Global Reverse Cap Bottles Market Size, Share, Growth Analysis By Material Type (Plastic, Glass, Metal, Composite, Others), By Cap Type (Screw Cap, Snap Cap, Dispensing Cap), By End Use (Food and Beverage, Pharmaceuticals, Cosmetics, Household Products, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 156330

- Number of Pages: 355

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

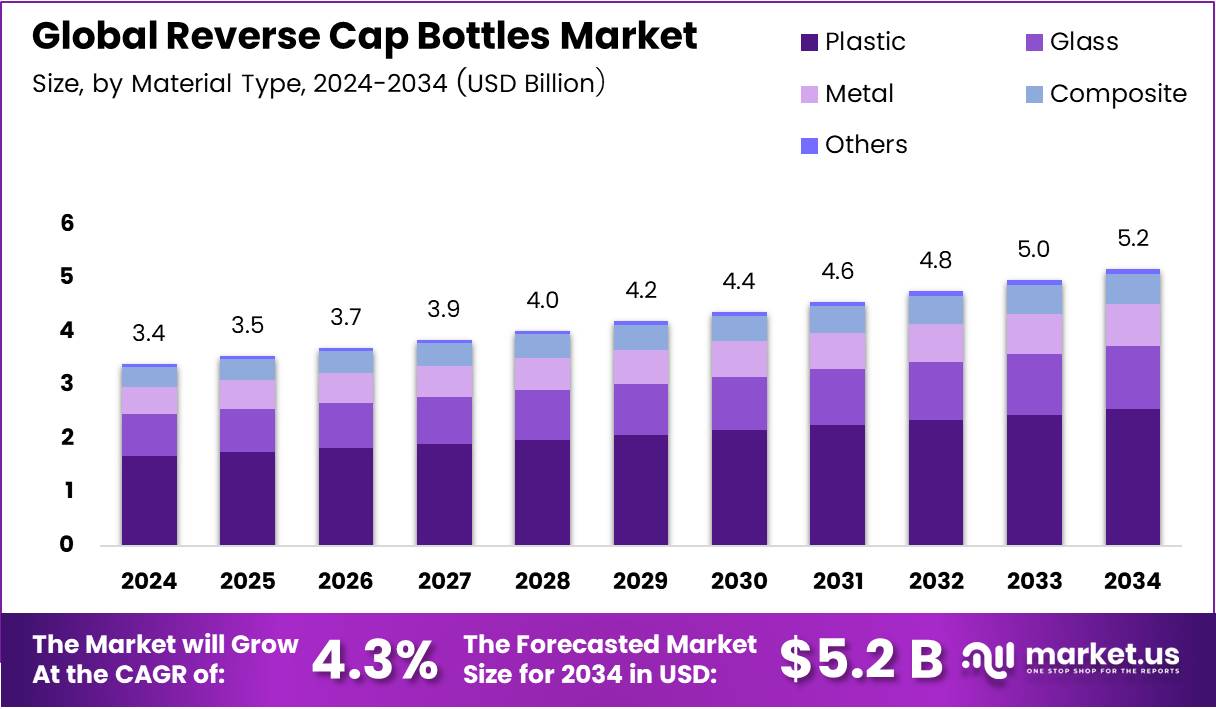

The Global Reverse Cap Bottles Market size is expected to be worth around USD 5.2 Billion by 2034, from USD 3.4 Billion in 2024, growing at a CAGR of 4.3% during the forecast period from 2025 to 2034.

The Reverse Cap Bottles Market refers to a specialized segment of the packaging industry that focuses on bottles with unique upside-down cap designs, typically used for condiments, pharmaceuticals, and personal care products. These bottles improve product dispensing, reduce waste, and enhance consumer convenience. The demand for efficient and user-friendly packaging formats has led manufacturers to prioritize innovative solutions such as reverse cap bottles.

The market is experiencing steady growth due to rising consumer preference for squeezable and easy-to-use packaging. With applications in food, beverages, cosmetics, and healthcare, these bottles provide controlled product flow and minimize spillage. The growing awareness around hygiene and convenience is reinforcing adoption across both developed and emerging economies, pushing companies to expand product portfolios with customized options.

