Global Restaurant Digitalization Market By Component (Software and Hardware), By Restaurant Type (Cafes, Fast Food, and Dining), By Application (Contactless Payment, Online Ordering Systems & Delivery Apps, Automated Inventory Management Software, Digital Kitchen Boards, Marketing, Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Aug. 2024

- Report ID: 101122

- Number of Pages: 365

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

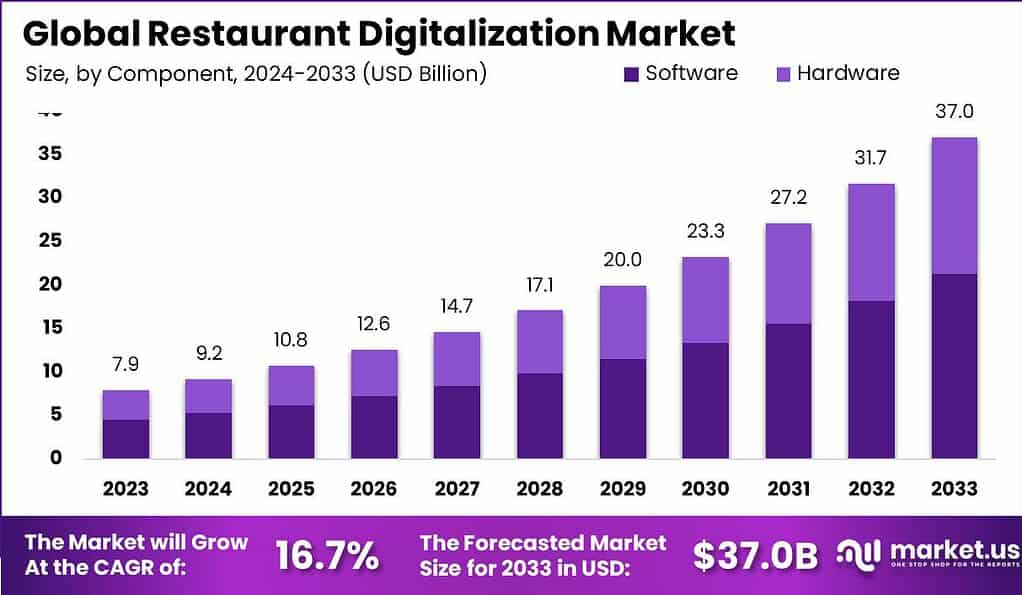

The Global Restaurant Digitalization Market size is expected to be worth around USD 37.0 Billion By 2033, from USD 7.9 Billion in 2023, growing at a CAGR of 16.7% during the forecast period from 2024 to 2033.

The process of restaurant digitalization involves integrating advanced digital tools into all aspects of restaurant operations, from front-of-house to kitchen management. This transformation is geared towards enhancing customer experience, streamlining operations, and increasing profitability.

Key components of digitalization in this sector include online reservations and ordering systems, digital point-of-sale (POS) systems, and customer relationship management (CRM) platforms, as well as the implementation of AI for personalized service and predictive analytics to optimize inventory and labor.

The restaurant digitalization market is experiencing significant growth, driven by the increasing demand for convenience and efficiency by consumers and the need for cost-effective solutions by restaurant owners. The adoption of these technologies allows restaurants to better meet customer expectations, adapt to changing market conditions, and reduce operational costs.

As restaurants continue to navigate the post-pandemic landscape, digital solutions are becoming indispensable tools for maintaining competitiveness and ensuring sustainability in a rapidly evolving industry. Key factors driving this growth include the increasing adoption of smartphones and internet access, which enable customers to utilize online food ordering and digital payment solutions.

Notably, the software component of digital solutions, which includes online ordering systems and delivery apps, is leading this expansion. These platforms are designed to offer convenience and efficiency, allowing customers to place orders, make payments, and track deliveries seamlessly.

Technological advancements play a crucial role in this market. The integration of AI and automation in restaurant operations is streamlining processes and improving efficiency. Self-order kiosks and AI-powered chatbots are enhancing customer service, while predictive inventory management helps in minimizing food wastage and optimizing stock levels. The rise of cloud kitchens, which operate solely for delivery, is another notable trend, reducing operational costs and expanding market reach.

However, the market faces challenges such as the complexity of integrating various digital systems and ensuring data security. Protecting customer data from breaches is paramount as digital ordering and loyalty programs become more widespread. Additionally, there is a need for skilled labor to manage and operate these advanced digital tools, posing a challenge for restaurant operators.

