Global Robot Safety Monitoring AI Market Size, Share Report Analysis By Component (Software, Hardware, Services), By Deployment Mode (On-Premises, Cloud), By Application (Industrial Robots, Collaborative Robots, Mobile Robots, Others), By End-Use Industry (Manufacturing, Automotive, Electronics, Healthcare, Logistics, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 169792

- Number of Pages: 200

- Format:

-

keyboard_arrow_up

Quick Navigation

- Market Size and Forecast

- Top Market Takeaways

- Report Overview

- Key Statistics

- By Component

- By Deployment Mode

- By Application

- By End Use Industry

- US Market Size

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

Market Size and Forecast

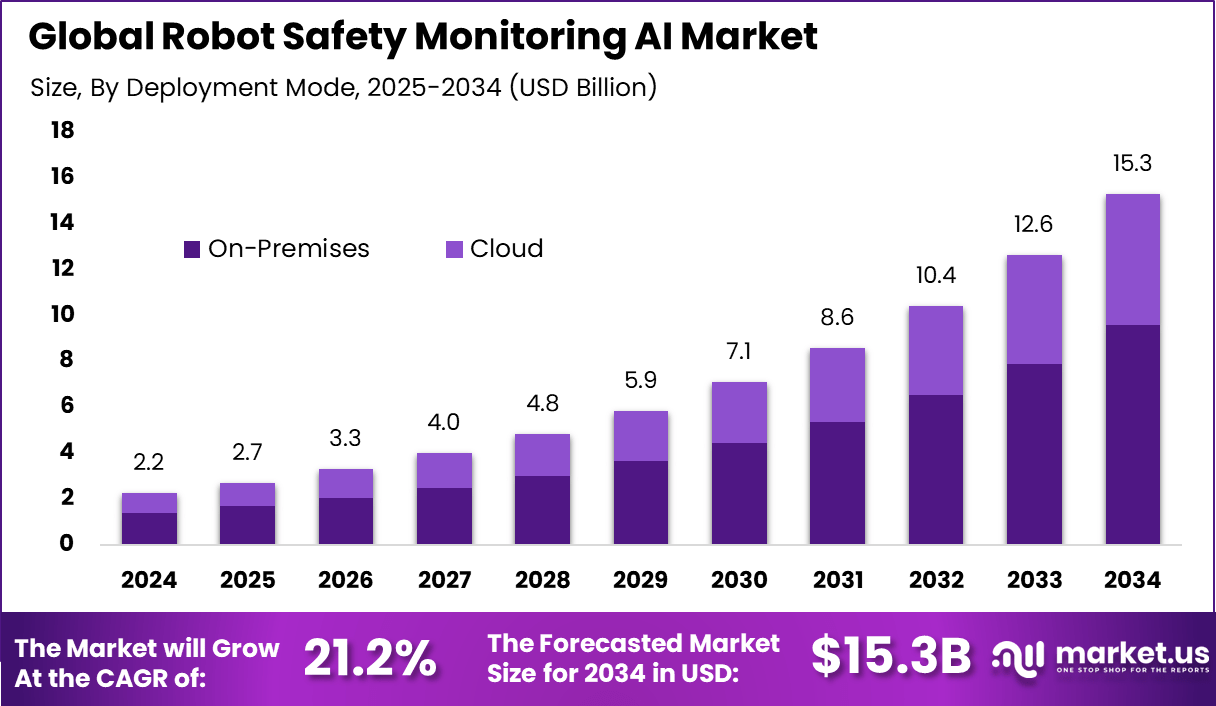

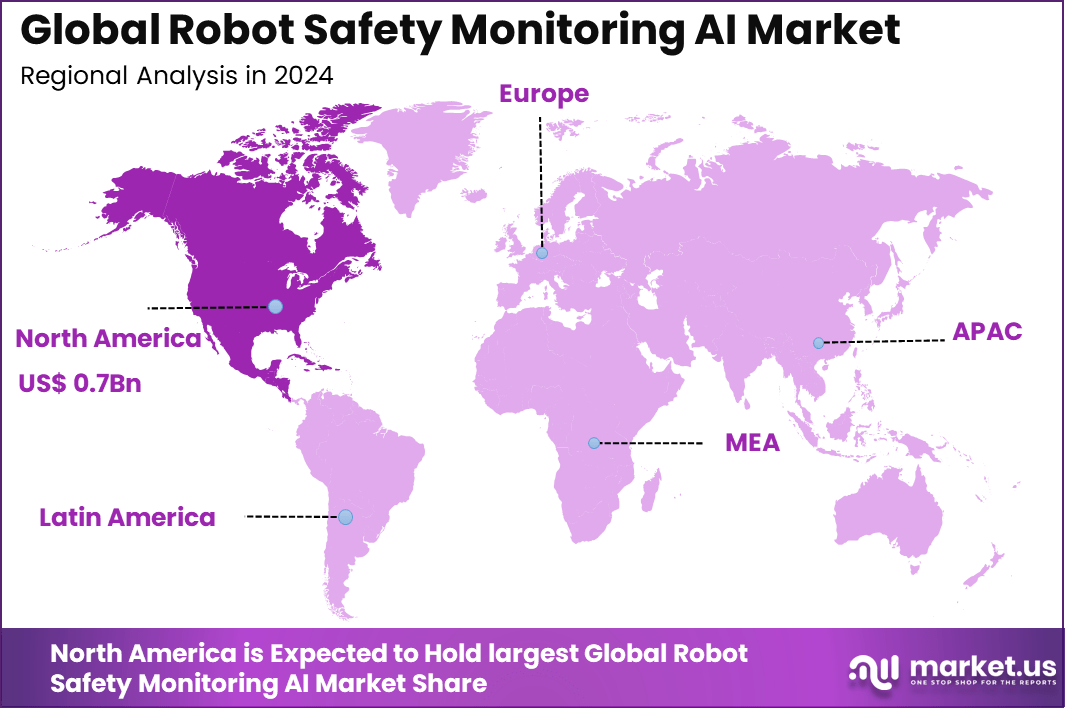

The Global Robot Safety Monitoring AI Market generated USD 2.2 billion in 2024 and is predicted to register growth from USD 2.7 billion in 2025 to about USD 15.3 billion by 2034, recording a CAGR of 21.2% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 36.3% share, holding USD 21.2 Billion revenue.

