Global Real Time Bidding Market Size, Share Analysis By Auction Type (Open Auction, Invitation Auction), By Advertisement Format (Video, Image), By Application (Media & Entertainment, Retail and E-commerce, Games, Travel & Luxury, Mobile Applications, Others), By Device(Mobile, Desktop, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155219

- Number of Pages: 374

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts’ Viewpoint

- Role of AI in RTB Market

- U.S. RTB Market Size

- Auction Type Analysis

- Advertisement Format Analysis

- Application Analysis

- Device Segment Analysis

- Growth Factors

- Key Trends and Innovations

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Regional Highlights: A Global Perspective

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

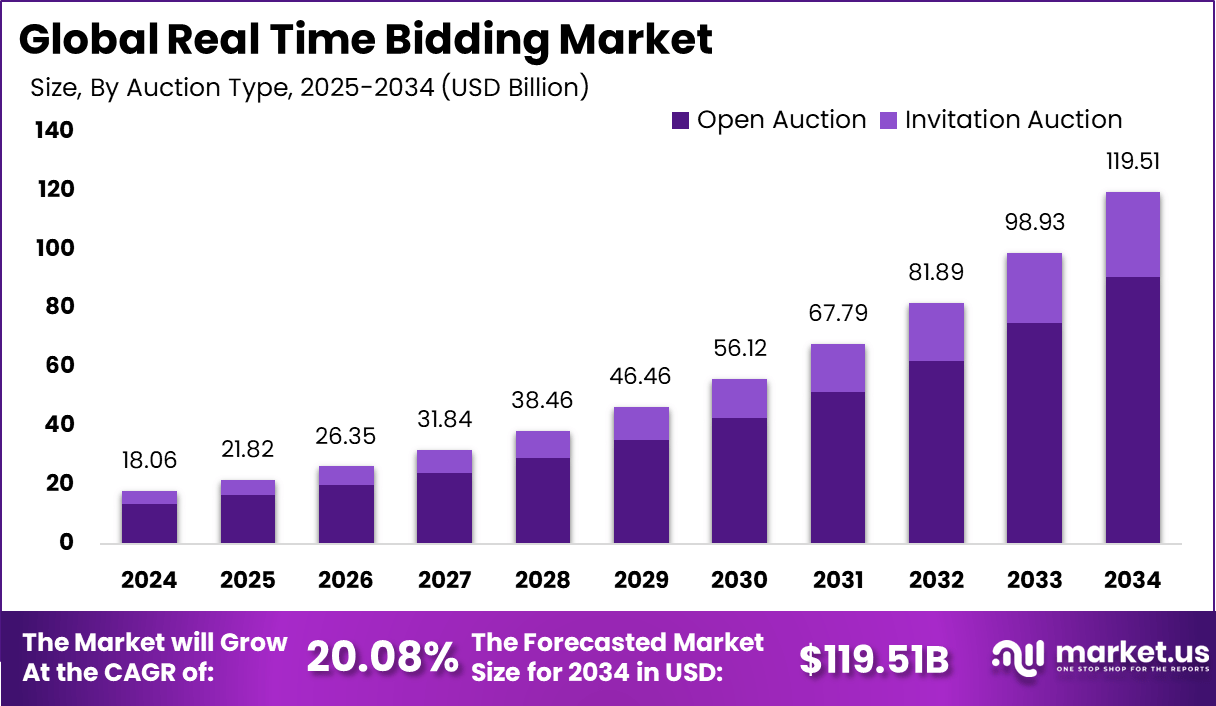

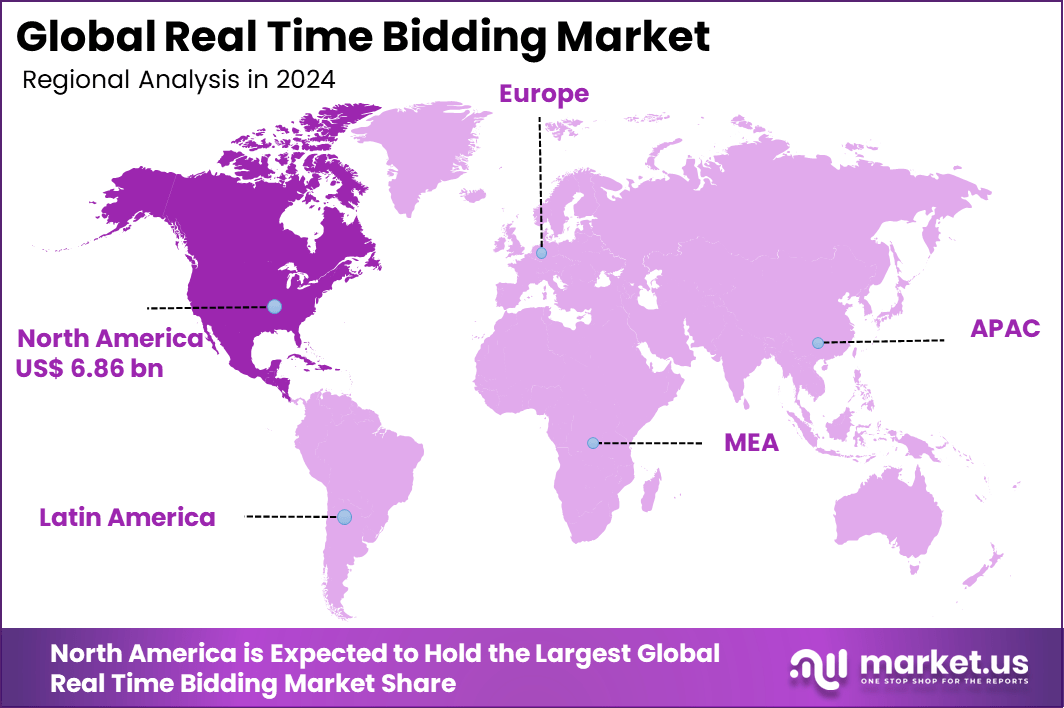

The Global Real-Time Bidding Market size is expected to be worth around USD 119.51 billion by 2034, from USD 18.06 billion in 2024, growing at a CAGR of 20.8% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 38% share, holding USD 6.86 billion in revenue.

The Real-Time Bidding (RTB) market revolves around a dynamic digital advertising technology that allows advertisers to buy and sell ad impressions through automated auctions that happen within milliseconds. When a user visits a website or app, an auction occurs in real time where marketers bid for the opportunity to display their ad to that specific user, based on data such as demographics, interests, and browsing behavior.

Key Takeaways

- By auction type, Open Auction dominated with a 76% share, reflecting its broad accessibility and widespread use among advertisers seeking large audience reach.

- Video advertising led by format with 58%, driven by rising demand for engaging, high-impact ad creatives across streaming platforms and social media.

