Global Probiotic Sports Nutrition Market Size, Share Analysis Report By Product Type (Protein-Based Probiotics, Beverages / Drinks, Capsules And Tablets, Powders And Mixes, Others), By Application (Muscle Recovery And Growth, Endurance And Energy Boost, Immunity And Gut Health, Weight Management, Others), By Distribution Channel (Direct Sales, Online / E-commerce Platforms, Retail Stores / Supermarkets, Pharmacies / Health Stores, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 172553

- Number of Pages: 331

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

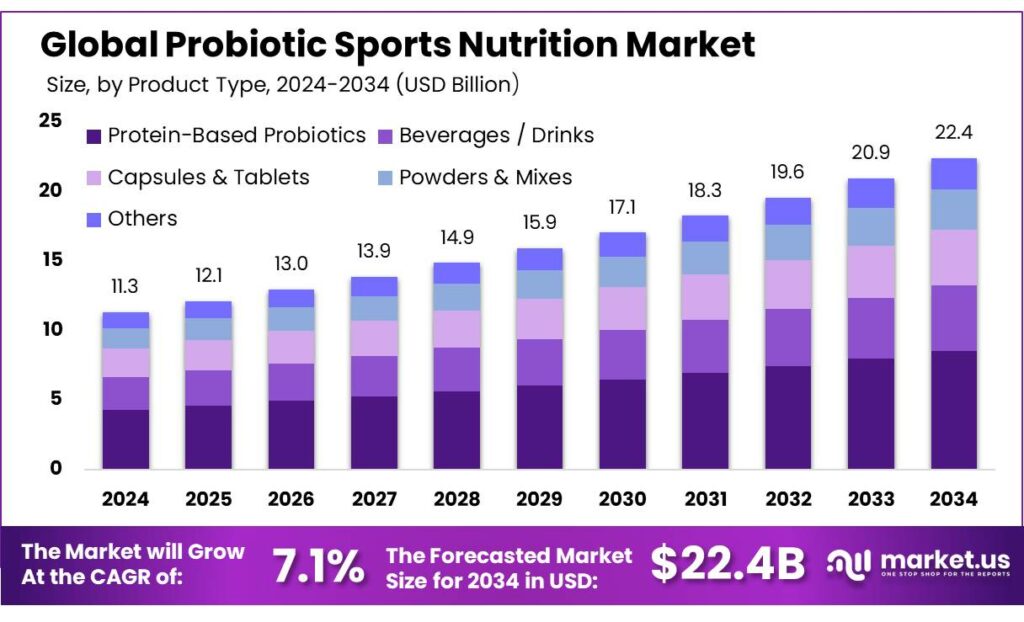

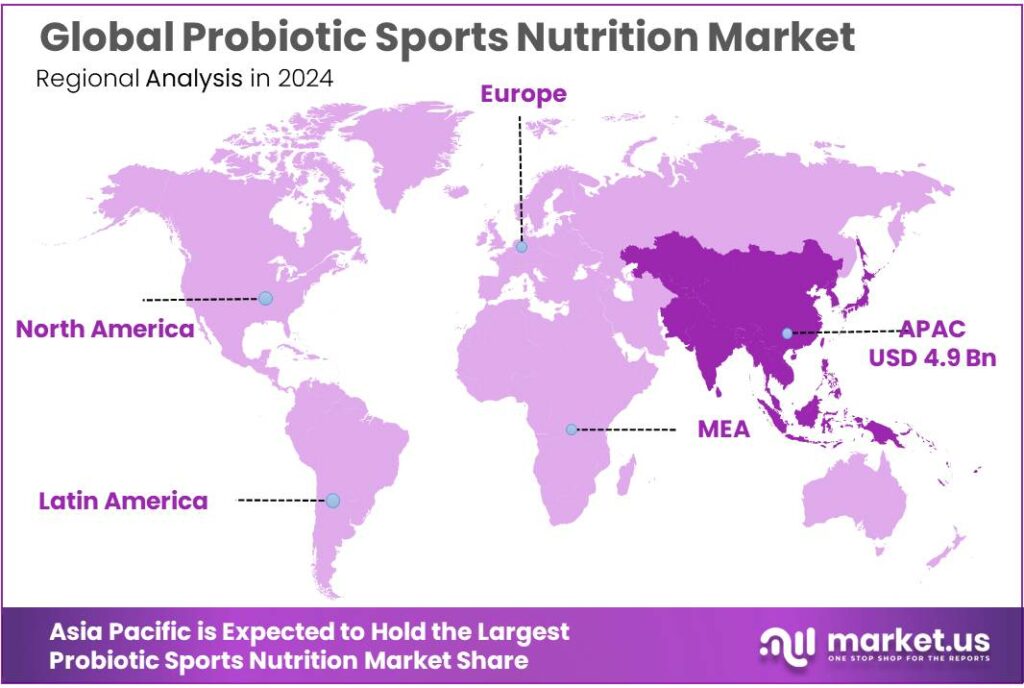

The Global Probiotic Sports Nutrition Market size is expected to be worth around USD 105.5 Billion by 2034, from USD 20.5 Billion in 2024, growing at a CAGR of 17.8% during the forecast period from 2025 to 2034. In 2024 Asia Pacific (APAC) held a dominant market position, capturing more than a 43.8% share, holding USD 4.9 Billion in revenue.

Probiotic sports nutrition sits at the intersection of performance-focused nutrition and the fast-growing functional gut health space. In practical terms, it includes powders, capsules, chews, and fermented or dairy-based formats positioned for athletes and active consumers who want better digestion, improved nutrient utilization, and more reliable day-to-day training comfort. The category is also benefiting from the broader normalization of supplements: in the U.S., 57.6% of adults reported using any dietary supplement in the prior 30 days, showing how mainstream “daily supplement routines” have become.

