Global Resilient Flooring Market By Product (Vinyl Sheet & Floor Tile, Luxury Vinyl Tiles), By Application (Non-residential and Residential), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2023

- Report ID: 22868

- Number of Pages: 316

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

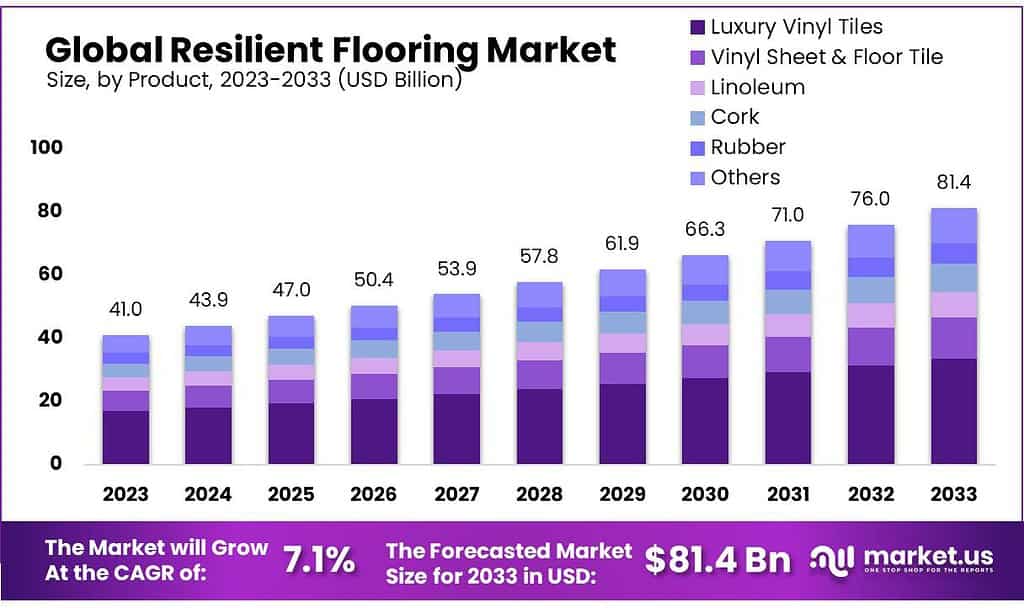

The Resilient Flooring Market size is expected to be worth around USD 81.4 billion by 2033, from USD 41 billion in 2023, growing at a CAGR of 7.1% during the forecast period from 2023 to 2033.

Globally, resilient flooring saw a tremendous increase due to increased demand for environmentally-friendly building materials and increased construction that allows for more buildings to be built before commercial units.

The rise in tourism, hospitality, and commercial construction in China and India has led to a rise in residential and commercial buildings in these countries. This is where resilient flooring is in high demand. This market is booming with manufacturers who produce more resilient products. Industry growth is supported by the rapid rise in research and development activities of some key players.

*Actual Numbers Might Vary In The Final Report

Key Takeaways

- Market Growth and Projection: The resilient flooring market is set to grow significantly, with a projected worth of around USD 81.4 billion by 2033, exhibiting a CAGR of 7.1% from 2023.

- Product Dominance: Luxury Vinyl Tiles (LVT) emerged as a dominant player in 2023, capturing over 41.2% market share due to durability, diverse design options, and cost-effectiveness.

- Material Preferences: Materials like linoleum, known for durability and biodegradability, are gaining traction, especially in environmentally conscious markets like the U.S., U.K., and Germany.