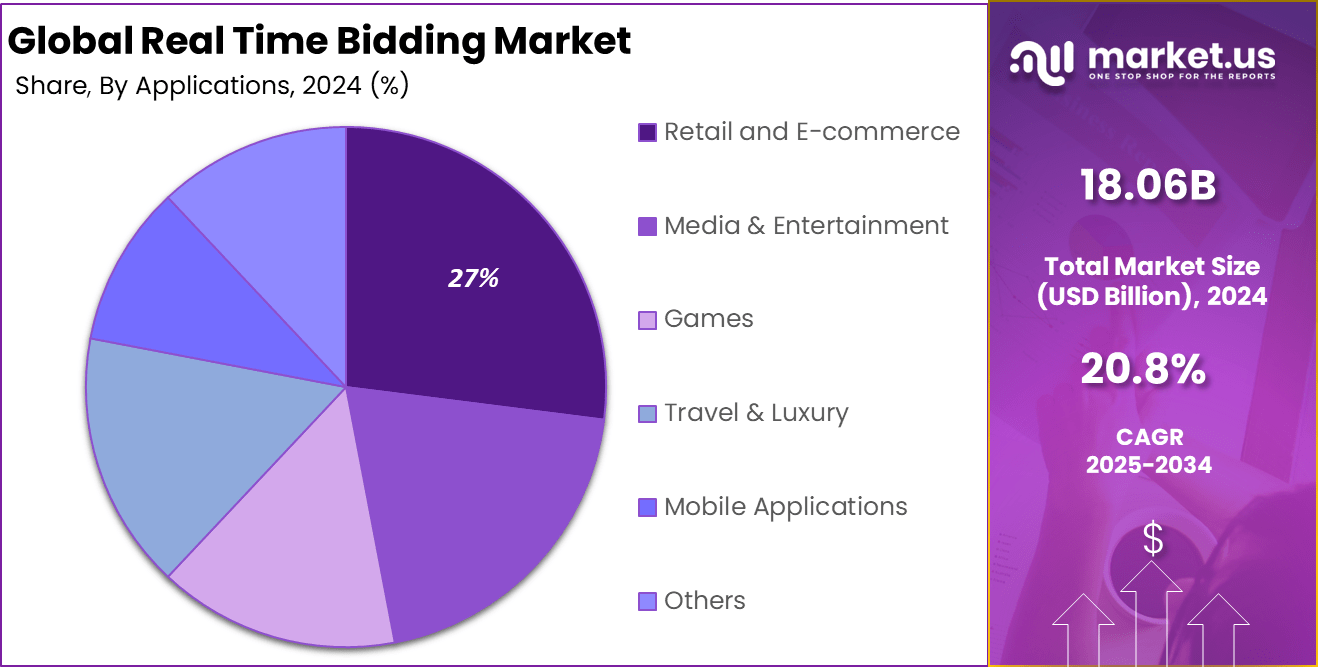

- The Retail & E-commerce sector accounted for 27% of RTB applications, leveraging targeted ads to boost conversions and customer acquisition.

- Mobile devices held a commanding 65% share, underscoring the dominance of mobile-first advertising strategies and in-app programmatic campaigns.

- North America captured 38% of the global market, supported by mature ad-tech ecosystems and high advertiser spend.

