Global Pyridine & Pyridine Derivatives Market By Product Type(Pyridine, Beta Picoline, Alpha Picoline, Gamma Picoline, Others), By Production Process(Chemical Synthesis, Extraction from Coal Tar), By Application(Agrochemicals, Pharmaceuticals, Chemicals, Food & Beverage, Nutritional Supplements, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: June 2024

- Report ID: 121579

- Number of Pages: 327

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

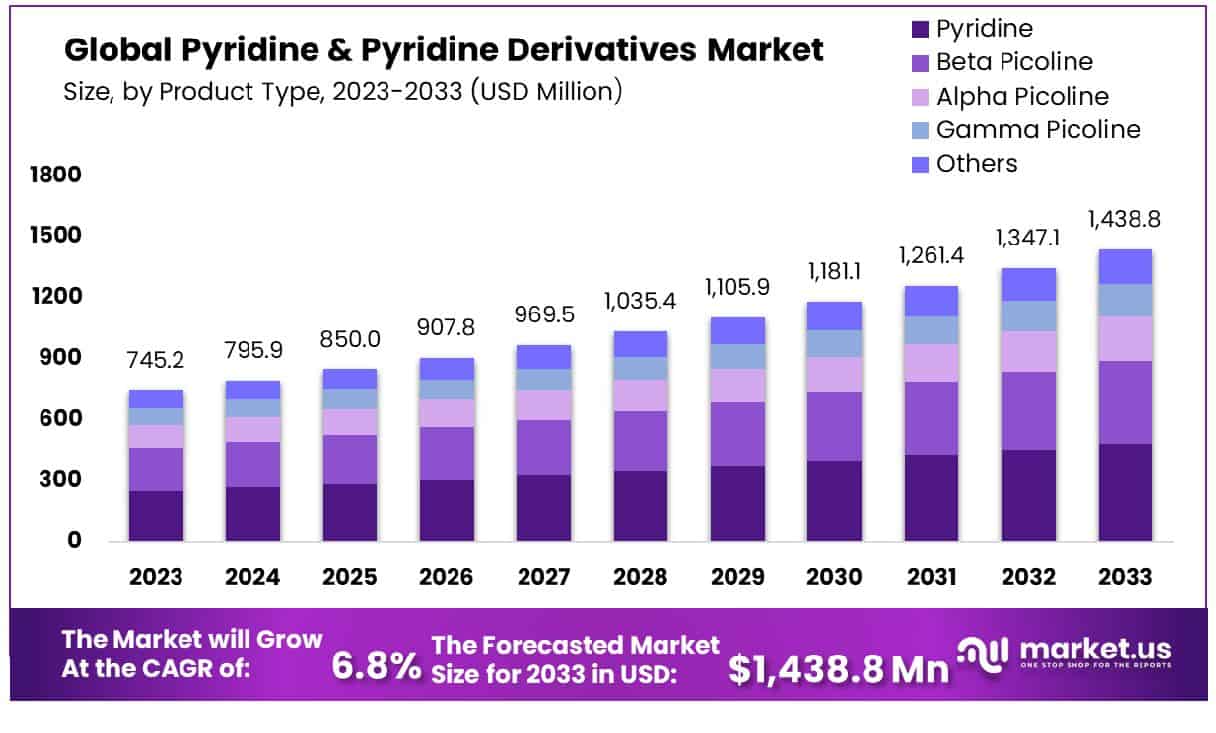

The Global Pyridine & Pyridine Derivatives Market size is expected to be worth around USD 1,438.8 Million by 2033, From USD 745.2 Million by 2023, growing at a CAGR of 6.8% during the forecast period from 2024 to 2033.

The Pyridine & Pyridine Derivatives Market encompasses the global production and distribution of pyridine, a basic heterocyclic organic compound, along with its various derivatives. This market is critical for several industrial applications including pharmaceuticals, agriculture, and chemicals, where pyridine derivatives serve as key ingredients in synthesis and formulation processes.

As leaders in your respective companies, understanding the dynamics of this market is essential for strategic decision-making, particularly in activities involving chemical synthesis and product development. This market’s growth is propelled by the expanding demand for agrochemicals and pharmaceuticals, reflecting its integral role in modern industrial applications.

