Global Resorcinol Market Size, Share, And Business Benefits By Grade (Industrial Grade, Pharmaceutical Grade), By Application (Rubber and Tire Adhesives, Wood Adhesives, Pharmaceuticals, Cosmetics, Dyes and Specialty Chemicals, Others), By End-Use (Automotive, Construction, Healthcare and Consumer Goods, Chemicals and Materials, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 165331

- Number of Pages: 306

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

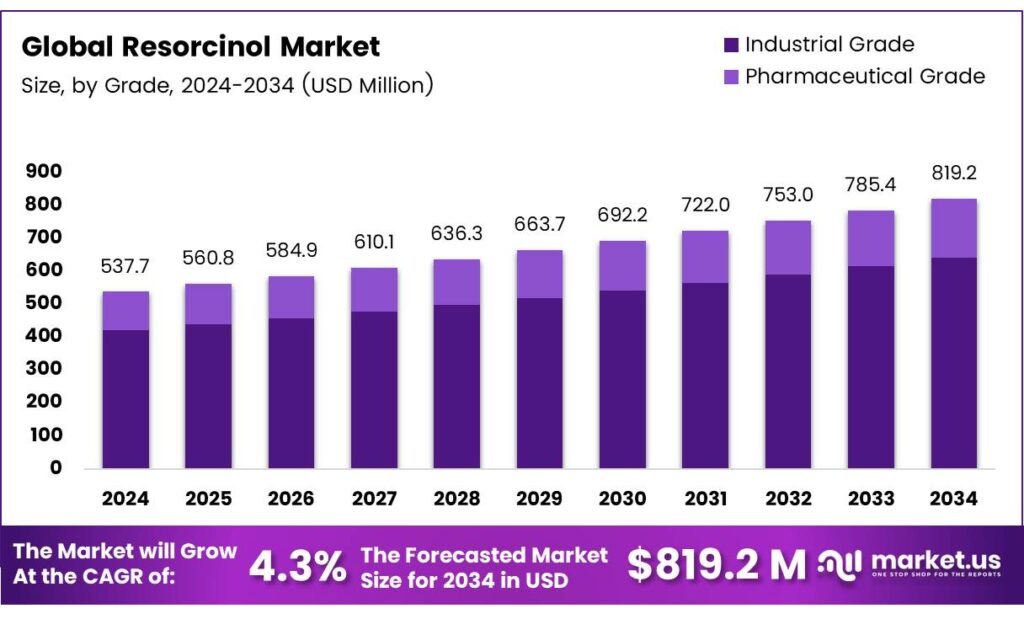

The Global Resorcinol Market size is expected to be worth around USD 819.2 Million by 2034, from USD 537.7 Million in 2024, growing at a CAGR of 4.3% during the forecast period from 2025 to 2034.

Resorcinol is a highly toxic phenol, appearing as a white crystalline solid that turns pink on exposure to light if impure. With a density of about 1.28 g/cm³, it burns with difficulty but irritates skin and eyes and is toxic via absorption. Primarily used as an antiseptic and ointment for skin conditions, it treats acne, eczema, psoriasis, corns, calluses, and warts through its keratolytic, antiseptic, and antimycotic properties.

As the 1,3-isomer of benzenediol (C₆H₄(OH)₂), resorcinol breaks down hard, scaly skin while aiding disinfection. Though mainly topical, it shows anti-thyroidal activity, rarely used formally. However, it poses serious risks, including cyanosis, thyrotoxicosis, dermatitis, and convulsions. Easily absorbed through skin and gastrointestinal tract, its environmental persistence demands sensitive detection methods.

In industrial chemistry, resorcinol enables high-barrier polymeric materials. Key derivatives include resorcinol dioxyacetic acid (RDOA), bis-(hydroxyethyl)-ether of resorcinol (HER), and resorcinol diglycidyl ether (RDGE). These enhance gas barrier performance in packaging, especially for PET bottles used by breweries like Miller, Heineken, and Carlsberg. Resorcinol’s unique asymmetry and flexibility thus drive innovation in durable, high-performance packaging materials.

