Global Regulatory & Compliance Management Consulting Market Size, Share Analysis Report By Service Type (Compliance Risk Management, Consumer Protection, Financial Crime Compliance, Regulatory Remediation, Compliance Transformation, Anti-Money Laundering (AML) Compliance, Others), By Organization Size (Small & Medium Enterprise, Large Enterprise), By Vertical (BFSI, Construction & Engineering, Energy & Utilities, Government, Healthcare, Manufacturing, Retail & Consumer Goods, Telecom & IT, Transportation & Logistics, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151115

- Number of Pages: 216

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

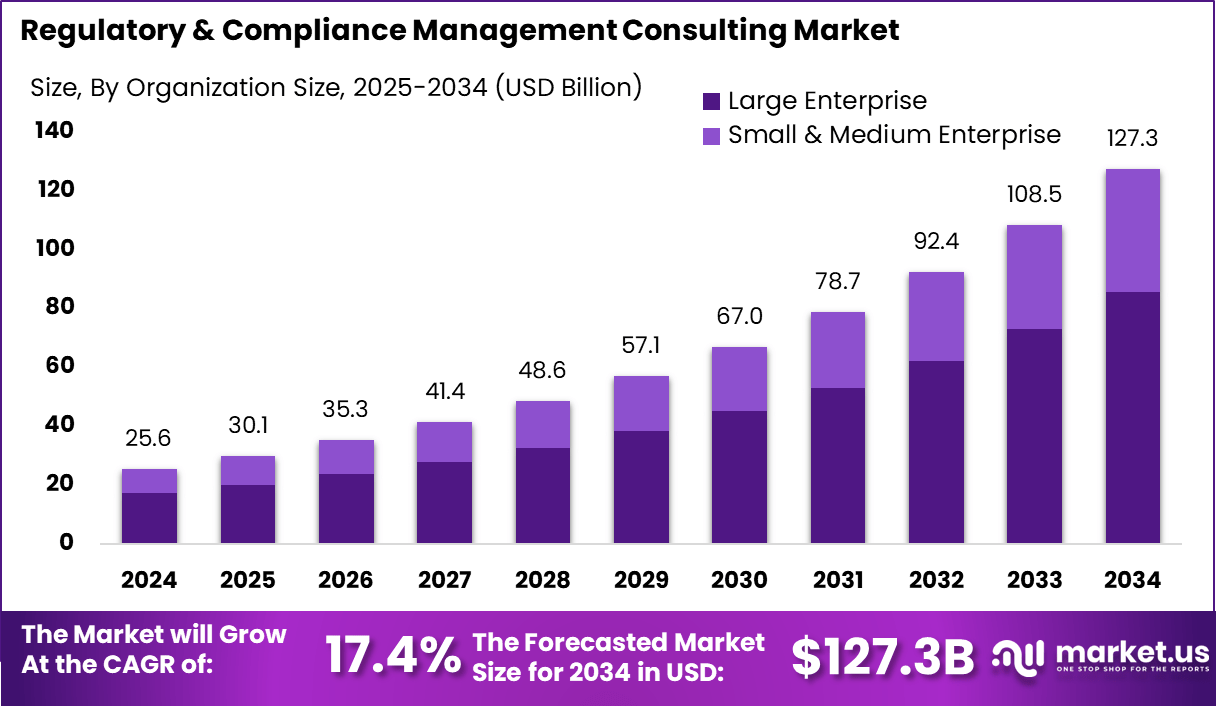

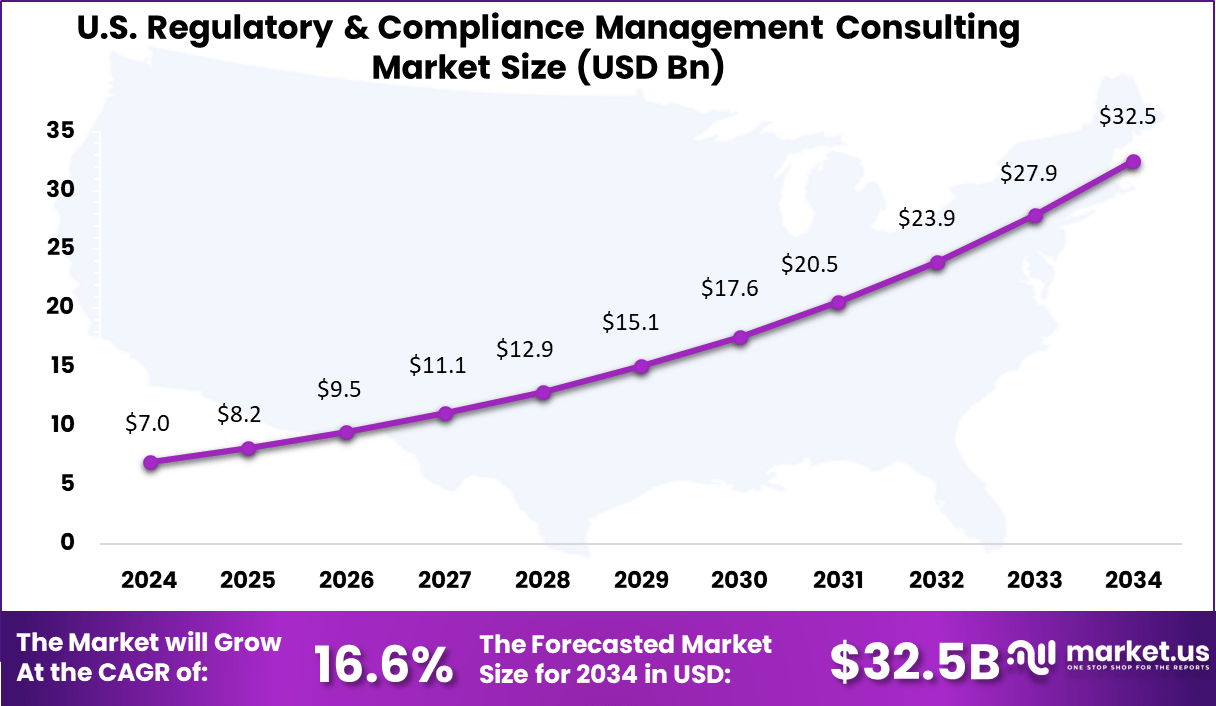

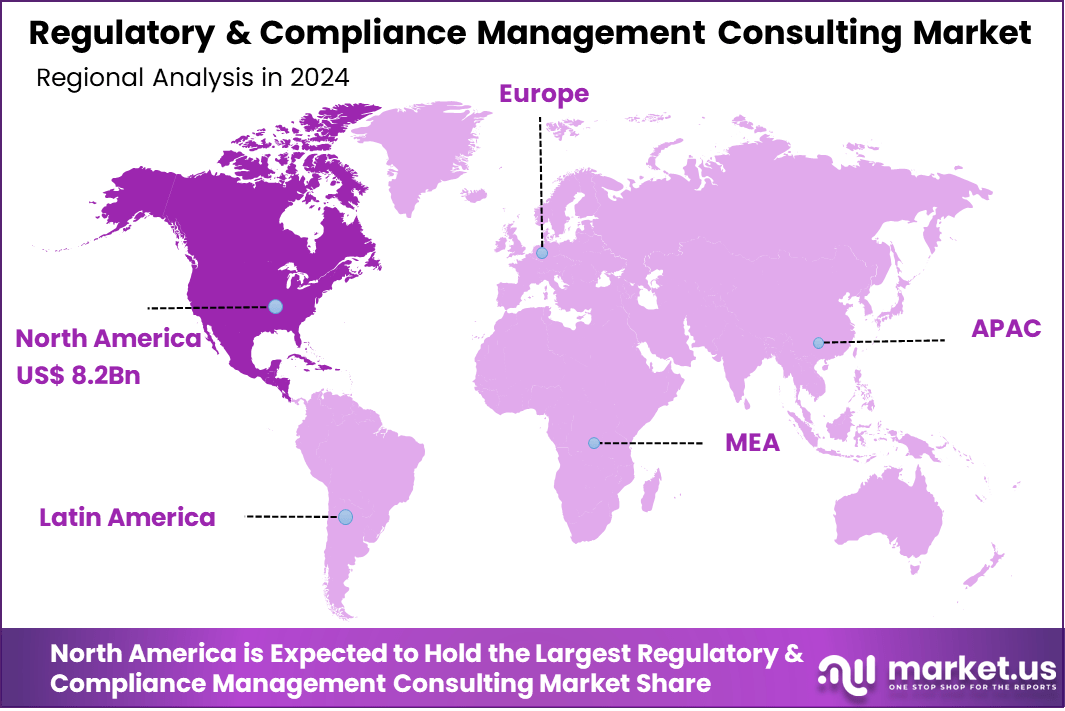

The Regulatory & Compliance Management Consulting Market size is expected to be worth around USD 127.3 Bn By 2034, from USD 25.6 Bn in 2024, growing at a CAGR of 17.4% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 32.4% share, holding USD 8.2 Bn revenue. In the U.S. market reached USD 7.05 Bn with a robust CAGR of 16.6%, reflecting growing demand for governance and risk advisory services.

