Global Quick Service Restaurants Market By Type(Dine-In, Takeaway, Delivery), By Service Type(Self-Serviced, Assisted Self-Service, Fully Serviced), By Category(Single Outlet, QSR Chain), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: March 2024

- Report ID: 116636

- Number of Pages: 267

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

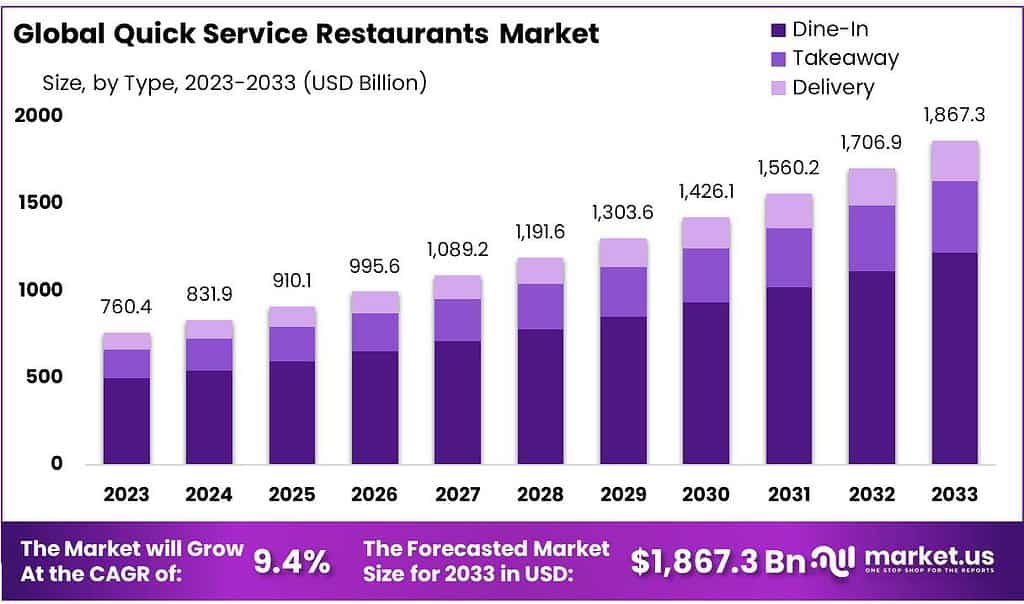

The global Quick Service Restaurants Market size is expected to be worth around USD 1867.3 billion by 2033, from USD 760.4 billion in 2023, growing at a CAGR of 9.4% during the forecast period from 2023 to 2033.

The Quick Service Restaurants (QSR) market refers to the sector of the food service industry that specializes in providing fast food products and services to consumers. These establishments are characterized by a limited service or self-service format, where food is prepared in advance or quickly prepared upon order and paid for before consumption. The QSR market encompasses a wide variety of food types, including, but not limited to, burgers, pizzas, chicken, sandwiches, and ethnic foods, catering to a broad spectrum of tastes and preferences.

QSRs are distinguished by their fast delivery of service, convenience, and competitive pricing. They often operate through various formats such as stand-alone restaurants, drive-thru locations, food courts in malls, and airports, among others. The market is driven by factors such as the increasing pace of life, demand for quick meal solutions, urbanization, and the growth of the middle class with disposable income for eating out.

The global QSR market has been experiencing significant growth, attributed to technological advancements like digital ordering and delivery services, as well as menu diversification to include healthier options. These changes reflect the industry’s adaptability to evolving consumer preferences, including the demand for convenience, value for money, and the desire for healthier eating options.

Key Takeaways

- Projected Growth: QSR market to reach USD 1867.3 billion by 2033, with a 9.4% CAGR from 2023, indicating substantial expansion.

- Segment Preference: Dine-In dominates with 65.4% market share in 2023, showcasing consumer inclination towards traditional dining experiences.