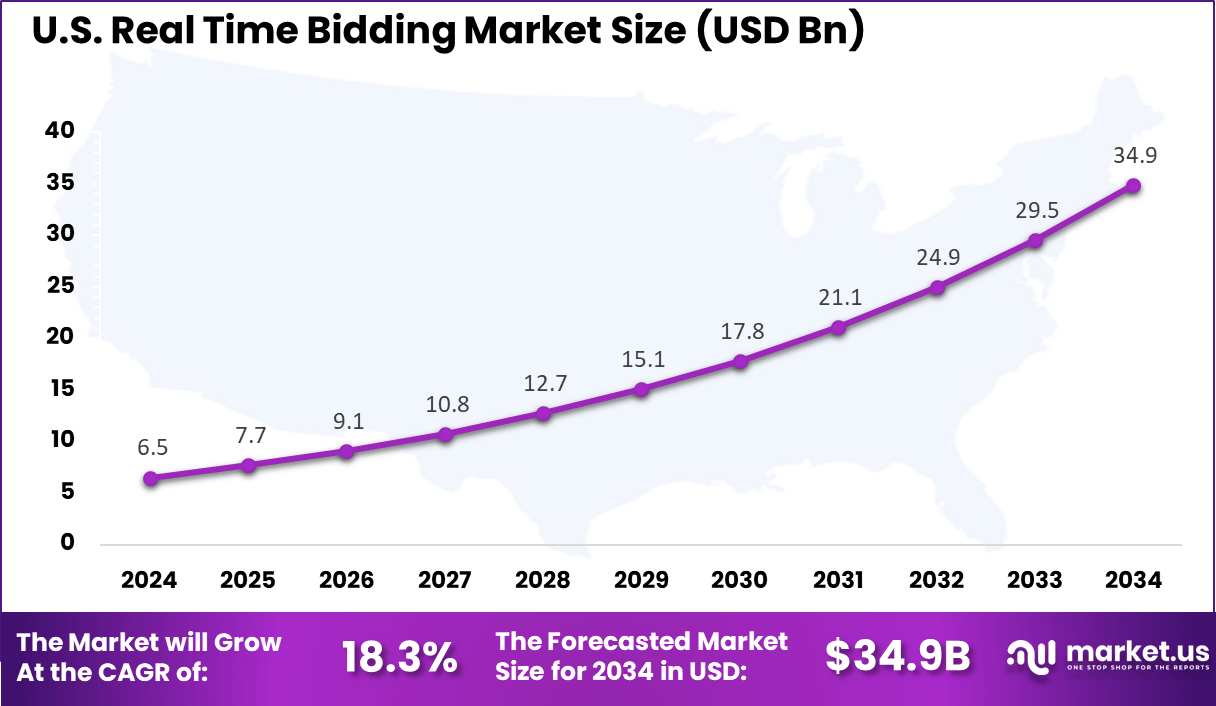

- The U.S. market was valued at USD 6.5 billion in 2024 and is expected to grow at a strong CAGR of 18.3%, driven by increasing adoption of AI-powered ad targeting and dynamic bidding strategies.

Market Size and Growth

Metric Statistic / Value Market Value (2024) USD 18.06 Bn Forecast Revenue (2034) USD 119.51 Bn CAGR(2025-2034) 20.08% Leading Segment By Auction Type: Open Auction : 76% The top driving factors behind the growth of the RTB market include the rising shift towards programmatic advertising, which enhances efficiency and reach. The widespread use of mobile devices and the increasing adoption of connected TVs (CTV) and video advertising have further accelerated demand. Advances in artificial intelligence and machine learning contribute significantly by optimizing bid strategies and improving campaign outcomes.

The increasing adoption of technologies like AI, machine learning, and programmatic platforms is a key reason for the rising prominence of RTB. These technologies enable automated decision-making that optimizes bids based on real-time data analysis, enhances fraud detection, and continuously improves user targeting accuracy. RTB integration with programmatic audio and connected TV widens reach and engagement while keeping campaign control.

For instance, in 2025, AWS showcased how Databricks on AWS is optimizing Real-Time Bidding (RTB) through advanced machine learning techniques, as detailed in a company blog. By leveraging Databricks’ unified analytics platform and AWS’s scalable infrastructure, advertisers can build and deploy predictive models that analyze massive volumes of bid request data in real-time. This integration enables dynamic bid pricing, improved audience segmentation, and better ad performance forecasting.

Analysts’ Viewpoint

The RTB market presents strong investment opportunities driven by rapid advertising digitization and the demand for advanced targeting solutions. Key growth areas include privacy-compliant technologies to meet regulatory demands, advanced analytics for better campaign measurement, and expansion into private marketplaces offering premium inventory. Innovations in video and mobile advertising powered by RTB are also attracting investor attention.

RTB delivers significant business benefits, including optimized ad spend by focusing only on relevant impressions, enhanced campaign results through precise targeting, and broad inventory access across platforms. Its automation capabilities streamline campaign management, enabling quick adaptation to market trends and user behaviors, which improves efficiency and return on investment.

The regulatory framework for RTB is evolving, with strict focus on data privacy and transparency. Laws such as GDPR and CCPA dictate how data can be collected and used in auctions. Addressing compliance requires investment in privacy-preserving technologies and transparent practices to ensure data security, user consent, and ethical data usage while maintaining consumer trust.

Role of AI in RTB Market

- AI and machine learning enhance RTB by improving bidding accuracy, campaign optimization, and real-time decision-making.