The Regulatory & Compliance Management Consulting market is characterized by escalating strategic significance, as businesses face increasingly complex legal frameworks and operational risks. Its scope spans industries such as finance, healthcare, energy, and manufacturing. Demand for these services is driven by the need to proactively manage regulatory scrutiny, align corporate practices with evolving global standards, and avoid potential financial and reputational penalties.

Top Driving Factors include mounting regulatory complexity with frameworks like ESG disclosures, data privacy, and cybersecurity mandates; rising international expansion that subjects firms to varied jurisdictional requirements; and emerging technology disruptions, especially AI and automation, which introduce new compliance dimensions. Technology now plays an instrumental role in compliance modernization.

Increasing Adoption of Technologies such as RegTech platforms, AI‑driven risk modelling, RPA for audit automation, and cloud-based monitoring tools is reshaping the market. Adoption is propelled by clear key reasons: improved efficiency and accuracy in compliance processes, cost savings of up to 30% through automation , and enhanced real-time transparency and risk responsiveness.

As per the latest insights from Keevee, 75% of businesses have raised their compliance budgets in 2025, reflecting a strategic shift in how organizations view regulatory alignment. The Asia-Pacific region is witnessing rapid momentum, with compliance spending growing at a steady pace of 12% annually. This growth is being driven by expanding regional economies and the rollout of more stringent regulations across industries.

At the same time, the average cost of non-compliance has reached $15 million per year, as businesses face mounting penalties, legal fees, and reputational damage that can take years to repair. There is a noticeable trend where companies are beginning to see compliance as a value driver, not just a legal requirement. Approximately 88% of firms have acknowledged that maintaining strong compliance frameworks enhances customer trust and reinforces ethical standards.

Key Takeaways

- North America led the global market with over 32.4% share, generating around USD 8.2 Bn, driven by rising regulatory complexity and audit readiness focus.

- The U.S. market alone contributed approximately USD 7.05 Bn, expanding at a solid CAGR of 16.6%, reflecting strong demand for governance and risk consulting.

