Global Prostate-Specific Antigen Testing Market By Test Type (Immunoassays, Strips, Radioimmunoassay, Lateral Flow Assays, and ELISA Kits), By Sample Type (Serum, Whole Blood, and Plasma), By End-user (Hospitals, Specialty Clinics, Diagnostics Laboratories, Research Institutes, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169087

- Number of Pages: 247

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

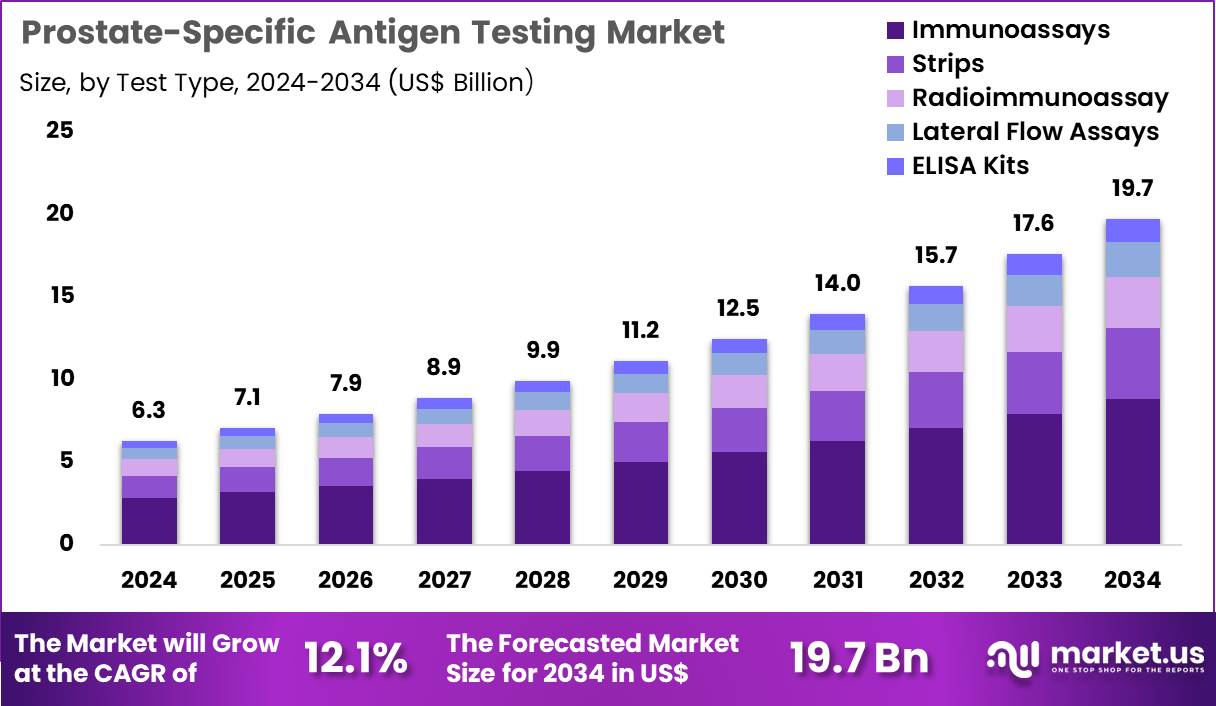

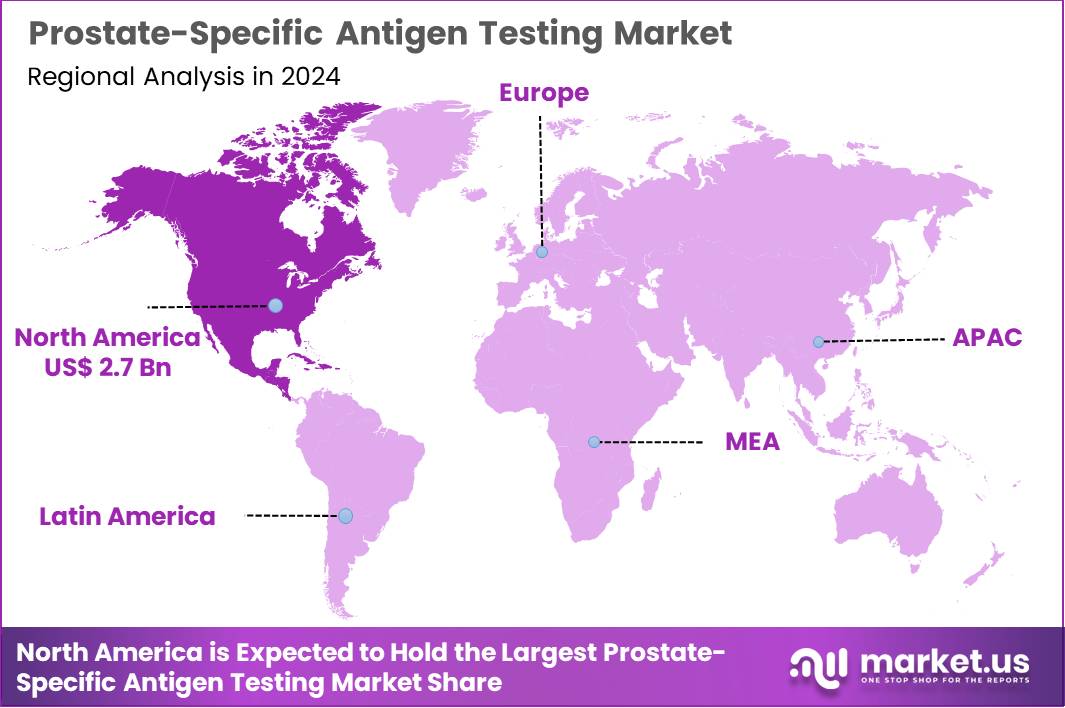

Global Prostate-Specific Antigen Testing Market size is expected to be worth around US$ 19.7 Billion by 2034 from US$ 6.3 Billion in 2024, growing at a CAGR of 12.1% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 42.1% share with a revenue of US$ 2.7 Billion.

Increasing emphasis on early prostate cancer detection propels the Prostate-Specific Antigen Testing market, as healthcare providers advocate routine screening to identify at-risk individuals before symptoms manifest. Diagnostic laboratories utilize automated immunoassay platforms that measure free and total PSA levels with high precision to guide clinical decisions. These tests support initial risk assessment in asymptomatic men over 50, biopsy decision-making through PSA density calculations, active surveillance monitoring in low-grade cancers, and recurrence evaluation post-prostatectomy via serial PSA kinetics.

Emerging opportunities lie in hybrid models that pair PSA with genetic or imaging biomarkers to minimize overdiagnosis and enhance specificity. Researchers from The Institute of Cancer Research in London presented compelling data at the ASCO annual meeting on May 29, 2024, showcasing a saliva-based Polygenic Risk Score test that analyzes 130 genetic markers to outperform standalone PSA in pinpointing aggressive prostate cancer risks. This breakthrough underscores the potential for integrated screening strategies that amplify PSA’s clinical utility.

Growing adoption of non-invasive urine-based assays accelerates the Prostate-Specific Antigen Testing market, as patients and clinicians seek alternatives to traditional blood draws that reduce procedural discomfort and improve compliance. Biotechnology firms develop multiplex kits that detect PSA isoforms alongside urinary biomarkers for more nuanced risk stratification.

Applications encompass post-treatment surveillance to detect biochemical recurrence early, differential diagnosis of prostatitis versus malignancy through PSA velocity tracking, eligibility screening for focal therapies like high-intensity focused ultrasound, and population health initiatives for high-risk cohorts such as BRCA mutation carriers.

