Global Prefabricated Housing Market Size, Share, Growth Analysis By Product Type (Modular Homes, Panelised & Componentised Systems, Manufactured Homes, Others), By Type (Single-Family, Multi-Family), By Material Type (Concrete, Glass, Metal, Timber, Others), By Application (Residential, Commercial, Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 176279

- Number of Pages: 358

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

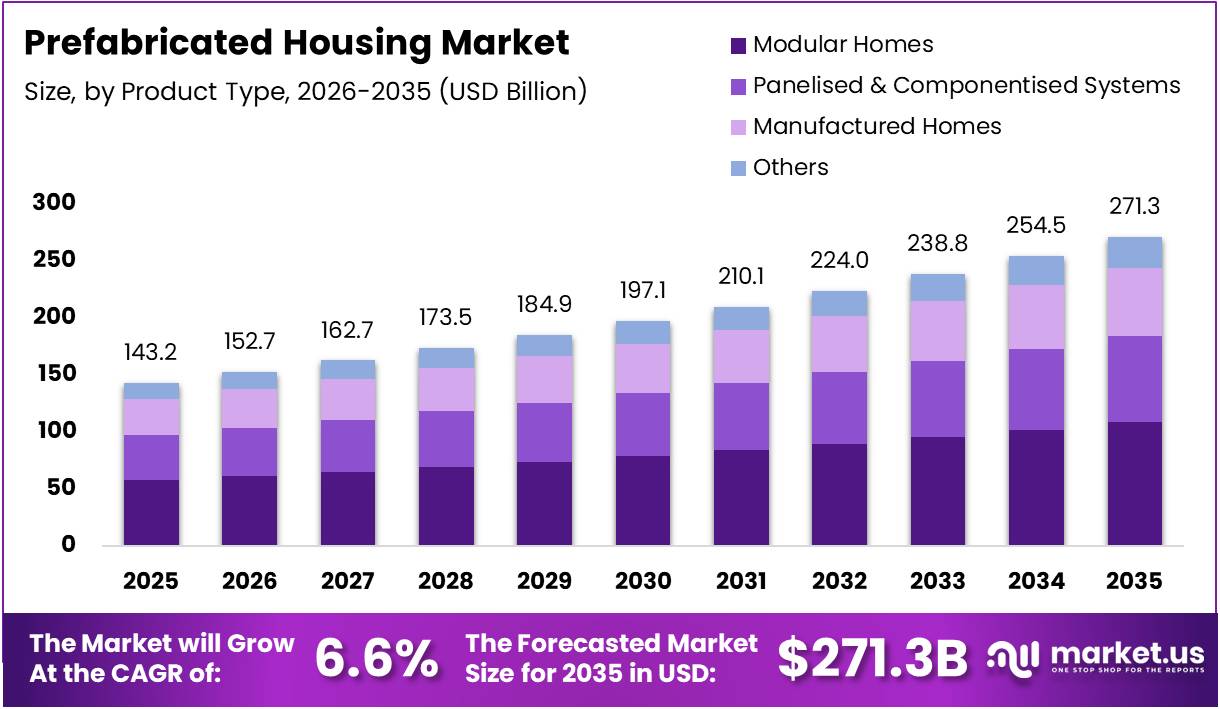

The Global Prefabricated Housing Market size is expected to be worth around USD 271.3 Billion by 2035, from USD 143.2 Billion in 2025, growing at a CAGR of 6.6% during the forecast period from 2026 to 2035.

Prefabricated housing represents a construction methodology where building components are manufactured in controlled factory environments before transportation to construction sites. This industrialized approach fundamentally transforms traditional building processes, delivering standardized modules or panels for rapid assembly. Consequently, prefabricated housing streamlines construction timelines while maintaining structural integrity and design flexibility.

The prefabricated housing market demonstrates robust expansion driven by urbanization, housing shortages, and sustainability imperatives. Modern consumers increasingly prioritize cost-effective, energy-efficient residential solutions that minimize environmental impact. Moreover, technological advancements in manufacturing processes enhance product quality and customization capabilities, attracting diverse demographic segments seeking affordable homeownership alternatives.

Growth opportunities emerge prominently through government infrastructure initiatives and affordable housing programs worldwide. Regulatory frameworks increasingly favor sustainable construction practices, incentivizing developers toward prefabricated methodologies. Additionally, labor shortages in traditional construction sectors accelerate market adoption, positioning prefabrication as a viable solution for addressing workforce challenges while maintaining project delivery schedules.