Despite these challenges, the market presents significant opportunities. The adoption of digital tools can aid in sustainability efforts, aligning with consumer preferences for environmentally responsible practices. Expanding into new delivery models, such as virtual kitchens, and leveraging AI for personalized marketing and loyalty programs can enhance customer engagement and retention. Overall, the restaurant digitalization market is set to transform the dining experience, driven by technological advancements and changing consumer behaviors.

According to Mvix Digital Signage, touchscreen kiosks are revolutionizing the quick service restaurant (QSR) industry by offering self-ordering, payment, and entertainment options. These interactive kiosks are facilitating quicker resolution to client challenges, leading to increased satisfaction. The market for touchscreen kiosks is projected to grow at a rate of 6.3%, reaching approximately $39.2 billion by 2027.

Globally, China is expected to generate the highest revenue in the online food delivery market, amounting to US$448.90 billion in 2024. The user penetration in China is also set to be around 27.5% in 2024, reflecting the increasing reliance on meal delivery services for daily sustenance.

The Publicis Sapient’s Digital Life Index reported that during the Covid period, 74% of respondents demanded high ranks in health and safety, while almost 55% of people demanded contactless technology, influencing their restaurant choices.

Research indicates that 39% of diners prefer to place their order on a mobile app or online, and half of the customers use their phones to look up menu items. Furthermore, nearly 60% of digital orders were placed via mobile apps in the past year, reflecting the growing importance of these platforms for restaurant owners.

Key Takeaways

- The Global Restaurant Digitalization Market is projected to reach USD 37.0 Billion by 2033, up from USD 7.9 Billion in 2023, demonstrating a Compound Annual Growth Rate (CAGR) of 16.7% during the forecast period from 2024 to 2033.

- In 2023, the Software segment occupied a leading position within the restaurant digitalization market, securing over 57.5% of the market share.

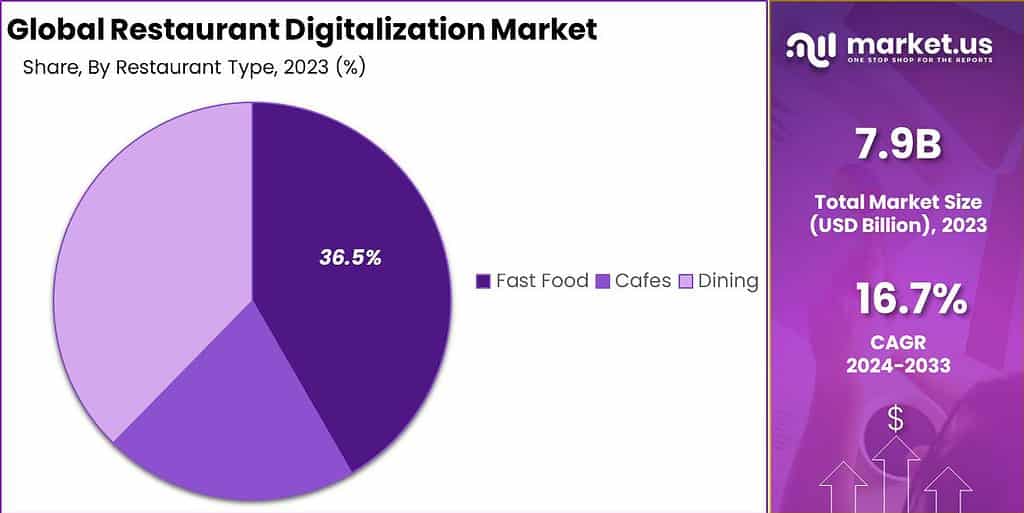

- The Fast Food segment also held a significant stance, accounting for more than 36.5% of the market in 2023.

- Furthermore, the Online Ordering Systems & Delivery Apps segment dominated, with over 24.5% market share in the same year.