Technological refinements create avenues for point-of-care deployment in primary care settings. LynxDx Inc. advanced this landscape in February 2023 with the launch of MyProstateScore 2, a urine test incorporating 18 biomarkers including the T2:ERG gene fusion to deliver personalized risk assessments. Such innovations drive market evolution toward accessible, multi-analyte diagnostics.

Rising integration of artificial intelligence in result interpretation invigorates the Prostate-Specific Antigen Testing market, as algorithms refine predictive models to contextualize PSA elevations and reduce unnecessary interventions. Instrument manufacturers embed machine learning modules into analyzers that correlate PSA trends with patient metadata for tailored recommendations.

These enhanced systems facilitate genomic risk integration for familial prostate cancer evaluation, therapeutic response monitoring during androgen deprivation therapy, prognostic scoring in metastatic disease management, and epidemiological studies tracking incidence patterns. AI-driven tools unlock opportunities for real-time clinical decision support and reduced healthcare disparities through automated alerts.

The U.S. FDA granted Breakthrough Device Designation on March 18, 2025, to Exact Check Diagnostics’ AI-powered PSA platform, which leverages machine learning to boost specificity and curb false positives in early detection. This regulatory milestone propels the adoption of intelligent analytics across diagnostic workflows.

Key Takeaways

- In 2024, the market generated a revenue of US$ 6.3 billion, with a CAGR of 12.1%, and is expected to reach US$ 19.7 billion by the year 2034.

- The test type segment is divided into immunoassays, strips, radioimmunoassay, lateral flow assays, and ELISA kits, with immunoassays taking the lead in 2024 with a market share of 44.9%.

- Considering sample type, the market is divided into serum, whole blood, and plasma. Among these, serum held a significant share of 52.4%.

