Global Population Health Management Market By Product (Software and Services), By End-User (Healthcare Providers, Healthcare Payers, and Other End-Users), By Delivery Mode (On-premise and Cloud-based), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: July 2024

- Report ID: 22881

- Number of Pages: 343

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

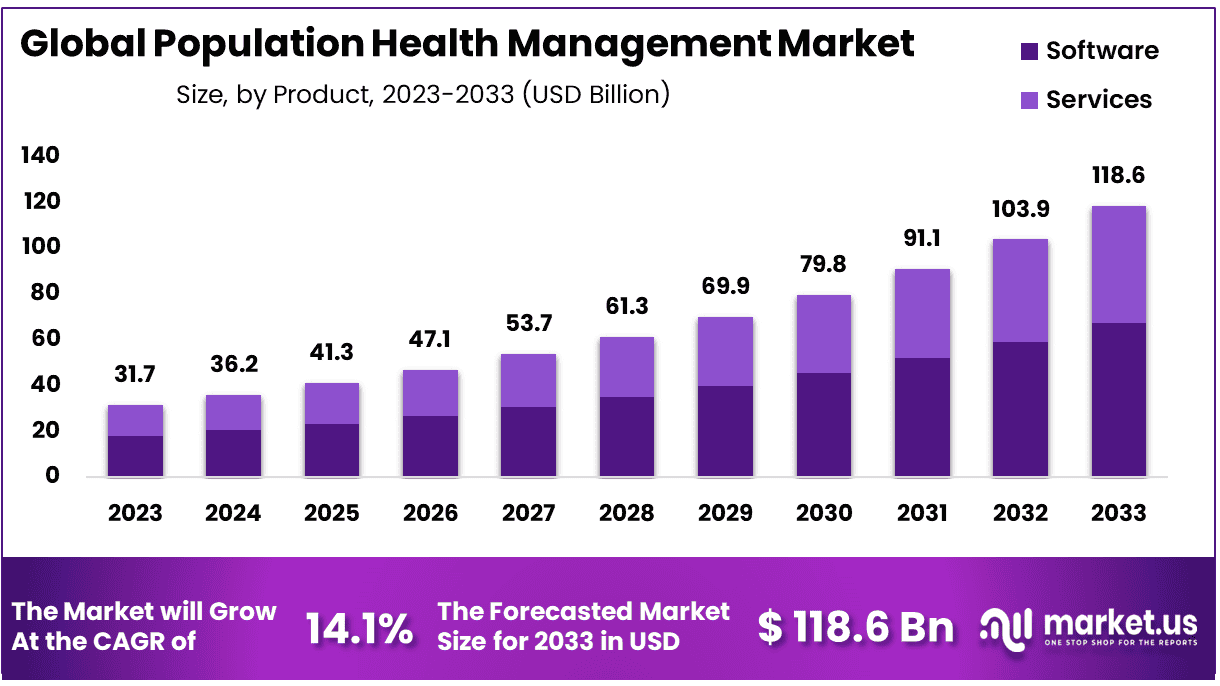

The global Population Health Management Market size is expected to be worth around USD 118.6 Billion by 2033 from USD 31.7 Billion in 2023, growing at a CAGR of 14.1% during the forecast period from 2024 to 2033.

The Population Health Management (PHM) market is experiencing significant growth, primarily fueled by government initiatives and regulations aimed at enhancing healthcare access and quality globally. The World Health Organization (WHO) emphasizes PHM strategies as crucial for achieving the Sustainable Development Goals (SDGs), notably in promoting universal health coverage and equitable healthcare services. This includes a commitment to monitoring over 50 health-related SDG indicators, reflecting a strong global push toward data-driven health improvements. Such regulatory support is vital for the expansion of the PHM market and aligns with broader goals of sustainable health development.

Key drivers of this market include advancements in healthcare technology and substantial investments in PHM solutions. These technologies are increasingly being integrated into hospitals and healthcare systems to improve patient outcomes and optimize healthcare costs. For instance, the U.S. initiative, Healthy People 2030, focuses on disease prevention and health promotion, enhancing the adoption of PHM tools. These tools leverage data-driven insights and digital innovations to improve patient care, ensuring cost-effective treatment and increased operational efficiency. They also assist healthcare providers and payers in managing risks associated with reimbursement policies and in reducing high medical care costs by minimizing readmissions.