Growth opportunities are being created by the expansion of the food and beverage industry and increasing disposable incomes in emerging markets. Brands in sauces, spreads, honey, and pharmaceuticals are investing in premium packaging to differentiate products. Reverse cap bottles are gaining traction as a sustainable option, especially when paired with recyclable plastics or bio-based materials, aligning with global sustainability agendas and consumer expectations.

Government investment in packaging innovation and waste reduction policies is shaping the regulatory landscape. Initiatives in the European Union to reduce plastic waste and the U.S. Food and Drug Administration’s emphasis on safe pharmaceutical packaging are directly supporting demand for advanced bottle formats. Companies are also encouraged to adopt reverse cap bottles that comply with food safety and recyclability standards, strengthening consumer trust.

Regulations around packaging recyclability are influencing manufacturers to design reverse cap bottles that meet circular economy principles. Governments across Asia and Europe are incentivizing the use of recyclable materials, offering subsidies and tax breaks to compliant producers. This creates a favorable environment for sustainable packaging solutions and accelerates large-scale industrial adoption of reverse cap bottle designs.

The Reverse Cap Bottles Market presents strong potential in personal care, where premium packaging boosts brand image. Increasing urbanization and busy lifestyles are driving single-use and on-the-go consumption, creating additional demand for efficient bottle designs. With regulatory backing and industry innovation, reverse cap bottles are anticipated to gain higher market penetration in global packaging trends.

Key Takeaways

- The global market is projected to reach USD 5.2 Billion by 2034, up from USD 3.4 Billion in 2024, growing at a CAGR of 4.3%.

- In 2024, Plastic led the material segment with a 49.3% share, driven by durability, molding ease, and wide application.

- Screw Cap dominated the cap type segment in 2024 with a 56.2% share, supported by resealability and strong demand in beverages.

