Global Racing Drone Market By Component (Batteries/ FPV goggles, Cameras/sensors, Propellers/motors, Others), By Drone Type (ARF and RTF), By Application(Rotorcross, Drag racing, Time trial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb. 2024

- Report ID: 114466

- Number of Pages: 232

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

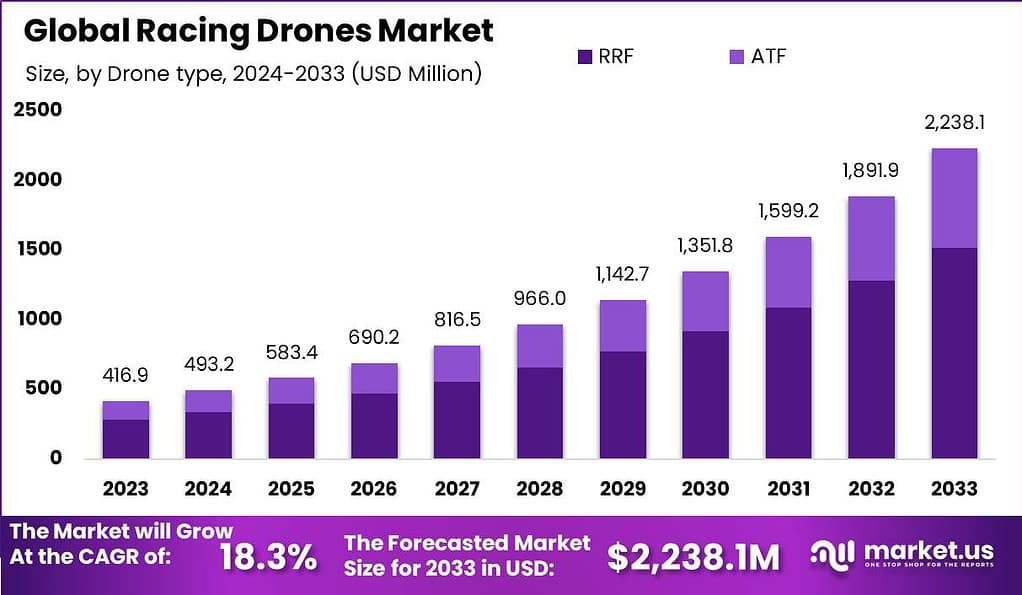

The Global Racing Drone Market size is expected to be worth around USD 2,238.1 Million by 2033, from USD 416.9 Million in 2023, growing at a CAGR of 18.3% during the forecast period from 2024 to 2033.

A racing drone, also known as a FPV (First Person View) drone, is a high-performance unmanned aerial vehicle designed specifically for competitive racing events. These drones are built to be fast, agile, and capable of performing intricate maneuvers at high speeds. They are equipped with powerful motors, lightweight frames, and advanced flight controllers to provide optimal control and responsiveness.

The racing drone market has experienced significant growth and popularity in recent years. The rise of drone technology and the increasing accessibility of FPV racing has fueled the demand for racing drones among enthusiasts and professional racers alike. The sport of drone racing has gained a dedicated following, with organized competitions and leagues taking place around the world.

Analyst Viewpoint

One of the primary driving factors is the increasing interest and participation in drone racing as a sport. The exhilarating nature of high-speed aerial racing combined with the immersive first-person view experience has captivated enthusiasts and spectators alike. As the popularity of drone racing continues to rise, it creates a demand for racing drones and related products. Investment in drone companies, including racing drone manufacturers, reached USD 1.54 billion in 2022, showcasing active investor interest.

Furthermore, the racing drone market presents various opportunities for businesses and entrepreneurs. Manufacturers of racing drones have the chance to capitalize on the growing demand by introducing new and advanced models that cater to different skill levels and racing preferences. Additionally, the market for aftermarket parts and accessories is thriving, providing opportunities for companies specializing in components like motors, propellers, batteries, and camera systems.

The professional racing drone sector offers unique opportunities for sponsorship, advertising, and brand partnerships. With the rise of professional racing leagues and events, there is potential for companies to align themselves with the sport and reach a targeted audience of engaged enthusiasts. This includes opportunities for technology companies, entertainment industry players, and sports brands to leverage the growing popularity of drone racing as a marketing platform.

Key Takeaways

- Growth Projection: The racing drone market is expected to grow significantly, with a projected worth of USD 2,238.1 million by 2033, indicating a robust Compound Annual Growth Rate (CAGR) of 18.3% from 2024 to 2033.

