Global Regulatory Information Management System Market Analysis By Component (Software (Cloud-based, On-premises), Services (Managed Services, System Integration Services, Consulting Services, Training and Support Services)), By Application (Registration, Submission, Publishing, e-Archiving, Other Applications), By Enterprise Size (Large Enterprises, Small and Medium Enterprises (SMEs)), By End-User (Pharmaceutical & Biotechnology Sector, Medical Device Sector, Clinical Research Organizations, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 157507

- Number of Pages: 290

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

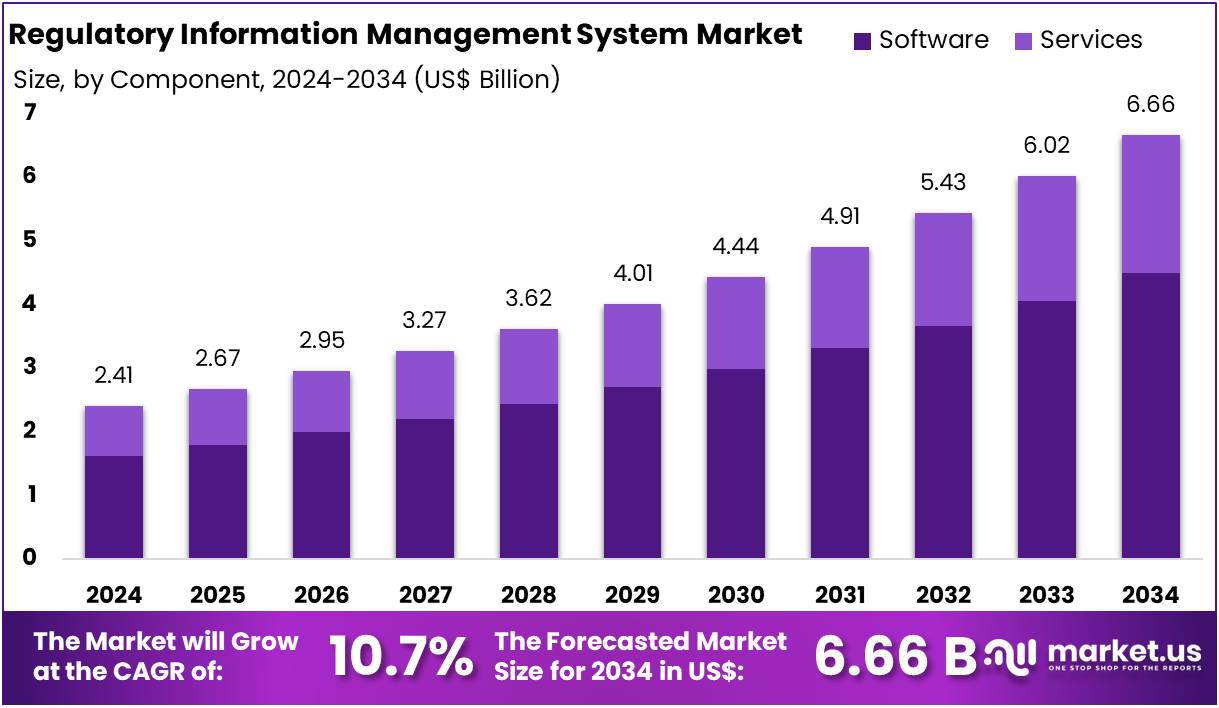

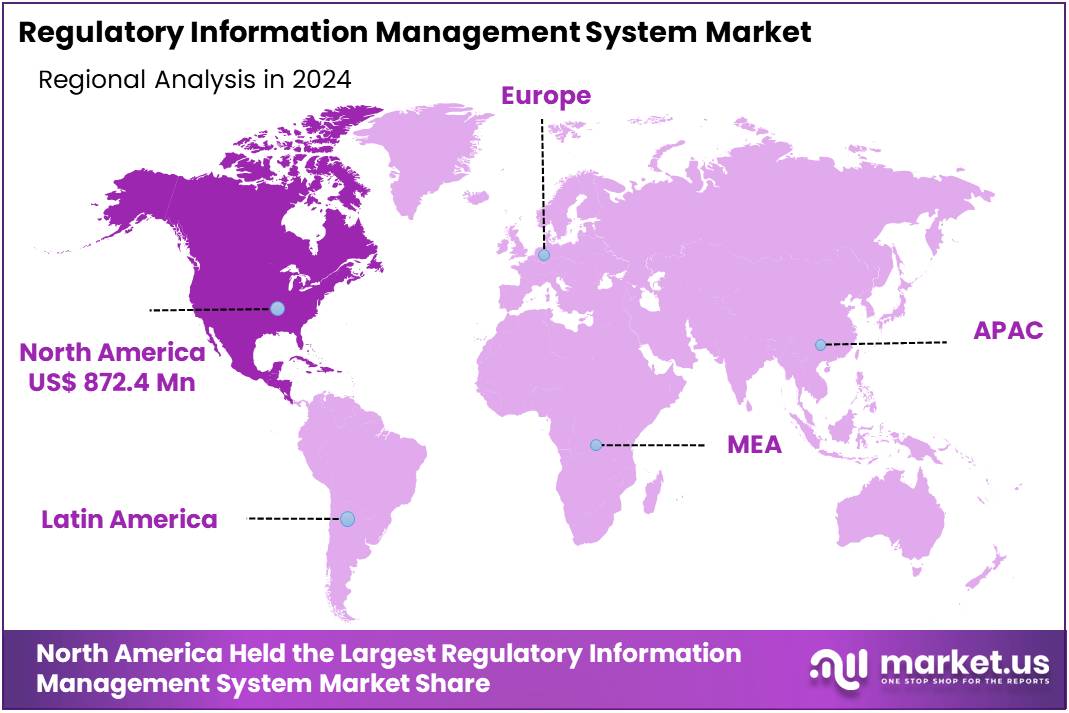

The Global Regulatory Information Management System Market size is expected to be worth around US$ 6.66 Billion by 2034, from US$ 2.41 Billion in 2024, growing at a CAGR of 10.7% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 36.2% share and holds US$ 872.4 Million market value for the year.

The Regulatory Information Management System (RIMS) market is expanding rapidly as businesses face increasing regulatory complexity. These software solutions streamline the collection, management, and reporting of regulatory data, ensuring compliance with local and global standards. Industries such as pharmaceuticals, biotechnology, and food & beverages, where strict regulations are prevalent, rely heavily on RIMS to track regulatory changes, manage submission timelines, and ensure accurate reporting. The market is driven by the need for automation and efficiency in compliance processes.