The global market for pyridine and its derivatives is anticipated to exhibit robust growth, propelled by the increasing utilization of these chemicals in key industrial sectors. Pyridine, a basic organic chemical used as a precursor to agrochemicals and pharmaceuticals, is benefiting significantly from the expansion in these industries.

The upward trajectory in global fertilizer and pesticide use underscores the burgeoning demand for pyridine derivatives. Notably, between 2000 and 2021, global fertilizer use escalated, with nitrogen—often synthesized using pyridine derivatives—representing 56% of the total usage by 2021. The spatial distribution of fertilizer usage reveals a concentration in Asia, of 176 kg/ha, indicating a substantial market for pyridine-based chemicals in this region.

Furthermore, the rise in pesticide consumption, which saw a 62% increase globally from 2000 to 2021, aligns with the heightened demand for pyridine derivatives utilized in pesticide formulations. The Americas emerged as a significant consumer, accounting for half of the global usage, suggesting a strong market presence in both North and South America. Additionally, the integration of organic agricultural practices, though still a smaller fraction of total agricultural land at 3.2% in 2021, points towards an evolving sector that may influence demand dynamics for more specialized pyridine formulations.

In synthesis, the pyridine and pyridine derivatives market is poised for substantial growth, driven by critical applications in agriculture sectors. The observed increase in global agrochemical usage solidifies the current demand and outlines potential growth territories, particularly in high-use regions such as Asia and the Americas.

Key Takeaways

- Market Growth: The Global Pyridine & Pyridine Derivatives Market size is expected to be worth around USD 1,438.8 Million by 2033, From USD 745.2 Million by 2023, growing at a CAGR of 6.8% during the forecast period from 2024 to 2033.

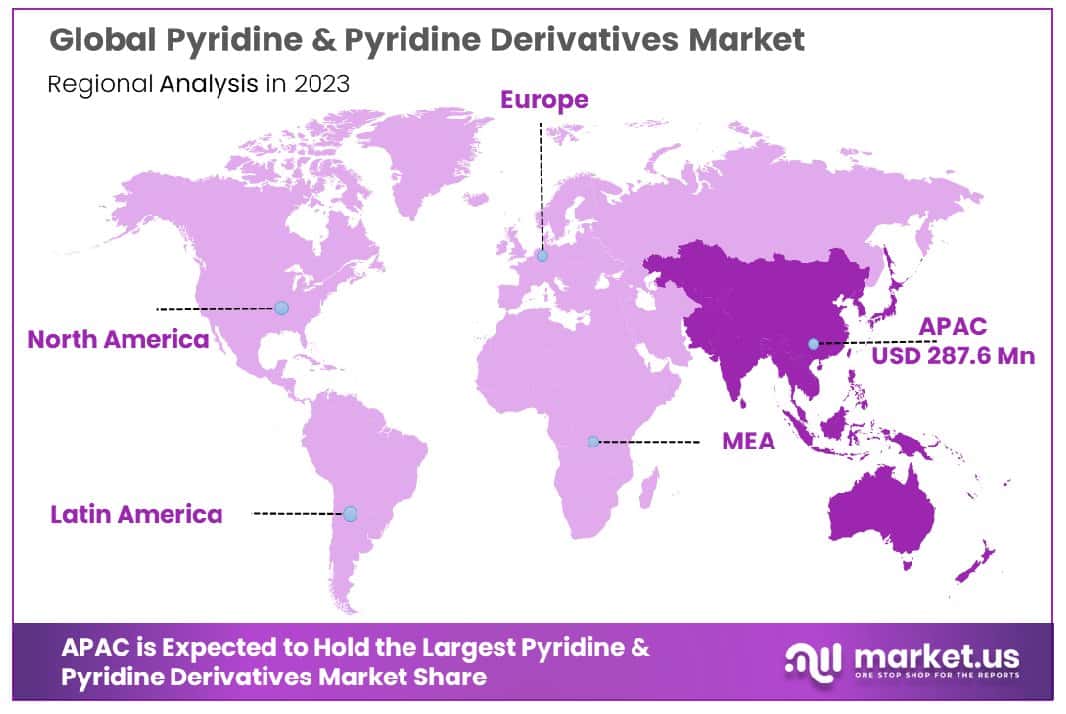

- Regional Dominance: The Pyridine & Pyridine Derivatives Market in Asia Pacific holds 38.6%, valued at USD 287.6 million.

