Global Polyurethane Sealants Market Size, Share, And Business Benefit By Type (One-Component, Two-Component), By Application (Glazing, Flooring and Joining, Concrete Joints, Sanitary, Submerged, Others), By End-User (Building and Construction, Automotive, Marine, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 162087

- Number of Pages: 269

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

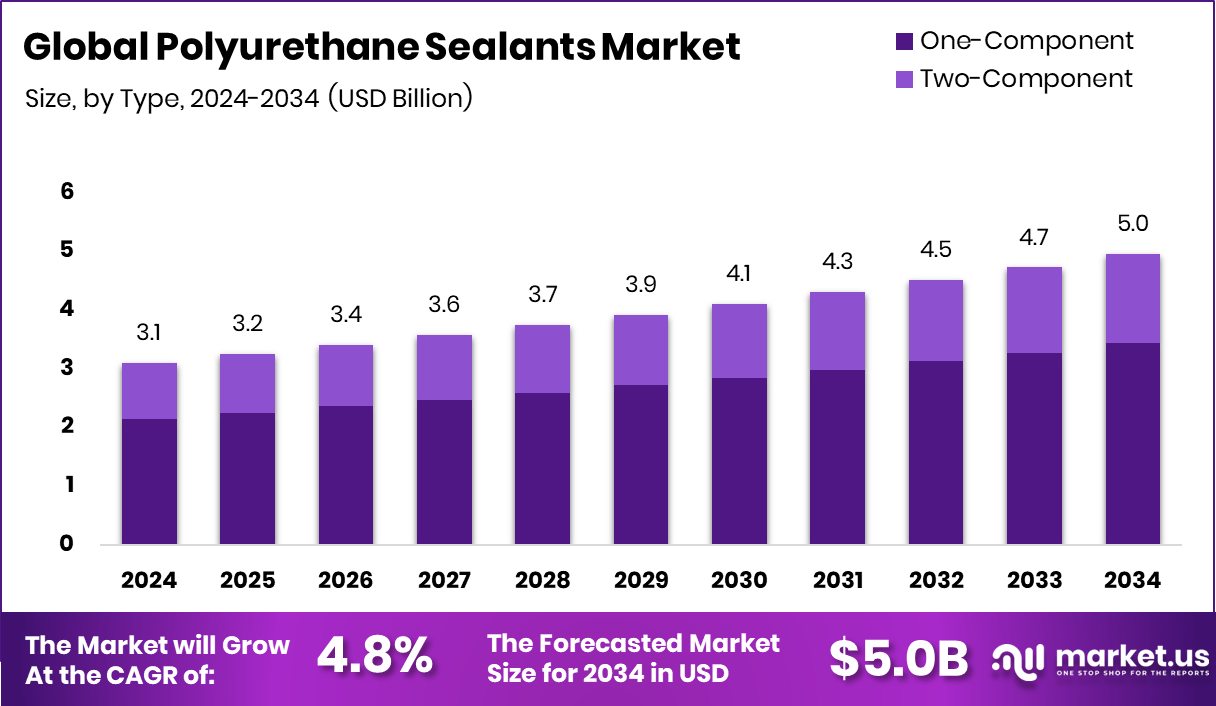

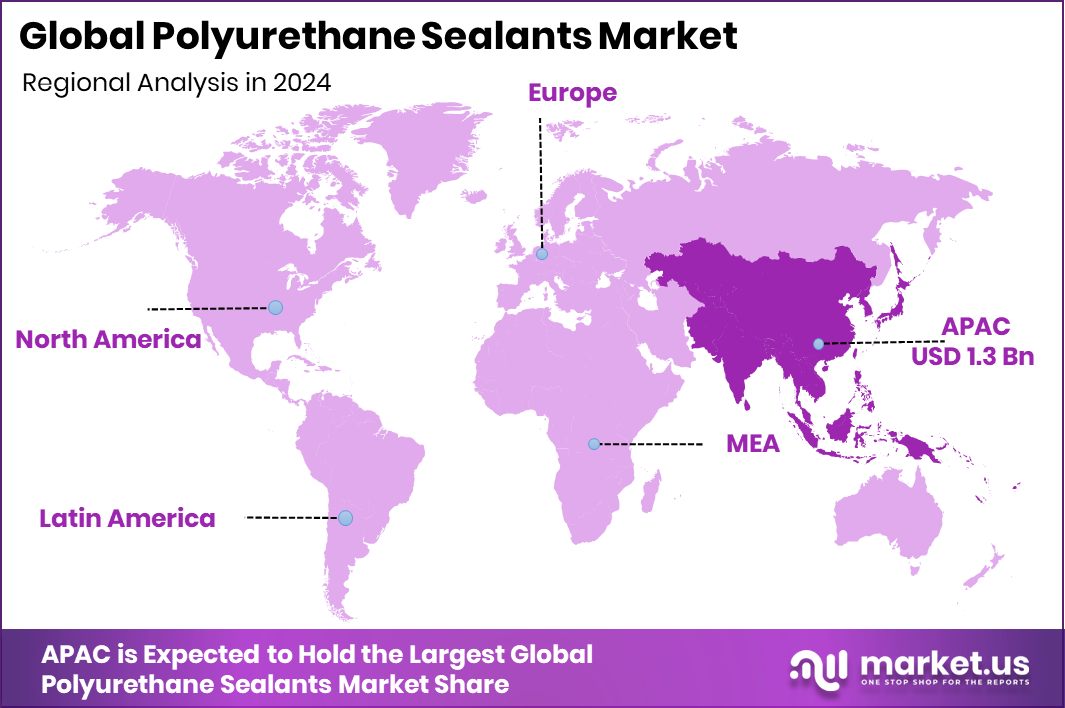

The Global Polyurethane Sealants Market is expected to be worth around USD 5.0 billion by 2034, up from USD 3.1 billion in 2024, and is projected to grow at a CAGR of 4.8% from 2025 to 2034. Rapid urbanization and construction expansion strengthened the Asia-Pacific’s 43.20% dominance in polyurethane sealants.

A polyurethane sealant is a flexible, adhesive-style material based on polyurethane chemistry that’s used to seal joints, gaps, and interfaces in construction, automotive, industrial, and other applications. It bonds well to substrates like concrete, masonry, metal, and wood and provides waterproof and airtight performance under movement and load. Because of its strong adhesion and elasticity, it is often selected where simple caulking won’t suffice—e.g., between prefabricated building elements, around window frames, on outdoor façades, or in HVAC installations.

Several factors fuel growth in the polyurethane sealants market: ongoing construction and infrastructure activity mean many new joints and façade systems that require effective sealing; the rising emphasis on building performance—energy efficiency, airtightness, and moisture control—makes quality sealants more important; and increasing use in automotive, marine, and industrial sectors adds further volume.

For example, large-scale construction funding, such as a record ₹70,744 crore allocated for construction workers’ welfare and mega school-related construction budgets of $19.4 billion, highlights just how big the built-environment opportunity is. At the same time, high-profile funding rounds in construction technologies—like $196 million raised by six contech startups and $52 million secured by a 3D-printed home manufacturer—reflect innovation and expansion in sectors where sealing systems will play a supporting role.