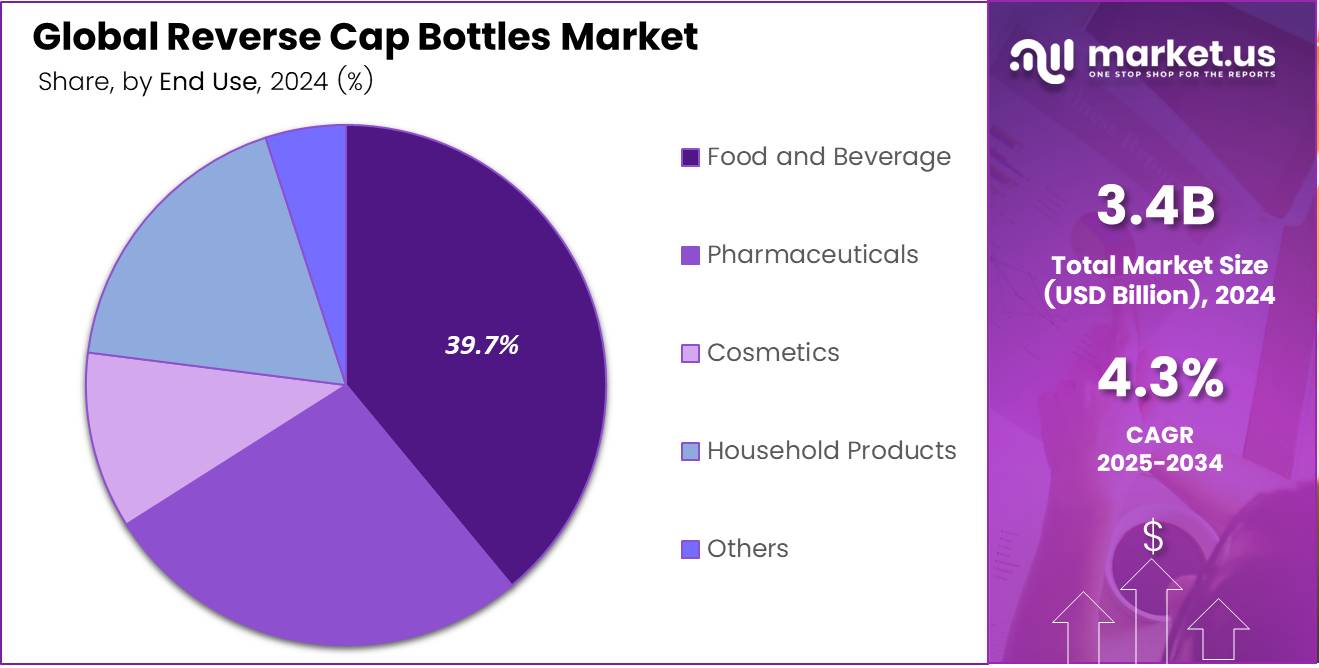

- Food and Beverage emerged as the largest end-use segment in 2024, holding a 39.7% share, fueled by packaged drinks and condiments.

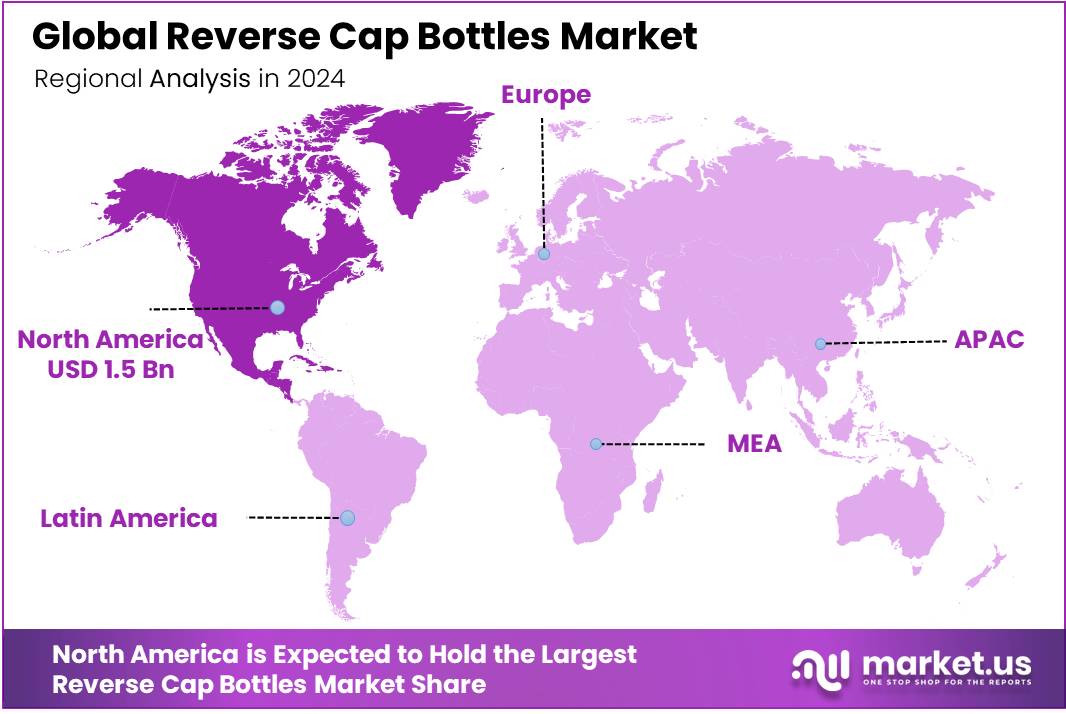

- North America accounted for the largest regional share at 46.7%, valued at USD 1.5 Billion, supported by strict packaging regulations and strong pharma demand.

Material Type Analysis

Plastic dominates with 49.3% due to its lightweight nature and cost-efficient manufacturing advantages.

In 2024, Plastic held a dominant market position in By Material Type Analysis segment of Reverse Cap Bottles Market, with a 49.3% share. Its dominance is attributed to durability, ease of molding, and high compatibility with diverse liquids. The segment benefits from rising adoption in food, beverages, and personal care sectors.

