Global Pre-Owned Luxury Watch Market Size, Share, Growth Analysis By Product Type (Manual and Automatic), By Category (Luxury, Premium Luxury, and Ultra Luxury), By End-User (Men, Women, and Unisex), By Sales Channel (Offline Stores and Online Platforms), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2024

- Report ID: 133209

- Number of Pages: 348

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

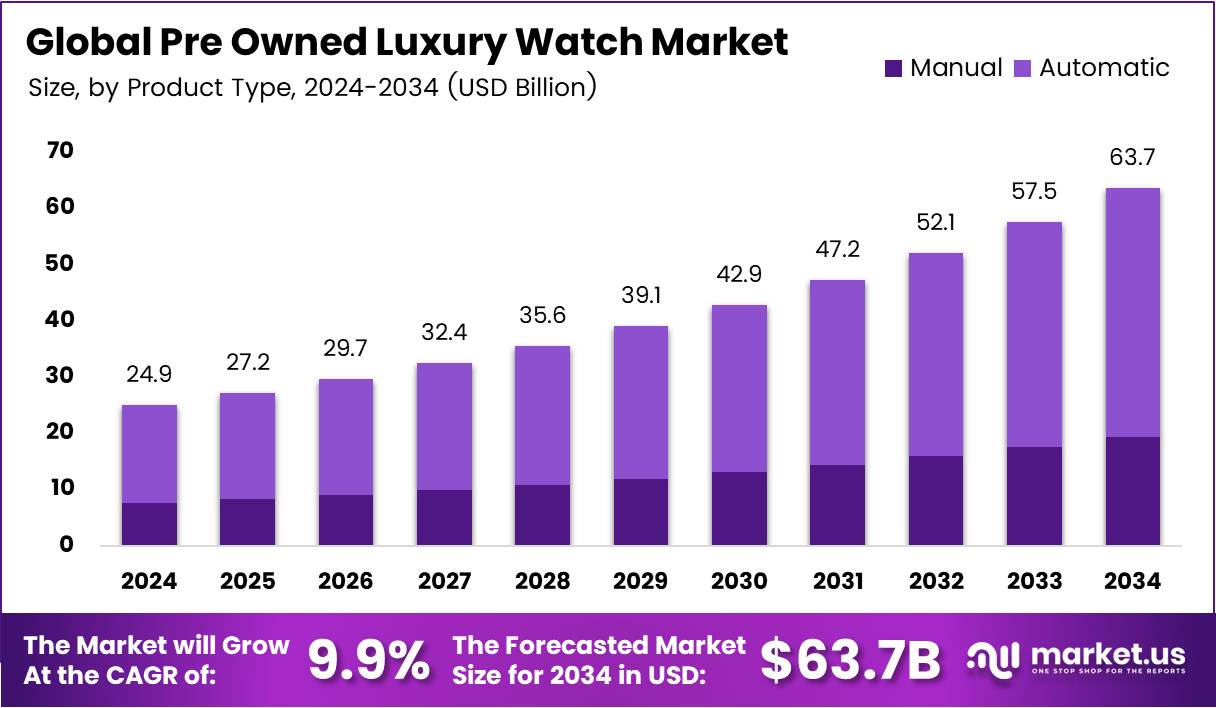

The Global Pre-Owned Luxury Watch Market size is expected to be worth around USD 63.7 Billion by 2034, from USD 24.9 Billion in 2024, growing at a CAGR of 9.9% during the forecast period from 2025 to 2034.

A luxury watch is a high-precision, high-quality timepiece made from premium materials, such as gold, platinum, and sapphire, often by hand, and known for its exceptional craftsmanship, durability, and longevity. Similarly, a pre-owned luxury watch is a timepiece from a premium or designer brand that has had one or more previous owners.

The surge in demand for pre-owned watches is largely fueled by growing interest among younger demographics. For instance, a survey found that 20% of individuals aged 18 to 24 expressed interest in purchasing a luxury watch within the next year, compared to an average of 11% across all age groups.

Furthermore, around 30% of upper-income teenagers had visited a pre-owned marketplace by the end of 2020, marking a 5 percentage point increase from earlier in the year. This shift is supported by changing perceptions of resale in various consumer categories, including fashion, where the concept of items being pre-owned and a more sustainable purchasing option has significantly diminished the stigma associated with buying pre-owned products. This change is especially pronounced among younger buyers and in regions with a less established culture of vintage stores.