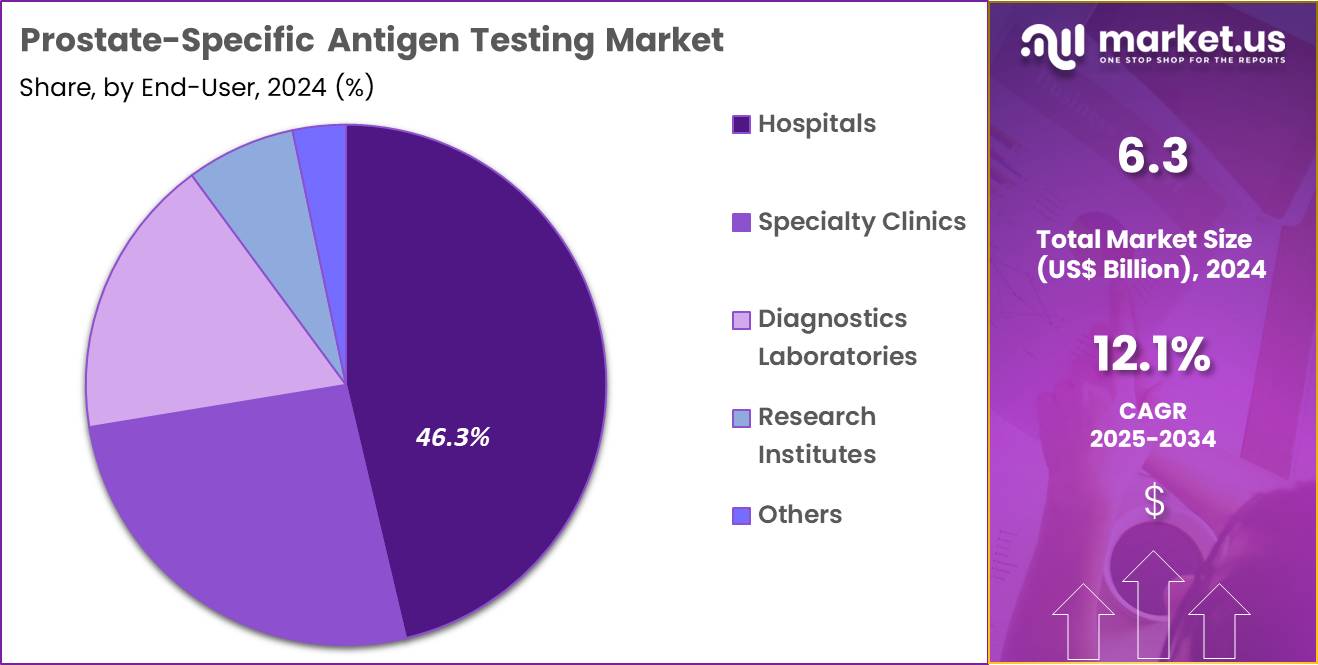

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, specialty clinics, diagnostics laboratories, research institutes, and others. The hospitals sector stands out as the dominant player, holding the largest revenue share of 46.3% in the market.

- North America led the market by securing a market share of 42.1% in 2024.

Test Type Analysis

Immunoassays, holding 44.9%, are expected to dominate due to their strong analytical sensitivity and ability to detect low PSA concentrations with high precision. Clinical teams prefer immunoassay-based PSA testing for early prostate cancer detection and risk stratification. Laboratories adopt automated immunoassay platforms that support high-throughput processing and reduce turnaround time. Manufacturers introduce ultrasensitive PSA assays that improve detection of recurrence and monitor therapeutic response.

Rising screening awareness among aging male populations strengthens immunoassay usage. Hospitals integrate immunoassay systems into routine diagnostic panels, increasing daily test volumes. Research groups study PSA kinetics in advanced disease stages, increasing reliance on sensitive assays. Public-health programs encourage PSA screening in high-risk populations, expanding adoption. Digital connectivity enhances reporting accuracy and supports clinical decision-making. These factors keep immunoassays anticipated to remain the leading PSA test type.

Sample Type Analysis

Serum, holding 52.4%, is anticipated to remain the dominant sample type because it offers stable PSA measurement and high diagnostic reliability. Clinicians depend on serum-based PSA values to evaluate prostate cancer risk, monitor disease progression, and assess treatment response. Laboratories choose serum samples due to minimal interference and strong compatibility with automated immunoassay analyzers. Serum testing provides consistent reproducibility across different PSA platforms, strengthening clinical confidence. Expanded screening programs in older men increase serum-based test frequency.

Research teams rely on serum samples for biomarker validation studies related to PSA isoforms and prostate cancer aggressiveness. Serum-based testing supports precise interpretation of free and total PSA ratios. Hospitals and clinics maintain large serum sample workflows, enhancing turnaround efficiency. High accuracy in low concentration ranges increases adoption for early detection. These dynamics keep serum projected to remain the most influential sample type.

End-User Analysis

Hospitals, holding 46.3%, are expected to dominate end-user adoption as they manage the highest patient volumes for prostate cancer screening and monitoring. Clinicians rely on PSA testing to guide biopsy decisions and evaluate therapy outcomes. Hospitals maintain integrated laboratory infrastructure equipped with automated immunoassay analyzers, enabling rapid testing. Rising prostate cancer incidence among aging populations increases hospital-based screening frequency.

Urology departments conduct follow-up PSA assessments to track recurrence risks. Multidisciplinary cancer teams incorporate PSA results into personalized treatment planning. Hospitals expand preventive health programs that include PSA testing for early risk detection. Emergency and outpatient departments use PSA measurements for differential diagnosis of prostate-related symptoms. Centralized hospital labs handle bulk testing during screening drives, raising throughput. These factors keep hospitals anticipated to remain the dominant end-user segment in the PSA testing market.