Glass remains an important material segment owing to its premium appeal and non-reactive nature. It is often chosen for pharmaceuticals and high-end cosmetics where purity and sustainability are prioritized. However, its higher cost and fragility restrict wider adoption compared to plastic.

Metal plays a smaller yet valuable role in packaging applications. It is primarily used in specialized products requiring enhanced protection and a longer shelf life. Strength, recyclability, and aesthetic appeal support its demand in niche categories.

Composite materials are gaining traction as innovation focuses on improving sustainability. These combinations of plastics, papers, or biopolymers are designed to balance performance with eco-friendly attributes. Their adoption is gradually expanding as consumers demand greener alternatives.

Others, including biodegradable and emerging specialty materials, contribute to innovation-led growth. This segment, although limited in share, reflects the industry’s shift toward circular economy practices and eco-conscious product development.

Cap Type Analysis

Screw Cap dominates with 56.2% owing to its secure closure and convenience in handling.

In 2024, Screw Cap held a dominant market position in By Cap Type Analysis segment of Reverse Cap Bottles Market, with a 56.2% share. Its strength lies in resealability, leakage prevention, and strong demand across food and beverage packaging. Ease of use makes it the most widely adopted option.

Snap Caps are valued for their quick application and affordability. They find relevance in cost-sensitive industries where high-speed packaging operations are critical. Although less durable than screw caps, their utility in single-use products continues to sustain demand.

Dispensing Caps are expanding in popularity, especially in cosmetics, pharmaceuticals, and household products. These caps provide controlled dispensing, convenience, and enhanced user experience. Growing consumer inclination toward precision and hygiene in packaging further supports their adoption.

End Use Analysis

Food and Beverage dominates with 39.7% supported by high demand for convenient and safe packaging.

In 2024, Food and Beverage held a dominant market position in By End Use Analysis segment of Reverse Cap Bottles Market, with a 39.7% share. The segment benefits from rising consumption of packaged drinks, sauces, and condiments, where safety and convenience are essential.

Pharmaceuticals represent a significant application segment, with bottles used extensively for liquid medicines and syrups. Compliance with regulatory standards and a growing focus on child-resistant packaging contribute to steady demand.

Cosmetics also remain a prominent end-use category. Reverse cap bottles are increasingly chosen for lotions, shampoos, and serums, where aesthetics and controlled dispensing enhance consumer appeal. This segment benefits from rising personal care consumption globally.

Household Products form another key application area. Cleaning solutions, detergents, and liquid soaps are frequently packaged in reverse cap bottles due to their safety, convenience, and spill-proof design.

Others, including industrial and niche product applications, showcase flexibility in design and adoption. Although smaller in share, these categories highlight the broader applicability of reverse cap bottles across multiple industries.

Key Market Segments

By Material Type

- Plastic

- Glass

- Metal

- Composite

- Others

By Cap Type

- Screw Cap

- Snap Cap

- Dispensing Cap

By End Use

- Food and Beverage

- Pharmaceuticals

- Cosmetics

- Household Products

- Others

Drivers

Increasing Demand for Child-Resistant Packaging in Pharmaceuticals Drives Market Growth

The rising demand for child-resistant packaging in pharmaceuticals is a major driver for the reverse cap bottles market. With stricter safety regulations and growing awareness among parents, pharmaceutical companies are increasingly adopting these solutions to prevent accidental ingestion, ensuring compliance and consumer trust.

The market is also benefitting from the rising adoption of convenience-oriented packaging for elderly consumers. Reverse cap bottles are designed for easy handling and simple usage, making them highly suitable for seniors who face difficulties with traditional caps. This usability feature is fueling greater acceptance in healthcare and personal use.

Additionally, the rapid growth of e-commerce is strengthening the need for secure packaging. Reverse cap bottles provide safety, leakage prevention, and durability, which are vital for online transportation of pharmaceuticals, nutraceuticals, and cosmetics. Their reliability in long-distance shipping is creating steady demand.

