Robotic Endoscopy Devices Market By Product Type (Diagnostic and Therapeutic), By Application (Laparoscopy, Colonoscopy, Bronchoscopy, and Others), By End-user (Hospitals and Outpatient Facilities), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 149909

- Number of Pages: 242

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

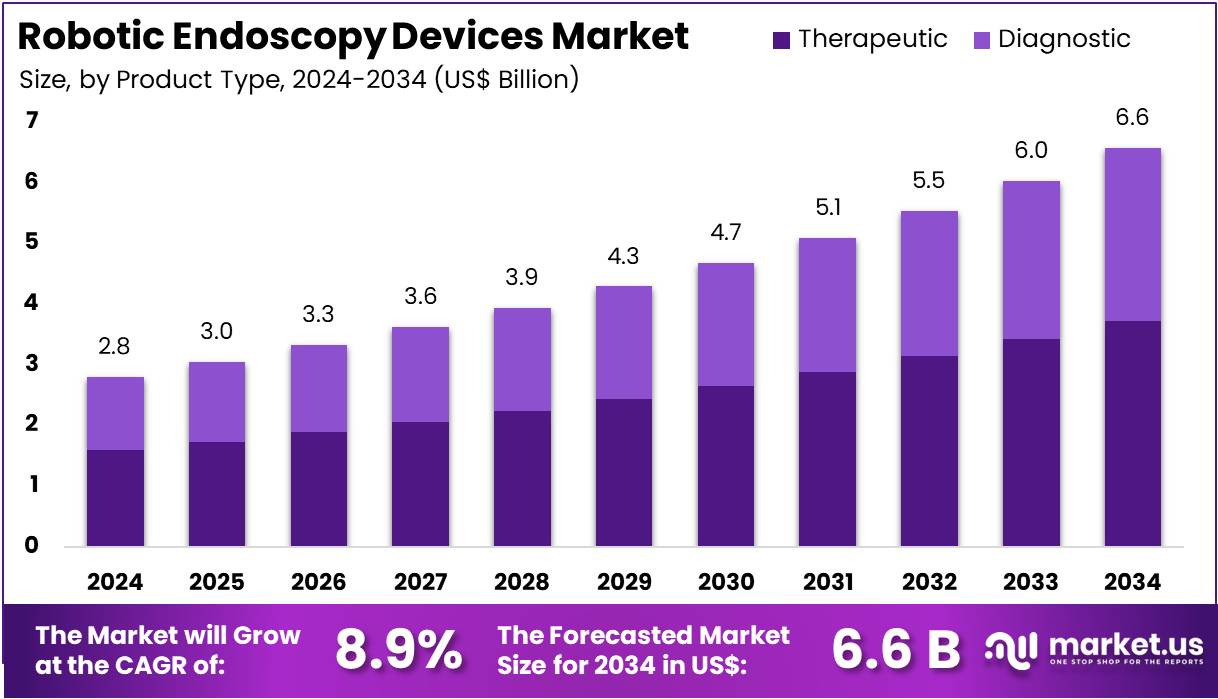

The Robotic Endoscopy Devices Market size is expected to be worth around US$ 6.6 billion by 2034 from US$ 2.8 billion in 2024, growing at a CAGR of 8.9% during the forecast period 2025 to 2034.

Increasing demand for minimally invasive diagnostic and therapeutic procedures drives growth in the robotic endoscopy devices market. These devices offer enhanced precision, flexibility, and control compared to conventional endoscopes, enabling physicians to perform complex gastrointestinal, respiratory, and urological interventions with improved outcomes and reduced patient discomfort.

Growing awareness of the benefits of robotic-assisted surgeries, including shorter recovery times and lower complication rates, further propels market adoption. In January 2023, Fujifilm expanded its portfolio of endoscopy solutions targeting therapeutic gastrointestinal applications, strengthening its market position and signaling confidence in the sector’s potential.

Technological advancements such as improved imaging quality, AI integration for better lesion detection, and enhanced maneuverability open new opportunities for expanding clinical applications. Rising incidences of gastrointestinal disorders and the aging population also contribute to increased demand for advanced endoscopic devices. The market witnesses a trend toward compact, user-friendly systems that streamline workflows and increase procedural efficiency.

Manufacturers are investing in research and development to introduce novel features like haptic feedback and autonomous navigation, aiming to enhance operator experience and patient safety. Furthermore, growing hospital investments in upgrading surgical technologies support market expansion. As robotic endoscopy devices enable earlier diagnosis and targeted treatment, they hold significant promise in improving patient care across multiple medical specialties, creating substantial growth opportunities in the coming years.

