Global Prepaid Card Market Size, Share, Industry Analysis Report By Offering Type (General Purpose Reloadable Card, Gift Cards, Government Benefit/Disbursement Card, Incentive/Payroll Card, Others), By Card Type (Closed Loop Prepaid Card, Open Loop Prepaid Card), By End Users (Individuals, Corporate/Businesses, Government/Public sector), By End User Industry (Retail, Healthcare, Travel and Hospitality, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 160520

- Number of Pages: 376

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Role of Generative AI

- Analysts’ Viewpoint

- Investment and Business benefits

- China Prepaid Card Market Size

- Offering Type Analysis

- Card Type Analysis

- End Users Analysis

- End User Industry Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

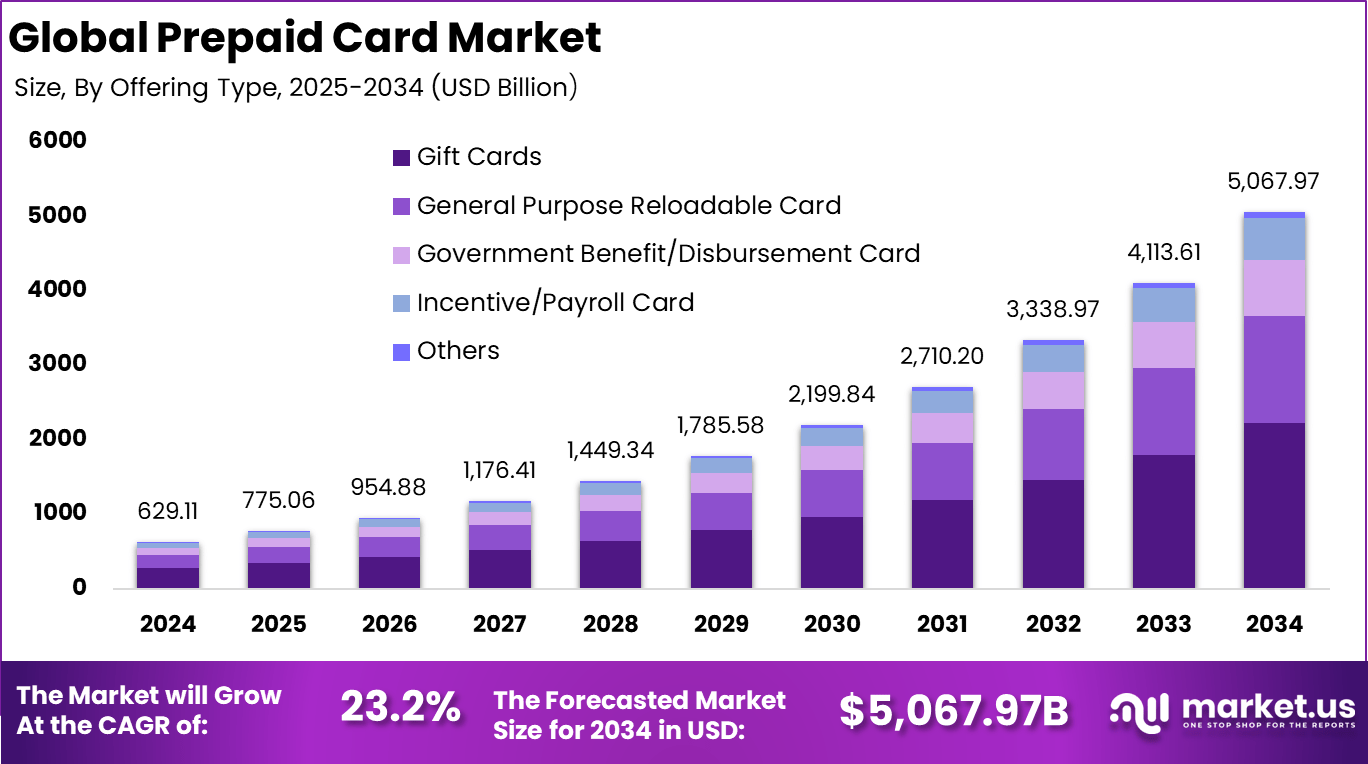

The Global Prepaid Card Market size is expected to be worth around USD 5,067.97 billion by 2034, from USD 629.11 billion in 2024, growing at a CAGR of 23.2% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 41.2% share, holding USD 259.19 billion in revenue.

