Global POS Terminals Market By Component (Hardware, Software, Service), By Product Type(Fixed POS Terminals, Wireless POS Terminals, Mobile POS Terminals), By Deployment (On-Premise, Cloud-Based), By Operating System (Window/Linux, Android, iOS), By End-User (Restaurants, Retail, Hospitality, Healthcare, Warehouse, Other End-Users), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Sept. 2024

- Report ID: 19779

- Number of Pages: 390

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

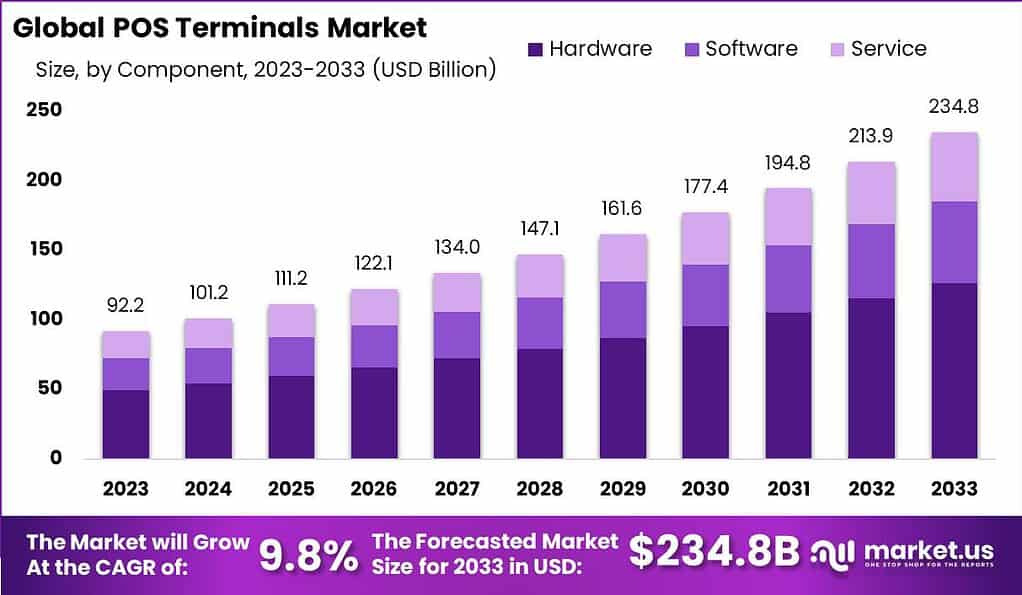

The Global POS Terminals Market size is expected to be worth around USD 234.8 Billion By 2033, from USD 101.2 Billion in 2024, growing at a CAGR of 9.8% during the forecast period from 2024 to 2033.

Point of Sale (POS) terminals are electronic devices used at retail checkout locations to process card payments. These terminals can scan items, total costs, and handle transactions using credit and debit cards. Modern POS terminals may also integrate with various systems to manage inventory, loyalty programs, and customer data. They come in different forms, including traditional stationary terminals, portable hand-held devices, and mobile versions that operate on smartphones or tablets.

The POS terminals market is growing, driven by increasing retail sales, advancements in technology, and the need for secure and efficient transaction methods. Businesses are shifting towards digital payments, pushing the demand for modern POS systems that offer more than just payment processing – such as data analytics and customer relationship management.

The trend towards mobile and contactless payments, along with the need for compliance with security standards, further fuels market expansion. The rise of e-commerce and the integration of payment systems across physical and digital platforms are creating new opportunities for the development and adoption of advanced POS terminals.

Demand for POS terminals is primarily driven by the retail and hospitality industries seeking efficient, reliable, and secure transaction solutions. As cashless payments become more common, there’s a rising demand for devices that can process these transactions quickly and safely. Furthermore, the need for comprehensive business management solutions integrated into POS systems is increasing.

This includes features for inventory management, sales reporting, and customer data analysis, which are becoming essential for businesses to stay competitive. The ongoing technological advancements and the shift towards digital and mobile-first economies present significant opportunities in the POS terminals market. There is a growing potential for companies that can offer innovative solutions that blend traditional payment processing with modern business management tools.

Additionally, markets in developing regions that are just beginning to embrace cashless transactions offer new growth areas for POS terminal providers. The evolution of payment technologies, such as NFC and biometric verification, also opens up new possibilities for product development and market expansion.

