Global Reverse Factoring Market By Type (Domestic Reverse Factoring, International Reverse Factoring), By Service Provider (Banks, Non-Bank Financial Institutions), By Industry Vertical (Manufacturing, IT & Telecom, Retail and E-Commerce, Construction, Healthcare, Other Industry Verticals), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: July 2024

- Report ID: 124853

- Number of Pages: 322

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

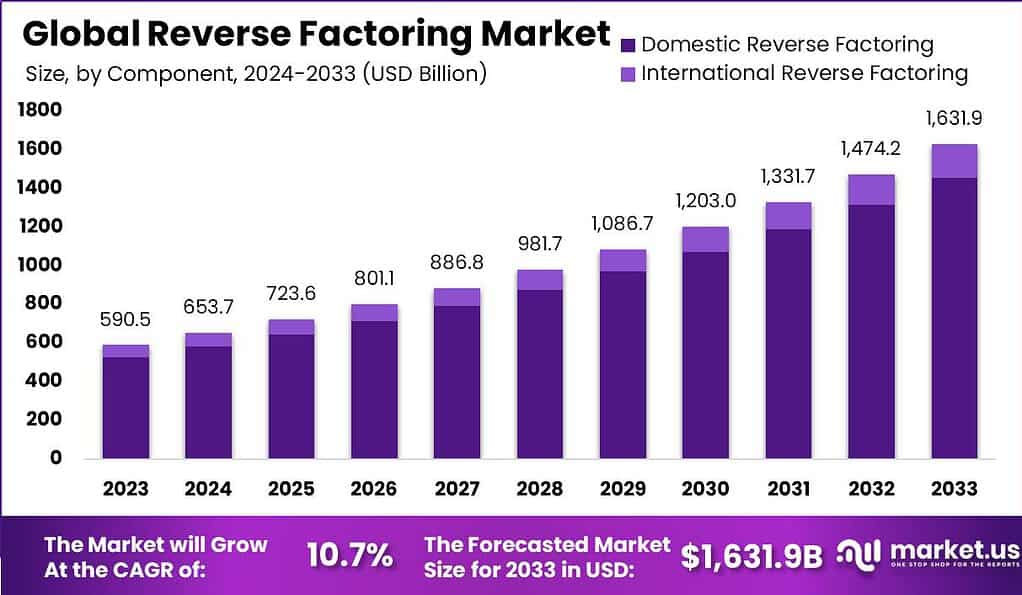

The Global Reverse Factoring Market size is expected to be worth around USD 1,631.9 Billion By 2033, from USD 590.5 Billion in 2023, growing at a CAGR of 10.7% during the forecast period from 2024 to 2033.

Reverse factoring, also known as supply chain finance, is a financial arrangement where a buyer extends the payment terms of their accounts payable to their suppliers, with a financial institution providing early payment to the suppliers at a discounted rate. This practice helps improve the cash flow of suppliers by allowing them to receive early payment while offering buyers extended payment terms.

The Reverse Factoring Market has been gaining traction as a vital financial tool that enhances liquidity and optimizes working capital among businesses. This financial arrangement benefits suppliers by allowing them to receive early payments on their invoices at a discounted rate, which is financed by a third party, usually a financial institution. The growth of this market can be attributed to the increasing demand for supply chain efficiency and the need for better cash flow management among small and medium-sized enterprises (SMEs).

Opportunities in the reverse factoring market are large, especially with the ongoing digital transformation in the financial sector. The adoption of digital platforms and artificial intelligence can streamline the reverse factoring process, making it more efficient and accessible to a broader range of businesses. Moreover, as awareness of its benefits grows, smaller enterprises are increasingly likely to adopt reverse factoring, expanding the market further.

However, the market faces challenges, particularly in terms of regulatory compliance and the need for technological integration. Different countries have varied regulatory environments, making it complicated for multinational corporations to implement a uniform reverse factoring program. Additionally, the integration of this financing solution with existing financial systems can be technically challenging and costly.

For instance, In September 2023, Bank of America initiated the CashPro Supply Chain Solutions program, marking the commencement of a comprehensive, multi-year endeavor aimed at transforming supply chain finance. This initiative is strategically designed to amplify the bank’s capabilities within this domain, ensuring the delivery of innovative and efficient solutions to its clientele engaged in supply chain management and financing.