According to a study by the U.S. Food and Drug Administration (FDA), the increased utilization of Real-World Evidence (RWE) in regulatory decision-making is one of the key factors shaping the growth of the RIMS market. The FDA’s Real-World Evidence Framework, introduced in 2018, aims to accelerate medical product development. In 2023, the FDA awarded four additional grants to explore innovative uses of real-world data in regulatory decisions, further solidifying RWE’s role in the regulatory landscape.

Another driver of the market’s expansion is the global adoption of the International Classification of Diseases, 11th Revision (ICD-11). As of May 2024, 132 WHO member states are at various stages of implementing ICD-11, with 72 countries already in the process. This widespread implementation requires robust regulatory management solutions to facilitate smooth integration into health systems. For example, the WHO has provided digital tools and APIs to support ICD-11’s seamless transition, which will increase the demand for RIMS in the healthcare sector.

The healthcare industry’s increasing reliance on electronic submission formats is another factor contributing to the growth of the RIMS market. In fiscal year 2022, 94% of all submissions to the FDA’s Center for Drug Evaluation and Research (CDER) were in electronic Common Technical Document (eCTD) format. This shift towards digital submissions aligns with industry trends aimed at enhancing regulatory efficiency. With near 100% compliance in eCTD submissions, RIMS providers are under increasing pressure to offer solutions that support these standardized electronic processes.

