Global Quantum Computing Market Size, Share Analysis Report By Offering (System, Services), By Deployment (On-Premises, Cloud), By Application (Optimization, Simulation, Machine Learning, Others), By End-user (Aerospace & Defense, BFSI, Healthcare, Automotive, Energy & Power, Chemical, Government, Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 12497

- Number of Pages: 219

- Format:

-

keyboard_arrow_up

Quick Navigation

Quantum Computing Market Size

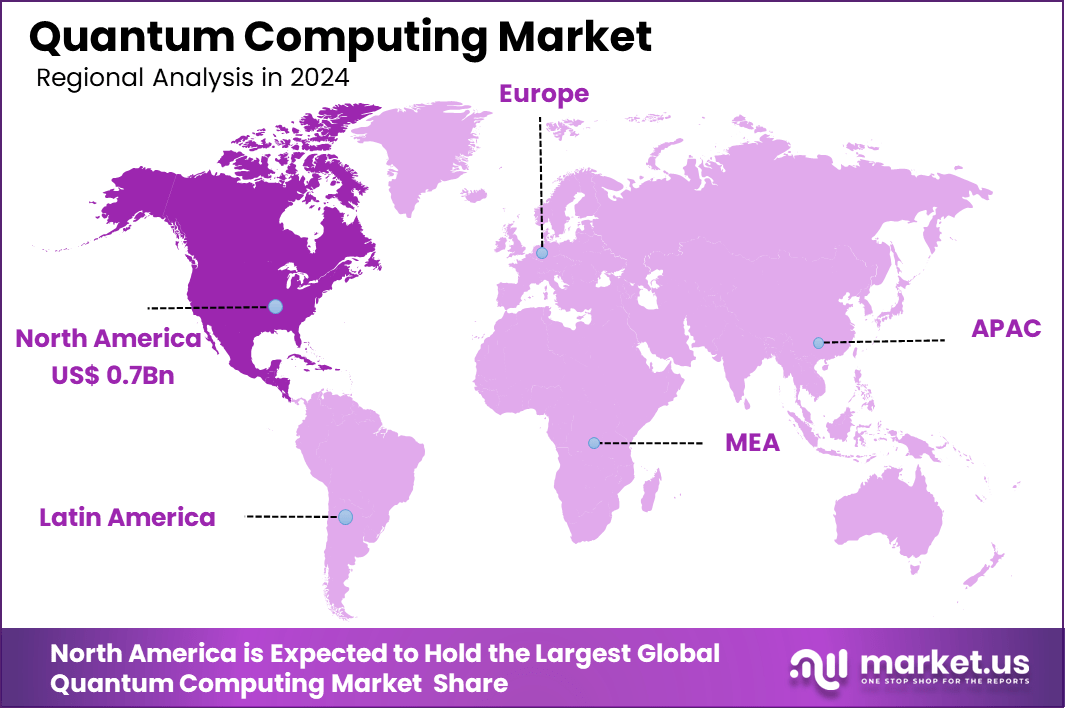

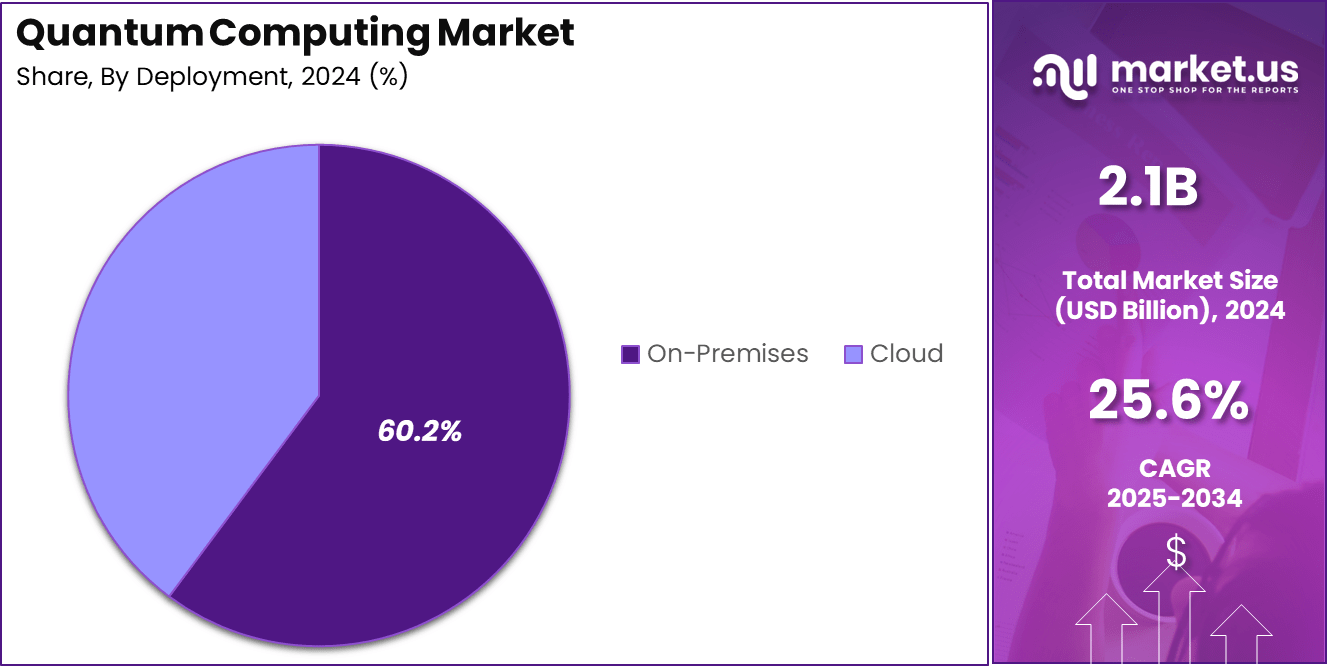

The Global Quantum Computing Market size is expected to be worth around USD 20.5 Billion by 2034, from USD 2.1 Billion in 2024, growing at a CAGR of 25.6% during the forecast period from 2024 to 2033. In 2024, North America held a dominant market position, capturing more than a 37.6% share, holding USD 0.7 Billion revenue.

Quantum computing is an emerging field of technology that leverages the principles of quantum mechanics to process information. Unlike classical computers, which use bits as the smallest unit of data (either 0 or 1), quantum computers use quantum bits, or qubits, which can exist in multiple states simultaneously due to superposition. This property allows quantum computers to perform complex calculations at speeds unattainable by classical computers.

The quantum computing market is experiencing significant growth, driven by advancements in technology and increasing investments from both public and private sectors. Key factors driving the adoption of quantum computing include the need for enhanced computational power to solve complex problems, advancements in quantum hardware and software, and the potential for significant breakthroughs in areas such as drug discovery and financial modeling.