Traditional PET offers limited shelf life, but advanced barriers target Po₂ < 0.5 BU and Pco₂ < 2–3 BU for 6–9 months. RDOA-based polyamides achieve Po₂ 0.25 BU—far better than MXD6’s 0.6 BU. The meta-phenylene linkage ensures amorphous, transparent, and tightly packed structures, reducing oxygen permeability by 30–40% versus para-linkages. RDGE-based thermoplastics rival EVOH, while thermoset coatings upgrade monolayer PET efficiently.

Key Takeaways

- The Global Resorcinol Market is projected to grow from USD 537.7 million in 2024 to USD 819.2 million by 2034 at a 4.3% CAGR.

- Industrial Grade dominated the By Grade segment in 2024 with 78.3% share, key for tire production and adhesives.

- Rubber and Tire Adhesives led by the Application segment in 2024 with 39.5% share, driven by automotive growth.

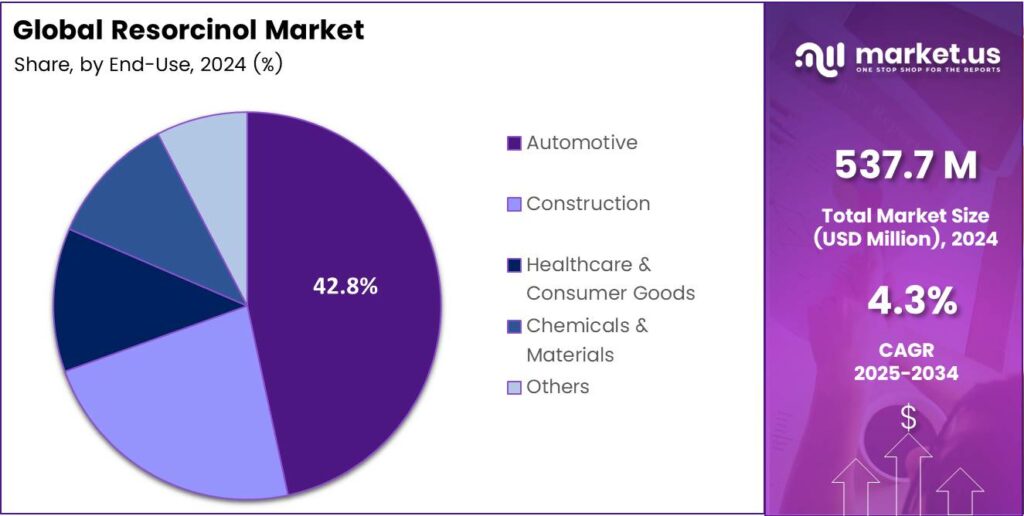

- The Automotive sector held the top position by end-use in 2024 with a 42.8% share, boosted by tire reinforcement and EV trends.