For instance, In April 2024, BharatPe introduced an innovative payment solution, BharatPe One, marking a significant evolution in the point-of-sale (POS) landscape. This all-in-one device is crafted to streamline the transaction process for merchants, integrating a POS system, a QR code scanner, and a speaker into a single compact unit. This integration facilitates a variety of payment methods, encompassing dynamic and static QR codes, tap-and-pay options, and traditional debit and credit card payments.

According to data from Fit Small Business, approximately 90% of restaurants leverage POS data to enhance various operational aspects including discounting strategies, loyalty programs, marketing efforts, menu optimization, and digital engagement.

Looking ahead, 43% of restaurant operators plan to research and implement new POS systems in 2024, with a focus on platforms offering mobility and cloud integration. This reflects a growing demand for advanced POS features, signaling a shift toward more sophisticated, cloud-based solutions.

Handheld POS terminals have seen a remarkable surge in adoption, with 61% of operators using them in 2022, compared to just under 30% in 2017. This trend is part of a broader move toward cloud-based POS systems, which are projected to grow significantly, reaching a market value of over $30 billion by 2031. The expected CAGR of 25% from $3.9 billion in 2022 underscores the rapid evolution and importance of these technologies in the industry.

The shift toward EMV-compliant POS terminals has also been significant, with a 590% increase in adoption over the past five years. Additionally, the acceptance of Apple Pay at POS terminals has risen, with 65% of US POS terminals now supporting this payment method.

Notably, 86% of small business owners believe that mobile POS technology enhances customer service. However, there remains room for improvement in transaction accuracy, as manual entry errors at POS terminals still account for over 70% of transaction mistakes in the retail sector.

Key Takeaways

- The global POS Terminals market is projected to expand significantly, reaching an estimated value of USD 234.8 Billion by 2033, up from USD 92.2 Billion in 2023. This growth represents a Compound Annual Growth Rate (CAGR) of 9.8% during the forecast period from 2024 to 2033.

- he Hardware segment emerged as a significant component, accounting for over 54% of the market share.

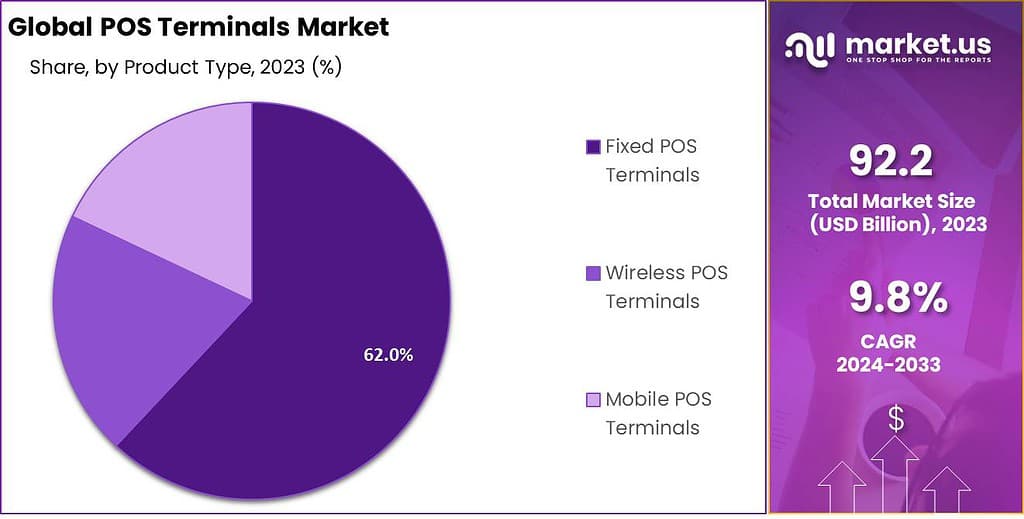

- Fixed POS Terminals also held a leading position, capturing more than 62% of the global market.

- The Cloud-Based solutions in the POS Terminals sector accounted for more than 50% of the market, indicating a strong preference for cloud-enabled functionalities.

- From an operating system perspective, Windows/Linux systems were prevalent, securing more than 48% of the market.

- The Retail sector represented a major application area for POS Terminals, with a dominant share exceeding 40%.