According to a report by PwC, the quantum computing field is predominantly driven by startups, which constitute 40% of the players, followed by academic institutions, making up 33%. This highlights a vibrant ecosystem where innovation is largely spearheaded by new and agile players alongside traditional academic research.

Quantum computing is set to revolutionize several key industries. The finance sector is at the forefront, expected to harness quantum computing in 28% of its operations. This is followed by the global energy and materials sector, which accounts for 16%, underscoring the technology’s potential in transforming energy efficiencies and material sciences. The advanced technology sectors also stand to benefit substantially.

D-Wave emerges as a leader in the quantum computing space, being the most funded private company, with investments totaling $216 million across 19 funding rounds, as per data from Crunchbase. This substantial investment underscores the confidence and potential seen in D-Wave’s technological advancements.

One of the remarkable aspects of D-Wave’s technology, particularly the D-Wave 2000Q quantum computer, is its ultra-low operating temperature of 0.015 Kelvin. This feature is crucial for maintaining quantum coherence and significantly enhances the machine’s performance capabilities.

Moreover, the phenomenon of quantum tunneling associated with quantum computing is anticipated to lead to a reduction in power consumption by 100-1000 times, presenting a major leap in computational efficiency and sustainability.

Key Takeaways

- The Global Quantum Computing Market is projected to reach USD 20.5 Billion by 2033, rising from USD 2.1 Billion in 2024, with a strong CAGR of 25.6% during 2024–2033.