The prepaid card market covers payment instruments that are loaded with funds in advance and used for purchases, cash access, disbursements, and expense control without drawing directly from a bank account. It spans open-loop consumer cards, payroll and government benefits cards, corporate expense and travel cards, gift and limited-network cards, and digital wallet-linked virtual cards. In India these products fall under Prepaid Payment Instruments, with issuance, KYC and usage governed by the Reserve Bank of India.

Top driving factors include the global appetite for seamless, secure payment experiences, as well as regulatory reforms that make prepaid cards more attractive as alternatives to traditional banking tools. Financial inclusion initiatives are especially impactful, pushing prepaid solutions into new regions and user groups. Preference for instant transaction capabilities and reward programs adds to this momentum, as does the integration between prepaid cards, mobile wallets, and digital payment systems.

Based on data from coinlaw.io, Mobile wallet-based prepaid card usage grew by 25% in 2023, reflecting the rapid rise in digital payment adoption. Government disbursements through prepaid cards reached approximately USD 350 billion, reinforcing their importance in social welfare distribution. Around 67% of U.S. millennials now prefer prepaid cards over credit cards due to better budgeting control and debt avoidance.

According to industry data, contactless prepaid card transactions surged by over 45% globally in the last two years, a jump closely linked to post-pandemic hygiene practices and the growing value placed on speed and convenience at checkout. Gift and closed-loop prepaid products are now preferred among individual users, while retail and travel segments report sustained growth in card-based spending.

Recent developments in the prepaid card market include the launch of a corporate forex card by ICICI Bank and Visa in October 2025, along with Zaggle raising capital and partnering with IDFC First Bank and Mastercard, while PhonePe and Mastercard introduced tap-and-pay services in India in September 2025. In 2024, Berhan Bank, Eastern Bank, Airtel Payments Bank, and the National Payments Corporation of India launched new prepaid cards, while Visa broadened its presence through a partnership with Western Union.

Top Market Takeaways

- Gift cards lead the market with 43.8%, supported by widespread use for personal gifting and corporate incentives.

- Closed-loop prepaid cards dominate with 71.9%, showing strong adoption for retailer-specific and brand-linked spending.