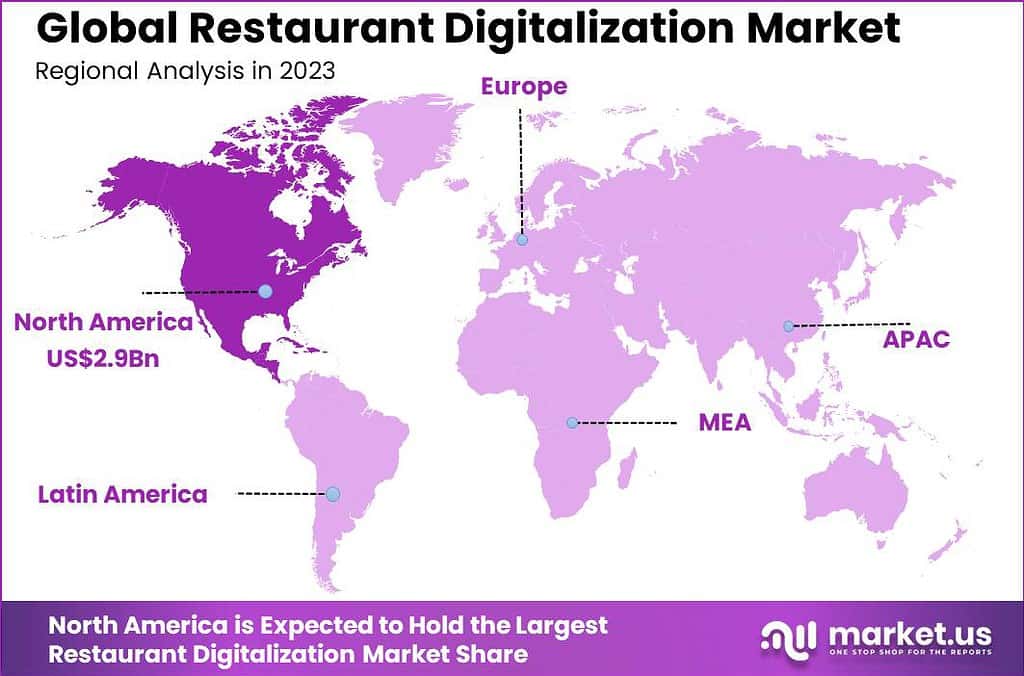

- Regionally, North America was predominant in the restaurant digitalization market, holding more than 37.5% share, which translated to revenues of approximately USD 2.9 billion in 2023.

- 60% of U.S. customers place orders from a restaurant each week, indicating a robust demand for regular dining options.

- Approximately 31% of customers utilize third-party delivery services at least twice weekly, showcasing a significant reliance on these platforms for meal solutions.

- A substantial 70% of customers express a preference for branded ordering capabilities, emphasizing the importance of restaurants maintaining control over their digital presence.

- Around 43% of restaurateurs believe that third-party services withhold crucial customer data, highlighting potential conflicts in the restaurant-delivery service dynamic.

- It is projected that delivery sales will increase by 20% over the next decade, reflecting growing consumer reliance on convenience-driven food options.

- Mobile ordering is expected to reach a market value of $38 billion in the next 12 months, underscoring the rapid expansion of this platform.

- Offering delivery services is reported to boost sales for 60% of restaurants, indicating significant profitability in adopting such models.

- 67% of those who order online are more likely to visit the restaurant providing digital ordering options more frequently, suggesting that digital engagement can enhance customer loyalty.

- One-third of diners report spending over $50 on online food orders, pointing to a segment of high-spending consumers within the digital ordering landscape.

Component Analysis

In 2023, the Software segment held a dominant market position in the restaurant digitalization market, capturing more than a 57.5% share. This segment’s leadership is largely attributed to the critical role that software solutions play in streamlining restaurant operations.

Software tools facilitate a wide range of functions, from front-end operations like reservations and ordering to back-end processes like inventory management and employee scheduling. As restaurants increasingly focus on enhancing customer experience and operational efficiency, the demand for integrated software solutions that can manage multiple functions seamlessly has surged.

Moreover, the adaptability and scalability of software solutions make them a preferred choice for restaurants of all sizes. Cloud-based systems, in particular, offer the flexibility to scale services according to the business’s needs, which is especially valuable for growing chains and seasonal establishments that need to adjust their operations dynamically. The integration of analytics and AI technologies in restaurant software also empowers businesses to make data-driven decisions, further boosting their efficiency and competitiveness.

The reliance on software in the restaurant industry is expected to continue growing as establishments seek to cater to the digital-savvy consumer base and optimize their operations in an increasingly digital world. This trend is further fueled by the ongoing developments in technology, including the integration of advanced analytics, machine learning, and personalized marketing tools, which are set to expand the capabilities of restaurant management software even further.