- Segmentation Insights:

- By Product Type: Pyridine represents 33.7% of the market, driven by diverse uses.

- By Production Process: Produced via chemical synthesis or extraction from coal tar, reflecting versatility.

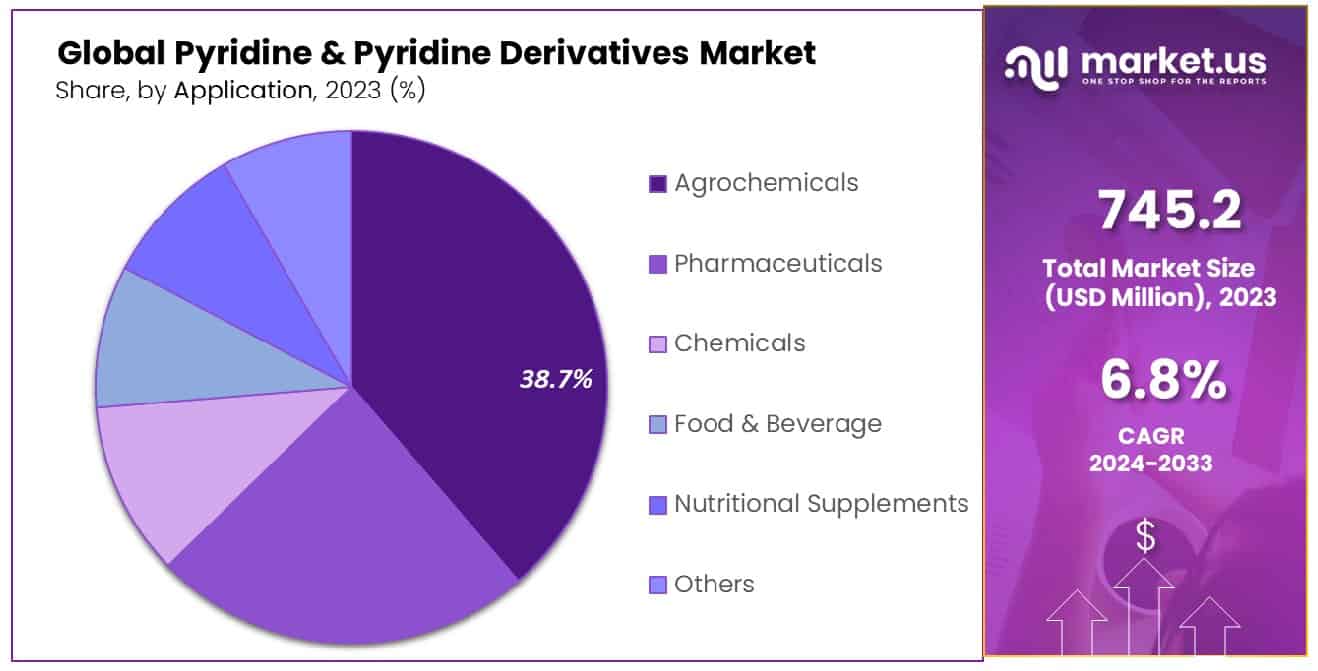

- By Application: Dominantly used in agrochemicals, accounting for 38.7% of application share.

- Growth Opportunities: In 2023, developing markets offer growth due to economic expansion and a rising middle class, while advances in green chemistry drive sustainability, enhancing corporate responsibility and market relevance.

Driving Factors

Increasing Demand for Agrochemicals Fuels Pyridine Market Growth

The pyridine and pyridine derivatives market is significantly bolstered by the rising demand for agrochemicals, primarily as a key component in pesticides like herbicides, insecticides, and fungicides. Pyridine’s role in synthesizing these products aids in enhancing crop yields and protecting crops against pests and diseases, which is crucial as global agricultural output must increase to feed a growing population.