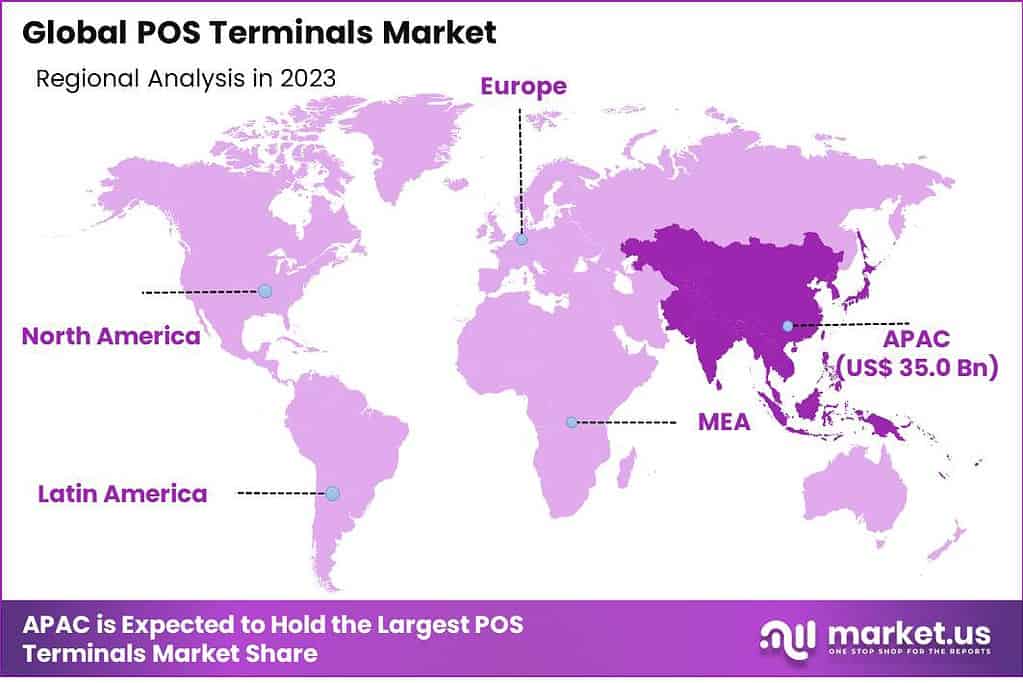

- Geographically, the Asia-Pacific (APAC) region led the market, contributing over 38% of the global share, with revenues surpassing USD 35 billion.

By Component Analysis

In 2023, the Hardware segment held a dominant market position in the POS Terminals market, capturing more than a 54% share. This segment’s leadership is primarily attributed to the essential role that physical infrastructure plays in facilitating transactions across diverse retail environments.

Hardware components, such as card readers, touch screens, barcode scanners, and receipt printers, form the backbone of POS systems, ensuring robust, real-time processing capabilities critical for both high-volume retail settings and smaller, service-oriented businesses.

The predominance of the Hardware segment is further bolstered by advancements in technology that have led to the development of more sophisticated and versatile POS terminals. These modern terminals offer enhanced functionalities including biometric authentication, near-field communication (NFC) capabilities, and integrated customer relationship management (CRM) systems. Such features not only streamline operations but also enrich the customer experience, thereby driving greater adoption of updated hardware systems.

Additionally, the ongoing expansion of retail and hospitality sectors globally necessitates robust POS systems that can handle a high volume of transactions efficiently. The hardware used in these systems is designed to withstand the rigors of constant use, adapt to various operational demands, and integrate seamlessly with other technological solutions, such as mobile payments and e-commerce platforms. This adaptability and durability underline the critical importance of the Hardware segment within the POS market.

Moreover, the shift towards omnichannel retailing strategies has prompted businesses to invest in hardware that can unify transactions across multiple sales channels, further cementing the segment’s market dominance. The continuous need for hardware upgrades to accommodate new payment methodologies and ensure security compliance also drives sustained investments in this segment, promising ongoing growth and innovation in the years ahead.

Product Type Analysis

In 2023, the Fixed POS Terminals segment held a dominant market position, capturing more than a 62% share of the global POS terminals market. This segment’s leadership can be attributed to several key factors that underscore its enduring relevance and robustness in diverse retail environments.

