Global Pre-Press And Packaging Graphics Services Market Size, Share, Growth Analysis By Service Type (Pre-media Concept and Design, Artwork and Reprographics, Color Management and Proofing, Plate/Tooling Supply, Workflow Automation), By Printing Technology (Flexography, Gravure, Offset Lithography, Digital Printing, Screen Printing, Others), By End-use (Food and Beverage, Personal Care and Cosmetics, Pharmaceuticals, Household and Homecare, Electronics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170755

- Number of Pages: 226

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

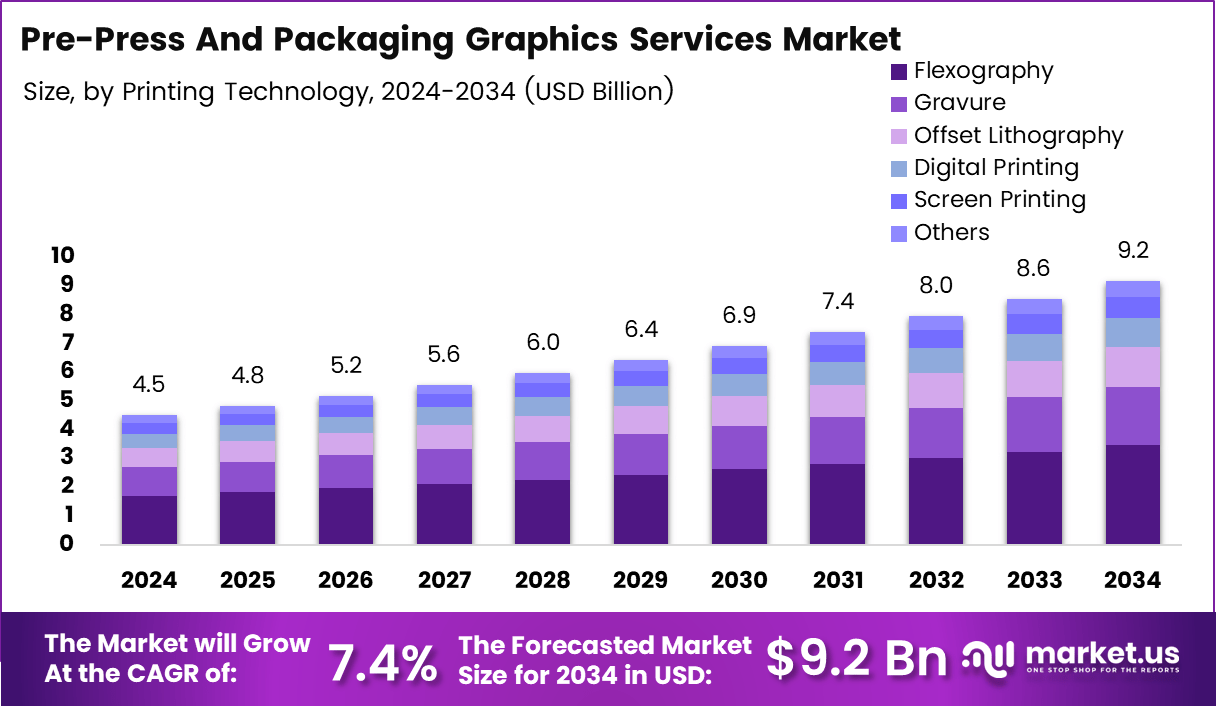

The Global Pre-Press And Packaging Graphics Services Market size is expected to be worth around USD 9.2 billion by 2034, from USD 4.5 billion in 2024, growing at a CAGR of 7.4% during the forecast period from 2025 to 2034.

The Pre-Press And Packaging Graphics Services market covers the planning, design preparation, color management, and print readiness activities that occur before packaging goes to production. This market enables brand consistency, print accuracy, and regulatory compliance. Consequently, it acts as a foundation layer for modern packaging supply chains across consumer and industrial sectors.

From a service perspective, Pre-Press And Packaging Graphics Services focus on translating creative intent into print ready formats. Therefore, businesses rely on these services to reduce print errors, control costs, and accelerate time to market. As packaging complexity increases, pre-press services are increasingly viewed as strategic quality assurance functions rather than support activities.

Market growth is driven by rising SKU proliferation, premium packaging demand, and frequent artwork updates. Moreover, digital printing adoption requires faster file turnaround and precise color consistency. As a result, pre-press providers are expanding automation, workflow integration, and remote collaboration capabilities to support high volume packaging environments efficiently.