Moreover, the market benefits from significant investments in innovative technologies that enhance healthcare efficiency. The integration of advanced data analytics in PHM allows for more personalized care by utilizing extensive patient data across different platforms. Additionally, data from organizations like the National Center for Health Statistics (NCHS) plays a pivotal role, providing insights into various health conditions and outcomes.

For example, recent data reveals that drug overdose deaths in the U.S. surged to 75,673 in the year ending April 2021, up from 56,064 the previous year. Also, about 25.7% of U.S. adults suffer from seasonal allergies, indicating health disparities and areas needing targeted interventions. Such statistics are essential for PHM strategies, ensuring the system adapts to changing health dynamics effectively.

The market’s expansion is further propelled by strategic partnerships, mergers, and acquisitions among key players, aimed at enhancing PHM capabilities and expanding their reach. Companies like McKesson Corporation, Allscripts Healthcare, and Cerner Corporation are at the forefront, actively engaging in strategic initiatives that strengthen their market positions. These developments highlight a dynamic market landscape where technological advancements and strategic corporate actions play pivotal roles in shaping the future of healthcare management.

Key Takeaways

- The worldwide population health management market is projected to grow at a CAGR of 14.1% over the next 10 years.

- By 2033, the population health management market is expected to reach USD 118.6 Billion.

- In 2023, the market was worth USD 31.7 Billion.

- The services segment had a market share of more than 57.05% in 2023.

- The healthcare provider segment held 69.9% dominant market share in 2023.

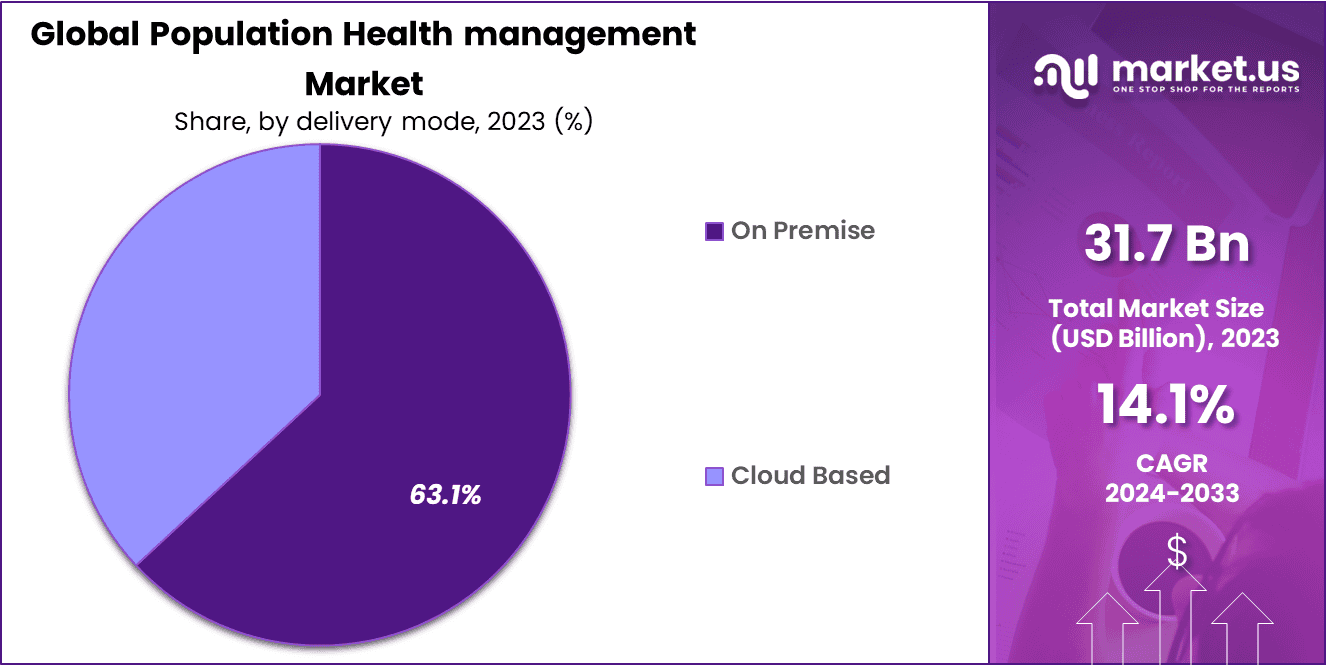

- The on-premise delivery mode segment had accounted 63.1% market share in 2023.

- Chronic diseases have resulted in a significant increase in demand for healthcare services.

- There’s a notable increase in the level of investment in the healthcare sector.