Key Market Segments

By Test Type

- Immunoassays

- Strips

- Radioimmunoassay

- Lateral Flow Assays

- ELISA Kits

By Sample Type

- Serum

- Whole Blood

- Plasma

By End-user

- Hospitals

- Specialty Clinics

- Diagnostics Laboratories

- Research Institutes

- Others

Drivers

Rising Incidence of Prostate Cancer is Driving the Market

The increasing incidence of prostate cancer across global populations has solidified its position as a primary driver for the prostate-specific antigen testing market, as elevated PSA levels serve as an initial indicator for further diagnostic evaluation. This trend is particularly pronounced in aging demographics, where hormonal and genetic factors heighten susceptibility, necessitating routine screening to detect asymptomatic cases early.

Healthcare organizations are incorporating PSA testing into preventive protocols, especially for men over 50, to facilitate timely interventions and improve survival rates. Diagnostic laboratories are expanding capacity to accommodate rising test volumes, supported by automated immunoassay platforms for efficiency. Regulatory endorsements validate PSA’s role in risk stratification, aligning with national cancer control strategies.

Collaborative surveillance systems between public health entities and providers enhance data utilization, informing targeted screening campaigns. The economic burden of advanced prostate cancer justifies investments in accessible testing, averting high-cost treatments for metastatic disease. Professional associations promote PSA as a foundational tool, embedding it within multidisciplinary care pathways. This driver spurs advancements in assay sensitivity, enabling detection of subtle elevations linked to aggressive subtypes.

Educational initiatives for primary care physicians underscore PSA’s prognostic value, encouraging proactive discussions with at-risk patients. In the European Union, prostate cancer accounted for an estimated 330,000 new cases in 2022. Such epidemiological data, derived from the European Cancer Information System, emphasize the imperative for widespread PSA utilization.

Restraints

Concerns Over Overdiagnosis and False Positives are Restraining the Market

Persistent concerns regarding overdiagnosis and false positives associated with PSA testing continue to restrain market expansion, as elevated levels often prompt unnecessary biopsies and patient anxiety without confirming malignancy. Benign conditions like prostatitis or benign prostatic hyperplasia frequently elevate PSA, leading to low specificity and cascading diagnostic procedures. This issue has prompted cautious guideline revisions, limiting routine screening recommendations to high-risk groups and reducing overall test volumes.

Healthcare providers face ethical dilemmas in balancing benefits against harms, resulting in selective application that curbs demand. Regulatory scrutiny intensifies on assay performance metrics, delaying approvals for enhanced variants. The restraint fosters reliance on adjunctive tools like MRI, diverting resources from standalone PSA platforms. Public health campaigns highlight risks, eroding consumer confidence and adherence to screening.

Manufacturers encounter challenges in refining thresholds without compromising sensitivity, prolonging R&D cycles. These factors collectively temper market predictability, as variable utilization patterns disrupt supply planning. Addressing this necessitates integrated risk calculators to contextualize PSA results effectively. A meta-analysis reported the pooled specificity of PSA for prostate cancer detection at 93.2%, underscoring the high false-positive rate contributing to overdiagnosis. Such performance limitations, documented in peer-reviewed literature, illustrate the diagnostic uncertainties impeding broader adoption.

Opportunities

Advancements in Blood-Based Biomarker Panels are Creating Growth Opportunities

The development of multi-biomarker blood panels incorporating PSA with novel proteins and genetic markers is generating substantial growth opportunities for the prostate-specific antigen testing market, enhancing specificity and reducing unnecessary procedures. These panels, such as the 4Kscore or Prostate Health Index, enable refined risk assessment, appealing to clinicians seeking to optimize biopsy decisions. Opportunities arise in partnering with pharmaceutical firms for companion diagnostics tied to targeted therapies, expanding market reach in precision oncology.

Regulatory fast-track pathways expedite validations, facilitating rapid commercialization of integrated assays. This innovation supports population-based screening in underserved regions, where cost-effective panels address access barriers. Economic models project savings from averted overtreatment, incentivizing payer reimbursements for advanced testing. Global consortia accelerate evidence generation through large-scale trials, bolstering guideline inclusions. These developments diversify portfolios toward subscription-based monitoring services, ensuring recurring revenue.