Fixed POS terminals continue to be preferred by large retail stores, supermarkets, and hospitality entities due to their reliability and comprehensive functionality. These terminals offer robust processing capabilities, extensive connectivity options for peripheral devices, and are capable of supporting a wide range of payment methods, from traditional magnetic stripe cards to EMV chips and contactless payments.

Their durability and ability to integrate with complex retail systems make them an indispensable asset for high-volume, fast-paced transaction environments where reliability is paramount. Furthermore, the ongoing modernization of retail infrastructure in both developed and developing markets has bolstered the demand for fixed POS systems.

Retailers are investing in these terminals as part of larger retail management systems to enhance customer experience, streamline operations, and facilitate better inventory management. The fixed nature of these terminals also offers added security features, which are critical in combating fraud and maintaining compliance with increasingly stringent data protection regulations.

Moreover, the fixed POS terminal market benefits from the relatively lower total cost of ownership compared to mobile alternatives. While initial investments in fixed POS systems might be higher, their long-term maintenance, operational costs, and robustness translate into significant savings for businesses. This economic advantage, coupled with their enhanced functionality and integration capabilities, ensures that fixed POS terminals maintain their leading position in the market despite the growing popularity of mobile solutions

Deployment Analysis

In 2023, the Cloud-Based segment held a dominant market position in the POS Terminals market, capturing more than a 50% share. This segment’s prominence is primarily driven by the increasing adoption of cloud technologies across various sectors, which offers scalability, flexibility, and cost-efficiency.

Cloud-based POS systems allow businesses to manage their operations remotely, with real-time data synchronization and storage capabilities that enhance operational efficiency and data accessibility. The surge in preference for cloud-based POS solutions can also be linked to their minimal upfront costs compared to traditional on-premise systems.

Businesses, especially small to medium-sized enterprises, favor cloud POS because it eliminates the need for significant initial investment in hardware and software. Moreover, cloud solutions provide ongoing updates and maintenance as part of their service, ensuring that businesses always have access to the latest functionalities without additional costs or system downtime.

Furthermore, the cloud-based POS terminals market benefits from the increasing integration of digital payments and mobile wallets, which require robust, flexible solutions that can adapt quickly to new payment methods and regulations. The ability of cloud-based systems to integrate with other cloud services- like accounting software, customer loyalty programs, and inventory management systems – creates a seamless ecosystem that significantly enhances business operations.

The ongoing digital transformation across global industries, paired with the need for businesses to provide superior customer service and maintain competitive edge, continues to drive the expansion of the cloud-based POS terminals market. This segment’s growth is expected to continue as more businesses recognize the strategic value of cloud technologies in enhancing customer interactions and operational efficiency

Operating System Analysis

In 2023, the Windows/Linux segment held a dominant market position in the POS Terminals market, capturing more than a 48% share. This leadership is largely due to the widespread familiarity and compatibility of these operating systems with various hardware and peripheral devices used in retail and hospitality sectors.

Windows and Linux platforms offer robust flexibility and reliability, which are crucial for businesses that operate in environments requiring high transaction volumes and continuous uptime. The preference for Windows/Linux in POS terminals also stems from their extensive support network and the vast repository of applications that are compatible with these operating systems. Businesses often choose Windows or Linux because they can leverage existing software solutions and integrate with other systems, reducing both the complexity and cost of technology deployments.

These operating systems support a wide range of business applications, from inventory management to customer relationship management, making them integral to seamless operations. Moreover, the open-source nature of Linux and the widespread professional use of Windows mean that developers have a substantial base for creating and deploying custom applications tailored to specific business needs.

This capability enables businesses to have POS systems that are precisely configured to their operational requirements, enhancing efficiency and user experience. Security features integrated into these operating systems, combined with regular updates and patches, further solidify their position in the market. Businesses that handle sensitive customer data, such as credit card and personal information, rely on the proven security frameworks of Windows and Linux to safeguard against data breaches and comply with regulatory standards.

End-User Analysis

In 2023, the Retail segment held a dominant market position in the POS Terminals market, capturing more than a 40% share. This substantial market share is primarily due to the critical role POS terminals play in modern retail operations, where they streamline transactions, manage inventory, and enhance customer service.

