Global Post-Quantum Cryptography Market Size, Share, Industry Analysis Report By Offering (Solution, Services), By Organization Size (Small & Medium-Seized Enterprises, Large Enterprises), By Vertical (BFSI, Government & Defense, Healthcare, IT & ITes, Retail & E-commerce, Other Verticals), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 157136

- Number of Pages: 378

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

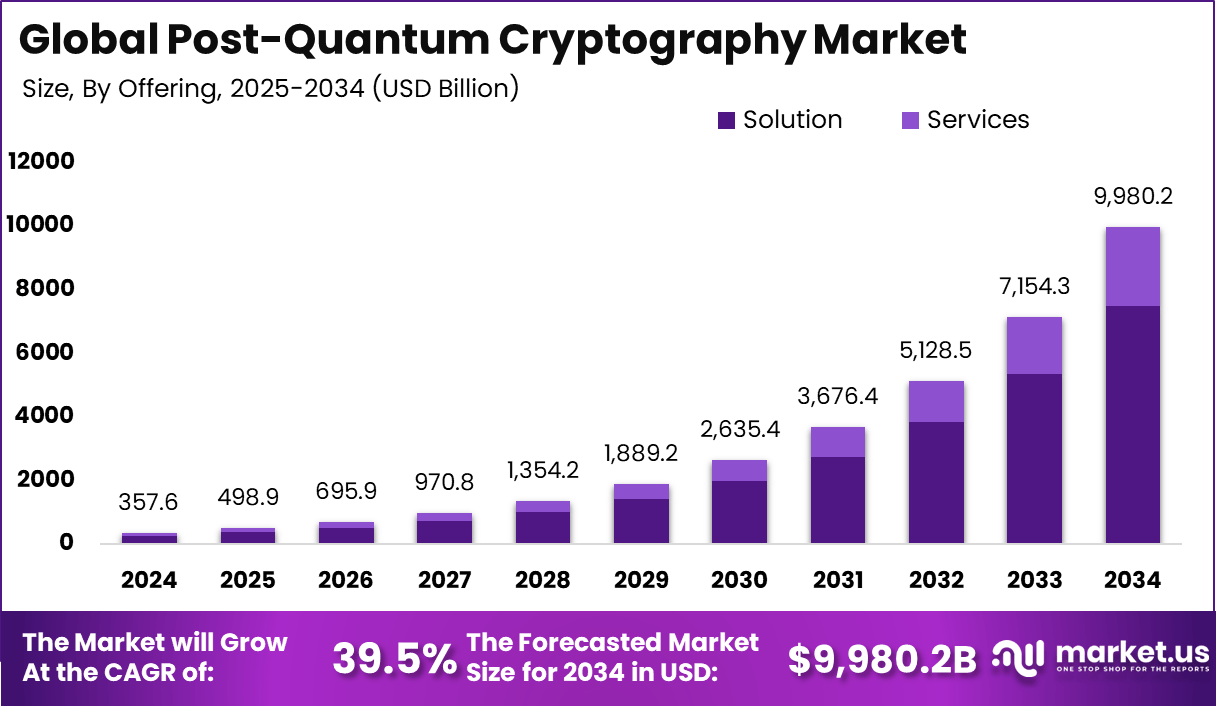

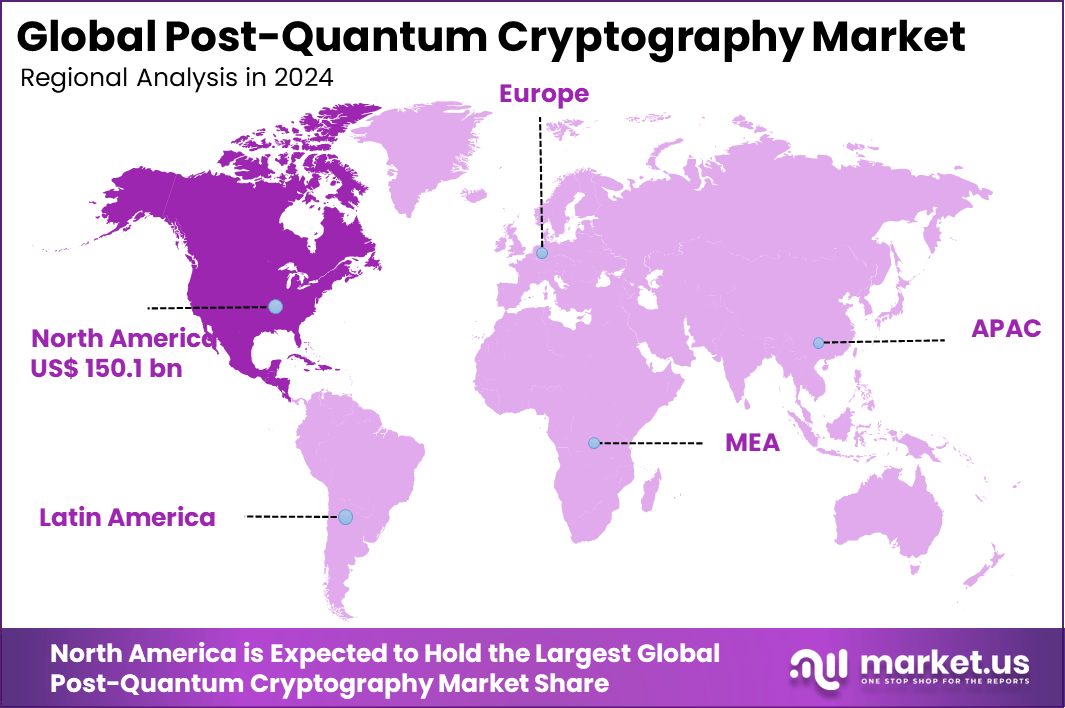

The Global Post-Quantum Cryptography Market size is expected to be worth around USD 9,980.2 billion by 2034, from USD 357.6 billion in 2024, growing at a CAGR of 39.5% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 42% share, holding USD 150.1 billion in revenue.

The Post-Quantum Cryptography (PQC) market is emerging as a crucial field focused on developing encryption methods resilient to the future threat posed by quantum computers. These advanced computers have the potential to break traditional cryptographic algorithms that protect sensitive data today, making PQC essential for securing communications and digital assets across various industries.

The market is propelled by efforts to create new standards and algorithms, such as lattice-based and hash-based cryptography, which are designed to resist quantum attacks and ensure data confidentiality in a quantum-enabled world. Top driving factors behind the growth of the PQC market include the rising awareness of quantum computing’s risks to current security systems and the increasing demand for robust cybersecurity, especially in sectors like finance, government, defense, and healthcare.

Organizations are recognizing the need to future-proof their data protection strategies as quantum technology advances. Moreover, stringent regulatory mandates and compliance requirements in many regions are pushing enterprises and public bodies to adopt quantum-safe encryption solutions proactively. Continued investments in research and innovation also play a vital role in accelerating the development and deployment of PQC technologies.

