Global Rhum Agricole Market Size, Share, And Industry Analysis Report By Variant Type (Vieux, Ambre, Blanc), By Distribution Channel (Supermarkets and Hypermarkets, Specialty liquor stores, Duty Free Stores, Online Retail, Others), By End-Use (Food Service, Retail and Household), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 177324

- Number of Pages: 222

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

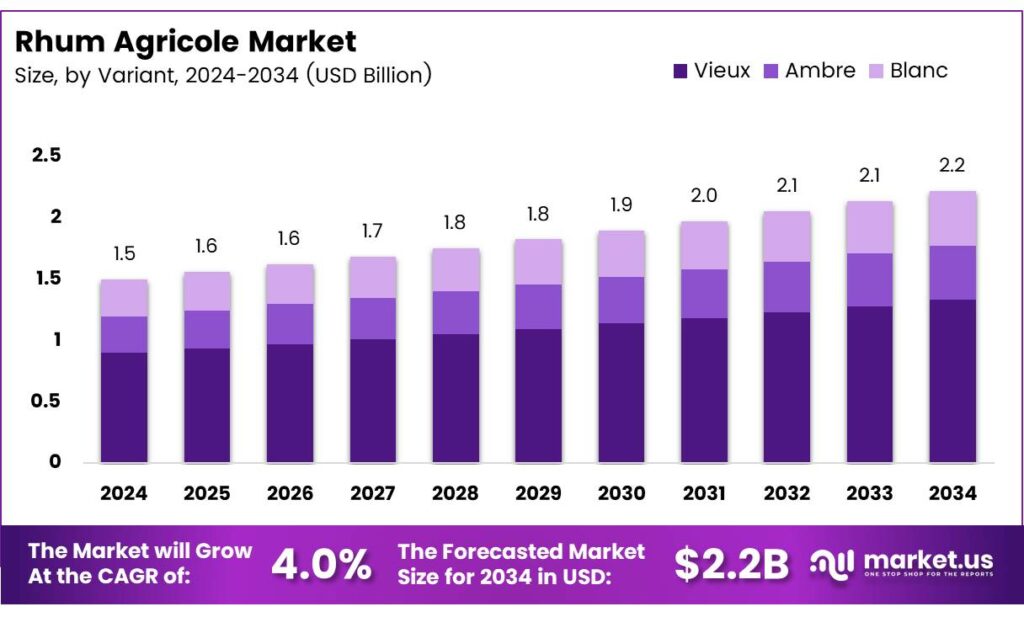

The Global Rhum Agricole Market size is expected to be worth around USD 2.2 billion by 2034, from USD 1.5 billion in 2024, growing at a CAGR of 4.0% during the forecast period from 2025 to 2034.

Rhum Agricole refers to a distinct rum category made directly from fresh sugarcane juice rather than molasses, giving it a vegetal, terroir-driven profile. The market includes producers across French Caribbean regions and emerging craft distillers globally, supported by growing premium-spirit demand, experiential consumption trends, and evolving government quality regulations.

The Rhum Agricole segment continues gaining attention as consumers shift toward authentic, origin-specific spirits. Moreover, rising interest in cane-juice-based rum encourages producers to modernize operations, improve sustainability, and extend product portfolios. This creates stronger trade activity, higher export value, and improved margins for distillers positioned in premium and ultra-premium categories.

- Government regulations continue to shape the authenticity of rhum agricole, requiring bottling at a minimum of 40% ABV while enforcing strict distillation caps 75% ABV in Martinique and 90% ABV in Guadeloupe to preserve purity and terroir.

- INAO rules allow fermentation to last as little as a day before distillation, and Martinique mandates a single distillation on a creole column still between 65–75% ABV. Producers may use approved coloring, much like cognac or whisky standards, and after resting in neutral vessels, the spirit is diluted and frequently bottled above 50% ABV to maintain its bold, expressive character.

