Global Robot Fleet Analytics Market Size, Share and Analysis Report By Component (Software & Platforms (Core Analytics Engines, Task & Path Optimization Software, Dashboard & Visualization Tools, Predictive Maintenance Modules, Others), Services (Implementation & Integration, Consulting, Managed Services)), By Deployment Mode (Cloud-Based, On-Premises), By Robot Type (Industrial Robots, Collaborative Robots, Autonomous Mobile Robots, Service Robots), By End-User Industry (Automotive, Electronics & Semiconductor, Logistics & E-commerce Fulfillment, Food & Beverage, Metals & Machinery, Healthcare & Pharmaceuticals, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 177263

- Number of Pages: 271

- Format:

-

keyboard_arrow_up

Quick Navigation

- Robot Fleet Analytics Market size

- Top Market Takeaways

- Report Overview

- Drivers Impact Analysis

- Restraint Impact Analysis

- By Component

- By Deployment Mode

- By Robot Type

- By End User Industry

- Regional Perspective

- Trends and Disruptions Impacting Customers

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Increasing Adoption Technologies

- Investment and Business Benefits

- Emerging Trends Analysis

- Growth Factors Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Key Market Segments

- Report Scope

Robot Fleet Analytics Market size

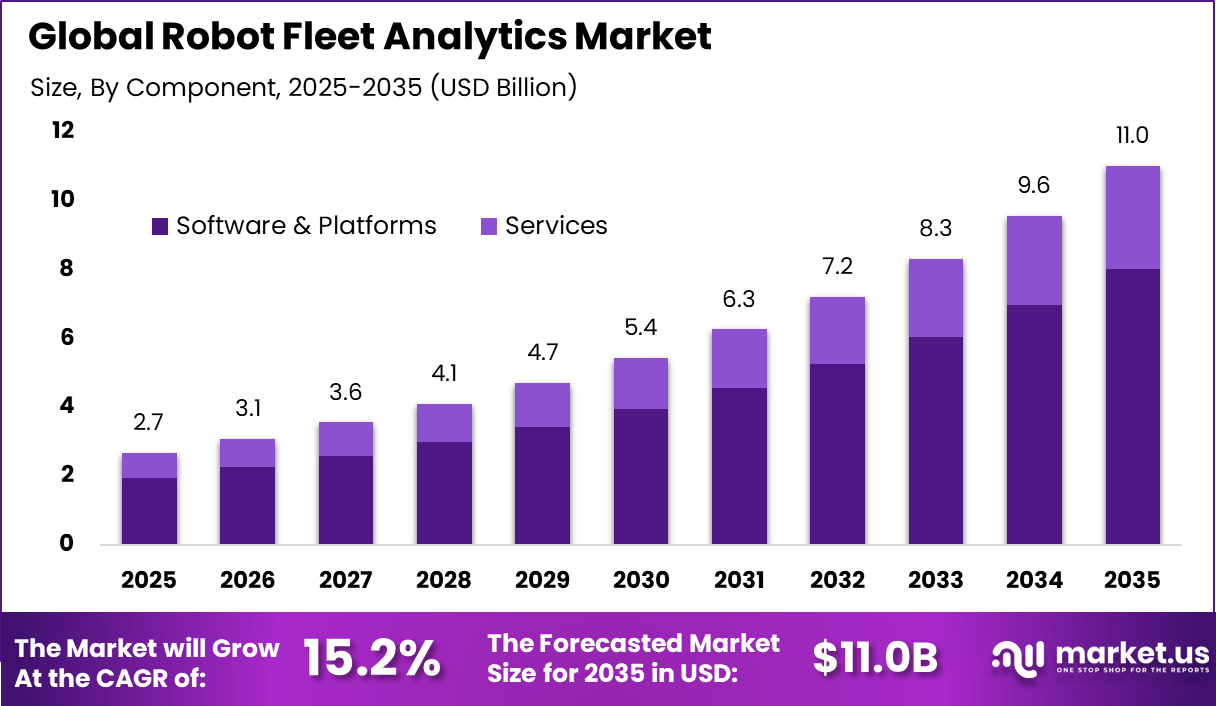

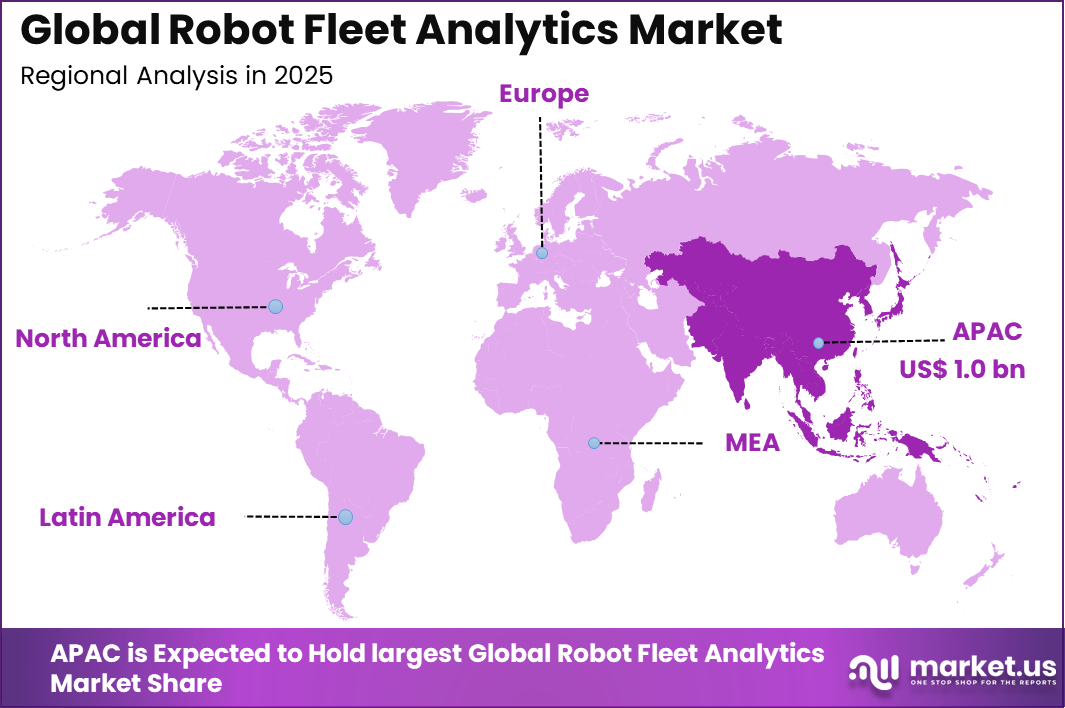

The Global Robot Fleet Analytics Market size is expected to be worth around USD 11 Billion By 2035, from USD 2.7 billion in 2025, growing at a CAGR of 15.2% during the forecast period from 2026 to 2035. Asia-Pacific held a dominant Market position, capturing more than a 40.2% share, holding USD 1.0 Billion revenue.

