Global Popping Boba Market Size, Share Analysis Report By Flavor (Fruit Flavors, Tea Flavors, Coffee Flavors, Chocolate Flavors, Others), By Application (Bubble Tea, Frozen Yogurt Toppings, Ice Cream Toppings, Smoothies and Beverages, Others), By Distribution Channel (Food Service, Retail, Supermarkets and Hypermarkets, Convenience Stores, Online, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159298

- Number of Pages: 272

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

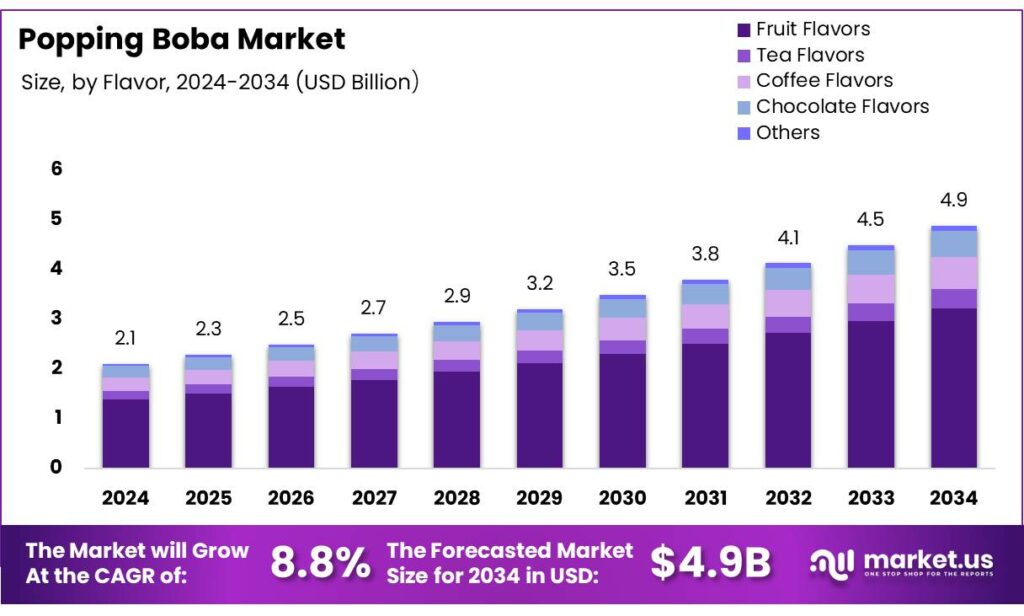

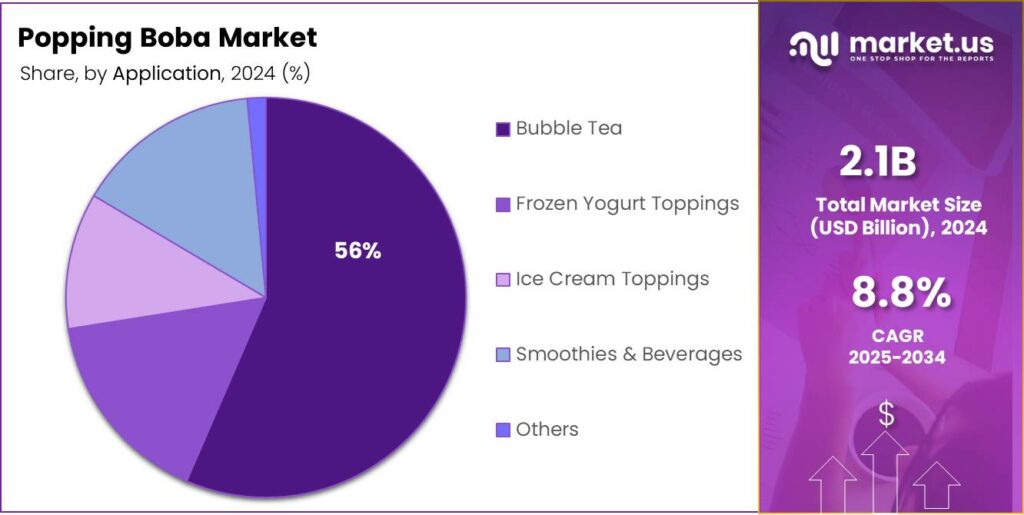

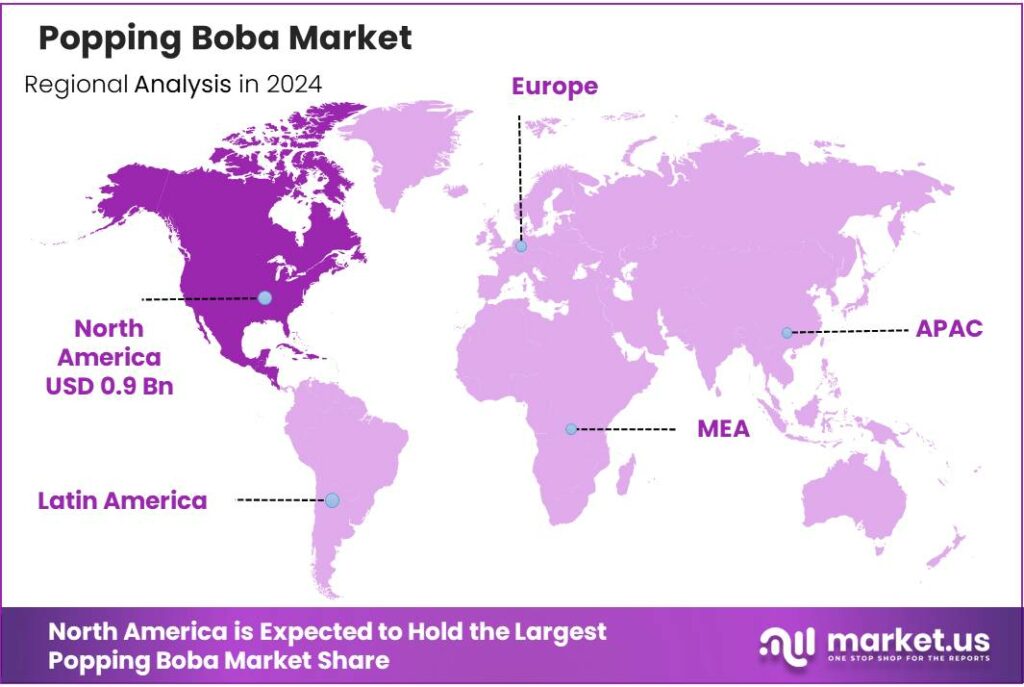

The Global Popping Boba Market size is expected to be worth around USD 4.9 Billion by 2034, from USD 2.1 Billion in 2024, growing at a CAGR of 8.8% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 43.7% share, holding USD 0.9 Billion in revenue.

Popping boba—juice-filled spheres made by spherification of fruit bases with alginate (typically sodium alginate) and calcium salts—sits at the intersection of hydrocolloid chemistry and modern beverage formats. Its primary functional input, alginate, is derived from brown seaweeds; secure access to this biomass underpins industrial scalability. Recent fisheries and aquaculture statistics indicate robust upstream availability: the Food and Agriculture Organization (FAO) reports that global fisheries and aquaculture output reached 223.2 million tonnes in 2022, including 37.8 million tonnes of algae, highlighting a broad and growing supply base for alginate extraction.

Industrial dynamics are increasingly Asia-centric because seaweed cultivation and bubble-tea retail originated and scaled there. FAO estimates place total global seaweed production at ~36.3 million tonnes in 2021—nearly triple the 11.8 million tonnes in 2001—reflecting long-term growth in algal feedstocks used for alginates. This strengthens raw-material security for popping boba manufacturers and enables cost-effective sourcing from established aquaculture hubs. On the demand side, beverage channels continue to widen.

For example, Taiwan—home to many bubble-tea brands—imported USD 177.5 million of soft drinks in 2024 (US$6.8 million from the United States), signaling sustained consumer throughput in a core reference market and the ecosystem into which toppings like popping boba are integrated.