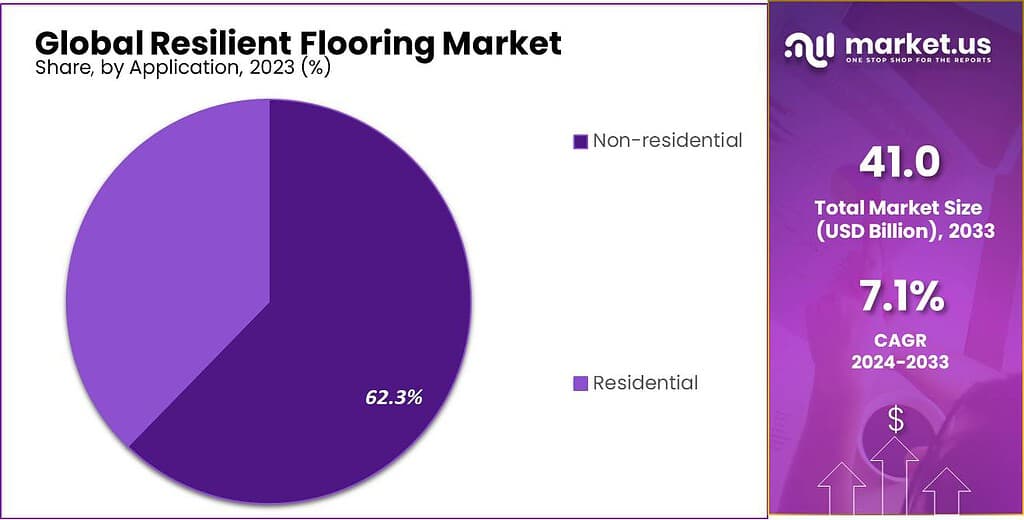

- Application Insights: The non-residential sector holds a significant share (more than 62.3%) in the market due to the durability and maintenance advantages, while residential sectors also witness a growing demand driven by population rise and increased disposable income.

- Market Drivers: Innovations in flooring techniques, moisture resistance, and compliance with environmental standards like LEED certifications drive market growth.

- Market Restraints: Fluctuating raw material prices and competition from alternative flooring options like carpets, rugs, ceramic, and stone tiles challenge market expansion.

- Opportunities: Rapid urbanization and industry growth present opportunities for resilient flooring market advancement, especially with the introduction of innovative products and environmentally friendly solutions.

- Challenges: Variation in raw material prices, dominance of key players in certain markets, and evolving consumer preferences pose challenges for manufacturers to keep up with demand while maintaining cost-effectiveness.

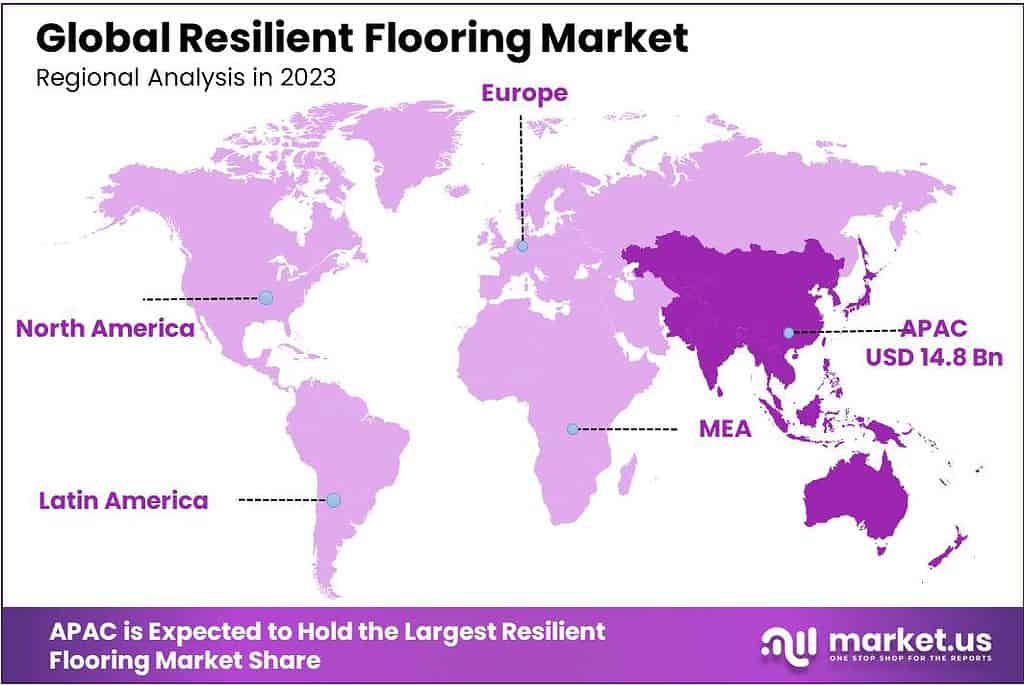

- Regional Analysis: Asia Pacific leads the market (36.3%) due to rising demands in residential applications and robust manufacturing industries. China and India’s construction projects play a pivotal role in market growth.

- Key Players: Major industry players like Tarkett S.A., Mohawk Industries, Inc., and others are focusing on developing products with enhanced aesthetic qualities and performance characteristics.

Product Analysis

In 2023, Luxury Vinyl Tiles emerged as the top player in the resilient flooring market, securing over a 41.2% share. This dominance reflects the strong preference for Luxury Vinyl Tiles due to their durability, diverse design options, and price-effectiveness. Customers favor these tiles for their ability to mimic the appearance of natural materials like wood or stone while offering enhanced resilience against scratches and moisture.

