Global Polyvinyl Acetate Adhesives Market Size, Share, And Enhanced Productivity By Product Type (Water-based, Solvent-based, Hot Melt, Others), By Application (Woodworking, Packaging, Construction, Textiles, Others), By End-use (Furniture, Paper and Packaging, Building and Construction, Automotive, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 177094

- Number of Pages: 230

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

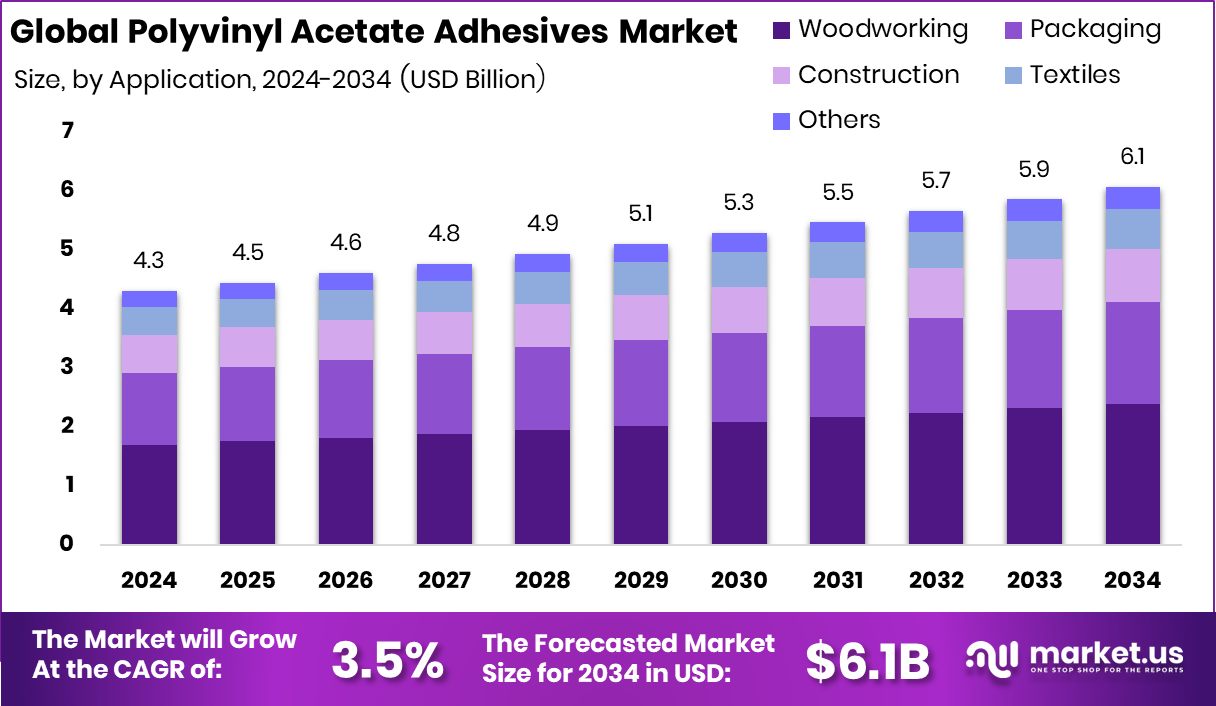

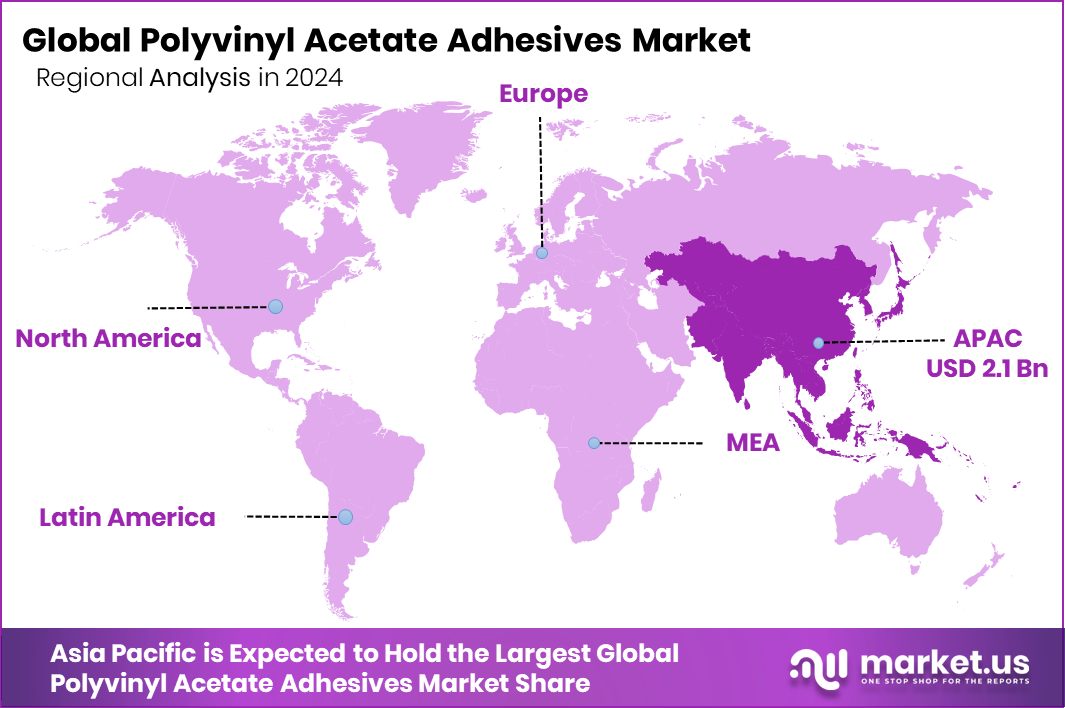

The Global Polyvinyl Acetate Adhesives Market is expected to be worth around USD 6.1 billion by 2034, up from USD 4.3 billion in 2024, and is projected to grow at a CAGR of 3.5% from 2025 to 2034. In the Asia Pacific, the Polyvinyl Acetate Adhesives Market achieved 49.7% and USD 2.1 Bn dominance.

Polyvinyl acetate adhesives are water-based or solvent-based bonding materials made from PVAc polymers, known for their strong adhesion to wood, paper, and porous surfaces. They are widely used in woodworking, furniture assembly, packaging, and interior construction because they dry quickly, form clean joints, and offer dependable strength for everyday applications. The Polyvinyl Acetate Adhesives Market represents the global demand for these adhesive types across product categories such as water-based, solvent-based, hot-melt, and specialty blends, serving major end-use sectors including furniture, paper packaging, construction, automotive, and textiles.

Growth in this market is strongly supported by rising woodworking activity and increased investment in training and manufacturing facilities. Recent funding updates—such as Slow Ventures’ $60M Creator Fund, its first $2M investment in woodworking creator Jonathan Katz-Moses, and Michigan’s $12 million state grant for the Sam Beauford Woodworking Institute—highlight expanding interest in woodcraft and skilled manufacturing. Additional support through InventWood’s $15M SuperWood funding, $9.6M federal grants for Oregon wood businesses, and $8M manufacturing funds for Vancouver Island operations reflects rising demand for wood products and advanced materials.

These investments create opportunities for higher-quality furniture production, stronger supply chains, and increased consumption of PVAc adhesives in woodworking, construction, and packaging applications, enabling long-term market expansion.

Key Takeaways

- The Global Polyvinyl Acetate Adhesives Market is expected to be worth around USD 6.1 billion by 2034, up from USD 4.3 billion in 2024, and is projected to grow at a CAGR of 3.5% from 2025 to 2034.

- Polyvinyl Acetate Adhesives Market growth strengthens as water-based products achieve 58.2% dominance across global industries.

- Rising woodworking demand at 39.5% continues to push steady expansion within the Polyvinyl Acetate Adhesives Market.

