Global Powersports Market Size, Share, Growth Analysis By Product (SXS, Heavyweight Motorcycle, ATV, Off Road Motorcycle, Others), By Fuel Type (Gasoline, Diesel, Electric), By Application (Recreational, Utility, Commercial, Sports, Defense, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170578

- Number of Pages: 267

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

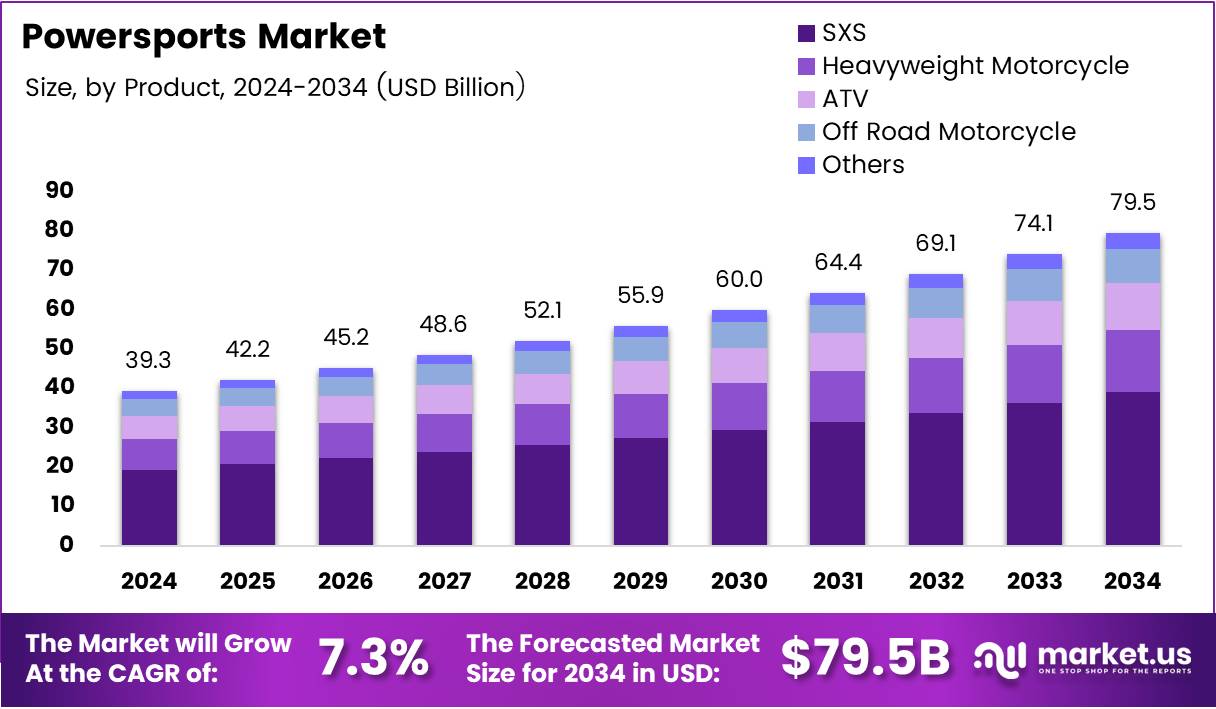

Global Powersports Market size is expected to reach around USD 79.5 Billion by 2034 from USD 39.3 Billion in 2024, growing at a CAGR of 7.3% during the forecast period 2025 to 2034. This robust expansion reflects increasing consumer interest in outdoor recreational activities and adventure tourism across global markets.

The powersports market encompasses motorized vehicles designed for off-road and recreational use, including all-terrain vehicles, side-by-side vehicles, motorcycles, and snowmobiles. These versatile machines serve multiple applications ranging from recreational riding to utility work and commercial operations. Growing urbanization and rising disposable incomes are fueling demand for leisure-oriented products worldwide.

Adventure tourism continues gaining momentum as consumers seek unique outdoor experiences and adrenaline-driven activities. This trend significantly boosts powersport vehicle adoption among enthusiasts and casual riders alike. Manufacturers are responding by introducing innovative models with enhanced performance capabilities and improved safety features to attract diverse customer segments.

Electric and hybrid powersport vehicles are emerging as game-changers in the industry landscape. Environmental consciousness and technological advancements are driving this transition toward sustainable mobility solutions. Government initiatives promoting clean energy adoption further accelerate the electrification of traditional gasoline-powered vehicles across multiple product categories.