- In 2024, North America led the global market, capturing 37.6% of the total share, valued at approximately USD 0.7 Billion.

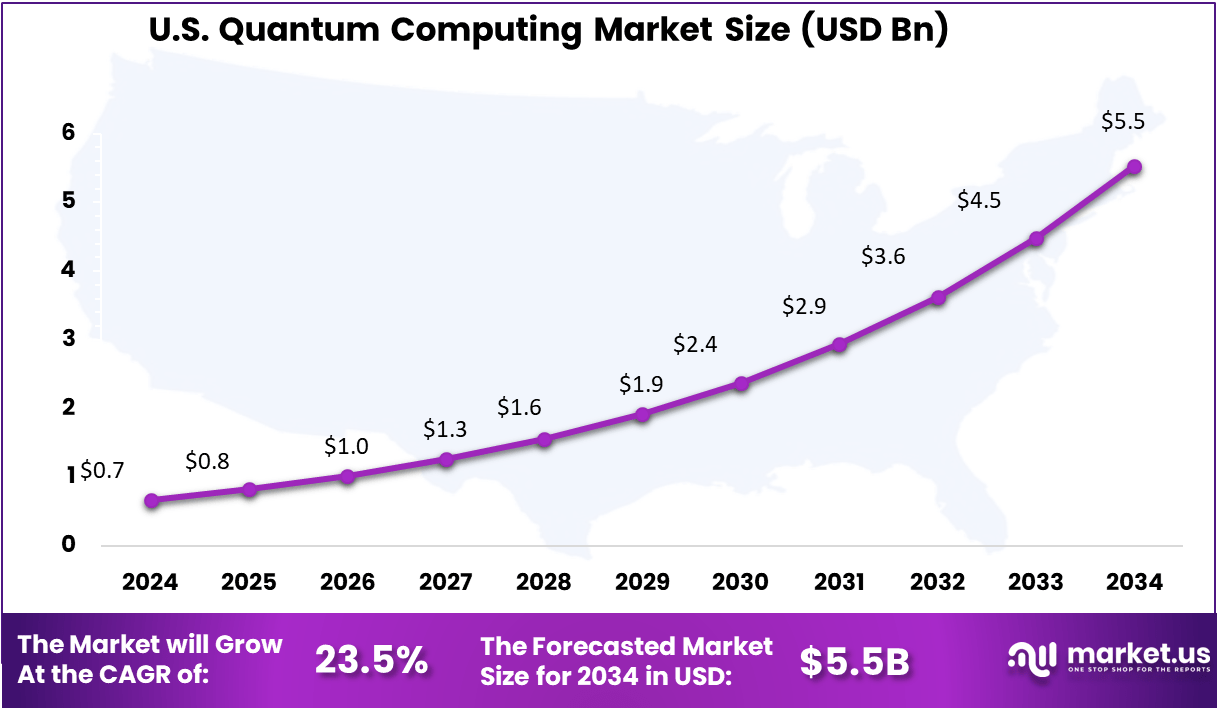

- The United States Quantum Computing Market is expected to grow from USD 0.8 Billion in 2025 to around USD 5.5 Billion by 2034, expanding at a CAGR of 23.5%.

- By offering, System-based quantum computing dominated with a 64.6% market share, driven by rising hardware adoption across industries.

- On the basis of deployment, the On-Premises segment accounted for 60.2%, reflecting strong demand for secure and locally managed infrastructure.

- Among applications, the Optimization segment led the market with a 40.5% share, due to its high relevance in logistics, finance, and supply chain problems.

- By end-user, Aerospace & Defense emerged as the top contributor with 32.6%, supported by rising investments in national security and complex simulation tasks.

Market Overview

The demand for quantum computing solutions is rising across various sectors. In finance, quantum algorithms can optimize investment portfolios and risk assessments. Healthcare industries are exploring quantum computing for drug discovery and genomics. Logistics and supply chain management benefit from quantum computing’s ability to solve complex optimization problems, enhancing efficiency and reducing costs.