RIMS adoption is also being driven by the need for stronger data governance in the face of rising healthcare data breaches. According to the U.S. Department of Health and Human Services (HHS), 717 breach reports affecting 500 or more individuals were filed in 2022. The average cost of a healthcare data breach in the U.S. reached $10 million per incident. This growing concern over data security emphasizes the importance of investing in regulatory information management systems that ensure data integrity and compliance with stringent regulatory requirements.

Finally, the integration of Artificial Intelligence (AI) in drug development is accelerating the need for advanced RIMS solutions. The FDA has received over 500 drug application submissions incorporating AI components from 2016 to 2023. As AI becomes increasingly involved in regulatory decision-making, RIMS systems must adapt to support the evolving regulatory landscape. In 2025, the FDA issued draft guidance on the responsible use of AI in drug development, highlighting the growing importance of RIMS in this area.

Key Takeaways

- The Global Regulatory Information Management System (RIMS) Market is projected to reach US$ 6.66 billion by 2034, up from US$ 2.41 billion in 2024, with a CAGR of 10.7%.

- In 2024, the Software component led the RIMS market, accounting for over 67.5% of the market share in the component segment.

- The Registration application dominated the RIMS market in 2024, holding more than 26.9% of the share within the application segment.

- Large Enterprises represented the largest share in the Enterprise Size segment of the RIMS market in 2024, with over 62.4% market share.