- According to the Federation of the Swiss Watch Industry, over 20 million luxury watches are sold worldwide annually. And 50% of the market value comes from Swiss luxury watches.

Key Takeaways

- The global pre owned luxury watch market was valued at US$24.9 billion in 2024.

- The global pre owned luxury watch market is projected to grow at a CAGR of 9.9% and is estimated to reach US$63.7 billion by 2034.

- On the basis of the product type of pre owned luxury watches, automatic luxury watches dominated the market in 2024, comprising about 69.5% share of the total global market.

- Based on the category of the pre owned luxury watch, luxury watches led the market, encompassing about 59.7% share of the total global market.

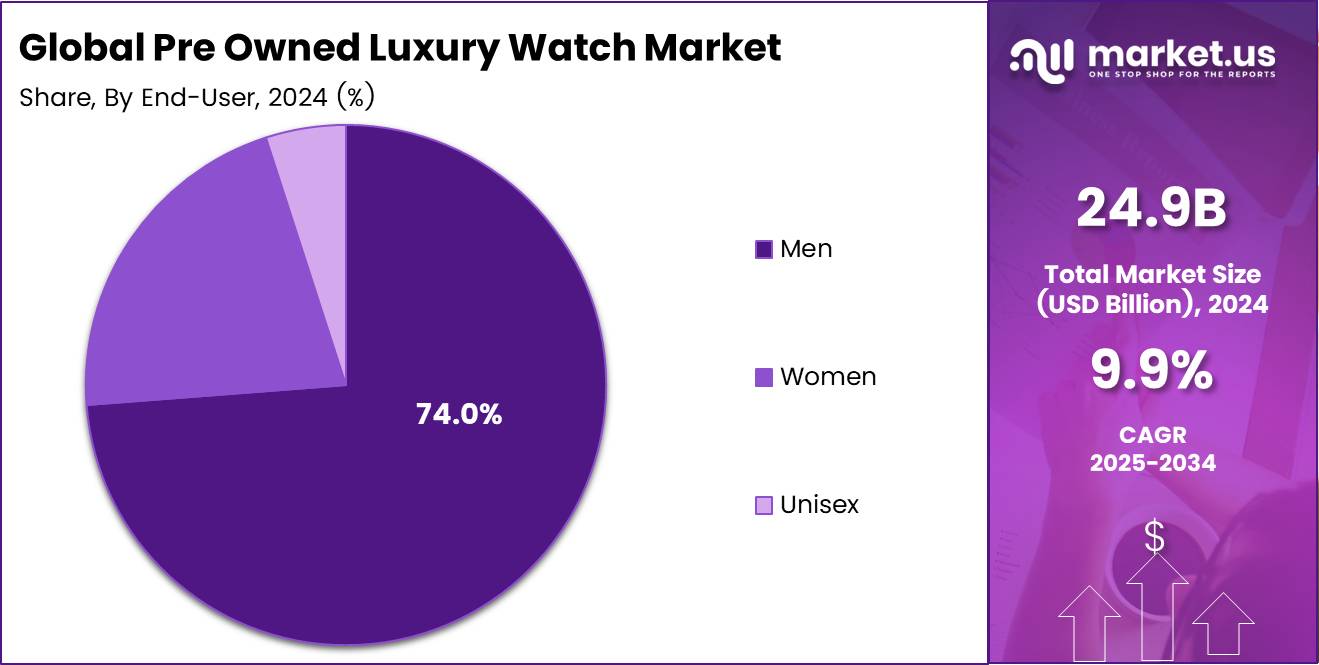

- Among the end-users of pre owned luxury watches, men held the majority of the share of the market with 74.0%.

- In 2024, the pre owned luxury watches were mainly bought through offline distribution channels due to consumer trust.