Restaurant Type Analysis

In 2023, the Fast Food segment held a dominant market position in the restaurant digitalization market, capturing more than a 36.5% share. This segment’s prominence is primarily due to the fast food industry’s inherent need for speed and efficiency, which digital solutions facilitate effectively.

Fast food restaurants have heavily adopted digital ordering systems, self-service kiosks, and mobile apps to streamline the ordering process and reduce wait times, enhancing customer satisfaction and throughput during peak hours.

Digital tools in the fast food sector also support robust data analytics capabilities that help businesses understand consumer behavior, manage inventory more effectively, and optimize staff scheduling. This ability to swiftly adapt to consumer preferences and operational demands is crucial in the fast-paced environment of fast food services, making digital solutions particularly valuable.

Furthermore, the widespread use of loyalty programs and targeted promotions through digital platforms in the fast food industry encourages repeat business and attracts a tech-savvy younger demographic. These digital strategies not only improve customer engagement but also provide a competitive edge by leveraging technology to meet the evolving expectations of convenience and speed that define the fast food market.

Application Analysis

In 2023, the Online Ordering Systems & Delivery Apps segment held a dominant market position in the restaurant digitalization market, capturing more than a 24.5% share. This segment’s lead can be attributed to the increasing consumer demand for convenience and speed in food service, which these technologies directly address.

Online ordering systems and delivery apps allow customers to easily browse menus, place orders, and make payments from their devices, offering a seamless, efficient, and contact-free dining experience. This has proven particularly appealing in urban areas, where fast-paced lifestyles drive demand for quick service.

The pandemic accelerated the adoption of these platforms as safety became a paramount concern, and even as the world moves past those immediate concerns, the convenience of such systems continues to influence dining habits. Furthermore, these digital platforms gather valuable data that restaurants use to analyze consumer preferences, modify menus, and optimize pricing strategies, which in turn enhances business operations and profitability.

Additionally, partnerships between restaurants and major delivery platforms have expanded market reach for many businesses, enabling them to attract and serve customers beyond their immediate geographic locations. This expansion capability, combined with improved customer satisfaction and data-driven business decisions, underscores why the online ordering systems and delivery apps segment continues to lead in the restaurant digitalization market.

Key Market Segments

By Component

- Software

- Hardware

By Restaurant Type

- Cafes

- Fast Food

- Dining

By Application

- Contactless Payment

- Online Ordering Systems & Delivery Apps

- Automated Inventory Management Software

- Digital Kitchen Boards

- Marketing

- Other Applications

Driver

Growth in Online Food Services and Technological Adoption

The rapid expansion of the restaurant digitalization market is driven by the growth of online food services and the widespread adoption of new technologies. As consumer preferences shift towards convenience and efficiency, restaurants are increasingly investing in digital solutions like online ordering platforms, delivery apps, and mobile payment systems. These tools not only improve customer satisfaction by reducing wait times and enhancing service delivery but also provide restaurants with valuable data for optimizing their operations and marketing strategies.

Restraint

High Costs and Complexity of Implementation

A significant restraint in the restaurant digitalization market is the high initial costs and complexity associated with implementing new technologies. Transitioning from traditional systems to advanced digital solutions often requires substantial financial investment, both for the technology itself and for training staff to effectively use these new tools. Additionally, the integration of systems can be complex, requiring adjustments in workflow and operations management that can be challenging for staff and management.

Opportunity

Expansion into New Markets with Enhanced Services

Digitalization opens up numerous opportunities for restaurants to expand into new markets and enhance their service offerings. Technologies such as artificial intelligence and machine learning can personalize the dining experience, providing tailored recommendations and promotions based on customer preferences collected from data analytics.

Furthermore, digital platforms enable restaurants to reach a broader audience by facilitating easier access to ordering and delivery services, which is particularly beneficial in urban areas where demand for convenience is high.

Challenge

Keeping Up with Rapid Technological Changes

One of the main challenges facing restaurants in the digitalization process is the rapid pace of technological change. Staying updated with the latest developments requires ongoing investments, which can be burdensome for small to medium-sized enterprises. Moreover, the need to continuously adapt and upgrade digital systems to meet consumer expectations and remain competitive can strain resources and operational focus, potentially leading to disruption in service if not managed carefully.

Growth Factors

The restaurant digitalization market is experiencing significant growth, driven by several key factors. One of the primary drivers is the increasing consumer demand for convenience and efficiency. Modern diners are accustomed to using digital platforms for various activities, and this extends to their dining experiences.

