotics

- Bollegraaf Recycling Machinery

- Greyparrot

- Zen Robotics Oy

- Tomra

- Machinex Industries Inc.

- Waste Robotics Inc.

- Other Key Players

Recent Developments

- In February 2023, Recycleye secured $17 million in Series A funding, led by DCVC, to advance its AI-powered waste sorting robots. The investment aims to enhance the company’s technology and expand its market presence.

- In February 2024, ZenRobotics launched its fourth-generation waste sorting robots, ZenRobotics 4.0, featuring the Heavy Picker 4.0 for bulky materials and the Fast Picker 4.0 for lightweight materials. These robots utilize advanced AI to recognize over 500 waste categories, enhancing sorting efficiency and reducing downtime.

- In March 2024, Amazon’s Climate Pledge Fund invested in Glacier, a female-led AI and robotics company focused on automating recycling processes. Glacier’s technology aims to improve the efficiency and accuracy of waste sorting.

Report Scope

Report Features Description Market Value (2023) USD 2.7 Bn Forecast Revenue (2033) USD 11.3 Bn CAGR (2024-2033) 15.4% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Sorting Type (Plastic Products Sorting, Metallic Waste Sorting,

Wood and Bricks Sorting, Others), By Application (Waste Recovery, Waste Recycling), By End-users (Muncipal, Industrial, Others)Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape General Kinematics Corporation, AMP Robotics Corp., ABB Ltd., Clean Robotics, Bollegraaf Recycling Machinery, Greyparrot, Zen Robotics Oy, Tomra, Machinex Industries Inc., Waste Robotics Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Robotic Waste Sorting MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample

Robotic Waste Sorting MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- General Kinematics Corporation

- AMP Robotics Corp.

- ABB Ltd.

- Clean Robotics

- Bollegraaf Recycling Machinery

- Greyparrot

- Zen Robotics Oy

- Tomra

- Machinex Industries Inc.

- Waste Robotics Inc.

- Other Key Players