Industrial momentum is reinforced by the expanding fitness and recreation economy. A 2025 update from the Health & Fitness Association highlighted that, across countries with comparable year-over-year data, fitness industry revenue grew by an average of 8% from 2023 to 2024, with facilities up nearly 4% and total membership up 6%—a useful proxy for the rising base of consistent gym-goers who are more likely to buy sports nutrition add-ons. At the same time, global public-health pressure is pushing more consumers into “start moving” mindsets: WHO reported that 31% of adults worldwide—about 1.8 billion people—did not meet recommended activity levels in 2022.

Regulation and compliance are meaningful drivers shaping industrial behavior. For example, India’s FSSAI framework for probiotic foods specifies a minimum viable count of ≥10⁸ CFU in the recommended serving size per day. Requirements like these encourage investments in QA/QC testing, validated enumeration methods, and conservative overfilling at production to ensure label claims remain true at end of shelf life.

From a manufacturing and commercialization standpoint, probiotic sports nutrition is quality- and compliance-led. Claims must be carefully managed, strain identity must be controlled, and viability must be protected through processing, packaging, and shelf-life. India’s regulatory direction is explicit on potency expectations: under FSSAI’s 2022 nutraceutical and probiotic framework, probiotic foods are expected to deliver at least ≥10⁸ CFU in the recommended serving size per day.

Key Takeaways

- Probiotic Sports Nutrition Market size is expected to be worth around USD 105.5 Billion by 2034, from USD 20.5 Billion in 2024, growing at a CAGR of 17.8%.

- Protein-Based Probiotics held a dominant market position, capturing more than a 38.2% share.

- Immunity & Gut Health held a dominant market position, capturing more than a 41.9% share.

