Global Potassium Chlorate Market Size, Share Analysis Report By Form (Powder, Granular, Liquid), By Application (Agriculture, Explosives, Chemicals, Pharmaceuticals, Food Additives, Others), By Distribution Channel (Direct Sales, Indirect Sales) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152004

- Number of Pages: 388

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

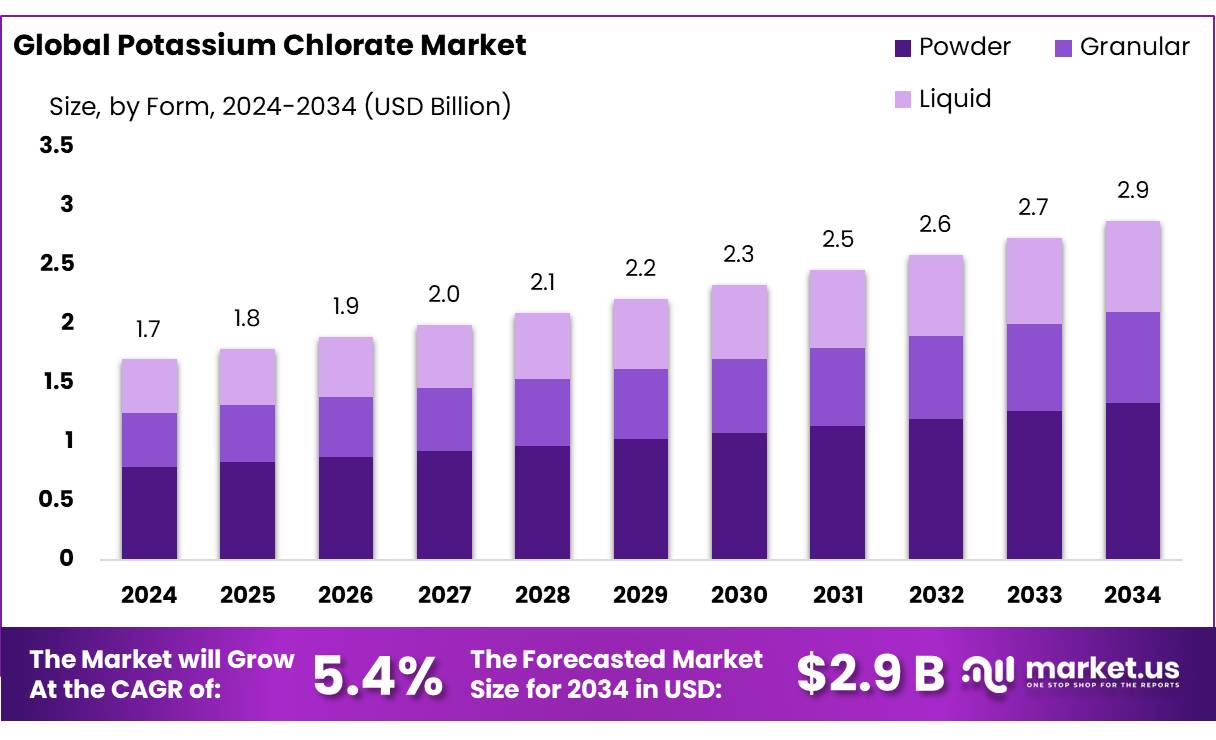

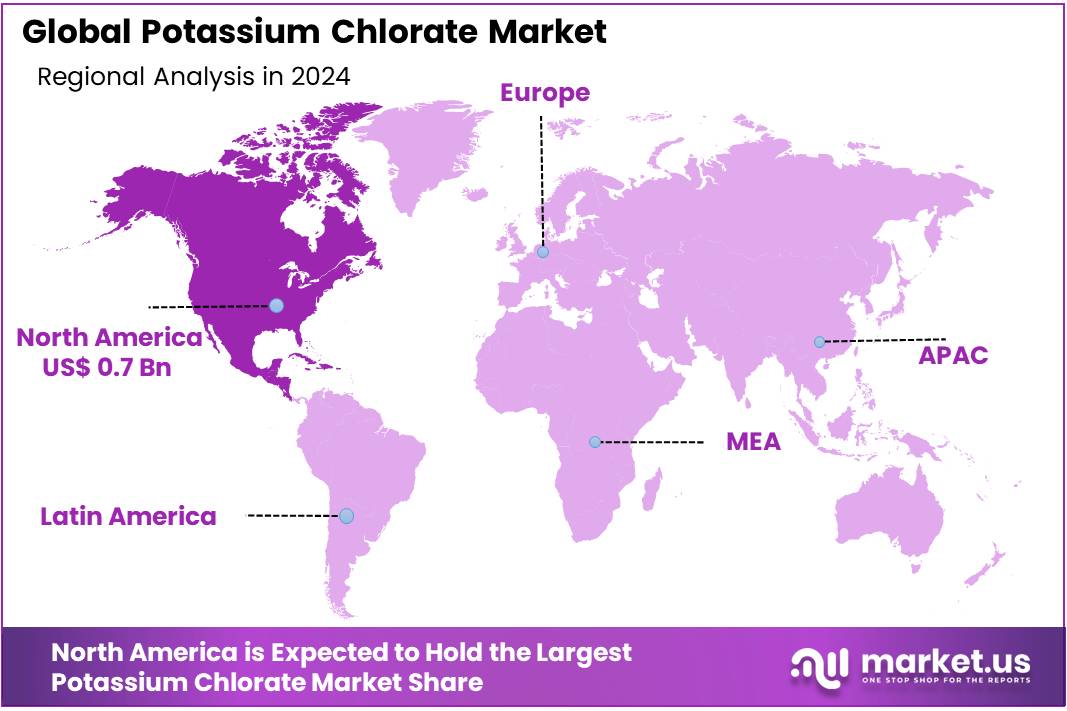

The Global Potassium Chlorate Market size is expected to be worth around USD 2.9 Billion by 2034, from USD 1.7 Billion in 2024, growing at a CAGR of 5.4% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 45.2% share, holding USD 0.7 billion revenue.

Potassium chlorate (KClO3) is a high-energy inorganic oxidizer commonly used in pyrotechnics, explosives, herbicides, disinfectants, and industrial chemical synthesis. Manufacture typically involves salt metathesis, where sodium chlorate and potassium chloride react under controlled conditions; alternative routes include direct electrolysis or chlorine treatment in caustic media. The product appears as a white crystalline solid and poses safety considerations due to its flammability and oxidizing potential.

The fireworks industry, particularly in Sivakasi, Tamil Nadu, remains a significant consumer of potassium chlorate, accounting for over 70% of the country’s output. Despite periodic restrictions, fireworks sales continue to rise across the country. For instance, West Bengal’s fireworks industry is projected to have nearly doubled its turnover from INR 8,000 crore in 2023 to INR 15,000 crore in 2024 . Government initiatives aimed at streamlining fireworks production with enhanced safety regulations are supporting steady market expansion.

Government initiatives have significantly impacted the potassium chlorate industry. The Indian government has allowed 100% Foreign Direct Investment (FDI) in the chemicals sector under the automatic route, excluding certain hazardous chemicals. This policy has encouraged both domestic and international investments, leading to technological advancements and increased production capacities. Furthermore, the government’s focus on infrastructure development and digital transformation has enhanced the efficiency of manufacturing processes, thereby reducing operational costs and improving product quality.

Key Takeaways

- Potassium Chlorate Market size is expected to be worth around USD 2.9 Billion by 2034, from USD 1.7 Billion in 2024, growing at a CAGR of 5.4%.

- Powder held a dominant market position, capturing more than a 46.2% share of the overall potassium chlorate market.

