Global Regenerative Artificial Skin Market By Material (Engineered Skin Material, Bi-layered Material, Permanent Skin Material, Single Layer Material and Temporary Skin Material), By End-user (Burn Care Centers and Hospitals & Clinics), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 172170

- Number of Pages: 204

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

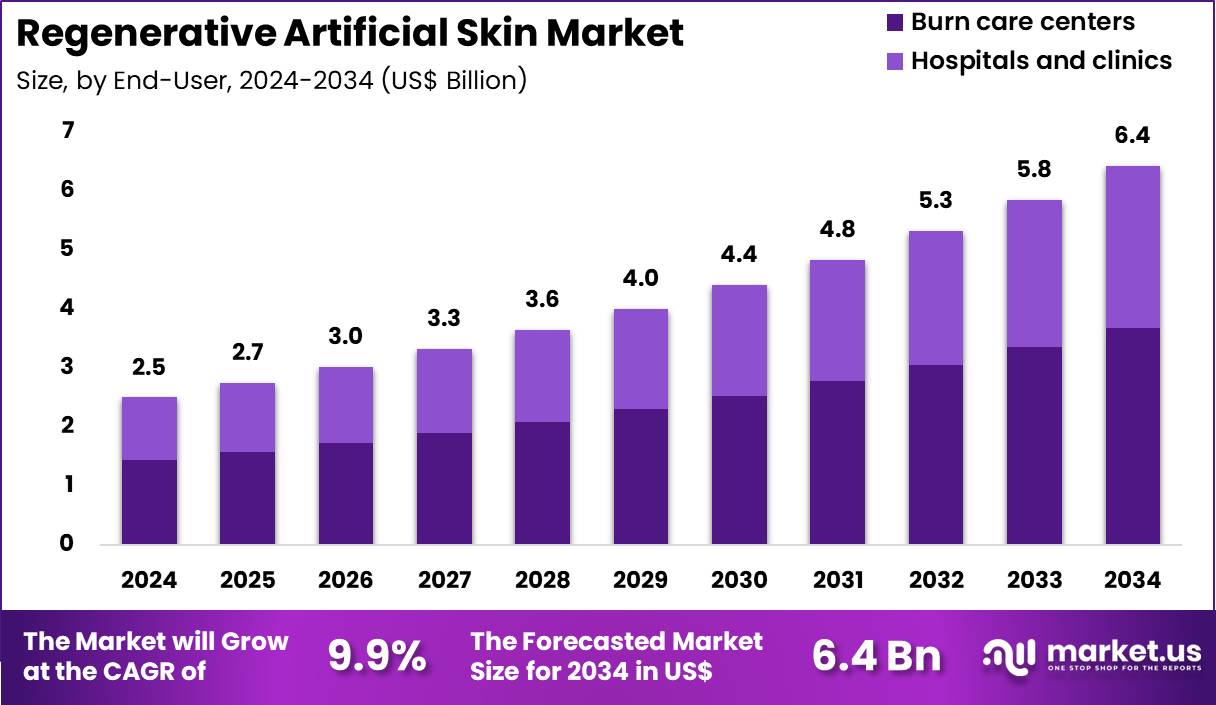

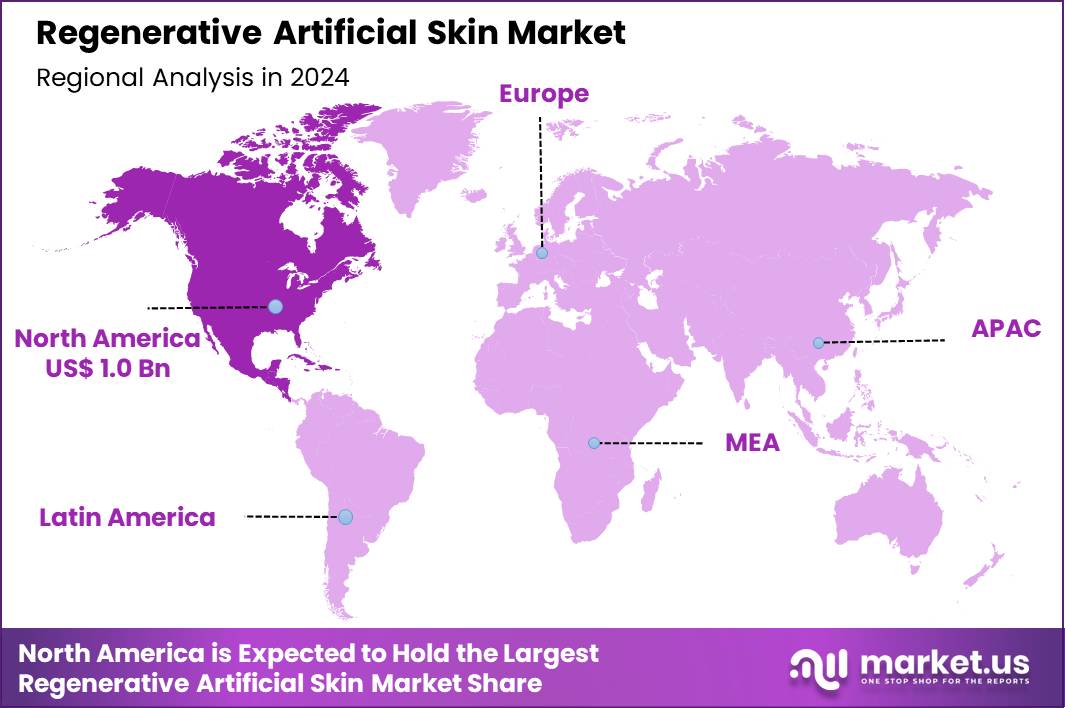

The Global Regenerative Artificial Skin Market size is expected to be worth around US$ 6.4 Billion by 2034 from US$ 2.5 Billion in 2024, growing at a CAGR of 9.9% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 41.6% share with a revenue of US$ 1.0 Billion.

Growing prevalence of severe burns and chronic ulcers drives the regenerative artificial skin market as clinicians seek superior alternatives to traditional grafts for effective dermal reconstruction. Medical device companies advance bilayered matrices to facilitate vascularization in deep thermal injuries, promoting rapid epithelialization and reduced scarring. Surgeons employ composite dermal templates for full-thickness wound coverage in traumatic injuries, ensuring structural integrity and functional recovery.

Wound care specialists integrate amniotic-derived substitutes to manage diabetic foot ulcers, accelerating granulation tissue formation and preventing amputations. Plastic surgeons utilize engineered epidermal layers for post-surgical defect repair, enhancing aesthetic outcomes in reconstructive procedures.

On November 25, 2025, Integra LifeSciences announced a positive reimbursement update from the Centers for Medicare & Medicaid Services, which improves Medicare coverage for the company’s skin substitute solutions, including Integra’s tissue matrices, supporting wider clinical adoption and improved access for patients requiring advanced wound reconstruction therapies.