Technological integration has transformed modern powersport vehicles into sophisticated machines equipped with smart diagnostics and connectivity features. Riders now demand advanced safety systems, GPS navigation, and performance monitoring capabilities. These innovations enhance user experience while providing manufacturers with opportunities to differentiate their offerings in competitive markets.

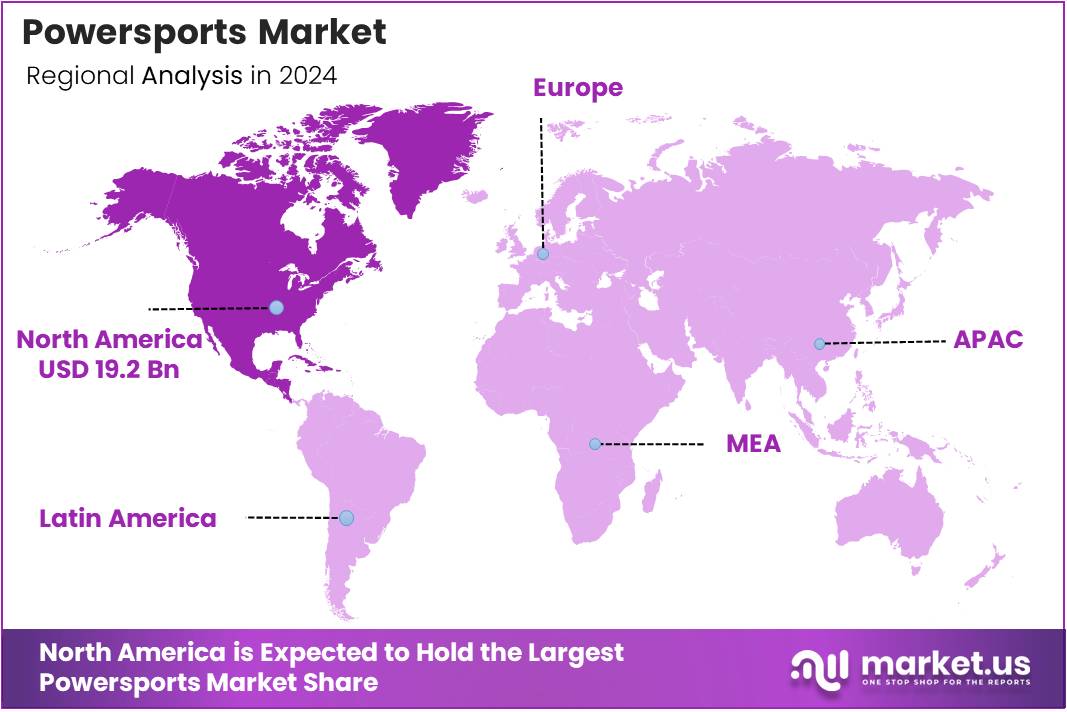

North America dominates the global powersports market with a commanding 48.9% share, valued at USD 19.2 Billion. The region benefits from established recreational culture, extensive trail networks, and strong consumer purchasing power. Meanwhile, emerging markets in Asia Pacific and Latin America present significant growth opportunities driven by increasing outdoor participation rates.

According to the Motorcycle Industry Council, there are 9.5 million registered motorcycles in the United States, demonstrating substantial market penetration. Furthermore, according to the Outdoor Industry Association, U.S. outdoor recreation reached 175.8 million participants in 2023, representing a 51.9% participation rate with males accounting for 62.9% of participants, highlighting the expanding consumer base for powersport activities.

Key Takeaways

- Global Powersports Market size projected to reach USD 79.5 Billion by 2034 from USD 39.3 Billion in 2024, at a CAGR of 7.3%.

- North America leads the market with 48.9% share, valued at USD 19.2 Billion.

- SXS segment dominates By Product category with 34.8% market share in 2024.

- Gasoline fuel type holds 79.3% market share, remaining the preferred choice.