- Adaptive AI algorithms enable dynamic bid adjustments and predictive targeting, ensuring ads reach the most relevant audiences efficiently.

- AI supports fraud detection and prevention, helping maintain brand safety and transparency in a complex ecosystem.

- Integration of AI-driven features in platforms like Google Ads increases automation, measurement accuracy, and personalization.

- The evolution toward privacy-compliant advertising and first-party data usage leverages AI to balance targeting efficiency with regulatory requirements.

U.S. RTB Market Size

The market for Real-Time Bidding within the U.S. is growing tremendously and is currently valued at USD 6.5 billion, the market has a projected CAGR of 18.3%. The U.S. Real-Time Bidding (RTB) market is experiencing significant growth driven by the country’s high digital ad spend and advanced technological infrastructure.

Increased consumer engagement across mobile devices, Connected TV (CTV), and streaming platforms is prompting advertisers to adopt RTB for precise, real-time audience targeting. Furthermore, the presence of major programmatic advertising platforms and ongoing innovation in AI-powered bidding algorithms are accelerating market expansion, positioning the U.S. as a key hub for RTB development and adoption.

For instance, In April 2025, The New Stack published a guide showing U.S. developers how to build an RTB system with Next.js and Stream, detailing auctions, bid flows, and dynamic placements, and demonstrating that startups can create scalable programmatic solutions without large ad networks.

In 2024, North America held a dominant market position in the Global Real Time Bidding Market, capturing more than a 38% share, holding USD 6.86 billion in revenue. North America maintained a dominant position in the global real-time bidding (RTB) market, driven by its advanced digital infrastructure, high internet penetration, and substantial digital advertising expenditure.

This region benefits from early adoption of programmatic advertising, advanced use of AI and machine learning for personalized targeting, and widespread utilization of mobile, video, and connected TV (CTV) ad formats, which enhance RTB efficiency and targeting precision. Additionally, the presence of major programmatic advertising platforms encourages responsible data use and further consolidates North America’s leadership in the RTB landscape.

For instance, In July 2024, FIFA revamped its media rights for the expanded Club World Cup, introducing RTB on digital platforms in North America to tap into rising streaming audiences and targeted ad demand. This move enables brands to bid in real time for premium ad slots during live matches, strengthening RTB’s role in high-value sports content and boosting monetization opportunities for global events.

Auction Type Analysis

In 2024, the Open Auction segment held a dominant market position, capturing a 76% share of the Global Real Time Bidding Market. This dominance is attributed to its broad accessibility, allowing multiple advertisers to compete for inventory in a transparent, real-time environment.

Open Auctions offer cost efficiency and scale, making them attractive for advertisers seeking wide reach and competitive pricing. Additionally, the growing adoption of programmatic advertising and demand for flexible, real-time media buying solutions have further fueled the segment’s prominence.

For instance, In August 2021, IPONWEB adopted AWS Spot Instances to improve the cost efficiency of its RTB workloads. Using AWS’s scalable cloud architecture, the company dynamically managed compute resources to maintain low-latency bid processing while reducing operational costs, showcasing how AdTech platforms optimize infrastructure for high-frequency, data-intensive RTB operations.

Advertisement Format Analysis

In 2024, the Video segment held a dominant market position, capturing a 58% share of the Global Real Time Bidding Market. This demand is primarily driven by the increasing consumption of video content across digital platforms, especially on mobile devices and Connected TV (CTV).

Video ads deliver higher engagement and better recall compared to other formats, prompting advertisers to allocate more budget to video-based programmatic campaigns. Additionally, advancements in streaming technology and the growing preference for personalized, immersive ad experiences have significantly contributed to the segment’s growth.

For instance, In May 2025, Spotify expanded its programmatic advertising by integrating AI and RTB into its audio and video inventory. This enables real-time bidding with enhanced targeting through AI-driven audience segmentation and predictive analytics. Spotify also introduced Gen AI Ads, allowing advertisers to auto-generate scripts and voiceovers, streamlining creative production and campaign execution.