Rising incidence of surgical wounds and pressure ulcers propels key opportunities in the regenerative artificial skin sector, as healthcare providers prioritize bioactive scaffolds for enhanced tissue integration. Dermatologists apply acellular dermal matrices to treat venous leg ulcers, stimulating fibroblast migration and collagen deposition for durable closure. Burn units leverage stem cell-enriched substitutes to regenerate hypodermal layers in extensive flame injuries, restoring elasticity and sensory function.

Vascular surgeons incorporate regenerative templates in limb salvage procedures for ischemic wounds, fostering angiogenesis and limb preservation. Biotech firms explore hydrogel-based artificial skins for pediatric scald treatments, minimizing contractures and supporting growth-accommodating healing. Favorable policy shifts open avenues for expanded reimbursement, enabling manufacturers to scale production and deliver cost-effective solutions that elevate patient outcomes across diverse wound etiologies.

Increasing integration of bioprinting technologies defines emerging trends in regenerative artificial skin, as innovators fabricate patient-specific constructs to optimize graft-host compatibility in complex reconstructions. Researchers develop trilayered substitutes incorporating adipocytes to mimic native skin architecture for severe degloving injuries, improving thermoregulation and mechanical resilience. Oncologists adopt radiation-damaged skin repair protocols using growth factor-loaded matrices, mitigating fibrosis and promoting follicular regeneration.