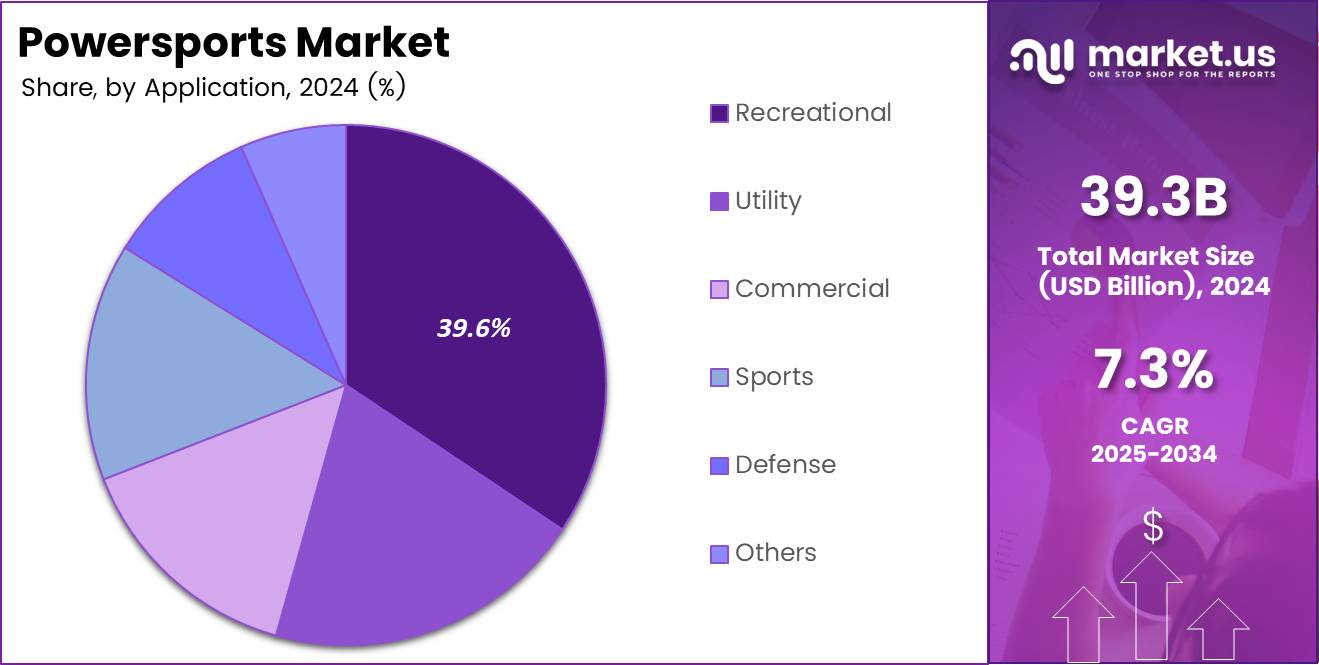

- Recreational application accounts for 39.6% of total market demand.

By Product Analysis

SXS dominates with 34.8% due to its versatility in both recreational and utility applications.

In 2024, SXS held a dominant market position in the By Product segment of Powersports Market, with a 34.8% share. Side-by-side vehicles offer superior passenger capacity and cargo hauling capabilities compared to traditional ATVs. Their enclosed cabin designs provide enhanced safety and weather protection, making them ideal for family outings and commercial operations. Growing demand from agricultural and construction sectors further strengthens this segment’s leadership position.

Heavyweight motorcycles represent a premium segment attracting experienced riders seeking high-performance touring and cruising experiences. These powerful machines feature advanced engineering, comfortable ergonomics, and extensive customization options. Brand loyalty and aspirational value drive consistent demand despite higher price points. Manufacturers continuously innovate with connected features and rider-assistance technologies to maintain competitive advantage.

ATV segment maintains steady demand across recreational and utility applications in diverse terrains. These four-wheeled vehicles excel in farm work, trail riding, and outdoor maintenance tasks. Their compact size and maneuverability make them ideal for navigating challenging landscapes. Cost-effectiveness and ease of operation contribute to sustained popularity among entry-level and professional users.

Off-road motorcycles cater to adventure enthusiasts and competitive motorsports participants seeking lightweight, agile performance. These specialized bikes dominate motocross, enduro, and trail riding activities worldwide. Technological advancements in suspension systems and engine efficiency continue enhancing rider experience. Youth participation in dirt biking further expands this segment’s growth potential.

Others category includes snowmobiles, personal watercraft, and specialty vehicles serving niche recreational markets. Seasonal demand patterns influence sales cycles, particularly in regions with distinct winter conditions. Innovation in electric propulsion systems is gaining traction within this diverse segment.

By Fuel Type Analysis

Gasoline dominates with 79.3% due to established infrastructure and superior range capabilities.