The Robot Fleet Analytics Market refers to software platforms and analytical systems that monitor, analyze, and optimize the performance of multiple robots operating simultaneously. These robots are deployed across warehouses, factories, hospitals, campuses, and outdoor operational environments. Fleet analytics focuses on collecting real time data related to robot location, task execution, battery status, utilization, errors, and downtime.

The market has gained strategic importance as organizations transition from isolated robot deployments to large scale autonomous fleets. Autonomous robotics usage has scaled rapidly across multiple sectors. By late 2024, Brain Corp’s autonomous robot fleet had surpassed 250 billion square feet of total coverage, reflecting large scale commercial deployment. Utilization of autonomous mobile robots increased sharply between 2022 and 2024, led by warehouse and industrial environments with a 340% rise.

Education recorded 123% growth, airports 91%, and retail 53%, showing broad based adoption beyond logistics. Fleet expansion and efficiency gains continue to reshape operations. Amazon now operates more than 1 million robots across its fulfillment network, making it the largest single robot fleet globally. AI driven path planning for large fleets has improved warehouse throughput by 4.4%, while also reducing travel distances and operational inefficiencies.

One of the primary driving factors is the rapid growth in multi robot deployments. Organizations are deploying dozens or hundreds of robots to meet productivity and labor efficiency goals. Manual oversight does not scale effectively at this level. Fleet analytics provides centralized visibility and control across all robots. Another key driver is the rising cost of operational downtime. When robots fail or underperform, workflows are disrupted immediately.

Top Market Takeaways

- By component, software and platforms dominated the Robot Fleet Analytics Market with a 72.8% share, driven by demand for centralized monitoring and performance optimization.

