Global Renewable Chemicals Market By Type(Alcohols, Biopolymers, Organic Acids, Ketones, Others), By Feedstock(Corn, Sugarcane, Biomass, Algae, Others), By Application(Petrochemical, Pharmaceutical, Packaging Products, Cleaning and Detergent products, Automotive, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Sep 2024

- Report ID: 129111

- Number of Pages: 264

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

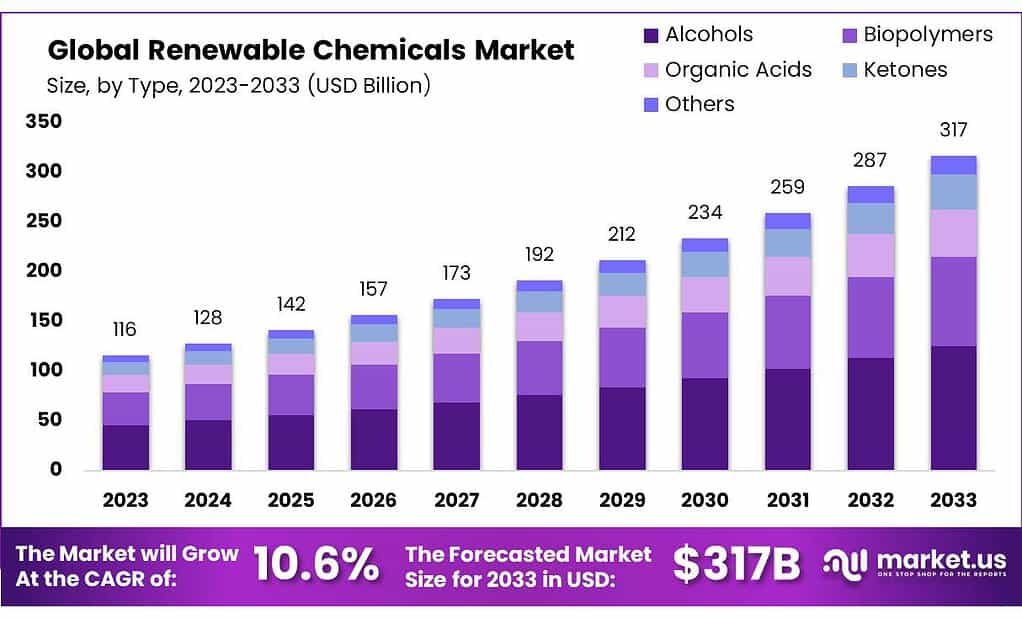

The global Renewable Chemicals Market size is expected to be worth around USD 317 billion by 2033, from USD 116 billion in 2023, growing at a CAGR of 10.6% during the forecast period from 2023 to 2033.

The renewable chemicals market is a rapidly growing segment within the chemical industry, focusing on the production of chemicals from renewable resources like plants, biomass, and biological waste. This market is integral to the shift towards more sustainable and environmentally friendly manufacturing practices. Renewable chemicals serve as eco-friendly alternatives to petroleum-based chemicals, offering similar functionalities while significantly reducing environmental impacts during production and disposal.

Driven by increasing environmental awareness, stringent government regulations on carbon emissions, and the rising cost of fossil fuels, the market is seeing robust growth. Governments globally are promoting the use of bio-based chemicals through supportive policies, further accelerating market expansion. Additionally, technological advancements in biotechnology and chemical engineering have led to more efficient and cost-effective production methods for renewable chemicals.

The transportation sector is the largest end-user of renewable chemicals, heavily utilizing biofuels like ethanol and biodiesel to reduce carbon emissions. The application of renewable chemicals is also expanding across various other industries, including textiles, agriculture, packaging, and petrochemicals, showcasing their versatility and growing demand.

