Global Recycled Packaging For Apparel Market Size, Share, Growth Analysis By Material Type (Paper & Cardboard, Plastics, Glass, Metals, Others), By Packaging Type (Primary Packaging, Secondary Packaging, Tertiary Packaging), By Printing Technology (Flexographic Printing, Offset Printing, Digital Printing, Silkscreen Printing, Others), By End Use (Fast Fashion Brands, Luxury Apparel Brands, Sportswear & Activewear, Kids & Baby Wear, Footwear Packaging, Accessories, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170241

- Number of Pages: 291

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Material Type Analysis

- By Packaging Type Analysis

- By Printing Technology Analysis

- By End Use Industry Analysis

- Key Market Segments

- Drivers

- Restraints

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Recycled Packaging For Apparel Company Insights

- Recent Developments

- Report Scope

Report Overview

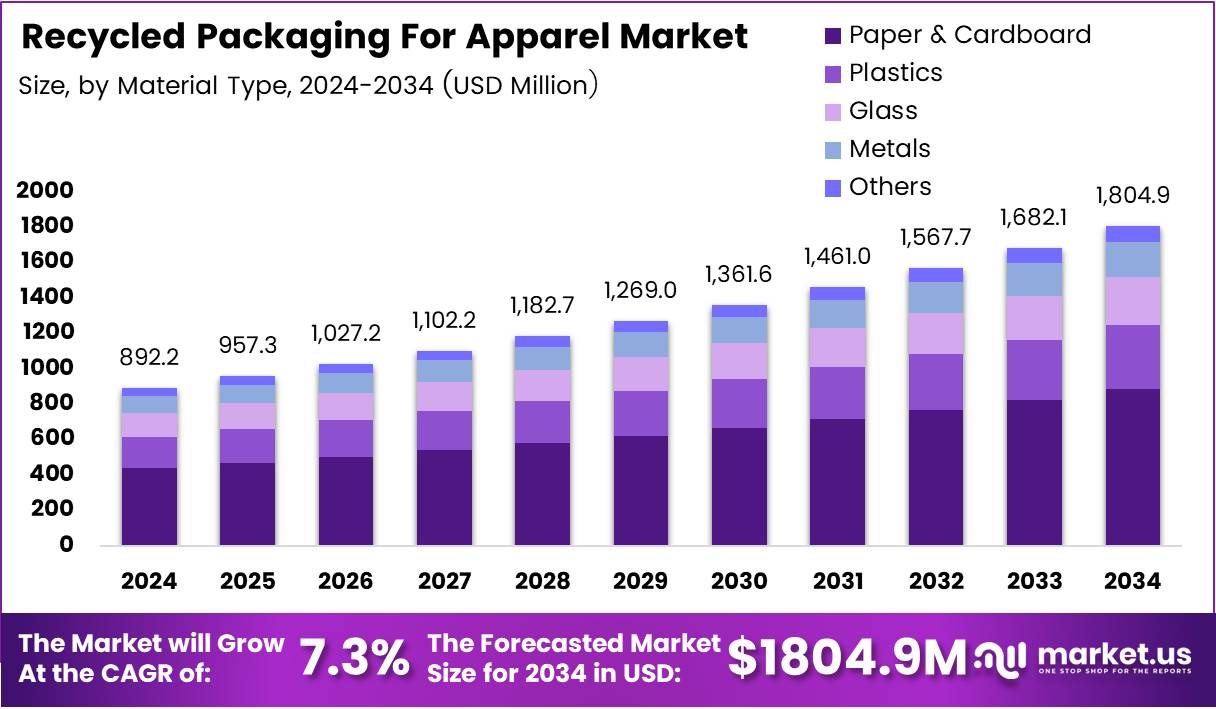

The global Recycled Packaging For Apparel Market size is expected to reach around USD 1804.9 Million by 2034 from USD 892.2 Million in 2024, growing at a CAGR of 7.3% during the forecast period from 2025 to 2034. This substantial expansion reflects accelerating industry transformation driven by sustainability mandates and evolving consumer expectations.

Recycled packaging for apparel represents packaging solutions manufactured from post-consumer or post-industrial waste materials. These materials are reprocessed into functional packaging components for clothing, footwear, and accessories. Furthermore, the market encompasses paper-based, plastic-based, and metal-based recyclable solutions across primary, secondary, and tertiary packaging formats.