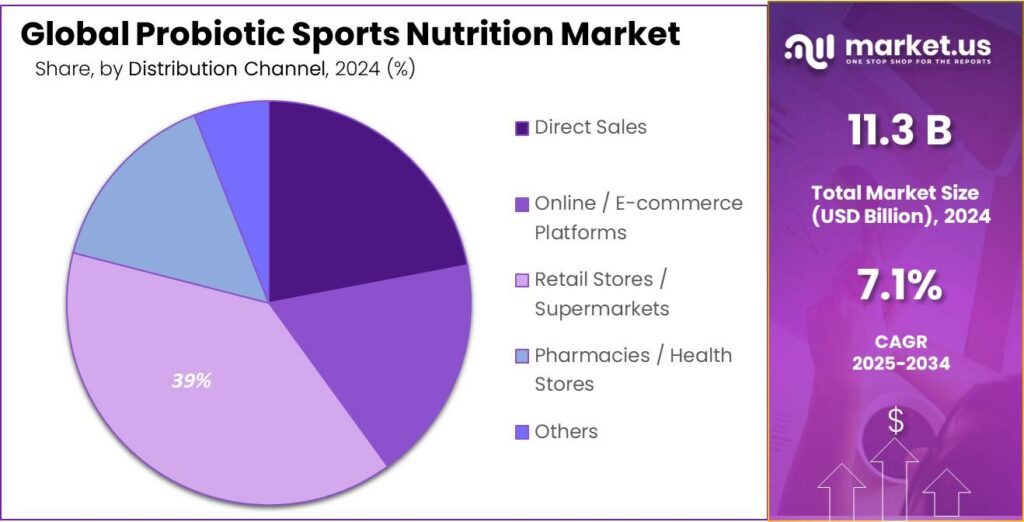

- Retail Stores / Supermarkets held a dominant market position, capturing more than a 39.3% share.

- Asia Pacific (APAC) region dominated the probiotic sports nutrition market, capturing 43.8% share and generating approximately USD 4.9 billion.

By Product Type Analysis

Protein-based probiotics lead with a 38.2% share, driven by demand for muscle support and gut balance.

In 2024, Protein-Based Probiotics held a dominant market position, capturing more than a 38.2% share in the probiotic sports nutrition market, as athletes and fitness-focused consumers increasingly preferred products that combine muscle recovery with digestive health benefits. These formulations were widely used in protein powders, ready-to-mix shakes, and nutrition blends designed for post-workout consumption, supporting both protein absorption and gut comfort.

The demand was supported by the rising popularity of strength training and high-protein diets, where digestive efficiency became an important consideration. Moving into 2025, adoption remained steady as consumers looked for multifunctional sports nutrition products that reduce supplement stacking and offer convenience. The segment’s leadership was reinforced by its compatibility with daily fitness routines, growing acceptance among professional and recreational athletes, and the perception of protein-based probiotics as a balanced solution that supports performance, recovery, and overall gut wellness.

By Application Analysis

Immunity & gut health leads with a 41.9% share, reflecting strong focus on everyday wellness support.

In 2024, Immunity & Gut Health held a dominant market position, capturing more than a 41.9% share in the probiotic sports nutrition market, as consumers increasingly connected digestive balance with immune strength and overall physical performance. Products targeting this application were commonly used by both athletes and active individuals seeking to reduce illness downtime and maintain consistent training routines.

Demand was supported by heightened awareness of preventive health and the role of gut microbiota in nutrient absorption and immune response. Moving into 2025, continued interest was observed as fitness consumers favored supplements that offer daily protection rather than short-term performance boosts. The segment’s strong position was further reinforced by regular usage patterns, broad acceptance across age groups, and the growing perception of immunity and gut health support as a foundational element of long-term sports nutrition and active lifestyle management.

By Distribution Channel Analysis

Retail stores and supermarkets lead with a 39.3% share, supported by everyday accessibility and consumer trust.

In 2024, Retail Stores / Supermarkets held a dominant market position, capturing more than a 39.3% share in the probiotic sports nutrition market, as they remained the most convenient and trusted purchase points for fitness and wellness products. Consumers favored these channels due to wide product availability, the ability to compare brands in person, and the convenience of combining supplement purchases with regular grocery shopping.

