Global Ride-Hailing Market Size, Share, Growth Analysis By Vehicle Type (Two-Wheelers, Three-Wheelers, Passenger Cars, Vans & MPVs, Buses & Shuttles), By Propulsion Type (ICE, Hybrid, Battery-Electric, CNG/LPG), By Service Type (E-Hailing, Car-Sharing (Peer-to-Peer), Robo-Taxi, Subscription-Based Ride Packages), By Booking Channel (App-Based, Voice / Phone), By End-User (Personal, Corporate / Institutional), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173684

- Number of Pages: 235

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

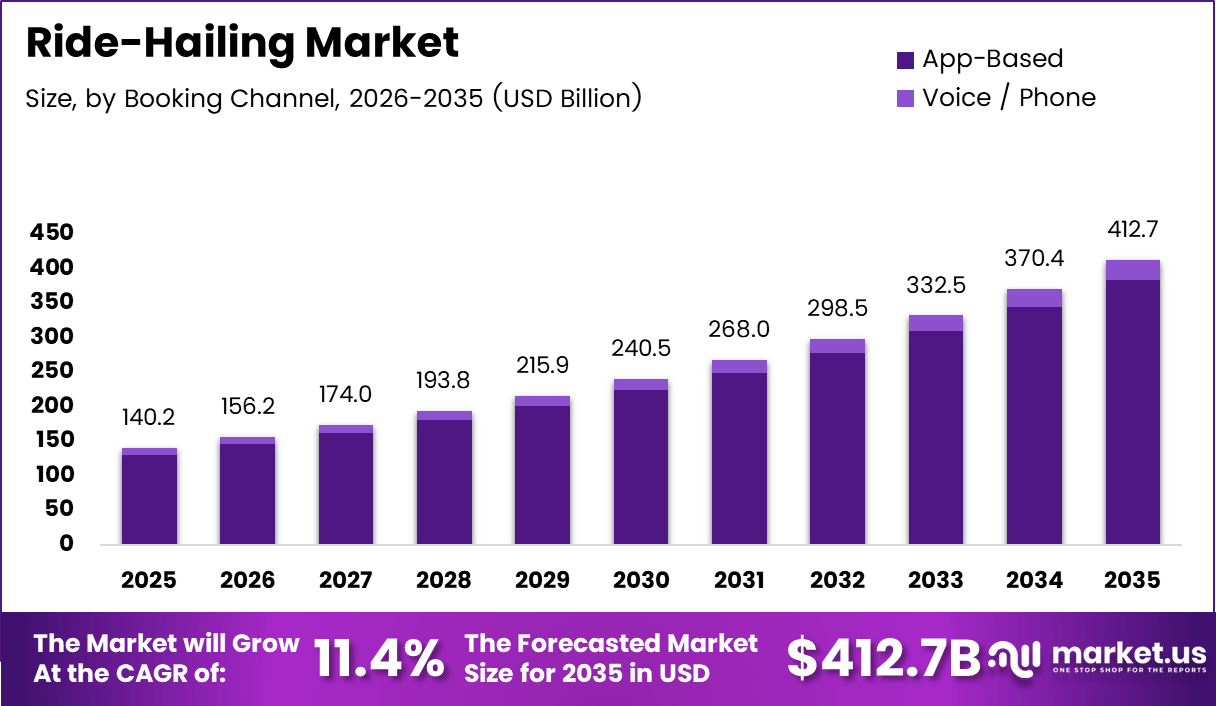

The Global Ride-Hailing Market size is expected to be worth around USD 412.7 billion by 2035, from USD 140.2 billion in 2025, growing at a CAGR of 11.4% during the forecast period from 2026 to 2035.

The ride hailing market refers to digital platforms that connect passengers with drivers through mobile applications for on demand transportation services. These platforms enable real time booking, cashless payments, route optimization, and service transparency. Ride hailing plays a critical role within the shared mobility and urban transportation ecosystem.

From an analyst viewpoint, the ride hailing market continues to expand as cities prioritize flexible and technology enabled mobility solutions. Growing urban density and evolving commuting preferences support demand for app based transport. Consequently, consumers increasingly favor convenience, reliability, and time efficiency over private vehicle ownership.

Market growth remains supported by rising smartphone penetration and the expansion of digital payment infrastructure worldwide. Additionally, platforms increasingly integrate delivery, logistics, and subscription mobility as a services to enhance user engagement. As a result, the ride hailing market maintains strong long term investment appeal.