Strategic movements such as mergers, acquisitions, and partnerships, alongside significant investments in research and development by major companies, are common as businesses strive to enhance the efficiency and application scope of renewable chemicals. Innovations in bio-based chemical pathways and biorefinery technologies are particularly noteworthy, reflecting the sector’s commitment to continuous improvement and sustainability.

Key Takeaways

- The renewable chemicals market is projected to grow from USD 116 billion in 2023 to USD 317 billion by 2033, at a 10.6% CAGR.

- In 2023, Alcohols (bioethanol, biobutanol) held 39.6% of the market share, dominating due to their role as biofuels and industrial solvents.

- Corn accounted for 33.4% of the feedstock market in 2023, mainly used for bioethanol production, a critical biofuel in renewable energy.

- The petrochemical sector used renewable chemicals in plastics and resins, holding a 35.3% market share in 2023, indicating its shift towards sustainability.

- Asia-Pacific led the renewable chemicals market in 2023, holding a 45.4% share, driven by industrialization and government incentives.

By Type

In 2023, Alcohols held a dominant market position in the renewable chemicals sector, capturing more than a 39.6% share. This segment primarily includes bioethanol and biobutanol, which are extensively used as biofuels and industrial solvents, highlighting their pivotal role in reducing reliance on fossil fuels.

Biopolymers are another significant segment, increasingly used in packaging, agriculture, and textile industries due to their biodegradability and lower environmental footprint. As industries seek sustainable material solutions, the demand for biopolymers continues to rise.

Organic Acids, comprising citric, lactic, and acetic acids, are widely utilized in food and beverage, pharmaceuticals, and cosmetics. Their versatility and eco-friendly profile drive their adoption across these vital sectors.

Ketones, including bio-acetone and bio-MEK, are gaining traction due to their applications in adhesives, paints, and coatings. As these industries move towards sustainable practices, the demand for renewable ketones is expected to grow.

By Feedstock

In 2023, Corn held a dominant market position in the renewable chemicals sector, capturing more than a 33.4% share. Corn is primarily utilized to produce ethanol, a key biofuel, which underscores its significant role in supporting renewable energy initiatives. Its widespread cultivation and high glucose content make it a preferred feedstock for fermentation processes.

Sugarcane follows closely, utilized extensively in regions like Brazil for the production of bioethanol. The high yield of sugarcane per acre and its efficient conversion into ethanol make it a vital component of the renewable chemicals market, especially in enhancing energy security and reducing carbon emissions.

Biomass, which includes organic materials like wood chips, grasses, and agricultural residues, is used to produce a variety of chemical products such as bio-oil and biogas. Its role in the renewable chemicals market is crucial due to its abundance and potential to reduce waste through its conversion into valuable chemicals.

Algae, an emerging feedstock, is garnering attention for its ability to produce biodiesel and other bio-based products. Its rapid growth rate and ability to sequester carbon dioxide make it an attractive option for sustainable chemical production, particularly in mitigating environmental impacts.

By Application

In 2023, Petrochemical applications held a dominant market position in the renewable chemicals sector, capturing more than a 35.3% share. This segment significantly benefits from the incorporation of renewable chemicals in the production of plastics and resins, reflecting a major shift towards sustainability in traditional petrochemical processes.

The Pharmaceutical industry also extensively utilizes renewable chemicals, particularly in the production of active pharmaceutical ingredients and excipients. The demand in this sector is driven by the need for safer, biodegradable, and non-toxic materials in medical products.

Packaging Products are another major application area, with renewable chemicals being used to create biodegradable packaging solutions. This segment’s growth is fueled by increasing consumer demand for sustainable packaging options that reduce environmental impact.

Cleaning & Detergent products that incorporate renewable chemicals are increasingly popular due to their reduced environmental footprint and effectiveness in reducing pollutants in wastewater. The shift towards eco-friendly cleaning products is evident in both industrial and residential markets.

The Automotive sector is leveraging renewable chemicals for the production of bio-based polymers, lubricants, and fuels. This application is part of the industry’s broader initiative to decrease carbon emissions and enhance the sustainability of automotive materials.