Environmental sustainability represents a critical market differentiator for prefabricated housing solutions. These structures offer superior thermal performance, with insulation in prefabricated houses being 4-5 times better than traditional constructions. Furthermore, modular and prefabricated strategies can cut construction waste by 40% to 70%, significantly reducing environmental footprints compared to conventional building methods.

Established markets showcase remarkable penetration rates, demonstrating long-term viability and consumer acceptance. In Sweden, 80% of family homes are prefabricated, illustrating widespread adoption in developed economies. Similarly, modular construction reduces construction time by up to 50% with up to 20% cost savings compared with traditional construction methods, according to construction industry analyses.

Operational efficiency continues driving market competitiveness through advanced manufacturing protocols and quality assurance systems. 80-95% of modules in prefabricated buildings are manufactured off-site, according to construction studies, increasing workflow efficiency and quality control. This controlled production environment eliminates weather-related delays while ensuring consistent standards, ultimately enhancing customer satisfaction and project predictability across residential developments.

Key Takeaways

- The global prefabricated housing market grows from USD 143.2 Billion in 2025 to USD 271.3 Billion by 2035, registering a 6.6% CAGR.

- Modular Homes lead the product segment with a 35.4% market share in 2025, reflecting strong adoption across residential projects.

- Single-Family homes dominate the type segment, accounting for 60.3% of total market share in 2025.

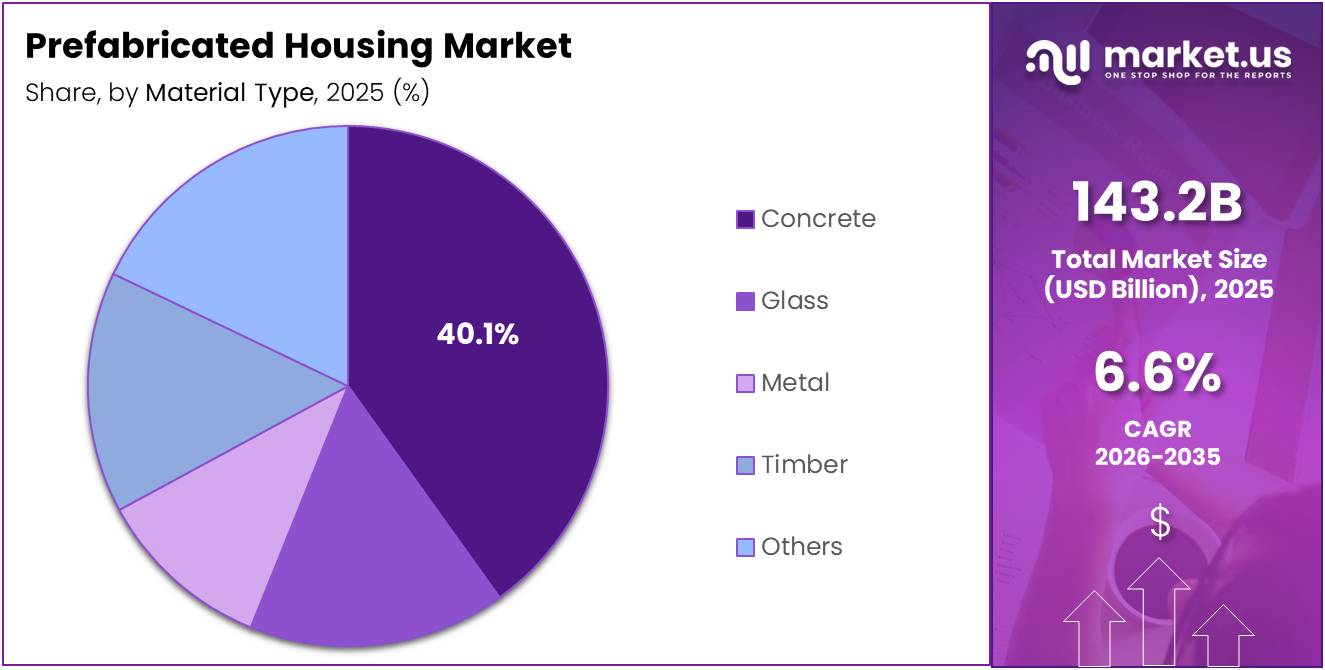

- Concrete emerges as the leading material type, holding a 40.1% share of the market in 2025.