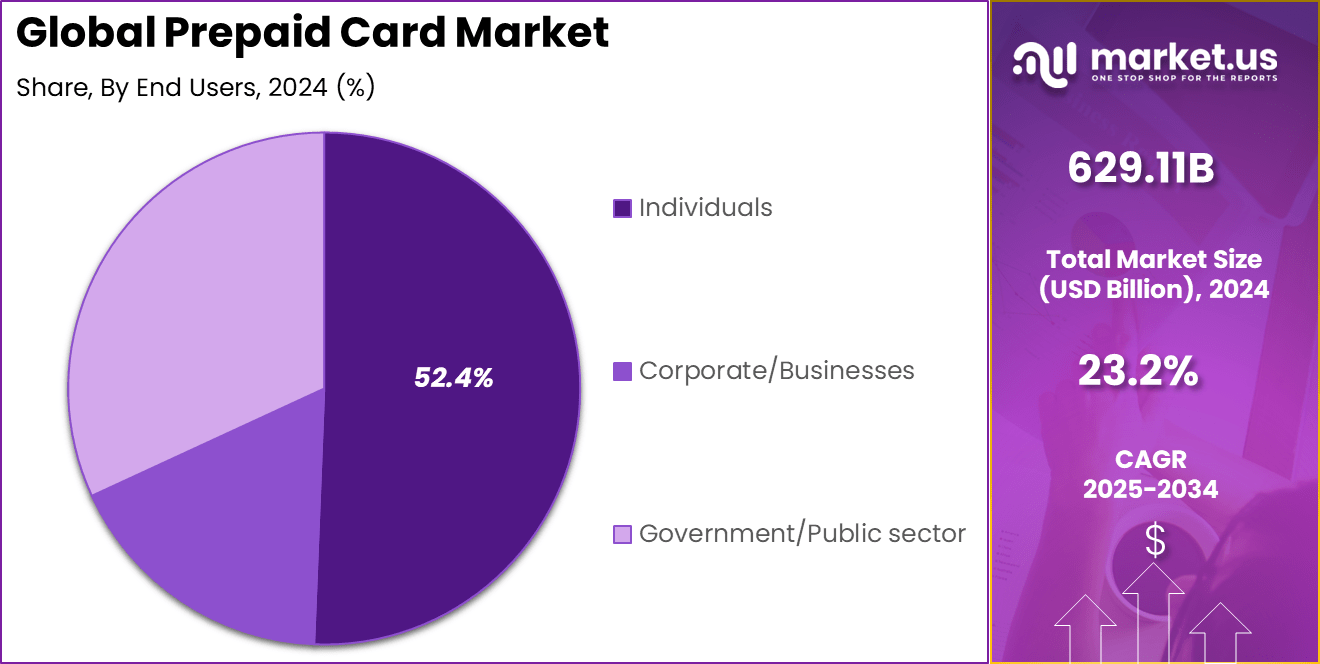

- Individuals account for 52.4%, highlighting consumer preference for prepaid options in daily transactions.

- Retail industry holds the largest share at 76.3%, reflecting its reliance on prepaid cards for promotions and customer loyalty programs.

- Asia Pacific captures 41.2%, driven by high digital payment adoption and rapid e-commerce growth.