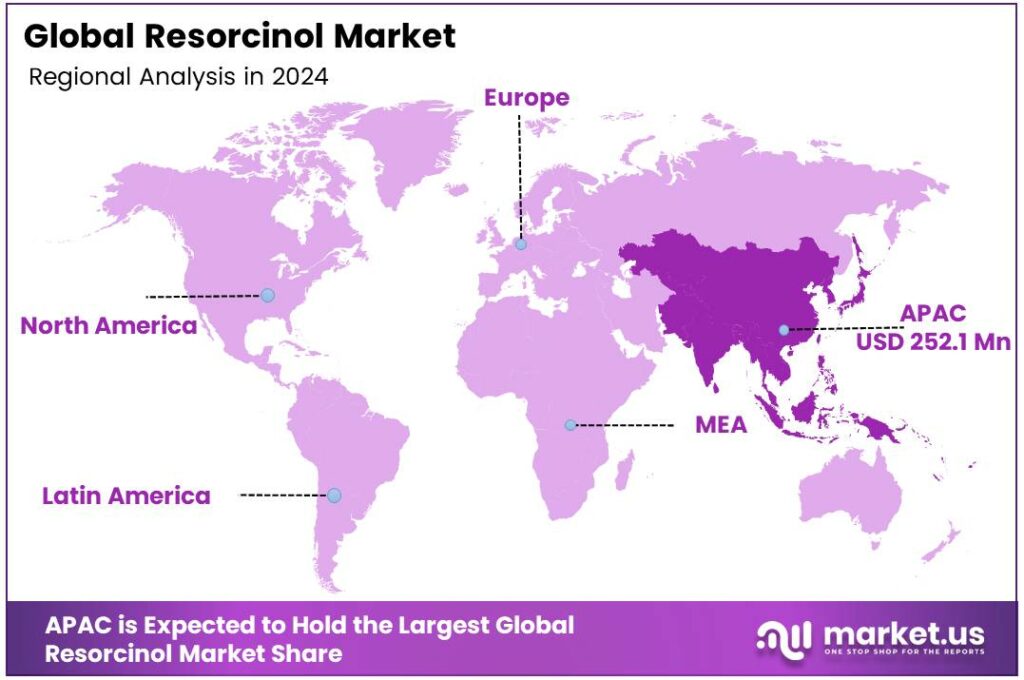

- Asia-Pacific commanded 46.9% market share in 2024, USD 252.1 million, led by manufacturing in China, Japan, South Korea, and India.

By Grades Analysis

Industrial Grade dominates with 78.3% due to its essential role in high-volume industrial processes and cost efficiency.

In 2024, Industrial Grade held a dominant market position in the By Grade Analysis segment of the Resorcinol Market, with a 78.3% share. This grade excels in robust applications. It powers tire production and adhesive formulations effectively.

Manufacturers prefer it for its reliability and affordability. As a result, it drives bulk demand across sectors. Transitioning smoothly, its versatility boosts overall market growth steadily. The Pharmaceutical Grade segment emerges as a vital player in specialized uses.

It ensures purity for medical formulations and skincare products. This grade supports antiseptic creams and drug intermediates precisely. Demand rises with healthcare advancements. Consequently, it fosters innovation in therapeutic solutions. Thus, it contributes meaningfully despite a smaller volume.

By Application Analysis

Rubber and Tire Adhesives dominate with 39.5% due to surging vehicle production and tire durability needs.

In 2024, Rubber and Tire Adhesives held a dominant market position in the By Application Analysis segment of the resorcinol Market, with a 39.5% share. This application strengthens bonding in tires and rubber goods. It enhances adhesion to metals and fabrics reliably. Automotive growth fuels its usage significantly. Therefore, it anchors market expansion dynamically.

Wood Adhesives form another key area where resorcinol shines. It creates strong, weather-resistant bonds for plywood and laminates. Construction booms increase their adoption steadily. Builders value its quick-curing properties. Hence, it supports sustainable building practices effectively.

Pharmaceuticals represent a growing niche for resorcinol integration. It acts as a base for ointments and disinfectants. Health awareness drives demand upward. Formulators rely on its anti-inflammatory benefits. Thus, it advances medical product development innovatively.

By End-Use Analysis

Automotive dominates with 42.8% due to rising global vehicle manufacturing and component enhancements.

In 2024, Automotive held a dominant market position in the By End-Use Analysis segment of the Resorcinol Market, with a 42.8% share. This sector leverages resorcinol for tire reinforcement and seals. Electric vehicle trends amplify its necessity. Producers integrate it to improve safety features. As such, it propels industry progress forward.

Construction utilizes resorcinol in durable adhesives and coatings. It fortifies wood structures against environmental stress. Urbanization spurs infrastructure projects rapidly. Engineers choose it for long-lasting performance. Therefore, it bolsters building resilience consistently.

Healthcare and Consumer Goods embrace resorcinol for personal care items. It features in creams that treat skin conditions effectively. Wellness trends heighten product variety. Consumers seek gentle, effective solutions. Hence, it nurtures market diversity thoughtfully.

Key Market Segments

By Grade

- Industrial Grade

- Pharmaceutical Grade

By Application

- Rubber and Tire Adhesives

- Wood Adhesives

- Pharmaceuticals

- Cosmetics

- Dyes and Specialty Chemicals

- Others

By End-Use

- Automotive

- Construction

- Healthcare and Consumer Goods

- Chemicals and Materials

- Others

Emerging Trends

Low-/No-Formaldehyde RFL Adhesives Are Moving Mainstream

A clear trend in resorcinol use is the rapid shift to low- or zero-formaldehyde bonding systems for tire cords and industrial fabrics. Resorcinol–formaldehyde–latex (RFL) dips set the standard because the resorcinol-derived resin gives strong adhesion to polyester, nylon, aramid, and steel cords. What’s changing now is the regulatory and customer push to cut formaldehyde exposure on the factory floor without giving up RFL-level bonding.