Emerging applications in active surveillance post-diagnosis further broaden utility, tailoring follow-up strategies. Sustained investments in AI-driven interpretations promise scalable solutions for primary care integration. In 2023, the U.S. National Institutes of Health funded biomarker discovery initiatives, contributing to a 7% increase in personalized medicine research allocations from 2022 levels. This fiscal commitment exemplifies the supportive landscape for innovative PSA enhancements.

Impact of Macroeconomic / Geopolitical Factors

Economic downturns and rising laboratory overheads force urology practices to restrict PSA testing frequency, particularly in publicly funded systems facing reimbursement cuts. Heightened awareness campaigns and aging male demographics, however, sustain steady order volumes as physicians push for earlier intervention protocols.

Geopolitical disruptions in Baltic and Black Sea routes delay monoclonal antibody shipments from European bioreactors, stretching replenishment windows and lifting kit prices for distributors. These bottlenecks, in contrast, energize local conjugation facilities and multi-source contracts that lock in reliability and moderate cost swings. Ongoing U.S. Section 301 tariffs at 25% on non-exempt imported immunoassay reagents, reinforced in 2025, elevate landed costs for American reference labs and pressure profit margins on high-throughput panels.

Labs respond decisively by qualifying domestic contract manufacturers and utilizing USMCA pathways that neutralize the tariff bite. Overall, these currents demand tighter inventory discipline yet open doors to smarter partnerships. The prostate-specific antigen testing sector presses forward with confidence, converting today’s constraints into tomorrow’s efficiencies that deliver faster, more accessible screening to men worldwide.

Latest Trends

Introduction of EpiSwitch PSA Enhancement Test is a Recent Trend

The integration of epigenetic technologies with traditional PSA testing has emerged as a defining trend in 2024, exemplified by the EpiSwitch platform that boosts diagnostic accuracy through chromosome conformation analysis. This approach identifies prostate cancer signatures in blood samples, achieving superior positive predictive value over standalone PSA. The trend prioritizes non-invasive enhancements, aligning with patient preferences for reduced procedural risks.

Developers are refining the test for multiplex compatibility, incorporating immune cell folding patterns for comprehensive profiling. Regulatory validations confirm its utility in triaging elevated PSA cases, streamlining biopsy pathways. Adoption in urology practices accelerates, where the test refines risk stratification for indolent versus aggressive disease. This evolution intersects with digital reporting apps, enabling seamless clinician review and patient education.

Competitive advancements include adaptations for high-throughput labs, supporting population screening pilots. Broader implications encompass hereditary risk assessments, adapting the technology for familial cohorts. The trend fosters international collaborations for validation in diverse ethnic groups. The Prostate Screening EpiSwitch (PSE) blood test demonstrated 94% accuracy in detecting prostate cancer in a 2023 pilot study involving 147 patients. This performance metric highlights the trend’s potential to revolutionize early detection paradigms.

Regional Analysis

North America is leading the Prostate-Specific Antigen Testing Market

North America accounted for 42.1% of the overall market in 2024, and the region saw strong growth as screening programs expanded across primary-care and urology networks targeting early detection in men aged 50 and above. Clinics increased adoption of both total and free PSA assays as physicians emphasized personalized risk assessment and earlier clinical intervention. Telehealth platforms enabled broader access to follow-up testing, which supported steady increases in laboratory volumes.

Pharmacies strengthened point-of-care screening events, making diagnostics more accessible for underserved groups. The National Cancer Institute reported an estimated 288,300 new prostate-cancer cases in the United States in 2023 (NCI – SEER Cancer Stat Facts: Prostate Cancer), and this rising incidence significantly fueled demand for timely PSA evaluation.