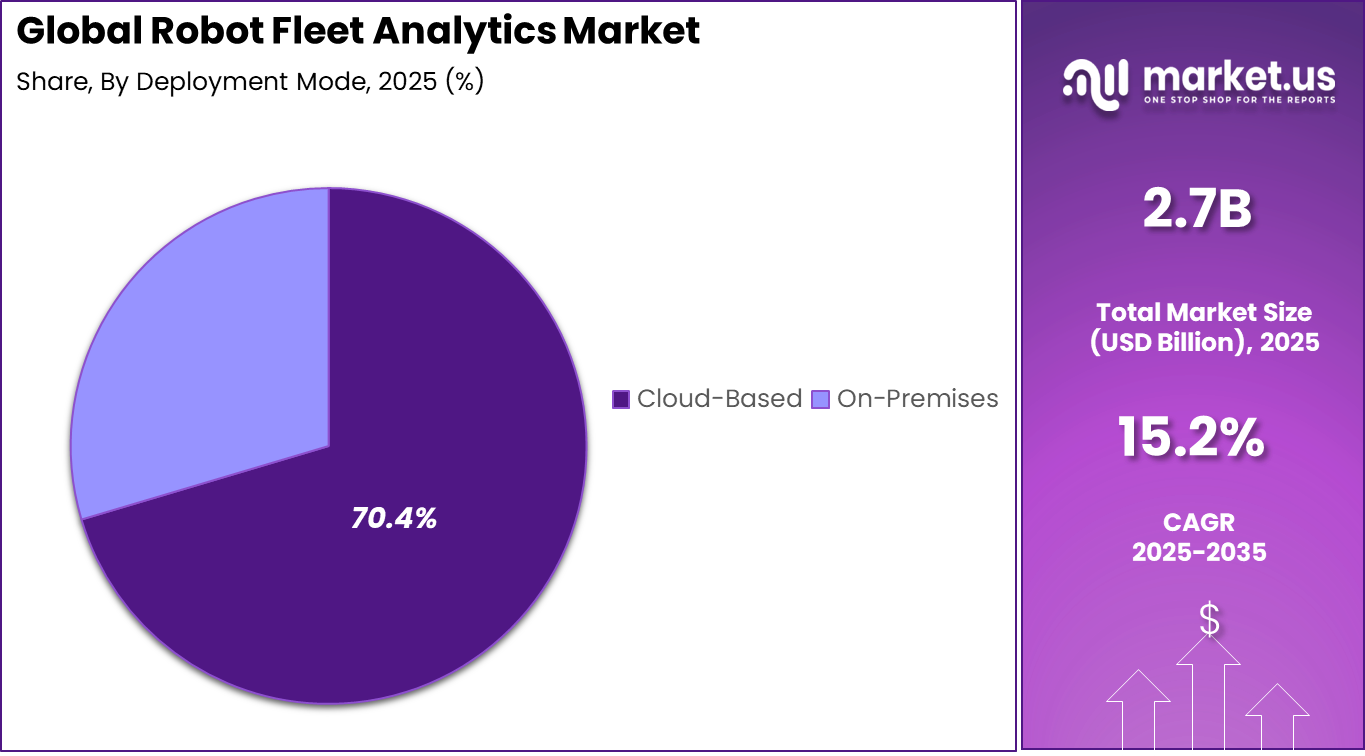

- By deployment mode, cloud based solutions led adoption with a 70.4% share, supported by scalability and real time data access.

- By robot type, industrial robots accounted for 41.6% of market usage, reflecting widespread deployment in manufacturing and automation facilities.

- By end user industry, logistics and e commerce held a 32.1% share, driven by growing warehouse automation and order fulfillment needs.

- Regionally, Asia Pacific led the market with a 40.2% share, supported by strong industrial automation activity.