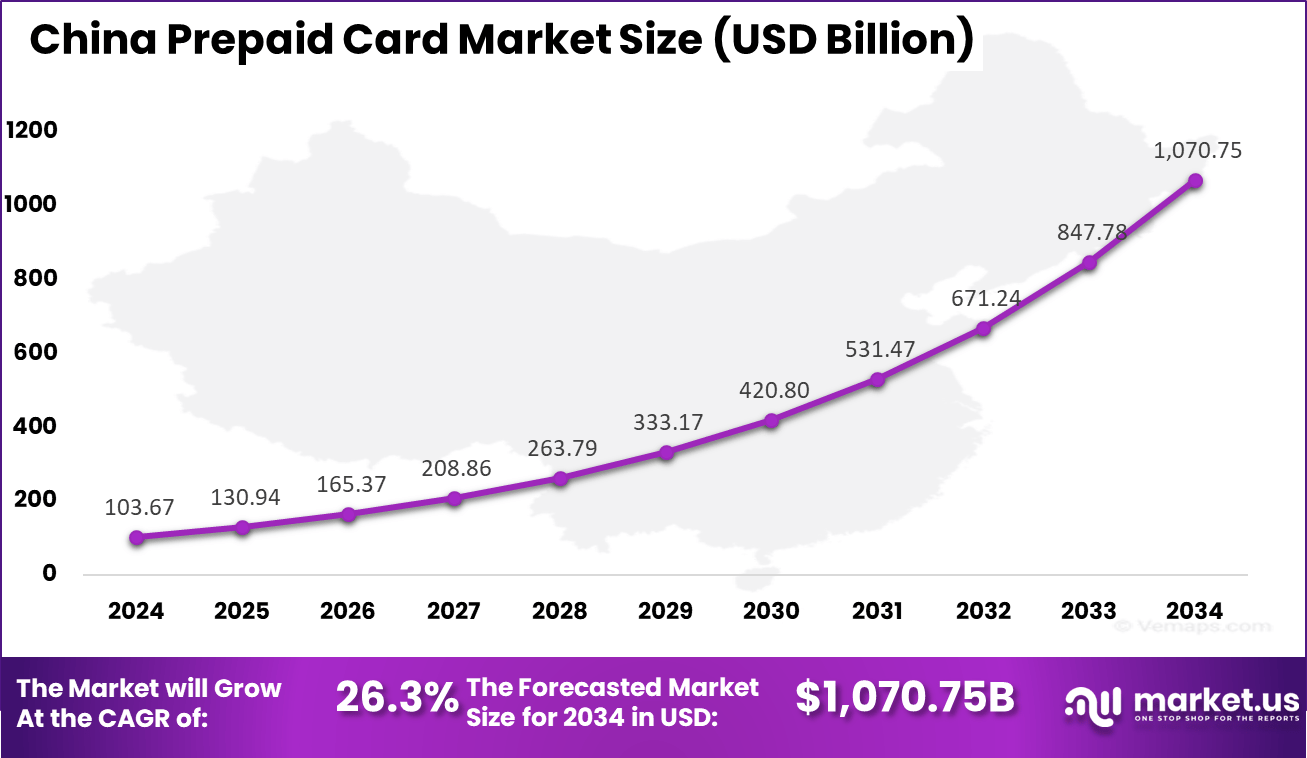

- The China market reached USD 103.67 billion and is expanding at a strong CAGR of 26.3%, underscoring its leadership in prepaid and digital-first payment ecosystems.

Role of Generative AI

Generative AI is transforming the prepaid card landscape by enabling real-time fraud detection and advanced risk assessment through intelligent analysis of transaction data. Financial institutions using these systems report that automated AI tools now identify up to 95% of anomalies, freeing analysts to focus on high-priority cases.

The same models also support hyper-personalized customer communication and targeted reward programs by accurately tracking individual spending behaviors. As a clear sign of impact, AI-powered systems have proven to reduce operational fraud costs by nearly 20% in pilot trials across major card-issuing sectors. Nearly 60% of new prepaid card products launched last year now offer AI-driven, real-time cash-back and loyalty rewards.

Natural language chatbots powered by generative AI are now handling more than 70% of all customer service requests, freeing up teams to resolve only nuanced or emotionally sensitive cases. This blend of automation and empathy is driving record-high satisfaction ratings among card users.

Analysts’ Viewpoint

Technologies fueling this growth include EMV chip cards, real-time transaction alerts, biometric authentication, and API integrations that let prepaid products tie easily into fintech apps. More than 60% of prepaid cards in the United States now use advanced EMV chip technology, and fingerprint or face recognition secures the vast majority of mobile wallet prepaid cards globally.

AI-driven fraud detection and blockchain verification have been incorporated to further minimize risks and boost user confidence. Key reasons for adopting prepaid cards include improved spend control, fraud prevention, wider acceptance across in-person and digital channels, and support for underbanked communities looking to access financial services safely.

Many businesses and individuals prefer prepaid card solutions for easy budgeting, managing travel expenses, and separating personal from business purchases. The ability to instantly load funds, freeze accounts remotely, and track spending in real time is highly valued, especially by digitally engaged consumers.

Investment and Business benefits

Investment opportunities in the prepaid card space are surfacing as companies enhance proprietary technology stacks with new biometric and contactless features. There is rising interest in prepaid-as-a-service, where fintechs and merchants deploy customizable programs for user loyalty or payroll administration.

Demand for white-labeled cards and embedded solutions is particularly pronounced as digital payment ecosystems expand into new industry sectors and geographies. Business benefits are substantial, ranging from operational cost savings and reduced risk of payment fraud to increased customer retention for retailers leveraging branded, closed-loop cards.

Many employers favor prepaid cards for distributing employee benefits or travel funds, which improves program transparency and administration while speeding up payment cycles. Real-time data from transaction alerts enables better analytics and financial oversight for both enterprises and individual cardholders.

China Prepaid Card Market Size

The market for Prepaid cards within China is growing tremendously and is currently valued at USD 103.67 billion, the market has a projected CAGR of 26.3%. The market is growing rapidly due to the nation’s strong digital payment infrastructure, widespread smartphone adoption, and increasing consumer preference for cashless transactions.