According to analysts at Market.us, the global factoring market is projected to reach USD 7,019.8 billion by 2033, growing at a steady compound annual growth rate (CAGR) of 6.4% during the forecast period from 2024 to 2033. The market size is anticipated to be USD 4,016.5 billion in 2024. Tipalti reports that reverse factoring could potentially manage approximately 25% of trade finance. Currently, reverse factoring represents just 3% of global trade finance, indicating significant untapped potential in this segment.

Key Takeaways

- The Global Reverse Factoring Market is projected to expand significantly, with a valuation expected to reach approximately USD 1,631.9 billion by 2033, up from USD 590.5 billion in 2023. This growth represents a Compound Annual Growth Rate (CAGR) of 10.7% over the forecast period from 2024 to 2033.

- In the Domestic Reverse Factoring segment, a dominant market share of 89.3% was held in 2023.

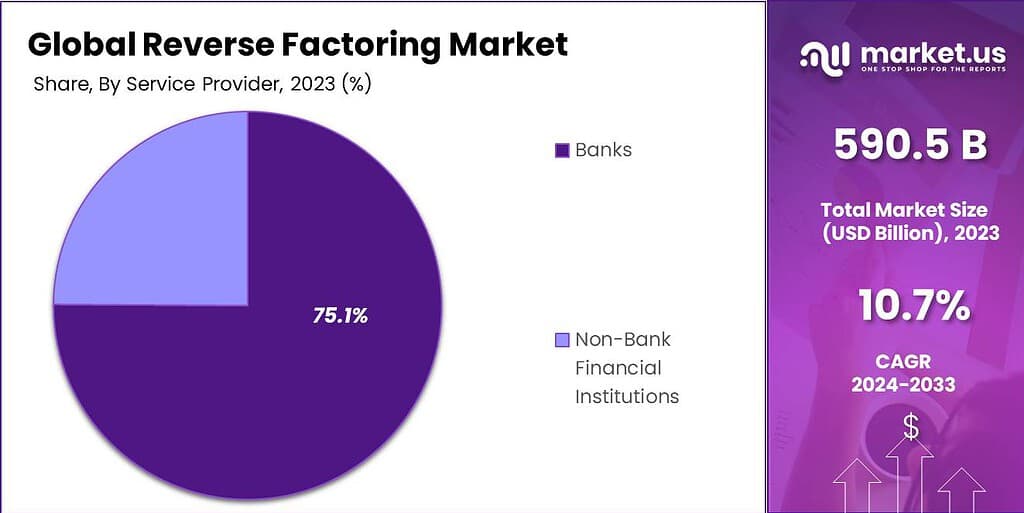

- The Banks segment maintained a dominant position in the market, capturing a significant 75.1% market share in 2023.

- In terms of industry verticals, the Manufacturing sector was a prominent contributor to the market, accounting for 29.2% of the total market share in 2023.