The apparel industry faces mounting pressure to reduce environmental footprints through circular economy principles. Consequently, brands increasingly adopt recycled packaging to meet regulatory requirements and consumer preferences. Major fashion retailers commit to eliminating virgin plastics while transitioning toward renewable and recyclable alternatives. Additionally, technological advancements enable higher-quality recycled materials that maintain protective functionality.

Market growth accelerates as governments worldwide implement Extended Producer Responsibility regulations and packaging waste reduction targets. Meanwhile, consumer awareness campaigns drive demand for transparent, eco-certified packaging across all apparel segments. E-commerce expansion particularly fuels demand for lightweight, recyclable shipping solutions that minimize carbon emissions during last-mile delivery.

Investment in recycling infrastructure and closed-loop systems strengthens supply chain resilience. Notably, collaborations between packaging manufacturers and fashion brands foster innovation in mono-material formats and biodegradable alternatives. The luxury segment demonstrates growing adoption of premium recycled packaging with enhanced aesthetic appeal.

According to bestcolorfulsocks, a remarkable 90% of consumers report being more likely to buy from brands using sustainable packaging. This overwhelming preference demonstrates shifting shopping values toward environmental responsibility. Additionally, according to bestcolorfulsocks, 54% of U.S. shoppers chose recyclable packaging recently, highlighting mainstream adoption. Furthermore, according to bestcolorfulsocks, 73% are open to new recyclable packaging formats, indicating strong market receptivity toward innovative solutions.

The market benefits from technological breakthroughs in chemical recycling and advanced sorting systems that improve material quality. Moreover, brand commitments toward net-zero emissions by 2030 and 2040 accelerate investments in sustainable packaging portfolios. Regional variations exist, with Europe leading regulatory frameworks while Asia Pacific expands manufacturing capabilities for recycled packaging materials.

Key Takeaways

- Global Recycled Packaging For Apparel Market valued at USD 892.2 Million in 2024, projected to reach USD 1804.9 Million by 2034.

- Market growing at CAGR of 7.3% during forecast period 2025-2034.

- Europe dominates with 43.6% market share, valued at USD 389.0 Million.

- Paper & Cardboard segment leads By Material Type with 47.9% share.

- Primary Packaging holds 54.2% dominance in By Packaging Type segment.

- Flexographic Printing captures 35.8% share in By Printing Technology segment.