- Investment Trends: Investment in drone companies, including manufacturers of racing drones, reached USD 1.54 billion in 2022, reflecting active investor interest in the industry.

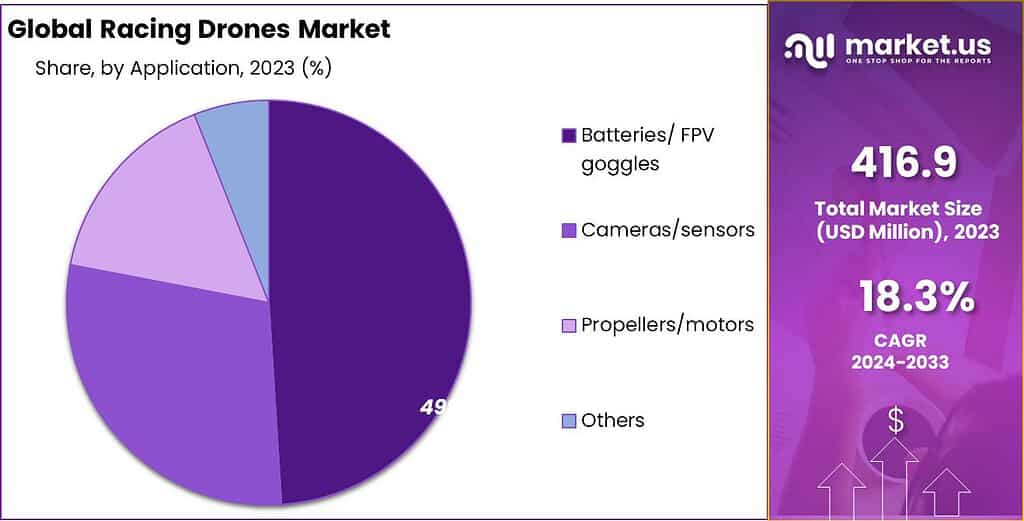

- Component Analysis: The Batteries/FPV goggles segment emerged as the dominant player in the racing drone market in 2023, capturing over 49% market share. This dominance is fueled by advancements in battery technology and the increasing adoption of FPV goggles among racing enthusiasts.

- Drone Type Analysis: Ready-to-Fly (RTF) drones held a dominant market position in 2023, capturing over 68% share. Their ease of use and consumer-friendly nature contribute to their popularity among novice pilots and seasoned enthusiasts.

- Application Analysis: Rotorcross emerged as the dominant application segment in 2023, capturing over 43% market share. The rising popularity of Rotorcross competitions is driving demand for advanced racing drones capable of navigating complex courses with agility and precision.

