Global Ranch Feeding Truck Market Size, Share, Growth Analysis By Type (Artificial Driving, Autonomous Driving, Others), By Feed Capacity (Small Scale (Under 5 tons), Medium Scale (5-15 tons), Large Scale (Above 15 tons), Others), By Application (Dairy Cattle Farm, Beef Cattle Farms, Mixed Livestock Operations, Sheep Farms, Others), By End-User (Large Dairy Operations, Commercial Ranches, Agricultural Cooperatives, Family Farms, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 164659

- Number of Pages: 210

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

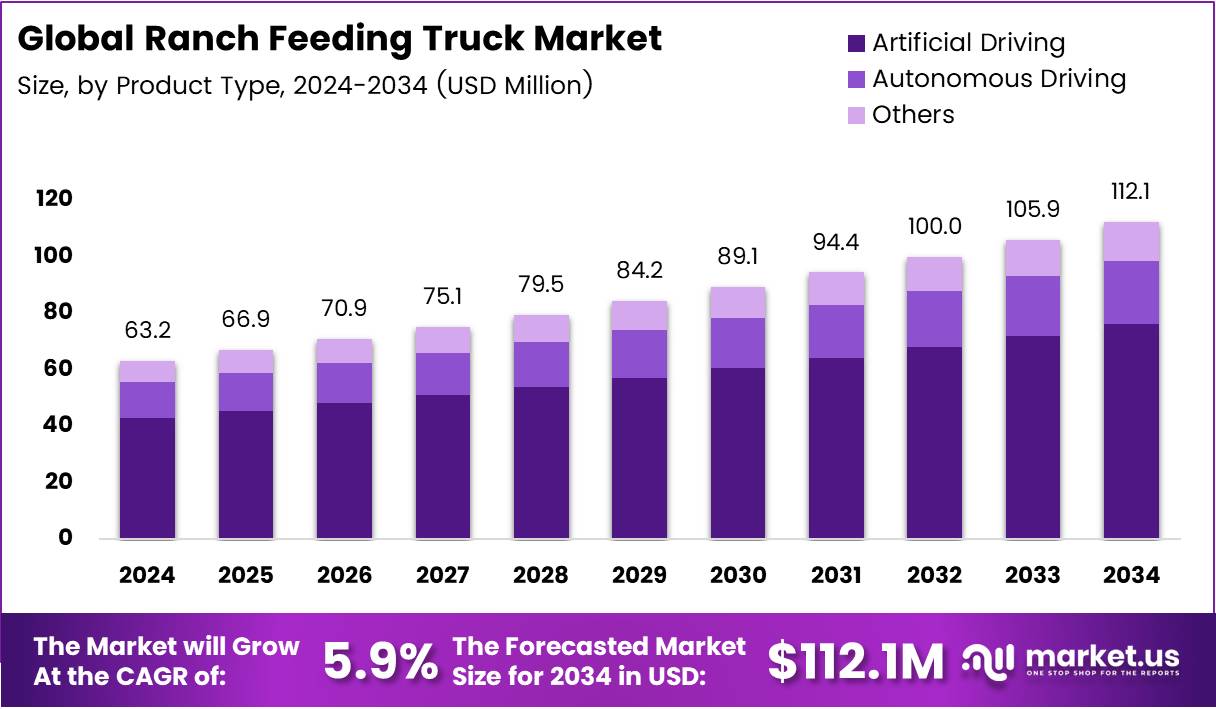

The Global Ranch Feeding Truck Market size is expected to be worth around USD 112.1 Million by 2034, from USD 63.2 Million in 2024, growing at a CAGR of 5.9% during the forecast period from 2025 to 2034.

Ranch feeding trucks are specialized equipment designed to deliver feed efficiently across large farmland and livestock ranches. These trucks help ranchers streamline feed distribution, reduce labor time, and improve cattle nutrition consistency. They integrate durable loading systems and controlled dispensing mechanisms, supporting daily ranch operations and ensuring steady livestock health outcomes.

The product reflects rising adoption of mechanized livestock management. Ranchers increasingly seek solutions that optimize feed usage and reduce manual workload. Moreover, technology upgrades such as automated auger controls and improved feed mixing enhance operational reliability. Therefore, product development focuses on durability, ease of maintenance, and adaptability to varied ranch conditions.