Government involvement significantly influences market development through regulations and urban mobility investments. Authorities emphasize passenger safety, labor compliance, and data protection frameworks. Simultaneously, policies promoting electric vehicles and smart city initiatives strengthen ride hailing’s position within sustainable transportation strategies.

From an opportunity perspective, suburban and semi urban areas present untapped growth potential for ride hailing platforms. Moreover, partnerships with public transportation systems improve first mile and last mile connectivity. These integrations position ride hailing as a complementary mobility solution rather than a competing transport mode.

According to study, adoption levels show clear demographic and income driven usage patterns. Around 36% of U.S. adults report having used a ride hailing service, compared with just 15% during early adoption phases. Usage remains highest among digitally active consumer groups.

study data further highlights age, income, and education based differences. Nearly 51% of individuals aged 18 to 29 report ride hailing usage, compared with 24% among those aged 50 and older. Higher income households show usage rates of 53% versus 24% in lower income groups.

Urbanization strongly correlates with frequency of use, according to study. While 45% of urban residents and 40% of suburban residents have used ride hailing apps, only 19% of rural residents report adoption. Weekly usage remains highest within urban populations.

Key Takeaways

- The global ride-hailing market is projected to reach USD 412.7 billion by 2035, expanding from USD 140.2 billion in 2025 at a CAGR of 11.4%.

- Passenger cars dominated the vehicle type segment in 2025 with a market share of 48.3%, reflecting strong urban and personal mobility demand.

- ICE vehicles led the propulsion type segment in 2025, accounting for 59.8% share due to existing fuel infrastructure and fleet availability.

- E-hailing emerged as the leading service type in 2025, capturing 73.9% of total market share driven by on-demand convenience.

- App-based booking dominated the booking channel segment in 2025 with a share of 93.1%, supported by high smartphone penetration.

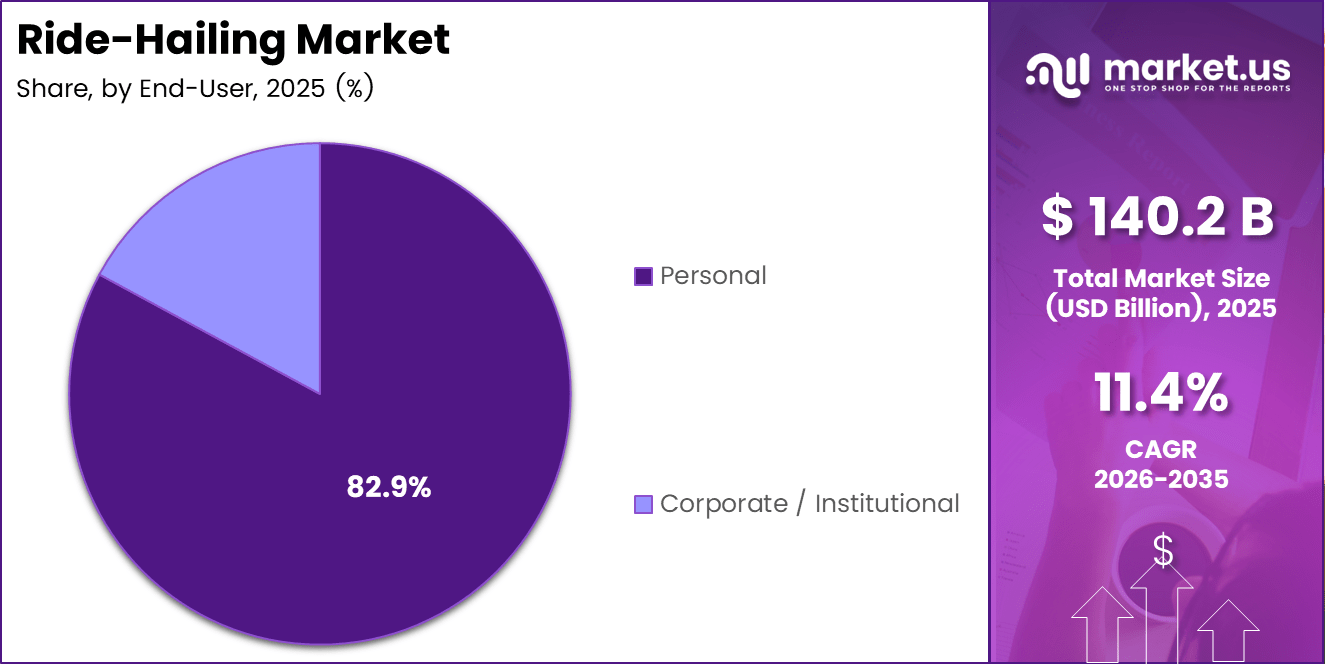

- Personal usage represented the largest end-user segment in 2025, contributing 82.9% of total ride-hailing demand.