Opportunities are emerging through government backed initiatives supporting packaging modernization, sustainable labeling, and traceability standards. According to packaging and print industry regulators, stricter labeling and compliance requirements are increasing demand for accurate artwork validation. Therefore, compliant pre-press workflows are becoming essential for food, pharmaceutical, and personal care packaging producers.

From a technology Survey, industry sources highlight that state of the art computer to plate systems are now widely adopted. According to printing Survey, advanced CTP devices can generate printing plates with resolutions up to 2400 DPI, enabling reproduction of fine design details. Consequently, high definition pre-press processes directly enhance shelf appeal and print clarity.

Color management expertise remains a critical value driver within this market. According to print production standards bodies, standard black uses 100% black ink, while rich black incorporates additional colors for deeper visual impact. Although both appear similar on screens, printed output differences are clearly visible, reinforcing the importance of professional pre-press calibration.

From an analyst viewpoint, long term market potential is reinforced by deep industry experience and evolving capabilities. According to packaging industry publications, service portfolios built on over 150 years of combined materials, packaging, and print knowledge offer unmatched technical depth. Therefore, Pre-Press And Packaging Graphics Services are positioned for sustained relevance as packaging complexity and quality expectations continue rising.

Key Takeaways

- The Global Pre-Press And Packaging Graphics Services Market is projected to expand from USD 4.5 billion in 2024 to USD 9.2 billion by 2034, growing at a 7.4% CAGR.

- By Service Type, workflow intensive offerings such as artwork preparation, color management, and automation remain core contributors to market expansion in 2024.

- By Printing Technology, digital and flexographic printing continue to drive demand for advanced pre-press services due to higher customization and faster turnaround needs.

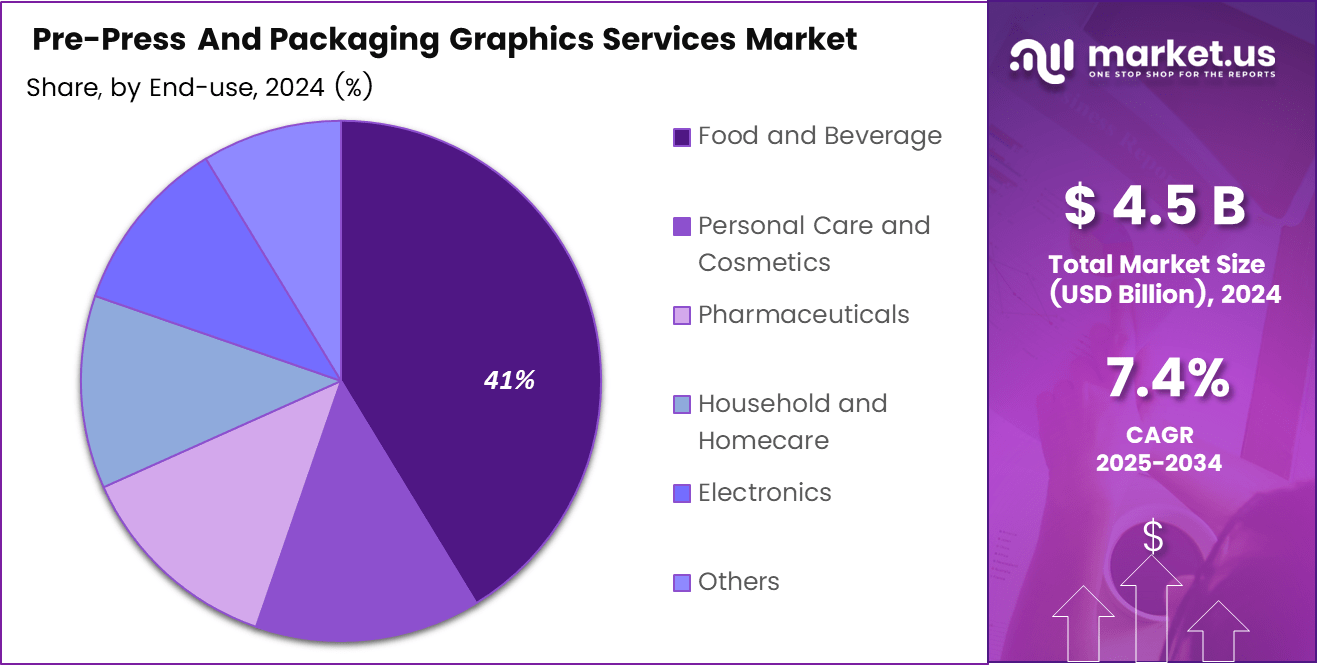

- By End-use, food and beverage, personal care, and pharmaceuticals remain the primary demand generating segments in 2024.