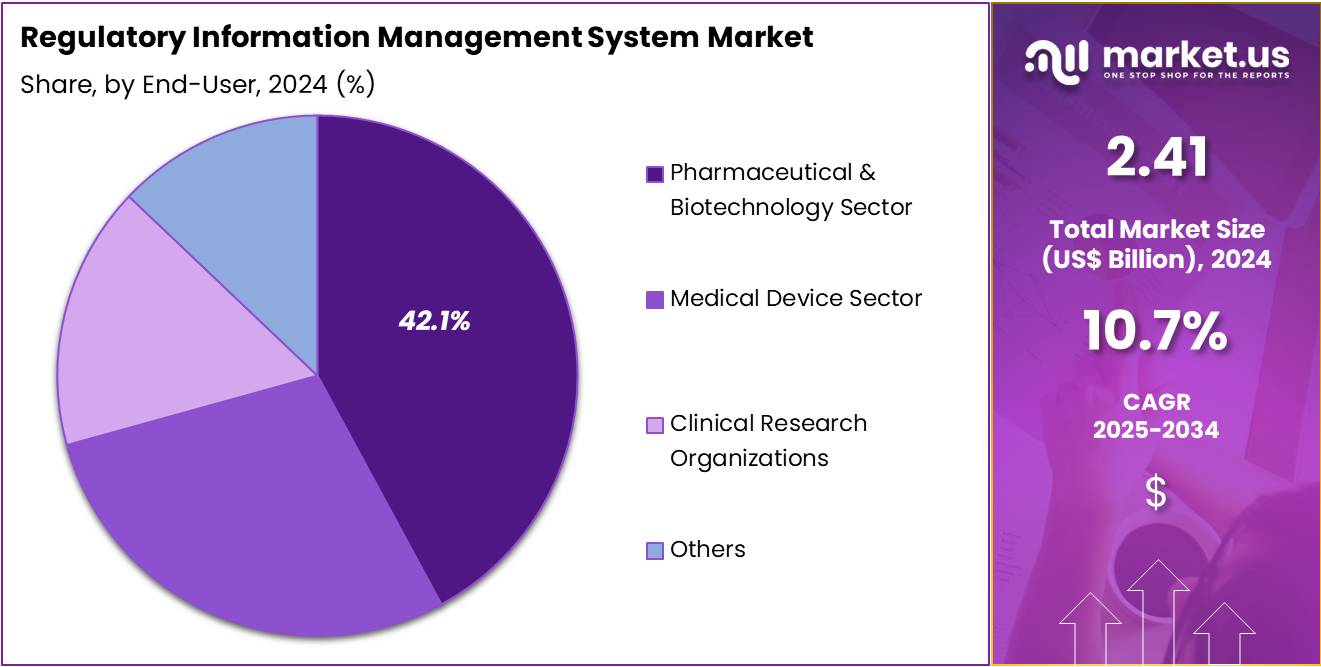

- In 2024, the Pharmaceutical & Biotechnology sector was the leading end-user of RIMS, capturing more than 42.1% of the market share.

- North America held the largest regional market share in 2024, commanding over 36.2% of the global RIMS market, valued at US$ 872.4 million.

Component Analysis

In 2024, the Software Section held a dominant market position in the Component Segment of the Regulatory Information Management System (RIMS) Market, capturing more than a 67.5% share. This strong position is driven by the rising complexity of regulatory demands and an increased focus on compliance and data security across various industries. Software solutions are essential in managing this complexity, helping organizations maintain compliance with evolving regulations while ensuring operational efficiency.

The Software segment is divided into cloud-based and on-premises solutions. Cloud-based software has seen significant growth, primarily due to its scalability, affordability, and ease of deployment. Organizations are increasingly adopting cloud-based solutions to manage their regulatory compliance needs. On the other hand, on-premises solutions, though less common, still offer certain benefits, such as enhanced control and customization, which make them appealing for larger organizations with complex regulatory needs.

The Services segment of the RIMS market includes managed services, system integration, consulting services, and training and support services. Managed services are key to ensuring that RIMS remains fully operational, offering ongoing support and maintenance. System integration services help businesses seamlessly incorporate RIMS into their existing IT systems. Additionally, consulting and training services support organizations by providing expert advice and ensuring that employees can effectively use RIMS to stay compliant with regulations.

While the Software segment currently leads the market, the Services segment is expected to grow rapidly. The demand for specialized services, which complement software solutions, is on the rise. Organizations seek these services to ensure comprehensive regulatory compliance and improve operational efficiency. As businesses continue to navigate regulatory challenges, the growth of the Services segment will be critical in supporting the wider adoption and effectiveness of RIMS solutions.

Application Analysis

In 2024, the Registration Section held a dominant market position in the Application Segment of the Regulatory Information Management System (RIMS) Market, capturing more than a 26.9% share. This segment is essential for ensuring that products meet the required standards and obtain necessary approvals from regulatory bodies. The growing complexity of global regulations has driven an increase in demand for efficient registration processes. Companies rely on RIMS to streamline these procedures and enhance compliance throughout the submission process.

The Submission segment plays a crucial role in managing regulatory filings. It includes preparing, tracking, and submitting necessary documents to health authorities. The tools in this segment help ensure that all submission deadlines are met, facilitating timely approvals. The demand for submission management systems has increased, as companies aim to streamline their regulatory processes. Efficient submissions reduce delays and increase the chances of securing market access for new products.

Publishing within the RIMS market ensures that regulatory documents are correctly disseminated to relevant stakeholders. This includes preparing documents for public access and meeting specific regulatory standards. The publishing process is vital for maintaining transparency and upholding compliance with regulatory agencies. As companies expand globally, having a reliable system for publishing regulatory documents is crucial for consistent and efficient communication with all parties involved.

e-Archiving involves storing regulatory documents in digital formats. This system ensures that all records are securely stored and can be easily accessed whenever needed. With the increase in regulatory documentation, e-Archiving has become essential for ensuring compliance with data retention laws. This segment helps organizations meet the growing need for quick access to past regulatory submissions and maintain a well-organized database for auditing and future reference.

Other applications within the RIMS market cover labeling management, regulatory intelligence, and compliance tracking. These tools ensure that products are accurately labeled according to regulatory requirements. They also track changes in regulations and monitor compliance throughout the product lifecycle. As regulatory landscapes continue to evolve, these additional applications are becoming increasingly important for maintaining compliance and keeping up with ever-changing industry standards.