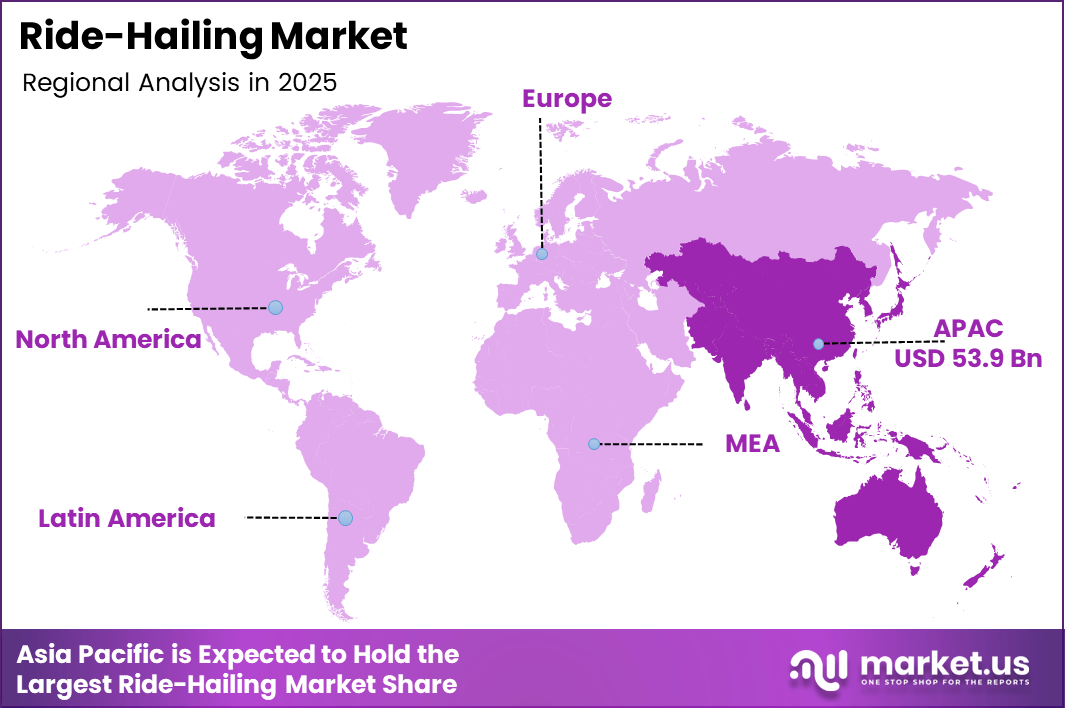

- Asia Pacific remained the dominant regional market in 2025, supported by large urban populations and high adoption of app-based mobility services.

Vehicle Type Analysis

Passenger Cars dominate with 48.3% due to comfort, availability, and suitability for urban travel.

In 2025, Passenger Cars held a dominant market position in the By Vehicle Type Analysis segment of Ride-Hailing Market, with a 48.3% share. This dominance reflects strong rider preference for comfort, privacy, and safety. Moreover, passenger cars support airport transfers and longer commutes, strengthening their overall utilization across daily and occasional travel needs.

Two wheelers support short distance mobility in congested urban environments. They enable faster navigation through traffic and reduce travel time for daily commuters. Additionally, affordability and efficiency make them attractive for last mile connectivity, especially as urban density and traffic congestion continue to intensify.

Three wheelers play a critical role in cost sensitive markets by offering economical shared mobility solutions. They support short trips and feeder routes connecting transit hubs. Furthermore, their compact design and lower operating costs sustain steady adoption across emerging cities and semi urban regions.