Growing demand for terroir-centric spirits strengthens long-term prospects as consumers value natural fermentation and cane-fresh profiles. The industry benefits from tourism-driven tasting experiences and heritage-based branding. Opportunities emerge in premiumization, with aged agricole categories gaining traction among collectors, mixologists, and spirits educators seeking distinctive, character-rich rum expressions.

Key Takeaways

- The Global Rhum Agricole Market is valued at USD 1.5 billion in 2024 and is projected to reach USD 2.2 billion by 2034 at a 4.0% CAGR.

- Vieux leads the Variant Type segment with a dominant share of 47.9%.

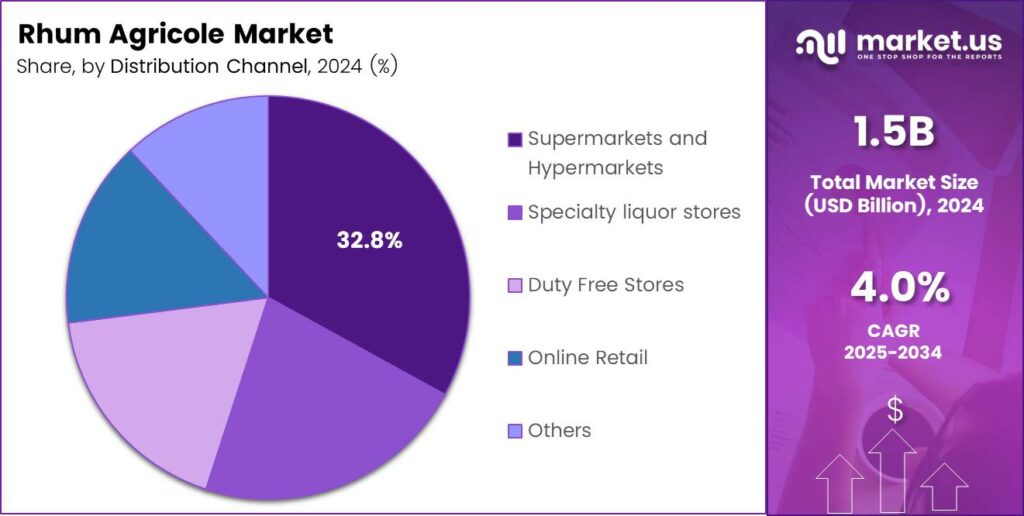

- Supermarkets & Hypermarkets hold the largest Distribution Channel share at 32.8%.

- Food Service is the top End-Use segment, capturing 69.2% of the market.