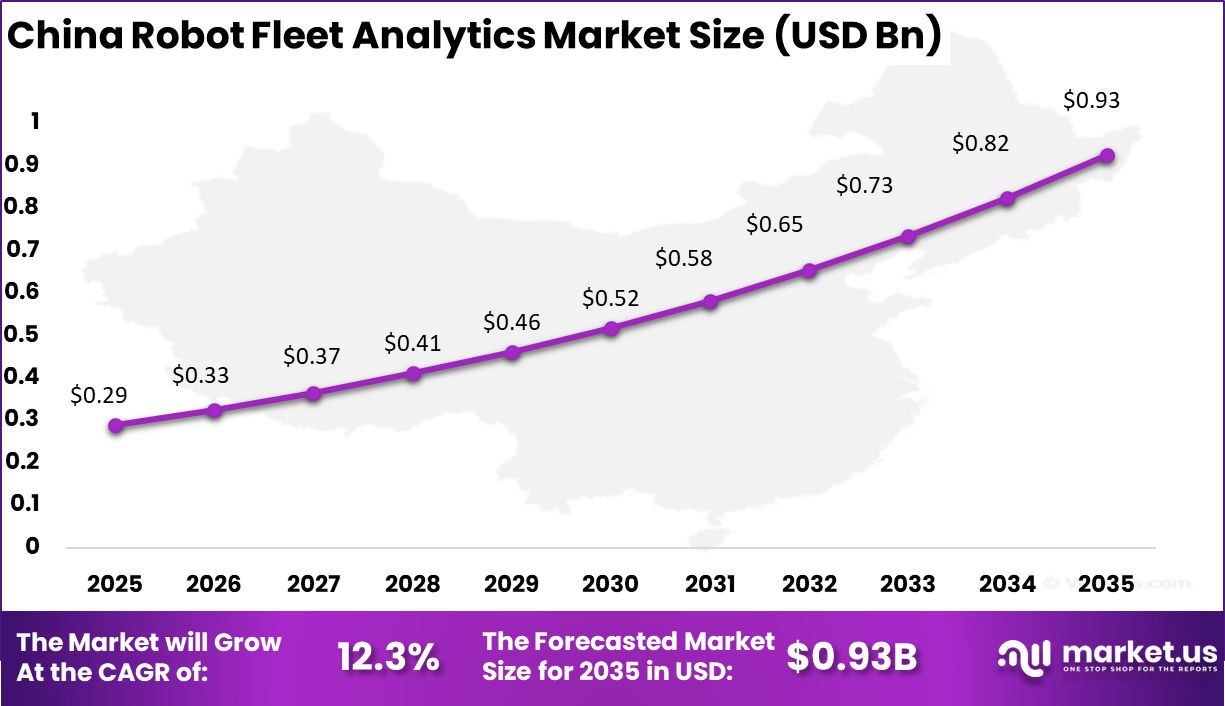

- China recorded a market value of USD 0.29 billion and showed a steady CAGR of 12.3%, driven by large scale robot deployment across industries.

Report Overview

The robot fleet analytics market focuses on software platforms and analytical tools used to monitor, manage, and optimize the performance of multiple robots operating as a coordinated fleet. These platforms collect and analyze data related to robot utilization, task efficiency, downtime, battery health, navigation patterns, and maintenance needs.

Robot fleet analytics is increasingly applied across warehouses, manufacturing facilities, hospitals, agriculture, and service environments where large numbers of robots operate simultaneously. Key driver factors shaping this market include rising deployment of autonomous robots, growing need for centralized fleet visibility, and pressure on organizations to improve operational efficiency and return on automation investments.

Demand for robot fleet analytics is growing strongly among enterprises scaling automation initiatives. Organizations moving from pilot projects to full production require centralized monitoring and reporting. Internal assessments show that analytics driven optimization can improve robot utilization by more than 20%. This efficiency gain directly supports demand growth.

Drivers Impact Analysis

Key Driver Impact on CAGR Forecast (~%) Geographic Relevance Impact Timeline Rapid deployment of robots across warehouses, factories, and logistics +4.1% North America, Asia Pacific Short to medium term Growing need for real-time monitoring and optimization of robot fleets +3.5% Global Medium term Rising focus on improving operational efficiency and uptime +3.0% Global Medium term Expansion of autonomous mobile robots in e-commerce and fulfillment +2.7% North America, Europe Medium term Adoption of data-driven maintenance and performance analytics +1.9% Global Medium to long term Restraint Impact Analysis

Key Restraint Impact on CAGR Forecast (~%) Geographic Relevance Impact Timeline High initial cost of analytics platforms and integration -2.8% Emerging Markets Short to medium term Complexity of integrating analytics across multi-vendor robot fleets -2.4% Global Medium term Limited analytics expertise among small and mid-sized operators -2.0% Asia Pacific, Latin America Medium term Data standardization and interoperability challenges -1.7% Global Medium term Cybersecurity risks in connected robotic systems -1.5% North America, Europe Medium to long term By Component

Software and platforms account for 72.8% of overall adoption in the Robot Fleet Analytics Market. This dominance reflects strong demand for centralized tools that monitor, analyze, and optimize robot performance across large fleets. Software platforms provide visibility into utilization, downtime, and task efficiency.