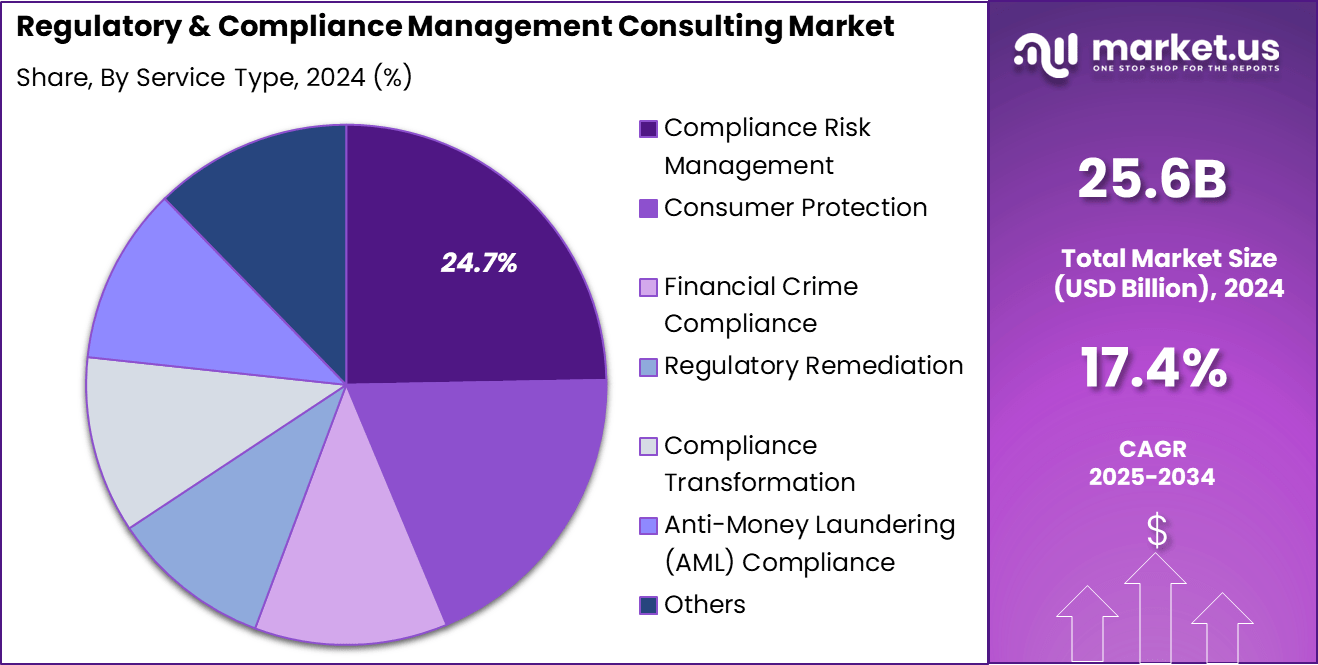

- Compliance Risk Management emerged as the leading service type, accounting for 24.7% of the global market, supported by rising regulatory penalties and stricter audit trails.

- Large Enterprises dominated the market with a significant 67.2% share, as they seek scalable compliance frameworks across multi-jurisdiction operations.

- The BFSI sector held the largest vertical share at 27.2%, due to ongoing financial regulations, anti-money laundering (AML) mandates, and risk management needs.

US Market Dominance

The US Regulatory & Compliance Management Consulting Market is valued at USD 7.0 Billion in 2024 and is predicted to increase from USD 15.1 Billion in 2029 to approximately USD 32.5 Billion by 2034, projected at a CAGR of 16.6% from 2025 to 2034.

In 2024, North America held a dominant position in the Regulatory & Compliance Management Consulting market, securing more than a 32.4% share with revenue reaching approximately USD 8.2 billion. This region’s leadership is attributed to a combination of mature legal frameworks, advanced technological infrastructure, and concentrated investments in advisory services.

By Service Type Analysis

In 2024, the Compliance Risk Management segment held a dominant market position, capturing more than a 24.7% share. The leadership of this segment is primarily driven by the rising demand from enterprises to proactively identify and manage compliance-related risks across their operations.

With regulatory frameworks becoming increasingly dynamic and industry-specific, organizations are placing a stronger focus on building integrated risk governance systems. Consulting services under this segment are often sought to design and implement internal controls, policy frameworks, and compliance audit mechanisms that ensure alignment with local and international regulatory expectations.

The segment’s growth is further supported by a shift in business behavior, where compliance is now viewed not merely as a legal necessity but as a strategic function to safeguard brand integrity and avoid reputational harm. The rapid adoption of digital platforms for monitoring, assessment, and reporting of compliance risks has also increased the complexity of managing regulatory obligations – making advisory services in this area even more critical.

Comparison Summary – Service Type

Service Type Key Insight Compliance Risk Management Leading segment; driven by regulatory complexity and proactive risk culture Consumer Protection Compliance Rising demand due to stricter consumer rights laws and transparency mandates Financial Crime Compliance Strong need for anti-fraud, sanctions, and internal policy enforcement Regulatory Remediation Critical for companies addressing past non-compliance or regulatory actions Compliance Transformation Focused on digital enablement and integrated compliance strategies Anti-Money Laundering (AML) Specialized area driven by international risk, cross-border regulation Others (Audit, Forensics, Privacy) Supporting functions gaining value in governance-focused environments By Organization Size Analysis

In 2024, the Large Enterprise segment held a dominant market position, capturing more than a 67.2% share of the Regulatory & Compliance Management Consulting market. The segment’s leadership is principally attributable to the intricate regulatory environments and extensive operational footprints of large organizations.