- In the EU, new occupational limits require employers to respect an 8-hour exposure value of 0.3 ppm formaldehyde, which has nudged tire and belt makers to upgrade chemistries and processes. Demand signals support this shift. U.S. tire makers projected 338.9 million shipments for 2024, surpassing the previous record, meaning adhesives that meet new health limits must scale at the industry level, not just in pilot lines.

Environmental performance also helps this transition land with EHS teams. On the supply side, leading producers continue to back resorcinol as a strategic intermediate for advanced bonding systems. Sumitomo Chemical—long a top producer—has reported >30,000 t/y of resorcinol capacity, reflecting deep process know-how and consistent availability for formulators working on low-formaldehyde or formaldehyde-free variants.

Drivers

Growing demand from the tyre and rubber industry

One major driving factor for the growth of the chemical Resorcinol is its critical use in rubber-based applications, especially tyre manufacturing. Resorcinol is used in resorcinol-formaldehyde-latex (RFL) adhesive systems that bind rubber to textile and steel cords, so as global tyre production expands, so does demand for resorcinol. Modern passenger car tyres typically incorporate about 0.8 – 1.2 kg of resorcinol per tyre, while truck tyres may need 2 – 4 kg, driving significant volumes.

- In India, which is emerging as a key growth region, the overall tyre industry is forecast to more than double in revenue, from about USD 9 billion to approximately USD 22 billion. The domestic push for vehicle production, replacement tyres, and export-oriented manufacturing all point to increasing rubber compound usage. As the downstream rubber industry grows, chemicals like resorcinol that contribute to high-performance bonding and durability become more essential.

Government initiatives also underpin this trend. In India, the Automotive Tyre Manufacturers’ Association (ATMA), in collaboration with the Rubber Board and the Ministry of Commerce & Industry, launched the project INROAD – Indian Natural Rubber Operations for Assisted Development. It aims to develop 200,000 ha of rubber plantations to secure raw material supply for the tyre industry (which relies on about 60% natural rubber) and reduce dependence on imports.

Restraints

Regulatory and Safety Constraints

One significant restraint facing the use and production of Resorcinol is the stringent health and environmental regulations driven by its toxicological profile and the challenges this creates for manufacturers. The New Jersey Department of Health, workplace exposure limits for resorcinol in air at 45 mg/m³ over an 8-hour shift, and must not exceed 90 mg/m³ as a short-term exposure limit.

From the production perspective, it’s also known that resorcinol is produced only in a very limited number of commercial plants globally. In the United States, Germany, China, and Japan. Limited manufacturing locations mean tighter supply chains, higher capital costs to maintain safety and compliance, and increased operational risk if regulations change.

- One EU safety data sheet reports an LC₅₀ for fish (96 h) of 26.8 mg/L, highlighting high aquatic toxicity. Manufacturers must therefore invest in wastewater treatment and containment to meet environmental standards. Although resorcinol is a useful chemical, its production, handling, and downstream uses come with heavy burdens.

Opportunity

Engineered-wood construction and bridge programs are lifting resorcinol demand

A practical growth engine for resorcinol is the steady rise of structural engineered-wood—glulam, LVL, and CLT—where phenol-resorcinol-formaldehyde (PRF) adhesives are specified for durable, exterior-grade bonds. The UN Food & Agriculture Organization released the first global dataset for engineered-wood products: glulam output reached 7 million m³, LVL 4 million m³, and CLT 1 million m³.

- The U.S. Bipartisan Infrastructure Law created two large bridge programs: the Bridge Formula Program, USD 27.5 billion over five years, and the Bridge Investment Program, USD 12.5 billion, which are actively awarding grants for replacements and major rehabilitations. More bridge projects—some choosing timber or hybrid solutions for speed, carbon, or site constraints—mean more structural adhesive use in laminated members.

Policy momentum in other regions points the same way. The European Economic and Social Committee has urged increasing wood’s share in construction to cut embodied carbon, and at least 20 EU member states operate timber-procurement policies that steer public buyers toward verified wood products—both directions that indirectly support structural laminates and the adhesives behind them.