Trauma centers pioneer sensor-embedded artificial skins for monitoring healing progress in combat-related blast wounds, facilitating timely interventions. Pharmaceutical leaders invest in immunomodulatory dermal substitutes to address rejection risks in allograft alternatives for large-scale excisional defects. These advancements herald a shift toward multifunctional regenerative platforms that not only close wounds but also restore comprehensive skin physiology and long-term functionality.

Key Takeaways

- In 2024, the market generated a revenue of US$ 2.5 Billion, with a CAGR of 9.9%, and is expected to reach US$ 6.4 Billion by the year 2034.

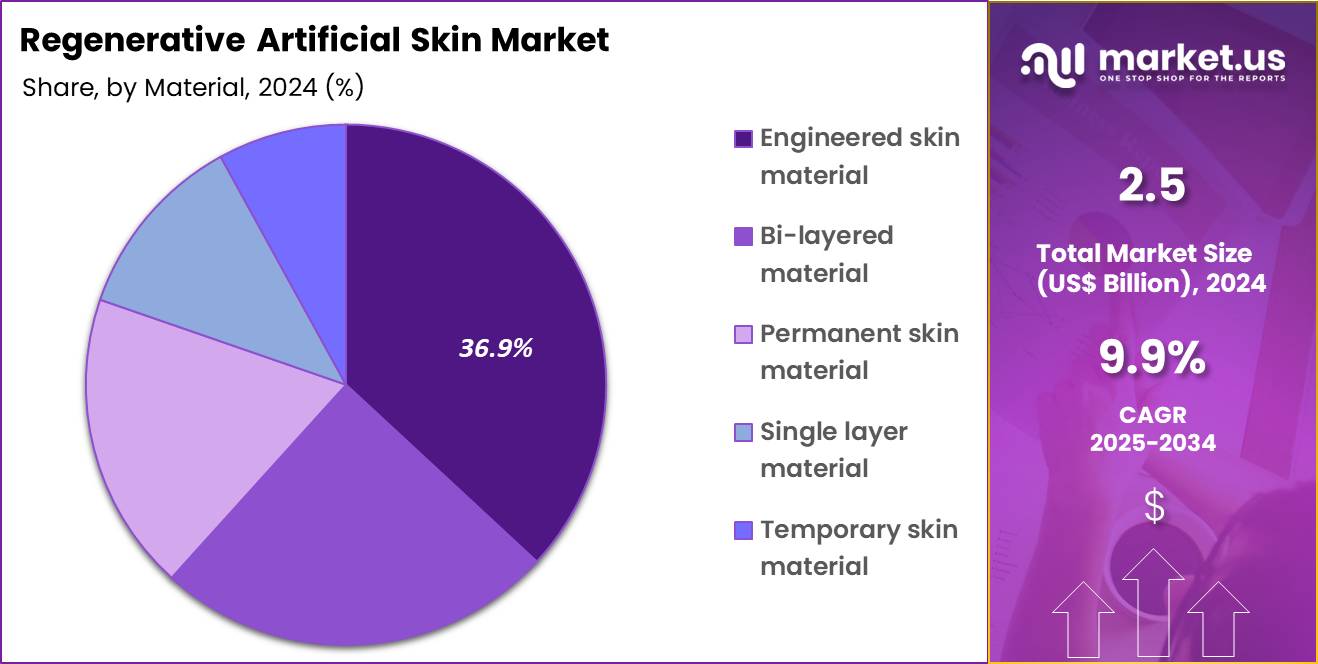

- The material segment is divided into engineered skin material, bi-layered material, permanent skin material, single layer material and temporary skin material, with engineered skin material taking the lead in 2024 with a market share of 36.9%.

- Considering end-user, the market is divided into burn care centers and hospitals & clinics. Among these, burn care centers held a significant share of 37.3%.

- North America led the market by securing a market share of 41.6% in 2024.