Expanding applications in nutraceuticals and personal care industries are further boosting the market. As health supplements, vitamins, and skincare products continue to grow in popularity, brands are adopting reverse cap bottles for product safety and enhanced user experience. This broadening application base is expected to reinforce long-term growth for the market.

Restraints

High Manufacturing Costs Due to Specialized Cap Mechanisms Restrain Market Growth

High manufacturing costs remain a significant restraint for the reverse cap bottles market. The specialized mechanisms required for safety and user-friendliness increase production expenses, creating pricing pressure for manufacturers and limiting mass adoption across price-sensitive markets.

Another challenge arises from limited recyclability of reverse cap materials. Many caps use mixed plastics and complex designs, making it harder to integrate them into recycling systems. In regions lacking advanced waste management infrastructure, this issue is more pronounced, impacting sustainability efforts.

Complex production processes also slow down the supply chain. The precision required in molding, assembling, and testing these caps often leads to longer lead times, making it difficult for suppliers to meet urgent or bulk demand. Such challenges reduce overall efficiency in global markets.

Combined, these restraints pose hurdles for manufacturers trying to balance cost-effectiveness with compliance and sustainability. Addressing these issues will be critical for long-term scalability and wider acceptance of reverse cap bottles.

Growth Factors

Integration of Smart Packaging Features Creates Growth Opportunities

The integration of smart packaging features presents a strong growth opportunity in the reverse cap bottles market. With the rise of digital healthcare and product tracking, adding QR codes, NFC tags, or freshness indicators enhances safety and consumer engagement, driving adoption in pharmaceuticals and nutraceuticals.

Eco-friendly and biodegradable material development is another major opportunity. As sustainability takes center stage globally, manufacturers are focusing on developing caps and bottles with recyclable and biodegradable polymers. This shift not only improves brand perception but also aligns with regulatory goals.

Rising demand for single-dose packaging in healthcare is further expanding prospects. Reverse cap bottles can be tailored for unit-dose formats, supporting medication adherence, accurate dosing, and safer consumption, particularly in hospitals and long-term care facilities.

Emerging markets with improving healthcare access are creating new growth corridors. As pharmaceutical and nutraceutical industries expand in Asia, Africa, and Latin America, the need for secure, user-friendly packaging is expected to rise, unlocking significant opportunities for reverse cap bottle manufacturers.

Emerging Trends

Adoption of Tamper-Evident Reverse Cap Designs is a Key Trend

Tamper-evident reverse cap designs are emerging as a key trend in the market. These solutions offer visible security, assuring consumers of product integrity and compliance with stringent regulatory frameworks, particularly in pharmaceuticals and nutraceuticals.

There is also a clear shift towards lightweight and ergonomic packaging solutions. Manufacturers are designing reverse cap bottles that use less material without compromising safety, ensuring cost-efficiency while improving portability and consumer convenience.

Premium packaging is gaining traction in cosmetics and personal care. Brands are using reverse cap bottles with aesthetic finishes, improved grip, and innovative designs to attract consumers seeking luxury and functionality in skincare and wellness products.

Automation and advanced molding technologies are shaping production trends. Manufacturers are adopting high-precision machinery and automated systems to reduce errors, lower production time, and meet growing global demand efficiently. This technological adoption is expected to define the competitive landscape of the market.

Regional Analysis

North America Dominates the Reverse Cap Bottles Market with a Market Share of 46.7%, Valued at USD 1.5 Billion

North America accounted for the largest share of the Reverse Cap Bottles Market, holding 46.7% and valued at USD 1.5 Billion. Growth in this region is primarily driven by strong demand in the pharmaceutical and nutraceutical sectors, alongside stringent packaging regulations emphasizing child-resistant features and safety compliance.

Europe Reverse Cap Bottles Market Trends

Europe is witnessing steady adoption of reverse cap bottles owing to increasing focus on eco-friendly materials and compliance with EU packaging standards. Rising healthcare spending and an expanding elderly population are also influencing demand, particularly for convenient and secure bottle designs.