Key Market Segments

By Type

- Alcohols

- Biopolymers

- Organic Acids

- Ketones

- Others

By Feedstock

- Corn

- Sugarcane

- Biomass

- Algae

- Others

By Application

- Petrochemical

- Pharmaceutical

- Packaging Products

- Cleaning & Detergent products

- Automotive

- Others

Drivers

Government Support and Environmental Regulations

A key driver propelling the growth of the renewable chemicals market is the robust government support coupled with stringent environmental regulations aimed at reducing carbon emissions and diminishing the reliance on fossil fuels. Governments worldwide are implementing policies that encourage the use of renewable resources and penalize carbon emissions to promote environmental sustainability.

For instance, in the United States, federal environmental taxes have been levied to discourage the use of carbon-intensive products, leading manufacturers to integrate bio-based alternatives like bio-ethanol into their offerings to enhance their environmental friendliness. Similarly, in the European Union, strong commitments to sustainability and green initiatives, including targets to reduce greenhouse gas emissions, are driving demand for bio-based chemicals across various sectors, including automotive, packaging, and construction.

The impact of these regulations is complemented by financial incentives, such as subsidies and tax benefits, which significantly lower the barriers to developing and adopting renewable chemical technologies. These governmental initiatives are crucial in fostering a conducive environment for the growth of the renewable chemicals market, ensuring continued investment and innovation in this sector.

Moreover, the market is benefiting from the rising global emphasis on reducing environmental footprints. This shift is evident in industries such as transportation, where there’s an increasing demand for renewable chemicals as feedstocks for biofuels, offering a cleaner and more sustainable alternative to traditional fossil fuels. The Asia-Pacific region, in particular, is witnessing rapid growth in the renewable chemicals sector, driven by escalating industrialization and urbanization, which in turn increases the demand for sustainable products.

Restraints

High Production Costs

One of the major restraining factors in the renewable chemicals market is the high cost of production compared to traditional petroleum-based chemicals. This is primarily due to the advanced technologies and processes required to convert raw biomass into usable chemical products, which are often more complex and expensive than those used in conventional chemical manufacturing. The high cost of production technology, along with the need for significant initial investments in research and development, makes it challenging for companies to transition fully to renewable chemical production without substantial financial resources.

Furthermore, the renewable chemicals market also faces challenges related to the volatility of raw material prices. Since many renewable chemicals are derived from biomass, which can vary widely in price due to factors like weather conditions, agricultural productivity, and competition for land use with food crops, cost stability becomes a concern. This volatility can deter companies from investing in renewable chemicals production due to fears of unpredictable costs.

In addition to financial and material cost challenges, another significant barrier is the lack of awareness and understanding of renewable chemicals among potential users and stakeholders. This includes uncertainties about the performance and reliability of renewable chemicals compared to their well-established fossil-based counterparts, which can slow down adoption rates.

Despite these challenges, growth opportunities exist, driven by increasing environmental concerns, government incentives, and advancements in production technologies that are gradually reducing costs and improving efficiency. The market is expected to continue expanding as these technologies mature and as more companies and consumers prioritize sustainability.

Opportunity

Expansion in the Bio-Alcohol Segment

The significant growth opportunity in the renewable chemicals market lies in the expansion of the bio-alcohol segment. Bio-alcohols such as bioethanol, biobutanol, and bio-methanol are becoming increasingly important due to their potential to replace traditional fossil fuels. This segment is not only pivotal in reducing dependency on non-renewable resources but also plays a crucial role in decreasing carbon emissions, aligning with global sustainability goals.

Growing Demand for Sustainable Solutions: The push towards sustainability is driving innovation and investment in renewable chemicals, particularly bio-alcohols. These substances are used extensively as eco-friendly alternatives in various industries including transportation, where they serve as crucial components for biofuels. The transportation sector’s shift towards sustainable and bio-based materials is propelling the demand for renewable chemicals, further supporting the growth of this market segment.