The reliance on software is further driven by the need for data driven decision making. Analytics dashboards enable operators to identify bottlenecks and improve throughput. This capability reduces operational inefficiencies and supports continuous improvement.

Software platforms also support integration with enterprise systems. Connectivity with warehouse management and manufacturing execution systems enhances coordination. These factors sustain the leading position of software and platforms.

By Deployment Mode

Cloud based deployment represents 70.4% of total adoption. Cloud environments enable scalable data processing and real time analytics across distributed robot fleets. Organizations benefit from centralized management without maintaining complex infrastructure. The preference for cloud deployment is also influenced by flexibility and speed.

Updates and feature enhancements can be deployed centrally. This allows rapid adaptation to changing operational needs. Cloud based models further support remote monitoring. Fleet managers can access insights from multiple locations. These advantages reinforce cloud deployment as the dominant mode.

By Robot Type

Industrial robots account for 41.6% of total robot type adoption. These robots are widely used in manufacturing and warehousing environments where precision and reliability are critical. Fleet analytics helps optimize task scheduling and maintenance. The dominance of industrial robots is also linked to high capital investment.

Organizations seek to maximize asset utilization and reduce downtime. Analytics provides actionable insights to achieve these goals. Industrial robots often operate in complex environments. Monitoring performance and health improves safety and productivity. This sustains strong adoption within this robot type segment.

By End User Industry

Logistics and e commerce represent 32.1% of end user demand. These industries rely heavily on automated material handling and order fulfillment systems. Fleet analytics supports efficiency in high volume operations. The growth of online retail increases pressure on logistics performance. Analytics enables real time tracking and optimization of robot workflows.

This improves order accuracy and delivery speed. E commerce operations also face seasonal demand fluctuations. Fleet analytics supports dynamic resource allocation. These needs maintain strong demand from logistics and e commerce users.

Regional Perspective

Asia Pacific holds a leading position in the Robot Fleet Analytics Market, accounting for 40.2% of total activity. The region benefits from rapid automation adoption and strong manufacturing growth. Investment in robotics continues to rise across industries. Government initiatives supporting smart manufacturing further drive regional demand. Analytics tools are increasingly used to optimize robotic investments. These factors reinforce Asia Pacific’s leadership.

China Market Overview

China represents a major contributor within the Asia Pacific region, with a market value of USD 0.29 Billion and a growth rate of 12.3% CAGR. Expansion is supported by large scale deployment of industrial robots and advanced logistics systems. Fleet analytics plays a key role in operational optimization.

Adoption in China is influenced by efficiency goals and labor cost considerations. Organizations focus on maximizing robot productivity. These dynamics collectively support steady growth in the China market segment.

Trends and Disruptions Impacting Customers

Customers are increasingly embracing robot fleet analytics as operations scale and become more complex. In warehousing and logistics, analytics help track inventory movement, reduce idle time, and improve order fulfilment performance.

The value of these insights is notable, as automated environments require coordination among many autonomous mobile robots and other equipment. At the same time, manufacturing and healthcare applications are relying on analytics to enhance safety, monitor task completion rates, and anticipate maintenance needs before breakdowns occur.

Disruptions and challenges in this market are connected to data integration, interoperability, and the need for advanced software platforms. Organisations often face difficulty in unifying data from robots made by different vendors, which can slow analytics deployment and reduce visibility into fleet performance.

Additionally, cybersecurity and data privacy concerns influence customer choices, especially as analytics systems are connected to enterprise networks. Despite these challenges, the increasing volume of robotics deployment encourages investment in analytics tools that can bring long term operational clarity and cost savings.

Investor Type Impact Matrix

Investor Type Growth Sensitivity Risk Exposure Geographic Focus Investment Outlook Robotics software and analytics providers Very High Medium North America, Europe Strong recurring SaaS revenue Industrial automation and robotics manufacturers High Medium Global Value-added analytics expansion Logistics and warehouse automation operators Medium Low to Medium Global Productivity-driven investment Private equity firms Medium Medium North America, Europe Platform scaling and consolidation Venture capital investors High High North America Innovation-led analytics platforms Technology Enablement Analysis

Technology Enabler Impact on CAGR Forecast (~%) Primary Function Geographic Relevance Adoption Timeline Cloud-based robot fleet management and analytics platforms +4.2% Centralized monitoring Global Short to medium term AI and machine learning for performance optimization +3.6% Predictive insights Global Medium term Real-time telemetry and sensor data analytics +3.1% Operational visibility Global Medium term Predictive maintenance and failure forecasting tools +2.5% Reduced downtime North America, Europe Medium to long term Integration with warehouse, MES, and ERP systems +1.8% End-to-end optimization Global Long term Increasing Adoption Technologies

Cloud based data aggregation technologies are widely adopted within robot fleet analytics platforms. These systems collect real time data from distributed robots and centralize analysis. Cloud architectures support scalability and remote access. This technology enables fleet level visibility across locations.