According to Market.us, The global quantum cryptography market is undergoing rapid transformation, driven by rising concerns over data security in the age of quantum computing. In 2024, the market was valued at USD 1.8 billion, and it is expected to reach approximately USD 22.7 billion by 2033, registering a strong compound annual growth rate (CAGR) of 32.13% during the forecast period from 2024 to 2033.

According to Coinlaw.io, quantum computing is expected to unlock a cumulative USD 1 trillion in value creation for end users by 2035, with its overall economic contribution projected to reach between USD 450 billion and USD 850 billion globally by 2040. European banks are anticipated to contribute 25% of the total spending on quantum technologies in finance, largely influenced by regulatory requirements aimed at strengthening cybersecurity infrastructure.

Quantum cryptography services designed for digital banking are projected to expand at an annual growth rate of 40%, as institutions seek to secure mobile and online transactions against evolving threats. In parallel, quantum-enabled blockchain solutions are gaining momentum, with financial applications expected to attract USD 300 million in funding by 2025.

For instance, in June 2025, Commvault announced the introduction of new post-quantum cryptography (PQC) capabilities, aimed at helping customers secure their data against future threats posed by quantum computing. With the advancement of quantum technologies, traditional encryption methods are at risk, and Commvault’s new solutions provide businesses with quantum-resistant tools to protect sensitive information.

Key Takeaway

- By offering, Solutions dominated the market, holding a strong 75% share.

- By organization size, Large Enterprises were the primary adopters, representing 72% share.