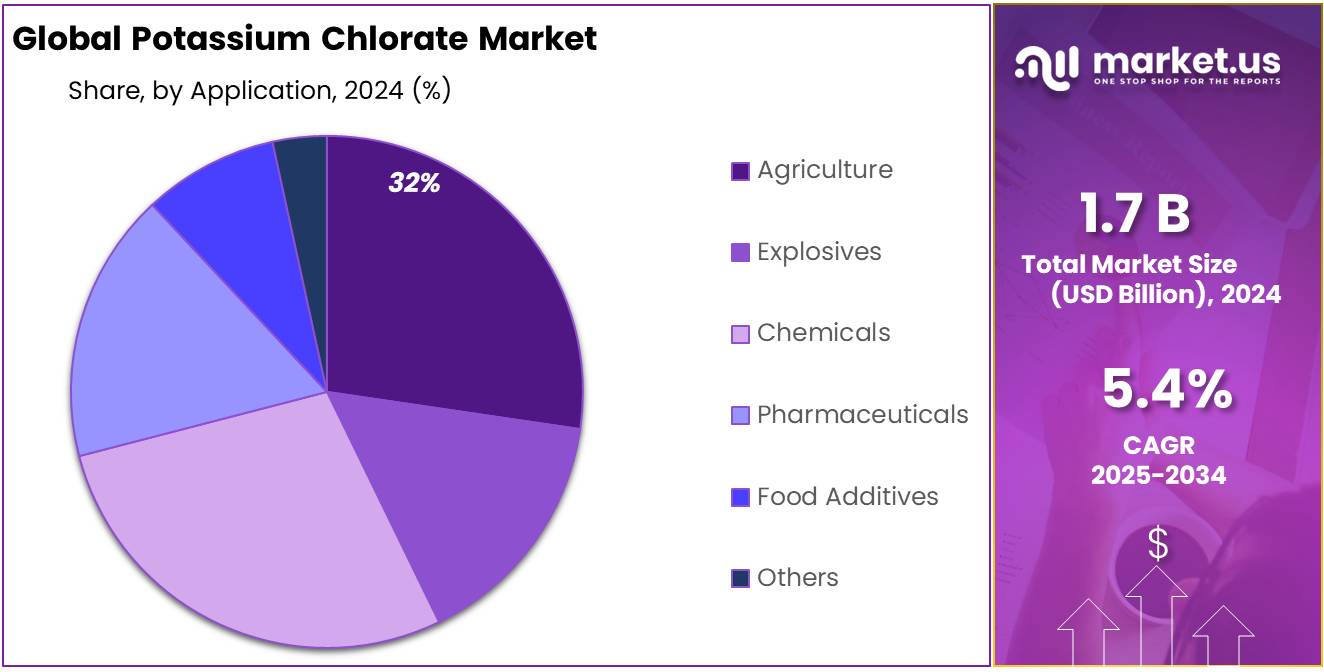

- Agriculture held a dominant market position, capturing more than a 32.5% share of the global potassium chlorate market.

- Direct Sales held a dominant market position, capturing more than a 67.3% share of the potassium chlorate market.

- North America dominates the potassium chlorate market, contributing a substantial 45.2% share in 2024—equivalent to approximately USD 0.7 billion.

By Form Analysis

Powder Form Leads with 46.2% Share Owing to Its Versatility and Industrial Preference

In 2024, Powder held a dominant market position, capturing more than a 46.2% share of the overall potassium chlorate market by form. This stronghold can be attributed to its wide-ranging use across key applications such as safety matches, pyrotechnics, explosives, and herbicides, where uniform granulation and ease of blending are critical.

The powder form allows for better mixing with other compounds, improving combustion efficiency and product consistency, especially in firework manufacturing hubs like Sivakasi, India. Its handling convenience and solubility also make it a preferred choice in chemical processing and laboratory-grade formulations.

By Application Analysis

Agriculture Leads with 32.5% Share Driven by Crop Maturity and Weed Control Needs

In 2024, Agriculture held a dominant market position, capturing more than a 32.5% share of the global potassium chlorate market by application. This leadership is largely driven by its role as a defoliant and desiccant, particularly in crops like cotton, where uniform boll opening and easier harvesting are essential.

Farmers in regions with labor shortages or mechanized farming practices increasingly rely on potassium chlorate to manage plant growth stages efficiently. In tropical countries, it is also used to induce flowering in off-season crops such as mangoes, enhancing yields and commercial returns. With agricultural practices becoming more input-efficient and climate-resilient, the demand for dependable chemical solutions like potassium chlorate is rising steadily.

By Distribution Channel Analysis

Direct Sales Dominates with 67.3% Share Owing to Bulk Procurement and Industrial Demand

In 2024, Direct Sales held a dominant market position, capturing more than a 67.3% share of the potassium chlorate market by distribution channel. This strong preference for direct procurement is primarily driven by large-scale buyers such as firework manufacturers, chemical plants, and agricultural suppliers who require consistent volumes and customized specifications.

Direct sales channels offer better pricing, reduced handling time, and assured product quality—key advantages for industrial users dealing with regulated chemicals. Manufacturers also benefit from maintaining direct relationships with end-users, allowing for better logistics coordination and technical support. The nature of potassium chlorate, being a controlled substance in many countries, further encourages regulated, traceable distribution through direct sales.

Key Market Segments

By Form

- Powder

- Granular

- Liquid

By Application

- Agriculture

- Explosives

- Chemicals

- Pharmaceuticals

- Food Additives

- Others

By Distribution Channel

- Direct Sales

- Indirect Sales

Emerging Trends

Trend Toward On-Site Chlorine Dioxide Production to Reduce Disinfection By-Products

A notable trend in the potassium chlorate market is the increasing adoption of on-site chlorine dioxide (ClO2) generation to address concerns over disinfection by-products (DBPs). This shift is gaining attention from food processors and industrial users aiming to minimize harmful residues such as chlorates in their operations.