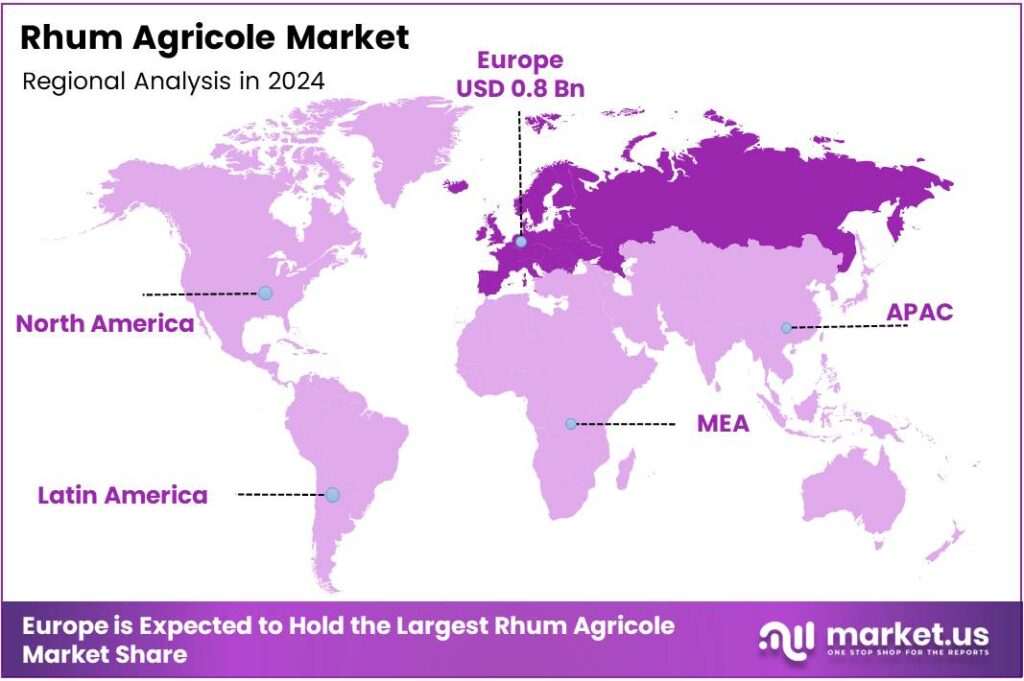

- Europe leads regionally with a 52.3% share, valued at USD 0.8 billion.

By Variant Type Analysis

Vieux dominates with 47.9% due to its mature profile and strong consumer preference.

In 2025, Vieux held a dominant market position in the By Variant Type segment of the Rhum Agricole Market, with a 47.9% share. Its long-aging process, richer flavors, and premium appeal continued to attract enthusiasts seeking authenticity. Additionally, its increasing use in craft cocktails helped strengthen its demand globally.

Ambre followed steadily, driven by consumers who prefer balanced flavor depth and affordability. Its mild aging process provides versatility in cocktails and neat consumption. As interest in mid-range spirits expanded, Ambre benefited from the shift toward nuanced yet accessible Rhum Agricole variants, making it a growing choice among modern drinkers.

Blanc also remained an essential category, especially in regions where traditional agricole cocktails dominate. Its raw, unaged character appeals to bartenders aiming for bold, grassy notes in classic drinks. With rising tourism and increased awareness of Caribbean spirits, Blanc continued finding new consumers who appreciate its fresh and vibrant profile.

By Distribution Channel Analysis

Supermarkets and Hypermarkets dominate with 32.8% due to their wide visibility and consumer reach.

In 2025, Supermarkets and Hypermarkets held a dominant market position in the By Distribution Channel segment of the Rhum Agricole Market, with a 32.8% share. Their broad shelf space, easy accessibility, and frequent in-store promotions significantly enhanced product visibility, making them the preferred choice for mainstream buyers.

Specialty liquor stores continued to attract enthusiasts seeking guidance and premium selections. These outlets offered curated ranges of Rhum Agricole, helping buyers discover unique variants. Their personalized service and exclusive product availability helped them maintain strong relevance, especially among connoisseurs and collectors.

Duty Free Stores benefited from international travel, as tourists increasingly purchased premium Rhum Agricole while transiting. Positioned as a souvenir and gifting option, these stores played a vital role in spreading global awareness and boosting premium-category sales for the brand.

Online Retail saw rising traction due to convenience, doorstep delivery, and the expanding digital liquor marketplaces. With users comparing prices and accessing reviews instantly, online platforms have become a strong emerging channel for both occasional and repeat buyers.

By End-Use Analysis

Food Service dominates with 69.2%, driven by high usage in cocktails and premium beverage menus.

In 2025, Food Service held a dominant market position in the By End-Use segment of the Rhum Agricole Market, with a 69.2% share. Restaurants, bars, and resorts increasingly incorporated agricole-based cocktails, boosting demand. Tourism, fine dining experiences, and premium drink trends continued to anchor this segment’s strong dominance.

Retail and Household consumption also expanded steadily as consumers experimented with craft cocktails at home. With rising awareness of Caribbean spirits and growing interest in premium alcohol varieties, households embraced Rhum Agricole for casual and celebratory use. Affordable options and online availability further supported its rising adoption.

Key Market Segments

By Variant Type

- Vieux

- Ambre

- Blanc

By Distribution Channel

- Supermarkets and Hypermarkets

- Specialty liquor stores

- Duty Free Stores

- Online Retail

- Others

By End-Use

- Food Service

- Retail and Household

Emerging Trends

Increasing Adoption of Craft and Terroir-Based Spirits Shapes Market Trends

A major trend influencing the Rhum Agricole market is the rising interest in terroir-driven beverages. Consumers now want spirits that reflect local soil, climate, and agricultural practices, and Rhum Agricole fits perfectly into this movement. Distilleries highlight their cane varieties, microclimates, and artisanal methods, making the product feel more authentic and story-driven.