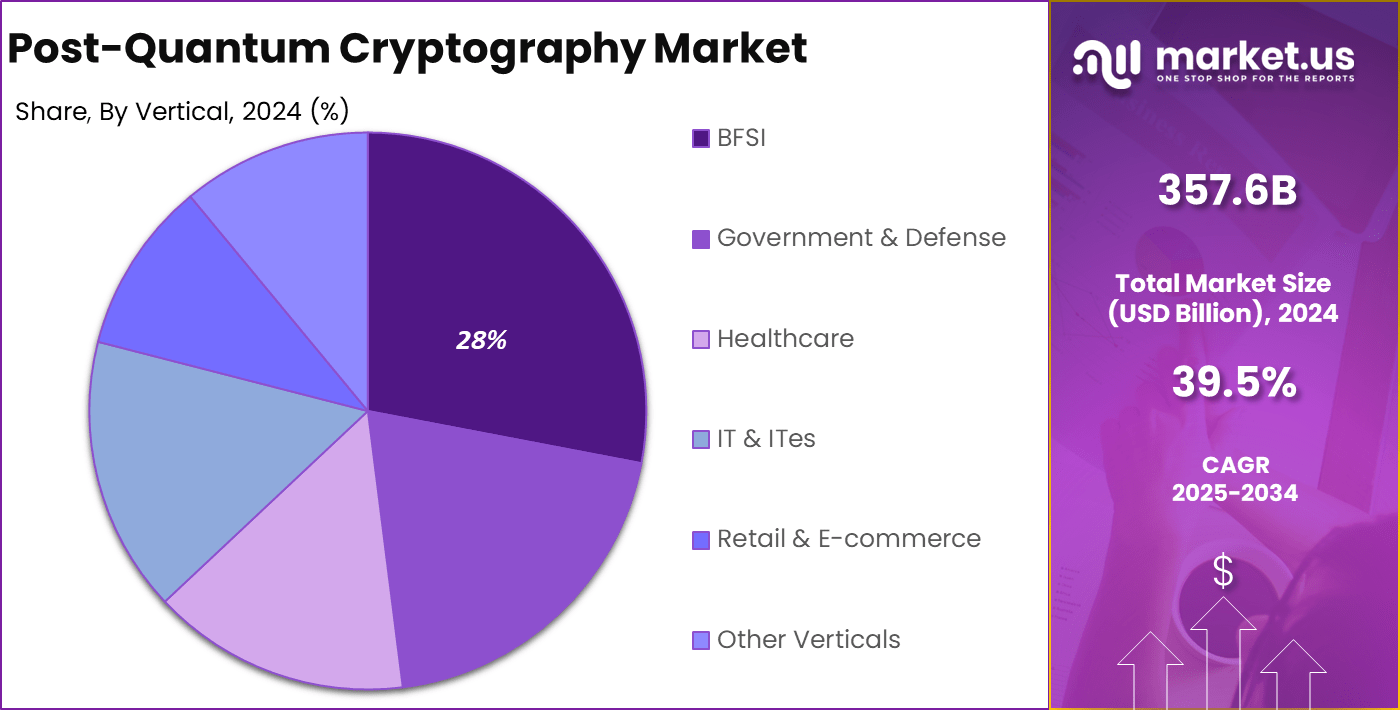

- By vertical, the BFSI sector led the market with 28% share.