Top Market Takeaways

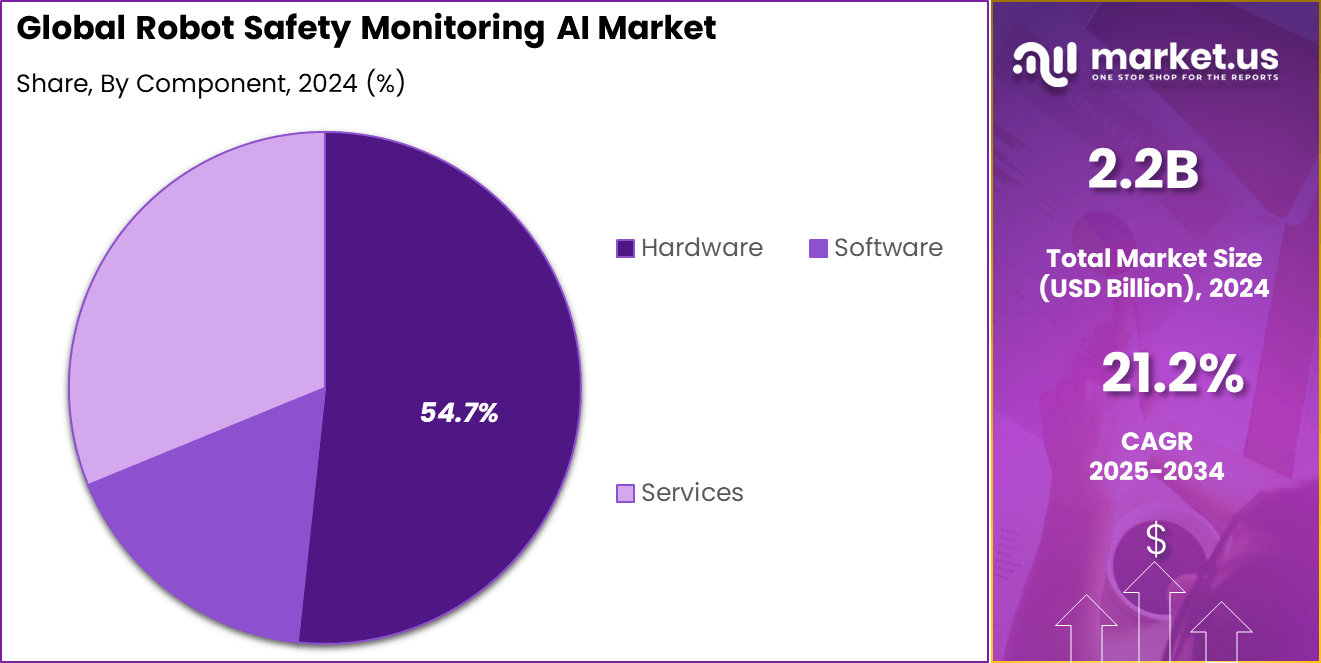

- Hardware dominated with 54.7%, showing that physical safety sensors, cameras, and control units remain the foundation of robot safety monitoring systems.

- On-premises deployment held 62.5%, reflecting strong preference for local control, low latency, and stricter safety compliance in factory environments.

- Industrial robots accounted for 44.6%, confirming that high-speed and high-load robotic operations drive the greatest demand for AI-based safety monitoring.

- Manufacturing led end-use adoption with 39.3%, supported by rising automation and stricter workplace safety regulations.

- North America captured 36.3%, driven by advanced factory automation and early adoption of AI-based machine safety systems.