The products’ low maintenance cost and long life expectancy will likely increase their popularity in residential areas such as laundry rooms, kitchens, bathrooms, or other moisture-prone spaces. Linoleum products are more durable and long-lasting than vinyl solutions. They are made from jute resin and flax plant, wood flour, and limestone, and are 100% biodegradable.

The demand for biodegradable flooring materials will increase due to the increasing importance of recycling and waste management in developed countries like the U.S., U.K., and Germany. In commercial and institutional spaces, rubber flooring is a popular resilient flooring option. Rubber floorings are durable and resistant to slip, making them ideal for harsh environments. These rubber floor tiles are available in both synthetic and natural rubber. They are used exclusively in gyms, health clubs, dance floors, or other high-impact areas.

Application Analysis

In 2023, the non-residential sector emerged as the dominant force in the resilient flooring market, capturing more than a 62.3% share. This sector primarily encompasses commercial and industrial spaces like offices, retail stores, healthcare facilities, and educational institutions.

The preference for resilient flooring in non-residential settings is due to its durability, ease of maintenance, and versatility in handling high foot traffic. Commercial spaces often opt for resilient flooring solutions to ensure long-lasting, cost-effective, and visually appealing flooring options that can withstand heavy usage without compromising on aesthetics or functionality.

Residential applications include apartments, complexes, single-family homes, and residential buildings. These structures are mainly made up of resilient floorings because they resist slippage, dirt, shock, and staining. The growing demand is also due to the cushion effect of resilient materials. The demand for flooring products will rise due to the growing population and increased demand for multi-family and single-family homes in major economies like India, China, and South Africa. This is due to the availability of loans and rising disposable income.

*Actual Numbers Might Vary In The Final Report

Key Market Segments

By Product

- Vinyl Sheet & Floor Tile

- Luxury Vinyl Tiles

- Linoleum

- Rubber

- Cork

By Application

- Non-residential

- Residential

Drivers

The resilient flooring market is experiencing growth due to significant investments made by major industry players. These investments are driving innovation in flooring techniques, particularly in residential and construction projects.

Contractors are adopting these new methods to install resilient flooring that offers smooth surfaces and easy maintenance. One of the key advantages of these flooring solutions is their moisture resistance, making them suitable for areas like bathrooms and kitchens where exposure to moisture is common.

Market growth is further driven by an increasing adoption of resilient flooring that meets LEED certification criteria, especially vinyl tiles that comply with these environmental standards. Their environmental-friendliness has played a significant role in their rise to popularity; contractors and homeowners alike appreciate them due to their eco-friendliness while remaining durable and straightforward for upkeep, driving market expansion even further.

Restraints

One challenge for the resilient flooring market is the changing prices of the materials used to make these floors. This can slow down the market’s growth. Other popular flooring choices such as carpets, rugs, ceramic, and stone tiles pose an even greater obstacle for resilient flooring to expand further.

Furthermore, in the US market is mostly controlled by just a handful of major players making expansion more difficult for the resilient flooring market.

The resilient flooring market faces several obstacles, one being fluctuating prices of materials used to manufacture these floors. When they change significantly it makes market expansion challenging. Another roadblock comes from carpets, rugs, ceramic and stone tiles becoming more popular and therefore hindering resilient flooring growth.

In the United States, the resilient flooring market is mainly controlled by a few big companies. This dominance can make it more difficult for the market to get even bigger. So, while resilient flooring has its advantages, it still faces obstacles that slow down its growth in the market.

Opportunities

Rapid urbanization and industrial growth have created opportunities for the swift advancement of resilient flooring products. Resilient flooring solutions play a vital role in enhancing the aesthetic appeal of infrastructure, contributing significantly to market expansion.

Numerous renovation initiatives aimed at altering user preferences have also contributed to the market’s size increase. The introduction of innovative products like luxury vinyl tiles has surged the demand for fiberglass vinyl sheets in recent times. Additionally, the incorporation of environmentally friendly commercial products has played a pivotal role in advancing market development.

Urban areas growing quickly and industries expanding fast have opened doors for better resilient flooring options. These floors help make buildings and homes look better, leading to a bigger market for them. Many renovations are focused on changing what people like, which has made the market grow. New types of flooring, like luxury vinyl tiles, are making fiberglass vinyl sheets more popular too. Also, using eco-friendly products in businesses has helped make the market for resilient flooring even bigger.