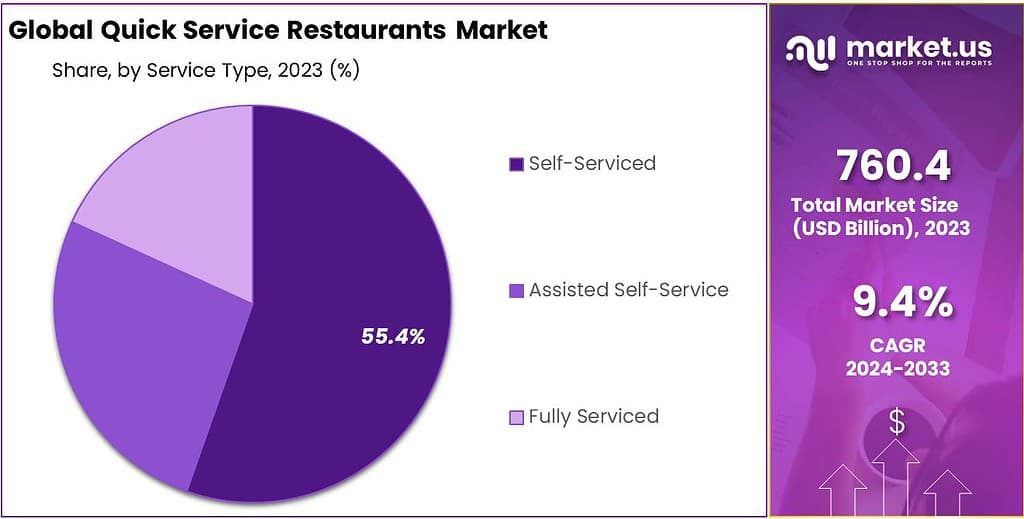

- Service Trend: Self-service leads with 55.4% market share, reflecting consumer preference for convenience and efficiency.

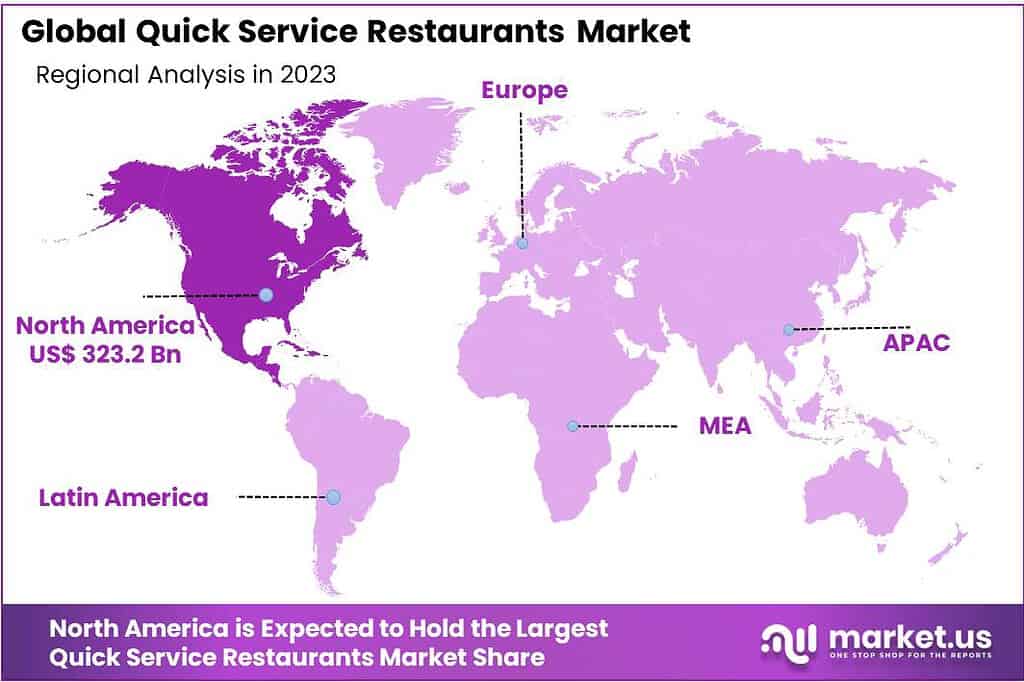

- Regional Focus: North America, especially the US, holds 42.5% market share, driven by strong demand and innovation.

- McDonald’s is the world’s largest QSR chain, with over 38,000 locations across more than 100 countries as of 2022.

- Burger chains account for the largest segment of the QSR market, with a market share of around 30% globally.

- Drive-thru accounts for around 70% of sales at major QSR chains in the United States.