In 2024, Gasoline held a dominant market position in the By Fuel Type segment of Powersports Market, with a 79.3% share. Conventional gasoline engines deliver proven performance, reliability, and immediate refueling convenience that riders trust. Extensive fuel station networks across recreational areas ensure uninterrupted adventures without range anxiety concerns. Cost advantages in vehicle acquisition and maintenance make gasoline powertrains the default choice for most consumers.

Diesel-powered powersport vehicles serve specialized utility and commercial applications requiring exceptional torque and fuel efficiency. Heavy-duty operations in agriculture, forestry, and industrial sectors benefit from diesel’s durability and lower operational costs. However, higher initial investment and regulatory pressures limit widespread consumer adoption in recreational segments.

Electric powersport vehicles are rapidly gaining momentum as environmental regulations tighten and battery technology advances. Zero emissions, reduced noise pollution, and lower maintenance requirements appeal to environmentally conscious consumers. Government incentives and expanding charging infrastructure are accelerating electric vehicle penetration. Major manufacturers are introducing competitive electric models across multiple product categories to capture this emerging segment.

By Application Analysis

Recreational dominates with 39.6% driven by growing outdoor participation and adventure tourism.

In 2024, Recreational held a dominant market position in the By Application segment of Powersports Market, with a 39.6% share. Weekend trail riding, camping adventures, and family outings fuel consistent demand for recreational powersport vehicles. Rising disposable incomes enable consumers to invest in leisure equipment that enhances outdoor experiences. Social media influence and motorsports content creators further amplify recreational riding’s popularity among younger demographics.

Utility applications encompass agricultural operations, property maintenance, and rural transportation needs requiring reliable work vehicles. Farmers and landowners depend on ATVs and side-by-sides for daily operational tasks across vast properties. These vehicles enhance productivity while reducing labor costs in challenging terrain conditions. Durability and load-carrying capacity remain critical selection criteria for utility buyers.

Commercial applications include rental fleets, guided tour operations, and facility management services across tourism and hospitality sectors. Business operators require robust vehicles capable of withstanding intensive daily use and multiple riders. Fleet management solutions and telematics integration optimize operational efficiency. Regulatory compliance and safety certifications play crucial roles in commercial procurement decisions.

Sports applications cater to competitive racing enthusiasts and professional motorsports participants demanding peak performance capabilities. Motocross, rally racing, and enduro competitions drive innovation in lightweight materials and advanced suspension systems. Sponsorships and brand partnerships with athletes elevate market visibility. Entry-level racing programs cultivate future enthusiast communities.

Defense applications involve military and law enforcement agencies utilizing specialized powersport vehicles for patrol and tactical operations. Rugged construction and tactical modifications enable deployment in challenging operational environments. Government procurement contracts provide stable revenue streams for qualified manufacturers.

Others category encompasses search and rescue operations, park services, and emergency response applications requiring versatile all-terrain mobility solutions.

Key Market Segments

By Product

- SXS

- Heavyweight Motorcycle

- ATV

- Off Road Motorcycle

- Others

By Fuel Type

- Gasoline

- Diesel

- Electric

By Application

- Recreational

- Utility

- Commercial

- Sports

- Defense

- Others

Drivers

Rising Adoption of Electric and Hybrid Powersport Vehicles Drives Market Growth

Environmental sustainability concerns are reshaping consumer preferences toward cleaner propulsion technologies in powersport markets. Electric and hybrid vehicles eliminate tailpipe emissions while delivering instant torque and quieter operation. Regulatory incentives and tax benefits further encourage adoption among environmentally conscious buyers seeking guilt-free recreational experiences.

Battery technology improvements have dramatically extended range capabilities and reduced charging times for electric powersport vehicles. Manufacturers are investing heavily in research and development to overcome traditional limitations. Infrastructure expansion with dedicated charging stations at popular trail networks removes barriers to widespread adoption.

Adventure tourism and outdoor recreational activities are experiencing unprecedented growth as consumers prioritize experiential spending over material possessions. National parks, off-road trails, and backcountry destinations attract millions of visitors annually seeking authentic nature connections. This trend directly translates into increased powersport vehicle sales and rental demand.

Technological advancements in vehicle dynamics enhance safety, performance, and rider confidence across all skill levels. Electronic stability control, traction management systems, and advanced suspension technologies prevent accidents and improve handling characteristics. GPS navigation, smartphone connectivity, and diagnostic monitoring systems add convenience and peace of mind for modern riders.

