Global Robotic Process Automation Market By Component(Software, Service), By Organization (Large Enterprises, Small & Medium Enterprises), By Operation(Rule Based, Knowledge Based), By Application(Administration and Reporting, Customer Support, Data Migration & Capture Extraction, Analysis, Others), By End-Use(Retail, Manufacturing and Logistics Industry, BFSI, Healthcare, IT and Telecom, Hospitality, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: September 2024

- Report ID: 12861

- Number of Pages: 348

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

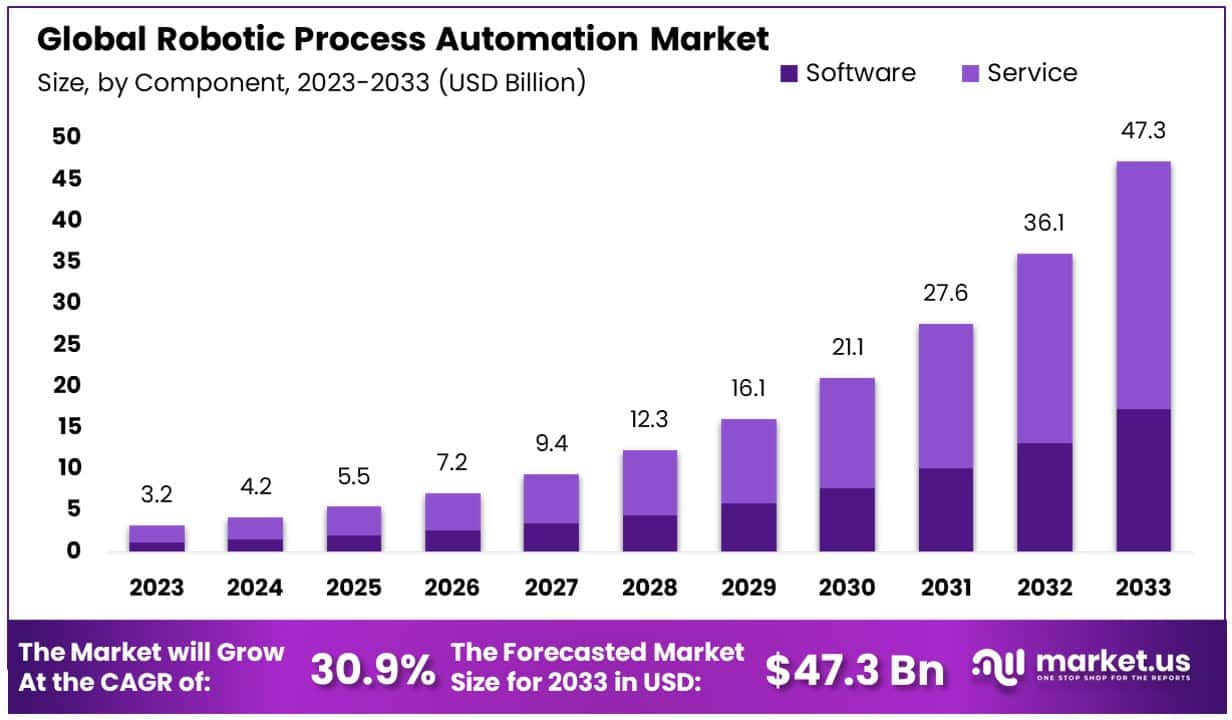

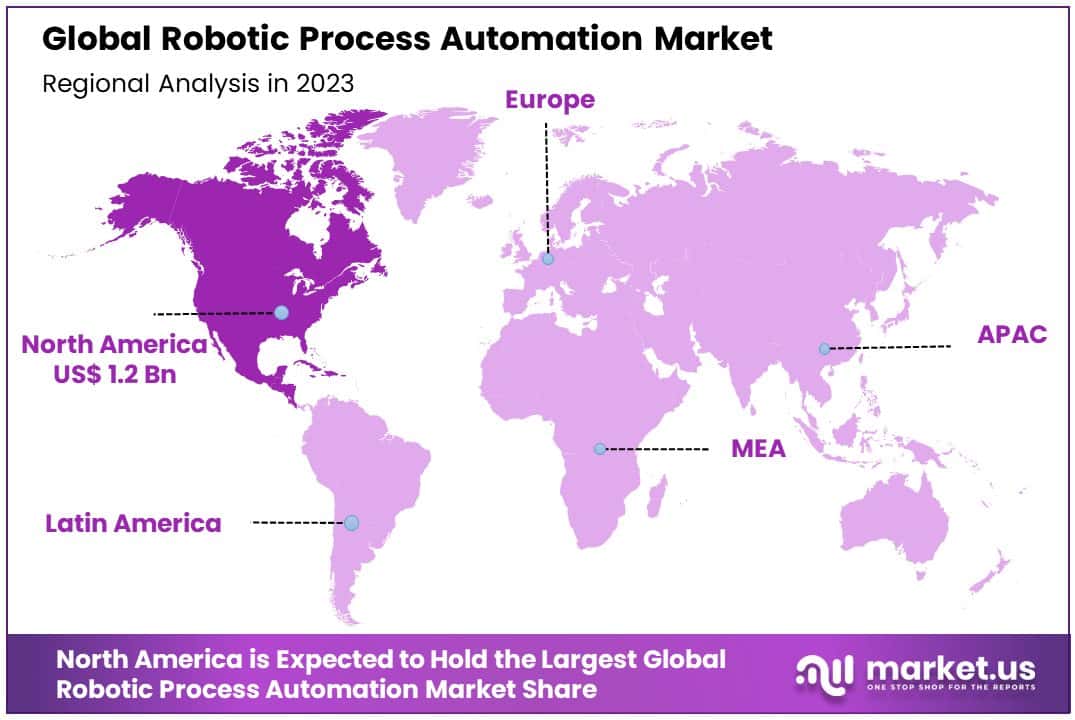

The Global Robotic Process Automation Market size is expected to be worth around USD 47.3 Billion by 2033, from USD 3.2 Billion in 2023, growing at a CAGR of 30.90% during the forecast period from 2024 to 2033. North America dominated a 37.8% market share in 2023 and held USD 1.12 Billion in revenue from the Robotic Process Automation Market.

Robotic Process Automation (RPA) is a technology that allows organizations to automate routine tasks using software robots, thereby mimicking human actions within digital systems. RPA is designed to streamline business processes, reduce manual effort, and enhance efficiency across various applications.

The Robotic Process Automation market is expanding as businesses across sectors adopt RPA for its ability to improve operational efficiency and reduce costs. The market encompasses the development, provision, and utilization of RPA technologies to enhance productivity and accuracy in data handling and processing tasks.

The growth of the RPA market can be attributed to the increasing demand for automation to reduce operational costs and enhance accuracy. Integration with artificial intelligence and machine learning further propels this expansion, optimizing decision-making processes and expanding the scope of automatable tasks.

Demand for RPA is driven by industries seeking operational efficiency and consistency in tasks prone to human error. Financial services, healthcare, and retail prominently harness RPA for tasks like transaction processing, patient data management, and inventory control, underscoring its widespread applicability.

The RPA market offers significant opportunities to enhance scalability and agility within organizations. As businesses strive for innovation, RPA provides a pathway to modernize legacy systems and integrate with emerging technologies, fostering digital transformation and competitive advantage.

The Robotic Process Automation (RPA) market is positioned at a transformative juncture, demonstrating profound impacts on operational efficiencies and workforce dynamics across various sectors, notably within the public domain.

As enterprises increasingly integrate RPA into their core operations, the technology is not just streamlining processes but also redefining job roles and contributing significantly to cost management.

According to Deloitte, an estimated 861,000 public sector jobs could be displaced by automation technologies, including RPA, by 2030, marking a critical shift in workforce allocation and task management within government entities. This shift underscores the dual narrative of technological advancement and the need for adaptive workforce strategies in the public sector.