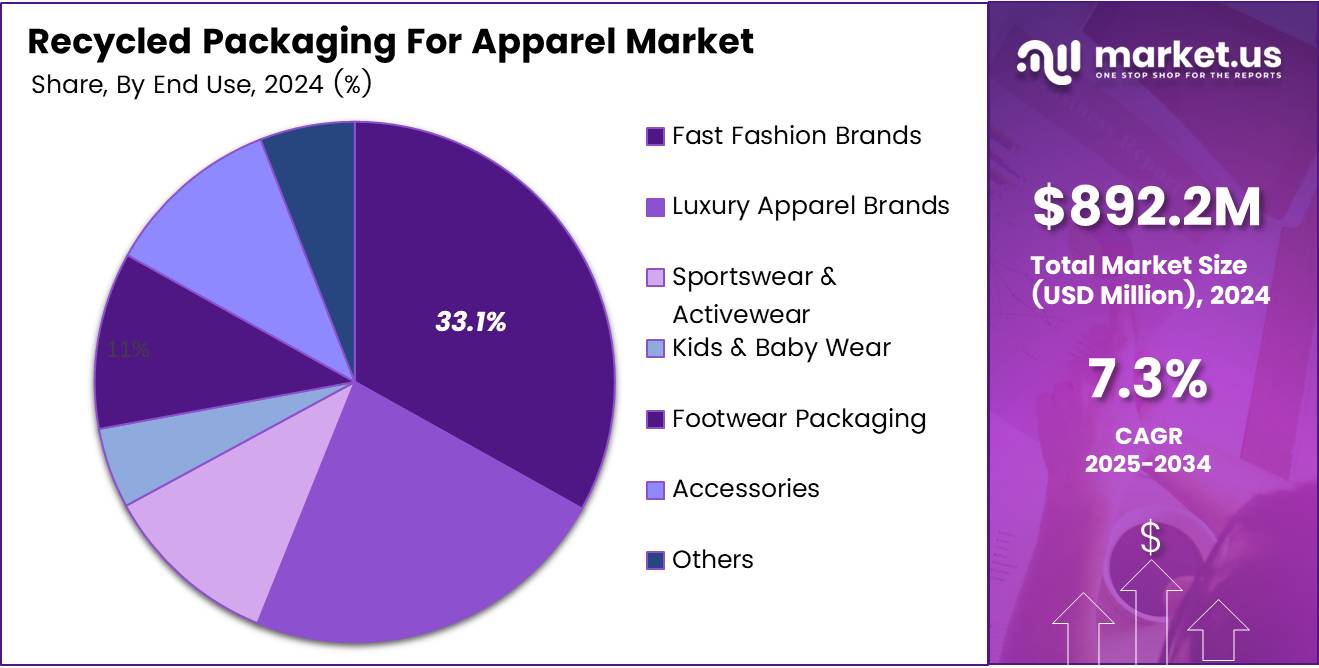

- Fast Fashion Brands account for 33.1% in By End Use Industry segment.

By Material Type Analysis

Paper & Cardboard dominates with 47.9% due to its renewable nature, recyclability, and widespread acceptance across apparel packaging applications.

In 2024, Paper & Cardboard held a dominant market position in the By Material Type segment of Recycled Packaging For Apparel Market, with a 47.9% share. This material excels in shipping boxes, hangtags, and folding cartons for clothing items. Additionally, paper-based solutions offer excellent printability for brand communication and product information. The fiber-based composition enables easy integration into existing municipal recycling streams. Moreover, advancements in barrier coatings enhance moisture resistance while maintaining recyclability standards.

Plastics represent the second-largest material category for recycled apparel packaging applications. These materials include recycled PET, HDPE, and LDPE used in polybags, mailers, and protective wraps. Furthermore, plastic recycling technologies continue improving, enabling higher-quality regrind materials. Brands increasingly specify post-consumer recycled content percentages to demonstrate sustainability credentials. However, challenges persist regarding multi-layer plastic structures that complicate mechanical recycling processes.

Glass packaging finds niche applications in luxury fragrance and cosmetic accessories within apparel retail environments. Meanwhile, recycled glass offers premium aesthetic qualities and infinite recyclability without quality degradation. The weight considerations limit broader adoption for direct apparel packaging but remain relevant for complementary product categories.

Metals including aluminum serve specialized functions in zipper packaging, accessory containers, and premium gift packaging. Similarly, metal’s durability and recyclability make it attractive for reusable packaging systems. The material’s higher cost positions it primarily in luxury and specialty apparel segments. Others category encompasses innovative bio-based and hybrid materials emerging in sustainable packaging solutions.

By Packaging Type Analysis

Primary Packaging dominates with 54.2% due to direct consumer interaction and critical role in brand presentation and product protection.

In 2024, Primary Packaging held a dominant market position in the By Packaging Type segment of Recycled Packaging For Apparel Market, with a 54.2% share. This category encompasses individual garment bags, hangtags, labels, and direct product wrapping materials.

Consequently, brands prioritize recycled content in primary packaging to communicate sustainability values at point of purchase. The visible nature drives investment in aesthetically appealing recycled materials that maintain premium brand image. Additionally, regulatory focus on single-use plastics intensifies innovation in primary packaging alternatives.

Secondary Packaging includes outer cartons, shelf-ready packaging, and point-of-sale displays used in retail environments. These materials facilitate product grouping and in-store merchandising while protecting primary packaged items. Moreover, secondary packaging represents significant volume opportunities for recycled material adoption across distribution channels. Retailers increasingly mandate recycled content specifications for supplier packaging to meet corporate sustainability targets.

Tertiary Packaging comprises pallets, stretch wrap, and bulk shipping containers used in logistics and warehouse operations. This category focuses on transportation efficiency and load protection during wholesale distribution. Furthermore, tertiary packaging decisions prioritize durability and reusability alongside recycled material content. Industrial-scale packaging solutions benefit from established recycling infrastructure and standardized material specifications that simplify circular economy implementation.

By Printing Technology Analysis

Flexographic Printing dominates with 35.8% due to its cost-effectiveness, speed, and compatibility with various recycled substrate materials.