Approximately 84% of customers check menus online before choosing a restaurant, and 29% order takeout or delivery at least once a week, highlighting the shift towards digital interactions. The COVID-19 pandemic further accelerated this trend, as contactless solutions became essential for maintaining safety and hygiene. The adoption of digital ordering systems, mobile payments, and online reservations has enhanced customer experience, making it more seamless and user-friendly.

Another growth factor is the rising need for operational efficiency and cost reduction in the competitive restaurant industry. Digital solutions such as automated inventory management software and cloud-based POS systems help streamline operations, reduce wastage, and optimize supply chain management. These technologies enable restaurant owners to make data-driven decisions, improving overall efficiency and profitability.

Emerging Trends

Several emerging trends are shaping the future of the restaurant digitalization market. One notable trend is the increasing use of AI and machine learning to enhance customer experiences and operational efficiency. AI-powered chatbots and virtual assistants are becoming common, providing real-time customer support and personalized recommendations. These technologies also help analyze customer data to tailor marketing strategies and improve service delivery.

Another significant trend is the adoption of contactless services, including payment solutions and digital menus accessed via QR codes. Contactless payment has become a preferred method due to its convenience and security, reducing the need for physical interactions. This technology is expected to continue evolving, offering more sophisticated and user-friendly solutions.

Additionally, self-order kiosks are gaining popularity, especially in fast-food segments, as they provide a convenient and efficient ordering process, often increasing the average order value through upselling prompts. Virtual and augmented reality technologies are also making inroads into the restaurant industry. These technologies offer immersive experiences, such as virtual tours of restaurants and interactive menu visualizations, enhancing the overall dining experience.

Furthermore, the concept of ghost kitchens and virtual restaurants is expanding, driven by the increasing demand for delivery services. These virtual establishments operate without a physical dining space, focusing solely on delivery, thus reducing overhead costs and reaching a broader customer base.

Regional Analysis

In 2023, North America held a dominant market position in the restaurant digitalization market, capturing more than a 37.5% share, with revenue amounting to USD 2.9 billion. The region’s leadership can be attributed to several factors, primarily its advanced technological infrastructure and high consumer adoption rates of digital solutions.

North America, particularly the United States, has a tech-savvy population that readily embraces digital innovations, which has driven the widespread adoption of digital ordering platforms, contactless payment systems, and AI-powered customer service tools. The competitive nature of the food service industry in North America further fuels the adoption of digital solutions. Restaurants and food chains in the region continuously seek innovative ways to enhance customer experience and operational efficiency.

The presence of major technology providers and the availability of robust internet infrastructure support the implementation of advanced digital tools, such as cloud-based POS systems and automated inventory management software. These technologies not only streamline operations but also provide valuable data analytics for better decision-making and personalized marketing strategies.

Moreover, the COVID-19 pandemic significantly accelerated the adoption of contactless solutions in North America. The necessity to minimize physical interactions led to a surge in the use of QR code menus, mobile payments, and online ordering systems. This shift not only ensured safety and hygiene but also improved customer convenience, making these digital solutions a permanent feature in the post-pandemic era. The region’s quick adaptation to these changes solidified its leading position in the global market.

The strong economic environment and consumer spending power in North America also play a crucial role in driving market growth. Consumers in the region have a higher disposable income, which increases their willingness to spend on dining experiences that offer convenience and efficiency through digital solutions. The high penetration of smartphones and the internet further supports the widespread use of digital platforms for dining, reinforcing North America’s dominant market position in the restaurant digitalization market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

The restaurant digitalization market has seen substantial growth, driven by the increasing demand for enhanced customer experiences and operational efficiency. Among the leading players, Digitory Solutions Pvt. Ltd., Panasonic Corp., and Cognizant Technology Solutions Corp. stand out due to their strategic initiatives and innovative solutions.

Digitory Solutions Pvt. Ltd. has established itself as a prominent player in the restaurant digitalization market through continuous innovation and strategic acquisitions. In 2023, the company acquired Clear Solutions to expand its portfolio of digital menu and ordering systems, enhancing its ability to offer comprehensive digital solutions to restaurants.

Panasonic Corp. has made significant strides in the market by launching cutting-edge products and forming strategic partnerships. In early 2024, Panasonic introduced a new suite of AI-powered kitchen management tools designed to streamline operations and reduce food waste. This product launch aligns with the company’s commitment to leveraging technology for operational efficiency.