Shelf visibility and in-store promotions supported higher impulse buying, particularly for probiotic protein blends and ready-to-use nutrition formats. Moving into 2025, this channel continued to perform strongly as health-focused product sections expanded within supermarkets. The segment’s leadership was further reinforced by consistent foot traffic, established retail networks, and consumer preference for purchasing sports nutrition products from familiar, regulated outlets that offer reliability and ease of access.

Key Market Segments

By Product Type

- Protein-Based Probiotics

- Whey Protein Probiotic

- Plant-Based Protein Probiotics

- Beverages / Drinks

- Ready-to-Drink Probiotic Shakes

- Fermented Sports Beverages

- Capsules & Tablets

- Single-Strain Formulations

- Multi-Strain Formulations

- Powders & Mixes

- Pre-Workout Powders

- Post-Workout Powders

- Others

By Application

- Muscle Recovery & Growth

- Endurance & Energy Boost

- Immunity & Gut Health

- Weight Management

- Others

By Distribution Channel

- Direct Sales

- Online / E-commerce Platforms

- Retail Stores / Supermarkets

- Pharmacies / Health Stores

- Others

Emerging Trends

Daily-use formats with clearer CFU and label cues

A clear latest trend in probiotic sports nutrition is the move away from “hardcore athlete-only” positioning toward daily-use products that people can take alongside training without overthinking it. This is showing up in product design (single-serve sticks, powders, capsules, and lighter wellness drinks) and in how brands communicate—more focus on what’s inside and how to recognize it on the pack, not just hype.

Consumer research from the International Food Information Council (IFIC) highlights why packaging and label cues are becoming a bigger part of the category. When people were asked how they would know if a food or beverage contains probiotics, 44% said a label stating the product “contains probiotics,” 31% looked for a label saying it “supports digestive/gut health,” and 19% looked for a label that states the number of colony-forming units (CFUs).

- The same IFIC survey also shows a generational split that is shaping where probiotic sports nutrition can grow fastest. Among people who actively try to consume probiotics, IFIC notes that 33% of probiotic consumers under age 45 say they seek probiotics from wellness drinks, compared with 3% of people age 65+.

At the same time, the market is getting more specific about dosing language. The U.S. NIH Office of Dietary Supplements explains that probiotics are measured in CFUs and that many probiotic supplements contain 1 to 10 billion CFU per dose, while some products contain 50 billion CFU or more—but higher CFU counts are not necessarily more effective. Public health guidance is also nudging this category toward everyday consistency. The World Health Organization reports that nearly 31% of the world’s adults—around 1.8 billion people—were physically inactive in 2022.

Drivers

Fitness Push and Gut Comfort Needs Drive Probiotic Sports Nutrition

A major driver for probiotic sports nutrition is the steady expansion of the “training-minded” population—people who are exercising more often, trying to stay consistent, and looking for products that feel easy on the stomach. When workouts become routine, digestion stops being a side topic and becomes part of performance. This is where probiotic positioning fits naturally: it speaks to everyday comfort, tolerance to higher protein or supplement use, and the feeling of staying “balanced” while training.

Global health bodies are also pushing the narrative that movement is non-negotiable. In 2022, the World Health Organization estimated that nearly 31% of adults worldwide—about 1.8 billion people—were not meeting recommended activity levels. The same WHO guidance highlights a clear benchmark for adults: at least 150 minutes of moderate activity per week, with additional benefits up to 300 minutes per week.

- Government-led fitness campaigns reinforce this shift by turning exercise into a public movement rather than a niche hobby. In India, for example, official government communications around the Fit India effort note that in October 2019 more than 1,500 Fit India Plog Runs were organized across the country. Separately, a Parliament document describing Fit India initiatives notes the Fit India Quiz carried a prize pool of ₹3.25 crore, with 36,780 participating schools and 1 lakh+ participating students.