Academic centers advanced biomarker research, prompting laboratories to upgrade analytical platforms. Expanded insurance coverage for routine screening encouraged more men to undergo annual checks. These combined trends reinforced North America’s dominant regional growth in 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to witness strong expansion during the forecast period as governments intensify awareness programs and promote earlier urological screening across aging male populations. Hospitals strengthen diagnostic capacity by adding automated immunoassay systems to manage rising prostate-cancer burdens in urban regions. Clinics adopt risk-stratification tools that allow physicians to recommend targeted follow-up testing for high-risk men.

Growth accelerates as private diagnostic chains expand standardized screening packages across Southeast Asia. Digital health platforms improve access to urology consultations, encouraging more men to complete regular evaluations. The Korea Central Cancer Registry reported 20,916 new prostate-cancer cases in 2022 (KCCR Annual Report 2022), and this upward trend underscores the growing need for widespread screening. Manufacturers enhance kit distribution efficiency throughout Japan, South Korea, and Australia. These developments collectively position Asia Pacific for robust diagnostic growth over the forecast horizon.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players amplify growth by releasing next-generation immunoassays and integrating digital workflows that enhance diagnostic precision and laboratory efficiency. They invest in global distribution expansion, particularly in Asia Pacific and Latin America, to access rising screening demand and improve market penetration. They form alliances with urology centres and diagnostics networks to embed their testing platforms into clinical pathways and boost adoption rates.

They prioritise high-throughput automation and multiplex platforms to lower cost-per-test, accelerate turnaround and appeal to centralised labs. They engage in strategic acquisitions of niche diagnostics firms to accelerate time-to-market for novel biomarker-driven solutions and broaden their product portfolios. Abbott Laboratories offers a strong example: the company holds a significant global footprint in diagnostics, compiles a wide immunoassay portfolio, and leverages its clinical-network relationships to support growth in prostate-specific antigen screening and monitoring.

Top Key Players

- Abbott Laboratories

- Siemens Healthineers

- Roche Diagnostics (F. Hoffmann‑La Roche Ltd)

- Bio‑Rad Laboratories, Inc.

- Bayer AG

- Beckman Coulter, Inc.

- DiaSorin S.p.A.

- OPKO Health, Inc.

Recent Developments

- On April 25, 2025, Clarius Mobile Health received FDA clearance for its Clarius Prostate AI tool. The system works with handheld ultrasound imaging and provides rapid, automated prostate volume calculations, which are essential for determining PSA Density and improving risk assessment in clinical practice.

- On March 24, 2025, the European Association of Urology released its updated Prostate Cancer Guidelines. The revisions emphasize a risk-adjusted approach that considers baseline PSA levels, including recommending extended follow-up intervals for men with very low PSA values—such as those below 1.5 ng/mL which directly influences how often PSA testing is performed.

Report Scope

Report Features Description Market Value (2024) US$ 6.3 Billion Forecast Revenue (2034) US$ 19.7 Billion CAGR (2025-2034) Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Test Type (Immunoassays, Strips, Radioimmunoassay, Lateral Flow Assays, and ELISA Kits), By Sample Type (Serum, Whole Blood, and Plasma), By End-user (Hospitals, Specialty Clinics, Diagnostics Laboratories, Research Institutes, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Abbott Laboratories, Siemens Healthineers, Roche Diagnostics (F. Hoffmann‑La Roche Ltd), Bio‑Rad Laboratories, Inc., Bayer AG, Beckman Coulter, Inc., DiaSorin S.p.A., OPKO Health, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Prostate-Specific Antigen Testing MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Prostate-Specific Antigen Testing MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Abbott Laboratories

- Siemens Healthineers

- Roche Diagnostics (F. Hoffmann‑La Roche Ltd)

- Bio‑Rad Laboratories, Inc.

- Bayer AG

- Beckman Coulter, Inc.

- DiaSorin S.p.A.

- OPKO Health, Inc.