Vans, MPVs, buses, and shuttles address group travel and corporate commuting requirements. These vehicles enable higher passenger capacity and structured routing. Consequently, demand remains stable for event transportation, institutional mobility, and shared shuttle based ride hailing services.

Propulsion Type Analysis

ICE dominates with 59.8% due to widespread fueling infrastructure and operational flexibility.

In 2025, ICE held a dominant market position in the By Propulsion Type Analysis segment of Ride-Hailing Market, with a 59.8% share. This leadership is supported by extensive fuel availability and lower upfront vehicle costs. As a result, ICE fleets efficiently serve both urban and intercity ride hailing operations.

Hybrid vehicles gain traction by combining fuel efficiency with reduced emissions. Operators increasingly adopt hybrids to lower operating expenses while meeting environmental expectations. Additionally, hybrids reduce range anxiety, making them appealing for drivers seeking long term cost optimization.

Battery electric vehicles witness gradual adoption as charging infrastructure expands. Lower maintenance requirements and regulatory incentives encourage fleet transition. However, charging downtime and range considerations continue influencing deployment speed across multiple operating regions.

CNG and LPG vehicles support cleaner mobility in regions with developed alternative fuel networks. They offer reduced emissions and lower fuel expenses compared to ICE vehicles. Adoption remains concentrated where supportive policies and pricing advantages exist.

Service Type Analysis

E Hailing dominates with 73.9% due to on demand convenience and real time availability.

In 2025, E Hailing held a dominant market position in the By Service Type Analysis segment of Ride-Hailing Market, with a 73.9% share. Instant booking, transparent pricing, and wide service coverage drive sustained adoption. Consequently, e hailing remains the preferred option for daily commuting and spontaneous travel.

Car sharing supports cost efficient mobility without ownership commitments. Peer to peer models optimize underutilized vehicles and appeal to price conscious users. Adoption remains higher in dense urban areas supported by strong digital trust and platform familiarity.

Robo taxi services represent an emerging segment focused on automation and efficiency. Although adoption remains limited, continuous progress in autonomous technology shapes long term mobility expectations. This segment remains strategically important for future operational scalability.

Subscription based ride packages attract frequent users seeking predictable travel expenses. These plans improve customer retention and increase usage frequency. Adoption grows steadily among professionals and urban residents with recurring mobility patterns.

Booking Channel Analysis

App Based booking dominates with 93.1% due to smartphone adoption and integrated digital payments.

In 2025, App Based booking held a dominant market position in the By Booking Channel Analysis segment of Ride-Hailing Market, with a 93.1% share. Ease of use, real time tracking, and seamless payments drive consumer preference. Continuous application enhancements further strengthen user engagement.

Voice and phone bookings remain relevant among elderly users and digitally underserved populations. This channel supports accessibility and inclusivity. However, its share remains secondary as smartphone penetration and app based usage continue expanding.

End User Analysis

Personal use dominates with 82.9% due to daily commuting and lifestyle mobility needs.

In 2025, Personal use held a dominant market position in the By End User Analysis segment of Ride-Hailing Market, with a 82.9% share. Frequent urban travel and flexible scheduling support strong demand. Rising urban lifestyles further reinforce personal ride hailing usage.

Corporate and institutional users adopt ride hailing for employee transport and business travel management. Organizations benefit from centralized billing and cost transparency. This segment expands steadily as companies prioritize flexible and asset light mobility solutions.

Key Market Segments

By Vehicle Type

- Two-Wheelers

- Three-Wheelers

- Passenger Cars

- Vans & MPVs

- Buses & Shuttles

By Propulsion Type

- ICE

- Hybrid

- Battery-Electric

- CNG/LPG

By Service Type

- E-Hailing

- Car-Sharing (Peer-to-Peer)

- Robo-Taxi

- Subscription-Based Ride Packages

By Booking Channel

- App-Based

- Voice / Phone

By End-User

- Personal

- Corporate / Institutional

Drivers

Expansion of Smartphone Based Mobility Ecosystems Drives Ride-Hailing Market Growth

The expansion of smartphone based mobility ecosystems strongly supports ride hailing market growth. Easy access to mobile applications enables users to book rides instantly, track drivers, and manage payments. As smartphone penetration increases, ride hailing services become more accessible across diverse income and age groups.

Rising urban congestion further accelerates demand for on demand, point to point transportation. City dwellers increasingly avoid private vehicle ownership due to traffic delays and parking constraints. Ride hailing offers a practical alternative by reducing travel stress and improving commuting efficiency in dense urban environments.