Government initiatives are strengthening upstream capacity in key sourcing regions. India’s Department of Fisheries (Government of India) targets >1.12 million tonnes of seaweed by 2025 under the Pradhan Mantri Matsya Sampada Yojana (PMMSY) and has invested ₹127.7 crore to establish a Multipurpose Seaweed Park in Tamil Nadu—measures that expand domestic seaweed cultivation and de-risk alginate supply for hydrocolloid users, including popping boba producers serving the fast-growing café and QSR channel.

Regulatory comfort further supports scale-up. The EFSA re-evaluation concluded there is no need for a numerical ADI (“ADI not specified”) for alginic acid and its salts (E 400–E 404) in food uses—important for products with variable serving sizes in cafés and foodservice. The Codex General Standard for Food Additives also lists alginic acid among acceptable additives in relevant food categories, facilitating multi-market compliance.

Key Takeaways

- Popping Boba Market size is expected to be worth around USD 4.9 Billion by 2034, from USD 2.1 Billion in 2024, growing at a CAGR of 8.8%.

- Fruit Flavors held a dominant market position, capturing more than a 65.9% share of the global Popping Boba market.

- Bubble Tea held a dominant market position, capturing more than a 56.5% share of the global Popping Boba market.

- Food Service held a dominant market position, capturing more than a 59.1% share of the global Popping Boba market.

- North America held a dominant position in the global Popping Boba market, capturing more than a 43.7% share, valued at approximately USD 0.9 billion.

By Flavor Analysis

Fruit Flavors dominate the Popping Boba Market with 65.9% share in 2024

In 2024, Fruit Flavors held a dominant market position, capturing more than a 65.9% share of the global Popping Boba market. This segment has consistently maintained its leading position due to the widespread popularity and familiarity of fruit-based flavors, which appeal to a broad range of consumers. Fruit-flavored Popping Boba is a key component in various applications, particularly in bubble tea, smoothies, and desserts, where its sweet, refreshing taste enhances the overall sensory experience. The variety of flavors, including popular options such as mango, strawberry, lychee, and passion fruit, allows brands to cater to diverse consumer preferences.

The growth of the fruit flavors segment can be attributed to the increasing demand for natural and fruity taste experiences. Fruit-based products are often perceived as healthier and more refreshing compared to other artificial flavor alternatives. Additionally, the growing trend of incorporating exotic fruits into food and beverage products has encouraged innovation within the Popping Boba category, further solidifying the dominance of fruit flavors in the market.

By Application Analysis

Bubble Tea dominates the Popping Boba Market with 56.5% share in 2024

In 2024, Bubble Tea held a dominant market position, capturing more than a 56.5% share of the global Popping Boba market. The increasing global demand for bubble tea, particularly among younger consumers, has contributed significantly to the growth of the Popping Boba segment. As a staple ingredient in bubble tea, Popping Boba adds both visual appeal and a unique texture, making it a key driver of the market’s expansion. The rising popularity of bubble tea, fueled by its cultural influence and customization options, has created a steady demand for Popping Boba in this application.

Bubble Tea’s success can also be attributed to the growing trend of experiential drinking, where consumers seek more interactive and fun beverages. With a variety of fruit flavors and customizable options available, bubble tea establishments are able to attract a wide range of customers, from traditional tea drinkers to those looking for novelty beverages. This has encouraged an increase in the number of bubble tea shops globally, especially in North America and Asia-Pacific regions.

By Distribution Channel Analysis

Food Service dominates the Popping Boba Market with 59.1% share in 2024

In 2024, Food Service held a dominant market position, capturing more than a 59.1% share of the global Popping Boba market. This segment has grown significantly due to the widespread popularity of bubble tea and other boba-based beverages served in cafés, restaurants, and specialized boba shops. Food service establishments offer an ideal platform for Popping Boba, as they provide a setting for consumers to enjoy the interactive and customizable nature of boba drinks, which can be made fresh and tailored to individual tastes. Additionally, food service businesses are increasingly experimenting with Popping Boba in a variety of applications, including smoothies, desserts, and alcoholic beverages, which further fuels its demand.