Operating across multiple jurisdictions, these entities encounter diversified regulatory demands – ranging from financial crime prevention and consumer protection to data privacy and sustainability requirements – which necessitate comprehensive and sophisticated compliance solutions. Consequently, large enterprises exhibit elevated demand for full-scale consulting engagements involving policy overhaul, system integration, and risk governance frameworks – driving their commanding share.

Comparison Summary – Organization Size

Organization Size Key Characteristics Large Enterprise Leading segment with > 67.2% share; driven by complex regulation, tech adoption, and scale SME Project-level advisory preferred; growing interest in scalable, cloud-based and modular compliance solutions By Vertical Analysis

In 2024, the BFSI segment held a dominant market position, capturing more than a 27.2% share of the Regulatory & Compliance Management Consulting market. This leadership is primarily driven by the multifaceted regulatory and operational risks inherent to banking, financial services, and insurance entities- such as credit, operational, cyber-fraud, and market risks.

The sector’s complexity is heightened by evolving digital landscapes, which amplify exposure to data and transaction-related threats. In this context, consulting services play an integral role in developing robust, end-to-end compliance frameworks and governance systems that ensure adherence to sensitive financial regulations.

Comparison Summary – Vertical Analysis

Vertical Compliance Focus and Advisory Needs BFSI Complex financial risk governance, real-time monitoring, eGRC tech, data security integration Construction & Engineering Safety and environmental compliance, EH&S integration Energy & Utilities Sustainability mandates, emissions control, grid and permitting compliance Government Anti-corruption, audit readiness, policy compliance, digital governance Healthcare Patient data protection, clinical governance, fraud control Manufacturing Safety, quality, trade compliance, supply chain governance Retail & Consumer Goods Consumer rights, data privacy, labeling and traceability Telecom & IT Cybersecurity, privacy regulations, compliance in digital services Transportation & Logistics Customs, hazardous transport, security frameworks, incident management Additionally, the integration of advanced governance, risk, and compliance (GRC) technologies – such as real-time risk dashboards, eGRC platforms, and AI-enhanced monitoring – is notably prominent within BFSI. These tools support proactive risk detection and automate compliance reporting.

As firms strive to reinforce internal controls, optimize data management processes, and enhance regulatory transparency, reliance on specialized consulting advisory has intensified. This has solidified the BFSI segment’s leading share and strategic position.

Key Market Segments

By Service Type

- Compliance Risk Management

- Consumer Protection

- Financial Crime Compliance

- Regulatory Remediation

- Compliance Transformation

- Anti-Money Laundering (AML) Compliance

- Others

By Organization Size

- Small & Medium Enterprise

- Large Enterprise

By Vertical

- BFSI

- Construction & Engineering

- Energy & Utilities

- Government

- Healthcare

- Manufacturing

- Retail & consumer goods

- Telecom & IT

- Transportation & Logistics

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trend

AI‑Driven Real‑Time Compliance Monitoring

An increasing integration of artificial intelligence and automation within regulatory compliance frameworks is becoming prominent, enabling firms to monitor and enforce compliance continuously rather than through periodic reviews.

This shift facilitates immediate detection of anomalies and policy breaches and improves transparency by generating real‑time audit trails. The adoption of AI‑powered compliance monitoring tools is increasingly viewed not only as a means to reduce costs and manual efforts but also to cultivate proactive risk management capabilities.

Driver

Rising Regulatory Complexity Across Jurisdictions

Regulatory frameworks are expanding and diverging across regions, especially concerning ESG, anti‑corruption, data privacy, and AI governance. Enterprises operating internationally are compelled to manage an increasingly intricate web of obligations. This proliferation and fragmentation of regulations are driving demand for expert consulting in interpreting and executing multifaceted compliance programmes.