Challenges

The resilient flooring market faces several challenges. One significant hurdle is the variation in prices of raw materials used for making these floors. These fluctuations can affect the market’s stability and growth potential. Additionally, the increasing popularity of substitute flooring options, such as carpets, rugs, ceramic, and stone tiles, poses a challenge for the resilient flooring market to expand further.

Moreover, the dominance of a few key players in the United States’ resilient flooring sector restricts the market’s broader growth and creates obstacles for new entrants. Lastly, evolving consumer preferences and trends constantly shape the market, demanding innovative and environmentally friendly flooring solutions, which can pose a challenge for manufacturers to keep up with changing demands while maintaining cost-effectiveness.

The resilient flooring market encounters several difficulties. Firstly, the changing prices of materials used in making these floors can make the market less predictable and harder to grow. Carpets, rugs, ceramic and stone tiles have grown increasingly popular over time, making it more challenging for resilient flooring manufacturers to expand. Furthermore, only a handful of companies dominate most of the US resilient flooring market, which makes entry difficult. Furthermore, people’s tastes change over time requiring eco-friendly or innovative floor options; therefore manufacturers face difficulty keeping pace without seeing costs skyrocket.

Regional Analysis

Asia Pacific was the dominant market, which accounted for 36.3% of global revenue in 2023. This is due to rising demand from residential applications and the extensive manufacturing industry. It also has government initiatives to build social infrastructure. Due to its steady growth in residential and commercial construction, the U.K. held a significant share of Europe’s resilient flooring market. The U.K.’s growing construction activity and consumer spending on commercial spaces will likely increase product demand.

China was the dominant market in the Asia Pacific due to its rising construction projects and higher adoption of LVT, vinyl sheets & floor tiles, as well as rubber floorings in residential and non-residential construction projects. The rise in emerging economies such as Brazil, Argentina, and Chile is responsible for the growth of the Central and South American markets. The rising awareness of the benefits of flooring is expected to have a significant impact on the increasing penetration of resilient flooring products.

*Actual Numbers Might Vary In The Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The development of products with high aesthetic qualities and additional performance characteristics, such as waterproof and indentation resistance, is a key industry focus. To develop low-cost products, these players look to integrate with new players and gain a competitive advantage.

Tarkett S.A., and Mohawk Industries, Inc., are the two main players in this industry, with many subsidiaries around the world. Tarkett S.A., the European market leader in flooring, offers a wide variety of flooring products across Europe. Mohawk, a North American company, has many subsidiaries, including IVC Group and Unilin.

Маrkеt Кеу Рlауеrѕ

- Tarkett S.A.

- Interface, Inc.

- Shaw Industries Group, Inc.

- Gerflor

- Mohawk Industries Inc.

- Beaulieu International Group

- MONDO S.p.A

- Forbo Flooring Systems

- Fatra a.s.

- IVC Group

Recent Development

In November 2022, Marilo vinyl tiles, an economical type of resilient flooring suitable for various spaces and environments were launched as the latest collection.

In April 2023,Beaulieu International Group recently acquired Signature Floors with the aim of strengthening their position in New Zealand and Australia’s resilient flooring markets.

Report Scope

Report Features Description Market Value (2023) USD 41.0 Billion Forecast Revenue (2033) USD 81.4 Billion CAGR (2024-2033) 7.1% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product( Vinyl Sheet & Floor Tile, Luxury Vinyl Tiles, Linoleum, Rubber, Cork), By Application(Non-residential, Residential) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Tarkett S.A., Interface, Inc., Shaw Industries Group, Inc., Gerflor, Mohawk Industries Inc., Beaulieu International Group, MONDO S.p.A, Forbo Flooring Systems, Fatra a.s., IVC Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is resilient flooring?Resilient flooring refers to a type of flooring material that is durable, flexible, and resistant to stains, scratches, and moisture. It includes materials like vinyl, linoleum, rubber, and cork.

How does resilient flooring compare to other flooring options?Resilient flooring offers advantages like durability, ease of maintenance, water resistance, and a wide range of design options compared to materials like hardwood, laminate, or carpeting.

What are the latest trends in the resilient flooring market?Trends include the development of innovative designs that mimic natural materials, increased use of eco-friendly materials, advancements in installation methods, and the incorporation of technology for easier maintenance and durability.

-

-

- Tarkett S.A.

- Mohawk Industries Inc.

- Beaulieu International Group

- Shaw Industries Group Inc.

- Gerflor SAS

- Fatra A.S.

- Forbo Flooring Systems

- Interface, Inc.

- Other Key Players