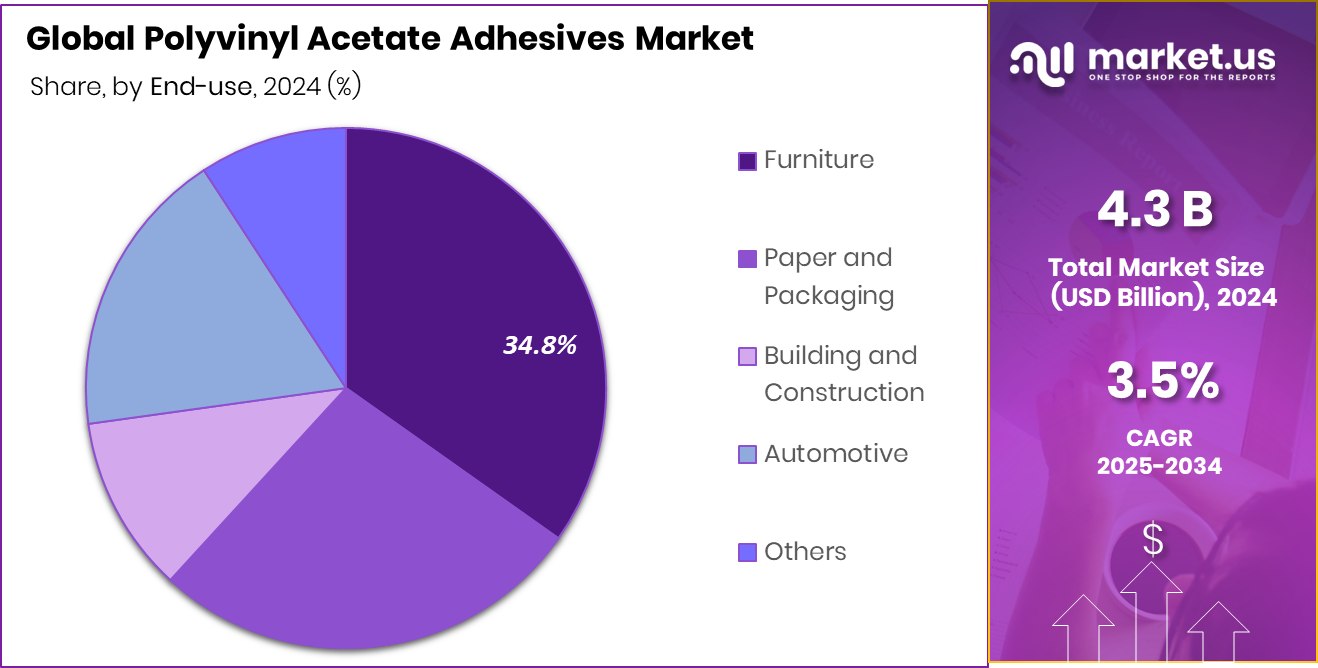

- Furniture applications holding 34.8% significantly enhance revenue momentum for the Polyvinyl Acetate Adhesives Market worldwide.

- Region shows strong demand supporting Asia Pacific’s 49.7% share and USD 2.1 Bn valuation.

By Product Type Analysis

Polyvinyl Acetate Adhesives Market dominated by water-based products with a 58.2% share.

In 2024, the Polyvinyl Acetate Adhesives Market was dominated by water-based formulations, holding a 58.2% share, as manufacturers increasingly preferred these adhesives for their low VOC content, safer handling profile, and strong bonding performance across porous substrates, supporting wider industrial and consumer adoption; this dominance was further reinforced by sustainability mandates, growing demand from environmentally conscious industries, and technological advancements improving drying speed, heat resistance, and durability, which collectively positioned water-based PVA adhesives as the most practical solution for mass-scale production lines, DIY applications, packaging, construction finishing tasks, and multiple woodworking processes, driving steady market expansion and strengthening their role as the primary product category shaping global industry demand.

By Application Analysis

Polyvinyl Acetate Adhesives Market woodworking application dominated with a strong 39.5% share.

In 2024, the Polyvinyl Acetate Adhesives Market was dominated by the woodworking segment, capturing a 39.5% share, as PVA adhesives remained the preferred choice for cabinet manufacturing, panel lamination, furniture joints, interior assemblies, and decorative applications due to their excellent tack, clean finish, fast curing, and reliable strength on hardwoods and engineered wood products; the expansion of residential construction, the surge in customized carpentry, and rising demand for premium interior décor materials further boosted PVA consumption in workshops and industrial woodworking units, while improved water-resistant and heat-resistant grades supported wider use across diverse climatic regions, solidifying woodworking as the leading application area shaping overall market utilization and growth patterns.