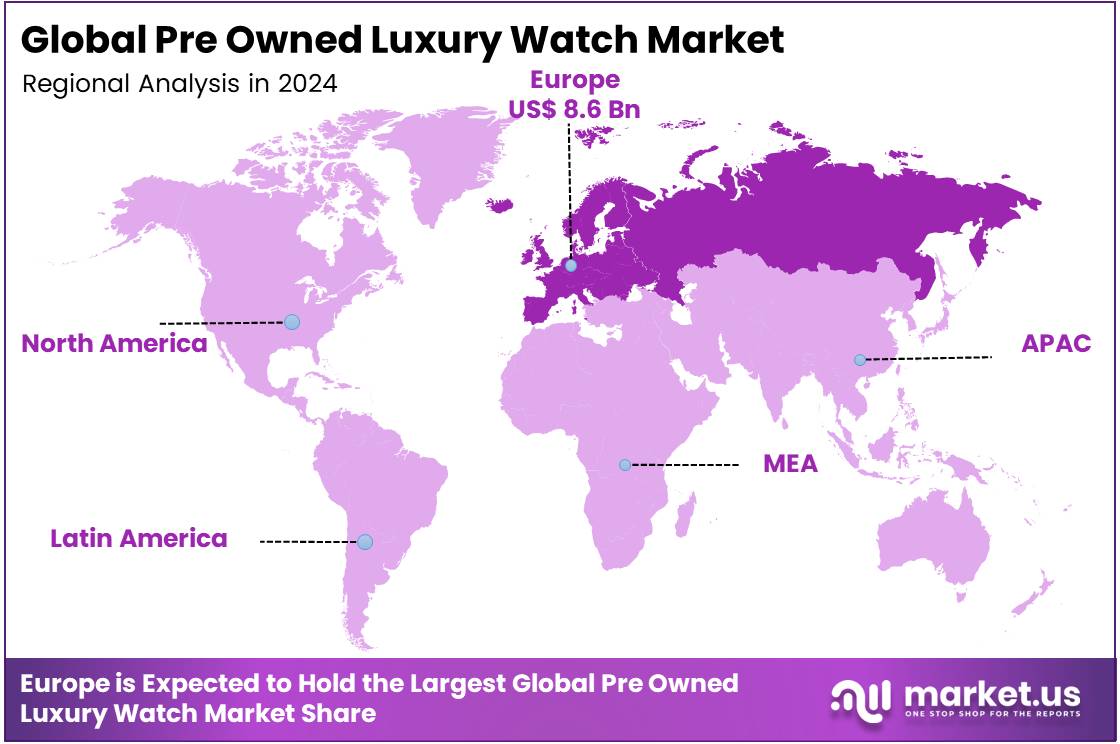

- Europe was the largest market for pre owned luxury watches in 2024, comprising roughly 34.7% of the total global consumption.

Product Type Analysis

Automatic Pre Owned Luxury Watches Accounted for the Largest Share of the Market.

On the basis of product types, the pre owned luxury watch market is segmented into manual and automatic. Automatic pre owned luxury watches dominated the market in 2024 with a market share of 69.5%.

Automatic pre-owned luxury watches are more frequently purchased than manual ones due to their convenience, mechanical sophistication, and widespread availability. Unlike manual watches, which require daily winding, automatic watches wind themselves through the motion of the wearer’s wrist, making them more practical for everyday use.

Many popular models from brands such as Rolex, Omega, and TAG Heuer feature automatic movements, appealing to both seasoned collectors and first-time buyers.

Additionally, automatic watches strike a balance between traditional craftsmanship and modern functionality, making them more attractive to a broader audience. Their reliability and lower maintenance effort further contribute to their higher demand in the pre-owned market.

Category Analysis

In 2024, Luxury Watches Held the Dominant Position in the Market.

Based on category, the pre owned luxury watch market is segmented into luxury, premium luxury, and ultra luxury. The luxury watches dominated the market in 2024 with a market share of 59.7%. Pre-owned luxury watches are more commonly purchased than pre-owned premium or ultra-luxury watches primarily due to their greater accessibility and affordability.

While premium and ultra-luxury timepieces often come with significantly higher price tags and limited availability, luxury watches offer a wider range of options that appeal to a broader audience. Many buyers view luxury watches as a practical entry point into high-end horology, balancing quality craftsmanship with more attainable pricing.

Additionally, luxury watches typically have a larger secondary market with more diverse styles and models, making it easier for buyers to find pieces that suit their tastes and budgets without the exclusivity barriers of ultra-luxury brands.