- Residential applications represent the largest use case, contributing 70.2% of total demand in 2025.

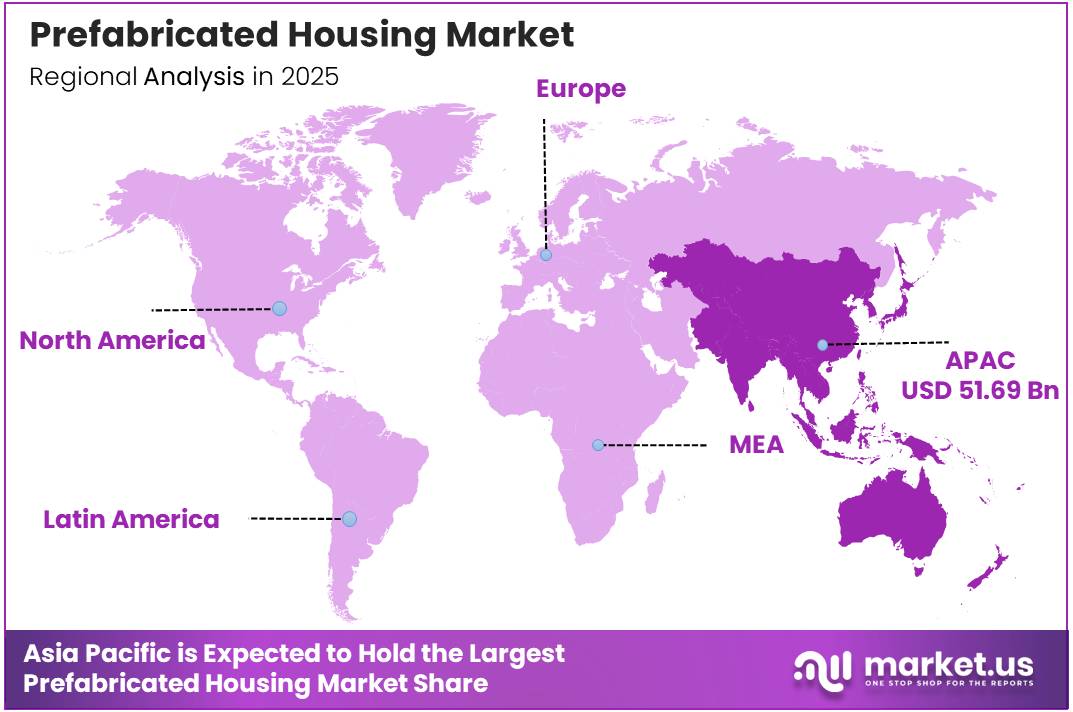

- Asia Pacific dominates regionally with a 36.1% market share, valued at USD 51.69 Billion.

Product Type Analysis

Modular Homes dominates with 35.4% due to its superior construction efficiency and customization capabilities.

In 2025, Modular Homes held a dominant market position in the By Product Type Analysis segment of Prefabricated Housing Market, with a 35.4% share. This leadership stems from their factory-controlled construction environment, which ensures consistent quality standards and accelerated build times. Modular homes offer extensive design flexibility while maintaining cost-effectiveness, making them increasingly attractive to modern homebuyers seeking personalized living spaces with reduced construction timelines.

Panelised & Componentised Systems represent another significant category within the prefabricated housing landscape. These systems deliver pre-manufactured wall panels, floor sections, and roof components directly to construction sites for rapid assembly. Their popularity continues growing among builders who value reduced on-site labor requirements and minimized weather-related construction delays, particularly in regions experiencing skilled labor shortages and tight project schedules.

Manufactured Homes maintain steady market presence as affordable housing solutions built entirely in controlled factory settings. These units appeal primarily to budget-conscious consumers and serve critical roles in addressing housing affordability challenges across various demographic segments. Manufactured homes provide immediate housing availability while meeting federal construction standards for safety and durability.

Others category encompasses emerging prefabricated housing innovations including hybrid construction methods and specialized temporary structures. This segment attracts niche market participants experimenting with sustainable materials and advanced construction technologies for specific applications. These alternative solutions cater to unique requirements such as disaster relief housing and mobile workforce accommodations.

Type Analysis

Single-Family dominates with 60.3% due to strong homeownership preferences and suburban development trends.