Key Takeaways

- In 2024, the market for robotic endoscopy devices generated a revenue of US$ 2.8 billion, with a CAGR of 8.9%, and is expected to reach US$ 6.6 billion by the year 2034.

- The product type segment is divided into diagnostic and therapeutic, with therapeutic taking the lead in 2023 with a market share of 56.7%.

- Considering application, the market is divided into laparoscopy, colonoscopy, bronchoscopy, and others. Among these, laparoscopy held a significant share of 38.5%.

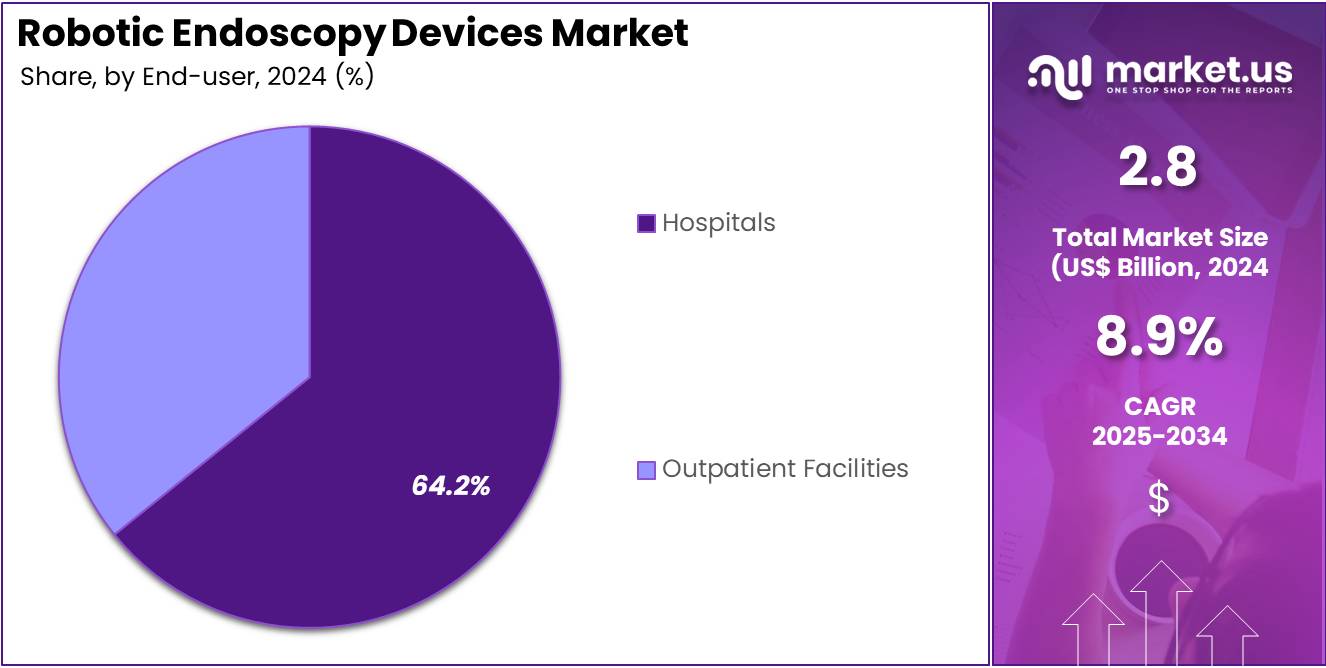

- Furthermore, concerning the end-user segment, the market is segregated into hospitals and outpatient facilities. The hospitals sector stands out as the dominant player, holding the largest revenue share of 64.2% in the robotic endoscopy devices market.

- North America led the market by securing a market share of 41.5% in 2023.

Product Type Analysis

The therapeutic segment claimed a market share of 56.7%. Increasing demand for minimally invasive surgical procedures drives adoption as therapeutic devices enhance precision and reduce patient recovery time. Technological advancements improve the capabilities of therapeutic systems, allowing for complex interventions with greater control and accuracy.

Healthcare providers focus on reducing procedural risks and improving outcomes, making therapeutic robotic devices highly desirable. Moreover, rising prevalence of chronic diseases requiring surgical treatment contributes to market expansion. The segment’s growth also benefits from expanding insurance coverage and favorable reimbursement policies supporting advanced therapeutic solutions.

Application Analysis

The laparoscopy held a significant share of 38.5% due to several reasons. Increasing preference for laparoscopic surgeries due to their minimally invasive nature, reduced complications, and faster recovery is a key driver. Technological innovations enhance robotic laparoscopy with better visualization, dexterity, and precision during procedures.