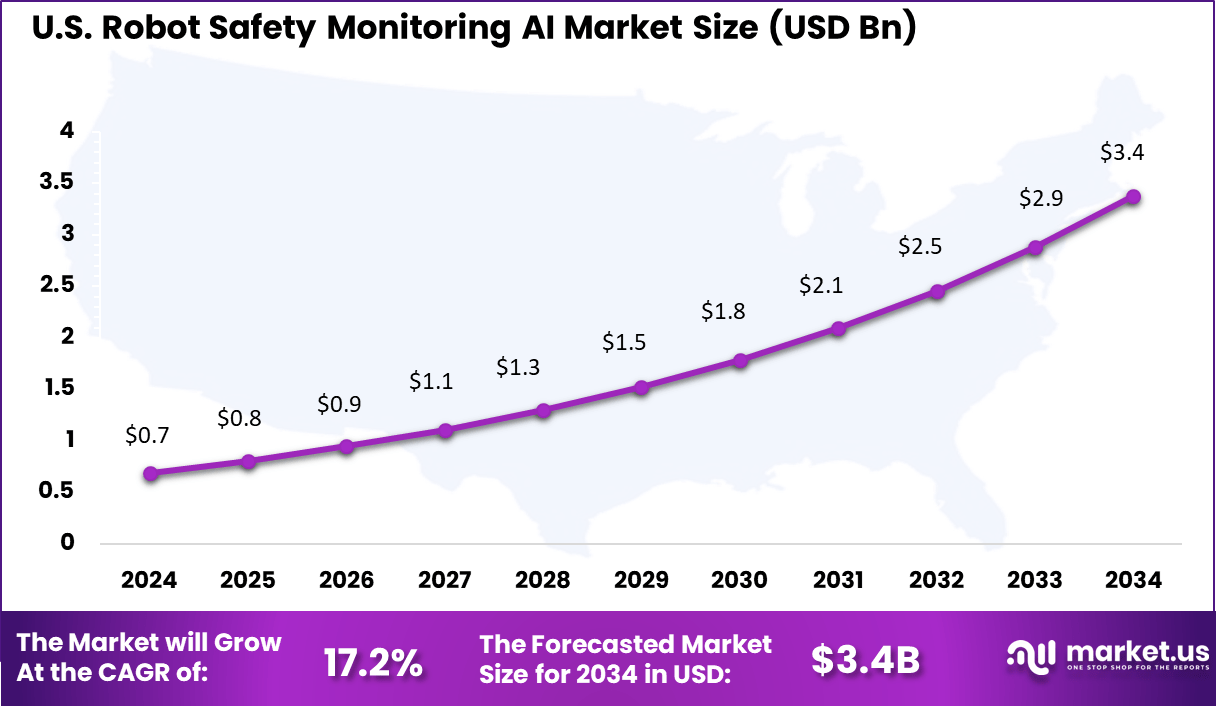

- The U.S. market reached USD 0.69 billion in 2024 with a strong 17.2% CAGR, showing fast growth in smart safety investments across automated production lines.

Report Overview

The robot safety monitoring AI market has grown as factories, warehouses and public facilities increase the use of robots in daily operations. Growth is linked to the need for safe interaction between humans and machines in shared work areas. Safety monitoring systems use AI to observe robot movement, human presence and surrounding conditions to prevent accidents and reduce operational risk.

The growth of the market can be attributed to rising robot adoption in manufacturing, logistics and service environments. As robots operate closer to human workers, the risk of collision and injury increases. Companies also face stronger safety compliance pressure and must ensure that automated systems meet strict workplace protection rules.

Demand is rising across industrial automation plants, warehouse operations, automotive assembly lines, electronics manufacturing units and medical robotics facilities. Service robots used in hospitals, hotels and public spaces also require safety monitoring. Regions with high automation density show stronger demand due to increased human robot interaction on factory floors and in public areas.

Key Statistics

Impact on Workplace Safety

- A rise of 1.34 robots per 1,000 workers is linked to a reduction of about 1.2 injuries per 100 workers in U.S. workplaces, showing a direct safety benefit from automation.

- Robotics sites reported lower recordable and lost-time incident rates than non-robotics sites, based on 2022 operational data, confirming safer work conditions.

- In AI-assisted robotic surgeries, operative time dropped by 25%, while intraoperative complications fell by 30%, and surgical precision improved by 40%.

- AI-based hazard detection systems achieved up to 97% accuracy in laboratory safety monitoring, showing strong reliability in real-time risk spotting.

- Autonomous construction robots reduced exposure to hazardous work by 72% in a 2025 safety study, highlighting strong protection in high-risk environments.

Adoption and Use

- By 2025, more than 16 million service robots are expected to be deployed globally, with 57% being AI-enabled.

- About 80% of new industrial robots are collaborative robots designed to work safely alongside human workers.

- Annual industrial robot installations grew at an average rate of 9% per year between 2015 and 2020, showing steady long-term automation growth.

By Component

The hardware segment leads with a 54.7% share, showing that physical safety equipment remains the foundation of robot safety monitoring systems. This includes vision sensors, cameras, motion detectors, emergency stop devices, and wearable safety tools used around robotic work zones.

Strong demand for hardware is driven by the need for real-time detection of human movement and machine behavior. These devices act as the first layer of protection by collecting live data that AI systems use to detect unsafe conditions and prevent accidents inside robotic environments.

By Deployment Mode

On-premises deployment dominates with a 62.5% share, reflecting the preference for localized control over safety systems within industrial facilities. Manufacturing plants rely on direct system access to ensure uninterrupted operation and faster response during safety events.

The use of on-premises platforms also helps organizations meet strict internal safety rules and data control policies. Many factories operate in environments with limited external connectivity, which further supports on-site deployment of AI safety monitoring systems.

By Application

Industrial robot monitoring represents 44.6% of overall application demand, making it the largest use case. These robots are widely used in assembly lines, welding, packaging, and material handling, where human and machine interaction is frequent.

AI-powered safety systems help monitor robot speed, movement patterns, and worker proximity. This reduces the risk of collisions, improves compliance with safety standards, and supports continuous production without frequent shutdowns.