The agrochemical sector’s expansion, driven by the need for higher agricultural productivity, directly correlates with the heightened consumption of pyridine. As countries increasingly focus on agricultural efficiency due to food security concerns, the demand for pyridine in this sector is expected to surge, reinforcing its market growth.

Pharmaceutical Industry Expansion Propels Pyridine Applications

The growth of the pharmaceutical industry presents another pivotal driver for the pyridine and pyridine derivatives market. Pyridine derivatives are essential in manufacturing various pharmaceuticals, serving as precursors and intermediates in the synthesis of active pharmaceutical ingredients (APIs).

The pharmaceutical sector’s expansion, spurred by the global population’s rising healthcare needs and the continual introduction of new drugs, has significantly increased the demand for pyridine. This relationship underscores a symbiotic growth pattern, where advancements in healthcare and medicine foster increased use and development of pyridine-based compounds, thereby contributing to the market’s expansion.

Rising Use in Food Flavoring and Nutrition Enhances Market Prospects

Pyridine derivatives are increasingly utilized in the food industry as flavoring agents and nutritional supplements, which marks a growing segment contributing to the market’s expansion. The enhancement of flavors in processed foods and the fortification of foods with nutritional additives are critical factors in the industry’s growth.

As consumer preferences shift towards more flavorful and nutritious food options, the demand for pyridine derivatives in these applications is expected to rise. This trend not only broadens the market for pyridine but also aligns with global shifts towards healthier and more sustainable food production practices, further driving market growth.

Restraining Factors

Stringent Environmental Regulations Limit Market Expansion

The pyridine and pyridine derivatives market faces significant challenges due to stringent environmental regulations. Pyridine compounds, known for their toxicity and potential environmental hazards, are subject to tight control by environmental protection agencies worldwide. These regulations impact the production, handling, and disposal of pyridine, imposing strict compliance costs and operational constraints on manufacturers.

The need to develop environmentally friendly and sustainable production methods also increases R&D expenditures, thereby affecting profit margins. Moreover, the tightening of regulations often leads to a reduction in the permissible usage of certain pyridine-based products, particularly in sensitive applications such as agrochemicals and food additives. This factor acts as a major restraint on the market’s growth, as companies must navigate the complex landscape of environmental compliance while trying to sustain production efficiency and market competitiveness.

Volatility in Raw Material Prices Challenges Market Stability

Volatility in the prices of raw materials, such as coal tar and crude oil derivatives which are primary sources for pyridine production, significantly affects the pyridine and pyridine derivatives market. Price fluctuations can lead to unpredictable costs, complicating budgeting and financial planning for manufacturers. This volatility can stem from geopolitical tensions, changes in energy policies, and market dynamics affecting oil and coal industries. Such unpredictability not only increases the risk of production but also forces companies to adjust their pricing strategies frequently, potentially making pyridine-based products less competitive.

Additionally, the interplay between raw material cost instability and stringent environmental regulations creates a compounded challenge, as manufacturers might find it difficult to both comply with environmental standards and manage cost-efficiency amidst fluctuating raw material prices. These factors collectively impede market growth, as they add layers of financial and regulatory uncertainty that can deter investment and innovation in the pyridine sector.

By Product Type Analysis

Pyridine accounts for 33.7% of the market, showing its prominence in various industrial uses.

In 2023, Pyridine held a dominant market position in the By Product Type segment of the Pyridine & Pyridine Derivatives Market, capturing more than 33.7% of the market share. The segment includes various key categories such as Beta Picoline, Alpha Picoline, Gamma Picoline, and others. Pyridine’s prominence is attributed to its extensive application across several industries, including pharmaceuticals, agrochemicals, and chemical synthesis, where it is valued for its versatility as a solvent and a reagent.

Beta Picoline, another significant derivative, follows closely, primarily utilized in the production of vitamins and agrochemicals. Its demand is driven by the growing health awareness and the increasing need for food security globally, which in turn, fuels the agrochemical sector. Alpha Picoline and Gamma Picoline, although smaller in market share, are crucial in specific niche applications that leverage their unique chemical properties for synthesizing various chemical compounds.

The category labeled “Others” encompasses a range of less common pyridine derivatives, each serving specialized roles in different chemical processes and formulations. This diversity within the pyridine derivatives range underlines the breadth of their applicability, ensuring sustained demand.