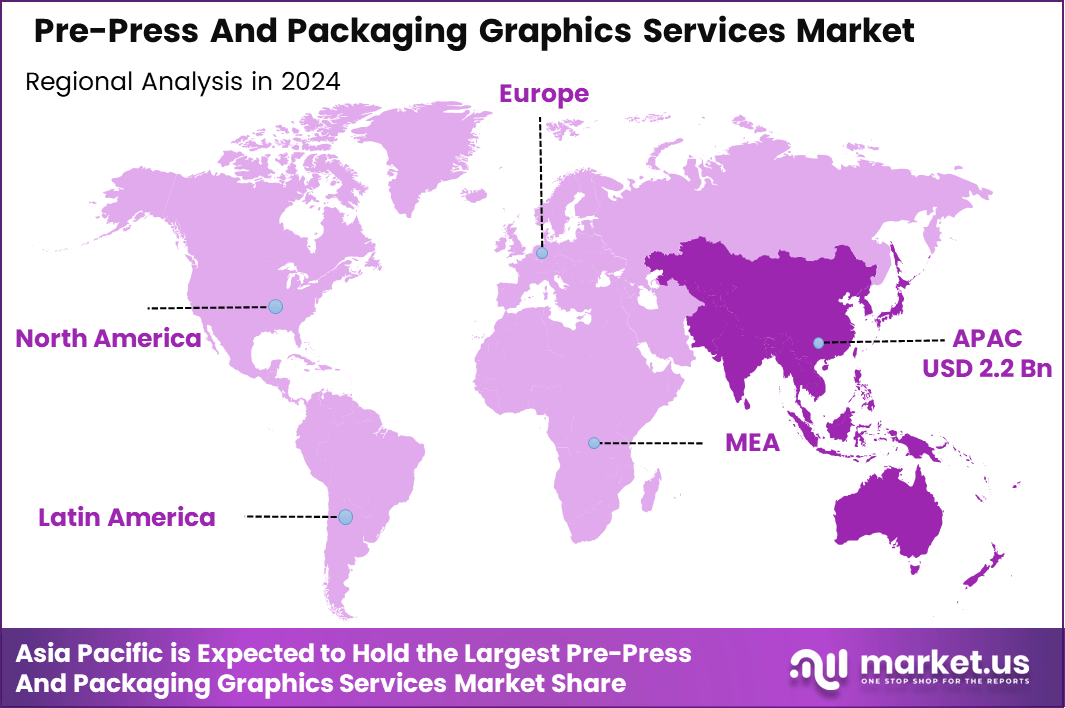

- Asia Pacific dominated the global market with a share of 48.9%, accounting for revenue of USD 2.2 Bn in 2024.

By Service Type Analysis

Pre-media Concept and Design dominates with 29.8% due to its central role in brand visualization and packaging differentiation.

In 2024, Pre-media Concept and Design held a dominant market position in the By Service Type Analysis segment of Pre-Press And Packaging Graphics Services Market, with a 29.8% share. This dominance is supported by rising brand competition, where packaging aesthetics influence purchasing decisions. Consequently, companies increasingly invest in conceptual design to align graphics with branding, regulatory, and sustainability goals.

Artwork and Reprographics play a critical supporting role by converting creative concepts into technically accurate, print-ready files. Moreover, this sub-segment ensures consistency across packaging formats and regions. As product portfolios expand, artwork services are increasingly relied upon to manage versioning, localization, and compliance without disrupting production timelines.

Color Management and Proofing ensure visual accuracy across substrates and printing methods. Therefore, brand owners depend on this service to maintain color consistency throughout global supply chains. Digital proofing tools further enhance efficiency by reducing rework, shortening approval cycles, and minimizing material wastage before full-scale printing begins.

Plate or Tooling Supply supports the physical preparation stage of printing by delivering precise plates and dies. Additionally, this service enables faster press setup and reduced downtime. Workflow Automation complements all services by integrating digital asset management, approvals, and prepress workflows, thereby improving turnaround times and operational transparency.