The Ranch Feeding Truck Market demonstrates gradual expansion supported by livestock farming stability. The market benefits from ongoing replacement demand and the shift from manual feeding to mechanized systems. Additionally, moderate price sensitivity encourages manufacturers to provide customizable configurations. This fosters broader market acceptance across small and medium ranch operators.

The market’s growth is driven by rising focus on livestock productivity and efficient feed utilization. Increasing demand for high-quality meat and dairy products encourages ranches to enhance feeding accuracy. Further, expansions in grazing land operations support equipment purchases. Therefore, ranch feeding trucks align with broader livestock modernization trends and practical operational improvements.

Opportunities emerge with digital monitoring systems and telematics integration, allowing ranchers to track feed usage and truck performance. Government support programs for agricultural mechanization strengthen procurement incentives. Environmental regulations encouraging controlled feed distribution also facilitate structured feeding operations. As a result, the market experiences steady technological progress and stronger value-added service adoption.

According to U.S. Department of Agriculture (USDA), the U.S. cattle and calves population reached 87.2 million head (Jan 1, 2024), indicating a core demand base requiring reliable feeding equipment. Meanwhile, Agriculture and Agri-Food Canada reported 10.9 million head (Jan 1, 2025), reflecting stable demand across Canada. These livestock volumes reinforce a consistent market foundation for ranch feeding trucks across North America.

Key Takeaways

- The Global Ranch Feeding Truck Market is valued at USD 63.2 Million (2024) and is projected to reach USD 112.1 Million by 2034 at a 5.9% CAGR.

- Artificial Driving dominates the market By Type segment with a share of 67.9%.

- Medium Scale (5–15 tons) leads the By Feed Capacity segment with 48.4% market share.

- Dairy Cattle Farms hold the highest share in By Application with 46.2%.

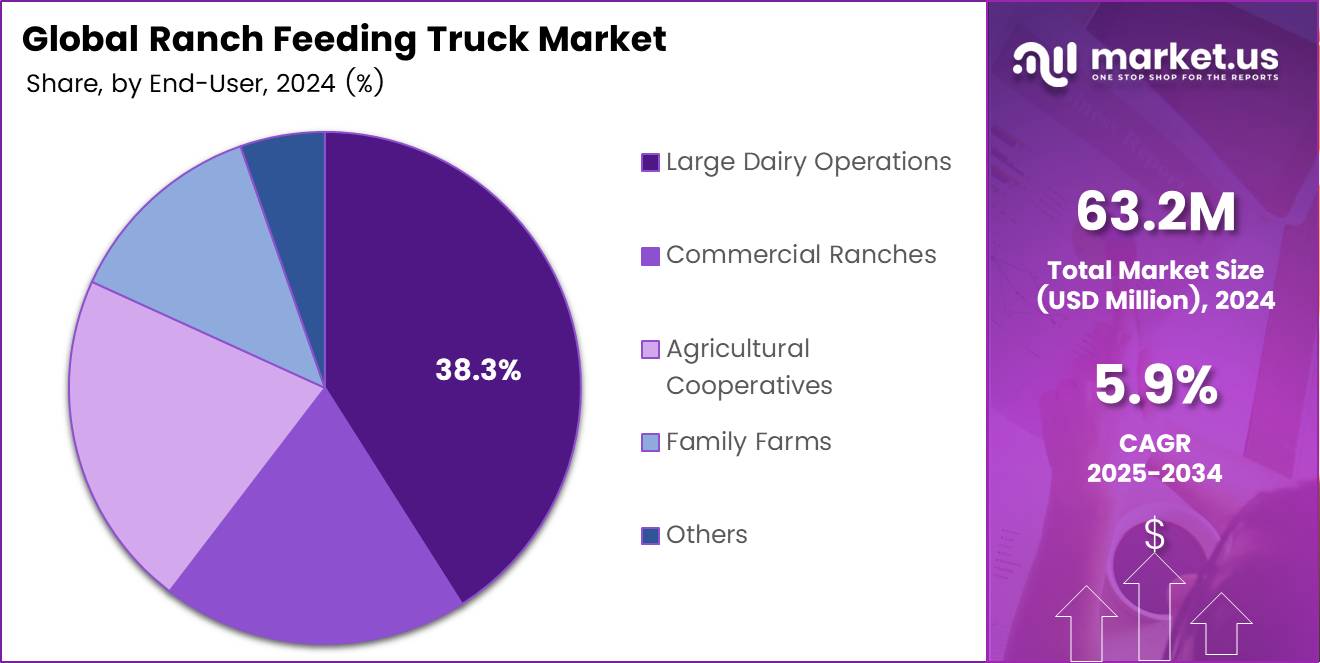

- Large Dairy Operations account for the largest share in By End-User at 38.3%.