On the industry side, probiotics are convenient to integrate into sports nutrition because they are already familiar to many consumers through yogurts, fermented drinks, and supplements. The U.S. NIH Office of Dietary Supplements notes that many probiotic supplements provide 1 to 10 billion CFU per dose, while some products contain 50 billion CFU or more—but higher counts are not automatically more effective.

Restraints

Regulatory Proof and Shelf-Life Viability Limit Fast Growth

One major restraining factor in probiotic sports nutrition is that brands must prove two things at once: the product still contains enough live microorganisms at the time of consumption, and the marketing claims stay within strict regulatory boundaries. This sounds simple, but in real manufacturing it is the difference between a product that can scale confidently and one that creates constant compliance risk.

On viability, regulators set clear minimum thresholds that are not always easy to maintain in sporty formats like protein powders, electrolyte blends, ready-to-drink shakes, and heat-exposed supply chains. In India, FSSAI’s compendium for nutraceutical regulations specifies that the viable number of added probiotic organisms in food shall be ≥10⁸ CFU in the recommended serving size per day. The same document notes a compliance timeline (industry expected to comply by 1 April 2022 for that amendment), which shows how firm such rules can become once notified.

That engineering is costly and technically demanding because probiotics are living organisms. High moisture, oxygen exposure, temperature swings, and certain acids can reduce live counts over time. Protein-rich mixes also bring formulation challenges (water activity control, flavor masking, compatibility with minerals, and stability during transport). As a result, companies must invest in strain selection, protective processing, and repeated testing—otherwise they risk selling a product that no longer meets the ≥10⁸ CFU expectation in the real world, even if it looked fine in a fresh lab sample.

This type of approach makes it harder for sports nutrition brands to communicate benefits in simple language on-pack, especially when consumers expect clear “why it helps” messaging. It also raises the bar for evidence-backed, carefully worded communications aligned with the EU Nutrition and Health Claims framework (Regulation (EC) No 1924/2006).

Opportunity

Mass Participation Fitness Wave Creates New Probiotic Demand

A major growth opportunity for probiotic sports nutrition is the widening base of people who are trying to become more active—and who want nutrition support that feels “light,” routine-friendly, and easy to tolerate. The audience is no longer only competitive athletes. It is office-goers restarting gym habits, runners training for their first 5K, and students joining sports again. This broad participation matters because probiotics are often purchased for everyday comfort, so they fit naturally into the “I’m getting consistent” phase of fitness.

Global public health targets are helping to expand this active population over time. The World Health Organization highlighted that nearly 31% of adults worldwide—about 1.8 billion people—were physically inactive in 2022, meaning they did not meet the global recommendation of at least 150 minutes of moderate-intensity activity per week. WHO’s physical activity guidance also points to higher benefit ranges, noting adults should aim for 150–300 minutes of moderate activity per week.

Government-backed programs can further accelerate this shift by making fitness social and visible. In India, a government press release on the Fit India Quiz reported a prize pool of Rs 3.25 crores, and participation of 36,299 students from 13,502 schools in the quiz prelims. Those figures show how fitness and sports awareness is being pushed at scale among younger consumers. Over time, that creates a stronger pipeline of sports participants and “fitness-first” households—an ideal environment for gut-health and performance-support products to become part of daily habits rather than occasional purchases.

Regional Insights

APAC leads probiotic sports nutrition with a 43.8% share and USD 4.9 billion in 2024, driven by rising health awareness and fitness adoption.

In 2024, the Asia Pacific (APAC) region dominated the probiotic sports nutrition market, capturing 43.8% share and generating approximately USD 4.9 billion in revenue, supported by strong consumer focus on gut health, immunity, and active lifestyles amid rapid urbanisation and higher disposable incomes. APAC’s leadership was underpinned by increasing participation in sports and fitness activities across major markets such as China, Japan, and India, where probiotic-fortified powders, drinks and supplements gained traction as consumers sought products that enhance digestive comfort and recovery benefits alongside physical performance.