Further emphasizing the operational efficiencies driven by RPA, a report by Reisystems highlights the substantial fiscal impact witnessed by the Internal Revenue Service (IRS) since its adoption of RPA technologies in 2017. The IRS has realized savings of approximately $1.2 billion, primarily through enhancements in compliance tasks like data entry and customer service.

Moreover, the adoption of RPA has facilitated a 20% reduction in tax return processing times, underscoring quicker compliance with tax regulations and enhancing taxpayer satisfaction. Such data not only reflects the tangible benefits of RPA but also illustrates its capacity to foster significant administrative and financial improvements.

Key Takeaways

- The Global Robotic Process Automation Market size is expected to be worth around USD 47.3 Billion by 2033, from USD 3.2 Billion in 2023, growing at a CAGR of 30.90% during the forecast period from 2024 to 2033.

- In 2023, Service held a dominant market position in the By Component segment of the Robotic Process Automation Market, with a 63.4% share.

- In 2023, Large Enterprises held a dominant market position in the By Organization segment of the Robotic Process Automation Market, with a 66.5% share.

- In 2023, Rule Based held a dominant market position in the By Operation segment of the Robotic Process Automation Market, with a 67.3% share.

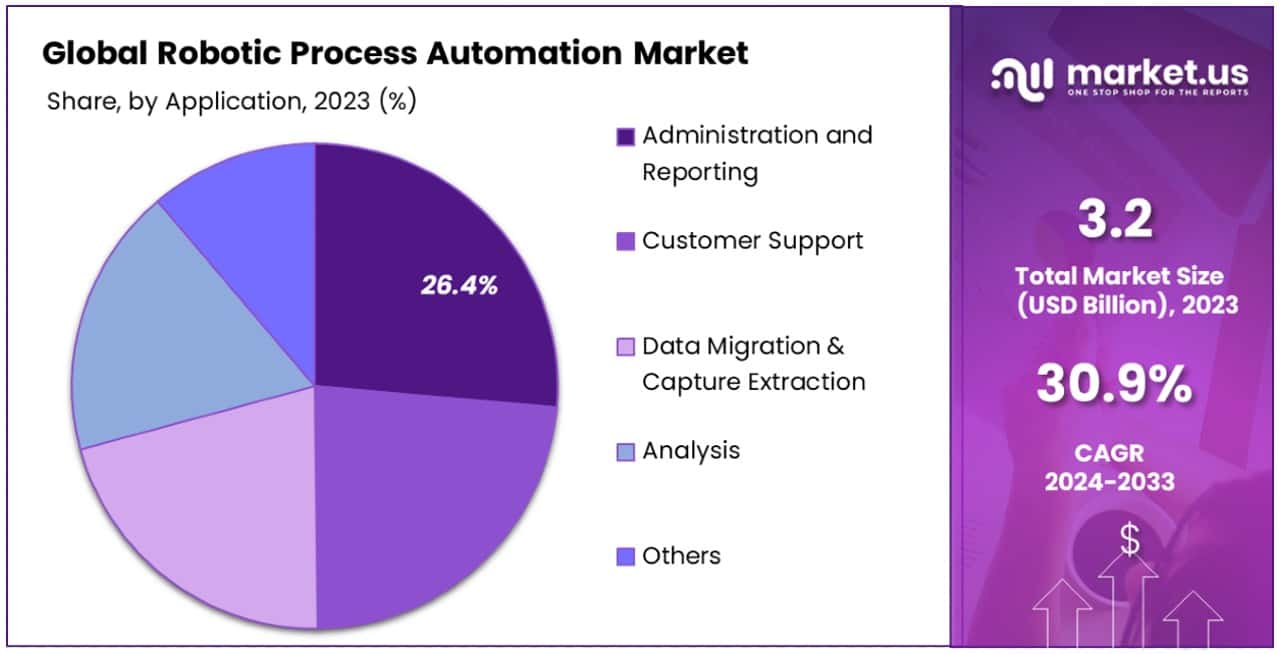

- In 2023, Administration and Reporting held a dominant market position in the By Application segment of the Robotic Process Automation Market, with a 26.4% share.