End-User Analysis

The Pre-Owned Luxury Watch Market was Predominantly Driven by Men in 2024.

On the basis of end-users, the pre owned luxury watch market is divided into men, women, and unisex. In the segment, male end-users dominated the market in 2024 with a market share of 74.0%.

Men’s pre-owned luxury watches tend to be purchased more frequently than women’s or unisex models, largely because of traditional preferences and the broader availability of styles designed for men. Historically, the luxury watch market has focused heavily on masculine designs, with larger case sizes and sportier or more intricate complications that appeal to male collectors.

Additionally, men are often more inclined to view watches as status symbols or investment pieces, driving demand in this segment. While women’s and unisex watches are gaining popularity, the selection and visibility of men’s models in both primary and secondary markets remain dominant, influencing buying patterns accordingly.

Sales Channel Analysis

Most of the Pre Owned Luxury Watches Were Bought Through Offline Distribution Channels in 2024.

Based on the sales channel, the market is divided into offline and online channels. The offline channels dominated the pre owned luxury watch market in 2024 with a market share of 62.1%.

Most pre-owned luxury watches are purchased through offline distribution channels because buyers often prefer the tactile experience of seeing and handling the watch in person before making such a significant investment. Consumer trust plays a crucial role, where physical stores and authorized dealers provide assurance through face-to-face interactions, certifications, and warranties that online platforms may lack.

Additionally, buyers can inspect the watch’s condition, authenticity, and functionality firsthand, which reduces the risk of counterfeit or misrepresented products. Similarly, the personalized customer service and expert guidance available offline contribute to a more confident purchasing decision.

Key Market Segments

By Product Type

- Manual

- Automatic

By Category

- Luxury

- Premium Luxury

- Ultra Luxury

By End-User

- Men

- Women

- Unisex

By Sales Channel

- Offline Stores

- Online Platforms

Drivers

Millennials & Generation Z Shaping the Market.

Millennials and Generation Z are significantly reshaping the pre-owned luxury watch industry through their distinct preferences, digital fluency, and evolving attitudes toward luxury consumption. These younger generations are driving a paradigm shift, emphasizing value, sustainability, and authenticity in their purchasing decisions.

A prominent trend is the increasing interest among Gen Z in vintage and second-hand luxury watches. Despite being raised in a digital era dominated by smartwatches, several Gen Z consumers are gravitating toward mechanical timepieces, valuing their craftsmanship and heritage.

This resurgence is partly fueled by the influence of social media platforms, where watch enthusiasts and influencers showcase vintage models, creating a sense of community and desirability around these timepieces. For instance, a survey found that 20% of individuals aged 18 to 24 expressed interest in purchasing a luxury watch within the next year, compared to an average of 11% across all age groups.

Purchase Behavior of Pre-owned Watches Among Demographics

Restraints

Authenticity Remains a Significant Challenge for the Pre Owned Luxury Watch Market.

The proliferation of counterfeit products and authentication challenges presents a significant barrier to the growth and credibility of the pre-owned luxury watches market. As demand for pre-owned luxury watches continues to rise, so too does the sophistication of counterfeiters, who are increasingly able to replicate design, branding, and even movement mechanisms with alarming accuracy. These counterfeit watches not only deceive unsuspecting buyers but also undermine trust in the secondary market as a whole.

Authenticity is a cornerstone of value in the luxury watch segment, and the presence of counterfeit products erodes consumer confidence, particularly among new and younger buyers who may be less familiar with the nuances of horology.

Authentication remains a complex and resource-intensive process, often requiring expert knowledge, specialized tools, and access to original manufacturer data. The lack of a standardized global protocol for verifying pre-owned luxury watches adds another layer of difficulty for both buyers and sellers.

- China accounts for 53.4% of counterfeit Swiss watches, serving as the primary production hub with sophisticated workshops in regions such as Guangzhou. Recent seizures reveal increasingly high-quality replicas, including complex tourbillon mechanisms that challenge authentication efforts.

- Hong Kong represents 24%, functioning both as a manufacturing base and transit point due to its logistical infrastructure.

- Singapore contributes 5.1%, while Turkey accounts for 5% of global seizures, with Turkish authorities confiscating 62,000 fake Swiss watches in 2023 alone.