- High costs, including the need for greater investments in healthcare infrastructure, can hamper market growth.

- The number of chronic diseases in the Asia-Pacific region is expected to double during the forecast period.

Product Analysis

In 2023, the services segment held the largest share of the global population health management market, accounting for over 57.05% of the market share. This dominance is attributed to hospitals and other is also driving the demand for population health management (PHM) services.

The global population health management market is divided into software and services based on the product type. While the services segment leads the market, the software segment also contributes significantly to the market’s value growth. Providers and payers are increasingly adopting software solutions to improve cost efficiency, reduce readmissions, enhance patient retention, and boost operational efficiency.

Software solutions aid in data analysis and integration, making them a vital part of the PHM market. The shift towards integrated healthcare systems and the need for efficient data management are key factors driving the adoption of these solutions.

End-User Analysis

In 2023, the healthcare providers segment held the dominant share in the population health management market. Based on end-users, this market is divided into healthcare providers, healthcare payers, and other end-users. The healthcare provider segment accounted for 69.9% of the market share in 2023. This segment is projected to achieve the highest CAGR. This growth is due to the increasing demand for healthcare solutions that improve clinical outcomes, manage diseases, and reduce healthcare costs.

Healthcare providers are adopting advanced health management solutions to enhance patient care. These solutions help in monitoring patients’ health, managing chronic diseases, and ensuring efficient healthcare delivery. This adoption is driving the market growth.

On the other hand, the healthcare payer segment is expected to witness the highest CAGR during the forecast period. This growth is driven by the rising demand for consumer healthcare solutions. The absence of third parties in these solutions makes them more appealing to consumers. Healthcare payers are focusing on personalized healthcare plans and digital health platforms to meet consumer needs.

Delivery Mode Analysis

In 2023, the population health management market is segmented into on-premise and cloud services based on delivery mode. The on-premise segment dominates, holding 63.1% of the market share. This segment is expected to register the highest CAGR in the upcoming period. The primary reasons include the customization of solutions, reduced risk of data breaches, and the ability to reuse existing servers.

On-premise solutions offer significant control over data and infrastructure. This control is crucial for organizations with strict data security requirements. Moreover, using existing servers can lower costs, making this option attractive for many institutions. Customization of on-premise solutions also allows organizations to tailor the system to their specific needs, enhancing operational efficiency.

Conversely, the cloud segment is anticipated to experience the highest growth rate during the forecast period. This growth is driven by the improved efficiency, enhanced security, and better accessibility offered by cloud services. Cloud solutions enable easier access to data from multiple locations, promoting better collaboration and decision-making. Additionally, cloud services often provide automatic updates and maintenance, reducing the burden on IT departments.

Key Market Segments

By Product

- Software

- Services

By End-Users

- Healthcare Providers

- Healthcare Payers

- Other End-Users

By Delivery Mode

- On-premise

- Cloud-based

Drivers

Rising Prevalence of Chronic Diseases

The prevalence of chronic diseases significantly impacts public health. Patients frequently visit hospitals to manage long-term illnesses. In such cases, storing and monitoring patient data is essential. The demand for effective treatments has grown as chronic diseases become more common. For instance, according to the World Health Organization, chronic diseases are responsible for 71% of all deaths globally. This surge has increased the need for additional health management services. As a result, the healthcare sector requires more efficient systems to handle the rising patient load.

Increase in Healthcare Sector Investments

Investments in the healthcare sector are rising, significantly impacting population health management (PHM). This investment surge has led to the introduction of advanced health information technology. For example, global health expenditure is expected to reach $10 trillion by 2022, according to the World Bank. Additionally, the growing geriatric population is a significant factor driving healthcare market growth. Urbanization and increased spending on healthcare infrastructure also contribute to this trend.

Restraints

High Costs and Skill Shortages

The high costs associated with acquiring advanced operating room equipment pose significant barriers to market expansion, particularly in low-income regions. This financial hurdle is primarily due to the substantial investments required to enhance healthcare infrastructure, which limits the accessibility and deployment of these essential tools in less affluent areas. Consequently, this restricts the growth of the population health management (PHM) market.

Moreover, the PHM market faces additional challenges stemming from a shortage of skilled analysts and inadequate data management capabilities. These deficiencies hinder the effective implementation and utilization of PHM systems, thereby impeding market progress. Furthermore, the sector is also grappling with issues related to interoperability and the security of health data. Data breaches and the inability of systems to seamlessly integrate pose substantial risks, undermining trust and efficiency in PHM practices.