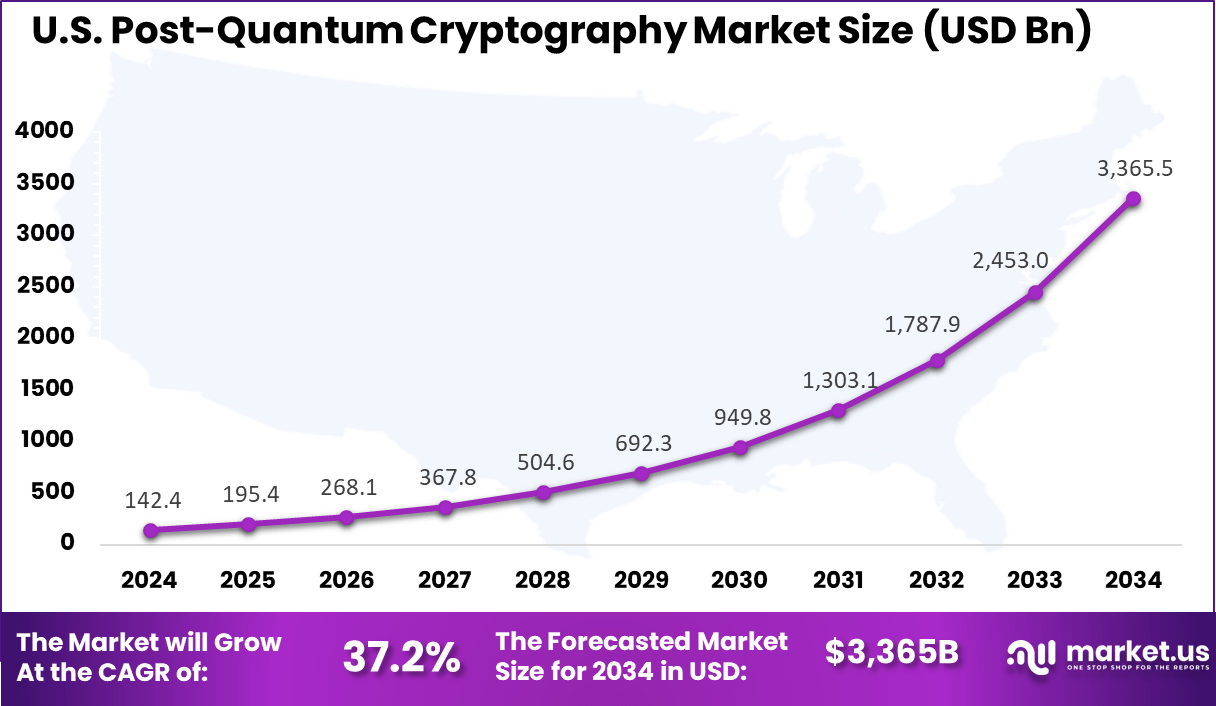

- The U.S. market reached USD 142.4 Billion, expanding at a rapid 37.2% CAGR.

- In 2024, North America held a dominant market position in the Global Post-Quantum Cryptography Market, capturing more than a 42% share.

Analysts’ Viewpoint

The adoption of post-quantum cryptography is being driven by technologies like lattice-based encryption, code-based cryptosystems, and hybrid cryptographic methods that combine classical and quantum-safe algorithms. These technologies provide better security without drastically compromising performance. Key reasons for adopting PQC include the need to safeguard critical infrastructure, protect intellectual property, comply with emerging regulations, and avoid potential reputational damage from data breaches.

Investment opportunities in the PQC market are expanding rapidly as governments, private sectors, and venture capitalists recognize the strategic importance of quantum-safe security. Funding is flowing into quantum cryptography startups, research projects, and technology collaborations aimed at commercializing these new encryption standards.

The push for standardized quantum-resistant algorithms by institutions like NIST establishes a solid foundation for broad industry investments, helping reduce integration risks and encouraging enterprise adoption. This growing investment landscape opens up opportunities for innovation in software, hardware, and service components related to PQC.

Business benefits from adopting post-quantum cryptography include enhanced security resilience, future-proofing of data protection systems, compliance with tightening cybersecurity regulations, and improved trust from customers and stakeholders. Early adoption positions businesses to handle quantum-era risks more confidently, ensuring operational continuity and competitive advantage.

U.S. Market Size

The market for Post-Quantum Cryptography within the U.S. is growing tremendously and is currently valued at USD 142.4 billion, the market has a projected CAGR of 37.2%. The market for Post-Quantum Cryptography (PQC) within the U.S. is growing tremendously due to the nation’s strong focus on cybersecurity and its leadership in quantum computing research.

As cyberattacks, particularly from nation-state actors, continue to become more common, it is imperative to use quantum-resistant encryption to protect sensitive information between government, military, and private organizations. Additionally, U.S. companies and regulators are actively preparing for the advent of quantum computing, with organizations like NIST setting the stage for quantum-safe cryptographic standards.

For instance, in March 2025, the National Institute of Standards and Technology (NIST) in the U.S. advanced its efforts in post-quantum cryptography standardization by selecting the HQC (Hamming Quasi-Cyclic) algorithm as part of its strategy to safeguard critical systems from the future threats posed by quantum computing.

In 2024, North America held a dominant market position in the Global Post-Quantum Cryptography Market, capturing more than a 42% share, holding USD 150.1 billion in revenue. The growth of this market is due to substantial investments made in cybersecurity measures, forward-looking government initiatives, and advanced technological arrangements.