A growing preference for cashless and integrated digital payment platforms also drives adoption. Consumers value secure, transparent, and quick payment options linked directly to mobility apps. This convenience improves user trust and repeat usage, especially among digitally active populations.

Additionally, flexible work models support non peak travel demand. Remote and hybrid work patterns encourage travel outside traditional rush hours. This behavioral shift helps stabilize ride volumes throughout the day, improving platform utilization and overall market sustainability.

Restraints

Regulatory Uncertainty Around Labor Frameworks Restrains Ride-Hailing Market Growth

Regulatory uncertainty surrounding driver classification remains a key restraint for the ride hailing market. Ongoing debates around employment status, benefits, and labor rights create compliance challenges. These uncertainties increase legal risks and complicate long term operational planning for service providers.

Labor compliance frameworks vary significantly across regions, adding complexity to market expansion. Differing local regulations require tailored operational models. This fragmentation limits scalability and increases administrative overhead for ride hailing platforms operating across multiple jurisdictions.

Rising operational costs further restrain market growth. Insurance premiums continue to increase due to accident risks and liability concerns. Fuel price volatility directly affects driver earnings and service pricing, impacting supply stability.

Platform commissions also influence driver retention and service affordability. Higher commission structures may discourage participation, while pricing pressures can reduce demand. These cost related challenges collectively limit profit margins and slow market expansion.

Growth Factors

Integration With Public Transit Creates Growth Opportunities in Ride-Hailing Market

Integration of ride hailing platforms with public transit networks presents a strong growth opportunity. First mile and last mile connectivity improves overall urban mobility efficiency. Such integration positions ride hailing as a complementary service rather than a competing transport option.

Expansion into suburban and semi urban areas offers untapped potential. These regions often lack reliable public transportation. Ride hailing services can bridge mobility gaps, supporting daily commuting and essential travel needs.

The development of electric vehicle based ride hailing fleets creates cost and sustainability advantages. Lower fuel and maintenance expenses improve driver economics over time. Environmental regulations further support the transition toward cleaner mobility solutions.

Bundled mobility subscriptions combining rides, delivery, and logistics also create new revenue streams. These offerings increase customer retention and usage frequency, strengthening long term market growth prospects.

Emerging Trends

AI Driven Optimization Accelerates Ride-Hailing Market Trends

AI driven dynamic pricing and route optimization increasingly shape ride hailing operations. Advanced algorithms improve trip efficiency, reduce wait times, and balance supply with demand. These capabilities enhance both customer experience and platform profitability.

Platforms also focus more on driver incentive optimization and retention analytics. Data driven insights help design targeted rewards and flexible work options. Improved driver satisfaction supports service reliability and availability.

In app safety, verification, and real time tracking features continue gaining importance. Users expect higher safety standards and transparency. Enhanced security features build trust and encourage repeat usage across diverse demographics.

Finally, convergence with food, grocery, and parcel delivery platforms represents a key trend. Shared infrastructure enables operational efficiency and revenue diversification, positioning ride hailing platforms as multi service mobility and logistics ecosystems.

Regional Analysis

Asia Pacific Ride-Hailing Market Trends

Asia Pacific represents the leading region in the ride-hailing market, supported by rapid urbanization, high smartphone penetration, and digitally active populations. The region accounted for 38.5% of the global market, valued at USD 53.9 billion, driven by dense metropolitan travel demand and strong adoption of app-based mobility services. Expanding urban infrastructure and affordability-focused mobility needs continue strengthening regional growth.

North America Ride-Hailing Market Trends

North America reflects a mature ride-hailing landscape supported by high digital payment adoption and strong consumer preference for convenience-based mobility. Urban commuters increasingly rely on ride-hailing for airport transfers, last-mile connectivity, and non-ownership travel preferences. Regulatory clarity in several cities has stabilized operations, supporting steady demand. The region also benefits from high disposable income levels and widespread smartphone usage.

Europe Ride-Hailing Market Trends

Europe demonstrates stable growth in ride-hailing adoption driven by dense urban centers and limited parking availability in major cities. Consumers increasingly use ride-hailing as a complement to public transportation rather than a replacement. Environmental awareness and reduced private vehicle usage trends support app-based shared mobility. However, regulatory diversity across countries shapes market expansion at varying speeds.