- Small distilleries are using sustainable sugarcane farming, natural fermentation, and minimal intervention techniques, which appeal to buyers who value purity and craftsmanship. The rum must be bottled at an alcoholic strength of at least 40% ABV, and it must meet defined aroma-chemistry thresholds (including 225 g per hectolitre of pure alcohol for certain volatile compounds, with higher thresholds for aged styles).

Rhum Agricole is becoming a favorite ingredient for tropical, herbal, and citrus-forward cocktails. Signature drinks like the “Ti’ Punch” are gaining attention on global bar menus, helping broaden the category’s visibility. Limited-edition batches and collectible bottles are also trending. Distilleries are releasing special cask-aged variants, single-estate editions, and anniversary bottles, attracting enthusiasts and investors.

Drivers

Growing Preference for Authentic Sugarcane Spirits Fuels Market Expansion

The Rhum Agricole market is gaining steady momentum as more consumers look for authentic, naturally crafted spirits. Unlike traditional rum made from molasses, Rhum Agricole is produced directly from fresh sugarcane juice, which offers a cleaner and more aromatic profile. This difference is increasingly appreciated by premium spirit buyers who want originality and transparency in production.

- Another important driver is the rise of craft cocktail culture. Bartenders across global hospitality markets are using Rhum Agricole for its fresh, grassy notes that create unique flavor combinations. The same dataset reports cruise stopovers declined by -8.1%, while pleasure boats still produced 19,093 port calls in 2024.

Tourism in the Caribbean and Indian Ocean islands also plays a key role. Countries like Martinique, Guadeloupe, and Réunion attract visitors who often discover Rhum Agricole during distillery tours, boosting brand awareness and exports. Health-conscious consumers also find appeal in Rhum Agricole because it is less processed, contains fewer additives, and is often produced in small batches by traditional distilleries.

Restraints

Limited Sugarcane Availability Restricts Large-Scale Market Growth

The Rhum Agricole market faces several limitations, largely due to its dependency on fresh sugarcane juice. Since this spirit must be produced immediately after harvest, distilleries require consistent access to high-quality sugarcane. Seasonal variations, unpredictable weather, and shrinking agricultural land often restrict supply, preventing large-scale production.

- Another major restraint is the higher production cost. Rhum Agricole requires more careful handling, quicker processing, and smaller batch operations compared with molasses-based rum. In the 2023–2024 campaign, over 2 million tonnes of sugar cane were harvested across 35,220 hectares in the DROM.

Geographical restrictions also play a role. Protected Designation of Origin rules in regions like Martinique mean that true AOC-certified Rhum Agricole can only be produced within specific territories. While this maintains quality, it also limits the global expansion of certified products.

Growth Factors

Rising Premiumization in Spirits Creates Strong Market Opportunities

The global shift toward premium and super-premium alcoholic beverages is opening meaningful opportunities for the Rhum Agricole market. Consumers are willing to spend more on spirits with heritage, craftsmanship, and natural production methods—areas where Rhum Agricole stands out strongly.

- Export growth represents another major opportunity. While historically centered in the French Caribbean, demand is increasing in North America, Europe, and parts of Asia. France exported “rum and tafia” worth $145,150.91K in 2024, with a reported quantity of 33,649,300 liters.

Innovation in aged expressions is also supporting growth. As more distilleries experiment with barrel-aging techniques—such as oak, cognac, or ex-bourbon barrels—Rhum Agricole is entering the same premium space as whiskey and high-end rum. This attracts connoisseurs and collectors seeking unique flavor experiences.

Regional Analysis

Europe Dominates the Rhum Agricole Market with a Market Share of 52.3%, Valued at USD 0.8 Billion

Europe leads the global Rhum Agricole Market, supported by strong consumer preference for premium cane-based spirits and a deeply rooted cocktail culture. The region’s share of 52.3% and valuation of USD 0.8 billion reflect sustained demand for artisanal and origin-specific products. Regulatory emphasis on authenticity and protected geographical indications further strengthens category growth.