Cognizant Technology Solutions Corp. has been a key player in driving digital transformation within the restaurant industry. The company merged with Snappy Innovation Inc. in 2023 to integrate advanced digital payment solutions into its existing service offerings. This merger has enabled Cognizant to provide a more robust and seamless customer experience, from ordering to payment.

Top Restaurant Digitalization Market Players

- Digitory Solutions Pvt. Ltd.

- Panasonic Corp.

- Cognizant Technology Solutions Corp.

- Oracle Corp.

- International Business Machines Corp.

- Clear Solutions

- Fourth Enterprises LLC

- Flipdish Ltd.

- Snappy Innovation Inc.

- ParTech Inc.

- MustHaveMenus Inc.

Recent Developments

- January 2024: Digitory introduced a new AI-driven solution for sales forecasting and inventory management aimed at reducing wastage and optimizing procurement processes for restaurants. This initiative focuses on integrating automation and accurate forecasting to improve restaurant operations.

- February 2024: Oracle launched the Oracle Restaurant Cloud, a new suite of digital solutions designed specifically for the restaurant industry. This suite includes advanced analytics, customer engagement tools, and supply chain management features.

- April 2024: IBM introduced a new AI-powered customer service platform for restaurants. This platform aims to enhance customer interactions through personalized experiences and efficient service management.

- January 2024: Flipdish announced the launch of a new self-service kiosk solution that integrates with their existing online ordering system. This product aims to streamline the ordering process for both customers and restaurant staff.

Report Scope

Report Features Description Market Value (2023) USD 7.9 Bn Forecast Revenue (2033) USD 37 Bn CAGR (2023-2032) 16.7% Base Year for Estimation 2023 Historic Period 2019-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component – Software and Hardware; By Restaurant Type – Cafes, Fast Food, and Dining; By Application – Online Ordering Systems & Delivery Apps, Contactless Payment, Digital Kitchen Boards, Automated Inventory Management Software, Marketing, and Other Applications Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Digitory Solutions Pvt. Ltd., Panasonic Corp., Cognizant Technology Solutions Corp., Oracle Corp., International Business Machines Corp., Clear Solutions, Fourth Enterprises LLC, Flipdish Ltd., Snappy Innovation Inc., ParTech Inc., MustHaveMenus Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Restaurant Digitalization Market?The Restaurant Digitalization Market refers to the integration of digital technologies into various aspects of restaurant operations. This includes online ordering, digital payment systems, customer relationship management (CRM) tools, digital menu boards, automated kitchen equipment, and data analytics to improve efficiency, customer experience, and profitability.

How big is Restaurant Digitalization Market?The Global Restaurant Digitalization Market size is expected to be worth around USD 37.0 Billion By 2033, from USD 7.9 Billion in 2023, growing at a CAGR of 16.7% during the forecast period from 2024 to 2033.

What are the key drivers of restaurant digitalization?Key drivers include the increasing demand for convenience from customers, the need for operational efficiency, the growth of online food delivery services, changing consumer behavior towards digital engagement, and the necessity for restaurants to adapt to new health and safety standards, especially post-pandemic.

What are the challenges faced in restaurant digitalization?Challenges include the high cost of implementing new technologies, the need for employee training, resistance to change from staff or customers, cybersecurity risks, and ensuring system integration across various platforms.

What trends are shaping the future of the Restaurant Digitalization Market?Key trends include the increasing use of AI and machine learning, the adoption of cloud-based POS systems, the rise of contactless dining experiences, integration with social media for marketing, the growth of ghost kitchens, and the use of blockchain for supply chain transparency.

What are the leading companies in the Restaurant Digitalization Market?Leading companies include Digitory Solutions Pvt. Ltd., Panasonic Corp., Cognizant Technology Solutions Corp., Oracle Corp., International Business Machines Corp., Clear Solutions, Fourth Enterprises LLC, Flipdish Ltd., Snappy Innovation Inc., ParTech Inc., MustHaveMenus Inc.

Restaurant Digitalization MarketPublished date: Aug. 2024add_shopping_cartBuy Now get_appDownload Sample

Restaurant Digitalization MarketPublished date: Aug. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Digitory Solutions Pvt. Ltd.

- Panasonic Corp.

- Cognizant Technology Solutions Corp.

- Oracle Corp.

- International Business Machines Corp.

- Clear Solutions

- Fourth Enterprises LLC

- Flipdish Ltd.

- Snappy Innovation Inc.

- ParTech Inc.

- MustHaveMenus Inc.