By End Use Industry

Manufacturing holds a strong 39.3% share, confirming its role as the primary end-use industry for robot safety monitoring AI. Factories use automated systems to increase output speed and consistency, which raises the need for advanced safety control.

AI-based monitoring supports worker protection by identifying unsafe behavior, machine faults, and restricted zone violations. These systems also help reduce injury-related downtime and improve plant-level safety performance.

US Market Size

The United States alone reached USD 0.69 Bn with a healthy CAGR of 17.2%, reflecting rising investment in smart factories and worker safety technologies. Growth is linked to increased robot deployment and strict workplace safety enforcement.

North America accounts for a 36.3% regional share, supported by early adoption of industrial automation and strong safety standards across factories. The region shows high use of AI-enabled monitoring systems in automotive, electronics, and heavy manufacturing plants.

Emerging Trends

A key trend in the robot safety monitoring AI market is the wider use of collaborative robots that operate in shared spaces with human workers. This shift increases the need for systems that can identify human presence, monitor movement patterns, and intervene when unsafe situations develop. Industries are moving toward open and flexible work layouts, which increases interest in AI tools that can maintain safety without relying solely on physical barriers.

Another trend is the improvement of perception technologies used in safety systems. Modern solutions now use cameras, depth sensors and LiDAR combined with AI models to detect workers, objects and changes in the workspace. These systems can adjust safety distances and stopping behavior in real time, allowing robots to work safely even in busy or unpredictable environments. This development is becoming more common in manufacturing, logistics and service robotics.

Growth Factors

One strong growth factor is the steady increase in robot adoption across industrial and service settings. As robots perform more tasks in factories, warehouses, hospitals and public areas, employers must ensure safe operation. AI systems that monitor robot activity and human movement help prevent accidents and reduce downtime. This growing reliance on automation supports strong demand for safety monitoring solutions.

Another growth factor is the tightening of workplace safety regulations. Many countries require employers to demonstrate that robots can operate safely around human workers. AI-enabled monitoring provides evidence of safe operation through continuous observation and recorded activity. Companies adopt these systems to comply with regulations, avoid penalties and maintain safe working conditions.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Deployment Mode

- On-Premises

- Cloud

By Application

- Industrial Robots

- Collaborative Robots

- Mobile Robots

- Others

By End-Use Industry

- Manufacturing

- Automotive

- Electronics

- Healthcare

- Logistics

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

A major driver is the expansion of human and robot collaboration. When workers and robots share the same space, there is a greater need for accurate detection of people, safe stopping behavior and prediction of risk. AI helps achieve this through continuous monitoring and quick response. This driver is especially strong in sectors where productivity depends on smooth cooperation between human workers and automated systems.

Another driver is improvement in sensor quality and AI interpretation. High resolution cameras and depth sensing allow more accurate understanding of worker positions and surroundings. As these technologies improve, AI safety monitoring becomes more reliable and attractive to companies that want safe and uninterrupted operation.

Restraint Analysis

A major restraint for the market is the high cost of installation and integration. Many facilities must install new sensors or adapt older robots to work with AI monitoring tools. This can require upgrades to software, networks and control systems. Smaller organizations may not have the budget or technical resources to adopt these solutions quickly.

Another restraint is concern about reliability. AI-based systems must perform correctly in changing conditions such as low lighting, dust, or crowded workspaces. If the system produces false alarms or fails to detect real risks, overall trust is reduced. Some companies remain cautious until they see consistent long-term performance.

Opportunity Analysis

There is a clear opportunity to expand into service industries such as healthcare, retail and public transport. Robots in these settings interact with people who may not be trained in robot safety. AI monitoring can help detect unsafe proximity, support navigation and reduce the chance of accidents. This creates new demand outside traditional industrial uses.

Another opportunity lies in providing adaptable safety systems for small and mid-sized enterprises. Many smaller firms are starting to use robots but lack the resources for complex safety infrastructure. Offering compact and affordable monitoring systems can increase adoption and open new customer segments.

Challenge Analysis

A major challenge is maintaining regulatory acceptance across regions. Safety standards differ between countries, and companies must show that AI monitoring meets local requirements. Achieving this across global markets is complex and can slow the pace of adoption.