Government support for financial digitization and corporate demand for efficient payroll and expense solutions further boost usage. Additionally, the rise of e-commerce and integration of prepaid cards with major platforms like Alipay and WeChat Pay enhances accessibility. These factors collectively position prepaid cards as a convenient, secure, and scalable payment tool in China’s dynamic economy.

For instance, In January 2025, Beijing introduced prepaid cards for international tourists to simplify payments across transport, shopping, and travel services. The initiative supports China’s wider push toward digital payments and offers visitors a secure, cash-free way to manage expenses during their stay.

In 2024, Asia Pacific held a dominant market position in the Global Prepaid Card Market, capturing more than a 41.2% share, holding USD 259.19 billion in revenue. This dominance is due to rapid digitalization, expanding e-commerce, and widespread smartphone penetration across major economies such as China, India, and Japan.

Strong government initiatives promoting financial inclusion and the transition toward cashless societies have further fueled adoption. Additionally, the thriving fintech ecosystem, coupled with growing consumer demand for secure and flexible payment options, has solidified its leadership.

For instance, In September 2025, Zaggle collaborated with Mastercard to introduce co-branded domestic prepaid cards in India, strengthening the Asia Pacific region’s lead in prepaid card adoption. The partnership expands secure and convenient payment options for everyday use, supported by rising digital payments and financial inclusion efforts.

Offering Type Analysis

In 2024, Gift cards make up 43.8% of prepaid card offerings, holding the largest segment. These cards have gained popularity because they provide convenience for both gifting and personal budgeting, especially during seasonal shopping and festive times. People use them as safe alternatives to cash for online shopping, contributing to their high share.

Gift cards also enable businesses to increase customer engagement and encourage spending. They are commonly chosen for promotional activities and customer rewards programs, which further drives their adoption. Their flexibility, ease of distribution, and suitability for digital wallet integration keep this segment at the forefront.

For Instance, In June 2025, Mastercard introduced a new Prepaid Gift Mastercard that can be used both online and in-store wherever Mastercard is accepted, offering a flexible and secure alternative to traditional gift cards. With personalization and easy reload options, it provides a convenient gifting solution with the added benefits of digital payments.

Card Type Analysis

In 2024, Closed loop prepaid cards account for 71.9% of the market, leading over open loop types. These cards can only be used at select merchants or within brand-specific networks, offering greater control to retailers and businesses over customer transactions. Such cards are widely used for gift cards, store value programs, and loyalty schemes.

Closed loop cards attract consumers through perks such as exclusive deals and tailored experiences. The tight integration with retail payment systems allows businesses to foster brand loyalty and reduce transaction costs. Their broad use in travel, education, and specialty retail supports their continued dominance.

For instance, in February 2021, Kiosk Prepaid introduced a multi-function kiosk that integrates features of an ATM with prepaid card capabilities. This innovative kiosk allows customers to load and reload their closed-loop prepaid cards, perform balance inquiries, and manage transactions within a secure, self-service environment.

End Users Analysis

In 2024, The Individuals contribute 52.4% of prepaid card end user share, reflecting a clear preference for flexible spending tools. Prepaid cards help consumers manage budgets, control spending, and make secure purchases without linking directly to a bank account. Many choose them for online purchases to reduce fraud risk.

Younger demographics value prepaid cards for their adaptability to e-commerce and mobile wallets. They also appeal to those without traditional banking access, providing a simple financial entry point. The security and convenience they offer have made them a mainstay for consumers in both urban and rural areas

For Instance, in January 2025, Paymint partnered with ADIB Egypt to launch Meeza Prepaid Cards, aimed at enhancing financial inclusion for individuals in Egypt. These prepaid cards provide unbanked and underbanked consumers with a secure and convenient way to access digital payments, manage funds, and make transactions at a wide range of merchants.