For instance, In January 2025, Accenture made a strategic investment in QuSecure, a pioneer in post-quantum cybersecurity, to strengthen its portfolio in quantum-resilient digital infrastructure. This collaboration is designed to deliver crypto agility solutions that align with the NIST-approved post-quantum encryption standards, helping organizations future-proof their data protection frameworks

Key reasons for adopting quantum computing include its ability to process vast amounts of data rapidly and solve complex problems that are beyond the reach of classical computers. Organizations are motivated by the prospect of gaining a competitive advantage through improved efficiency, innovation, and the ability to tackle challenges that were previously unsolvable.

It is estimated that quantum computing will generate an economic impact ranging from $2 billion to $3 billion by the year 2030. Furthermore, the global quantum computing landscape is projected to expand, with the number of quantum computers anticipated to reach between 2,000 and 5,000 units worldwide by 2030.

US Quantum Computing Market

The US Quantum Computing Market is valued at approximately USD 0.7 Billion in 2024 and is predicted to increase from USD 0.8 Billion in 2025 to approximately USD 5.5 Billion by 2034, projected at a CAGR of 23.5% from 2025 to 2034.

This dominance is primarily driven by the country’s established research infrastructure, with government-backed institutions such as the Department of Energy and the National Science Foundation actively supporting quantum research through consistent funding and public-private partnerships.

North America Growth

In 2024, North America held a dominant market position, capturing more than a 37.6% share, with revenue reaching approximately USD 0.7 billion. This leadership is largely attributed to the region’s early investments in quantum computing research, robust technological infrastructure, and strong presence of globally recognized tech companies.

The competitive advantage of North America also stems from its capacity to translate innovation into enterprise-ready solutions. Major players such as IBM, Google, and Microsoft are not only developing advanced quantum hardware but are also actively deploying hybrid quantum-AI platforms that appeal to industries like pharmaceuticals, aerospace, and financial services.

Additionally, venture capital and corporate investments have surged in recent years, making the U.S. one of the most attractive destinations for quantum computing startups. As a result, the region is expected to remain at the forefront of global quantum advancements throughout the coming decade.

Offering Analysis

In 2024, the System segment held a dominant position in the global quantum computing market, accounting for over 64.6% of the total market share. This leadership is primarily due to the substantial investments and advancements in quantum hardware development, which form the backbone of quantum computing capabilities .

The System segment encompasses the development and deployment of quantum computing hardware, including quantum processors, qubit architectures, and quantum interconnects. These components are crucial for achieving quantum supremacy and addressing complex computational problems that classical computers cannot solve efficiently.

Companies are focusing on increasing the number of qubits, enhancing qubit quality, and improving error correction techniques to make quantum systems more reliable and scalable. Furthermore, the demand for quantum systems is driven by their potential applications across various industries, such as pharmaceuticals, finance, and logistics.

For instance, quantum systems can significantly accelerate drug discovery processes by simulating molecular interactions with high precision. In finance, they can optimize complex portfolios and risk assessments, while in logistics, they can enhance supply chain efficiency through advanced optimization algorithms.

The dominance of the System segment is also supported by the growing interest in on-premises quantum computing solutions. Enterprises and research institutions prefer maintaining and operating their own quantum hardware to ensure greater control and security for sensitive applications. This trend underscores the critical role of quantum systems in the current and future landscape of quantum computing.

Deployment Mode Analysis

In 2024, the On-Premises segment held a dominant position in the global quantum computing market, capturing more than a 60.2% share. This leadership is primarily attributed to the need for enhanced control, security, and customization capabilities that on-premises deployments offer, especially for organizations handling sensitive data or requiring specialized configurations.

On-premises quantum computing allows organizations to maintain complete control over their infrastructure, ensuring data sovereignty and compliance with regulatory requirements. This is particularly crucial for sectors such as defense, finance, and healthcare, where data privacy and security are paramount.

By hosting quantum systems on-site, these organizations can tailor their computing environments to specific operational needs, leading to improved performance and reliability. Furthermore, on-premises deployments reduce latency issues associated with cloud-based solutions, enabling faster processing times essential for complex quantum computations.