Material Analysis

Engineered skin material, holding 36.9%, is expected to dominate because it closely mimics the structural and functional properties of natural human skin, supporting faster wound closure and tissue regeneration. These materials integrate bioengineered cells and scaffolds that promote vascularization and reduce infection risk in severe skin injuries. Rising incidence of complex burns and chronic wounds increases demand for advanced solutions that outperform traditional grafts.

Continuous innovation in biomaterials improves elasticity, durability, and biocompatibility, strengthening clinical confidence. Surgeons increasingly prefer engineered skin due to improved cosmetic and functional outcomes. Regulatory approvals for next-generation engineered constructs accelerate market penetration. Research collaborations advance scalable manufacturing, improving availability. These factors keep engineered skin material anticipated to remain the leading material segment in this market.

End-User Analysis

Burn care centers, holding 57.3%, are projected to dominate because they specialize in managing extensive thermal injuries that require advanced regenerative skin solutions. These centers treat high-acuity patients who benefit most from engineered and bi-layered artificial skin products.

Multidisciplinary burn teams rely on regenerative skin to reduce healing time, minimize scarring, and improve survival outcomes. Increasing establishment of dedicated burn units strengthens centralized adoption of advanced skin substitutes. Government and private funding support modernization of burn care infrastructure, expanding access to regenerative technologies.

Burn care centers also participate actively in clinical trials, accelerating early adoption of innovative products. These dynamics keep burn care centers expected to remain the dominant end-user segment in the regenerative artificial skin market

Key Market Segments

By Material

- Engineered Skin Material

- Bi-layered material

- Permanent skin material

- Single layer material

- Temporary skin material

By End-user

- Burn Care Centers

- Hospitals & Clinics

Drivers

Rising incidence of burn injuries is driving the market

The escalating number of burn injuries requiring medical intervention has intensified the demand for regenerative artificial skin products to facilitate rapid wound closure and minimize scarring in affected patients. These injuries often result in extensive tissue loss, necessitating advanced biomaterials that mimic native dermal architecture for optimal integration. Healthcare facilities are increasingly relying on such technologies to support reconstructive procedures, particularly in burn units where traditional autografts fall short due to limited donor sites.

Public health data from 2024 estimates that 600,000 individuals annually suffer a burn injury meriting emergent care in the United States, highlighting the scale of this clinical challenge. This volume underscores the urgency for scalable regenerative solutions to address both acute and long-term rehabilitative needs. Regulatory frameworks prioritize products demonstrating biocompatibility and vascularization potential, encouraging innovation in scaffold designs.

Economic analyses reveal that effective skin substitutes reduce hospitalization durations, influencing procurement priorities in resource-allocated systems. Collaborative networks among trauma centers promote standardized grafting protocols incorporating artificial skins. As injury patterns evolve with industrial and household hazards, the market benefits from diversified applications in pediatric and geriatric cohorts. Collectively, this driver advances the field toward more resilient, patient-specific regenerative paradigms.

Restraints

High discard rates in allograft processing is restraining the market

The substantial proportion of discarded skin allografts during processing represents a critical limitation, constraining the availability of viable materials for regenerative applications in wound management. Storage failures and quality inconsistencies lead to inefficiencies in supply chains, elevating costs and delaying treatments for patients with extensive defects. This issue is particularly pronounced in cryopreservation workflows, where viability assessments eliminate suboptimal units prior to clinical use.

A study documented a 27% discard rate from processed living donor skin, primarily attributable to storage-related complications, underscoring systemic vulnerabilities. Such losses exacerbate donor shortages, compelling reliance on synthetic alternatives with unproven long-term outcomes. Regulatory standards for tissue banking impose stringent viability thresholds, further amplifying processing overheads. Variability in facility capabilities perpetuates inequities, with under-resourced centers facing acute material deficits.

The resultant procedural postponements heighten patient morbidity risks, eroding confidence in allograft-dependent strategies. Mitigation efforts, including optimized cryopreservation protocols, remain nascent, prolonging market stagnation. Overall, this restraint necessitates robust quality enhancements to sustain therapeutic reliability.