Regional Analysis

Asia-Pacific leads with a 46.9% share and a USD 252.1 Million market value.

Asia-Pacific remains the dominating region in the global resorcinol market, accounting for 46.9% share valued at USD 252.1 million. The region’s leadership stems from its strong manufacturing base, particularly in China, Japan, South Korea, and India, where resorcinol is extensively used in the production of adhesives, dyes, UV stabilizers, and flame retardants.

The region’s robust automotive and construction sectors are major consumers of resorcinol-formaldehyde resins used for reinforcing tire cords and wood adhesives. The expanding tire manufacturing hubs in countries like Thailand and Indonesia further fuel product consumption.

Additionally, government-backed initiatives supporting industrial chemicals and specialty intermediates—such as India’s Production-Linked Incentive (PLI) scheme and China’s 14th Five-Year Plan emphasizing chemical innovation are fostering local production and R&D expansion.

Environmental compliance and growing interest in sustainable raw materials have prompted regional producers to invest in green chemistry approaches, using phenol derivatives from renewable feedstocks. Japan’s advancements in eco-friendly synthesis and South Korea’s focus on specialty resin exports are improving supply chain efficiency.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Kraeber & Co. GmbH is a pivotal force in the European resorcinol market. The company excels in supplying high-purity resorcinol to diverse industries, including adhesives, wood bonding, and tire cord dip. Its strength lies in a robust distribution network, deep technical expertise, and a commitment to stringent quality standards. By serving as a critical link between global producers and regional end-users, Kraeber ensures reliable supply and tailored support for its clients.

Akrochem Corporation is a key North American supplier of resorcinol, primarily serving the rubber and adhesive industries. The company leverages its extensive warehouse footprint and technical service capabilities to provide customers with consistent, high-quality products. Akrochem’s value is in its formulation expertise, helping clients optimize resorcinol use in applications like tire manufacturing and industrial bonding.

Jiangsu Zhongdan Group is a significant Chinese manufacturer and a major global producer of resorcinol. This vertical integration allows them to control production costs and ensure supply chain stability. Their competitive position influences global resorcinol pricing and availability, particularly serving the massive Asian market for rubber adhesives and tire reinforcement.

Top Key Players in the Market

- Kraeber and Co. GmbH

- Akrochem Corporation

- Jiangsu Zhongdan Group Co., Ltd.

- Dynea AS

- Amino-Chem Co. Ltd.

- Sumitomo Chemicals Co., Ltd.

- Atul Ltd.

- Isochem Kautschuk-GmbH

Recent Developments

- In 2024, Kraeber & Co. GmbH, a German-based supplier of active pharmaceutical ingredients (APIs), cosmetic substances, and fine chemicals, including resorcinol derivatives, has not announced major public developments specific to resorcinol based on available data from government and company-affiliated sources.

- In 2024, Akrochem Corporation, a U.S.-based manufacturer of rubber chemicals, including the resorcinol-based bonding agent for tire and adhesive applications. The company emphasizes high-quality refining processes for resorcinol grades suited to automotive and industrial uses.

Report Scope

Report Features Description Market Value (2024) USD 537.7 Million Forecast Revenue (2034) USD 819.2 Million CAGR (2025-2034) 4.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (Industrial Grade, Pharmaceutical Grade), By Application (Rubber and Tire Adhesives, Wood Adhesives, Pharmaceuticals, Cosmetics, Dyes and Specialty Chemicals, Others), By End-Use (Automotive, Construction, Healthcare and Consumer Goods, Chemicals and Materials, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Kraeber and Co. GmbH, Akrochem Corporation, Jiangsu Zhongdan Group Co., Ltd., Dynea AS, Amino-Chem Co. Ltd., Sumitomo Chemicals Co., Ltd., Atul Ltd., Isochem Kautschuk-GmbH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Kraeber and Co. GmbH

- Akrochem Corporation

- Jiangsu Zhongdan Group Co., Ltd.

- Dynea AS

- Amino-Chem Co. Ltd.

- Sumitomo Chemicals Co., Ltd.

- Atul Ltd.

- Isochem Kautschuk-GmbH