North America shows steady growth in the Rhum Agricole Market, driven by increasing interest in craft spirits and Caribbean-inspired mixology. Consumers in the U.S. and Canada are shifting toward niche and premium rum variants, boosting demand for authentic agricole expressions. Expanding distribution networks and rising brand awareness are also helping the category gain traction in the region.

Asia Pacific is emerging as a high-potential market as premium spirit consumption accelerates across urban centers. Growing hospitality investments, strong tourism inflows, and rising exposure to global cocktail trends create significant opportunities for Rhum Agricole adoption. Markets such as Japan, Singapore, and Australia are particularly influential in shaping demand for cane-origin premium spirits.

The Middle East and Africa region is gradually expanding its Rhum Agricole presence, supported by tourism, luxury hotel openings, and demand from premium bars. Although alcohol regulations vary widely, markets with established expatriate populations show notable growth. Increasing inclusion of agricole rum in curated bar menus also contributes to slow but consistent market development.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2025, the global Rhum Agricole market continues to expand steadily, supported by premiumization, rising consumer interest in terroir-driven spirits, and growth in European and North American specialty retail channels. Established distilleries with strong heritage positioning remain central to this momentum, particularly those from Martinique—the core production base for pure sugarcane-juice rum.

Clément maintains a resilient leadership role, benefiting from its strong AOC Martinique identity and consistent global brand recall. Analysts note that the company is successfully leveraging aged expressions and limited editions, which continue to appeal to collectors and high-end connoisseurs. Its distribution partnerships in Europe and the U.S. strengthen its footprint as demand for agricole rum rises.

Saint James stands out due to its scale, operational efficiency, and extensive product portfolio. Its strategic use of eco-friendly production methods and organic-certified lines resonates well with sustainability-focused consumers. The brand’s heritage and storytelling contribute to its competitive edge in mature markets.

La Mauny continues to build on its artisanal positioning, supported by a loyal consumer base that values authenticity. The company’s emphasis on craft production methods and small-batch releases enhances its premium market perception. Growing interest in mixology also boosts demand for its versatile blends.

Depaz benefits from its volcanic-soil terroir narrative and premium aged offerings, making it a preferred choice in upscale retail and travel-retail channels. Analysts highlight the brand’s steady improvement in export strategies, with rising visibility in Europe’s luxury spirits segment.

Top Key Players in the Market

- Clément

- Saint James

- La Mauny

- Depaz

- Trois Rivières

- Rhum J.M

- Bielle

- Karukera

- Rhum Bologne

- Rhum Père Labat

Recent Developments

- In 2025, the Rhum Agricole sector, primarily centered in Martinique, continues to emphasize its unique AOC (Appellation d’Origine Contrôlée) status, which was granted in 1996 and remains the only such designation for rum worldwide.

- In 2025, Rhum Clément, produced at Habitation Clément in Martinique, will focus on innovation in aging and finishes. The brand unveiled its Cask Finish Collection, a limited-edition range of seven double-aged agricole rums finished in various global casks, emphasizing exotic flavors like caramel, spice, and dried fruit.

Report Scope

Report Features Description Market Value (2024) USD 1.5 Billion Forecast Revenue (2034) USD 2.2 Billion CAGR (2025-2034) 4.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Variant Type (Vieux, Ambre, Blanc), By Distribution Channel (Supermarkets and Hypermarkets, Specialty liquor stores, Duty Free Stores, Online Retail, Others), By End-Use (Food Service, Retail and Household) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Clément, Saint James, La Mauny, Depaz, Trois-Rivières, Rhum J.M, Bielle, Karukera, Rhum Bologne, Rhum Père Labat Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Clément

- Saint James

- La Mauny

- Depaz

- Trois Rivières

- Rhum J.M

- Bielle

- Karukera

- Rhum Bologne

- Rhum Père Labat