Machine learning based performance analysis is also gaining adoption. These models identify patterns in robot behavior and predict failures before they occur. Automated anomaly detection reduces reliance on manual supervision. Technology adoption improves both responsiveness and decision accuracy.

Organizations adopt advanced analytics technologies to manage operational complexity. As fleets grow, manual tracking becomes unreliable. Automated analytics ensures consistent performance monitoring across all robots. This reduces operational risk and management overhead.

Another reason is optimization of resource usage. Analytics helps balance workloads, optimize charging cycles, and reduce idle time. These improvements lower energy consumption and extend hardware lifespan. The resulting cost savings strengthen the adoption case.

Investment and Business Benefits

Investment opportunities in this market exist in platforms that support heterogeneous robot fleets. Many organizations operate robots from different vendors. Analytics solutions that integrate across systems offer higher value. This interoperability focus attracts strong enterprise interest.

There are also opportunities in analytics solutions tailored for industry specific use cases. Warehousing, manufacturing, and healthcare each have distinct performance metrics. Specialized analytics improve relevance and adoption. Investors favor solutions that demonstrate clear operational impact.

For businesses, robot fleet analytics delivers improved productivity and reliability. Real time insights allow faster response to issues and better planning. This leads to smoother operations and higher throughput. Analytics transforms robotic fleets into predictable assets.

From a financial perspective, analytics reduces maintenance costs and extends robot service life. Early fault detection lowers repair expenses. Improved utilization increases return on automation investments. These benefits compound as fleet size increases.

Emerging Trends Analysis

An emerging trend in the robot fleet analytics market is the use of artificial intelligence for autonomous optimization. Machine learning models are increasingly applied to predict congestion, recommend task reassignment, and optimize fleet behavior over time. This shifts analytics from passive monitoring to active decision support. Intelligent automation is becoming a defining feature.

Another trend is integration with enterprise systems such as warehouse management, manufacturing execution, and facility management platforms. Linking robot analytics with broader operational data improves coordination and planning. This integration supports end to end visibility across automated and human driven processes.

Growth Factors Analysis

One of the key growth factors for the robot fleet analytics market is the continued expansion of warehouse and logistics automation. E commerce growth and labor constraints are driving large scale robot adoption. Managing these fleets efficiently requires analytics driven oversight. This structural demand supports sustained market growth.

Another growth factor is rising emphasis on performance accountability in automation investments. Organizations expect measurable productivity gains and cost savings from robots. Fleet analytics provides the metrics and insights needed to justify and optimize these investments. As automation budgets increase, demand for analytics grows in parallel.

Opportunity Analysis

A significant opportunity in the robot fleet analytics market lies in optimization driven automation. Analytics can be used not only to monitor performance but also to dynamically adjust task allocation, routing, and workload balancing across robots. This level of optimization improves throughput and reduces energy consumption. Organizations seeking higher automation efficiency increasingly value these capabilities.

Another opportunity is expansion into service and healthcare robotics. Hospitals, hotels, and public facilities are deploying fleets of service robots for delivery, cleaning, and assistance. These environments require high reliability and compliance with operational standards. Fleet analytics supports oversight, reporting, and performance assurance, creating new demand outside traditional industrial settings.

Challenge Analysis

A major challenge for the robot fleet analytics market is ensuring reliable real time data connectivity. Fleet analytics depends on continuous data streams from robots operating across large facilities or multiple locations. Network interruptions or latency can affect visibility and decision making. Ensuring resilient connectivity remains critical.

Another challenge is translating technical metrics into actionable business insights. Raw robot telemetry may not be meaningful to operations managers. Analytics platforms must present insights in an intuitive and decision oriented manner. Bridging the gap between technical data and operational outcomes is essential for adoption.