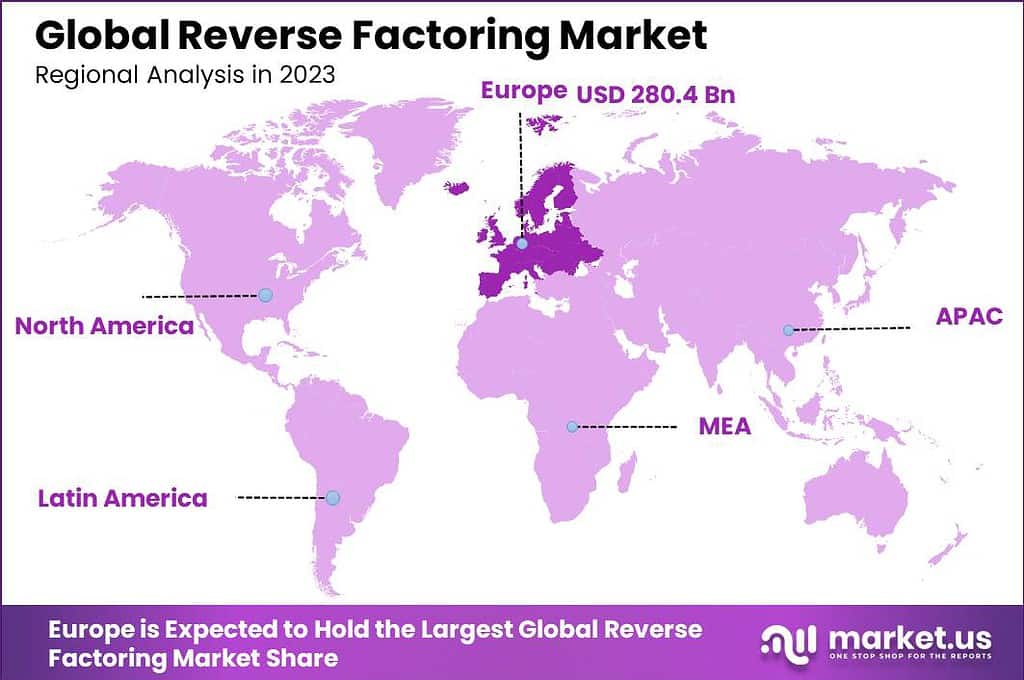

- Europe emerged as the leading region in the Reverse Factoring Market, holding a 47.5% market share, translating to revenues of approximately USD 280.4 billion in 2023.

Type Analysis

In 2023, the Domestic Reverse Factoring segment held a dominant market position in the Reverse Factoring Market, capturing more than an 89.3% share. This segment’s leadership can be attributed to several key factors. Primarily, domestic reverse factoring simplifies the financial transactions between buyers and suppliers within the same country, eliminating the complexities associated with currency exchange and international trade regulations. This simplicity and the reduced risk of currency fluctuations make it an attractive option for many businesses.

Furthermore, domestic reverse factoring benefits from stronger legal and financial infrastructures that are consistent within a country, which facilitates smoother operations and easier dispute resolution. Businesses are more likely to engage with domestic factoring services due to the familiarity with local market practices and regulations. Additionally, the quicker verification process and shorter transaction cycles associated with domestic transactions enhance its appeal, providing businesses with faster access to working capital.

The dominance of the Domestic Reverse Factoring segment is also reinforced by its accessibility to a wider range of businesses, including small and medium enterprises that may not have the means or the need to engage in international factoring. This accessibility helps in bolstering the liquidity of these smaller businesses, enabling them to maintain a steady cash flow and invest in growth opportunities more readily.

Service Provider Analysis

In 2023, the Banks segment held a dominant market position in the Reverse Factoring Market, capturing more than a 75.1% share. This substantial market share is primarily due to the trust and reliability that businesses place in established banking institutions.

Banks have a longstanding reputation for stability and security, which is crucial when companies choose partners for financial transactions such as reverse factoring. This trust is particularly significant in financial services, where the assurance of having transactions handled securely and professionally can influence the choice of provider significantly.

Moreover, banks offer comprehensive financial services, which often include customized reverse factoring solutions that can be integrated with other financial offerings. This integration allows businesses to manage their finances more cohesively, making banks a preferred choice for companies looking to streamline financial operations.

Additionally, banks typically have robust infrastructures and extensive networks that facilitate quicker and more efficient processing of reverse factoring transactions, further enhancing their appeal to large and medium-sized enterprises.

The leadership of the Banks segment is also supported by their ability to leverage existing client relationships. Businesses already banking with these institutions find it easier and more convenient to extend their services to include reverse factoring. This convenience, combined with the competitive rates that major banks can offer due to their scale and efficiency, helps to solidify their position in the market.

As digital technologies continue to evolve, banks are increasingly adopting innovative solutions to improve their reverse factoring services, such as incorporating blockchain and artificial intelligence to reduce fraud and speed up transaction times. This proactive approach in adopting technology not only improves service delivery but also positions banks to maintain their dominance in the reverse factoring market by appealing to a tech-savvy clientele and meeting the growing demand for more efficient financial processes.

Industry Vertical Analysis

In 2023, the Manufacturing segment held a dominant market position in the Reverse Factoring Market, capturing more than a 29.2% share. This leading position is primarily driven by the inherent characteristics of the manufacturing industry, which include extensive supply chains and significant capital requirements for raw materials and production processes.