Application Analysis

In 2024, the Retail and E-commerce segment held a dominant market position, capturing a 27% share of the Global Real Time Bidding Market. This dominance is driven by the sector’s increasing reliance on digital channels to engage consumers with personalized offers and dynamic pricing in real time.

The surge in online shopping and omnichannel retail strategies has heightened the need for precise audience targeting and efficient ad spending, making RTB an essential tool for retailers to optimize customer acquisition and retention in a highly competitive landscape.

For instance, In April 2025, Criteo introduced an Onsite Video solution in its retail media mix, using RTB to power shoppable, in-context video ads on digital storefronts. Integrated with programmatic technology, it enables real-time auctions and precise targeting, engaging consumers at critical decision points. This reflects the shift toward immersive, commerce-focused advertising formats that leverage RTB’s agility to drive engagement and revenue.

Device Segment Analysis

In 2024, the mobile segment held a dominant market position, capturing a 65% share of the Global Real Time Bidding Market. This dominance is driven by the widespread adoption of smartphones and increasing mobile internet usage, which has transformed consumer behavior and media consumption patterns.

Mobile devices enable advertisers to deliver highly targeted, location-based, and contextually relevant ads through RTB, enhancing engagement and conversion rates. Additionally, the growth of mobile apps and mobile-first platforms further fuels the demand for programmatic mobile advertising.

For instance, In May 2025, mobile app developers in Tampa, Florida, adopted white-label RTB solutions to build independent ad networks and directly manage monetization strategies. This approach reduces reliance on third-party providers while increasing transparency, flexibility, and profitability, reflecting a growing trend in the programmatic advertising landscape.

Growth Factors

Key Factors Description Increasing Adoption of Programmatic Advertising Automated, data-driven ad placement growing preferred over traditional buying for efficiency and scale Expansion of Mobile and Video Advertising Rising video content consumption and mobile device usage fuel RTB demand across channels and formats Connected TV (CTV) Advertising Growth Major streaming platforms incorporate RTB for premium inventory, offering advertisers scale and precision Rise of E-commerce and Digital Consumerism Online shopping triggers greater advertising spend and dynamic ad placements via real-time auctions Advances in AI & Data Analytics AI-powered personalization, predictive analytics, and machine learning optimize targeting and budgeting Key Trends and Innovations

Trend/Innovation Description Increasing Contextual & Cookieless Targeting Responding to privacy regulations, advertisers focus on context-based ads combined with AI for effective reach First-Price Auctions and Header Bidding Shift from second-price to first-price auctions and server-side header bidding improves transparency and revenues Integration with Multi-Channel Marketing Unified auctions and cross-device targeting enhance campaign consistency on mobile, desktop, CTV, and DOOH AI and Machine Learning Enhancements Reinforcement learning, advanced predictive models, and real-time campaign tuning become standard features Emphasis on Brand Safety & Fraud Prevention Adoption of sophisticated AI tools to mitigate ad fraud, ensuring safer, more reliable advertising environments Key Market Segments

By Auction Type

- Open Auction

- Invitation Auction

By Advertisement Format

- Video

- Image

By Application

- Retail and E-commerce

- Media & Entertainment

- Games

- Travel & Luxury

- Mobile Applications

- Others

By Device

- Mobile

- Desktop

- Others

Drivers

Increasing Digital Ad Spend

A pronounced shift in marketing budgets from traditional media to digital advertisement underpins the growth of RTB. This trend is further accelerated by the expanding user base across mobile and connected devices, which is fueling increased investment in programmatic advertising and real-time bidding technologies.

The enhanced targeting capabilities and automation efficiencies of Real-Time Bidding are positioning it as a core mechanism for advertisers aiming to optimize reach and engagement in an increasingly digital-first environment.