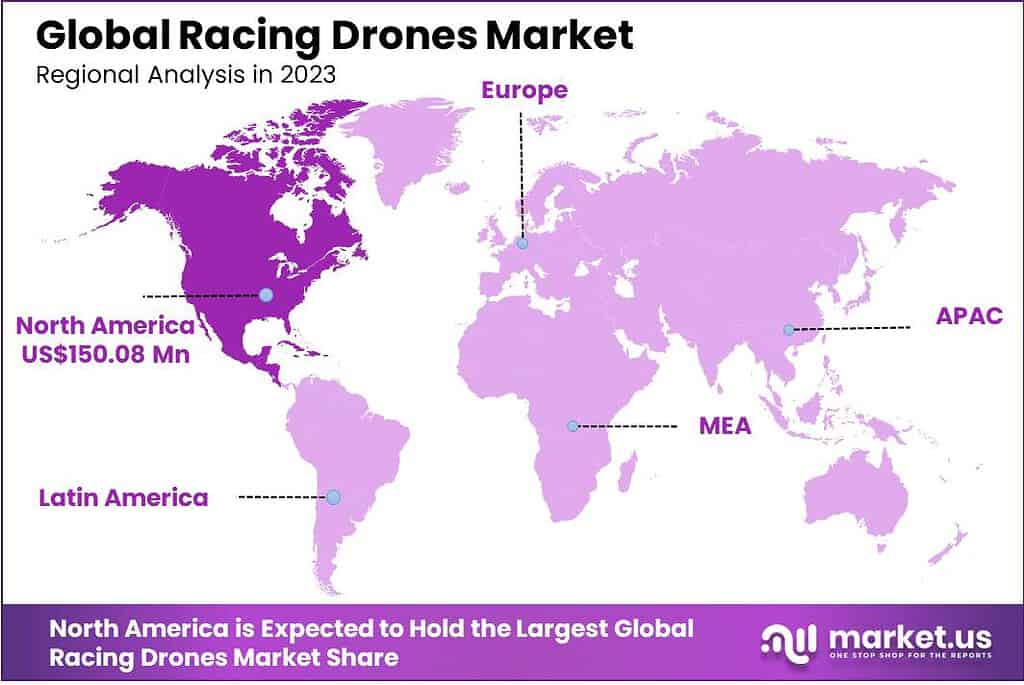

- Regional Analysis: In 2023, North America held a dominant market position in the racing drone market, capturing more than a 36% share.

Component Analysis

In 2023, the Batteries/FPV goggles segment emerged as the dominant player in the racing drone market, capturing more than a 49% share.

This segment’s strong market position can be attributed to several factors. Firstly, batteries play a critical role in racing drones, as they provide the necessary power to drive the motors and electronics. With the increasing demand for higher speeds and longer flight times, there has been a significant focus on developing batteries with improved energy density and power output.

Manufacturers have been investing in research and development to enhance battery technology, resulting in the availability of high-performance batteries that meet the specific requirements of racing drones. Additionally, the segment’s growth can be attributed to the increasing adoption of FPV goggles among racing enthusiasts. FPV goggles provide a first-person view experience, allowing pilots to immerse themselves in the race by seeing what the drone sees in real-time.

The advancements in FPV goggles technology, such as higher resolutions, reduced latency, and improved signal range, have significantly enhanced the racing experience. Furthermore, the affordability and accessibility of FPV goggles have made them more widely available to drone racing enthusiasts, contributing to their market dominance.

The Batteries/FPV goggles segment’s strong market position is also influenced by the growing demand for replacement and upgrade parts. Racing drones are subject to crashes and wear and tear, necessitating the replacement of components such as batteries and FPV goggles. As the racing drone market expands, there is a parallel demand for spare parts and accessories, driving the growth of this segment.

Drone Type Analysis

In 2023, the RTF (Ready-to-Fly) segment held a dominant market position in the racing drone market, capturing more than a 68% share. This segment’s prominence is primarily attributed to its ease of use and consumer-friendly nature.

RTF drones come fully assembled and require minimal setup before flight, making them an ideal choice for both novice pilots and seasoned enthusiasts seeking immediate aerial action. The appeal of RTF drones extends beyond convenience; it includes the integration of advanced technology that allows for out-of-the-box functionality, such as pre-calibrated flight controls and integrated camera systems for FPV (First Person View) racing.

The RTF segment’s growth can also be linked to the rising popularity of drone racing as a competitive sport and recreational activity. With the increasing number of drone racing leagues and events worldwide, there is a growing demand for drones that can be flown without extensive preparation or technical knowledge. This has led to a surge in consumer preference for RTF models, which offer a quick entry point into the sport.

Moreover, manufacturers have responded to this demand by continually enhancing the performance and features of RTF drones, further cementing their market position. Innovations in battery life, speed, and agility, alongside the incorporation of sophisticated flight stabilization technologies, have made RTF drones highly appealing to a broad audience. These advancements not only improve the flying experience but also enable pilots to focus on racing tactics and skills development.

Application Analysis

In 2023, the Rotorcross segment held a dominant market position, capturing more than a 43% share of the racing drone market. This prominence is primarily due to Rotorcross’s rising popularity as a competitive sport. It demands drones that can navigate complex courses with agility and precision, appealing to both amateur and professional pilots.

The attractiveness of Rotorcross competitions, characterized by their thrilling and high-stakes nature, has significantly driven the demand for advanced racing drones. These drones are equipped with features that enhance battery life, speed, and maneuverability, meeting the high requirements of the sport.

Moreover, the growth of the Rotorcross segment has been bolstered by the increasing number of organized competitions and events. These gatherings, held on both national and international stages, have not only expanded the Rotorcross community but have also spotlighted the sport, attracting more participants and spectators.

With ongoing technological advancements in drone capabilities and the expanding global fan base, the Rotorcross segment is expected to continue its growth trajectory. This presents substantial opportunities for manufacturers and stakeholders within the racing drone industry, signaling a promising future for the Rotorcross market segment.