According to FAO/WHO standards, the use of active chlorine compounds in food processing undergoes rigorous risk–benefit evaluations. One expert assessment underscores how chlorinated disinfectants reduce microbial hazards dramatically—by up to 97% in certain scenarios—while emphasizing the importance of managing DBP residues.

Government regulations are supporting this trend. The Codex Alimentarius Commission and FAO/WHO recommend using chlorine disinfectants only within Hazard Analysis and Critical Control Points (HACCP) frameworks—highlighting that storage conditions significantly influence residual chemical levels.

On-site generation aligns well with these guidelines by ensuring controlled dosages, immediate application, and stable operational conditions. Food safety agencies in the EU and US increasingly scrutinize chlorate levels in bottled water, dairy, and ready-to-eat products, raising pressure on processors to adopt cleaner sanitizing methods.

Drivers

Growing Agricultural Demand as a Key Market Driver

In recent years, the increasing demand for reliable crop maturation and efficient weed control has emerged as a major driver of potassium chlorate usage in agriculture. In 2022, global agricultural pesticide usage reached approximately 3.70 million tonnes of active ingredients—marking a 4% increase from 2021 and a notable 13% increase over the past decade. This growth reflects intensified agricultural practices aimed at supporting the global food supply for a growing population, which in turn fuels the adoption of chemical aids like potassium chlorate.

Government initiatives have also played a supportive role. For example, the Government of India, through its Department of Chemicals and Petrochemicals, has promoted integrated chemical parks since 2007 to improve agrochemical manufacturing efficiency and sustainability. Such policies encourage the domestic production of value-added chemicals—including potassium chlorate—by ensuring that adequate infrastructure and fiscal support are available to manufacturers.

The demand for efficient chemical inputs like potassium chlorate is expected to continue growing. As governments and international bodies push for higher agricultural yields while stabilizing food prices, reliance on targeted agrochemicals will likely intensify. The combination of rising global pesticide volumes (approaching 3.7 Mt), governmental support frameworks, and mechanization trends places potassium chlorate as a reliable and essential component in modern farming systems.

Restraints

Rising Regulatory and Health Constraints Limit Market Growth

In recent years, tightening regulations and safety concerns around potassium chlorate have emerged as a substantial restraint on market expansion. This chemical was previously used in agriculture, but its application against pests is now banned in the European Union. As of 2015, the EU prohibited potassium chlorate usage in plant protection products and set a default maximum residue level (MRL) at just 0.01 mg/kg for all foods under Regulation (EC)396/2005.

This strict limit reflects growing evidence from the European Food Safety Authority (EFSA), which in 2015 identified chlorate residues in drinking water and food that posed thyroid risks, particularly to infants and children. Such regulatory measures significantly restrict the use of potassium chlorate in agricultural and food-processing applications.

Across Europe, monitoring of chlorate levels in infant formula and baby foods revealed routine exceedances of the 0.01 mg/kg MRL. A 2021 assessment by the Dutch Office for Risk Assessment & Research (BuRO) showed that 65–70% of products monitored failed to comply with this limit, prompting both industry caution and additional regulatory scrutiny. The resulting pressure has led manufacturers and regulators to pursue alternative chemicals and stricter hygiene controls in food processing—capturing market segments previously reliant on potassium chlorate.

Moreover, the U.S. Environmental Protection Agency (EPA) began reassessing inorganic chlorate pesticides in 2006. Its risk evaluations revealed that while average chronic dietary exposure for the general population remained within acceptable levels, certain groups, like infants under one year, experienced exposures up to 174% of the chronic population-adjusted dose(cPAD), exceeding safe thresholds.

Opportunity

Expansion Through Eco Friendly Bleaching Initiatives

Across regions like North America and Europe, paper producers are under growing pressure to lower harmful by products associated with traditional chlorine bleaching – such as dioxins and furans. This regulatory push is encouraging adoption of Elemental Chlorine-Free (ECF) processes, which use chlorine dioxide derived from chlorate instead of elemental chlorine gas. Leveraging potassium chlorate for on site chlorine dioxide generation aligns well with these eco-friendly protocols, supporting industry goals of minimizing environmental impact while maintaining pulp quality.

Government bodies are reinforcing this transition with clear policies. For example, stricter wastewater discharge regulations limit organochlorine residues in effluent—encouraging manufacturers to adopt cleaner bleaching agents. According to recent FAO data, the global pesticide use in agriculture reached 3.70 million tonnes in 2022—a 13% rise over the decade—which highlights a broader trend: industries are embracing precise, safer chemical applications.