By End-use Analysis

The polyvinyl acetate adhesives market furniture end-use segment dominated, holding a notable 34.8% share.

In 2024, the Polyvinyl Acetate Adhesives Market was dominated by the furniture end-use sector, accounting for a 34.8% share, as global demand for modular furniture, premium home décor products, and lightweight yet durable wooden structures accelerated the use of PVA adhesives in assembly, edge bonding, veneering, fixing upholstery frames, and repairing components across residential, commercial, and institutional spaces; rapid urbanization, growth in ready-to-assemble product lines, and the expansion of both online and offline furniture retail networks further supported adhesive consumption, while manufacturers developed higher-performance PVA grades tailored for modern furniture production cycles, reinforcing the sector’s strong influence over overall market trends and long-term consumption patterns.

Key Market Segments

By Product Type

- Water-based

- Solvent-based

- Hot Melt

- Others

By Application

- Woodworking

- Packaging

- Construction

- Textiles

- Others

By End-use

- Furniture

- Paper and Packaging

- Building and Construction

- Automotive

- Others

Driving Factors

Rising woodworking activities increase adhesive consumption

Rising woodworking activities continue to push the demand for Polyvinyl Acetate Adhesives as manufacturers, training centers, and small workshops expand their capabilities. This momentum is strengthened by major funding boosts that indirectly support adhesive consumption. The U.S. Forest Service, awarding $80 million in Wood Innovation Grants, encourages new wood-based product development, which increases the need for reliable bonding materials.

At the same time, Mercer Mass Timberis planning a $30 million expansion, which reflects the growing use of engineered wood in construction, further elevating demand for strong, clean-curing PVAc adhesives. Together, these developments create a more robust environment for woodworking operations, reinforcing a steady rise in adhesive usage across furniture making, structural wood components, and interior applications.

Restraining Factors

Limited heat resistance reduces application suitability

Limited heat resistance remains a key challenge for Polyvinyl Acetate Adhesives, especially in high-temperature environments where stronger or more specialized adhesives are required. Market restraints also emerge from uneven industrial investments that shift attention toward alternative materials or broader manufacturing priorities. For example, an Alabama company receiving a $180,000 grant for a planned $115 million sawmill highlights capital moving into raw wood processing rather than adhesive advancement.

Additionally, the Lowe’s Foundation announced $9 million in grants to workforce nonprofits shows funding directed toward training and workforce development instead of chemical formulation improvements. These patterns slow the pace at which PVAc adhesives can expand into more demanding or heat-intensive applications.

Growth Opportunity

Growing packaging sector supports adhesive expansion

The packaging sector remains one of the strongest opportunity areas for Polyvinyl Acetate Adhesives, especially as companies seek dependable water-based bonding solutions for paper, cartons, and specialty packaging formats. Growth potential is reinforced by community and industry funding programs that help expand woodcraft and construction-adjacent skills. The Home Depot Foundation’s $30 million investment in veteran-helping grants supports training pathways that often include carpentry and material handling, indirectly increasing adhesive use.

Meanwhile, the Children’s Services Council, seeking $15,000 from Community Carpentry USA, highlights how smaller initiatives contribute to grassroots woodworking growth. These activities encourage wider adoption of PVAc adhesives across packaging, education, light manufacturing, and repair operations.

Latest Trends

Shift toward sustainable water-based adhesive systems

A noticeable shift toward sustainable water-based adhesive systems defines the current trend in the Polyvinyl Acetate Adhesives Market, driven by environmental expectations and cleaner production standards. This movement aligns with community-focused funding supporting woodworking, learning spaces, and skill development. Recent examples include community groups applying for up to £7,500 for local projects that promote wellbeing and independence, many of which involve craft programs requiring reliable adhesives.

Additionally, NCSD1 trustees are considering approval of a $100,000 mental health grant and reviewing a $525,000 woodworking lab upgrade, which shows a growing emphasis on educational environments where safe, low-VOC adhesives like PVAc are preferred. These efforts collectively support the trend toward cleaner, more user-friendly adhesive technologies.