The region benefits from the presence of major technology companies such as IBM, Microsoft, Google, Intel, and Amazon, as well as robust regulatory frameworks and ongoing standardization efforts led by agencies like NIST. These factors have accelerated early adoption of quantum-resistant encryption, particularly in critical sectors such as finance, healthcare, and defense, ensuring North America’s continued leadership in the market.

For instance, in June 2025, IBM in North America patented a groundbreaking post-quantum cryptography (PQC) technology designed to secure execution environments for edge devices. This innovation focuses on protecting sensitive data and ensuring the integrity of operations across distributed networks, a critical component as edge computing grows.

Offering Analysis

The solution segment dominated the post-quantum cryptography market in 2024, accounting for 75% of the total market share. Solutions include quantum-resistant cryptographic algorithms and software platforms designed to secure data transmissions and communications against potential quantum computing threats.

These solutions provide organizations the necessary encryption tools that remain secure even as quantum computers grow more capable of breaking existing cryptographic protocols. Their broad applicability across diverse sectors supports the ongoing investments in enhancing algorithms like lattice-based and code-based cryptography, which are recognized by standards bodies such as NIST.

For Instance, in June 2025, F5 announced the launch of its Post-Quantum Cryptography (PQC) solutions designed to enhance application security. As quantum computing poses significant risks to traditional encryption methods, F5 is introducing quantum-safe cryptographic technologies to ensure the protection of sensitive data in web applications and digital environments.

Organization Size Analysis

Large enterprises accounted for 72% of the post-quantum cryptography market share in 2024, reflecting their critical need to safeguard extensive amounts of sensitive digital assets. These organizations face elevated cybersecurity risks due to their scale, complexity, and exposure across global markets, making quantum-safe encryption a strategic priority.

As quantum computing advances threaten to compromise current encryption standards like RSA and ECC, large enterprises lead proactive investments in post-quantum cryptography solutions to maintain data confidentiality, integrity, and regulatory compliance. Large enterprises use their financial and technical strength to adopt advanced cryptographic systems, work with vendors and regulators, and set best practices that drive wider adoption and ensure long-term protection against evolving cyber threats.

For instance, in March 2025, the National Cyber Security Centre (NCSC) launched a comprehensive roadmap for post-quantum cryptography (PQC) migration. This roadmap outlines the steps necessary for organizations to transition to quantum-safe cryptographic systems, ensuring they are protected against the future threats posed by quantum computing.

Vertical Analysis

The BFSI vertical was the largest end-user segment, holding 28% of the post-quantum cryptography market in 2024. This sector handles highly sensitive financial transactions and personal data, making it a prime target for cyberattacks and quantum computing threats. Banks, insurers, and financial institutions are adopting post-quantum cryptography to safeguard customer data, secure digital platforms, and meet strict regulatory standards on privacy and cybersecurity resilience.

Furthermore, as BFSI organizations digitally transform their operations and integrate new technologies like blockchain and digital wallets, the need for quantum-resistant encryption intensifies. The sector’s investments in PQC solutions are driven by risk mitigation imperatives and the desire to future-proof critical infrastructures against the predicted impact of quantum-enabled cyberattacks.

For Instance, in November 2024, Banque de France and Singapore announced a strategic collaboration focused on enhancing the resilience of the banking sector through the adoption of quantum cryptography. This partnership aims to future-proof banking systems against the potential threats posed by quantum computing, which could compromise traditional encryption methods.

Emerging Trends

Key Trend Description Regulatory Compliance Governments mandate PQC adoption for critical infrastructure, accelerating enterprise readiness. Hybrid Encryption Schemes Combining classical and post-quantum algorithms to ensure smooth transition and compatibility with legacy systems. Quantum-Safe Hardware Security Modules (HSMs) Increased deployment of quantum-safe HSMs integrated with PQC for securing cryptographic keys. CSP Integration Cloud service providers like AWS, Microsoft Azure, and Google Cloud embed PQC natively in services. Crypto-Agility Frameworks Emphasis on flexible algorithm adoption to quickly switch between cryptographic standards as needed. Government and Defense Leading Adoption National security sectors prioritize PQC for safeguarding sensitive communication and data. Key Use Cases

Use Case Description Network Security Protecting critical network infrastructure from quantum-enabled cyber threats. Secure Communications Ensuring confidentiality and integrity for government, defense, and enterprise communications. Cloud Security Embedding PQC protocols in cloud services to secure data in transit and at rest. Blockchain and Crypto Systems Providing quantum-resistant encryption to blockchain ledgers and crypto-assets to maintain trust and security. Identity and Access Management Securing digital identities with quantum-resistant algorithms for authentication and authorization. Key Market Segments