In 2024, Flexographic Printing held a dominant market position in the By Printing Technology segment of Recycled Packaging For Apparel Market, with a 35.8% share. This technology excels in high-volume production runs for corrugated boxes and paper-based packaging materials. Additionally, flexographic systems accommodate water-based and UV-curable inks that align with sustainability objectives. The process handles varied recycled paper textures while maintaining consistent print quality across long production runs. Moreover, rapid setup times and material flexibility make flexography ideal for diverse apparel packaging applications.

Offset Printing provides superior image quality and color consistency for premium recycled packaging applications. This method suits medium-to-large volume runs requiring detailed graphics and brand imagery. Furthermore, offset technology delivers excellent results on smooth recycled paperboard surfaces used in luxury apparel packaging. However, longer setup times and plate production costs position offset for applications prioritizing visual impact over production speed.

Digital Printing enables short-run customization and on-demand production for personalized recycled apparel packaging. The technology eliminates plate-making requirements, reducing waste and enabling rapid design iterations. Similarly, digital systems support variable data printing for promotional campaigns and limited edition releases. Growing e-commerce adoption drives demand for digitally printed recycled mailers with personalized brand messaging.

Silkscreen Printing serves specialized applications requiring thick ink deposits and unique tactile effects on recycled packaging. This technique creates premium finishes for luxury brand packaging and specialty retail applications. Others category includes emerging technologies like hybrid printing systems and eco-solvent methods that expand creative possibilities for sustainable apparel packaging solutions.

By End Use Industry Analysis

Fast Fashion Brands dominate with 33.1% due to high volume throughput and increasing sustainability commitments across rapid production cycles.

In 2024, Fast Fashion Brands held a dominant market position in the By End Use Industry segment of Recycled Packaging For Apparel Market, with a 33.1% share. These retailers process massive packaging volumes across global supply chains and consumer touchpoints. Consequently, fast fashion operators face significant pressure from consumers and activists to reduce environmental impacts. Recycled packaging adoption demonstrates tangible sustainability progress while managing operational costs. Additionally, standardized packaging formats across fast fashion enable efficient recycled material integration and supply chain optimization.

Luxury Apparel Brands increasingly adopt premium recycled packaging solutions that maintain brand prestige and aesthetic standards. These companies invest in high-quality recycled materials with enhanced finishes and textures. Furthermore, luxury segment consumers demonstrate strong receptivity toward sophisticated sustainable packaging narratives. Brand storytelling emphasizes craftsmanship and environmental stewardship through carefully designed recycled packaging experiences.

Sportswear & Activewear segments prioritize functional recycled packaging that reflects performance-oriented brand identities. These categories leverage technical material innovations and lightweight solutions for e-commerce shipping. Moreover, activewear brands often lead sustainability initiatives aligned with health and wellness consumer values.

Kids & Baby Wear emphasizes safety-certified recycled materials and gentle packaging solutions for sensitive consumer segment. Footwear Packaging requires durable recycled materials for heavier products and specialized protective structures. Accessories packaging spans diverse formats from jewelry to handbags, each requiring tailored recycled solutions. Others category encompasses workwear, uniforms, and specialty apparel segments adopting sustainable packaging practices.

Key Market Segments

By Material Type

- Paper & Cardboard

- Plastics

- Glass

- Metals

- Others

By Packaging Type

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

By Printing Technology

- Flexographic Printing

- Offset Printing

- Digital Printing

- Silkscreen Printing

- Others

By End Use Industry

- Fast Fashion Brands

- Luxury Apparel Brands

- Sportswear & Activewear

- Kids & Baby Wear

- Footwear Packaging

- Accessories

- Others

Drivers

Rising Brand Commitments Toward Circular Fashion Packaging Drive Market Expansion

Major apparel retailers increasingly pledge to eliminate virgin plastics from packaging operations by 2025 and 2030. These commitments translate into substantial procurement shifts toward recycled material suppliers. Consequently, brands invest in supply chain partnerships that ensure consistent recycled content availability and quality.

Furthermore, corporate sustainability reports showcase packaging transformation as measurable progress toward environmental goals. Consumer awareness campaigns amplify brand differentiation through visible recycled packaging adoption.

Government regulations supporting recyclable packaging compliance accelerate industry-wide transitions. Extended Producer Responsibility schemes require brands to fund collection and recycling infrastructure. Moreover, plastic taxes and packaging waste levies create financial incentives for recycled material adoption.