The rapid expansion of bubble tea chains and other specialty beverage outlets, particularly in Asia-Pacific and North America, has contributed to the growth of the Food Service segment. As consumers look for new dining experiences and innovative products, food service businesses are leveraging Popping Boba to differentiate their offerings and attract a diverse customer base. Moreover, the increasing trend of “Instagrammable” food and drinks has pushed food service businesses to incorporate visually appealing ingredients like Popping Boba into their menus to enhance customer engagement.

Key Market Segments

By Flavor

- Fruit Flavors

- Tea Flavors

- Coffee Flavors

- Chocolate Flavors

- Others

By Application

- Bubble Tea

- Frozen Yogurt Toppings

- Ice Cream Toppings

- Smoothies & Beverages

- Others

By Distribution Channel

- Food Service

- Retail

- Supermarkets & Hypermarkets

- Convenience Stores

- Online

- Others

Emerging Trends

Rise of Customization and Unique Flavor Profiles

One of the latest trends driving the growth of the popping boba market is the increasing demand for customization and unique flavor profiles. Consumers are no longer just looking for traditional or basic food experiences; they are seeking innovative, personalized, and adventurous flavors. This trend has been particularly prominent in the beverage and dessert industries, where consumers want to create their own combinations of flavors, textures, and toppings.

According to a 2023 survey by Mintel, 57% of consumers in the U.S. said they enjoy customizing their food and beverages to suit their tastes. This customization trend is fueled by social media platforms like Instagram and TikTok, where visually appealing and shareable food experiences are highly sought after. The ability to choose from a variety of popping boba flavors—ranging from tropical fruits like mango and passion fruit to exotic combinations like lychee and matcha—has contributed to its growing popularity.

The trend towards customization also ties into the increasing interest in healthier and cleaner food options. Consumers are looking for ways to tailor their food choices to meet dietary preferences or health goals. As a result, there is growing demand for popping boba that is made with natural ingredients, free from artificial colors and sweeteners. Many manufacturers are responding to this trend by offering organic or clean-label popping boba, which is perceived as a healthier and more sustainable option.

- The U.S. Department of Agriculture (USDA) has reported that organic food sales in the U.S. reached USD 62 billion in 2023, with consumers increasingly prioritizing products that are free from synthetic chemicals and additives. Manufacturers who can provide customizable, health-conscious popping boba options are tapping into this broader market trend.

Furthermore, with sustainability becoming a significant concern for consumers, customization in the form of eco-friendly packaging is also gaining momentum. Brands that offer personalized packaging solutions—such as biodegradable cups and straws—are seeing a positive response from environmentally conscious consumers. The Environmental Protection Agency (EPA) reported that in 2023, 75% of Americans supported businesses that prioritized sustainability, especially in the food industry. Popping boba brands that incorporate sustainable packaging into their customizable offerings can differentiate themselves in a competitive market, appealing to both eco-conscious consumers and those seeking unique dining experiences.

Drivers

Growing Demand for Novel and Fun Food Products

The growing demand for novel and fun food products, particularly in the dessert and beverage sectors, is a major driving factor behind the rapid growth of the popping boba market. Popping boba, which is a fruit-filled gelatinous ball that bursts with juice when bitten, has captivated consumers, especially younger demographics, with its unique texture and interactive experience. The trend toward more engaging and fun food experiences is significantly influencing market expansion, particularly in regions such as North America and Asia-Pacific.

The increasing popularity of bubble tea and other dessert drinks, such as frozen yogurt, smoothies, and fruit teas, has directly boosted the demand for popping boba. According to a report by the National Restaurant Association, the rise of customizable and Instagram-worthy food products has led to greater consumer interest in innovative ingredients like popping boba.

The association’s 2024 forecast indicates that more than 56% of consumers are interested in new, unique, and fun food options when dining out. This trend is especially prominent among millennials and Gen Z, who are constantly seeking novel food experiences and are more inclined to share these experiences on social media platforms like Instagram and TikTok.