Technological Advancements and Cost Efficiency: Technological advancements in the production and application of bio-alcohols are making these options more viable and cost-effective. Improved production processes are helping to overcome previous barriers related to efficiency and cost, which historically impeded the broader adoption of renewable chemicals.

Governmental Support and Regulation: Strong regulatory support for eco-friendly products, combined with financial incentives for using renewable resources, is fostering market growth. Governments worldwide are implementing policies that promote the use of renewable chemicals, thereby creating a favorable environment for the expansion of the bio-alcohol market.

Strategic Industry Focus: Key industry players are increasingly focusing on expanding their renewable chemicals offerings, particularly bio-alcohols, through strategic initiatives such as capacity improvement, product innovation, and partnerships. This not only enhances their market positioning but also meets the rising demand for sustainable chemical solutions.

Trends

Growth in Bio-Alcohol Production: A significant trend in the renewable chemicals market is the increasing focus on bio-alcohols such as ethanol and biodiesel. These bio-based alternatives are gaining traction due to their lower carbon emissions and reduced environmental impact compared to traditional fossil fuels.

The transportation sector, in particular, is adopting these sustainable fuels to comply with stringent environmental regulations and reduce greenhouse gas emissions. This shift is driving innovation and investment in renewable chemicals, especially in regions like Asia-Pacific where rapid industrialization is accompanied by heightened environmental awareness.

Technological Innovations and Sustainability Focus: Technological advancements are enabling more efficient production of renewable chemicals, reducing costs, and improving scalability. Industries are increasingly integrating sustainability into their core operations, aligning with global efforts to foster a circular economy. This includes exploring new feedstocks and improving biorefinery processes to enhance the environmental benefits of renewable chemicals.

Stringent Environmental Regulations: Governments worldwide are tightening regulations to encourage the use of renewable resources and decrease reliance on non-renewable chemicals. This regulatory landscape is not only promoting the adoption of renewable chemicals across various sectors but also spurring technological advancements to meet these new standards.

Rising Consumer Awareness and Demand: There is a growing consumer demand for green and natural products, which is influencing market dynamics across the globe. This trend is particularly strong in developed regions like Europe, where there is a robust commitment to sustainability. Consumers are increasingly aware of the environmental impact of their consumption patterns, driving demand for products made from renewable chemicals.

Investment in Research and Development: Key industry players are ramping up their investments in research and development to expand their renewable chemical portfolios and explore new applications. These investments are crucial for developing cost-effective and high-performing renewable chemicals that can compete with traditional chemicals on price and functionality

Regional Analysis

The global renewable chemicals market is experiencing substantial growth, driven by increased environmental concerns and a shift towards sustainable manufacturing processes. Among the regions, Asia Pacific (APAC) dominates, accounting for 45.4% of the market share, valued at USD 52.5 billion. This dominance is propelled by rapid industrialization, supportive government policies, and significant investments in renewable resources, particularly in countries like China, India, and Japan.

North America also shows significant market activity, fueled by advancements in biotechnology and stringent environmental regulations that mandate the use of renewable materials. The U.S. leads this regional market due to its robust technological innovations and the presence of key market players.

Europe’s market is driven by a strong regulatory framework supporting environmental sustainability and a high consumer preference for green products. The region benefits from numerous initiatives such as the European Green Deal, aiming to achieve climate neutrality by 2050. Germany, the UK, and France are pivotal contributors, focusing on research and development to advance the bio-based chemical sector.

The Middle East & Africa (MEA), though a smaller market, is gradually expanding. Investments in renewable resources are primarily concentrated in the Gulf Cooperation Council (GCC) countries, which are diversifying their oil-dependent economies and investing in renewable energy and chemical sectors.