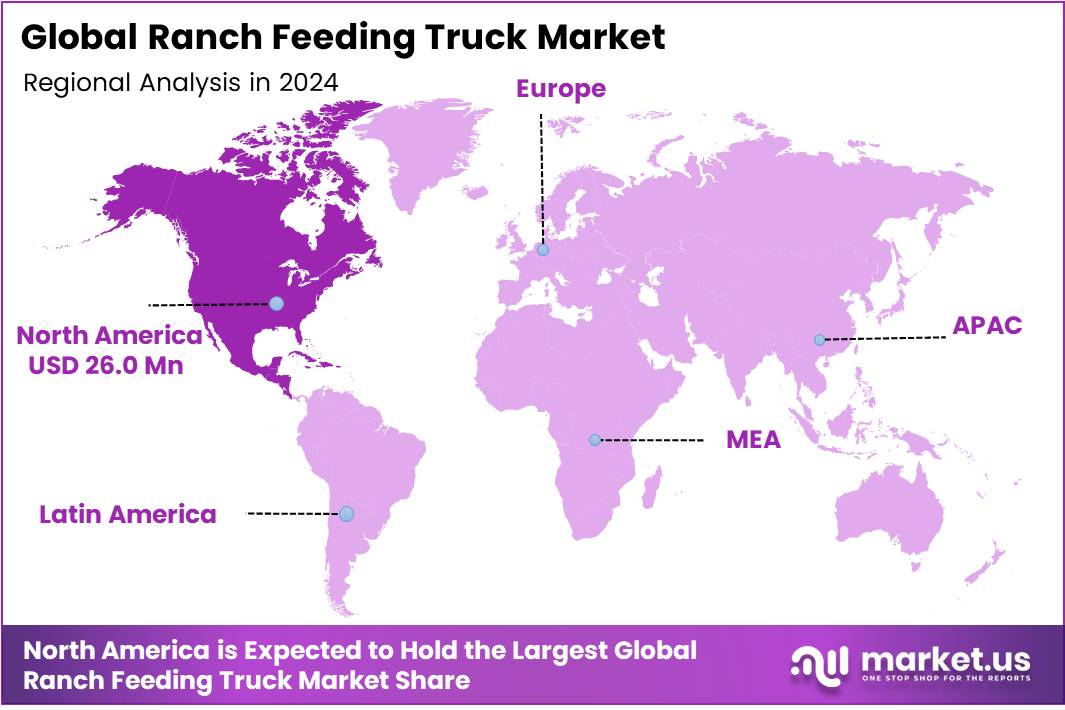

- North America leads regionally with a 41.2% market share valued at USD 26.0 Million.

By Type Analysis

Artificial Driving dominates with 67.9% due to its reliability and cost-efficiency.

In 2024, Artificial Driving held a dominant market position in the By Type segment of the Ranch Feeding Truck Market, with a 67.9% share. This segment benefits from dependable driver control, easier maintenance, and compatibility with conventional feeding routines, making it widely preferred, especially in mid to large ranch setups.

Autonomous Driving is steadily emerging as an advanced alternative with its promise of labor efficiency and precision feeding. Adoption is rising in technologically progressive ranches. However, its higher initial investment, need for skilled handling, and limited awareness among smaller farm operators slow its broader market penetration.

The Others segment includes hybrid or customized operational models used in niche ranch conditions. These solutions are selected when ranches require unique performance parameters. Although this segment has a smaller share, specific ranch owners adopt it for flexibility in handling varied feed distribution environments.

By Feed Capacity Analysis

Medium Scale (5-15 tons) dominates with 48.4% due to balanced efficiency and cost.

In 2024, Medium Scale (5-15 tons) held a dominant market position in the By Feed Capacity segment of the Ranch Feeding Truck Market, with a 48.4% share. This capacity range suits most mid-size ranches, offering efficiency, moderate operating costs, and adaptability across diverse livestock feeding systems.

Small Scale (Under 5 tons) trucks are preferred in small family farms and compact ranches. Their lower purchase and running costs support operations with limited feeding demand. Although they lack the efficiency required for large herds, they remain essential for cost-conscious and local-scale livestock feeding.