Key Market Segments

By Component

- Batteries/ FPV goggles

- Cameras/sensors

- Propellers/motors

- Others

By Drone Type

- ARF

- RTF

By Application

- Rotorcross

- Drag racing

- Time trial

Driver

Technological Advancements in Drone Racing Equipment

The racing drone market is significantly driven by the continuous technological advancements in drone racing equipment. Innovations such as enhanced battery life, improved camera quality for first-person view (FPV) racing, and superior motor speeds have substantially increased the performance and reliability of racing drones. These advancements have not only made drones faster and more agile but have also improved the overall racing experience for pilots and spectators alike.

As drones become more capable of performing intricate maneuvers and sustaining longer flight times, the appeal of drone racing as a sport grows, attracting new enthusiasts and retaining the interest of seasoned pilots. This trend is expected to foster a vibrant competitive landscape, encouraging further investment in research and development to push the boundaries of what racing drones can achieve.

Restraint

Regulatory and Safety Concerns

Regulatory and safety concerns pose significant restraints to the growth of the racing drone market. As the popularity of drone racing increases, so does the scrutiny from regulatory bodies concerned with airspace safety and privacy issues. Strict regulations regarding where drones can be flown and the need for pilots to adhere to specific guidelines can limit the accessibility of the sport.

Additionally, the potential for accidents or injuries during races necessitates comprehensive safety protocols, which can be a barrier to entry for new pilots and event organizers. These concerns necessitate ongoing dialogue between industry stakeholders and regulatory authorities to find a balance that ensures the safe operation of racing drones while allowing the sport to flourish.

Opportunity

Expansion of Racing Drone Events and Leagues Globally

The expansion of racing drone events and leagues across the globe presents a significant opportunity for market growth. As drone racing gains international recognition, the establishment of professional leagues and high-profile competitions can attract sponsorships, media coverage, and a broader audience. This global expansion not only promotes the sport but also stimulates demand for racing drones, accessories, and training programs.

The proliferation of local, national, and international events provides a platform for pilots to showcase their skills, fostering a sense of community and camaraderie among participants. This trend towards globalization has the potential to transform drone racing from a niche hobby to a mainstream sport, opening up new markets and revenue streams for industry participants.

Challenge

High Entry and Maintenance Costs

One of the major challenges facing the racing drone market is the high entry and maintenance costs associated with the sport. The initial investment in a competitive racing drone, along with necessary accessories such as FPV goggles, controllers, and spare parts, can be prohibitively expensive for newcomers.

Additionally, the cost of regularly upgrading equipment to stay competitive, coupled with the potential for crash-related repairs, adds to the financial burden. These costs can deter potential enthusiasts from participating in the sport and limit the growth of the racing drone community. Addressing this challenge requires efforts to lower the cost of entry-level drones and develop more durable and cost-effective components, making drone racing more accessible to a wider audience.

Regional Analysis

In 2023, North America held a dominant market position in the racing drone market, capturing more than a 36% share. This leadership can be attributed to the region’s strong culture of technological innovation and early adoption of new technologies, coupled with a well-established community of drone enthusiasts and pilots.

North America, especially the United States, has been at the forefront of organizing professional drone racing events and leagues, which has significantly contributed to the popularity and growth of the sport within the region. The presence of key market players and manufacturers in the region has also facilitated access to high-quality racing drones and components, further boosting the market. Moreover, supportive regulations and the availability of numerous racing circuits and arenas have made it easier for participants to engage in drone racing, encouraging both amateur and professional involvement.

Europe follows closely, with a focus on technological advancements and a growing drone racing community. The region has seen a rise in the number of drone racing events, supported by a strong framework of regulations that ensure safety while promoting the sport. Europe’s market growth is also driven by the increasing availability of drone racing kits and accessories, making it more accessible to enthusiasts at all levels.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The racing drone market features several key players who play pivotal roles in shaping the industry landscape. These key players are typically renowned manufacturers, technology innovators, and influential entities within the drone racing community. DJI is a leading manufacturer of consumer and professional drones, known for its innovative technology and high-quality products. The company offers a range of racing drones and accessories tailored for both amateur and professional pilots.

Airjugar Technology Co. Ltd., Autel Robotics, eachine, Guangzhou Walkera Technology CO. LTD are key players, along with several other manufacturers and technology providers, contribute to the growth and development of the racing drone market through their product innovations, technological advancements, and contributions to the drone racing community. Their presence and influence shape the competitive landscape of the industry, driving innovation and fostering growth opportunities for stakeholders across the globe.