- In 2023, BFSI held a dominant market position in the end-use segment of the Robotic Process Automation Market, with a 28.4% share.

- North America dominated a 37.8% market share in 2023 and held USD 1.12 Billion in revenue from the Robotic Process Automation Market.

By Component Analysis

In 2023, the “By Component” segment of the Robotic Process Automation (RPA) market was predominantly led by Service, capturing a 63.4% share. This segment’s dominance is primarily driven by the growing need for ongoing support and optimization of RPA implementations in complex enterprise environments.

Services such as consulting, implementation, and training are crucial, as they ensure successful deployment and integration of RPA solutions into existing IT infrastructures and workflows. These services not only facilitate the initial adoption of RPA technologies but also enhance their scalability and effectiveness, enabling organizations to achieve a higher return on investment and sustained operational improvements.

Conversely, the Software segment also plays a critical role, forming the foundational framework upon which RPA deployments are built. Although it holds a smaller portion of the market, the demand for RPA software is integral to the expansion of RPA applications across new industries and sectors.

The development of more intuitive and robust RPA software continues to lower entry barriers for businesses, democratizing access to automation benefits across smaller enterprises and various verticals. As such, while services currently lead the market in terms of share, the software component remains essential, driving the core functionalities and innovations within the RPA ecosystem.

By Organization Analysis

In 2023, Large Enterprises held a dominant market position in the “By Organization” segment of the Robotic Process Automation (RPA) market, with a 66.5% share. This significant market share is attributable to large enterprises’ capacity to invest in and deploy RPA at scale, leveraging the technology to enhance efficiency across global operations.

These organizations typically manage extensive and complex processes that benefit substantially from automation, thereby driving substantial reductions in operational costs and improvements in speed and accuracy. Large enterprises also tend to be early adopters of technological innovations, including RPA, positioning them to reap early benefits and establish competitive advantages.

Conversely, Small & Medium Enterprises (SMEs) are progressively recognizing the benefits of RPA, although they constitute a smaller share of the market. For SMEs, RPA presents an opportunity to streamline operations and compete more effectively with larger rivals by enhancing productivity and operational flexibility.

As RPA software becomes more accessible and cost-effective, it is anticipated that the adoption rate among SMEs will increase, potentially reshaping the market dynamics and fostering more inclusive growth across various sectors within the RPA market.

By Operation Analysis

In 2023, Rule Based held a dominant market position in the “By Operation” segment of the Robotic Process Automation (RPA) market, with a 67.3% share. This prominence is largely due to the straightforward nature and implementation ease of rule-based automation, which operates on predefined rules and structured data.

Rule-based RPA is particularly effective in environments where processes are repetitive and predictable, making it an ideal solution for industries like banking, insurance, and finance, where precision and compliance are paramount. This form of automation ensures consistent outputs without human error, significantly enhancing operational efficiency and reliability.

Conversely, Knowledge Based RPA, which deals with unstructured data and requires artificial intelligence to make decisions, holds a smaller market share. While it is gaining traction, particularly in sectors that handle complex decision-making and data interpretation such as healthcare and customer service, its adoption is slower due to higher implementation complexities and costs.

However, as technologies advance and organizations seek more dynamic automation solutions, the growth in knowledge-based RPA is expected to accelerate, potentially shifting future market dynamics and broadening the scope of RPA applications.

By Application Analysis

In 2023, Administration and Reporting held a dominant market position in the “By Application” segment of the Robotic Process Automation (RPA) market, with a 26.4% share. This leading position underscores the critical role RPA plays in automating routine administrative tasks such as data entry, scheduling, and report generation.

Organizations leverage RPA to enhance the accuracy and speed of these tasks while freeing up human resources for more complex and strategic activities. The efficiency gained by automating repetitive administrative processes not only reduces operational costs but also improves compliance and minimizes the likelihood of errors, thereby enhancing overall business performance.