Competitive Analysis

Industrial automation and robotics leaders such as ABB Ltd., Siemens AG, and Rockwell Automation play a central role in the robot fleet analytics market. Their platforms integrate analytics with factory automation, warehouse management, and industrial IoT systems. Fleet-level data is used to monitor utilization, downtime, and predictive maintenance. Strong enterprise integration and global customer bases support adoption. Demand is driven by the need to improve operational efficiency and reduce unplanned robot downtime.

Warehouse and mobile robotics specialists such as Amazon Robotics, Locus Robotics, and GreyOrange focus on analytics for large robot fleets. Geekplus Technology, Mobile Industrial Robots, and Fetch Robotics emphasize real-time visibility, task optimization, and fleet orchestration. These players benefit from rapid growth in eCommerce fulfillment and logistics automation. Analytics helps customers scale robot deployments with predictable performance.

Advanced robotics and navigation-focused providers such as Boston Dynamics, Clearpath Robotics, and KUKA AG offer analytics tied to motion control and autonomous navigation. Omron Corporation, Honeywell International Inc., and BlueBotics support fleet monitoring through software intelligence. Seegrid Corporation and Vecna Robotics address material handling use cases. Other vendors expand competition and innovation, supporting scalable robot fleet analytics across industries.

Top Key Players in the Market

- Amazon Robotics

- ABB Ltd.

- Boston Dynamics

- Clearpath Robotics

- KUKA AG

- Omron Corporation

- Siemens AG

- Rockwell Automation

- Honeywell International Inc.

- Locus Robotics

- GreyOrange

- Geekplus Technology

- Mobile Industrial Robots (MiR)

- Seegrid Corporation

- BlueBotics

- Vecna Robotics

- Others

Recent Developments

- April, 2025 – Locus Robotics surpassed 5 billion picks globally with LocusONE platform providing real-time orchestration, predictive analytics, and labor guidance across 350+ sites, enabling dynamic scaling from 87 daily bots to 104 peak bots.

- February, 2025 – Boston Dynamics launched Orbit fleet management platform for Spot robots, unifying multi-site visibility, mission scheduling, predictive alerts, and cloud connectivity across 1,500+ Spots worldwide.

Key Market Segments

By Component

- Software & Platforms

- Core Analytics Engines

- Task & Path Optimization Software

- Dashboard & Visualization Tools

- Predictive Maintenance Modules

- Others

- Services

- Implementation & Integration

- Consulting

- Managed Services

By Deployment Mode

- Cloud-Based

- On-Premises

By Robot Type

- Industrial Robots

- Collaborative Robots

- Autonomous Mobile Robots

- Service Robots

By End-User Industry

- Automotive

- Electronics & Semiconductor

- Logistics & E-commerce Fulfillment

- Food & Beverage

- Metals & Machinery

- Healthcare & Pharmaceuticals

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Report Scope

Report Features Description Market Value (2025) USD 2.7 Bn Forecast Revenue (2035) USD 11.0 Bn CAGR(2026-2035) 15.2% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software & Platforms (Core Analytics Engines, Task & Path Optimization Software, Dashboard & Visualization Tools, Predictive Maintenance Modules, Others), Services (Implementation & Integration, Consulting, Managed Services)), By Deployment Mode (Cloud-Based, On-Premises), By Robot Type (Industrial Robots, Collaborative Robots, Autonomous Mobile Robots, Service Robots), By End-User Industry (Automotive, Electronics & Semiconductor, Logistics & E-commerce Fulfillment, Food & Beverage, Metals & Machinery, Healthcare & Pharmaceuticals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amazon Robotics, ABB Ltd., Boston Dynamics, Clearpath Robotics, Fetch Robotics, KUKA AG, Omron Corporation, Siemens AG, Rockwell Automation, Honeywell International Inc., Locus Robotics, GreyOrange, Geekplus Technology, Mobile Industrial Robots (MiR), Seegrid Corporation, BlueBotics, Vecna Robotics, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Robot Fleet Analytics MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample

Robot Fleet Analytics MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Amazon Robotics

- ABB Ltd.

- Boston Dynamics

- Clearpath Robotics

- KUKA AG

- Omron Corporation

- Siemens AG

- Rockwell Automation

- Honeywell International Inc.

- Locus Robotics

- GreyOrange

- Geekplus Technology

- Mobile Industrial Robots (MiR)

- Seegrid Corporation

- BlueBotics

- Vecna Robotics

- Others