By Offering

- Solution

- Quantum-Safe Hardware

- Quantum-Resistant Algorithms

- Quantum-Safe Cryptographic Libraries

- Quantum-Safe VPN, Email Service, and Messaging Systems

- Quantum-Safe Blockchain Solutions

- Quantum-Safe Authentication Solutions

- Quantum-Resistant Encryption Solutions

- Services

- Design, Implementation, and Consulting

- Migration Services

- Quantum Risk Assessment

By Organization Size

- Small & Medium-Seized Enterprises

- Large Enterprises

By Vertical

- BFSI

- Government & Defense

- Healthcare

- IT & ITes

- Retail & E-commerce

- Other Verticals

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Growing Threat from Quantum Computing to Traditional Cryptography

The increasing advancements in quantum computing pose a significant threat to conventional cryptographic systems, such as RSA and elliptic curve cryptography. Quantum computers have the potential to break these classical algorithms efficiently, exposing sensitive information across diverse sectors.

This growing risk is prompting organizations worldwide to urgently adopt post-quantum cryptography solutions that use quantum-resistant algorithms to safeguard their data. This push is particularly strong in critical industries like finance, government, healthcare, and defense, where data security is paramount.

For instance, in January 2025, GlobalSign, a leading provider of digital certificates and security solutions, announced a strategic reseller partnership aimed at accelerating the adoption of post-quantum cryptography (PQC) solutions. This collaboration is designed to help businesses transition to quantum-safe encryption technologies, ensuring long-term data protection as quantum computing advances.

Restraint

High Complexity and Cost of Implementation

Despite the clear need for PQC, the high complexity of integrating these solutions into existing infrastructures is a considerable barrier. Implementing quantum-resistant algorithms involves significant technical challenges due to differences in computational requirements, key sizes, and compatibility with current protocols.

Many organizations face difficulties adapting these new cryptographic methods without disrupting their legacy systems, leading to delays in widespread adoption. Moreover, the financial burden of transitioning to PQC is substantial. Expenses include upgrading hardware, software, and training personnel in specialized quantum-safe cryptography skills.

For instance, in June 2025, Thales likely emphasized its role in offering quantum-safe solutions and working with federal systems to integrate post-quantum cryptographic standards into critical government infrastructure. Given that NIST’s post-quantum cryptography standardization process is advancing, Thales would be well-positioned to help agencies adopt these new standards to protect sensitive data.

Opportunities

Increasing Demand for Secure IoT and Emerging Technologies

The pervasive growth of IoT, 5G networks, cloud computing, and blockchain technologies presents a significant opportunity for post-quantum cryptography. These technologies generate vast amounts of sensitive data and rely heavily on secure communication protocols. Quantum computing threatens to expose these data streams, which makes lightweight yet robust PQC solutions essential for resource-constrained devices widely used in IoT ecosystems.

Furthermore, as organizations move toward digital transformation, there is a rising need for next-generation security frameworks that can protect emerging technologies. PQC innovations tailored for low-power and low-bandwidth devices can unlock new markets by ensuring secure, efficient encryption for smart cities, healthcare devices, and industrial automation. This demand positions PQC providers to capitalize on the security needs of rapidly evolving digital environments.

For instance, in March 2025, Vodafone and IBM announced a strategic collaboration to integrate quantum-safe cryptography into smartphone security systems, aiming to future-proof mobile devices against the evolving threats posed by quantum computing. The partnership focuses on leveraging IBM’s expertise in quantum computing and cryptography to develop next-generation security solutions that can protect smartphones from potential quantum attacks.

Challenges

Shortage of Skilled Professionals and Standardization Issues

A key challenge facing the PQC market is the lack of sufficient expertise in quantum-resistant cryptography. The field is relatively new and specialized, requiring deep knowledge in both quantum computing and advanced cryptographic methods. This skill gap slows development, testing, and deployment of effective PQC solutions. Organizations struggle to find qualified staff capable of integrating and maintaining these complex systems.

Alongside talent shortages, the absence of universally accepted standards for post-quantum algorithms complicates adoption. While initiatives like NIST’s PQC standardization project are underway, the process is still ongoing, causing uncertainty among enterprises about which algorithms to adopt. This lack of clarity impacts investment and delays operational readiness. Until skill shortages are addressed and standards fully established, the PQC market growth will face significant hurdles.