Manufacturing companies often face long production cycles and payment terms, which can strain their cash flow. Reverse factoring provides a vital financial tool, enabling these companies to pay suppliers promptly without compromising their working capital. The prevalence of international sourcing in manufacturing further bolsters the need for reverse factoring.

Manufacturers sourcing raw materials and components from various global locations encounter diverse payment conditions and credit terms. Reverse factoring simplifies these complexities by ensuring suppliers are paid quickly, thereby maintaining strong supplier relationships and ensuring the continuity of supply chains. This financial solution is particularly advantageous for manufacturers dealing with high volumes of transactions and extended credit terms.

Moreover, the competitive nature of the manufacturing sector drives companies to seek efficiencies and financial advantages wherever possible. Reverse factoring helps manufacturing firms not only manage their cash flows more effectively but also leverage better terms from suppliers due to the assurance of timely payments facilitated by financial institutions. This can result in cost savings and improved profit margins.

As manufacturing continues to evolve with advancements in technology and global trade dynamics, the role of reverse factoring in supporting this sector’s financial stability and growth is expected to grow. This will likely sustain the dominance of the Manufacturing segment in the reverse factoring market, as manufacturers increasingly recognize the strategic benefits of this financial mechanism.

Key Market Segments

Type

- Domestic Reverse Factoring

- International Reverse Factoring

Service Provider

- Banks

- Non-Bank Financial Institutions

Industry Vertical

- Manufacturing

- IT & Telecom

- Retail and E-Commerce

- Construction

- Healthcare

- Other Industry Verticals

Driver

Increasing Demand for Working Capital Optimization

The primary driver of the reverse factoring market is the increasing need for working capital optimization among businesses. As companies seek to enhance their liquidity and manage cash flows more efficiently, reverse factoring has become a preferred financial tool.

This arrangement allows companies to pay suppliers promptly while maintaining cash on hand for operational needs, effectively strengthening the supply chain and business relationships. The use of reverse factoring is particularly appealing because it offers early payment to suppliers at a discount, which is beneficial during economic fluctuations where cash flow management becomes crucial.

Restraint

Risk of Fraud

One significant restraint in the reverse factoring market is the risk of fraud, which includes potential issues like double financing and invoice misrepresentation. These risks can lead to considerable financial losses and damage the credibility of the financial institutions involved. To mitigate these risks, robust fraud detection and prevention measures are necessary, which can add to the operational complexity and cost for companies implementing reverse factoring.

Opportunity

Technological Advancements in Finance

Technological advancements present a major opportunity in the reverse factoring market. The integration of technologies such as artificial intelligence, blockchain, and data analytics enhances the efficiency, security, and transparency of reverse factoring transactions. These technologies automate the invoice processing and risk assessment processes, making reverse factoring accessible to a broader range of businesses, including smaller suppliers who may lack previous access to efficient financing options.

Challenge

Complexity of Implementation

A major challenge in the reverse factoring market is the complexity of its implementation, which involves multiple parties including buyers, suppliers, and financial institutions. Managing these relationships and ensuring seamless transaction flow requires sophisticated coordination and a high level of trust among all parties. Moreover, integrating reverse factoring into existing financial and procurement systems can be technically challenging and costly, requiring significant investment in technology and training.

Growth Factors

- Optimization of Working Capital: The primary growth factor for the reverse factoring market is the increasing need among businesses to optimize their working capital. This financial tool helps companies manage cash flow more effectively by allowing them to pay suppliers promptly without tying up their cash reserves. It is particularly crucial for maintaining liquidity and operational efficiency in industries with long production cycles or extended payment terms.

- Globalization of Supply Chains: As businesses expand globally, the complexity of managing international transactions increases. Reverse factoring provides a streamlined solution for handling cross-border payments, reducing the risks associated with currency fluctuations and differences in trade regulations. This is essential for companies looking to expand their operations internationally and require robust financial mechanisms to support global trade.

- Technological Integration: The incorporation of advanced technologies such as AI, blockchain, and data analytics into reverse factoring processes enhances transaction efficiency, reduces risks, and improves transparency. These technologies enable faster processing of transactions and better risk assessment, making reverse factoring more attractive to a broader spectrum of businesses, including small and medium enterprises (SMEs).