Surgeons value the improved ergonomics and control provided by these systems, which help reduce fatigue and improve surgical outcomes. Rising incidence of conditions such as gallbladder disease, appendicitis, and hernias fuels demand for laparoscopic interventions. As healthcare facilities expand minimally invasive surgical programs, this application segment is likely to maintain a dominant market position.

End-user Analysis

The hospitals segment had a tremendous growth rate, with a revenue share of 64.2%. Hospitals invest heavily in advanced surgical technologies to improve patient care, reduce hospital stays, and minimize complications. The integration of robotic endoscopy devices aligns with goals to enhance surgical precision and efficiency. Hospitals benefit from increased procedural volume and improved clinical outcomes, driving the adoption of robotic systems.

Additionally, outpatient facilities are expanding their capabilities, but hospitals continue to lead due to higher patient throughput and access to specialized surgeons. Supportive reimbursement frameworks and government initiatives to modernize healthcare infrastructure further stimulate growth in this segment.

Key Market Segments

By Product Type

- Diagnostic

- Therapeutic

By Application

- Laparoscopy

- Colonoscopy

- Bronchoscopy

- Others

By End-user

- Hospitals

- Outpatient Facilities

Drivers

Rising Preference for Minimally Invasive Surgeries is Driving the Market

The increasing adoption of minimally invasive surgical (MIS) procedures is a significant driver for the robotic endoscopy devices market. MIS offers numerous benefits over traditional open surgery, including smaller incisions, reduced scarring, less pain, shorter hospital stays, and faster recovery times. As patient awareness of these advantages grows, there is a greater demand for MIS options across various medical specialties.

Robotic endoscopy enhances the capabilities of MIS by providing surgeons with improved visualization, greater dexterity, and more precise control over surgical instruments within the body’s natural orifices or through small incisions. This leads to better patient outcomes and increased procedural efficiency, further fueling the demand for robotic endoscopy devices.

According to a study evaluating the impact of robotic-assisted surgery (RAS) on MIS rates across 408 US hospitals between 2016 and 2022, hospitals that introduced RAS saw their MIS rates increase from 60.5% to 65.8%, a more significant rise compared to hospitals that did not adopt RAS, where the increase was from 56.1% to 57.0%. This data underscores the role of robotic systems in expanding the application of minimally invasive techniques.

Restraints

High Cost of Robotic Endoscopy Devices is Restraining the Market

The substantial upfront and maintenance costs associated with robotic endoscopy systems pose a significant restraint on the widespread adoption of these devices. The initial investment for purchasing a robotic system, along with the recurring expenses for accessories, servicing, and specialized training for medical personnel, can be prohibitive for many healthcare facilities, particularly in developing economies or smaller hospitals with budget constraints.

While the long-term benefits of robotic endoscopy, such as reduced hospital stays and fewer complications, can lead to cost savings, the immediate financial outlay can deter adoption. This financial barrier can limit the availability of robotic endoscopy procedures, restricting market growth despite the clinical advantages offered by these technologies. Efforts to develop more cost-effective robotic systems and innovative financing models could help mitigate this restraint.

Opportunities

Technological Advancements are Creating Growth Opportunities

Continuous advancements in robotics, imaging, and artificial intelligence (AI) are creating significant growth opportunities in the robotic endoscopy devices market. The integration of AI algorithms enhances image analysis during endoscopic procedures, aiding in the early and more accurate detection of abnormalities.

Improved robotic platforms offer greater flexibility, maneuverability, and precision, expanding the range of procedures that can be performed robotically through natural orifices or minimally invasive incisions. Furthermore, the development of smaller and more versatile robotic endoscopes allows access to previously hard-to-reach areas within the body.

For instance, the EndoDrive system offers electro-mechanical support for flexible endoscopes, and the Endoscopic Operation Robot developed in Japan can attach to conventional scopes, providing greater degrees of freedom. In October 2024, Momentis Surgical received FDA approval for its Anovo surgical robotic system for single-point abdominal hernia repair, highlighting the expanding clinical applications enabled by technological innovation in this field. These ongoing innovations are expected to drive further adoption and market expansion.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors exert a considerable influence on the robotic endoscopy devices market. Economic downturns can lead to reduced healthcare spending, potentially delaying hospital investments in capital-intensive robotic systems. Fluctuations in currency exchange rates can affect the cost of imported robotic technologies and components, impacting market prices and profitability.

Geopolitical tensions, such as trade disputes or sanctions, can disrupt supply chains, leading to increased costs and longer lead times for device manufacturing and delivery. Conversely, stable economic growth and international collaborations can foster market expansion by increasing healthcare budgets and facilitating technology transfer.