In 2025, Single-Family held a dominant market position in the By Type Analysis segment of Prefabricated Housing Market, with a 60.3% share. This overwhelming preference reflects cultural homeownership aspirations and the desire for private outdoor spaces. Single-family prefabricated homes combine traditional housing aesthetics with modern construction efficiency, attracting families seeking detached residences with customizable layouts and dedicated yards in suburban communities.

Multi-Family prefabricated housing addresses urban density challenges and rental market demands through efficient apartment complexes and townhouse developments. This segment experiences robust growth in metropolitan areas where land scarcity drives vertical construction solutions. Developers increasingly adopt multi-family prefabrication to accelerate project timelines, reduce construction costs, and meet urgent affordable housing needs while maintaining quality standards across residential units.

Material Type Analysis

Concrete dominates with 40.1% due to exceptional durability and superior structural performance.

In 2025, Concrete held a dominant market position in the By Material Type Analysis segment of Prefabricated Housing Market, with a 40.1% share. Concrete’s dominance reflects its outstanding fire resistance, thermal mass properties, and longevity advantages. Prefabricated concrete panels and modules withstand extreme weather conditions while providing excellent sound insulation, making them preferred choices for permanent residential and commercial structures requiring robust foundations.

Glass materials enhance prefabricated housing aesthetics through expansive windows and transparent architectural elements. Modern glass technologies incorporate energy-efficient coatings and insulated glazing systems that maximize natural lighting while maintaining thermal comfort. Glass components appeal to design-conscious consumers prioritizing contemporary living environments with seamless indoor-outdoor connections and enhanced visual appeal.

Metal components provide lightweight yet strong structural frameworks for prefabricated housing construction. Steel and aluminum materials offer excellent strength-to-weight ratios, enabling faster installation and reduced foundation requirements. Metal prefabrication ensures precision engineering with consistent quality control, while providing recyclability benefits that align with sustainable construction practices and environmental responsibility goals.

Timber remains a popular natural material choice offering warmth, sustainability, and renewable resource advantages. Wood-based prefabricated systems provide excellent insulation properties and carbon sequestration benefits while maintaining affordability. Timber construction appeals to environmentally conscious consumers and builders seeking traditional aesthetics combined with modern prefabrication efficiency.

Others material category includes innovative composites, recycled materials, and hybrid systems combining multiple material types. These alternatives address specific performance requirements such as enhanced insulation, moisture resistance, or specialized environmental conditions. Emerging materials continue gaining attention for their potential to improve sustainability metrics and construction performance standards.

Application Analysis

Residential dominates with 70.2% due to increasing housing demand and urbanization pressures.

In 2025, Residential held a dominant market position in the By Application Analysis segment of Prefabricated Housing Market, with a 70.2% share. This substantial dominance reflects global housing shortages and the critical need for affordable living solutions. Residential prefabricated housing addresses population growth challenges through faster construction delivery, reduced costs, and improved quality consistency, making homeownership accessible to broader demographic groups.

Commercial application encompasses prefabricated offices, retail spaces, hospitality facilities, and educational buildings. This segment benefits from reduced business disruption during construction and faster occupancy timelines. Commercial developers leverage prefabrication to achieve predictable budgets and accelerated returns on investment while maintaining professional aesthetics and functional workspace requirements.

Industrial application includes prefabricated warehouses, manufacturing facilities, storage units, and logistics centers. This sector values rapid deployment capabilities and scalable construction solutions that minimize operational downtime. Industrial prefabrication enables quick facility expansion to meet changing production demands while ensuring compliance with safety regulations and operational efficiency standards.

Key Market Segments

By Product Type

- Modular Homes

- Panelised & Componentised Systems

- Manufactured Homes

- Others

By Type

- Single-Family

- Multi-Family

By Material Type

- Concrete

- Glass

- Metal

- Timber

- Others

By Application

- Residential

- Commercial

- Industrial

Drivers

Rising Demand for Sustainable and Energy-Efficient Construction Solutions Drives Market Growth

Governments worldwide are launching major initiatives to address housing shortages through prefabricated construction. These programs focus on deploying homes quickly in urban and rural areas. Public funding and policy support are making prefab housing more accessible to low-income groups. Regulatory frameworks are also being simplified to speed up approvals for modular projects. This government backing is creating a strong foundation for market expansion.