Large Scale (Above 15 tons) trucks are used mainly in industrial-level ranching environments. They deliver high-volume feeding efficiency suitable for large herd operations. However, higher operating costs and increased maintenance needs restrict adoption to well-funded ranch owners or cooperative ranch networks.

The Others category includes customized or modified feed capacities designed for specific operational environments. These trucks serve unique feeding workflows that don’t fit standard models. They remain a smaller market segment but meet specialized ranch requirements effectively.

By Application Analysis

Dairy Cattle Farm dominates with 46.2% due to consistent feeding needs and herd size.

In 2024, Dairy Cattle Farm held a dominant market position in the By Application segment of the Ranch Feeding Truck Market, with a 46.2% share. These farms require precise and frequent feeding cycles, making feeding trucks essential for improving milk productivity and herd health consistency.

Beef Cattle Farms use feeding trucks to support controlled weight gain and growth. The demand comes from operations focusing on market-ready cattle conditioning. While not as frequent as dairy feeding cycles, efficiency in feed delivery remains important, increasing adoption gradually.

Mixed Livestock Operations integrate cattle, sheep, or other animals, requiring adaptable feeding systems. Feeding trucks support flexible feeding cycles and varied feed composition, enhancing labor efficiency. Adoption continues to grow where diverse livestock management practices are expanding.

Sheep Farms generally have smaller feed distribution requirements. However, larger-scale sheep ranches adopt feeding trucks for streamlined feed handling. Their growth is steady but more limited compared to cattle-based operations.

The Others category serves specialized livestock environments where feeding needs vary. While smaller, this segment supports customized feeding solutions.

By End-User Analysis

Large Dairy Operations dominate with 38.3% due to high-volume feeding efficiency.

In 2024, Large Dairy Operations held a dominant market position in the By End-User segment of the Ranch Feeding Truck Market, with a 38.3% share. These operations manage sizeable herds, requiring efficient and consistent feeding schedules that feeding trucks handle effectively, reducing labor and improving herd nutrition balance.

Commercial Ranches adopt feeding trucks to streamline operations, minimize feed wastage, and maintain uniform feeding standards. These ranches often expand herd count, increasing reliance on mechanized feeding systems. Their adoption is closely tied to productivity optimization goals.

Agricultural Cooperatives use shared feeding truck resources to support community-based livestock operations. This approach reduces ownership costs while improving feeding efficiency across multiple member farms. Adoption is increasing in regions where cooperative farming is encouraged.

Family Farms adopt feeding trucks at a smaller scale, primarily when herd sizes expand beyond manual feeding capacity. Although adoption depends on budget considerations, awareness and affordability improvements are gradually supporting growth in this segment.

The Others end-user group includes research-based ranches and specialty livestock breeders. Their feeding truck use remains limited but essential where precision feed control is necessary.

Key Market Segments

By Type

- Artificial Driving

- Autonomous Driving

- Others

By Feed Capacity

- Small Scale (Under 5 tons)

- Medium Scale (5-15 tons)

- Large Scale (Above 15 tons)

- Others

By Application

- Dairy Cattle Farm

- Beef Cattle Farms

- Mixed Livestock Operations

- Sheep Farms

- Others

By End-User

- Large Dairy Operations

- Commercial Ranches

- Agricultural Cooperatives

- Family Farms

- Others

Drivers

Rising Need for Efficient Livestock Feeding Operations Drives Market Growth

The market for ranch feeding trucks is growing as livestock farms aim to improve feeding efficiency and reduce manual labor. Large herds require consistent and timely feeding, and trucks help distribute feed evenly across wide ranch areas, reducing wastage and ensuring healthier livestock management practices.

The expansion of large-scale cattle and dairy farms further supports demand. As ranch sizes grow, the workload increases, making manual feeding impractical. Feeding trucks enable organized routines, which help maintain animal weight, milk production, and overall productivity across commercial farming operations.

Mechanized feeding systems are increasingly preferred because they lower dependency on physical labor. Many regions face labor shortages, so automated systems like feeding trucks help maintain operational continuity while cutting long-term labor expenses.

Additionally, there is a growing awareness of maintaining nutritional consistency in livestock diets. Feeding trucks offer controlled distribution, enabling farmers to measure and deliver accurate feed portions. This ensures better herd health outcomes and improved farm profitability.