Restraint

Shortage of Skilled Regulatory Professionals

Despite growing demand, the supply of qualified compliance and risk specialists remains limited. Compliance teams are often found to have median ages on the higher side, with insufficient new talent pipeline emerging. This talent shortage hampers firms’ capacities to scale their regulatory services and to remain agile in response to evolving frameworks.

Opportunity

Expansion of RegTech and Cloud‑Based Advisory

The rise of regulatory technology (RegTech) presents significant opportunities. By leveraging cloud-native platforms, data analytics, and AI, consulting firms can deliver scalable, automated compliance solutions.

Such offerings reduce manual overhead and enhance cost‑efficiency, particularly in sectors facing frequent compliance updates like financial services and healthcare. This trend allows consultancies to broaden their service portfolios and attract cost‑conscious clients.

Challenge

Diverging Global Standards and ESG Demands

Organizations face increasing complexity due to varying global standards – for example, differing ESG disclosure regimes like the EU’s CSRD and divergent voluntary frameworks. Compliance teams must tailor policies to local requirements without fragmenting corporate governance structures. This balancing act complicates implementation and strains both internal resources and consulting firms that must sustain continuous updates and jurisdiction‑specific expertise.

Key Player Analysis

IBM bolstered its regulatory consulting portfolio in early 2025 by acquiring Applications Software Technology LLC, reinforcing its capabilities in compliance automation and system integration. This acquisition is projected to close in Q1 2025, underscoring IBM’s strategic move toward smart compliance solutions.

Maclear Global advanced its risk‑management consulting in 2025 through the launch of MACK, a generative‑AI powered platform designed for automated control testing and compliance assurance. Its vendor risk tool continues to earn praise for “ideal integrated risk management” and modular ease of use.

MetricStream sustains its leadership in eGRC through ongoing product innovation and strategic collaborations focused on audit, policy, and risk workflows. The company remains central in shaping enterprise compliance technology, supported by consistent market acknowledgement.

Top Key Players Covered

- FIS

- Genpact

- IBM

- Maclear Global

- MetricStream

- Microsoft

- NAVEX Global, Inc.

- Oracle

- RSA Security LLC

- SAI360 Inc.

- SAP SE

- SAS Institute Inc.

- Software GmbH

- Thomson Reuters

- Wolters Kluwer N.V.

- Others

Recent Developments

- In March 2025, Partnered with ValidMind to launch Model Risk Management as a Service (MRMaaS). Combines Genpact’s risk/compliance expertise with ValidMind’s AI framework for MRM and AI governance in financial institutions.

- In November 2024, FIS acquired Dragonfly Financial Technologies, a move aimed at strengthening its real-time cash management services for banks and corporations. This acquisition reflects FIS’s strategy to offer more tailored compliance and treasury solutions for the financial sector.

Report Scope

Report Features Description Market Value (2024) USD 25.6 Bn Forecast Revenue (2034) USD 127.3 Bn CAGR (2025-2034) 17.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Service Type (Compliance Risk Management, Consumer Protection, Financial Crime Compliance, Regulatory Remediation, Compliance Transformation, Anti-Money Laundering (AML) Compliance, Others), By Organization Size (Small & Medium Enterprise, Large Enterprise), By Vertical (BFSI, Construction & Engineering, Energy & Utilities, Government, Healthcare, Manufacturing, Retail & Consumer Goods, Telecom & IT, Transportation & Logistics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape FIS, Genpact, IBM, Maclear Global, MetricStream, Microsoft, NAVEX Global, Inc., Oracle, RSA Security LLC, SAI360 Inc., SAP SE, SAS Institute Inc., Software GmbH, Thomson Reuters, Wolters Kluwer N.V., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Regulatory & Compliance Management Consulting MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Regulatory & Compliance Management Consulting MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- FIS

- Genpact

- IBM

- Maclear Global

- MetricStream

- Microsoft

- NAVEX Global, Inc.

- Oracle

- RSA Security LLC

- SAI360 Inc.

- SAP SE

- SAS Institute Inc.

- Software GmbH

- Thomson Reuters

- Wolters Kluwer N.V.

- Others