Another challenge is maintaining a balance between safety and smooth operation. If the system stops robots too often, productivity suffers. If it stops too rarely, safety is compromised. Achieving consistent and correct behavior requires careful tuning and ongoing oversight, which adds workload for operators and engineers.

Competitive Analysis

ABB, Siemens, FANUC, KUKA, and Yaskawa Electric lead the robot safety monitoring AI market with integrated safety controllers, vision-based monitoring, and real-time hazard detection. Their platforms enable collision avoidance, zone protection, and safe human-robot collaboration in factories. These companies focus on high system reliability, fast response times, and compliance with global safety standards. Rising adoption of collaborative robots continues to reinforce their leadership.

Omron, Rockwell Automation, Universal Robots, SICK, and Keyence strengthen the competitive landscape with AI-enabled safety sensors, machine vision, and smart light curtains. Their solutions improve worker protection during high-speed automation and flexible production. These providers emphasize adaptive sensing, easy integration, and continuous safety diagnostics. Growing focus on zero-accident manufacturing supports wider deployment.

Honeywell, Schneider Electric, Mitsubishi Electric, Pilz, Cognex, Banner Engineering, DENSO, Epson Robots, Bosch Rexroth, and Teradyne expand the market with safety PLCs, AI cameras, and smart interlock systems. Their technologies support automotive, electronics, and logistics automation. These companies focus on scalable safety architecture and predictive risk monitoring. Increasing automation density continues to drive demand for AI-based robot safety systems.

Top Key Players in the Market

- ABB Ltd.

- Siemens AG

- FANUC Corporation

- KUKA AG

- Yaskawa Electric Corporation

- Omron Corporation

- Rockwell Automation

- Universal Robots

- SICK AG

- Keyence Corporation

- Honeywell International Inc.

- Schneider Electric SE

- Mitsubishi Electric Corporation

- Pilz GmbH & Co. KG

- Cognex Corporation

- Banner Engineering Corp.

- DENSO Corporation

- Epson Robots

- Bosch Rexroth AG

- Teradyne Inc.

- Others

Recent Developments

- July, 2025 – Siemens rolled out AI-driven Operations Copilot and Safe Velocity for AMRs and AGVs, blending camera data with auto speed controls to cut collision risks and speed deployments without constant oversight.

- June, 2025 – FANUC demoed AI-supported maintenance at Automatica on its M-410 palletizer, spotting wear early via network monitoring to hit near-zero downtime in collaborative setups.

Report Scope

Report Features Description Market Value (2024) USD 2.2 Bn Forecast Revenue (2034) USD 15.3 Bn CAGR(2025-2034) 21.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Hardware, Services), By Deployment Mode (On-Premises, Cloud), By Application (Industrial Robots, Collaborative Robots, Mobile Robots, Others), By End-Use Industry (Manufacturing, Automotive, Electronics, Healthcare, Logistics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ABB Ltd., Siemens AG, FANUC Corporation, KUKA AG, Yaskawa Electric Corporation, Omron Corporation, Rockwell Automation, Universal Robots, SICK AG, Keyence Corporation, Honeywell International Inc., Schneider Electric SE, Mitsubishi Electric Corporation, Pilz GmbH & Co. KG, Cognex Corporation, Banner Engineering Corp., DENSO Corporation, Epson Robots, Bosch Rexroth AG, Teradyne Inc., Others. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Robot Safety Monitoring AI MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Robot Safety Monitoring AI MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB Ltd.

- Siemens AG

- FANUC Corporation

- KUKA AG

- Yaskawa Electric Corporation

- Omron Corporation

- Rockwell Automation

- Universal Robots

- SICK AG

- Keyence Corporation

- Honeywell International Inc.

- Schneider Electric SE

- Mitsubishi Electric Corporation

- Pilz GmbH & Co. KG

- Cognex Corporation

- Banner Engineering Corp.

- DENSO Corporation

- Epson Robots

- Bosch Rexroth AG

- Teradyne Inc.

- Others