Enterprise Size Analysis

In 2024, the Large Enterprises Section held a dominant market position in the Enterprise Size Segment of the Regulatory Information Management System (RIMS) Market, capturing more than a 62.4% share. This strong position reflects the significant regulatory data management needs of large organizations. These companies handle complex regulatory frameworks across multiple regions, making RIMS an essential tool for ensuring compliance. Their scale and diverse product portfolios drive the demand for robust, enterprise-grade solutions to streamline processes and maintain efficiency.

Large enterprises require RIMS platforms that can handle high volumes of regulatory data. These systems often include features like multi-region support and integration with existing Enterprise Resource Planning (ERP) and quality management systems. With advanced capabilities, these solutions help large organizations ensure compliance across various markets. As a result, the demand for comprehensive RIMS solutions continues to grow among larger businesses, allowing them to stay ahead in a highly regulated environment.

On the other hand, Small and Medium Enterprises (SMEs) make up a smaller share of the market but are seeing rapid adoption of RIMS solutions. In 2024, their segment growth was driven by the increasing need for efficient compliance management. SMEs benefit from cost-effective, cloud-based RIMS platforms that offer scalability and flexibility. These solutions provide them with the tools necessary to streamline regulatory processes without the need for large IT teams or complex infrastructure.

As regulatory requirements become more complex, both large enterprises and SMEs are turning to RIMS for support. Technological advancements, such as cloud-based solutions, are making it easier for SMEs to integrate RIMS into their operations. The market for RIMS is expected to grow further as businesses of all sizes look to optimize regulatory workflows and maintain compliance in an increasingly regulated global environment.

End-User Analysis

In 2024, the Pharmaceutical & Biotechnology Sector held a dominant market position in the End-User Segment of the Regulatory Information Management System (RIMS) Market, capturing more than a 42.1% share. This sector’s significant share can be attributed to the complex regulatory landscape surrounding drug development and approval. Pharmaceutical and biotechnology companies rely on RIMS to manage regulatory submissions, clinical trial data, and pharmacovigilance. These systems ensure compliance with strict regulations while improving efficiency in the drug approval process.

The Medical Device Sector is another key player in the RIMS market. As medical device regulations become more intricate, companies are increasingly adopting RIMS solutions. These systems help manage product registrations, ensure labeling compliance, and monitor post-market surveillance activities. By streamlining these regulatory tasks, medical device companies can expedite their market access. RIMS solutions are essential for maintaining compliance across various global regulatory requirements, which is a growing concern for this sector.

Clinical Research Organizations (CROs) are increasingly adopting RIMS as part of their services. These organizations support pharmaceutical and biotechnology firms by managing clinical trials and regulatory submissions. CROs utilize RIMS to ensure efficient data management, regulatory compliance, and accurate reporting. This enhances the overall drug development process and reduces the time to market. In addition, other end-users such as regulatory consultants and contract manufacturers contribute to the market by providing specialized services in regulatory compliance.

Key Market Segments

By Component

- Software

- Cloud-based

- On-premises

- Services

- Managed Services

- System Integration Services

- Consulting Services

- Training and Support Services

By Application

- Registration

- Submission

- Publishing

- e-Archiving

- Other Applications

By Enterprise Size

- Large Enterprises

- Small and Medium Enterprises (SMEs)

By End-User

- Pharmaceutical & Biotechnology Sector

- Medical Device Sector

- Clinical Research Organizations

- Others

Drivers

Increasing Regulatory Complexity and Compliance Requirements

The healthcare industry is facing an increase in regulatory complexity, especially with frameworks such as the European Union’s Medical Devices Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR). These regulations demand strict adherence to detailed documentation and approval processes. As a result, healthcare organizations are increasingly adopting Regulatory Information Management Systems (RIMS) to efficiently manage compliance and ensure smooth operations. RIMS helps streamline the process of meeting these regulatory demands, which have become more time-consuming and intricate.