According to the TAM AdEx Digital Advertising Report 2024, RTB made up 36% of India’s programmatic ad insertions, with mobile devices leading delivery at 71%, followed by desktops at 22%. E-commerce accounted for 22% of RTB usage, with media and entertainment close behind at 19%.

Restraint

Data privacy concerns and regulatory complexities

The RTB market faces challenges primarily rooted in data privacy concerns and regulatory complexities. The reduction in third-party cookies and stricter privacy regulations like GDPR and CCPA complicate user data collection and targeting accuracy, impacting advertiser confidence and operational practices.

Ad fraud remains a persistent issue, with fraudulent clicks, impressions, and invalid traffic leading to wasted advertising budgets and undermining trust in RTB platforms. Ensuring ad inventory quality and brand safety in a fast-moving auction environment also presents hurdles, as advertisers seek control over where their ads appear.

Additionally, high implementation costs for sophisticated RTB platforms, integration complexities with legacy systems, and the need for skilled personnel to manage real-time data-driven bidding processes can restrain adoption, especially among smaller players. Increased competition among RTB providers drives a need for continual innovation to maintain differentiation and profitability.

Opportunities

Cross-Device and Omnichannel Integration

Real-time bidding platforms that successfully integrate cross-device tracking and expand into omnichannel environments, including OTT (over-the-top), CTV (connected TV), and audio advertising, can offer advertisers a unified and comprehensive view of consumer engagement. This integration enables holistic campaign management and improved attribution, thereby enhancing return on investment and driving more effective media spending across diverse digital touchpoints.

For instance, in June 2024, Madhive, a leading technology provider for local Connected TV (CTV) advertising, announced the acquisition of Frequence, a platform specializing in omnichannel advertising automation, as reported by Business Wire.

This strategic move enables Madhive to integrate Real-Time Bidding (RTB) capabilities across a broader range of media channels, delivering full-service, end-to-end advertising solutions to enterprise and agency clients. The combined offering enhances local media market access, enabling more precise audience targeting and campaign optimization through unified, programmatic infrastructure.

Challenges

Persistent Ad Fraud

Despite advances in fraud detection and verification technologies, ad fraud remains a persistent and costly issue within the real-time bidding ecosystem. Malicious activities such as fraudulent traffic, bot-driven impressions, and invalid clicks erode advertiser budgets, with billions lost annually.

Combatting this requires a continued adoption of industry standards and transparency tools like ads.txt and sellers.json, aimed at validating inventory quality and ensuring that only legitimate ad impressions are transacted. Maintaining trust and inventory integrity remains a critical challenge for the long-term sustainability of real-time bidding markets.

For instance, in April 2025, a recent analysis by MarTech Cube sheds light on the growing challenge of mobile ad fraud within the MarTech industry, particularly in environments driven by Real-Time Bidding (RTB). The report highlights that fraudsters exploit RTB’s automated and rapid-fire nature to deploy tactics such as spoofed traffic, click injection, and app install fraud, significantly inflating marketing costs and undermining campaign integrity.

Regional Highlights: A Global Perspective

APAC Real Time Bidding Market Trends

The Asia Pacific region is emerging as the fastest-growing market for real-time bidding (RTB), driven by massive smartphone penetration, expanding digital advertising budgets, and a booming e-commerce sector. Countries like China, India, and Southeast Asia are at the forefront, with advertisers leveraging mobile-first strategies and programmatic advertising to reach large, digitally savvy audiences.

Europe Real Time Bidding Market Trends

Europe holds a significant share of the global RTB market and is characterized by steady growth marked by strong emphasis on user privacy and data compliance, especially under GDPR regulations. The market here is evolving with a focus on precision targeting, transparency, and mobile-first advertising strategies. Advertisers increasingly adopt RTB to enhance campaign effectiveness while adhering to strict data protection laws.