These factors collectively contribute to the restrained growth prospects of the PHM market, as projected for the period from 2024 to 2033. Addressing these challenges is crucial for leveraging the full potential of population health management solutions and extending their benefits across a broader spectrum of healthcare settings.

Opportunity

Increase In Focus On Personalized Medicines

The rising emphasis on personalized medicine is significantly enhancing the potential for growth in the Population Health Management (PHM) sector. By leveraging advanced analytics and predictive modeling, healthcare providers can offer tailored treatments that yield optimal outcomes. This approach has gained considerable traction in managing diseases such as cancer, where personalized treatment protocols are critical.

Additionally, the shift towards value-based medicine, coupled with the expansion into new markets, further augments the growth prospects for PHM. Technological advancements play a pivotal role, supported by various government initiatives aimed at enhancing public health. According to the Centers for Disease Control and Prevention (CDC), initiatives that integrate technology to monitor and improve patient health are essential for advancing population health outcomes. This integration is expected to continue propelling the PHM market forward during the forecast period.

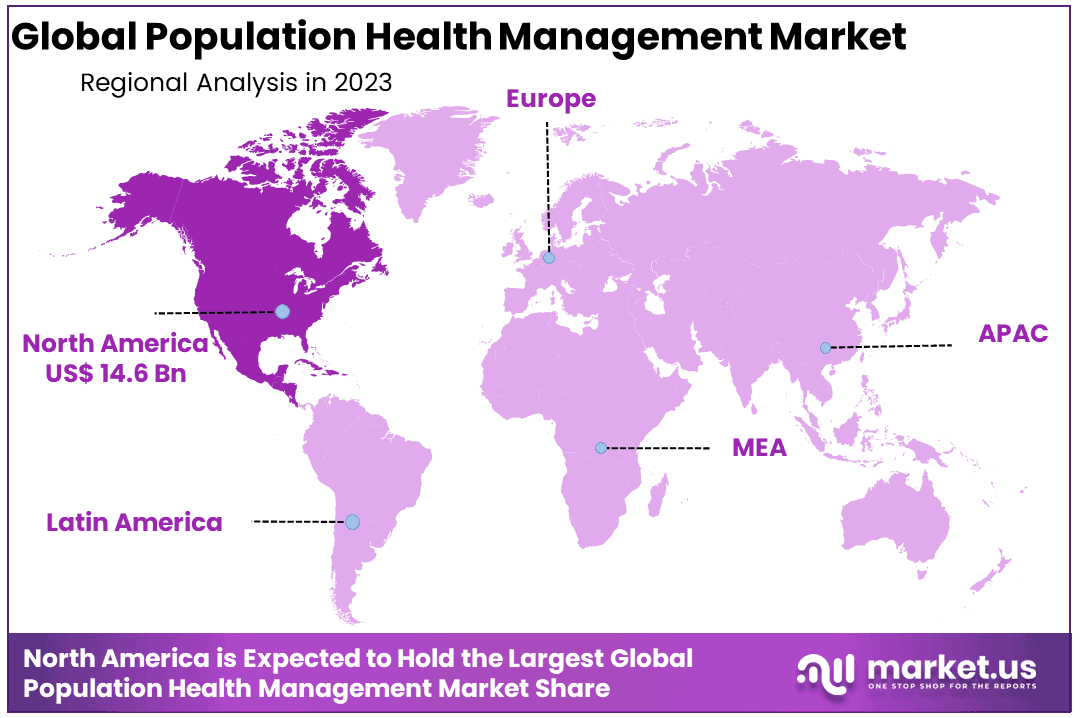

Regional Analysis

In 2023, North America led the global population health management market and is projected to maintain this dominance throughout the forecast period. North America captured 46.2% of the market share in healthcare, driven by technological advancements in population health solutions. The integration of advanced software and data analytics, along with the presence of major players in the region, supports this dominance.

The Asia Pacific region is expected to grow at the fastest rate during the forecast period. This growth is attributed to the improvement of healthcare infrastructure and increasing healthcare expenditure. The prevalence of chronic diseases in Asia Pacific is anticipated to double during the forecast period. Managing this data surge will require advanced data analytics, boosting the region’s population health management market.