The construction industry is shifting toward environmentally friendly building methods. Prefabricated housing reduces material waste and energy consumption during production. Factory-controlled manufacturing ensures better insulation and lower carbon footprints. Homebuyers and businesses are increasingly prioritizing green credentials in their property choices.

Modern manufacturing technologies have transformed prefabricated housing quality and efficiency. Automated production lines enable precise component fabrication with minimal errors. Advanced materials improve structural integrity and design flexibility. Digital tools streamline the assembly process on-site, reducing construction time significantly.

Restraints

Perception Challenges Related to Durability and Long-Term Asset Value Restrain Market Adoption

Many potential buyers still view prefabricated homes as lower quality compared to traditional construction. Concerns about structural durability in extreme weather conditions persist among consumers. The perception that prefab units depreciate faster affects investment decisions. Real estate professionals sometimes undervalue modular properties during appraisals.

The prefabricated housing sector faces significant logistical challenges in material procurement. Global supply chain disruptions impact the timely delivery of specialized components. Shortages of steel, timber, and insulation materials create production delays. Transportation costs for large modular units can be prohibitive in remote locations. Limited local supplier networks in emerging markets further complicate sourcing strategies.

Growth Factors

Expansion of Prefab Solutions in Disaster Relief and Emergency Sheltering Creates Growth Opportunities

Natural disasters and humanitarian crises demand rapid deployment of temporary housing. Prefabricated units can be manufactured and installed within weeks compared to months for traditional builds. Relief organizations and governments are recognizing prefab solutions as cost-effective emergency responses. This application opens new revenue streams beyond conventional residential markets. The growing frequency of climate-related disasters is expected to sustain this demand.

The integration of smart home technology into prefabricated units is attracting tech-savvy buyers. IoT sensors enable remote monitoring of energy usage, security, and maintenance needs. Smart homes offer enhanced comfort and operational efficiency. Developers are partnering with technology providers to embed connectivity features during manufacturing.

Construction firms are forming strategic alliances with modular technology specialists to enhance capabilities. These partnerships combine traditional development expertise with advanced manufacturing processes. Joint ventures enable knowledge transfer and scalability across geographic markets. Collaborative models reduce entry barriers for developers new to prefabricated construction, accelerating overall market growth.

Emerging Trends

Integration of Green Building Certifications in Prefabricated Projects Shapes Market Trends

Prefabricated projects are increasingly seeking LEED, BREEAM, and other environmental certifications. These credentials enhance marketability and meet corporate sustainability commitments. Factory-controlled production makes it easier to achieve consistent green building standards. Certified prefab homes command premium pricing and attract environmentally conscious buyers.

Modern prefab systems offer extensive customization options for diverse customer needs. Buyers can select floor plans, finishes, and architectural styles before manufacturing begins. Commercial clients are using modular units for offices, retail spaces, and hospitality projects. This design flexibility eliminates the cookie-cutter stereotype previously associated with prefabricated construction.

Digital twin technology and Building Information Modeling are revolutionizing prefab project planning. These tools create virtual replicas for testing designs before physical production. BIM enables seamless coordination between architects, engineers, and manufacturers. Real-time simulations identify potential issues early, reducing costly modifications.

Regional Analysis

Asia Pacific Dominates the Prefabricated Housing Market with a Market Share of 36.1%, Valued at USD 51.69 Billion

Asia Pacific holds the leading position in the global prefabricated housing market, accounting for a commanding market share of 36.1% with a valuation of USD 51.69 billion. The region’s dominance is driven by rapid urbanization, substantial population growth, and government initiatives promoting affordable housing across China, India, and Japan. Rising labor costs and the need for disaster-resistant housing in earthquake-prone areas have significantly accelerated the adoption of prefabricated housing technologies throughout the region.

North America Prefabricated Housing Market Trends

North America represents a significant market for prefabricated housing, driven by advanced construction technologies and growing consumer preference for customizable, energy-efficient homes. The United States leads the regional market with substantial investments in modular construction to address housing affordability challenges, labor shortages, and stringent environmental regulations promoting sustainable building practices.

Europe Prefabricated Housing Market Trends

Europe maintains a robust presence in the prefabricated housing market, characterized by strong regulatory frameworks supporting sustainable construction and energy efficiency standards. The region benefits from well-established manufacturing infrastructure and increasing adoption of off-site construction methods across key markets including Germany, the United Kingdom, and Scandinavian countries to minimize environmental impact and reduce construction timelines.