Retail environments – from large-scale supermarkets to small boutiques – rely heavily on POS systems for daily operations, making this technology indispensable in the sector. The leading position of the Retail segment is further reinforced by the evolution of retail strategies that increasingly incorporate omni-channel retailing, requiring robust POS systems that can integrate seamlessly across various sales channels.

This integration allows for a unified customer experience, whether shopping online, in-store, or via mobile platforms, and demands advanced POS technology to manage complexities efficiently. Additionally, the expansion of contactless payments and mobile wallet usage in the retail sector accelerates the adoption of new POS technologies.

Retailers are upgrading their systems to accommodate NFC and RFID technologies, which facilitate faster and more secure transactions. As consumers increasingly prefer cashless transactions for convenience and safety, especially post-pandemic, the demand for sophisticated POS terminals in the retail sector has surged.

Moreover, the push towards detailed consumer analytics in retail drives further investments in POS systems that can collect and analyze customer purchase patterns, preferences, and feedback. This data is pivotal for retailers aiming to optimize their marketing strategies and product offerings, ultimately enhancing the customer shopping experience and boosting sales. The convergence of these factors ensures the continued dominance of the Retail segment in the POS Terminals market.

Key Market Segments

By Component

- Hardware

- Software

- Service

Product Type

- Fixed POS Terminals

- Wireless POS Terminals

- Mobile POS Terminals

Deployment

- On-Premise

- Cloud-Based

Operating System

- Window/Linux

- Android

- iOS

End-User

- Restaurants

- Retail

- Hospitality

- Healthcare

- Warehouse

- Other End-Users

Driver

Growth in Contactless Payments and Technological Integration

The POS Terminals market is experiencing significant growth driven by the rising demand for more efficient and convenient payment options, including the surge in contactless payments. This trend is facilitated by advancements in technology such as the integration of Artificial Intelligence (AI) and analytics, which enhance customer experiences by enabling businesses to gain valuable insights. These factors collectively improve the transaction process’s speed and hygiene, which is especially valued in the post-pandemic landscape.

Restraint

Security Concerns

Security and privacy concerns remain a significant restraint in the adoption of POS terminals. The vulnerabilities associated with contactless and NFC devices pose risks such as data breaches and cyber attacks. These concerns can affect customer trust and slow down market acceptance. Additionally, the high setup and ongoing operational costs associated with POS systems can further deter businesses from adopting these technologies.

Opportunity

Expansion in Retail and Hospitality

There’s a substantial opportunity for the POS Terminals market within the retail and hospitality sectors due to the growing requirement for systems that can handle a high volume of transactions and integrate various operational functions. This demand is propelled by the need for businesses to offer seamless customer services across multiple platforms, which POS systems can facilitate efficiently.

Challenge

Supply Chain Disruptions

The market has faced challenges like supply chain disruptions, primarily due to the pandemic’s impact and geopolitical issues. These disruptions have affected the availability and cost of components needed for POS systems, hindering the ability of manufacturers to meet demand efficiently. Recovery from these disruptions varies by region and is influenced by local economic and health conditions.

Emerging Trend

Mobile POS Solutions

A notable emerging trend in the POS Terminals market is the shift towards mobile POS (mPOS) solutions. These systems offer flexibility and mobility, catering especially to small and medium-sized businesses in sectors like hospitality and retail. The portability of mPOS systems allows for transactions in diverse settings without the need for traditional checkout counters, aligning with the increasing consumer preference for personalized and efficient service.

Regional Analysis

In 2023, Asia-Pacific (APAC) held a dominant market position in the POS Terminals market, capturing more than a 38% share with revenues exceeding USD 35 billion. This substantial market share can be attributed to several pivotal factors that underscore the region’s leadership in the POS terminals landscape.

The rapid expansion of retail and hospitality sectors across major APAC economies, including China, India, and Japan, plays a crucial role in driving demand for advanced POS solutions. As these industries grow, the need for efficient transaction management and enhanced customer service intensifies, which in turn fuels the adoption of modern POS systems.

Additionally, the region’s pronounced shift towards digital payments, spurred by increasing smartphone penetration and government initiatives to promote cashless transactions, has significantly contributed to the market growth.