By Printing Technology Analysis

Flexography dominates with 37.9% due to its versatility, cost efficiency, and suitability for high-volume packaging.

In 2024, Flexography held a dominant market position in the By Printing Technology Analysis segment of Pre-Press And Packaging Graphics Services Market, with a 37.9% share. This leadership is driven by its wide application across flexible packaging and labels. As a result, prepress services increasingly optimize files specifically for flexographic requirements.

Gravure printing supports premium packaging where image quality and consistency are critical. Accordingly, prepress providers focus on precision engraving and tonal control. Although capital intensive, gravure remains relevant for long production runs in food and beverage and personal care packaging.

Offset Lithography remains widely used for cartons and paperboard packaging. Therefore, prepress services emphasize color separation accuracy and layout optimization. Digital Printing continues to gain traction for short runs and customization, encouraging agile prepress workflows that support variable data and rapid revisions.

Screen Printing and Others address niche applications such as specialty finishes and industrial packaging. Meanwhile, prepress support for these technologies focuses on stencil preparation, layer management, and substrate compatibility, ensuring that specialized printing requirements are met without compromising visual integrity.

By End-use Analysis

Food and Beverage dominates with 41.3% due to high packaging volumes and strict labeling requirements.

In 2024, Food and Beverage held a dominant market position in the By End-use Analysis segment of Pre-Press And Packaging Graphics Services Market, with a 41.3% share. This dominance is reinforced by frequent product launches and regulatory labeling needs. Consequently, prepress services ensure accuracy, compliance, and visual appeal across large production volumes.

Personal Care and Cosmetics rely heavily on premium design and color precision to convey brand value. Therefore, prepress providers focus on advanced proofing and surface finish optimization. Pharmaceuticals emphasize compliance and clarity, making accurate artwork management and version control essential within this sub-segment.

Household and Homecare packaging prioritizes durability and readability. As a result, prepress workflows balance functional design with cost efficiency. Electronics packaging demands precision and technical accuracy, driving demand for structured layouts and multilingual content handling.

Others include industrial and specialty products where packaging formats vary widely. Accordingly, prepress services in this category emphasize flexibility and customization, supporting diverse substrates, printing technologies, and distribution requirements while maintaining consistent brand representation.

Key Market Segments

By Service Type

- Pre-media Concept and Design

- Artwork and Reprographics

- Color Management and Proofing

- Plate/Tooling Supply

- Workflow Automation

By Printing Technology

- Flexography

- Gravure

- Offset Lithography

- Digital Printing

- Screen Printing

- Others

By End-use

- Food and Beverage

- Personal Care and Cosmetics

- Pharmaceuticals

- Household and Homecare

- Electronics

- Others

Drivers

Rising Demand for High Quality Brand Consistent Packaging Drives Market Growth

The pre-press and packaging graphics services market is strongly driven by rising demand for brand consistent packaging across FMCG and consumer goods. Companies are increasingly focused on maintaining uniform colors, layouts, and messaging across regions. As brands expand globally, pre-press services help ensure visual consistency across different printing technologies and substrates.

Another important driver is the rapid increase in SKU proliferation. Product variants, limited editions, and regional packaging changes require frequent artwork updates. As a result, businesses rely on pre-press service providers for efficient version control, error reduction, and faster approvals, especially in high volume packaging environments.

Growth in premium packaging is also supporting market expansion. Premium products demand precise color reproduction, fine graphic details, and high print accuracy. Pre-press services play a critical role in advanced color management and proofing, ensuring shelf differentiation and improved consumer perception.

Additionally, the expansion of organized retail is increasing standardized packaging and labeling requirements. Large retail chains demand uniform packaging formats, compliance ready artwork, and consistent print output. Therefore, pre-press services are becoming an essential part of retail driven packaging supply chains.

High Dependency on Skilled Graphic Professionals Limits Market Efficiency

One of the key restraints in the pre-press and packaging graphics services market is the high dependency on skilled graphic technicians and color specialists. Advanced color correction, file preparation, and print optimization require specialized expertise. However, availability of trained professionals remains limited in many regions.

Long approval cycles between brand owners, converters, and printers further restrain market efficiency. Multiple stakeholders are involved in packaging validation, leading to repeated revisions and delays. These extended timelines increase costs and reduce responsiveness, especially for fast moving consumer goods.