This setup also facilitates seamless integration with existing IT infrastructure, allowing for more efficient workflows and better resource management. While cloud-based quantum computing offers scalability and accessibility, the preference for on-premises solutions in 2024 underscores the importance of control and customization in the early stages of quantum technology adoption.

Application Analysis

In 2024, the Optimization segment held a dominant position in the global quantum computing market, capturing more than a 40.5% share. This leadership is primarily attributed to the unique capabilities of quantum computing in solving complex optimization problems that are computationally intensive for classical computers.

Optimization problems are prevalent across various industries, including logistics, finance, and manufacturing. Quantum algorithms, such as the Quantum Approximate Optimization Algorithm (QAOA), offer significant advantages in finding optimal solutions more efficiently than traditional methods. For instance, in logistics, quantum computing can optimize delivery routes, reducing time and fuel consumption.

In finance, it aids in portfolio optimization by analyzing vast datasets to identify the best investment strategies. The dominance of the Optimization segment is also driven by the increasing demand for efficient resource utilization and cost reduction. Companies are investing in quantum computing to enhance their decision-making processes, leading to improved operational efficiency and competitive advantage.

End-User Analysis

In 2024, the Aerospace & Defense segment held a dominant position in the global quantum computing market, capturing more than a 32.6% share. This leadership is primarily attributed to the critical need for advanced computational capabilities in national security and defense applications. Quantum computing offers unparalleled potential in solving complex problems related to cryptography, optimization, and simulation, which are essential for modern defense strategies.

The aerospace and defense sectors are increasingly investing in quantum technologies to enhance capabilities such as secure communication, threat detection, and mission planning. For instance, quantum key distribution (QKD) provides theoretically unbreakable encryption, ensuring secure communication channels for military operations.

Moreover, the integration of quantum computing in aerospace applications enables the simulation of complex aerodynamic models and materials science, facilitating the development of advanced aircraft and spacecraft. These simulations can significantly reduce the time and cost associated with prototyping and testing, accelerating the deployment of cutting-edge aerospace technologies.

The dominance of the Aerospace & Defense segment is also supported by substantial government funding and public-private partnerships aimed at advancing quantum research and development. As global geopolitical tensions rise, nations are prioritizing the development of quantum technologies to maintain strategic advantages, further propelling the growth of this segment in the quantum computing market.

Key Market Segments

By Offering

- System

- Services

By Deployment

- On-Premises

- Cloud

By Application

- Optimization

- Simulation

- Machine Learning

- Others

By End-user

- Aerospace & Defense

- BFSI

- Healthcare

- Automotive

- Energy & Power

- Chemical

- Government

- Others

Driver

Strategic Investments Fueling Quantum Advancements

In 2024, the quantum computing sector is experiencing significant momentum, primarily driven by substantial investments from both public and private entities. Governments worldwide are allocating considerable funds to quantum research, recognizing its potential to revolutionize industries.

For instance, India’s National Quantum Mission has earmarked over $730 million to bolster quantum research and development, aiming to position the country at the forefront of this technological frontier. Simultaneously, private sector investments are accelerating progress.

Companies like Nvidia are exploring significant stakes in quantum startups such as PsiQuantum, indicating a strong belief in the commercial viability of quantum technologies. These strategic investments are not only advancing hardware and software development but also fostering collaborations that are essential for overcoming existing technological barriers.

Restraint

High Development Costs and Technical Complexities

Despite the promising outlook, the quantum computing industry faces considerable restraints, notably the high costs associated with development and the intricate technical challenges. Building and maintaining quantum systems require specialized environments, often necessitating ultra-low temperatures and isolation from external interferences, which significantly escalate operational expenses.

Moreover, the scarcity of skilled professionals in quantum physics and engineering further complicates development efforts. This talent gap hampers the pace at which companies can innovate and bring products to market, potentially delaying the widespread adoption of quantum computing solutions.

Opportunity

Integration with Artificial Intelligence and Machine Learning

A significant opportunity lies in the integration of quantum computing with artificial intelligence (AI) and machine learning (ML). Quantum algorithms have the potential to process complex datasets more efficiently than classical computers, enhancing AI and ML capabilities. This synergy could lead to breakthroughs in various fields, including drug discovery, financial modeling, and climate forecasting.