For instance, in February 2025, Bill Gates expressed optimism about the arrival of quantum computing, predicting that it could become practical within the next three to five years. This marks a significant viewpoint from one of the industry’s leading figures, aligning with Microsoft’s heavy investments in quantum technologies. However, despite this relatively optimistic timeline, the field of quantum computing remains uncertain, with experts offering a broad range of predictions.

Key Players Analysis

In the post-quantum cryptography market, multinational technology firms such as NXP Semiconductors, Thales, and IBM Corporation are leading the innovation curve. Their focus has been on developing hardware-based and software-integrated cryptographic frameworks that can resist attacks from quantum computing. These companies are investing heavily in research and standardization efforts to align with government initiatives and regulatory requirements.

Specialized security providers such as IDEMIA, Palo Alto Networks, and DigiCert have emerged as strong players by offering identity verification, network security, and digital certification solutions with quantum-safe capabilities. Their strategies involve integrating advanced algorithms into authentication and encryption processes. The growth of these firms is driven by the rising demand for secure communication in financial services and critical infrastructure.

Emerging innovators such as Kloch Technologies, Post-Quantum, PQShield, PQ Solutions Limited, and Entrust Corporation are contributing to the market by focusing on niche and highly specialized quantum-safe encryption technologies. These firms are often more agile in adapting to changes in algorithm development and standardization led by bodies such as NIST.

Top Key Players in the Market

- NXP Semiconductor

- Thales

- SWA

- IBM Corporation

- IDEMIA

- Palo Alto Networks

- Digicert

- Kloch Technologies, LLC

- Post-Quantum

- PQShield

- PQ Solutions Limited

- Entrust Corporation

- Others

Recent Developments

- In April 2025, PQShield launched PQPlatform-TrustSys, a quantum-safe Root of Trust solution designed for ASICs and FPGAs. Built on a PQC-first architecture, it supports secure boot, secure update, and key lifecycle management while complying with standards such as NSA’s CNSA 2.0. It ensures strong key origin and permission tracking, even if the host system is compromised.

- In April 2025, NetApp integrated post-quantum cryptography into its storage portfolio for file and block workloads. Using NIST-standardized algorithms, the solution secures data at rest and in transit, enabling customers to strengthen cyber resilience and adopt quantum-resistant security at the storage level.

- In March 2025, NIST selected the HQC algorithm as a backup post-quantum encryption standard to complement ML-KEM, the primary algorithm. HQC is based on error-correcting codes, offering an alternative cryptographic base. A draft standard is expected within a year, with finalization planned by 2027, supporting a diversified and secure encryption framework.

- In March 2025, IDEMIA Secure Transactions unveiled its first hardware accelerator designed to support post-quantum cryptography (PQC). This groundbreaking innovation is tailored to enhance the performance and security of cryptographic systems as the industry prepares for the advent of quantum computing. By integrating quantum-resistant algorithms, IDEMIA’s accelerator ensures that organizations can safeguard sensitive data against potential future quantum threats.

- In January 2025, Palo Alto Networks introduced its QRNG Open API, a key initiative designed to help organizations prepare for the upcoming era of quantum security. This technology leverages Quantum Random Number Generation (QRNG) to enhance the security of cryptographic systems, which will be crucial as quantum computing evolves and threatens traditional encryption methods.

Report Scope

Report Features Description Market Value (2024) USD 357.6 Bn Forecast Revenue (2034) USD 9,980.2 Bn CAGR(2025-2034) 39.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Offering (Solution, Services), By Organization Size (Small & Medium-Seized Enterprises, Large Enterprises), By Vertical (BFSI, Government & Defense, Healthcare, IT & ITes, Retail & E-commerce, Other Verticals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape NXP Semiconductor, Thales, SWA, IBM Corporation, IDEMIA, Palo Alto Networks, Digicert, Kloch Technologies, LLC, Post-Quantum, PQShield, PQ Solutions Limited, Entrust Corporation, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Post-Quantum Cryptography MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Post-Quantum Cryptography MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- NXP Semiconductor

- Thales

- SWA

- IBM Corporation

- IDEMIA

- Palo Alto Networks

- Digicert

- Kloch Technologies, LLC

- Post-Quantum

- PQShield

- PQ Solutions Limited

- Entrust Corporation

- Others