The U.S. Food and Drug Administration (FDA) is another key player in global regulatory oversight, especially for medical devices that incorporate advanced technologies like artificial intelligence (AI) and machine learning (ML). These emerging technologies require meticulous monitoring and management throughout their lifecycle to guarantee their safety and efficacy. As the FDA strengthens its regulatory requirements, healthcare companies are turning to RIMS to simplify compliance and ensure that these devices meet safety standards from development through post-market monitoring.

The MDR and IVDR have raised the stakes by requiring more comprehensive clinical evidence and enhanced post-market surveillance. This has resulted in a heavier administrative workload for healthcare organizations. To keep pace with these heightened demands, many organizations are investing in RIMS solutions to manage and store the vast amounts of data required by these regulations. RIMS offers a centralized platform for managing documentation, approvals, and compliance records, thus reducing the risk of regulatory breaches and penalties.

The growing complexity of regulatory requirements across global markets underscores the critical role of RIMS in ensuring compliance. Organizations in the healthcare sector are adopting RIMS to reduce the manual burden of managing regulations and streamline approval processes. By utilizing RIMS, businesses can meet the stringent standards set by the FDA, MDR, and IVDR, enhancing their ability to operate efficiently while maintaining compliance with increasingly complex regulatory frameworks.

Restraints

High Implementation Costs as a Barrier to RIMS Adoption

The high implementation costs associated with Regulatory Information Management Systems (RIMS) represent a significant barrier to adoption, particularly for small and medium-sized enterprises (SMEs). The substantial initial investment required for software acquisition, training, and system integration can strain the financial resources of these organizations. Such costs limit the ability of SMEs to deploy RIMS effectively, ultimately slowing down market growth and adoption.

In healthcare, the financial burden of implementing RIMS is even more pronounced. Hospitals, for example, incur high costs for regulatory compliance. The American Hospital Association (AHA) reports that hospitals spend about $1,200 per patient admission on regulatory activities. This includes costs for staff salaries, which account for over 80% of the total expenditures. The continuous need for such investments makes the implementation of RIMS a complex decision for healthcare organizations.

Furthermore, the AHA’s 2024 report highlights that hospitals are increasingly investing in information management systems and technology infrastructure. While these investments are essential for improving operational efficiency and care quality, they typically require substantial financial resources. For many healthcare providers, balancing these costs with other financial priorities poses a significant challenge, slowing the pace of RIMS adoption.

The combination of regulatory compliance costs and ongoing investments in technology infrastructure creates a major financial constraint. Healthcare organizations must weigh the long-term benefits of RIMS against the immediate financial strain caused by these high implementation costs. As a result, many smaller organizations may delay or even forego the adoption of RIMS, limiting the system’s potential impact on the broader market.

Opportunities

Adoption of Cloud-Based Solutions for Regulatory Information Management Systems (RIMS)

The adoption of cloud-based solutions for Regulatory Information Management Systems (RIMS) presents a significant opportunity, especially for small and medium-sized enterprises (SMEs). With cloud computing, these organizations can access scalable, cost-efficient solutions without the need for substantial upfront investments in infrastructure. This reduces barriers to entry, allowing SMEs to manage regulatory compliance more effectively while maintaining a flexible and growth-oriented approach.

For healthcare organizations, cloud-based RIMS can significantly improve operational efficiency. By leveraging scalable cloud solutions, organizations can better manage and store regulatory information, leading to enhanced compliance with industry regulations. This approach ensures that regulatory data is easily accessible, reducing the time and resources needed for regulatory management while supporting overall business growth.

The shift to cloud computing also ensures enhanced security and privacy for sensitive data. The U.S. Department of Health and Human Services (HHS) mandates that healthcare entities and business associates enter into HIPAA-compliant agreements with cloud service providers. This ensures that healthcare organizations meet all necessary security standards, safeguarding protected health information (ePHI) while minimizing the risk of data breaches.