The opportunity extends beyond existing pulp mills. Emerging paper packaging and tissue sectors in Asia Pacific are driving substantial demand. Asia exported 3.5 Mt of pesticides in 2022, valued at USD 21.7 billion—signaling strong infrastructure and scale for chemical production in the region. These same supply chains can support expanded potassium chlorate usage for bleaching.

Regional Insights

North America dominates the potassium chlorate market, contributing a substantial 45.2% share in 2024—equivalent to approximately USD 0.7 billion in revenue. This commanding position rests on the region’s well-developed industrial chemistry base and consistent demand from multiple heavy-use sectors such as pyrotechnics, mining, pulp and paper, and agriculture.

Another critical driver is the fireworks and explosives industry. Although potassium chlorate has largely been replaced by perchlorates owing to safety considerations, it remains essential in specific mining and demolition applications. The region’s robust demand is supported by stringent quality control and direct manufacturer to industry procurement channels, particularly evident in sectors that handle hazardous oxidizers.

Chemically linked industries—such as water treatment and herbicides—also contribute to the North American footprint. Sodium and potassium chlorate’s role across these domains, combined with extensive chlor alkali infrastructure (with U.S. chlorine production exceeding 10 million tonnes annually).

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ICL Group Ltd. is a leading global manufacturer of potash, phosphates, and specialty minerals, with substantial presence in industrial-grade chloride products. As one of the world’s top six potash producers, it also delivers potassium chloride and related compounds for industrial uses like oil and gas drilling. Its vertically integrated model, spanning mining to finished goods, enhances supply chain reliability. ICL’s operations across 125 facilities enable it to serve diverse markets—including agriculture, water treatment, and industrial sectors—with high purity and consistency.

Tianjin Xinyuan Chemical Co., Ltd. (now Cangzhou Xinyuanquan) has specialized in perchloric acid and perchlorate salts since its founding in 1995. It operates a modern production facility in Hebei, with a capacity of approximately 9,900 tons per year of perchlorate compounds. Equipped with advanced German analytical instruments, the company ensures product purity down to parts-per-billion, enabling its exports to meet REACH certification standards. Its expertise in high-grade inorganic oxidizers supports tailored industrial applications.

Hebei Xinji Chemical Group Co., Ltd.—a subsidiary of China National Chemical Corp—has operated since 1947 and employs around 5,000 staff. It leads China’s barium and strontium salts market and also produces potassium carbonate—an adjacent inorganic compound. While its portfolio spans multiple inorganic salts, Xinji’s established capacities and chemical expertise position it well to enter or expand in potassium chlorate production. Its large-scale operations and export capabilities reflect a robust platform for future diversification.

Top Key Players Outlook

- ICL Group

- Tianjin Xinyuan Chemical

- Hebei Xinji Chemical

- Kingenta Ecological Engineering Group

- Vaighai Agro

- Chenzhou Chenxi Metal Co. Ltd.

- Nouryon Chemicals Holding BV

- Pangea Chemicals Pvt. Ltd.

Recent Industry Developments

In 2024, ICL reported total annual sales of USD 6,841 million and adjusted EBITDA of USD 1,469 million, with the Industrial Products division—responsible for key salts—generating USD 1,239 million in segment sales and USD 281 million in EBITDA.

Tianjin Xinyuan Chemical Co., Ltd. has carved out a respected niche in the potassium chlorate and perchlorate industry with a focused approach to high-purity oxidizing compounds. Founded in 1995, the company employs around 51–100 professionals and reports an annual revenue of US $500,000–$1,000,000 (2024).

Report Scope

Report Features Description Market Value (2024) USD 1.7 Bn Forecast Revenue (2034) USD 2.9 Bn CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Powder, Granular, Liquid), By Application (Agriculture, Explosives, Chemicals, Pharmaceuticals, Food Additives, Others), By Distribution Channel (Direct Sales, Indirect Sales) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ICL Group, Tianjin Xinyuan Chemical, Hebei Xinji Chemical, Kingenta Ecological Engineering Group, Vaighai Agro, Chenzhou Chenxi Metal Co. Ltd., Nouryon Chemicals Holding BV, Pangea Chemicals Pvt. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ICL Group

- Tianjin Xinyuan Chemical

- Hebei Xinji Chemical

- Kingenta Ecological Engineering Group

- Vaighai Agro

- Chenzhou Chenxi Metal Co. Ltd.

- Nouryon Chemicals Holding BV

- Pangea Chemicals Pvt. Ltd.