End User Industry Analysis

In 2024, The retail industry commands 76.3% of end user industry share, making prepaid cards a prominent payment tool in this sector. Retailers use them extensively for customer incentives, loyalty programs, and as secure payment solutions both online and in stores. The ability to tie rewards and discounts to prepaid card usage is a significant driver in this segment.

Retail prepaid cards help brands build ongoing relationships with customers and offer cost-effective alternatives to handling cash or managing credit payments. The segment also benefits from the growing popularity of contactless payments and in-store digital shopping experiences, which further raise adoption rates.

For Instance, in September 2025, AU Small Finance Bank partnered with Zaggle to launch a retail credit and prepaid card program in India. The initiative aims to provide consumers with flexible, secure, and convenient payment solutions for retail spending. By integrating prepaid and credit functionalities, the program enhances financial accessibility for retail customers, supports digital transactions, and strengthens engagement through loyalty and reward programs.

Key Market Segments

By Offering Type

- General Purpose Reloadable Card

- Gift Cards

- Government Benefit/Disbursement Card

- Incentive/Payroll Card

- Others

By Card Type

- Closed Loop Prepaid Card

- Open Loop Prepaid Card

By End Users

- Individuals

- Corporate/Businesses

- Government/Public sector

By End User Industry

- Retail

- Healthcare

- Travel and Hospitality

- Others

Driver

Rising Demand for Cashless Payments

The prepaid card market is driven strongly by the rising demand for cashless payment methods. As consumers increasingly prefer digital transactions over cash, prepaid cards provide a convenient alternative that supports online shopping, bill payments, and peer-to-peer transfers. This trend is accelerated by smartphone penetration and innovations in wireless technology, making prepaid cards an easy way to participate in the growing digital economy.

The convenience factor is key, as prepaid cards are accepted widely in both physical stores and online platforms, helping them gain popularity among young adults and international travelers. Digital wallets often integrate prepaid cards, further boosting their use. These drivers are expected to fuel significant expansion in the prepaid card market as consumers and businesses seek faster, safer ways to pay and get paid without relying on cash.

Restraint

Security Concerns and Fraud Risks

A major restraint on the prepaid card market is the ongoing concern about security and fraud risks. Prepaid cards are vulnerable to unauthorized transactions, identity theft, and other fraudulent activities, leading to consumer hesitation in adopting these products fully. The lack of direct linkage to bank accounts can also make prepaid cards attractive tools for criminal misuse, such as money laundering or illegal purchases.

This mistrust around security inhibits market growth as consumers and businesses question the safety of storing funds on prepaid cards. Companies issuing these cards face pressure to implement stronger fraud prevention systems and enhance security protocols. However, the cost and complexity of these measures can be burdensome, creating a challenging environment to assure users enough confidence to drive widespread adoption.

Opportunity

Financial Inclusion for Unbanked Populations

Prepaid cards represent a significant opportunity to improve financial inclusion by providing accessible payment solutions to unbanked and underbanked individuals. Many people worldwide lack traditional bank accounts due to barriers like credit history, geographic location, or income level. Prepaid cards allow these individuals to engage in digital transactions, access government benefits, and participate in the online economy without needing a bank account.

Governments and corporations are increasingly adopting prepaid card programs to distribute social benefits, salaries, and subsidies directly, fueling demand. The opportunity to offer financial services to a broader population not only supports economic growth but also empowers millions with a practical tool for managing everyday expenses and online shopping. This ongoing trend will likely help expand the prepaid card market, especially in emerging regions where banking infrastructure is limited.

Challenge

Regulatory Compliance and Costs

One of the major challenges in the prepaid card market is navigating increasing regulatory compliance, which includes Know Your Customer (KYC), Anti-Money Laundering (AML), and other financial regulations. These mandates require prepaid card issuers to invest in complex verification processes and ongoing monitoring to prevent misuse of cards, which adds operational costs and can delay product rollout.

Small-scale issuers and non-bank prepaid card providers may find these regulations particularly burdensome, potentially limiting innovation and expansion in the market. Additionally, frequent policy changes by regulators create uncertainty, which can deter investment and slow down adoption rates. This regulatory environment demands that companies balance compliance with affordability and customer experience to remain competitive and foster market growth.