Overall, the Pyridine & Pyridine Derivatives Market is expected to expand, driven by innovations in chemical synthesis and growing demands in end-user industries. Despite this, the market faces challenges such as stringent regulatory frameworks and the environmental impacts associated with pyridine production, which could affect future market dynamics and competitive strategies.

By Production Process Analysis

Pyridine is produced mainly via chemical synthesis and extraction from coal tar, highlighting traditional methods.

In 2023, Chemical Synthesis, followed closely by Extraction from Coal Tar, held a dominant market position in the By Production Process segment of the Pyridine & Pyridine Derivatives Market. Chemical synthesis, as the leading method, is primarily favored due to its efficiency and the ability to scale production according to market demands. This method supports the consistent quality and purity required for applications in sensitive industries such as pharmaceuticals and agrochemicals.

Extraction from coal tar, although less predominant than chemical synthesis, remains vital due to its cost-effectiveness and the ability to source from existing coal processing operations. This method taps into a byproduct of coal production, thereby aligning with resource utilization efficiencies and supporting sustainability in industrial practices.

Both production processes are integral to meeting the global demand for pyridine and its derivatives, which are crucial components in a variety of applications including chemical synthesis, pharmaceuticals, and agrochemicals. The choice between these methods often depends on factors such as cost considerations, environmental impact, and regional availability of raw materials.

As the market continues to evolve, technological advancements and environmental regulations are likely to influence these production processes. Innovations aimed at improving yield, reducing waste, and minimizing environmental footprint are expected to be key drivers for the segment. Furthermore, the shifting regulatory landscape could potentially reshape production strategies, as stakeholders are compelled to adopt more sustainable and environmentally friendly methods.

By Application Analysis

Agrochemicals utilize 38.7% of pyridine, indicating its critical role in the synthesis of pesticides.

In 2023, Agrochemicals held a dominant market position in the By Application segment of the Pyridine & Pyridine Derivatives Market, capturing more than 38.7% of the market share. This segment comprises various categories including Pharmaceuticals, Chemicals, Food & Beverage, Nutritional Supplements, and others. The substantial share held by Agrochemicals can be attributed to the critical role of pyridine derivatives in the synthesis of pesticides and herbicides, which are essential for enhancing crop yield and quality in the face of global food demand pressures.

Pharmaceuticals follow as a significant application area, leveraging pyridine derivatives for the synthesis of drugs and active pharmaceutical ingredients, reflecting the sector’s innovation and expansion in response to evolving healthcare needs. The Chemicals category also represents a major portion of the market, utilizing these derivatives in a range of industrial processes.

Lesser, yet noteworthy contributions come from the Food & Beverage and Nutritional Supplements sectors. In these areas, pyridine derivatives are used to enhance flavors and as additives in nutritional products, driven by consumer demand for enhanced taste profiles and health benefits.

The category labeled “Others” includes various smaller applications across different industries, each finding unique utility for pyridine derivatives. Despite the dominance of Agrochemicals, growth opportunities exist across all sectors, influenced by technological advancements and regulatory changes, which could redefine market dynamics in the coming years. However, environmental concerns and regulatory compliance are key challenges that could impact the growth trajectory of the pyridine and pyridine derivatives market.

Key Market Segments

By Product Type

- Pyridine

- Beta Picoline

- Alpha Picoline

- Gamma Picoline

- Others

By Production Process

- Chemical Synthesis

- Extraction from Coal Tar

By Application

- Agrochemicals

- Pharmaceuticals

- Chemicals

- Food & Beverage

- Nutritional Supplements

- Others

Growth Opportunities

Expansion in Developing Markets

The global landscape presents significant growth opportunities in developing markets, driven by robust economic expansion, increasing consumer spending, and governmental reforms aimed at improving business environments. In 2023, these markets are expected to offer fertile ground for businesses looking to diversify their operations and tap into new consumer bases.

The rise of the middle class, particularly in regions such as Asia, Africa, and Latin America, has led to increased demand for products and services previously considered unaffordable. Companies that strategically enter these markets can leverage cost advantages and local partnerships to enhance their global footprint and competitive edge. However, successful expansion will require tailored marketing strategies and products adapted to local tastes and cultural nuances.