Restraints

Limited Availability of Skilled Operators in Rural Regions Restrains Market Adoption

One of the main restraints for this market is the shortage of trained operators in rural and ranching regions. Feeding trucks require proper handling and maintenance knowledge, and the lack of workforce familiarity slows adoption among ranch owners.

Fuel price fluctuations also pose challenges. Since these trucks require frequent use across large ranch fields, rising fuel costs significantly increase operating expenses. This may discourage cost-sensitive ranchers from investing in these systems.

Additionally, modernization rates among small and mid-sized ranchers remain slow. Many smaller livestock farmers still rely on traditional feeding methods and may view mechanized feeding trucks as high-cost investments.

Limited financial access and low awareness about long-term efficiency benefits further reduce adoption rates in less-developed ranching areas, creating a gap between large industrial farms and smaller, family-run ranch operations.

Growth Factors

Development of Solar and Hybrid-Powered Feeding Truck Models Creates New Market Opportunities

The introduction of solar and hybrid-powered feeding trucks offers strong growth potential, especially in regions where fuel costs are high. These solutions reduce long-term operating expenses and support sustainable livestock management practices.

Emerging livestock markets in Latin America and Africa present significant expansion potential. Increasing commercial ranching activities in these regions create demand for reliable, efficient feeding equipment to support herd growth.

Integrating smart sensors and automated measurement tools into feeding trucks offers another major opportunity. These technologies help track feed levels, measure consumption patterns, and prevent nutrient imbalances in herds.

Manufacturers also have opportunities to offer customization options based on feed type, animal diet, and ranch size. Flexible capacity and design features can help serve diverse livestock categories, from beef and dairy cattle to sheep and goats.

Emerging Trends

Adoption of GPS-Based Fleet Management for Precision Feeding Routes is a Key Market Trend

Ranch operators are increasingly using GPS-based fleet management systems to optimize feeding routes. This ensures timely feed delivery and reduces unnecessary fuel consumption. Precision route planning is particularly useful for large open-range ranches.

There is also rising demand for stainless steel and corrosion-resistant feed tanks. These materials extend equipment life by resisting weather damage and feed-induced corrosion, reducing long-term maintenance costs.

Mobile feeding solutions are gaining popularity as ranches move toward open-range and pasture-based systems. Trucks that can travel long distances and operate on rough terrain are becoming essential for dispersed livestock herds.

Additionally, real-time data analytics tools are being adopted to analyze feed efficiency and livestock nutrition. Data-driven decision-making helps improve herd health outcomes, lower feed waste, and increase ranch profitability.

Regional Analysis

North America Dominates the Ranch Feeding Truck Market with a Market Share of 41.2%, Valued at USD 26.0 Million

North America holds the leading position in the ranch feeding truck market, accounting for a significant share of 41.2% and reaching a valuation of USD 26.0 Million. The region benefits from extensive cattle farming activities, large-scale ranch operations, and strong adoption of mechanized feeding to enhance efficiency. Additionally, increasing focus on operational cost reduction and labor optimization further supports the growing demand for specialized feeding equipment across North American ranches.

Europe Ranch Feeding Truck Market Trends

Europe shows steady growth due to rising emphasis on animal health management and farm automation. The region benefits from well-established livestock industries and supportive regulatory frameworks encouraging advanced feeding practices. Modernization of agricultural fleets and interest in sustainability also drive increased adoption of automated ranch feeding solutions across European countries.

Asia Pacific Ranch Feeding Truck Market Trends

Asia Pacific is witnessing rapid growth driven by expanding livestock populations and increasing commercialization of cattle farming. Countries in the region are gradually shifting from manual feeding methods to mechanized solutions to improve efficiency and productivity. Growing investments in agricultural modernization and government support for rural development are further accelerating market uptake.

Middle East and Africa Ranch Feeding Truck Market Trends

The Middle East and Africa market is evolving as ranching practices expand, particularly in regions focusing on beef and dairy production. The need to maintain herd nutrition in arid environments supports interest in efficient feeding systems. While market penetration remains developing, increasing awareness of mechanized agricultural tools presents significant long-term potential.

Latin America Ranch Feeding Truck Market Trends

Latin America benefits from a strong cattle ranching tradition, particularly in countries with large grazing lands. Adoption of ranch feeding trucks is rising as producers aim to improve feed distribution efficiency and animal growth performance. Economic growth and improvements in agricultural infrastructure are expected to further stimulate demand in the region.