U.S. Ride-Hailing Market Trends

The U.S. remains a key contributor within North America due to high urban travel demand and flexible commuting patterns. Ride-hailing platforms continue to serve daily commuting, leisure travel, and event-based transportation needs. Growing acceptance of cashless payments and real-time mobility access strengthens user engagement. Demand also benefits from suburban-to-urban travel and airport connectivity requirements.

Middle East and Africa Ride-Hailing Market Trends

The Middle East and Africa region shows emerging growth supported by rapid urban development and increasing smartphone adoption. Ride-hailing services address gaps in public transportation infrastructure in several cities. Younger populations and rising digital literacy contribute to gradual adoption. Government-backed smart city initiatives further encourage app-based mobility solutions.

Latin America Ride-Hailing Market Trends

Latin America experiences growing ride-hailing demand due to traffic congestion and the need for reliable urban transportation. Consumers increasingly prefer app-based mobility for safety, convenience, and predictable pricing. Expanding mobile internet access supports platform penetration across major cities. Economic urbanization and changing commuting habits continue to support regional market growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Ride-Hailing Company Insights

Uber Technologies Inc. continues to shape the global ride-hailing market in 2025 through scale-driven platform economics and diversified mobility offerings. The company focuses on optimizing pricing algorithms, improving driver utilization, and expanding into integrated urban mobility solutions. Its data-led operational model supports strong market penetration across mature and emerging urban regions.

Didi Global Inc. maintains a strong strategic position by leveraging deep localization capabilities and high-frequency urban demand. In 2025, its emphasis remains on operational efficiency, fleet optimization, and regulatory alignment within complex mobility ecosystems. The company benefits from dense city networks and data-intensive route planning to sustain user engagement.

Lyft Inc. positions itself as a focused regional mobility platform prioritizing service reliability and user experience. Its 2025 strategy emphasizes disciplined cost structures, targeted geographic concentration, and partnerships aligned with sustainable transport goals. This approach supports stable demand while improving unit economics in competitive metropolitan markets.

Grab Holdings Inc. operates as a super-app-driven mobility ecosystem, integrating ride-hailing with digital payments and urban services. In 2025, its strength lies in platform stickiness and multi-service usage across Southeast Asian cities. This ecosystem-led strategy enhances customer retention while supporting long-term monetization across urban mobility use cases.

Top Key Players in the Market

- Uber Technologies Inc.

- Didi Global Inc.

- Lyft Inc.

- Grab Holdings Inc.

- Bolt Technology OU

- GoJek

- Cabify

- Gett Group

- BlaBlaCar

- Xanh SM (GSM)

Recent Developments

- In March 19, 2025, VEON Ltd. announced that its wholly owned subsidiary Kyivstar signed an agreement to acquire Uklon Group, strengthening its expansion into digital consumer services beyond core telecom operations. This move aligns with VEON’s broader digital operator strategy and accelerates platform based mobility and delivery adoption in Ukraine.

- In April 2025, U.S. based Lyft disclosed its acquisition of European taxi app FreeNow for 175 million euros (USD 199 million), marking its first strategic entry into the European market. The deal, expected to close in the second half of 2025, is projected to create a combined user base of over 50 million annual users.

Report Scope

Report Features Description Market Value (2025) USD 140.2 billion Forecast Revenue (2035) USD 412.7 billion CAGR (2026-2035) 11.4% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Vehicle Type (Two-Wheelers, Three-Wheelers, Passenger Cars, Vans & MPVs, Buses & Shuttles), By Propulsion Type (ICE, Hybrid, Battery-Electric, CNG/LPG), By Service Type (E-Hailing, Car-Sharing (Peer-to-Peer), Robo-Taxi, Subscription-Based Ride Packages), By Booking Channel (App-Based, Voice / Phone), By End-User (Personal, Corporate / Institutional) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Uber Technologies Inc., Didi Global Inc., Lyft Inc., Grab Holdings Inc., Bolt Technology OU, GoJek, Cabify, Gett Group, BlaBlaCar, Xanh SM (GSM) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Uber Technologies Inc.

- Didi Global Inc.

- Lyft Inc.

- Grab Holdings Inc.

- Bolt Technology OU

- GoJek

- Cabify

- Gett Group

- BlaBlaCar

- Xanh SM (GSM)