Moreover, cloud-based RIMS facilitate improved collaboration and data sharing across healthcare networks. As cloud solutions enable real-time access to regulatory data, healthcare providers can easily collaborate and stay compliant with ever-evolving regulations. This fosters a more streamlined regulatory process, reducing errors, improving efficiency, and enhancing the overall quality of healthcare operations.

Trends

Integration of AI and Automation in Regulatory Information Management Systems (RIMS)

The integration of Artificial Intelligence (AI) and automation in Regulatory Information Management Systems (RIMS) is significantly enhancing the industry’s operational efficiency. These advanced technologies streamline tasks such as document processing, submission tracking, and regulatory intelligence. By automating repetitive processes, RIMS systems reduce human error and accelerate compliance procedures. This shift aligns with the broader trend of digital transformation within regulatory environments, ultimately improving accuracy and speed in meeting regulatory requirements.

AI-driven solutions, particularly those utilizing natural language processing (NLP), are revolutionizing regulatory compliance in healthcare. These technologies enable automated documentation of patient visits in electronic health records, optimizing workflows, and enhancing the efficiency of clinical operations. This advancement allows healthcare professionals to focus more on patient care, reducing administrative burdens and improving overall service delivery. Consequently, healthcare providers experience improved operational efficiency, contributing to better patient outcomes.

Machine learning and AI are also innovating medical devices, a key aspect of regulatory compliance. These technologies improve the design, functionality, and performance of medical devices, making them more effective in supporting healthcare providers. Through continuous learning from data, AI can assist in predictive analytics, helping anticipate issues and providing actionable insights. This fosters an environment of proactive care and better decision-making, positioning healthcare systems to respond more effectively to patient needs and regulatory challenges.

Overall, the incorporation of AI and automation into RIMS is reshaping the healthcare regulatory landscape. The continued development of these technologies promises enhanced regulatory processes, reducing compliance risks, and improving healthcare service delivery. As digital transformation accelerates, the role of AI and automation in healthcare regulatory management will become increasingly vital, driving efficiencies and supporting regulatory compliance across the industry.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 36.2% share and holds a US$ 872.4 Million market value for the year. This significant share in the Regulatory Information Management System (RIMS) market can be attributed to several driving factors. The region’s complex regulatory landscape, especially in the U.S., creates a strong demand for efficient regulatory management solutions to ensure compliance with constantly changing regulations.

The presence of key players in the healthcare, pharmaceutical, and life sciences industries in North America further boosts the demand for RIMS. These industries rely heavily on effective regulatory systems to manage their extensive compliance requirements. As these sectors continue to expand, the adoption of RIMS is expected to grow steadily to meet the increasing regulatory demands.

Moreover, North America’s advanced technological infrastructure supports the widespread adoption of RIMS. Cloud-based solutions and artificial intelligence (AI) are increasingly utilized to streamline regulatory workflows. These technologies not only enhance the accuracy of processes but also significantly reduce the time needed for compliance, making them highly attractive to companies in the region.

The rise in mergers and acquisitions within the healthcare and pharmaceutical sectors further fuels the demand for regulatory information management systems. With increased industry consolidation, regulatory requirements have become more complex, prompting businesses to invest in RIMS. North America’s skilled workforce also plays a key role in ensuring the successful implementation of these systems across organizations, sustaining the market’s growth trajectory.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Regulatory Information Management System (RIMS) market is experiencing significant growth due to the increasing complexity of global regulatory requirements. Organizations seek to streamline compliance processes, which fuels the demand for RIMS solutions. Key players in this market are leveraging technological advancements to improve their offerings. The market is expected to grow as more companies adopt cloud-based solutions for scalable and efficient regulatory management.