Top Market Leaders

- Airjugar Technology Co. Ltd.

- Autel Robotics

- DJI

- eachine

- Guangzhou Walkera Technology CO. LTD

- Hubsan

- ImmersionRC Limited

- mjxrc.net

- Parrot Drones SAS

- RotorX

- Spin Master (Air Hogs)

- Skyrocket LLC (Sky Viper)

- UVify Inc.

- 3D Robotics

- SkyTech

- Lumenier

- GoPro

- Storm

- Gemo Copter

- TBS and YUNEEC

Recent Developments

1. Autel Robotics:

- March 2023: Released the “EVO II Pro Racing Edition Drone,” featuring powerful motors and improved flight stability for competitive performance.

- June 2023: Partnered with the “Drone Racing League China” to provide official drones and technical support for the racing series.

- December 2023: Showcased the “Autel Robotics Dragonfly” concept drone, hinting at potential future developments in racing-focused designs.

2. DJI:

- May 2023: Updated the “FPV Drone” with improved range and video transmission capabilities, catering to both racing and freestyle pilots.

- August 2023: Collaborated with “Red Bull” to sponsor and film the “Drone Champions League” events throughout the year.

- November 2023: Launched the “DJI Avata” cinewhoop drone, offering a blend of racing agility and high-quality video capture for freestyle enthusiasts.

Report Scope

Report Features Description Market Value (2023) US$ 416.9 Mn Forecast Revenue (2033) US$ 2,238.1 Mn CAGR (2024-2033) 18.3% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Batteries/ FPV goggles, Cameras/sensors, Propellers/motors, Others), By Drone Type (ARF and RTF), By Application(Rotorcross, Drag racing, Time trial) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Airjugar Technology Co. Ltd., Autel Robotics, DJI, eachine, Guangzhou Walkera Technology CO. LTD, Hubsan, ImmersionRC Limited, mjxrc.net, Parrot Drones SAS, RotorX, Spin Master (Air Hogs), Skyrocket LLC (Sky Viper), UVify Inc., 3D Robotics, SkyTech, Lumenier, GoPro, Storm, Gemo Copter, TBS and YUNEEC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is a racing drone?A racing drone is a small, agile unmanned aerial vehicle (UAV) designed specifically for competitive racing events. These drones are typically equipped with high-performance motors, lightweight frames, and first-person view (FPV) cameras to provide pilots with an immersive racing experience.

How big is Racing Drone Industry?The Global Racing Drone Market size is expected to be worth around USD 2,238.1 Million by 2033, from USD 416.9 Million in 2023, growing at a CAGR of 18.3% during the forecast period from 2024 to 2033.

What are some popular racing drone racing leagues and events?Popular racing drone leagues and events include the Drone Racing League (DRL), MultiGP, International Drone Racing Association (IDRA), and various local and regional competitions held around the world. These events feature thrilling races where pilots compete head-to-head on challenging courses.

What factors are driving the growth of the racing drone market?The growth of the racing drone market can be attributed to factors such as increasing interest in drone racing as a spectator sport, advancements in drone technology, growing participation from enthusiasts and professional pilots, and the availability of racing drone leagues and events worldwide.

Which region will dominate the racing drone market?In 2023, North America held a dominant market position in the racing drone market, capturing more than a 36% share

What are the leading Key players in the Racing Drones Market?The Key players operating in the racing drones market includes Airjugar Technology Co. Ltd., Autel Robotics, DJI, eachine, Guangzhou Walkera Technology CO. LTD, Hubsan, ImmersionRC Limited, mjxrc.net, Parrot Drones SAS, RotorX, Spin Master (Air Hogs), Skyrocket LLC (Sky Viper), UVify Inc., 3D Robotics, SkyTech, Lumenier, GoPro, Storm, Gemo Copter, TBS and YUNEEC

-

-

- Airjugar Technology Co. Ltd.

- Autel Robotics

- DJI

- eachine

- Guangzhou Walkera Technology CO. LTD

- Hubsan

- ImmersionRC Limited

- mjxrc.net

- Parrot Drones SAS

- RotorX

- Spin Master (Air Hogs)

- Skyrocket LLC (Sky Viper)

- UVify Inc.

- 3D Robotics

- SkyTech

- Lumenier

- GoPro

- Storm

- Gemo Copter

- TBS and YUNEEC