Retailer preference for recycled mailers and biobased shipping materials reflects evolving procurement standards. Additionally, certification programs validate recycled content claims and build consumer trust in sustainable packaging statements across apparel categories.

Restraints

Limited Availability of High-Quality Post-Consumer Recycled Feedstock Constrains Market Growth

Inadequate collection infrastructure in many regions restricts recycled material supply for apparel packaging manufacturers. Contamination issues during collection and sorting degrade recyclate quality and limit application suitability.

Consequently, packaging producers struggle to source consistent volumes meeting technical specifications for demanding apparel applications. Furthermore, competition from other industries for recycled feedstock creates supply volatility and price fluctuations. Regional disparities in recycling systems complicate global supply chain planning for multinational apparel brands.

Higher production and processing costs compared to conventional packaging impact adoption rates among cost-sensitive apparel segments. Recycled material processing requires additional sorting, cleaning, and reprocessing steps that increase manufacturing expenses.

Moreover, economies of scale remain limited for specialized recycled packaging grades. Investment requirements for recycling equipment and facility upgrades create financial barriers for smaller packaging converters. Additionally, performance trade-offs in certain recycled materials necessitate reformulation efforts that extend development timelines and costs.

Growth Factors

Adoption of Advanced Recycling Technologies Creates New Opportunities for Apparel Packaging Innovations

Chemical recycling processes enable conversion of difficult-to-recycle plastics into virgin-quality polymers for packaging applications. These technologies unlock previously unusable waste streams and expand feedstock availability. Consequently, apparel brands access higher-performance recycled materials matching conventional packaging specifications.

Furthermore, depolymerization and pyrolysis methods produce food-grade recycled content suitable for premium packaging. Investment in enzymatic recycling and advanced sorting systems improves material recovery rates and quality consistency.

Expansion of apparel e-commerce drives demand for recyclable protective packaging optimized for shipping environments. Online sales growth necessitates right-sized, lightweight solutions that reduce dimensional weight charges.

Moreover, direct-to-consumer models enable brands to control packaging specifications and communicate sustainability values. Brand collaborations to develop closed-loop apparel packaging systems foster innovation through shared investment and knowledge. Additionally, increasing use of recycled paper and polymer blends in premium clothing packaging demonstrates material science advances.

Emerging Trends

Rapid Shift Toward Mono-Material Recycled Packaging Formats Transforms Industry Practices

Single-material packaging structures simplify recycling processes and improve material recovery in sorting facilities. Brands eliminate multi-layer laminates in favor of recyclable mono-material alternatives that maintain functional performance. Consequently, packaging converters develop innovative barrier coatings and paper-based solutions replacing plastic composites.

Furthermore, standardization efforts around mono-materials facilitate infrastructure investment and collection system optimization. Supply chain collaboration ensures material compatibility across manufacturing, use, and end-of-life recycling stages.

Surge in demand for recycled packaging with QR-based traceability features enables transparency and consumer engagement. Digital watermarks and blockchain integration verify recycled content claims and material provenance.

Moreover, growth of luxury fashion brands using high-aesthetic recycled packaging designs demonstrates premium market acceptance. Rising popularity of lightweight recycled mailers for carbon-reduction goals aligns packaging optimization with broader climate commitments. Additionally, innovations in texture, color, and finishing techniques elevate recycled material perceptions among discerning consumers.

Regional Analysis

Europe Dominates the Recycled Packaging For Apparel Market with 43.6% Market Share, Valued at USD 389.0 Million

In 2024, Europe held a dominant position in the Recycled Packaging For Apparel Market with 43.6% market share, valued at USD 389.0 Million. The region’s leadership stems from stringent EU packaging regulations and ambitious circular economy targets. Additionally, Extended Producer Responsibility directives mandate recycled content minimums across member states. Strong consumer environmental awareness drives brand adoption of sustainable packaging solutions. Moreover, established recycling infrastructure and collection systems support high-quality material recovery for packaging manufacturers.

North America Recycled Packaging For Apparel Market Trends

North America demonstrates robust growth driven by state-level plastic regulations and corporate sustainability commitments. Major apparel retailers headquartered in the region lead voluntary packaging transition initiatives. Furthermore, investment in recycling technology and infrastructure expansion improves material availability. E-commerce penetration creates substantial demand for recyclable shipping solutions across diverse apparel segments.