Companies are increasingly exploring this intersection to develop advanced solutions that leverage the strengths of both technologies. Such integrations are expected to open new markets and applications, driving further investment and interest in quantum computing.

Challenge

Quantum Decoherence and Error Correction

One of the most formidable challenges in quantum computing is managing quantum decoherence and implementing effective error correction. Quantum bits, or qubits, are highly sensitive to environmental disturbances, which can lead to loss of information and computational errors. Developing systems that can maintain coherence and correct errors in real-time is a complex task that requires significant research and innovation.

Addressing these challenges is critical for the practical deployment of quantum computers. Advancements in materials science, cryogenics, and quantum error correction codes are essential to enhance the stability and reliability of quantum systems, paving the way for their integration into mainstream applications.

Key Players Analysis

Leading companies in the quantum computing market, such as Accenture Plc, D-Wave Systems Inc., Google LLC, and IBM Corporation, are intensifying efforts to expand their customer base and reinforce their market position.

To achieve a competitive advantage, these firms are actively pursuing strategic collaborations, including mergers, acquisitions, and partnerships with other prominent players. These initiatives are aimed at accelerating technological advancements, scaling quantum capabilities, and securing early-mover benefits in an industry poised for transformational growth.

In 2024, IBM made significant strides in quantum computing. The company launched the IBM Quantum Flex Plan, offering flexible access to its quantum systems, catering to research and development needs . Additionally, IBM unveiled the Quantum System Two, a modular quantum computer designed for scalability and integration with classical systems.

Google’s Quantum AI division achieved a breakthrough with the introduction of the Willow quantum chip. This chip significantly reduces errors as it scales, marking a major advancement in quantum error correction. Willow performed a computation in under five minutes that would take a supercomputer 10 septillion years, demonstrating its potential for solving complex problems beyond the reach of classical computers.

Microsoft introduced the Majorana 1 chip, the world’s first quantum chip powered by a new Topological Core architecture . This innovation is expected to lead to quantum computers capable of solving meaningful, industrial-scale problems in years, not decades. Microsoft also launched the Quantum Ready program, designed to help businesses prepare for the transformative impact of quantum computing .

Listed below are some of the most prominent quantum computing industry players.

- IBM Corporation

- Google Quantum AI

- Microsoft Corporation

- Amazon Web Services, Inc

- Atos Quantum

- D-Wave Quantum Inc.

- Intel

- Hitachi

- QC Ware

- Zapata Computing

- Toshiba Corporation

- Other Key Players

Recent Developments

- In May 2025, IonQ announced its intention to acquire Lightsynq Technologies, a Boston-based startup specializing in quantum memory. This acquisition aims to accelerate IonQ’s quantum networking and computing capabilities, particularly through photonic interconnects and long-distance repeaters.

- As of May 2025, Nvidia is reportedly in advanced discussions to invest in PsiQuantum, a quantum computing startup. This potential investment aligns with Nvidia’s broader strategy to expand its presence in quantum technologies.

- In May 2025, Quantinuum, a quantum computing company, entered into a $1 billion joint venture with Qatar’s Al Rabban Capital. The partnership aims to develop quantum computing applications in sectors such as finance, precision medicine, and genomics within the region.

Report Scope

Report Features Description Market Value (2024) USD 2.1 Bn Forecast Revenue (2034) USD 20.5 Bn CAGR (2025-2034) 25.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Offering (System, Services), By Deployment (On-Premises, Cloud), By Application (Optimization, Simulation, Machine Learning, Others), By End-user (Aerospace & Defense, BFSI, Healthcare, Automotive, Energy & Power, Chemical, Government, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBM Corporation, Google Quantum AI, Microsoft Corporation, Amazon Web Services, Inc, Atos Quantum, D-Wave Quantum Inc., Intel, Hitachi, QC Ware, Zapata Computing, Toshiba Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- IBM Corporation

- Google Quantum AI

- Microsoft Corporation

- Amazon Web Services, Inc

- Atos Quantum

- D-Wave Quantum Inc.

- Intel

- Hitachi

- QC Ware

- Zapata Computing

- Toshiba Corporation

- Other Key Players