Regional Analysis

Asia Pacific dominated with 49.7%, USD 2.1 Bn, leading the Polyvinyl Acetate Adhesives Market growth.

The Asia Pacific region remained the dominant market in the Polyvinyl Acetate Adhesives Market, holding a 49.7% share valued at USD 2.1 billion, supported by strong manufacturing activity, expanding construction output, and increasing demand for woodworking and furniture adhesives across China, India, and Southeast Asia. This leadership is reinforced by the region’s large-scale production capacity and the rapid shift toward water-based adhesive solutions in consumer and industrial applications.

North America showed steady adoption driven by the packaging industry, home renovation trends, and the rising use of engineered wood products across the U.S. and Canada. Europe maintained a mature yet stable outlook, supported by stricter environmental standards and the widespread use of low-VOC bonding materials in furniture and interior applications.

The Middle East & Africa recorded gradual growth due to ongoing urban development, rising furniture manufacturing, and expanding local production clusters. Latin America continued to progress on the back of increasing woodworking activities and growing demand for economically efficient, water-based adhesive solutions in the region’s furniture and construction sectors.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Henkel AG & Co. KGaA continued strengthening its position through a broad portfolio of adhesive technologies tailored for woodworking, packaging, and furniture assembly. The company’s focus on enhancing bond strength, improving environmental compatibility, and offering user-friendly formulations helped it maintain strong demand across industrial and consumer segments. Henkel’s established distribution networks and emphasis on performance-driven PVA solutions supported its resilience in the evolving adhesives landscape.

3M Company maintained a prominent role by integrating material science expertise with practical adhesive applications, addressing diverse needs from construction to interior assembly. Its long-standing reputation for reliability and consistent product performance positioned it as a preferred supplier in multiple regions. The company’s continuous refinement of adhesive systems supported the shift toward cleaner, efficient water-based options.

H.B. Fuller Company contributed strongly to market development with its specialized bonding solutions designed for manufacturing operations and commercial woodworking. The company’s commitment to customized adhesive systems, durable performance, and application-specific solutions further reinforced its competitive stance. Together, these players shaped a market characterized by quality enhancement, stronger material compatibility, and sustained industrial adoption.

Top Key Players in the Market

- Henkel AG & Co. KGaA

- 3M Company

- H.B. Fuller Company

- Arkema Group

- Sika AG

- Dow Inc.

- Ashland Global Holdings Inc.

- Avery Dennison Corporation

- Bostik SA

- Franklin International

- Pidilite Industries Limited

- Wacker Chemie AG

Recent Developments

- In May 2024, Arkema agreed to buy Dow’s flexible packaging laminating adhesives business, a company known for making adhesives used in food, medical packaging, and industrial lamination. This deal will help Arkema expand its adhesives range and strengthen its presence in flexible packaging markets around the world.

- In April 2024, Sika acquired Kwik Bond Polymers, LLC, a U.S. company that makes polymer systems used for concrete repairs and infrastructure work, which strengthens Sika’s product range and service offerings in construction chemicals.

Report Scope

Report Features Description Market Value (2024) USD 4.3 Billion Forecast Revenue (2034) USD 6.1 Billion CAGR (2025-2034) 3.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Water-based, Solvent-based, Hot Melt, Others), By Application (Woodworking, Packaging, Construction, Textiles, Others), By End-use (Furniture, Paper and Packaging, Building and Construction, Automotive, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Henkel AG & Co. KGaA, 3M Company, H.B. Fuller Company, Arkema Group, Sika AG, Dow Inc., Ashland Global Holdings Inc., Avery Dennison Corporation, Bostik SA, Franklin International, Pidilite Industries Limited, Wacker Chemie AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Polyvinyl Acetate Adhesives MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample

Polyvinyl Acetate Adhesives MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Henkel AG & Co. KGaA

- 3M Company

- H.B. Fuller Company

- Arkema Group

- Sika AG

- Dow Inc.

- Ashland Global Holdings Inc.

- Avery Dennison Corporation

- Bostik SA

- Franklin International

- Pidilite Industries Limited

- Wacker Chemie AG