Restraints

Escalating Maintenance Costs and Complex Repair Requirements Restrain Market Expansion

Modern powersport vehicles incorporate sophisticated electronic systems and specialized components that increase maintenance complexity and expense. Routine servicing requires trained technicians and proprietary diagnostic equipment not readily available in rural areas. Parts availability challenges and lengthy repair turnaround times frustrate owners and discourage potential buyers.

Insurance premiums, storage facilities, and seasonal preparation costs add significant ownership burdens beyond initial purchase prices. Many consumers underestimate total cost of ownership when making buying decisions. Economic uncertainties and inflation pressures force households to reconsider discretionary spending on recreational vehicles.

Stringent environmental and noise emission regulations impose compliance burdens on manufacturers while limiting vehicle performance characteristics. Sound restrictions at popular recreational areas reduce riding opportunities and diminish user experiences. Evolving regulatory landscapes create uncertainty for industry participants regarding future product development investments and market viability.

Growth Factors

Integration of Connected Telematics and Smart Diagnostics Fuels Market Expansion

Connected vehicle technologies are revolutionizing powersport ownership experiences through real-time monitoring and predictive maintenance capabilities. Telematics systems track vehicle health, riding patterns, and location data to optimize performance and safety. Manufacturers leverage connectivity to offer over-the-air updates and personalized customer engagement improving brand loyalty.

Customization and aftermarket performance upgrades represent lucrative revenue opportunities for manufacturers and specialty retailers. Enthusiasts invest heavily in accessories, protective gear, and performance enhancements tailored to individual preferences. This thriving aftermarket ecosystem extends vehicle lifecycles while deepening customer relationships through ongoing engagement.

Emerging Asian and Latin American markets present enormous growth potential as middle-class populations expand and infrastructure develops. Rising urbanization paradoxically increases demand for rural escape experiences and outdoor recreation. International manufacturers are establishing local production facilities and distribution networks to capitalize on these opportunities.

Lightweight composite materials reduce vehicle weight while maintaining structural integrity and durability. Advanced manufacturing techniques enable cost-effective production of carbon fiber and aluminum components. Enhanced efficiency translates into improved fuel economy, extended electric range, and superior handling characteristics that attract performance-oriented buyers.

Emerging Trends

Rapid Shift Toward Electric Four-Wheelers and All-Terrain EV Platforms Transforms Industry

Electric four-wheelers and all-terrain electric vehicles are rapidly gaining market acceptance as battery costs decline and performance capabilities improve. Major manufacturers are launching competitive electric models across product categories to meet evolving consumer expectations. Silent operation opens previously restricted areas to powersport activities while reducing environmental impact concerns.

Subscription-based vehicle access models are disrupting traditional ownership paradigms by offering flexible short-term usage without long-term commitments. Urban dwellers appreciate hassle-free access to recreational vehicles without storage, maintenance, or insurance responsibilities. Digital platforms connect owners with potential renters creating peer-to-peer sharing economies.

Immersive augmented reality and virtual reality solutions enhance training programs and elevate rider experiences through gamification and simulation. New riders develop skills safely in controlled virtual environments before attempting real-world trails. Entertainment applications merge physical riding with digital overlays creating engaging experiences that attract younger audiences.

Social media and motorsports content creators wield unprecedented influence over consumer purchasing decisions and brand perceptions. Authentic user-generated content resonates more powerfully than traditional advertising campaigns with millennial and Gen-Z audiences. Manufacturers collaborate with influencers to reach target demographics and build aspirational brand identities.

Regional Analysis

North America Dominates the Powersports Market with a Market Share of 48.9%, Valued at USD 19.2 Billion

North America maintains its leadership position with a commanding 48.9% market share, valued at USD 19.2 Billion, driven by deeply ingrained recreational culture and extensive trail infrastructure. The United States and Canada offer vast wilderness areas, designated off-road parks, and well-maintained trail systems supporting year-round powersport activities. High disposable incomes enable consumers to invest in premium vehicles and accessories. Strong dealer networks provide comprehensive sales and service support across urban and rural markets.

Europe Powersports Market Trends

Europe demonstrates steady growth supported by adventure tourism and Alpine recreational traditions across mountainous regions. Environmental regulations drive rapid electric vehicle adoption particularly in Scandinavian countries leading sustainability initiatives. Stringent noise restrictions shape product development priorities for manufacturers targeting European markets. Cross-border trail networks facilitate international riding experiences.