Asia Pacific Reverse Cap Bottles Market Trends

Asia Pacific is projected to experience strong growth due to increasing pharmaceutical manufacturing, expanding nutraceutical consumption, and a rising middle-class population. Governments in the region are encouraging safe packaging practices, further boosting the market outlook for reverse cap bottles.

Middle East and Africa Reverse Cap Bottles Market Trends

The Middle East and Africa region is gradually adopting reverse cap bottles, supported by rising healthcare infrastructure development and growing import of packaged medicines. Increasing awareness around child safety in packaging is also expected to support long-term market growth.

Latin America Reverse Cap Bottles Market Trends

Latin America shows moderate growth potential with demand being driven by an expanding pharmaceutical industry and higher focus on safe packaging solutions. Rising investments in consumer healthcare products are further expected to contribute to steady adoption of reverse cap bottles.

U.S. Reverse Cap Bottles Market Trends

The U.S. represents the key contributor within North America, benefiting from advanced packaging innovations and stringent FDA regulations for child-resistant solutions. The widespread use of reverse cap bottles in pharmaceuticals and nutraceuticals continues to reinforce its dominance in the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Reverse Cap Bottles Company Insights

Amcor continues to strengthen its foothold in the reverse cap bottles market by focusing on sustainable and innovative packaging formats. The company leverages its extensive global presence and advanced R&D capabilities to deliver lightweight, recyclable solutions that align with evolving consumer and regulatory demands for eco-friendly packaging.

Silgan Holdings plays a significant role in shaping the market with its specialization in rigid packaging and closures. Its emphasis on tailored bottle cap designs for pharmaceuticals and nutraceuticals ensures compliance with child-resistant standards while meeting the growing need for convenience-driven packaging for elderly consumers.

Ball Corporation brings its strong expertise in metal packaging into the reverse cap bottle space, focusing on durability and secure transport of liquid-based products. By integrating innovative closure technologies, the company expands applications beyond traditional beverage markets into healthcare and personal care, supporting growth in diversified end-user segments.

AptarGroup distinguishes itself through its focus on dispensing technologies and premium packaging solutions. The company integrates advanced safety features with functional design, making it a key player in pharmaceutical-grade reverse cap bottles. Its investments in customization and consumer-friendly innovations enable adoption in both regulated healthcare markets and fast-growing nutraceutical applications.

Top Key Players in the Market

- Amcor

- Silgan Holdings

- Ball Corporation

- AptarGroup

- Green Rush Packaging

- Mondi Group

- Silgan Holdings

Recent Developments

- In Jan 2024, Valgroup acquired plastic cap manufacturer Mirvi Brasil, strengthening its packaging portfolio and expanding presence in Brazil’s caps and closures market. This move is aimed at enhancing production capacity and meeting rising demand in Latin America.

- In Jul 2024, ProMach announced the acquisition of Italy-based MBF, a global leader in filling solutions for wine and spirits industries. This deal expands ProMach’s international footprint and complements its portfolio with advanced bottling technologies tailored for premium beverages.

- In Apr 2025, Ardagh Glass Packaging partnered with CAP Glass to establish dedicated glass recycling services. The collaboration emphasizes circular economy goals, promoting sustainable packaging solutions by increasing recycled glass usage in production.

Report Scope

Report Features Description Market Value (2024) USD 3.4 Billion Forecast Revenue (2034) USD 5.2 Billion CAGR (2025-2034) 4.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Plastic, Glass, Metal, Composite, Others), By Cap Type (Screw Cap, Snap Cap, Dispensing Cap), By End Use (Food and Beverage, Pharmaceuticals, Cosmetics, Household Products, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Amcor, Silgan Holdings, Ball Corporation, AptarGroup, Green Rush Packaging, Mondi Group, Silgan Holdings Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Amcor

- Silgan Holdings

- Ball Corporation

- AptarGroup

- Green Rush Packaging

- Mondi Group

- Silgan Holdings