Technological advancements have also been pivotal. Local manufacturers are increasingly investing in research and development to innovate POS features such as biometric authentication, NFC capabilities, and mobile connectivity. These enhancements not only cater to the evolving demands of a tech-savvy population but also position APAC as a hub for cutting-edge POS terminal technologies.

Furthermore, regulatory support across the region, aimed at enhancing the financial infrastructure to support secure electronic transactions, has bolstered the market’s expansion. For instance, policies mandating the use of EMV-compliant POS terminals have been implemented to curb fraud, thereby boosting the confidence of both consumers and merchants in adopting modern POS systems. This alignment of market dynamics with regulatory frameworks propels APAC to the forefront of the global POS terminals market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The analysis of key players in the POS Terminals Market provides valuable insights into the competitive landscape of this industry. These players are central to shaping the market dynamics, driving innovation, and influencing trends. Key players in the POS Terminals Market typically include leading companies that manufacture, distribute, and provide POS solutions and services.

This analysis delves into various aspects such as market share, revenue, product offerings, geographical presence, and strategic initiatives undertaken by these key players. Understanding the strategies and strengths of these market leaders is crucial for businesses and stakeholders seeking to navigate the POS Terminals Market effectively.

Top Kеу Рlауеrѕ

- Acrelec

- AURES Group

- HM Electronics

- Hewlett Packard Development LP

- NCR Corp.

- Oracle

- Presto Group

- Qu Inc.

- Quail Digital

- Revel Systems

- Toast Inc.

- Toshiba Corp.

- Other Key Players

Recent Development

- Acrelec: Acrelec has focused on enhancing customer experience by introducing new technology for the quick-service restaurant (QSR) sector. In 2023, the company teamed up with SSP Group to modernize airport dining with POS solutions and launched advanced facial authentication technology for QSRs.

- AURES Group: In October 2023, AURES announced its financial results for the first half of the year, with a 14.2% increase in revenue, driven by increased demand for POS systems, especially in retail and hospitality sectors.

- Toast Inc.: Toast Inc. introduced new POS software features in September 2023, which focus on enhancing restaurant efficiency by integrating advanced reporting and analytics tools.

Report Scope

Report Features Description Market Value (2023) US$ 92.2 Bn Forecast Revenue (2032) US$ 234.8 Bn CAGR (2023-2032) 9.8% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2023-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware, Software, Service), By Product Type(Fixed POS Terminals, Wireless POS Terminals, Mobile POS Terminals), By Deployment (On-Premise, Cloud-Based), By Operating System (Window/Linux, Android, iOS), By End-User (Restaurants, Retail, Hospitality, Healthcare, Warehouse, Other End-Users) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Acrelec, AURES Group, HM Electronics, Hewlett Packard Development LP, NCR Corp., Oracle, Presto Group, Qu Inc., Quail Digital, Revel Systems, Toast Inc., Toshiba Corp., Other Key Players Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is a POS Terminal?A POS Terminal is a device used in retail and hospitality industries for processing transactions. It enables customers to make payments for goods and services and assists businesses in managing sales and inventory.

What is POS Terminal Market?The POS Terminal Market refers to the industry involved in the manufacturing, distribution, and utilization of Point of Sale (POS) terminals. These devices are used in various businesses to process transactions, including retail, hospitality, and healthcare.

How Big is the POS System Market?The Global POS Terminals Market is anticipated to be USD 234.8 billion by 2033. It is estimated to record a steady CAGR of 9.8% in the Forecast period 2023 to 2033. It is likely to total USD 92.2 billion in 2023.

What are 3 Benefits of a POS?Three benefits of a POS system include:

- Efficient Transactions: Speeds up the checkout process.

- Inventory Management: Helps track and manage stock.

- Accurate Reporting: Provides detailed sales and financial reports.

What is a POS Example?An example of a POS is a cash register or a modern POS system with a touchscreen display used in a retail store to process customer transactions.

What are 2 Uses of POS?Two common uses of POS systems are:

- Transaction Processing: Facilitating sales transactions efficiently.

- Inventory Management: Keeping track of stock levels and reordering as necessary.

-

-

- Acrelec

- AURES Group

- HM Electronics

- Hewlett Packard Development LP

- NCR Corp.

- Oracle

- Presto Group

- Qu Inc.

- Quail Digital

- Revel Systems

- Toast Inc.

- Toshiba Corp.

- Other Key Players