Opportunities

Advancements in 3D bioprinting techniques are creating growth opportunities

Innovations in 3D bioprinting have revolutionized the fabrication of multilayered skin constructs, enabling precise deposition of cellular and acellular components for enhanced regeneration. These techniques allow customization to patient-specific wound geometries, improving adherence and functional restoration over conventional sheets. Integration of vascular networks within printed scaffolds addresses historical perfusion barriers, fostering neotissue development in avascular zones.

Bioink formulations incorporating decellularized matrices promote biocompatibility, reducing inflammatory responses in vivo. Scalability through automated platforms unlocks potential for mass production, aligning with high-volume clinical demands. Collaborative validations demonstrate accelerated re-epithelialization, informing expanded indications in chronic ulcer management.

Cost reductions from streamlined extrusion and laser-assisted methods enhance economic viability for ambulatory applications. Global consortia facilitate knowledge transfer, bridging gaps in technology adoption across regions. Synergies with gene-editing tools amplify therapeutic potency, targeting underlying etiologies like fibrosis. In essence, these developments herald a versatile arsenal for personalized dermatological repair.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic dynamics bolster the regenerative artificial skin market as escalating healthcare budgets and mounting chronic wound cases worldwide spur biotech firms to scale up production of bioengineered substitutes for burn treatments and diabetic ulcers. Executives at prominent companies strategically roll out advanced scaffolds and cellular therapies, seizing momentum from precision medicine trends to penetrate expanding segments in emerging economies.

Lingering inflation and global slowdowns, however, inflate expenses for biomaterials and R&D, compelling smaller enterprises to trim project scopes and defer expansions in cash-strapped regions. Geopolitical frictions, especially U.S.-China trade clashes and regional disputes, routinely fracture supply lines for key polymers and growth factors, fostering delays and operational hurdles for manufacturers with overseas dependencies.

Current U.S. tariffs, including Section 301 duties up to 25 percent on Chinese medical devices and ongoing Section 232 investigations into imports, amplify procurement outlays for American providers and erode competitive edges in domestic channels. These tariffs also incite reciprocal restrictions from trading partners that curb U.S. exports of cutting-edge skin technologies and stall multinational clinical partnerships.

Still, the challenges ignite fresh capital inflows toward U.S.-centric fabrication and supply realignments, nurturing fortified infrastructures that promise accelerated breakthroughs and resilient market advancement in the years forward.

Latest Trends

FDA approval of ZEVASKYN for recessive dystrophic epidermolysis bullosa is a recent trend

In April 2025, the U.S. Food and Drug Administration approved ZEVASKYN, a novel autologous cell therapy utilizing patient’s own fibroblasts for treating wounds associated with recessive dystrophic epidermolysis bullosa. This approval, based on phase 3 trial outcomes showing significant wound healing improvements, marks a milestone in genetically tailored skin regeneration.

The therapy involves ex vivo genetic correction via CRISPR-Cas9 to restore functional collagen VII expression, addressing the root cause of blistering fragility. Its single-administration model minimizes repeat interventions, appealing to rare disease management paradigms. Regulatory recognition under accelerated pathways validates manufacturing scalability for ultra-orphan indications. Early implementations emphasize multidisciplinary monitoring for durability, with follow-ups extending beyond one year.

This advancement complements existing topicals, offering curative potential in a field dominated by symptomatic relief. Stakeholder engagements accelerate reimbursement negotiations, broadening access for affected pedigrees. The decision catalyzes analogous gene-edited constructs for other dystrophies. Overall, this 2025 endorsement exemplifies precision regenerative strides in inherited dermatoses.

Regional Analysis

North America is leading the Regenerative Artificial Skin Market

North America accounted for 41.6% of the overall market in 2024, and the region recorded strong growth as hospitals expanded use of bioengineered skin substitutes for burn care, chronic wounds, and reconstructive surgery. Rising prevalence of diabetes and vascular disorders increased demand for advanced wound-healing solutions that promote tissue regeneration and reduce infection risk. Trauma centers and burn units adopted regenerative matrices to improve healing outcomes and shorten hospital stays.