For instance, higher per capita gross domestic product often correlates with greater healthcare expenditure, including the adoption of advanced medical technologies. While uncertainties in the global economic and political landscape can create headwinds, the fundamental drivers of the market, such as the increasing prevalence of chronic diseases and the demand for minimally invasive procedures, are expected to sustain long-term growth.

The imposition of tariffs by the US can have both positive and negative repercussions for the robotic endoscopy devices market. Increased tariffs on imported components, many of which are sourced from countries like China, can raise the manufacturing costs for US-based robotic system producers. This can lead to higher prices for the final devices, potentially slowing down their adoption, especially among smaller healthcare facilities with tighter budgets.

Several major medical device companies, including Johnson & Johnson, Boston Scientific, and Abbott, have reported that US tariff policies will cost them hundreds of millions of US dollars. On the other hand, tariffs might incentivize domestic production of robotic components and systems within the US. This could lead to increased investment in local manufacturing, fostering innovation and creating jobs within the country.

While the immediate effect of tariffs might be increased costs and supply chain adjustments, the long-term outcome could be a more resilient domestic industry, less susceptible to international trade disruptions. Despite the added financial burden in the short term, the drive for advanced medical technologies is likely to ensure continued, albeit potentially modulated, growth in the US market.

Latest Trends

Integration of Artificial Intelligence (AI) is a Recent Trend

A prominent recent trend in the robotic endoscopy devices market is the increasing integration of artificial intelligence (AI) to enhance diagnostic and therapeutic capabilities. AI algorithms are being developed to analyze endoscopic images and videos in real-time, assisting physicians in identifying subtle lesions, polyps, and other abnormalities that might be missed by the human eye.

This can lead to earlier and more accurate diagnoses, potentially improving patient outcomes. AI is also being explored for tasks such as automated navigation of the endoscope and predictive analytics to personalize treatment plans. The focus on real-time image processing and AI-powered navigation systems demonstrates the growing importance of AI in the evolution of robotic endoscopy.

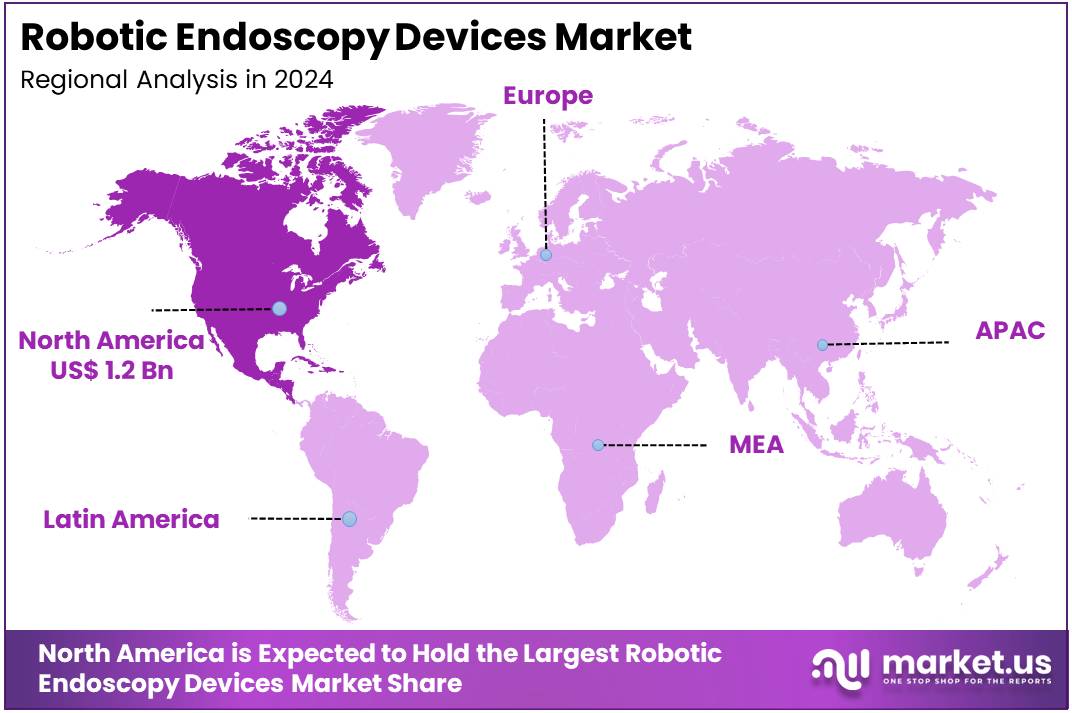

Regional Analysis

North America is leading the Robotic Endoscopy Devices Market

North America dominated the market with the highest revenue share of 41.5% owing to the increasing embrace of minimally invasive diagnostic and therapeutic procedures alongside continuous technological evolution. The enhanced precision, improved surgeon dexterity, and superior visualization offered by these devices are key factors driving their adoption.