Other significant segments within the RPA market include Customer Support, Data Migration & Capture Extraction, and Analysis, each harnessing automation to optimize different facets of business operations. For instance, Customer Support uses RPA to automate responses and ticket sorting, improving response times and customer satisfaction.

Data Migration & Capture Extraction benefits from RPA by automating the transfer and updating of data across systems, ensuring consistency and accessibility. Meanwhile, RPA in Analysis automates the processing and interpretation of large data sets, enabling quicker and more accurate business insights. Collectively, these applications demonstrate RPA’s versatility and its expanding influence across various business functions.

By End-Use Analysis

In 2023, the Banking, Financial Services, and Insurance (BFSI) sector held a dominant market position in the “By End-Use” segment of the Robotic Process Automation (RPA) market, with a 28.4% share. This substantial market share is driven by the high demand within the BFSI sector for automation solutions that enhance operational efficiency, compliance, and customer service.

RPA enables banks and financial institutions to automate complex, rule-based tasks such as claims processing, compliance reporting, and fraud detection. The technology not only accelerates these processes but also reduces errors and operational costs, significantly improving service delivery and customer satisfaction.

Other industries, including Retail, Manufacturing and Logistics, Healthcare, IT and Telecom, and Hospitality, also integrate RPA to optimize various operational aspects. For instance, in Retail, RPA is used to manage supply chains and customer relations more efficiently. Manufacturing and Logistics leverage RPA for inventory management and logistics planning, whereas Healthcare employs it to handle patient records and billing systems.

IT Telecom and Hospitality sectors utilize RPA for improving service management and enhancing guest experiences, respectively. Each sector’s adoption reflects RPA’s versatility and its critical role in driving digital transformation and operational excellence across diverse industries.

Key Market Segments

By Component

- Software

- Service

By Organization

- Large Enterprises

- Small & Medium Enterprises

By Operation

- Rule Based

- Knowledge Based

By Application

- Administration and Reporting

- Customer Support

- Data Migration & Capture Extraction

- Analysis

- Others

By End-Use Retail

- Manufacturing and Logistics Industry

- BFSI

- Healthcare

- IT and Telecom

- Hospitality

- Others

Drivers

Key Drivers of RPA Adoption

Robotic Process Automation (RPA) is becoming increasingly popular across various industries due to its ability to significantly improve efficiency and reduce costs. As businesses strive for greater operational excellence, RPA emerges as a key driver of digital transformation.

This technology automates repetitive and time-consuming tasks, allowing employees to focus on more strategic activities. Additionally, RPA enhances accuracy and speeds up processing times, which is crucial in sectors like finance and healthcare where precision is vital.

The push towards digitalization in companies, coupled with the need to manage large volumes of data and improve customer service, further propels the adoption of RPA. The technology’s scalability and compatibility with existing systems make it an attractive investment for businesses looking to innovate and stay competitive in the digital age.

Restraint

Challenges Hindering RPA Growth

Despite the advantages of Robotic Process Automation (RPA), several challenges restrict its broader adoption. Key among these is the initial cost of implementing RPA systems, which can be prohibitively high, especially for small and medium-sized enterprises (SMEs).

These costs include not just the software itself but also the expenses associated with training employees and integrating the technology into existing IT infrastructures. Additionally, concerns around data security arise when automating processes that handle sensitive information, potentially deterring companies from deploying RPA solutions.

There is also a significant learning curve associated with optimizing RPA for specific business needs, which can slow down its adoption. Moreover, resistance to change from within organizations, where employees fear job displacement due to automation, further complicates RPA implementation and acceptance. These factors collectively act as significant restraints on the growth of the RPA market.

Opportunities

Expanding Opportunities in the RPA Market

The Robotic Process Automation (RPA) market presents significant opportunities for growth, particularly as technologies like artificial intelligence (AI) and machine learning (ML) continue to evolve. Integrating RPA with AI and ML can enhance automation capabilities to include more complex and decision-based processes, opening new avenues for application in industries that rely on cognitive tasks.