Key Players Analysis

The Prepaid Card Market is led by major financial institutions and payment networks such as Mastercard, Visa Inc., American Express Company, and Bank of America Corporation. These companies provide globally accepted prepaid and reloadable card solutions, enabling cashless transactions for both consumers and businesses.

Key financial service providers including Western Union Holdings, Inc., J.P. Morgan Chase & Co., The PNC Financial Services Group, Inc., CAIXABANK, S.A., and RBL Bank Ltd. are expanding prepaid card offerings across remittance, corporate payout, and government disbursement channels.

Specialized prepaid card issuers such as NetSpend Corporation, Green Dot Corporation, BlackHawk Network Holdings, Inc., Kaiku Finance LLC, DFS Services LLC, Mango Financial, Inc., Travelex Foreign Coin Services Limited, City Bank PLC, and HRB Digital LLC. offer niche products such as travel cards, payroll cards, incentive cards, and youth-oriented spending cards.

Top Key Players in the Market

- Mastercard

- Western Union Holdings, Inc.

- P. Morgan Chase And Co.

- Kaiku Finance LLC

- DFS Services LLC

- Mango Financial, Inc.

- The Points Guy, LLC

- HRB Digital LLC.

- American Express Company

- NetSpend Corporation

- Travelex Foreign Coin Services Limited

- Green Dot Corporation

- CAIXABANK, S.A.

- RBL Bank Ltd.

- BlackHawk Network Holdings, Inc.

- The PNC Financial Services Group, Inc.

- City Bank PLC

- Visa Inc.

- Bank of America Corporation

- Others

Recent Developments

- In September 2025, Mastercard and Corpay, a global leader in business payments, announced an expansion of their partnership to extend near-real-time payment capabilities to 22 additional markets worldwide. Leveraging Mastercard Move, this initiative enhances cross-border and corporate disbursement efficiency, enabling faster, secure, and transparent payments to prepaid cards, debit cards, and other endpoints.

- In September 2025, Siinqee Bank partnered with Mastercard to launch prepaid cards in Ethiopia, expanding access to digital payments in the region. This collaboration marks a significant step in enhancing financial inclusion by providing Ethiopian consumers with secure, convenient payment solutions, particularly in underserved areas.

Report Scope

Report Features Description Market Value (2024) USD 629.1 Bn Forecast Revenue (2034) USD 5,067.9 Bn CAGR(2025-2034) 23.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Offering Type (General Purpose Reloadable Card, Gift Cards, Government Benefit/Disbursement Card, Incentive/Payroll Card, Others), By Card Type (Closed Loop Prepaid Card, Open Loop Prepaid Card), By End Users (Individuals, Corporate/Businesses, Government/Public sector), By End User Industry (Retail, Healthcare, Travel and Hospitality, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Mastercard, Western Union Holdings, Inc., J.P. Morgan Chase And Co., Kaiku Finance LLC, DFS Services LLC, Mango Financial, Inc., The Points Guy, LLC, HRB Digital LLC., American Express Company, NetSpend Corporation, Travelex Foreign Coin Services Limited, Green Dot Corporation, CAIXABANK, S.A., RBL Bank Ltd., BlackHawk Network Holdings, Inc., The PNC Financial Services Group, Inc., City Bank PLC, Visa Inc., Bank of America Corporation, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Mastercard

- Western Union Holdings, Inc.

- P. Morgan Chase And Co.

- Kaiku Finance LLC

- DFS Services LLC

- Mango Financial, Inc.

- The Points Guy, LLC

- HRB Digital LLC.

- American Express Company

- NetSpend Corporation

- Travelex Foreign Coin Services Limited

- Green Dot Corporation

- CAIXABANK, S.A.

- RBL Bank Ltd.

- BlackHawk Network Holdings, Inc.

- The PNC Financial Services Group, Inc.

- City Bank PLC

- Visa Inc.

- Bank of America Corporation

- Others