Emerging Trends

- Digital Platforms: The rise of digital platforms for reverse factoring is revolutionizing the market. These platforms provide a convenient, transparent, and efficient means for businesses to manage their supply chain finances. By automating the reverse factoring process, these platforms reduce administrative overhead and make it easier for companies to engage with multiple suppliers and financial institutions on a single platform.

- Sustainability-Linked Reverse Factoring: There is a growing trend towards linking reverse factoring arrangements with sustainability goals. Companies are increasingly adopting sustainable supply chain finance programs that reward suppliers for meeting specific environmental and social criteria. This not only promotes sustainable practices but also enhances the corporate social responsibility profiles of the companies involved.

- Integration with Broader Financial Services: Reverse factoring is being integrated with broader financial service offerings to provide a more comprehensive financial management solution. This integration helps businesses manage all their financial needs under one roof, improving overall financial efficiency and reducing transaction costs.

Regional Analysis

In 2023, Europe held a dominant market position in the Reverse Factoring Market, capturing more than a 47.5% share, with revenues amounting to USD 280.4 billion.

This leadership can be attributed to several factors that uniquely position Europe at the forefront of the reverse factoring industry.

Regulatory Support and Financial Infrastructure: Europe boasts a robust regulatory framework that supports financial innovations like reverse factoring. The region’s well-established financial services sector offers a conducive environment for the growth of such financial tools, facilitating easier adoption among businesses. European governments and financial regulators have also been proactive in promoting supply chain finance solutions to enhance business liquidity and stability, further driving the market’s growth.

High Adoption in the Manufacturing and Automotive Industries: Europe’s strong manufacturing base, particularly in countries like Germany, Italy, and France, significantly contributes to the region’s dominance. The automotive industry, in particular, utilizes reverse factoring extensively to manage the complex and extensive supply chains that are typical in this sector. This usage is driven by the need to improve cash flow and reduce operational risks, ensuring timely payments and financial health among suppliers.

Technological Advancements and Integration: European companies are leaders in integrating advanced technologies such as AI and blockchain into their financial operations, including reverse factoring. These technologies enhance the efficiency, security, and transparency of transactions. Moreover, Europe’s emphasis on digital transformation in financial services has encouraged the adoption of online reverse factoring platforms, making the process more accessible and manageable across the continent.

Focus on Sustainability: There is a growing trend in Europe to align financial practices like reverse factoring with sustainability goals. Many European companies are implementing green reverse factoring programs that incentivize suppliers to adhere to environmentally friendly practices. This not only supports sustainability but also attracts companies interested in responsible financial tools, further bolstering the market’s growth in Europe.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the Reverse Factoring Market, key players such as Citigroup Inc., HSBC Holdings plc, JPMorgan Chase & Co., and BNP Paribas have been actively engaged in strategic activities to enhance their market positions. Here’s a look at some recent developments:

Citigroup Inc. has made significant strides in expanding its financial services offerings. In September 2023, Citigroup sold its “Bridge built by Citi” platform to Foro Holdings, Inc., enhancing its focus on digital and commercial lending services. This move aligns with Citigroup’s strategy to simplify its operations and focus more sharply on core businesses, aiming to streamline decision-making processes and enhance client services.

HSBC Holdings plc continues to leverage its global network, enhancing its services through digital transformation and sustainability initiatives. HSBC has been focusing on integrating digital technologies to streamline its operations and improve customer experience, although specific mergers, acquisitions, or product launches in 2023 were not highlighted in the latest updates.

JPMorgan Chase & Co. consistently invests in technology to improve its financial services, although specific new product launches or acquisitions in the reverse factoring sphere were not detailed in the latest available reports.

BNP Paribas has been active in developing its digital capabilities and expanding its global reach. The bank focuses on strengthening its technological infrastructure to support various financial services, including reverse factoring, although no specific transactions were reported for 2023.

Top Key Players in the Market

- Citigroup Inc.

- HSBC Holdings plc

- JPMorgan Chase & Co.

- BNP Paribas

- Deutsche Bank AG

- Standard Chartered PLC

- DBS Bank Limited

- CaixaBank S.A.

- Traxpay GmbH

- Banco Santander S.A.

- UniCredit S.p.A.

- PrimeRevenue Inc.