Asia Pacific Recycled Packaging For Apparel Market Trends

Asia Pacific represents significant growth potential as manufacturing hub for global apparel industry. Regional governments implement waste management improvements and recycling capacity expansions. Moreover, rising middle-class consumer awareness drives sustainable packaging preferences. Local brands increasingly adopt recycled materials to compete in export markets requiring environmental compliance certifications.

Middle East and Africa Recycled Packaging For Apparel Market Trends

Middle East and Africa show emerging adoption driven by luxury retail expansion and international brand presence. Government initiatives to reduce plastic waste create regulatory momentum for recycled packaging. Furthermore, infrastructure development projects improve waste collection and material recovery capabilities across urban centers.

Latin America Recycled Packaging For Apparel Market Trends

Latin America experiences growing demand as regional apparel production increases and export requirements mandate sustainable packaging. Informal recycling sector integration into formal systems expands material availability. Additionally, multinational brand subsidiaries implement global sustainability standards across local manufacturing and distribution operations.

Key Recycled Packaging For Apparel Company Insights

Leading players in the global Recycled Packaging For Apparel Market demonstrate strategic focus on sustainable innovation and capacity expansion during 2024.

Smurfit Kappa Group strengthens its position through fiber-based packaging solutions and circular economy partnerships with major apparel retailers. The company’s integrated operations enable customized recycled packaging development across diverse fashion segments.

Mondi Group advances sustainable paper and flexible packaging solutions specifically designed for apparel applications. Their EcoSolutions portfolio offers certified recycled content products meeting stringent performance requirements for clothing protection and brand presentation.

DS Smith Plc leverages closed-loop recycling systems and design expertise to deliver optimized packaging solutions for fast fashion and e-commerce channels. The company’s circular design principles reduce material usage while maintaining structural integrity during shipping.

International Paper Company expands recycled paperboard capacity serving apparel packaging demand with focus on North American and European markets. Their renewable fiber sourcing and recycling infrastructure integration support consistent quality for brand-critical packaging applications. These market leaders invest significantly in recycling technology, material science research, and collaborative partnerships with fashion brands seeking to advance packaging sustainability.

Key Companies

- Smurfit Kappa Group

- Mondi Group

- DS Smith Plc

- International Paper Company

- WestRock Company

- Stora Enso

- Amcor Plc

- Tetra Pak

- Seaman Paper

- Ecolife Recycling

Recent Developments

- In July 2024, Smurfit Kappa acquired WestRock, enhancing capacity to invest in circular and recyclable secondary packaging solutions including fiber-based alternatives to plastic.

- In January 2025, Danish fashion brand Ganni signed a four-year offtake deal with Ambercycle, ensuring use of Cycora recycled polyester made from post-consumer and post-industrial textile waste to support scaled adoption of next-gen recycled materials.

- In July 2025, Dow unveiled INNATE TF 220 Precision Packaging Resin, a new recyclable packaging material designed to improve performance and recyclability of flexible packaging films.

- In June 2025, Chanel launched the Nevold circularity platform, a collaborative initiative to create future materials using recycled fibers alongside global partners in yarn mills and recyclers.

Report Scope

Report Features Description Market Value (2024) USD 892.2 Million Forecast Revenue (2034) USD 1804.9 Million CAGR (2025-2034) 7.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Paper & Cardboard, Plastics, Glass, Metals, Others), By Packaging Type (Primary Packaging, Secondary Packaging, Tertiary Packaging), By Printing Technology (Flexographic Printing, Offset Printing, Digital Printing, Silkscreen Printing, Others), By End Use (Fast Fashion Brands, Luxury Apparel Brands, Sportswear & Activewear, Kids & Baby Wear, Footwear Packaging, Accessories, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Smurfit Kappa Group, Mondi Group, DS Smith Plc, International Paper Company, WestRock Company, Stora Enso, Amcor Plc, Tetra Pak, Seaman Paper, Ecolife Recycling Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Recycled Packaging For Apparel MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Recycled Packaging For Apparel MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Smurfit Kappa Group

- Mondi Group

- DS Smith Plc

- International Paper Company

- WestRock Company

- Stora Enso

- Amcor Plc

- Tetra Pak

- Seaman Paper

- Ecolife Recycling