Cost pressure from in house packaging design teams at large manufacturers also impacts market growth. Many large brands prefer internal teams to control costs and protect intellectual property. This limits outsourcing opportunities and creates pricing pressure for external pre-press service providers.

Overall, these restraints increase operational complexity and limit scalability, particularly for small and mid sized pre-press service providers.

Restraints

High Dependency on Skilled Graphic Professionals Limits Market Efficiency

One of the key restraints in the pre-press and packaging graphics services market is the high dependency on skilled graphic technicians and color specialists. Advanced color correction, file preparation, and print optimization require specialized expertise. However, availability of trained professionals remains limited in many regions.

Long approval cycles between brand owners, converters, and printers further restrain market efficiency. Multiple stakeholders are involved in packaging validation, leading to repeated revisions and delays. These extended timelines increase costs and reduce responsiveness, especially for fast moving consumer goods.

Cost pressure from in house packaging design teams at large manufacturers also impacts market growth. Many large brands prefer internal teams to control costs and protect intellectual property. This limits outsourcing opportunities and creates pricing pressure for external pre-press service providers.

Overall, these restraints increase operational complexity and limit scalability, particularly for small and mid sized pre-press service providers.

Growth Factors

Increasing Adoption of Digital Printing Creates New Growth Opportunities

The growing adoption of digital printing is creating strong growth opportunities for pre-press and packaging graphics services. Digital printing requires flexible file preparation, faster turnaround times, and precise color control. Pre-press providers are well positioned to support short runs, customization, and rapid design changes.

Rising outsourcing of packaging graphics by mid sized brand owners is another major opportunity. These companies often lack in house design infrastructure and rely on specialized service providers. Outsourcing allows them to access advanced tools, skilled talent, and scalable workflows without heavy capital investment.

Additionally, increasing regulatory complexity across food, pharmaceutical, and personal care packaging is driving demand for compliant artwork preparation. Pre-press services help brands meet labeling standards, reduce rework, and avoid costly print errors.

Together, these factors support steady expansion opportunities for specialized and technology enabled pre-press providers.

Emerging Trends

Shift Toward Cloud Based and Automated Workflows Shapes Market Trends

One of the most notable trends in the pre-press and packaging graphics services market is the shift toward cloud based workflow and collaboration platforms. Cloud solutions enable real time file sharing, faster approvals, and remote coordination between global stakeholders.

Automation is also becoming increasingly important. Tools for file correction, preflight checks, and color optimization reduce manual effort and improve consistency. These technologies help service providers handle growing volumes without compromising quality.

Another emerging trend is the increasing use of data driven packaging personalization. Brands are leveraging consumer data to create targeted designs and localized packaging. This trend increases demand for agile pre-press workflows capable of managing multiple design variations efficiently.

Overall, these trends are reshaping service delivery models and improving speed, accuracy, and scalability across the market.

Regional Analysis

Asia Pacific Dominates the Pre-Press And Packaging Graphics Services Market with a Market Share of 48.9%, Valued at USD 2.2 Bn

Asia Pacific leads the Pre-Press And Packaging Graphics Services market due to its large scale manufacturing base and expanding consumer goods production. In 2024, the region accounted for a dominant 48.9% share, generating revenue of USD 2.2 Bn. Rapid growth in FMCG packaging, pharmaceuticals, and organized retail is increasing demand for standardized, high quality packaging graphics. Rising adoption of digital printing and outsourcing further supports regional leadership.

North America Pre-Press And Packaging Graphics Services Market Trends

North America represents a mature market supported by strong brand management practices and strict packaging regulations. High demand for premium packaging, regulatory compliant labeling, and color accuracy continues to drive pre-press service adoption. The region benefits from advanced printing infrastructure and early adoption of workflow automation and cloud based collaboration platforms.

Europe Pre-Press And Packaging Graphics Services Market Trends

Europe’s market is driven by strong emphasis on sustainability, regulatory compliance, and multilingual packaging requirements. Pre-press services play a key role in managing complex labeling and eco compliance standards. Demand remains steady across food, personal care, and pharmaceutical packaging, supported by established print and packaging ecosystems.

Middle East and Africa Pre-Press And Packaging Graphics Services Market Trends

The Middle East and Africa market is gradually expanding due to growth in packaged food, personal care, and pharmaceutical sectors. Increasing investment in local manufacturing and retail infrastructure is driving demand for professional packaging graphics services. Adoption remains uneven but shows steady improvement across key urban markets.