Japan’s long-standing cultural acceptance of probiotic foods and higher health consciousness among older and active adults further reinforced regional uptake. India experienced notable growth due to a rising number of gyms, fitness centres, and consumer interest in preventive wellness through nutrition. Retail expansion and rapid e-commerce penetration also enhanced product accessibility across urban and emerging markets in APAC.

By 2025, the region maintained its dominant position as health-oriented buying behaviour continued, supported by ongoing product innovation and tailored formulations that align with local taste preferences and nutritional expectations. The APAC market’s dynamic growth outlook reflected a combination of traditional probiotic usage patterns and modern sports nutrition trends, positioning it as a crucial engine for global growth in the probiotic sports nutrition segment.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BLIS Probiotics: BLIS Probiotics is a biotechnology firm from New Zealand known for pioneering oral probiotics with over 30 years of research supporting strain efficacy. Its portfolio includes clinically studied probiotic cultures that enhance immune and digestive health, reinforcing recovery and performance benefits sought in sports nutrition products. Popularity among athletes and active adults has contributed to wider formulation adoption.

Zinereo Pharma: Zinereo Pharma (Spain) develops and manufactures pharmaceutical-grade probiotic products, expanding its portfolio to address digestive and systemic health. By 2025, the company offered over 15 commercial products and multiple clinical development lines, emphasising innovation, quality standards, and distribution across more than 10 countries, aligning with growing sports nutrition demand.

DSM-Firmenich: DSM-Firmenich, formed in 2023 through merger, reported €12.8 billion in revenue in 2024 across nutrition and health segments. Its probiotic and nutritional ingredient solutions support digestive and immune health, underpinning development of performance-oriented functional products that align with sports nutrition frameworks focused on recovery, wellness, and microbial balance.

Top Key Players Outlook

- Wren Laboratories

- BLIS Probiotics

- FrieslandCampina N.V.

- Zinereo Pharma

- DSM‑Firmenich

- Lonza Group AG

- Glanbia plc

- Vitaquest International LLC

- Premiere Nutrition Limited

- Twinlab Consolidation Corporation

Recent Industry Developments

In 2024, Zinereo also expanded its global footprint through partnerships—for example, strategic agreements in the Middle East aimed at widening access to its probiotic solutions across 6 countries, which reflects a growing demand for probiotic applications beyond strict clinical segments.

In 2024, Lonza Group AG reported stable overall business performance with CHF 6.6 billion in sales, a 29.0 % CORE EBITDA margin, and continued innovation in health and delivery technologies, even as its capsules and health ingredients segment saw headwinds and overall group focus shifted more toward its core contract development and manufacturing organization (CDMO) services.

Report Scope

Report Features Description Market Value (2024) USD 11.3 Bn Forecast Revenue (2034) USD 22.4 Bn CAGR (2025-2034) 7.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Protein-Based Probiotics, Beverages / Drinks, Capsules And Tablets, Powders And Mixes, Others), By Application (Muscle Recovery And Growth, Endurance And Energy Boost, Immunity And Gut Health, Weight Management, Others), By Distribution Channel (Direct Sales, Online / E-commerce Platforms, Retail Stores / Supermarkets, Pharmacies / Health Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Wren Laboratories, BLIS Probiotics, FrieslandCampina N.V., Zinereo Pharma, DSM‑Firmenich, Lonza Group AG, Glanbia plc, Vitaquest International LLC, Premiere Nutrition Limited, Twinlab Consolidation Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Probiotic Sports Nutrition MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Probiotic Sports Nutrition MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Wren Laboratories

- BLIS Probiotics

- FrieslandCampina N.V.

- Zinereo Pharma

- DSM‑Firmenich

- Lonza Group AG

- Glanbia plc

- Vitaquest International LLC

- Premiere Nutrition Limited

- Twinlab Consolidation Corporation