Government initiatives and industry support have also contributed to the growth of the popping boba market. Various food regulatory bodies, such as the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA), have established guidelines to ensure the safety and quality of food products, including popping boba. These measures have provided consumers with greater confidence in the product’s safety, leading to increased demand.

According to the Taiwan External Trade Development Council (TAITRA), the popularity of bubble tea, which often features popping boba as a key ingredient, has led to significant growth in the food and beverage market.

- In 2023, Taiwan alone reported that over 45,000 bubble tea shops had been opened globally, many of which offer popping boba as an essential topping. The trend has since expanded to global markets, especially in North America and Europe, where interest in Asian-inspired beverages and foods is rapidly increasing.

Restraints

Health and Safety Concerns Over Artificial Ingredients

One of the major restraining factors hindering the growth of the popping boba market is the growing concern over the use of artificial ingredients, preservatives, and additives in food products. Consumers are becoming increasingly health-conscious and are scrutinizing the ingredients in their food more carefully. This has led to increased skepticism surrounding products like popping boba, which often contains artificial flavorings, colors, and sweeteners. In particular, concerns regarding the safety of food additives such as high fructose corn syrup and artificial coloring agents have become a significant barrier to the widespread adoption of popping boba.

In addition to health concerns, the growing emphasis on sustainability and environmental impact has put pressure on popping boba producers. Many traditional popping boba products come in plastic packaging, which contributes to the rising concerns about plastic waste and environmental degradation.

- According to a report by The Environmental Protection Agency (EPA), the U.S. generates approximately 34 million tons of plastic waste annually, with much of it coming from single-use food packaging. As consumer awareness of environmental issues rises, the demand for more sustainable and eco-friendly packaging solutions is growing.

Government regulations are also tightening in response to these health and environmental concerns. For instance, in 2023, the European Union introduced stricter regulations regarding food additives and the use of synthetic colors in food products. These regulations require companies to disclose all ingredients transparently and limit the use of certain artificial ingredients that may pose health risks.

Similarly, the U.S. FDA has proposed new guidelines for food products, including bubble tea and popping boba, to limit the use of artificial colors and sweeteners. These regulatory measures can be burdensome for manufacturers, as they may require reformulations and adjustments to their production processes, potentially driving up costs.

Opportunity

Expansion in Health-Conscious and Natural Product Segments

One of the significant growth opportunities for the popping boba market lies in the increasing consumer demand for health-conscious and natural products. As more consumers seek alternatives to artificial ingredients and processed foods, there is an emerging opportunity for manufacturers to develop healthier, clean-label popping boba variants. This trend is being driven by a growing preference for natural, organic, and minimally processed foods across global markets. Manufacturers who can innovate by using natural sweeteners, organic ingredients, and eco-friendly packaging can tap into this expanding market segment.

According to the American Heart Association, nearly 50% of Americans are actively reducing their sugar intake, with many choosing to avoid artificial sweeteners and additives commonly found in conventional popping boba. This presents a significant opportunity for manufacturers to reformulate their products using natural sweeteners like stevia, monk fruit, or agave nectar, which can help reduce sugar content while still providing a sweet flavor.

The Plant-Based Foods Association reported that in 2023, plant-based food sales in the U.S. surpassed USD 7 billion, growing by 27% in just two years. As plant-based and vegan diets become more mainstream, there is a growing demand for plant-based alternatives across various food categories, including beverages and snacks. Popping boba products that use plant-based ingredients, such as fruit-based gelatins or tapioca starch, could appeal to the expanding market of health-conscious consumers who follow plant-based or vegan diets.

In 2023, the International Food Information Council (IFIC) found that 67% of consumers were interested in functional foods that could help support immune health, digestion, and overall well-being. Integrating such health-promoting ingredients into popping boba could further expand its appeal to a more health-conscious audience.

- According to National Geographic, over 8 million tons of plastic end up in the oceans every year, and the global push for sustainable packaging has led to stricter regulations in Europe and North America. Manufacturers of popping boba who adopt sustainable practices and reduce their carbon footprint through eco-friendly packaging can enhance their brand image and appeal to environmentally conscious consumers.