Latin America Pre-Press And Packaging Graphics Services Market Trends

Latin America is witnessing moderate growth driven by expanding FMCG consumption and rising private label products. Brands are increasingly focusing on packaging differentiation and print quality. Improvements in printing capabilities and outsourcing of pre-press activities are supporting gradual market development across the region.

U.S. Pre-Press And Packaging Graphics Services Market Trends

The U.S. market benefits from high packaging innovation, frequent product launches, and strong regulatory oversight. Demand for accurate artwork, rapid design changes, and digital print readiness continues to support pre-press service utilization. The market emphasizes speed, compliance, and brand consistency across multiple packaging formats.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Pre-Press And Packaging Graphics Services Company Insights

the global Pre-Press And Packaging Graphics Services market in 2024 is shaped by players that combine technical expertise, process discipline, and deep understanding of print and packaging workflows. Leading service providers are increasingly positioned as strategic partners, supporting brand consistency, color accuracy, and faster time to market across complex packaging portfolios.

Propelis Group plays a significant role in the market by focusing on integrated pre-press solutions and standardized workflows. In 2024, the company’s strength lies in managing high volumes of packaging artwork while maintaining accuracy across multiple substrates and printing technologies. Its approach supports scalability and consistency for large packaging programs.

Janoschka AG is recognized for its strong capabilities in color management and reprographics. The company supports premium packaging and high quality print outcomes by emphasizing precision and process control. Its expertise aligns well with growing demand for premium branding and advanced print reproduction across global consumer goods markets.

Miller Graphics AB maintains a strong market position through its focus on packaging graphics optimization and print readiness. In 2024, the company benefits from supporting brand owners and converters with efficient file preparation and reduced print errors. Its services address increasing SKU complexity and frequent artwork updates.

YRG Group Ltd contributes to the market by offering specialized pre-press and artwork management services. The company’s strengths include handling diverse packaging formats and managing approval workflows across stakeholders. This capability supports faster turnaround and improved coordination between brands and printers.

Overall, these key players influence market dynamics by emphasizing workflow automation, quality assurance, and collaborative packaging development. Their combined focus on accuracy, speed, and process reliability reflects broader industry priorities. As packaging requirements grow more complex, such service providers remain central to ensuring efficient, compliant, and visually consistent packaging production worldwide.

Top Key Players in the Market

- Propelis Group

- Janoschka AG

- Miller Graphics AB

- YRG Group Ltd

- Reproflex3 Ltd

- Sun Branding Solutions Ltd

- Glunz & Jensen Holding A/S

- Steurs Graphic Solutions NV

- Kwality Offset Printers

Recent Developments

- In Jan 2024, C-P Flexible Packaging (C-P) introduced Intelligraphix Systems, a new division focused on prepress, platemaking, and color management services for flexographic printers. The division aims to deliver higher precision, improved operational efficiency, and meaningful cost savings for printers seeking advanced flexographic production capabilities.

- In Mar 2025, XSYS announced the completion of its acquisition of the MacDermid Graphics Solutions business from Element Solutions Inc. The acquisition strengthens XSYS’s position in the global printing plates and prepress solutions market, expanding its technology portfolio and customer reach.

Report Scope

Report Features Description Market Value (2024) USD 4.5 billion Forecast Revenue (2034) USD 9.2 billion CAGR (2025-2034) 7.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service Type (Pre-media Concept and Design, Artwork and Reprographics, Color Management and Proofing, Plate/Tooling Supply, Workflow Automation), By Printing Technology (Flexography, Gravure, Offset Lithography, Digital Printing, Screen Printing, Others), By End-use (Food and Beverage, Personal Care and Cosmetics, Pharmaceuticals, Household and Homecare, Electronics, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Propelis Group, Janoschka AG, Miller Graphics AB, YRG Group Ltd, Reproflex3 Ltd, Sun Branding Solutions Ltd, Glunz & Jensen Holding A/S, Steurs Graphic Solutions NV, Kwality Offset Printers Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Pre-Press And Packaging Graphics Services MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Pre-Press And Packaging Graphics Services MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Propelis Group

- Janoschka AG

- Miller Graphics AB

- YRG Group Ltd

- Reproflex3 Ltd

- Sun Branding Solutions Ltd

- Glunz & Jensen Holding A/S

- Steurs Graphic Solutions NV

- Kwality Offset Printers