- The top 5 QSR chains in the United States by revenue in 2022 were McDonald’s, Starbucks, Subway, Burger King, and Taco Bell.

By Type

In 2023, Dine-In dominated the Quick Service Restaurants (QSR) market, commanding over 65.4% of the market share. Customers preferred dining in at QSRs, enjoying the experience of eating at the restaurant.

Takeaway services also played a significant role in the QSR market, accounting for a substantial portion of sales. Customers appreciated the convenience of ordering food to go and consuming it at their preferred location.

Delivery services witnessed notable growth in 2023, with an increasing number of QSRs offering delivery options to meet customer demand. Delivery services provided added convenience for customers, allowing them to enjoy QSR meals in the comfort of their homes or workplaces.

Overall, the QSR market saw diverse preferences among consumers, with Dine-In, Takeaway, and Delivery each catering to different needs and preferences. While Dine-In remained the dominant segment, Takeaway and Delivery services showed promising growth potential, reflecting changing consumer lifestyles and preferences.

By Service Type

In 2023, Self-Serviced was the top-performing segment in the Quick Service Restaurants (QSR) market, commanding over 55.4% of the market share. Customers preferred the convenience and efficiency of serving themselves at QSR establishments.

Assisted Self-Service also played a significant role in the QSR market, with customers appreciating the balance between convenience and personalized assistance. This segment accounted for a notable portion of QSR sales.

Fully Serviced options were also available in the QSR market, catering to customers seeking a more traditional dining experience with full table service. Although representing a smaller share compared to other segments, Fully Serviced options remained popular among certain customer demographics.

Overall, the QSR market saw a mix of service types catering to diverse customer preferences. While Self-Serviced dominated the market, Assisted Self-Service and Fully Serviced options provided additional choices for customers, contributing to the overall growth and diversity of the QSR industry.

By Category

In 2023, QSR Chain emerged as the dominant segment in the Quick Service Restaurants (QSR) market, securing over 62.4% of the market share. Customers favored the reliability and consistency offered by well-established QSR chains, attracting them to these establishments.

Single Outlet QSRs also maintained a significant presence in the market, appealing to customers seeking unique or local dining experiences. While representing a smaller portion of the market share compared to QSR chains, single outlets contributed to the diversity and innovation within the QSR industry.

Overall, the QSR market saw a mix of both QSR Chain and Single Outlet establishments catering to different customer preferences. While QSR Chain dominated in terms of market share, Single Outlet QSRs played a crucial role in providing variety and local flavor to consumers, contributing to the overall growth and vibrancy of the QSR industry.

Key Market Segments

By Type

- Dine-In

- Takeaway

- Delivery

By Service Type

- Self-Serviced

- Assisted Self-Service

- Fully Serviced

By Category

- Single Outlet

- QSR Chain

Driving Factors

The increasing demand for American cuisine is evident, with restaurants now offering a diverse range of menu options including frozen desserts, burgers, fries, wraps, and more.

The love for American food is on the rise, and it’s no wonder why. Restaurants these days offer a diverse menu filled with delicious treats like frozen desserts, juicy burgers, crispy fries, flavorful wraps, and much more. This surge in popularity isn’t just a coincidence; it’s fueled by a combination of factors such as modern cooking techniques, the widespread growth of franchises, and our increasingly busy lifestyles.

As industrial processes streamline food production and distribution, it’s become easier for restaurants to offer a wide variety of American cuisine to satisfy our taste buds. This trend isn’t just about satisfying our cravings; it’s also boosting the growth prospects of quick-service restaurants (QSRs) and the fast-food market as a whole, all thanks to the soaring popularity of American culinary delights.

The trend of incorporating healthier food choices into joints and restaurants is on the rise.

The rising popularity of American cuisine isn’t just a passing trend; it’s a reflection of our evolving tastes and preferences. With a diverse menu filled with irresistible treats like frozen desserts, juicy burgers, crispy fries, and flavorful wraps, it’s no wonder that American food has captured the hearts and taste buds of people around the world.And as industrial processes continue to streamline food production and distribution, it’s becoming easier than ever for restaurants to satisfy our cravings for American delights. This trend isn’t just about indulgence; it’s also driving growth in the quick service restaurants (QSRs) and fast-food market segments, as more and more people flock to these establishments to enjoy their favorite American dishes.