Regional Insights

North America dominates the Popping Boba Market with a 43.7% share in 2024

In 2024, North America held a dominant position in the global Popping Boba market, capturing more than a 43.7% share, valued at approximately USD 0.9 billion. The region’s substantial market share can be attributed to the rapid expansion of bubble tea chains and the growing interest in unique, customizable beverages, which has driven the demand for Popping Boba. North America’s large consumer base, particularly in the United States and Canada, has embraced the trend of innovative beverages, making it a key region for Popping Boba sales.

In the U.S., the bubble tea market has grown significantly in recent years, with the number of bubble tea shops increasing annually. According to the National Restaurant Association, the number of bubble tea establishments in the U.S. has surged by more than 15% between 2020 and 2024, fueling demand for Popping Boba. Moreover, consumer preferences for exotic and visually engaging food and beverages have prompted foodservice businesses to introduce Popping Boba into their menus. This has further solidified North America’s position as the leading regional market for Popping Boba.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

PT. Formosa Ingredient Factory Tbk, operating under the brand name Bobaking, is a leading producer of various food and beverage ingredients, including popping boba, tapioca pearls, syrups, and sauces. The company emphasizes the use of premium imported raw materials and adheres to international quality standards such as ISO 22000 and Halal certifications. Their products are widely distributed across Indonesia and exported to international markets, serving prominent clients in the food and beverage industry.

Brilsta is a Chinese company specializing in the production of popping boba and other food ingredients. Their popping boba products are made from natural seaweed extract, offering a crystal-clear appearance and a burst of flavor when consumed. Brilsta emphasizes innovation and quality in their product development, aiming to provide unique and appealing ingredients for the food and beverage industry.

Sunnysyrup Food Co., Ltd. is a Taiwanese manufacturer with over 60 years of experience in the beverage industry. They offer a wide range of products, including popping boba, syrups, flavored powders, and bubble tea equipment. The company provides OEM/ODM services, allowing clients to customize products to meet their specific needs. Sunnysyrup is committed to delivering high-quality ingredients and supporting the growth of the bubble tea industry through training programs and product innovation.

Top Key Players Outlook

- Tachiz Group

- PT. Formosa Ingredient Factory Tbk.

- Nam Viet F&B

- Italian Beverage Company

- Brilsta

- Sunnysyrup Food Co, Ltd.

- Possmei

- Golden Choice Marketing Sdn Bhd

- Bossen

- Boba Box Limited

Recent Industry Developments

In 2024, Formosa had expanded its distribution network to include over 1,000 retail outlets across Indonesia, including partnerships with major chains like KFC and Starbucks.

In 2024, Formosa had expanded its distribution network to include over 1,000 retail outlets across Indonesia, including partnerships with major chains like KFC and Starbucks. The company’s commitment to quality is evident in its adherence to international standards, holding certifications such as ISO 22000 and Halal.

Report Scope

Report Features Description Market Value (2024) USD 2.1 Bn Forecast Revenue (2034) USD 4.9 Bn CAGR (2025-2034) 8.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Flavor (Fruit Flavors, Tea Flavors, Coffee Flavors, Chocolate Flavors, Others), By Application (Bubble Tea, Frozen Yogurt Toppings, Ice Cream Toppings, Smoothies and Beverages, Others), By Distribution Channel (Food Service, Retail, Supermarkets and Hypermarkets, Convenience Stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Tachiz Group, PT. Formosa Ingredient Factory Tbk., Nam Viet F&B, Italian Beverage Company, Brilsta, Sunnysyrup Food Co, Ltd., Possmei, Golden Choice Marketing Sdn Bhd, Bossen, Boba Box Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Tachiz Group

- PT. Formosa Ingredient Factory Tbk.

- Nam Viet F&B

- Italian Beverage Company

- Brilsta

- Sunnysyrup Food Co, Ltd.

- Possmei

- Golden Choice Marketing Sdn Bhd

- Bossen

- Boba Box Limited