This integration allows businesses to handle large volumes of data more efficiently, fostering better decision-making and innovative customer interactions. Furthermore, the push for digital transformation across sectors creates a fertile environment for RPA expansion, as companies seek to streamline operations and improve productivity.

Additionally, as RPA technology becomes more user-friendly and cost-effective, smaller businesses are increasingly able to adopt these solutions, further expanding the market’s reach and depth. This scenario underscores a promising trajectory for RPA adoption across diverse business landscapes.

Challenges

Navigating Challenges in RPA Deployment

The expansion of the Robotic Process Automation (RPA) market is not without its challenges. One significant hurdle is the integration complexity with existing IT systems, particularly in organizations with outdated technology infrastructures. This can lead to extended deployment times and increased costs.

Additionally, there’s a prevalent skills gap, as many companies lack the in-house expertise necessary to implement and manage RPA solutions effectively. Training existing employees or hiring new talent can be costly and time-consuming. Another challenge is managing the expectations of both management and employees, as there can be resistance due to fears of job displacement and a misunderstanding of RPA’s role and benefits.

Finally, maintaining the security of automated processes and the data they handle remains a critical concern, especially in highly regulated industries. These challenges require careful planning and strategy to overcome, ensuring successful RPA adoption and optimization.

Growth Factors

Key Growth Drivers for the RPA Market

The Robotic Process Automation (RPA) market is experiencing robust growth, driven by several key factors. Primarily, the increasing demand for efficiency and cost reduction in business processes fuels the adoption of RPA. By automating routine and repetitive tasks, companies can significantly reduce labor costs and minimize errors, leading to enhanced productivity.

Additionally, the integration of RPA with emerging technologies like artificial intelligence and machine learning is expanding its capabilities, making it possible to automate more complex processes. This technological synergy is unlocking new use cases and applications, particularly in data-intensive industries.

The ongoing digital transformation in various sectors also propels RPA deployment, as businesses seek innovative solutions to stay competitive. Furthermore, the COVID-19 pandemic has accelerated the need for digital workflows and remote operation capabilities, further boosting the RPA market growth.

Emerging Trends

Emerging Trends in the RPA Sector

Emerging trends in the Robotic Process Automation (RPA) market are reshaping how businesses approach process automation. One notable trend is the increasing adoption of RPA in small and medium-sized enterprises (SMEs), driven by more accessible and affordable solutions.

This democratization of technology allows smaller businesses to compete on equal footing with larger corporations. Additionally, there’s a shift towards cloud-based RPA solutions, offering greater scalability, flexibility, and reduced overhead costs compared to traditional on-premise deployments. Another trend is the convergence of RPA with artificial intelligence (AI) and machine learning (ML), enhancing the intelligence of RPA systems to handle complex decision-making tasks.

This integration is particularly impactful in areas requiring cognitive capabilities, such as natural language processing and predictive analytics. These trends indicate a broadening scope and sophistication of RPA applications, promising continued growth and innovation in the field.

Regional Analysis

The Robotic Process Automation (RPA) market is experiencing robust growth across various regions, reflecting a widespread adoption of automation technologies aimed at enhancing operational efficiencies and reducing costs.

In North America, the market is particularly dominant, commanding a 37.8% share with a valuation of USD 1.2 billion. This leadership is driven by a strong presence of key industry players and a significant uptake in sectors such as finance, healthcare, and telecommunications.

Moving to Europe, the market is propelled by stringent regulatory requirements and the need for precision in industries like manufacturing and logistics. Asia Pacific is witnessing rapid growth, fueled by digital transformation initiatives and the increasing integration of AI with RPA, especially in countries like Japan, China, and India.

The Middle East & Africa, and Latin America are emerging as potential growth areas, driven by a push towards modernizing IT infrastructure and increasing competitive pressures, although they currently hold smaller shares of the global market.