- As of 2023, 10% of Americans have unknowingly purchased fake watches, with nearly half spending $500+ per fake.

Growth Factors

Desire for Vintage and Rising Disposable Income Across the World Boosts the Market.

The growing global fascination with vintage luxury watches, coupled with rising disposable incomes, has significantly fueled the expansion of the pre-owned luxury watch market. Vintage timepieces, often viewed as timeless symbols of heritage and craftsmanship, appeal to collectors and younger consumers alike who seek authenticity and exclusivity. Iconic models such as the Omega Speedmaster Moonwatch or the vintage Rolex Submariner are highly coveted for their design, historical significance, and limited availability.

Simultaneously, rising middle and upper-middle-class populations in regions such as Southeast Asia, the Middle East, and parts of Africa have led to greater purchasing power and increased interest in luxury goods. For instance, the Asia Pacific has emerged as the fastest-growing market in 2024 as its disposable income rises at a rapid pace.

At the end of 2025, it is estimated that the disposable income per capita in the Asia Pacific would be US$9,311. Additionally, millennials and Gen Z buyers are more likely to purchase pre-owned items, valuing sustainability and uniqueness. This intersection of nostalgic appeal and broader access to discretionary spending is reshaping the dynamics of the luxury watch market, making pre-owned options especially attractive.

- Neo-vintage watches are experiencing rapid growth in the pre-owned watch market. Sales of neo-vintage timepieces have surged by 123% since 2023, outpacing modern models and making them the fastest-growing segment in the secondary market.

Emerging Trends

Focus on Certified Pre-Owned (CPO) Luxury Watches.

The growing emphasis on Certified Pre-Owned (CPO) luxury watches is a defining trend in the pre-owned market, driven by consumer demand for authenticity, trust, and quality assurance. As counterfeit concerns and mechanical complexity make buying secondhand watches risky, CPO programs offer peace of mind by ensuring each timepiece is inspected, serviced, and authenticated by professionals.

Brands such as Rolex, Cartier, and Omega, along with reputable retailers such as WatchBox and Tourneau, have embraced the CPO model to build consumer confidence and extend brand loyalty. For instance, Rolex’s official CPO program includes a two-year international warranty and authentication through authorized dealers, significantly enhancing buyer trust. This trend elevates the credibility of the pre-owned market and encourages more first-time buyers to enter it confidently.

Geopolitical Impact Analysis

US Tariff Impact On the Pre Owned Luxury Watch Market.

Tariff-driven price increases may become permanent, pushing Swiss watches further upmarket and excluding price-sensitive U.S. buyers. The U.S. accounts for 16.8% of Swiss watch exports (CHF 4.4 billion annually), watch exports from the global Swiss watch exports worth CHF 26 billion, making it the industry’s largest foreign market. Tariffs threaten to reverse recent growth, including 5.0% U.S. sales growth in 2024.

Since 2021, the US has become Switzerland’s largest export market, a trend that extends to the export of luxury Swiss watches. According to industry data from the Federation of the Swiss Watch Industry (FHS), the US has held the position of the world’s top consumer of Swiss watches since 2021. By 2024, the US had spent over CHF 4.372 billion on Swiss luxury watches, far outpacing China, which had been the former leader.

China now occupies second place, with a spend of CHF 2.053 billion, well behind the US. In addition to surpassing previous records, the US market has seen consistent year-on-year growth. In 2020, total watch sales amounted to CHF 1.987 billion, a modest figure in comparison. However, the market rebounded sharply in 2021, with sales reaching unprecedented levels globally.

Regional Analysis

Europe as the Dominated in the Global Pre Owned Luxury Watch Market.

Europe held the major share of the global pre owned luxury watch market, valued at around US$8.6 billion, commanding an estimated 34.7% of total revenue share. The region stands as the largest market for pre-owned luxury watches, driven by a strong horological heritage, dense concentration of high-net-worth individuals, and a well-established network of watchmakers, collectors, and dealers.

Countries such as Switzerland, Germany, France, and the UK play central roles in the manufacturing of iconic brands such as Rolex, Omega, and Patek Philippe, and in facilitating a vibrant secondary market. Additionally, Switzerland, known as the heart of watchmaking, hosts renowned marketplaces and trade fairs that support the authentication and resale of vintage and contemporary models.