Latin America Real Time Bidding Market Trends

Latin America is gaining momentum in the RTB space, with key markets such as Brazil and Mexico leading adoption. The region’s rising internet penetration and mobile commerce activities are boosting the digital advertising ecosystem. Data-driven advertising is increasingly embraced, helping marketers optimize real-time ad placements and audience targeting. Latin America, though still emerging, offers strong RTB growth potential as digital infrastructure expands and brand investment in programmatic rises.

Middle East & Africa Real Time Bidding Market Trends

The Middle East and Africa region is witnessing dynamic changes in the RTB market with increasing investments in digital infrastructure and programmatic advertising solutions. The rise in social media usage and mobile content consumption is creating fertile ground for real-time bidding expansion. Advertisers in this region are becoming more tech-savvy, adopting data-driven approaches to improve ad efficiency and targeting precision.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading technology companies such as Adobe Inc., Google LLC, and Facebook Inc. play a significant role in shaping the Real Time Bidding (RTB) market. Their advanced programmatic advertising platforms, extensive data ecosystems, and AI-driven targeting capabilities enable advertisers to achieve higher precision and ROI.

Prominent demand-side and supply-side platform providers, including AppNexus Inc., Criteo SA, and MediaMath, Inc., are instrumental in facilitating automated, data-driven ad transactions. These companies focus on improving transparency, fraud prevention, and cross-device targeting to optimize advertiser spending. Their partnerships with publishers, agencies, and data providers strengthen their market presence.

Specialized ad tech firms such as PubMatic, Inc., The Rubicon Project, Inc., and Smaato, Inc. contribute to expanding RTB adoption across mobile, video, and in-app advertising. They emphasize efficient monetization strategies, real-time inventory optimization, and robust programmatic infrastructure for publishers.

Top Key Players in the Market

- Adobe Inc.

- AppNexus Inc.

- Criteo SA

- Facebook Inc.

- Google LLC

- Match2One AB

- MediaMath, Inc.

- MoPub/ Twitter, Inc.

- PubMatic, Inc.

- Salesforce.com, inc.

- Smaato, Inc.

- The Rubicon Project, Inc.

- Verizon Media

- WPP plc

- Yandex Europe AG

- Others

Recent Developments

- In January 2025, Disney integrated RTB into its live sports advertising inventory through partnerships with Google, The Trade Desk, and Yahoo, enabling real-time bidding for premium ad slots on ESPN+ and other streaming platforms. This allows advertisers to achieve precise targeting and optimized reach during live broadcasts.

- In May 2025, mobile app developers embraced white-label RTB solutions to take direct control of their programmatic infrastructure, customizing demand sources, pricing, and data usage. This shift enhances yield, transparency, and alignment between ad delivery and user experience objectives.

- In April 2024, SpotX enhanced its server-to-server bidding product, enabling media owners to integrate yield management strategies with third-party header bidders. The upgraded suite, built on SpotX’s cloud-based ad serving technology, now offers both server-side and client-side header bidding capabilities.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Auction Type (Open Auction, Invitation Auction), By Advertisement Format (Video, Image), By Application (Media & Entertainment, Retail and E-commerce, Games, Travel & Luxury, Mobile Applications, Others), By Device(Mobile, Desktop, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Adobe Inc., AppNexus Inc., Criteo SA, Facebook Inc., Google LLC, Match2One AB, MediaMath, Inc., MoPub/ Twitter, Inc., PubMatic, Inc., Salesforce.com, inc., Smaato, Inc., The Rubicon Project, Inc., Verizon Media, WPP plc, Yandex Europe AG, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Real Time Bidding MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Real Time Bidding MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Adobe Inc.

- AppNexus Inc.

- Criteo SA

- Facebook Inc.

- Google LLC

- Match2One AB

- MediaMath, Inc.

- MoPub/ Twitter, Inc.

- PubMatic, Inc.

- Salesforce.com, inc.

- Smaato, Inc.

- The Rubicon Project, Inc.

- Verizon Media

- WPP plc

- Yandex Europe AG

- Others