Advances in Green Chemistry

The shift towards sustainability is accelerating the adoption of green chemistry practices across industries, offering substantial opportunities for growth in 2023. Advances in green chemistry are enabling companies to reduce waste, lower emissions, and decrease energy usage, aligning with global regulatory trends and consumer preferences for environmentally friendly products. This progress is not only enhancing environmental outcomes but also opening up new markets for sustainable products and technologies.

As industries face increasing pressure to demonstrate corporate responsibility, the integration of green chemistry processes will become a critical factor in maintaining market relevance and consumer trust. Companies at the forefront of this transformation are positioned to gain market share and enhance their brand loyalty through proactive environmental stewardship.

Latest Trends

Increasing Adoption of Synthetic Pyridine

The year 2023 has witnessed a rising trend in the adoption of synthetic pyridine across various industries, marking it as a significant growth opportunity globally. Synthetic pyridine, a versatile organic compound, is increasingly utilized in pharmaceuticals, agrochemicals, and food additives, thanks to its ability to enhance properties and efficiencies. The pharmaceutical industry, in particular, has capitalized on this compound to develop drugs with improved potency and stability.

As regulatory bodies continue to approve its varied applications, companies investing in synthetic pyridine production are likely to see substantial returns. However, navigating the environmental and health regulations will be crucial for firms looking to expand their footprint in this market segment.

Development of New Applications in Biodegradable Products

2023 is also defining itself as a pivotal year for the expansion of biodegradable products, with significant strides being made in developing new applications. This trend is driven by the growing consumer demand for sustainable alternatives to traditional plastics and the increasing strictness of governmental regulations regarding waste management. Innovations in biodegradable materials are now extending beyond packaging to include sectors like smart agriculture, automotive, and electronics, which presents broad market opportunities.

Companies that are innovating in this space are not only contributing to environmental sustainability but are also likely to benefit from early market entry advantages and enhanced brand loyalty among eco-conscious consumers. As this trend continues to evolve, the potential for disruptive innovation in biodegradable products remains high.

Regional Analysis

The Pyridine & Pyridine Derivatives Market in Asia Pacific accounts for 38.6% with a valuation of USD 287.6 million.

The Pyridine & Pyridine Derivatives market exhibits diverse trends and opportunities across different regions. In North America, the market is driven by robust demand from the pharmaceutical and agrochemical sectors. Enhanced regulatory frameworks and technological advancements in synthesis methods further bolster the regional market growth.

Europe follows a similar trajectory, with significant contributions from the chemical and healthcare industries. Stricter environmental regulations in Europe also promote the development of bio-based pyridine derivatives, aligning with sustainability goals.

Asia Pacific stands as the dominant region, commanding a 38.6% market share with a valuation of USD 287.6 million. This dominance is underpinned by the expansive industrial base in countries like China and India, coupled with increasing investments in pharmaceuticals and agrochemicals. The region benefits from lower production costs and relaxed regulations, which attract significant foreign investments in pyridine production facilities.

The Middle East & Africa, and Latin America regions, though smaller in scale compared to their counterparts, are witnessing gradual growth. This growth is fueled by increasing industrial activities and the gradual establishment of regulatory frameworks that could pave the way for market expansion. In these regions, the focus on diversifying the economic base, particularly in Middle Eastern countries, presents new opportunities for the pyridine market.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

Key Players Analysis

In the global Pyridine & Pyridine Derivatives Market for 2023, several key players have demonstrated significant market influence and strategic advancements. Mitsubishi Chemical Corporation stands out for its robust integration across the value chain, which enhances its supply chain efficiency and product customization capabilities. Eastman Chemical Company continues to innovate in product offerings, focusing on sustainability, which appeals to environmentally conscious consumers and industries.

BASF SE, a giant in the chemical industry, leverages its extensive R&D capabilities to introduce novel pyridine derivatives, which are critical for agricultural chemicals and pharmaceutical applications. Their global presence allows them to tap into emerging markets effectively. Similarly, Vertellus Specialties Inc. has carved a niche in niche applications of pyridine derivatives, particularly in the life sciences and agricultural sectors, showing strong growth potential.