Restraining Factors

Storage expenses are a major cost burden for quick-service restaurants and the fast-food market

In the bustling world of the food industry, managing large inventories of perishable and non-perishable items is a constant challenge for quick-service restaurants and the fast-food market. This necessity drives up operational costs significantly, squeezing profit margins and creating a major financial obstacle.

The pressure to store ample supplies adds strain to the already competitive environment, underscoring the substantial burden posed by the high expenses associated with storage.

Moreover, the fast-food and quick-service restaurant sector faces another critical challenge: a shortage of labor. With fewer workers available to meet the demands of customers and maintain service standards, operational efficiency takes a hit.

This scarcity of labor not only affects the ability to keep up with customer orders but also impacts the overall quality of service provided. As a result, the industry finds itself vulnerable to disruptions caused by labor-related issues, which in turn, negatively affect market performance and impede growth opportunities.

Amidst these challenges, the global quick-service restaurants and fast-food market is constantly evolving. Recent developments in trade regulations, import-export analysis, and production trends are shaping the landscape of the industry. Additionally, efforts are being made to optimize the value chain and enhance market share.

Domestic and localized market players are adapting to changes in regulations and exploring emerging revenue opportunities. Product approvals and launches, along with geographic expansions and technological innovations, are driving strategic growth in the market. With a focus on category market growth, application niches, and maintaining dominance, stakeholders in the industry are navigating through these challenges while seeking new avenues for growth and success.

Growing Opportunities

The restaurant industry is transforming with the increasing adoption of advanced technology. Quick-service restaurants and the fast-food market are leveraging innovations such as self-order kiosks and touchscreen POS terminals to reshape their operations. These technologies offer user-friendly interfaces and customizable options, enhancing the overall customer experience.

With easier ordering processes and tailored choices, these advancements are driving up order volumes and average check sizes. Embracing such technological innovations presents a significant opportunity for the industry to grow and thrive in today’s competitive market.

Alongside technological advancements, virtual kitchens are gaining popularity, revolutionizing the way restaurants operate. These virtual kitchens allow businesses to operate without physical dine-in facilities, focusing instead on delivery and takeaway services.

This shift in the culinary landscape is expected to unlock substantial growth opportunities for the market. The convenience and efficiency of virtual kitchens cater to evolving consumer preferences and lifestyle choices, making them an attractive option for both businesses and customers alike.

The adoption of advanced technology, including self-order kiosks and touchscreen POS terminals, is playing a crucial role in reshaping the operations of quick-service restaurants and the fast-food market. These innovations are enhancing the customer experience by offering user-friendly interfaces and customization options.

As a result, there is an increase in order volume and average check sizes, contributing to industry growth. Embracing advanced technology presents a significant opportunity for restaurants to stay competitive and meet the evolving demands of their customers.

Similarly, the rising popularity of virtual kitchens is transforming the restaurant landscape. Virtual kitchens enable businesses to operate without physical dine-in facilities, focusing instead on delivery and takeaway services.

This shift is anticipated to unlock substantial growth opportunities for the market as the convenience and efficiency of virtual kitchens cater to evolving consumer preferences. As more restaurants embrace this trend, the industry is poised for significant expansion and innovation in the coming years.

Latest Trends

The rapid expansion of global fast-food chains.

The food service market has seen significant growth in both global and domestic restaurant chains in recent years. This expansion has had a profound impact on consumers worldwide, offering them a wider range of dining options and increasing the frequency of restaurant visits. The demand for fast food has been on the rise, prompting market players to expand their outlets to better serve customers.

One notable example of this expansion is Yum! Brands, are a major player in the food service industry. Known for popular brands like KFC, Pizza Hut, and Taco Bell, Yum! Brands has embarked on ambitious expansion plans across the globe. These efforts aim to strengthen the company’s presence in target markets and meet the growing demand for fast food.

Furthermore, the introduction of plant-based menu items is reshaping the fast-food landscape. In January 2022, KFC made headlines by becoming the first major fast-food chain to offer plant-based chicken nuggets in the United States. This move reflects a broader trend towards healthier and more sustainable dining options, driven by consumer demand for environmentally friendly alternatives to traditional meat products.