For instance, Switzerland exported the equivalent of US$29.5 billion in 2024. Additionally, the rise of certified pre-owned boutiques in cities such as London, Paris, and Geneva has made it easier for consumers to trust and engage in secondhand purchases, reinforcing Europe’s leadership in this sector.

- According to the Federal Customs Service of Russia, imports of Swiss watches declined by nearly 40% in 2023 compared to pre-sanction years. This drop has pushed buyers to explore the domestic second-hand market, where supply comes from both individual sellers and established resellers with strong authentication protocols. Additionally, cities like Moscow, St. Petersburg, and Almaty (Kazakhstan) have emerged as regional hubs for luxury watch resale.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Pre-Owned Luxury Watch Company Insights

The major participants in the pre owned luxury watch market are RealReal, European Watch Company, Watchnian Group Corporation, Watchfinder, Vestiaire Collective, Rebag, Fashionphile, Confidential Couture, Bob’s Watches, Yoogi’s Closet, What Goes Around Comes Around LLC, The Luxury Closet, Thredup, Poshmark, Timepiece360, Rewind Vintage Affairs, Chrono24, and Watches of Switzerland Group.

Bob’s Watches is a leading online marketplace focused on buying, selling, and trading pre-owned and vintage luxury watches, with a specialization in Rolex. The company provides fair market value, carries a large inventory, and offers services like authentication, repair, and appraisal, aiming for a trustworthy and transparent experience for its customers in the luxury watch market.

Watchfinder & Co. is a global luxury watch marketplace, specializing in buying, selling, and part-exchanging pre-owned luxury watches. The company operates online and through physical stores and boasts a manufacturer-certified service center and a 60-stage authentication process to guarantee authenticity.

Vestiaire Collective is a global online luxury resale marketplace that allows users to buy and sell pre-owned designer items, including luxury watches. The company focuses on sustainability by promoting a circular economy within the fashion industry.

Top Key Players in the Market

- The RealReal, Inc.

- European Watch Company

- Watchnian Group Corporation

- Watchfinder & Co.

- Vestiaire Collective

- Rebag

- Fashionphile

- Confidential Couture

- Bob’s Watches

- Yoogi’s Closet

- What Goes Around Comes Around LLC

- The Luxury Closet

- Thredup

- Poshmark

- Timepiece360

- Rewind Vintage Affairs

- Chrono24

- Watches of Switzerland Group

- Other Key Players

Recent Developments

- In June 2025, European Watch Company (EWC), the premier destination for luxury pre-owned timepieces, announced its exclusive partnership with Chubb, a world leader in insurance. The collaboration is to make worldwide coverage available for EWC clients’ valuable watch collections.

- In October 2023, Chrono24, the world’s largest online marketplace for luxury watches, unveiled its proprietary new Watch Index tool built on the hallmark of real sales data, called ChronoPulse.

Report Scope

Report Features Description Market Value (2024) USD 24.9 Billion Forecast Revenue (2034) USD 63.7 Billion CAGR (2025-2034) 9.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Manual and Automatic), By Category (Luxury, Premium Luxury, and Ultra Luxury), By End-User (Men, Women, and Unisex), By Sales Channel (Offline Stores and Online Platforms) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape The RealReal, European Watch Company, Watchnian Group Corporation, Watchfinder, Vestiaire Collective, Rebag, Fashionphile, Confidential Couture, Bob’s Watches, Yoogi’s Closet, What Goes Around Comes Around LLC, The Luxury Closet, Thredup, Poshmark, Timepiece360, Rewind Vintage Affairs, Chrono24, Watches of Switzerland Group, Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Pre-Owned Luxury Watches MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample

Pre-Owned Luxury Watches MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- The RealReal, Inc.

- European Watch Company

- Watchnian Group Corporation

- Watchfinder & Co.

- Vestiaire Collective

- Rebag

- Fashionphile

- Confidential Couture

- Bob’s Watches

- Yoogi's Closet

- What Goes Around Comes Around LLC

- The Luxury Closet

- Thredup

- Poshmark

- Timepiece360

- Rewind Vintage Affairs

- Chrono24

- Watches of Switzerland Group

- Other Key Players