A notable development in January 2024 was AnX Robotica’s FDA de novo clearance for its NaviCam ProScan, an AI-assisted colonoscopy system. This clearance underscores the growing integration of artificial intelligence to augment the diagnostic capabilities of robotic endoscopy, potentially leading to more accurate and efficient detection of abnormalities during examinations. The established preference among both physicians and patients for less invasive surgical techniques further bolsters the demand for these advanced systems across the region.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is projected to register the fastest CAGR due to rising investments in healthcare infrastructure across the region. A growing demand for minimally invasive surgical options is fueling this trend. The region’s expanding geriatric population, which often requires less invasive procedures, is a major contributing factor. Additionally, the focus on early disease detection is increasing. These factors combined are driving interest in advanced medical technologies. Healthcare systems in the region are progressively adopting robotic endoscopy devices to improve patient outcomes and procedural efficiency.

The growing medical tourism sector in Asia Pacific is also contributing to this market growth. Countries like India, Thailand, and Singapore are attracting international patients seeking advanced treatments. This demand supports the expansion of hospitals and specialized centers offering robotic-assisted surgeries. At the same time, advancements in endoscopic technology are making procedures safer and more effective. The increasing acceptance of robotic systems by healthcare professionals will continue to boost adoption. Together, these trends indicate a strong outlook for the robotic endoscopy device market in Asia Pacific.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the robotic endoscopy devices market are driving growth through strategic technology investments and global expansion. Their focus lies in integrating artificial intelligence (AI), machine learning, and cloud computing to improve surgical precision and diagnostic accuracy. Many companies also collaborate with hospitals and research institutions to develop innovative and targeted solutions. Emphasis is placed on user-friendly interfaces and mobile accessibility to enhance patient care. Continuous investment in research and development enables these firms to remain competitive in a rapidly evolving medical technology landscape.

Intuitive Surgical, Inc. stands out as a market leader in robotic-assisted surgical systems. Founded in 1995 and based in Sunnyvale, California, the company is known for its da Vinci Surgical System. This platform is widely used in urology, gynecology, and general surgery for minimally invasive procedures. By 2021, more than 6,700 da Vinci systems had been installed globally, with strong adoption across the United States, Europe, and Asia. Intuitive Surgical’s dedication to precision, innovation, and service excellence has solidified its position in the robotic endoscopy devices market.

Top Key Players in the Robotic Endoscopy Devices Market

- Virtuoso Surgical, Inc

- Olympus Corporation

- Novus Health Products R&D Consultancy

- Medtronic

- Intuitive Surgical

- Fujifilm

- CMR Surgical Ltd.

- Brainlab AG

Recent Developments

- In March 2024: Intuitive Surgical received FDA clearance for its next-generation multiport robotic system, the da Vinci 5. This system represents a significant advancement in robotic-assisted surgery, building on the legacy of the da Vinci Xi, which has already been utilized in more than 7 million procedures worldwide. The da Vinci 5 is seen as a major technological leap, offering enhanced capabilities for precision and control in minimally invasive surgeries.

- In December 2023: Medtronic entered into a strategic collaboration with Cosmo Intelligent Medical Devices to co-develop the GI Genius intelligent endoscopy module. This partnership centers on the integration of artificial intelligence (AI) into endoscopic procedures, with the objective of improving diagnostic accuracy, enhancing patient outcomes, and advancing the capabilities of AI-powered medical technologies.

Report Scope

Report Features Description Market Value (2024) US$ 2.8 billion Forecast Revenue (2034) US$ 6.6 billion CAGR (2025-2034) 8.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Diagnostic and Therapeutic), By Application (Laparoscopy, Colonoscopy, Bronchoscopy, and Others), By End-user (Hospitals and Outpatient Facilities) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Virtuoso Surgical, Inc, Olympus Corporation, Novus Health Products R&D Consultancy, Medtronic, Intuitive Surgical, Fujifilm, CMR Surgical Ltd., Brainlab AG. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Robotic Endoscopy Devices MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Robotic Endoscopy Devices MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Virtuoso Surgical, Inc

- Olympus Corporation

- Novus Health Products R&D Consultancy

- Medtronic

- Intuitive Surgical

- Fujifilm

- CMR Surgical Ltd.

- Brainlab AG