Regional Analysis

North America is considered to be the Most Profitable Market within the Global Quick-Service Restaurant Market.

In 2023, North America accounted for a significant 42.5% share of the global QSR market. The United States, in particular, boasts one of the highest rates of fast food consumption globally, reflecting a strong demand for QSR offerings.

The advanced infrastructure of the North American QSR market supports the development and distribution of innovative menu items and services. With a plethora of QSR chains and outlets, consumers benefit from a diverse range of offerings tailored to their tastes and preferences.

Furthermore, leading QSR brands in North America invest heavily in research and development to continually innovate and improve their offerings. This commitment to excellence ensures that consumers have access to high-quality and innovative menu options that meet their evolving needs and preferences.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

The Quick Service Restaurants (QSR) market features several key players that play pivotal roles in shaping the industry. These players are often characterized by their global presence, extensive networks of franchises, innovative menu offerings, and strong brand recognition.

Top Key Players

- McDonald’s Corporation

- Starbucks Corporation

- Chick-fil-A, Inc.

- Taco Bell Corp.

- KFC Corporation

- Subway IP LLC

- Burger King Corporation

- Pizza Hut, LLC

- Domino’s Pizza, Inc.

- International Dairy Queen, Inc.

- The Wendy’s Company

- Baskin-Robbins, Inc.

- Tim Hortons Inc.

- Papa John’s International, Inc.

- Checkers Drive-In Restaurants, Inc.

Recent Developments

2024: McDonald’s launched a partnership with a leading food delivery platform to expand its delivery services and reach more customers in key markets.

2024: Starbucks announced the launch of a new line of premium coffee blends sourced from select regions around the world, catering to discerning coffee connoisseurs

2024: Taco Bell announced plans to expand its international footprint with the opening of new locations in key markets, leveraging its iconic brand and unique menu offerings to drive growth in new territories.

Report Scope

Report Features Description Market Value (2023) USD 760.4 Bn Forecast Revenue (2033) USD 1867.3 Bn CAGR (2024-2033) 9.4% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Dine-In, Takeaway, Delivery), By Service Type(Self-Serviced, Assisted Self-Service, Fully Serviced), By Category(Single Outlet, QSR Chain) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, &Rest of MEA Competitive Landscape McDonald’s Corporation, Starbucks Corporation, Chick-fil-A, Inc., Taco Bell Corp., KFC Corporation, Subway IP LLC, Burger King Corporation, Pizza Hut, LLC, Domino’s Pizza, Inc., International Dairy Queen, Inc., The Wendy’s Company, Baskin-Robbins, Inc., Tim Hortons Inc., Papa John’s International, Inc., Checkers Drive-In Restaurants, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Quick Service Restaurants Market?Quick Service Restaurants Market size is expected to be worth around USD 1867.3 billion by 2033, from USD 760.4 billion in 2023

What CAGR is projected for the Quick Service Restaurants Market?The Quick Service Restaurants Market is expected to grow at 9.4% CAGR (2023-2032).Name the major industry players in the Quick Service Restaurants Market?McDonald's Corporation, Starbucks Corporation, Chick-fil-A, Inc., Taco Bell Corp., KFC Corporation, Subway IP LLC, Burger King Corporation, Pizza Hut, LLC, Domino's Pizza, Inc., International Dairy Queen, Inc., The Wendy's Company, Baskin-Robbins, Inc., Tim Hortons Inc., Papa John's International, Inc., Checkers Drive-In Restaurants, Inc.

Q: What is the projected CAGR at which the Construction Equipment Rental market is expected to grow at?

Quick Service Restaurants MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample

Quick Service Restaurants MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- McDonald's Corporation

- Starbucks Corporation

- Chick-fil-A, Inc.

- Taco Bell Corp.

- KFC Corporation

- Subway IP LLC

- Burger King Corporation

- Pizza Hut, LLC

- Domino's Pizza, Inc.

- International Dairy Queen, Inc.

- The Wendy's Company

- Baskin-Robbins, Inc.

- Tim Hortons Inc.

- Papa John's International, Inc.

- Checkers Drive-In Restaurants, Inc.