Asia Pacific Powersports Market Trends

Asia Pacific represents the fastest-growing regional market fueled by expanding middle class and increasing outdoor participation rates. Countries like China, India, and Australia are witnessing surging demand for recreational vehicles as urbanization intensifies. Infrastructure development and government tourism promotion campaigns unlock new riding destinations. Local manufacturers are emerging to serve price-sensitive segments with affordable products.

Middle East and Africa Powersports Market Trends

Middle East and Africa markets cater to niche adventure tourism and desert motorsports enthusiasts seeking unique experiences. Harsh operating conditions demand specialized vehicles with enhanced cooling and filtration systems. Oil-rich nations demonstrate strong purchasing power for premium motorcycle and utility vehicle segments. Safari operations and eco-tourism ventures create commercial demand opportunities.

Latin America Powersports Market Trends

Latin America offers significant untapped potential as economic development progresses and outdoor recreation gains popularity. Brazil, Mexico, and Argentina lead regional demand with diverse terrain attracting adventure riders. Agricultural applications drive utility vehicle sales in rural farming communities. Import restrictions and economic volatility present challenges for international manufacturers seeking market entry.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Powersports Company Insights

Yamaha Motor Co., Ltd. maintains a strong global presence with diversified product portfolios spanning motorcycles, ATVs, and side-by-sides across multiple price segments. The company’s reputation for reliability and innovation keeps it competitive in mature and emerging markets alike.

Arctic Cat Inc. specializes in snowmobiles and off-road vehicles designed for extreme conditions and performance-oriented riders. Their focus on niche segments and aftermarket partnerships strengthens brand loyalty among enthusiast communities.

BRP leads innovation in recreational vehicles with popular Can-Am and Ski-Doo brands recognized for cutting-edge technology and design. Their aggressive electric vehicle development strategy positions them favorably for future market transitions.

Honda Motor Co., Ltd. leverages its extensive automotive expertise to deliver dependable powersport vehicles emphasizing quality, durability, and customer satisfaction. Their global manufacturing footprint enables efficient market penetration worldwide.

Other significant players including Kawasaki Heavy Industries, Ltd., Polaris Inc., Textron Inc., Harley Davidson, CF Moto, and KTM contribute to competitive market dynamics through specialized product offerings and regional strengths. Strategic partnerships, technological investments, and customer-centric approaches differentiate leading manufacturers in this fragmented industry landscape.

Key Companies

- Yamaha Motor Co., Ltd.

- Arctic Cat Inc.

- BRP

- Honda Motor Co., Ltd.

- Kawasaki Heavy Industries, Ltd.

- Polaris Inc.

- Textron Inc.

- Harley Davidson

- CF Moto

- KTM

Recent Developments

- In October 2024, Taiga Motors announced that the Superior Court of Quebec approved the acquisition of substantially all of its business by the backer of a leading electric marine group. This strategic move integrates Taiga into a broader electric mobility ecosystem focused on marine and powersport electrification, strengthening their market position.

- In February 2024, BRP confirmed the addition of two new electric snowmobile models, the Ski-Doo Expedition Electric and the Lynx Adventure Electric, to its 2025 snowmobile lineup. This expansion advances BRP’s commitment to electrify its powersport product offerings and meet growing environmental demands.

- In October 2025, Polaris Inc. announced it will sell a majority stake in Indian Motorcycle to Carolwood LP, establishing Indian as a standalone company. This major strategic restructuring marks a significant transformation in the powersport motorcycle segment and corporate portfolio management.

- In August 2025, BRP expanded its electric off-road lineup by launching the all-new 2026 Can-Am Outlander Electric ATV. This fully electric alternative offers compelling options in the utility and adventure quad market, demonstrating continued innovation leadership.

Report Scope

Report Features Description Market Value (2024) USD 39.3 Billion Forecast Revenue (2034) USD 79.5 Billion CAGR (2025-2034) 7.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (SXS, Heavyweight Motorcycle, ATV, Off Road Motorcycle, Others), By Fuel Type (Gasoline, Diesel, Electric), By Application (Recreational, Utility, Commercial, Sports, Defense, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Yamaha Motor Co., Ltd., Arctic Cat Inc., BRP, Honda Motor Co., Ltd., Kawasaki Heavy Industries, Ltd., Polaris Inc., Textron Inc., Harley Davidson, CF Moto, KTM Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Yamaha Motor Co., Ltd.

- Arctic Cat Inc.

- BRP

- Honda Motor Co., Ltd.

- Kawasaki Heavy Industries, Ltd.

- Polaris Inc.

- Textron Inc.

- Harley Davidson

- CF Moto

- KTM