Jubilant Life Sciences focuses on cost-effective production methodologies, which make it a competitive player in markets with high price sensitivity. Lonza Group AG, renowned for its high-quality standards and compliance, leads in regulatory expertise, making it a preferred partner in highly regulated markets such as pharmaceuticals and biotech.

Chinese firms like Nanjing Redsun Co., Ltd., Shangdong Luba Chemical Co., Ltd., and Hubei Sanonda Co., Ltd., benefit from localized manufacturing advantages, government support, and rapid scalability, positioning them strategically in the fast-growing Asian markets. Chang Chun Petrochemical Co., Ltd. has expanded its capacity, emphasizing the production of high-purity pyridine used in electronic chemicals.

Western players like Koei Chemical Company Limited and C-Chem Co., Ltd. focus on specialized applications, which command higher margins. Evonik Industries AG and Merck KGaA continue to enhance their offerings through technological innovations and strategic partnerships, which broaden their application scope.

Resonance Specialties Limited, though smaller in scale, compete effectively by offering customized solutions and maintaining strong customer relationships in niche segments. Collectively, these companies are set to drive the market forward through innovation, strategic market placement, and adaptive manufacturing practices.

Market Key Players

- Mitsubishi Chemical Corporation

- Eastman Chemical Company

- BASF SE

- Vertellus Specialties Inc.

- Jubilant Life Sciences

- Lonza Group AG

- Nanjing Redsun Co., Ltd.

- Shangdong Luba Chemical Co., Ltd.

- Hubei Sanonda Co., Ltd.

- Chang Chun Petrochemical Co., Ltd.

- Koei Chemical Company Limited

- C-Chem Co., Ltd.

- Resonance Specialties Limited

- Evonik Industries AG

- Merck KGaA

Recent Development

- In May 2023, Exelixis led in quinoline derivatives for cancer treatment, focusing on renal and hepatocellular carcinomas. President, Biogen, and LEO Foundation excel in application diversity. Cytokinetics tops in geographic reach.

- In September 2014, Indian bulk drug makers excelled in niche areas despite Chinese competition. Virchow leads in Sulfamethoxazole, Lupin in Lisinopril, Divi’s in Dextromethorphan and Naproxen, and Jubilant in Pyridine derivatives.

Report Scope

Report Features Description Market Value (2023) USD 745.2 Million Forecast Revenue (2033) USD 1,438.8 Million CAGR (2024-2033) 6.8% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type(Pyridine, Beta Picoline, Alpha Picoline, Gamma Picoline, Others), By Production Process(Chemical Synthesis, Extraction from Coal Tar), By Application(Agrochemicals, Pharmaceuticals, Chemicals, Food & Beverage, Nutritional Supplements, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Mitsubishi Chemical Corporation, Eastman Chemical Company, BASF SE, Vertellus Specialties Inc., Jubilant Life Sciences, Lonza Group AG, Nanjing Redsun Co., Ltd., Shangdong Luba Chemical Co., Ltd., Hubei Sanonda Co., Ltd., Chang Chun Petrochemical Co., Ltd., Koei Chemical Company Limited, C-Chem Co., Ltd., Resonance Specialties Limited, Evonik Industries AG, Merck KGaA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Pyridine & Pyridine Derivatives MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample

Pyridine & Pyridine Derivatives MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample - Market Growth: The Global Pyridine & Pyridine Derivatives Market size is expected to be worth around USD 1,438.8 Million by 2033, From USD 745.2 Million by 2023, growing at a CAGR of 6.8% during the forecast period from 2024 to 2033.

-

-

- Mitsubishi Chemical Corporation

- Eastman Chemical Company

- BASF SE

- Vertellus Specialties Inc.

- Jubilant Life Sciences

- Lonza Group AG

- Nanjing Redsun Co., Ltd.

- Shangdong Luba Chemical Co., Ltd.

- Hubei Sanonda Co., Ltd.

- Chang Chun Petrochemical Co., Ltd.

- Koei Chemical Company Limited

- C-Chem Co., Ltd.

- Resonance Specialties Limited

- Evonik Industries AG

- Merck KGaA