Latin America is witnessing growth in the renewable chemicals market due to its abundant biomass resources and increasing governmental support for sustainable practices. Brazil stands out in the region, leveraging its extensive sugarcane resources to produce bio-ethanol and other renewable chemicals, thus fostering regional market growth.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The renewable chemicals market is characterized by the presence of several key players that significantly influence its growth and innovation landscape. Companies such as BASF SE, DuPont, and Cargill Inc. are at the forefront, leveraging their extensive research and development capabilities to enhance bio-based chemical production.

BASF SE, known for its diverse portfolio, is investing in sustainable production methods to meet increasing consumer demand for renewable products. Similarly, DuPont is focusing on developing innovative solutions in biopolymers and biofuels, aiming to capitalize on the transition toward sustainability.

Other notable players include Amyris Inc. and NatureWorks LLC, which specialize in the production of renewable chemicals derived from biomass. Amyris utilizes advanced fermentation technologies to create sustainable alternatives for various applications, while NatureWorks is a leader in bioplastics, focusing on the production of polylactic acid (PLA).

Furthermore, companies like Braskem and DSM are expanding their operations through strategic partnerships and acquisitions, thereby enhancing their competitive edge. As the market evolves, these key players are expected to continue driving innovation and market growth, responding to regulatory pressures and consumer preferences for greener alternatives.

Market Key Players

- 3M

- Amyris Inc.

- Archer-Daniels-Midland Company (ADM)

- AVERY DENNISON CORPORATION

- BASF SE

- Biomethanol Chemie Nederland B.V

- BRASKEM

- Braskem

- Cargill Inc

- Cobalt Technology, LLC.

- Corbion N.V.

- DAIKIN

- DSM

- DSM, E. I

- DuPont

- Elevance

- Evonik Industries AG

- Genomatica Inc.

- Mitsubishi Chemical Holdings Corporation

- Mitsui Chemicals Inc.

- NatureWorks LLC

- Novamont S.p.A.

- Novozymes

- OCI N.V.

- Solvay

- Trucent

Recent Development

In 2023 3M reported that approximately 25% of its sales were generated from sustainable solutions, showcasing its commitment to renewable resources.

In 2023 Amyris Inc., reported revenues of approximately USD 175 million, driven by strong demand for its bio-based products in the personal care and cosmetics industries.

Report Scope

Report Features Description Market Value (2023) US$ 116 Bn Forecast Revenue (2033) US$ 317 Bn CAGR (2024-2033) 10.6% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Alcohols, Biopolymers, Organic Acids, Ketones, Others), By Feedstock(Corn, Sugarcane, Biomass, Algae, Others), By Application(Petrochemical, Pharmaceutical, Packaging Products, Cleaning and Detergent products, Automotive, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape 3M, Amyris Inc., Archer-Daniels-Midland Company (ADM), AVERY DENNISON CORPORATION, BASF SE, Biomethanol Chemie Nederland B.V, BRASKEM, Braskem, Cargill Inc, Cobalt Technology, LLC., Corbion N.V., DAIKIN, DSM, DSM, E. I, DuPont, Elevance, Evonik Industries AG, Genomatica Inc., Mitsubishi Chemical Holdings Corporation, Mitsui Chemicals Inc., NatureWorks LLC, Novamont S.p.A., Novozymes, OCI N.V., Solvay, Trucent Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- 3M

- Amyris Inc.

- Archer-Daniels-Midland Company (ADM)

- AVERY DENNISON CORPORATION

- BASF SE

- Biomethanol Chemie Nederland B.V

- BRASKEM

- Braskem

- Cargill Inc

- Cobalt Technology, LLC.

- Corbion N.V.

- DAIKIN

- DSM

- DSM, E. I

- DuPont

- Elevance

- Evonik Industries AG

- Genomatica Inc.

- Mitsubishi Chemical Holdings Corporation

- Mitsui Chemicals Inc.

- NatureWorks LLC

- Novamont S.p.A.

- Novozymes

- OCI N.V.

- Solvay

- Trucent