- Other Key Players

Recent Developments

- UniCredit: In April 2024, UniCredit introduced a new reverse factoring program targeting the automotive sector in Europe. This program is designed to support suppliers facing liquidity challenges by offering early payment of invoices validated by large automotive manufacturers. The initiative is part of UniCredit’s broader effort to enhance its supply chain financing offerings.

- In October 2023, HSBC signed an agreement to acquire Citigroup’s retail wealth management portfolio in China. While this move primarily targets wealth management, it strengthens HSBC’s overall financial services, potentially impacting their reverse factoring capabilities by expanding their customer base and enhancing financial product offerings.

- In May 2023, Standard Chartered expanded its reverse factoring solutions by partnering with a leading fintech company to offer more flexible financing options for SMEs in Asia. This partnership aims to support the growth of small and medium-sized enterprises by providing them with easier access to working capital.

- In November 2023, DBS Bank launched a new digital trade finance platform that includes advanced reverse factoring features. This platform leverages blockchain technology to ensure the authenticity and security of transactions, making it easier for suppliers to receive early payments and for buyers to manage their cash flow more effectively.

Report Scope

Report Features Description Market Value (2023) USD 590.5 Bn Forecast Revenue (2033) USD 1,631.9 Bn CAGR (2024-2033) 10.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Domestic Reverse Factoring, International Reverse Factoring), By Service Provider (Banks, Non-Bank Financial Institutions), By Industry Vertical (Manufacturing, IT & Telecom, Retail and E-Commerce, Construction, Healthcare, Other Industry Verticals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Citigroup Inc., HSBC Holdings plc, JPMorgan Chase & Co., BNP Paribas, Deutsche Bank AG, Standard Chartered PLC, DBS Bank Limited, CaixaBank S.A., Traxpay GmbH, Banco Santander S.A., UniCredit S.p.A., PrimeRevenue Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Reverse Factoring?Reverse factoring is a financing arrangement initiated by a buyer to help its suppliers obtain financing at lower interest rates based on the buyer's creditworthiness rather than the supplier's.

How big is Reverse Factoring Market?The Global Reverse Factoring Market size is expected to be worth around USD 1,631.9 Billion By 2033, from USD 590.5 Billion in 2023, growing at a CAGR of 10.7% during the forecast period from 2024 to 2033.

What are the benefits of Reverse Factoring?The main stakeholders include buyers (large corporations or entities with strong credit ratings), suppliers (small to medium-sized enterprises that benefit from improved cash flow), and financial institutions (banks or third-party financiers providing the financing).

What are the key factors driving the growth of the Reverse Factoring Market?Key factors include the increasing need for working capital management, rising demand from SMEs for better cash flow solutions, advancements in financial technology, supportive regulatory frameworks, and the growing adoption of reverse factoring by large corporates to stabilize their supply chains.

What are the current trends and advancements in the Reverse Factoring Market?Current trends include the use of blockchain for enhanced transparency and security, the rise of digital platforms and marketplaces for reverse factoring, the integration of AI and machine learning for credit risk assessment, and the growing collaboration between fintech companies and traditional financial institutions.

What are the major challenges and opportunities in the Reverse Factoring Market?Major challenges include the risk of supplier dependency on financing, potential for increased costs for small suppliers, regulatory and compliance issues, and the need for robust risk management practices. Opportunities lie in expanding services to emerging markets, developing innovative financing solutions, leveraging technology for streamlined processes, and enhancing partnerships with financial institutions.

Who are the leading players in the Reverse Factoring Market?Leading players include Citigroup Inc., HSBC Holdings plc, JPMorgan Chase & Co., BNP Paribas, Deutsche Bank AG, Standard Chartered PLC, DBS Bank Limited, CaixaBank S.A., Traxpay GmbH, Banco Santander S.A., UniCredit S.p.A., PrimeRevenue Inc., Other Key Players

-

-

- Citigroup Inc.

- HSBC Holdings plc

- JPMorgan Chase & Co.

- BNP Paribas

- Deutsche Bank AG

- Standard Chartered PLC

- DBS Bank Limited

- CaixaBank S.A.

- Traxpay GmbH

- Banco Santander S.A.

- UniCredit S.p.A.

- PrimeRevenue Inc.

- Other Key Players