Several factors contribute to the growth in Asia Pacific. These include the rise in medical tourism, healthcare reforms, and investments to modernize China’s healthcare infrastructure. Additionally, the rapidly growing healthcare industry in India and the launch of new ICT guidelines in Japan play significant roles. The implementation of IT programs in Australia and New Zealand also significantly contributes to market growth.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Companies are using strategic initiatives to strengthen their market position. These include mergers and acquisitions, offering customized solutions, and forming business partnerships with major players. Significant investments are made in developing new products and platforms with advanced features. These strategies are part of their marketing approach to stay competitive.

According to industry analysis, companies aim to enhance their market share through these initiatives. Mergers and acquisitions help them expand their reach and capabilities. Customized solutions cater to specific client needs, increasing customer satisfaction. Business partnerships allow for shared resources and expertise. The investment in advanced products ensures they meet evolving market demands. This multifaceted approach enables companies to maintain a strong market presence and drive growth.

Market Key Players

- Allscripts Healthcare Solutions, Inc

- McKesson Corporation

- Cerner Corporation

- Conifer Health Solutions LLC

- eClinicalWorks

- Enli Health Intelligence (US)

- UnitedHealth Group

- IBM Corporation

- Conifer Health Solutions (US)

- Health Catalyst, Inc.

- Nextgen Healthcare

- HealthEC LLC

- Color Health, Inc

- Athenahealth, Inc.

Recent Developments

- In June 2023: Cerner Corporation expanded its capabilities by acquiring Change Healthcare’s population health management business. This strategic move is designed to enhance Cerner’s population health offerings, providing more comprehensive solutions to its customers.

- In May 2023: Optum acquired Accolade, a company specializing in providing population health management services to employers and health plans. This acquisition aims to extend Optum’s services into the employer market, ensuring a more integrated population health management solution.

- In April 2023: Allscripts launched a new platform called Expanse Population Insight. This tool is designed to aid healthcare providers in improving patient health through advanced data insights, focusing on identifying and managing patient risk factors more effectively.

- In March 2023: IBM Watson Health introduced a new solution called Watson for Population Health. This product is aimed at enhancing the health management capabilities of providers by offering deep insights into patient data, which supports better health outcomes.

Report Scope

Report Features Description Market Value (2023) USD 31.7 Billion Forecast Revenue (2033) USD 118.6 Billion CAGR (2024-2033) 14.1% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product – Software and Services; By End-User – Healthcare Providers, Healthcare Payers, and Other End-Users; By Delivery Mode – On-premise and Cloud-based Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Allscripts Healthcare Solutions, Inc, McKesson Corporation, Cerner Corporation, Conifer Health Solutions LLC, eClinicalWorks, Enli Health Intelligence (US), UnitedHealth Group, IBM Corporation, Conifer Health Solutions (US), Health Catalyst, Inc., Nextgen Healthcare, HealthEC LLC, Color Health, Inc, Athenahealth, Inc., and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Population Health Management market in 2023?The Population Health Management market size is USD 31.7 Billion in 2023.

What is the projected CAGR at which the Population Health Management market is expected to grow at?The Population Health Management market is expected to grow at a CAGR of 14.1% (2023-2032).

List the segments encompassed in this report on the Population Health Management market?Market.US has segmented the Population Health Management market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product the market has been segmented into Software and Services. By End-User the market has been segmented into Healthcare Providers, Healthcare Payers, and Other End-Users. By Delivery Mode the market has been segmented into On-premise and Cloud-based.

List the key industry players of the Population Health Management market?Allscripts Healthcare Solutions, Inc, McKesson Corporation, Cerner Corporation, Conifer Health Solutions LLC, eClinicalWorks, Enli Health Intelligence (US), UnitedHealth Group, IBM Corporation, Conifer Health Solutions (US), Health Catalyst, Inc., Nextgen Healthcare, HealthEC LLC, Color Health, Inc, Athenahealth, Inc., and Other Key Players.

Which region is more appealing for vendors employed in the Population Health Management market?North America is expected to account for the highest revenue share with 46.2%, and boasting an impressive market value of USD 14.6 Billion. Therefore, the Population Health Management industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Population Health Management?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the Population Health Management Market.

Population Health Management MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample

Population Health Management MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Allscripts Healthcare Solutions, Inc

- McKesson Corporation

- Cerner Corporation

- Conifer Health Solutions LLC

- eClinicalWorks

- Enli Health Intelligence (US)

- UnitedHealth Group

- IBM Corporation

- Conifer Health Solutions (US)

- Health Catalyst, Inc.

- Nextgen Healthcare

- HealthEC LLC

- Color Health, Inc

- Athenahealth, Inc.