This regional diversification highlights the global reach of RPA solutions and underscores North America’s leading position in driving forward the technological advancements in this field.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global Robotic Process Automation (RPA) market, key players such as Automation Anywhere Inc., Blue Prism Group PLC, and Jacada Inc. are pivotal in shaping the landscape of automation technologies.

Automation Anywhere Inc. stands out as a leader, primarily due to its expansive portfolio of RPA solutions that cater to a variety of industries including finance, healthcare, and manufacturing. Their approach to offering user-friendly, scalable solutions has significantly enhanced their market presence and customer base globally in 2023.

Blue Prism Group PLC is another major contender, renowned for its enterprise-grade RPA offerings that emphasize security and compliance. Blue Prism has carved a niche in providing robust automation capabilities that integrate seamlessly with existing IT environments, making it a preferred choice for large corporations looking to automate complex, rule-based processes.

Jacada Inc., although smaller compared to its counterparts, has made notable strides with its innovative customer service automation solutions. Jacada’s focus on improving customer interactions through automated processes has enabled it to secure a vital position in industries where customer service is a critical component of business operations.

Collectively, these companies are driving the advancement of RPA technologies by focusing on innovation, ease of integration, and scalability. Automation Anywhere and Blue Prism, with their broad and deep technological capabilities, continue to dominate the market, while Jacada’s specialized solutions offer significant value in niche areas.

As businesses increasingly adopt automation to enhance productivity and reduce costs, the influence of these key players is expected to grow, further steering the global RPA market dynamics.

Top Key Players in the Market

- Automation Anywhere Inc.

- Blue Prism Group PLC

- Jacada Inc.

- Kofax Inc.

- Datamatics Global Services Limited

- Nice Systems Ltd.

- Pegasystems Inc.

- NTT Advanced Technology Corporation

- Genpact Ltd.

- NICE Ltd.

- UiPath Inc.

- WorkFusion Inc.

Recent Developments

- In September 2023, Nice Systems Ltd. received a substantial investment of $50 million aimed at expanding its RPA solutions across healthcare and telecommunications industries. This funding is intended to support the development of customized automation tools that cater specifically to the complex needs of these sectors.

- In August 2023, Datamatics Global Services Limited launched a new RPA solution designed to streamline operations in the banking and finance sector. The product focuses on improving transaction speeds and accuracy, reflecting their commitment to enhancing sector-specific automation needs.

- In July 2023, Kofax Inc. enhanced its RPA capabilities by acquiring a smaller technology firm specializing in artificial intelligence. This strategic move aims to integrate AI with their existing automation solutions to offer more advanced features to their clients.

Report Scope

Report Features Description Market Value (2023) USD 3.2 Billion Forecast Revenue (2033) USD 47.3 Billion CAGR (2024-2033) 30.90% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component(Software, Service), By Organization (Large Enterprises, Small & Medium Enterprises), By Operation(Rule Based, Knowledge Based), By Application(Administration and Reporting, Customer Support, Data Migration & Capture Extraction, Analysis, Others), By End-Use(Retail, Manufacturing and Logistics Industry, BFSI, Healthcare, IT and Telecom, Hospitality, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Automation Anywhere Inc., Blue Prism Group PLC, Jacada Inc., Kofax Inc., Datamatics Global Services Limited, Nice Systems Ltd., Pegasystems Inc., NTT Advanced Technology Corporation, Genpact Ltd., NICE Ltd., UiPath Inc., WorkFusion Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Robotic Process Automation MarketPublished date: September 2024add_shopping_cartBuy Now get_appDownload Sample

Robotic Process Automation MarketPublished date: September 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Automation Anywhere Inc.

- Blue Prism Group PLC

- Jacada Inc.

- Kofax Inc.

- Datamatics Global Services Limited

- Nice Systems Ltd.

- Pegasystems Inc.

- NTT Advanced Technology Corporation

- Genpact Ltd.

- NICE Ltd.

- UiPath Inc.

- WorkFusion Inc.