Middle East and Africa Prefabricated Housing Market Trends

The Middle East and Africa region is experiencing growing adoption of prefabricated housing solutions, driven by large-scale infrastructure development projects and urbanization initiatives. The market is supported by government-led housing programs addressing population growth, temporary housing requirements for migrant workers, and reconstruction efforts, with particular growth observed in Gulf Cooperation Council countries and South Africa.

Latin America Prefabricated Housing Market Trends

Latin America is witnessing increasing interest in prefabricated housing as a solution to address housing deficits and informal settlements across the region. Market growth is fueled by government social housing programs and the cost-effectiveness of prefabricated solutions compared to traditional construction methods, with Brazil, Mexico, and Chile emerging as key markets driving regional adoption.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

The global prefabricated housing market in 2025 is characterized by intense competition among established manufacturers and innovative startups, each bringing distinct capabilities to address the growing demand for efficient, sustainable housing solutions. The market leaders demonstrate varying approaches to prefabrication, from traditional manufactured housing to cutting-edge modular construction technologies.

Clayton Homes maintains its position as a dominant force in the prefabricated housing sector, leveraging decades of experience in manufactured and modular home production. The company’s extensive dealer network and diverse product portfolio enable it to serve multiple market segments effectively, from affordable housing to upscale custom builds. Clayton’s vertical integration strategy, encompassing manufacturing, financing, and retail operations, provides significant competitive advantages in cost control and customer accessibility.

Skyline Champion Corporation has emerged as a formidable competitor through strategic acquisitions and operational excellence in the manufactured housing space. The company’s focus on quality construction standards and innovative floor plans appeals to value-conscious consumers seeking homeownership alternatives. Their multi-brand approach allows targeted marketing across different price points and regional preferences.

Cavco Industries Inc. distinguishes itself through product diversification, offering both manufactured homes and park model RVs to capture broader market opportunities. The company’s emphasis on energy-efficient designs and customization options positions it well for environmentally conscious consumers. Their financial services division further strengthens customer relationships and market penetration.

Sekisui House Ltd brings Japanese engineering precision and sustainability leadership to the global prefabricated housing market. The company’s advanced modular construction techniques and commitment to net-zero energy homes represent the premium segment of the industry, targeting markets where quality and environmental performance command price premiums.

Top Key Players in the Market

- Clayton Homes

- Skyline Champion Corporation

- Cavco Industries Inc.

- Sekisui House Ltd

- Boxabl Inc.

- Plant Prefab Inc.

- Method Homes

- Made for Planet

- BluHomes Inc.

- Module Housing

- Indie Dwell Inc.

- FullStack Modular

- Weyerhaeuser NR Co.

- MiTek Inc.

- Other Key Players

Recent Developments

- In January 2025, EPACK Prefab raised $20 million from GEF Capital Partners to strengthen its modular construction capabilities and support capacity expansion across industrial and residential projects.

- In February 2025, Built Prefab acquired Lake Country Modular to expand its prefabricated housing footprint, enhancing regional manufacturing capacity and accelerating delivery of modular homes.

- In July 2025, Cavco completed the $190 million acquisition of American Homestar Corporation, adding two manufacturing lines and nineteen retail locations to scale its production and retail presence.

Report Scope

Report Features Description Market Value (2025) USD 143.2 Billion Forecast Revenue (2035) USD 271.3 Billion CAGR (2026-2035) 6.6% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Modular Homes, Panelised & Componentised Systems, Manufactured Homes, Others), By Type (Single-Family, Multi-Family), By Material Type (Concrete, Glass, Metal, Timber, Others), By Application (Residential, Commercial, Industrial) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Clayton Homes, Skyline Champion Corporation, Cavco Industries Inc., Sekisui House Ltd, Boxabl Inc., Plant Prefab Inc., Method Homes, Made for Planet, BluHomes Inc., Module Housing, Indie Dwell Inc., FullStack Modular, Weyerhaeuser NR Co., MiTek Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Prefabricated Housing MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Prefabricated Housing MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Clayton Homes

- Skyline Champion Corporation

- Cavco Industries Inc.

- Sekisui House Ltd

- Boxabl Inc.

- Plant Prefab Inc.

- Method Homes

- Made for Planet

- BluHomes Inc.

- Module Housing

- Indie Dwell Inc.

- FullStack Modular

- Weyerhaeuser NR Co.

- MiTek Inc.

- Other Key Players