United States Ranch Feeding Truck Market Trends

Within North America, the United States represents a major contributor to market expansion due to its extensive commercial ranching operations. Producers are increasingly investing in automated feeding trucks to reduce labor dependency and enhance feeding consistency. Technological advancements and innovation in feed handling equipment continue to support market growth in the U.S.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Ranch Feeding Truck Company Insights

SmoothAg is positioned as a North American innovator, pushing autonomy and telematics into ranch feeding trucks to cut labor and feed wastage. In 2024, its strategy emphasizes retrofit-ready sensor kits and software subscriptions, enabling mixed fleets to gain route optimization without full vehicle replacement; this plays well with ranchers seeking ROI within 18–24 months amid tight operating margins.

Laird Manufacturing leverages deep dealer networks and rugged, serviceable designs to defend share in the mid- to heavy-capacity segment. Its differentiation rests on uptime economics—robust mixers, straightforward hydraulics, and parts availability—appealing to large feed operations that prioritize predictable TCO over bleeding-edge autonomy, while still piloting selective automation to future-proof the lineup.

Beijing UISEE brings an autonomy-first thesis, using vision and LiDAR stacks to target highly repeatable feeding routes. In 2024, the company’s value proposition is labor displacement and precision delivery, with pilots on battery-electric platforms where charging is practical; export growth depends on regulatory alignment and local integration partners to navigate data governance and safety validation.

Shandong Yimeite competes through cost-effective, durable trucks aimed at value-oriented buyers in Asia and emerging markets. Its 2024 playbook blends incremental automation (assisted navigation, weigh-scale telemetry) with modular options—allowing customers to step up capabilities as herd sizes grow—while focusing on local content and financing to reduce acquisition barriers and accelerate fleet upgrades.

Top Key Players in the Market

- SmoothAg

- Laird Manufacturing

- Beijing UISEE

- Shandong Yimeite

- DK INFUSETEK

- Nanjing Runze Fluid Control Equipment

- KUHN SAS

- Dichbio Agricultural

- Lead Agricultural Equipment

- Automated Feeding Solutions

Recent Developments

- In March 2024, GEA Group Aktiengesellschaft acquired CattleEye Ltd. to integrate an AI-based monitoring system for body-condition scoring and lameness detection in dairy cattle. This acquisition strengthened GEA’s digital livestock management portfolio by enhancing precision feeding and welfare monitoring capabilities.

- In August 2024, AGCO Corporation introduced new farmer-focused solutions, including a fully equipped mobile on-farm service truck, at the 2024 Farm Progress Show. This launch highlighted AGCO’s continued focus on improving field service accessibility and reducing machinery downtime for livestock and crop producers.

- In February 2025, Forge Industries re-launched under its new ownership and strategic branding direction, signaling expansion into truck-mounted feed mixer wagons and automated feeding equipment. The re-branding positioned the company to serve broader livestock nutrition and mechanized feeding markets.

- In March 2025, the automated feeding vehicle called V1 Ranch Rover was showcased in a Texas case study, demonstrating robotic feeding operations for livestock herds. This system showed potential to reduce manual labor demands and enhance consistency in daily ranch feeding practices.

Report Scope

Report Features Description Market Value (2024) USD 63.2 Million Forecast Revenue (2034) USD 112.1 Million CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Artificial Driving, Autonomous Driving, Others), By Feed Capacity (Small Scale (Under 5 tons), Medium Scale (5-15 tons), Large Scale (Above 15 tons), Others), By Application (Dairy Cattle Farm, Beef Cattle Farms, Mixed Livestock Operations, Sheep Farms, Others), By End-User (Large Dairy Operations, Commercial Ranches, Agricultural Cooperatives, Family Farms, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape SmoothAg, Laird Manufacturing, Beijing UISEE, Shandong Yimeite, DK INFUSETEK, Nanjing Runze Fluid Control Equipment, KUHN SAS, Dichbio Agricultural, Lead Agricultural Equipment, Automated Feeding Solutions Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- SmoothAg

- Laird Manufacturing

- Beijing UISEE

- Shandong Yimeite

- DK INFUSETEK

- Nanjing Runze Fluid Control Equipment

- KUHN SAS

- Dichbio Agricultural

- Lead Agricultural Equipment

- Automated Feeding Solutions