Plastic and reconstructive surgeons increasingly relied on artificial skin products for complex grafting procedures. The Centers for Disease Control and Prevention reported 1.6 million new diabetes diagnoses in the United States in 2022, a population with elevated risk of non-healing wounds that require regenerative solutions. Continued FDA approvals of advanced skin substitutes strengthened clinician confidence. Investment in biomaterials research further supported product innovation. These drivers collectively fueled market growth across North America in 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to experience robust expansion during the forecast period as healthcare systems increase focus on advanced wound care and burn management across densely populated regions. Hospitals adopt bioengineered skin solutions to manage rising trauma cases, surgical wounds, and diabetes-related ulcers. Growing access to specialized burn centers improves utilization of regenerative technologies.

Medical tourism growth in countries such as India, Thailand, and South Korea accelerates adoption of advanced reconstructive treatments. Government support for tissue engineering research strengthens local production and innovation.

The World Health Organization reported that nearly 6 million people in Southeast Asia suffer moderate to severe burns each year, highlighting significant unmet clinical need. Expanding private healthcare infrastructure improves patient access to advanced therapies. These factors position Asia Pacific for sustained and accelerating market growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Regenerative Artificial Skin market drive growth by advancing bioengineered dermal substitutes and scaffold technologies that accelerate wound closure and improve functional skin restoration in burns and chronic ulcers. Companies operating in the Regenerative Artificial Skin market strengthen scale through collaborations with burn centers, plastic surgeons, and trauma hospitals to integrate products into standardized treatment pathways.

Innovation teams in the Regenerative Artificial Skin market invest in biomaterials, cellular integration, and vascularization techniques to enhance graft durability and clinical outcomes. Commercial strategies within the Regenerative Artificial Skin market focus on expanding geographic presence by navigating regulatory approvals and building localized distribution and training networks.

Market leaders in the Regenerative Artificial Skin market also emphasize clinical evidence generation and long-term outcome studies to support reimbursement and surgeon confidence. Integra LifeSciences represents a prominent player in the Regenerative Artificial Skin market, leveraging its advanced dermal regeneration templates, global manufacturing capabilities, and strong clinical partnerships to support adoption across complex wound and reconstructive care settings.

Top Key Players

- Integra LifeSciences

- Smith+Nephew

- 3M Health Care

- Organogenesis Holdings Inc.

- MiMedx Group, Inc.

- Kerecis

- Molnlycke Health Care

- Verbio

Recent Developments

- In April 2025, Abeona Therapeutics obtained U.S. regulatory clearance for its autologous gene-corrected skin therapy, Zevaskyn. The therapy is designed for individuals with a rare inherited skin disorder characterized by fragile skin and persistent lesions. The treatment process uses a patient’s own skin cells, which are genetically corrected, expanded into epithelial sheets, and surgically applied as a single, definitive intervention intended to promote durable wound closure.

- In September 2025, Smith+Nephew broadened its biological wound care offerings with the introduction of the CENTRIO Platelet-Rich Plasma system. The platform enables point-of-care preparation of patient-derived biologics, allowing clinicians to combine PRP with skin substitute therapies to enhance regenerative outcomes in difficult-to-treat wounds.

Report Scope

Report Features Description Market Value (2024) US$ 2.5 Billion Forecast Revenue (2034) US$ 6.4 Billion CAGR (2025-2034) 9.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Material (Engineered Skin Material, Bi-layered Material, Permanent Skin Material, Single Layer Material and Temporary Skin Material), By End-user (Burn Care Centers and Hospitals & Clinics) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Integra LifeSciences, Smith+Nephew, 3M Health Care, Organogenesis Holdings Inc., MiMedx Group Inc., Kerecis, Molnlycke Health Care, Verbio Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Regenerative Artificial Skin MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Regenerative Artificial Skin MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Integra LifeSciences

- Smith+Nephew

- 3M Health Care

- Organogenesis Holdings Inc.

- MiMedx Group, Inc.

- Kerecis

- Molnlycke Health Care

- Verbio