Veeva Systems is a leading player in the RIMS market, with over 450 companies using its Veeva Vault QMS platform. Notably, 19 of the top 20 biopharmaceutical companies rely on Veeva’s solutions for regulatory compliance. The company’s cloud-based platform is known for its scalability and robust compliance features, making it a preferred choice for large enterprises. Veeva continues to dominate the market, driving innovation in regulatory information management.

LORENZ Life Sciences Group specializes in regulatory submission management and document compliance solutions. Its flagship product, docuBridge, streamlines the regulatory submission process for pharmaceutical and biotechnology firms. While LORENZ has a niche presence, its focus on regulatory affairs enables it to serve specialized needs within the RIMS landscape. The company’s solutions are vital for firms looking to optimize their submission processes and maintain compliance.

DDi provides a comprehensive suite of RIMS solutions, including regulatory intelligence, submission management, and compliance tracking. Their platform is designed to support life sciences organizations in adhering to global regulatory standards. DDi focuses on regulatory data management and submission automation, addressing the evolving needs of the industry. The company’s solutions ensure organizations stay compliant with ever-changing regulations across regions.

Market Key Players

- Veeva Systems

- LORENZ Life Sciences Group

- DDi

- Kalypso (Rockwell Automation)

- Ennov

- MasterControl

- Rimsys

- Calyx

- Amplexor Life Sciences

- PhlexGlobal

- Körber AG

- ArisGlobal

- Ithos Global Inc. (Cordance Group)

- AmpleLogic

- Dassault Systemes

- DXC Technology

Recent Developments

- In March 2025: Rimsys entered into a strategic alliance with KPMG to advance digital transformation in the MedTech industry. This collaboration aims to integrate Rimsys’ RIM software with KPMG’s advisory services, enabling MedTech companies to streamline regulatory processes and enhance compliance through automation and digitization. The partnership is expected to support large and enterprise MedTech companies in their regulatory management and transformation strategies.

- In August 2023: Calyx’s Regulatory Information Management (RIM) system was successfully utilized by a leading global pharmaceutical company to submit key regulatory information to the U.S. Food and Drug Administration (FDA) as part of the FDA’s eCTD 4.0 pilot program. This achievement underscores the system’s capability to support complex regulatory submissions and its alignment with evolving industry standards.

- In May 2023: Veeva unveiled Vault CRM, the next generation of Customer Relationship Management (CRM) tailored for the life sciences industry. Built on the Veeva Vault Platform, Vault CRM integrates with Veeva’s RIM applications, enabling seamless data flow across commercial and regulatory functions. The platform includes innovations such as an AI-powered CRM Bot and an integrated Service Center, designed to enhance productivity and streamline customer engagement processes.

Report Scope

Report Features Description Market Value (2024) US$ 2.41 Billion Forecast Revenue (2034) US$ 6.66 Billion CAGR (2025-2034) 10.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Software (Cloud-based, On-premises), Services (Managed Services, System Integration Services, Consulting Services, Training and Support Services)), By Application (Registration, Submission, Publishing, e-Archiving, Other Applications), By Enterprise Size (Large Enterprises, Small and Medium Enterprises (SMEs)), By End-User (Pharmaceutical & Biotechnology Sector, Medical Device Sector, Clinical Research Organizations, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Veeva Systems, LORENZ Life Sciences Group, DDi, Kalypso (Rockwell Automation), Ennov, MasterControl, Rimsys, Calyx, Amplexor Life Sciences, PhlexGlobal, Körber AG, ArisGlobal, Ithos Global Inc. (Cordance Group), AmpleLogic, Dassault Systemes, DXC Technology, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Regulatory Information Management System MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Regulatory Information Management System MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Veeva Systems

- LORENZ Life Sciences Group

- DDi

- Kalypso (Rockwell Automation)

- Ennov

- MasterControl

- Rimsys

- Calyx

- Amplexor Life Sciences

- PhlexGlobal

- Körber AG

- ArisGlobal

- Ithos Global Inc. (Cordance Group)

- AmpleLogic

- Dassault Systemes

- DXC Technology