Demand for polyurethane sealants is thus influenced by the volume of constructed area, refurbishment and expansion of existing assets, and the retrofitting of older buildings for better performance (air sealing, waterproofing). The fact that large-scale mixed-use construction financing of $23.15 million and other capital flows, like a $3 million investment to measure/reduce carbon emissions in building materials, suggest that not only new construction but also sustainable upgrades are happening. Because polyurethane sealants help control moisture and air ingress and bond strongly across many substrates, they become a go-to for high-performance sealing in sustainable building practices.

Looking forward, opportunities lie in specialty applications—for instance, low-modulus or high-movement sealants for façade systems, seismic-resilient buildings, and joints in modular or prefab construction. The rising trend in 3D-printed buildings and modular components (backed by that $52 million funding to a 3D-printed home producer) means new materials and joint types that may require advanced sealants. And since marrying innovation with standard construction funds is happening (think mixed-use building finance, sector-wide contech investment), manufacturers and applicators of polyurethane sealants have a chance to embed their solutions early in evolving construction methods.

Key Takeaways

- The Global Polyurethane Sealants Market is expected to be worth around USD 5.0 billion by 2034, up from USD 3.1 billion in 2024, and is projected to grow at a CAGR of 4.8% from 2025 to 2034.

- In 2024, one-component polyurethane sealants dominated the market with a 69.3% share, ensuring superior flexibility and easy application.

- In 2024, flooring and joining applications held a 33.6% share in the polyurethane sealants market globally.

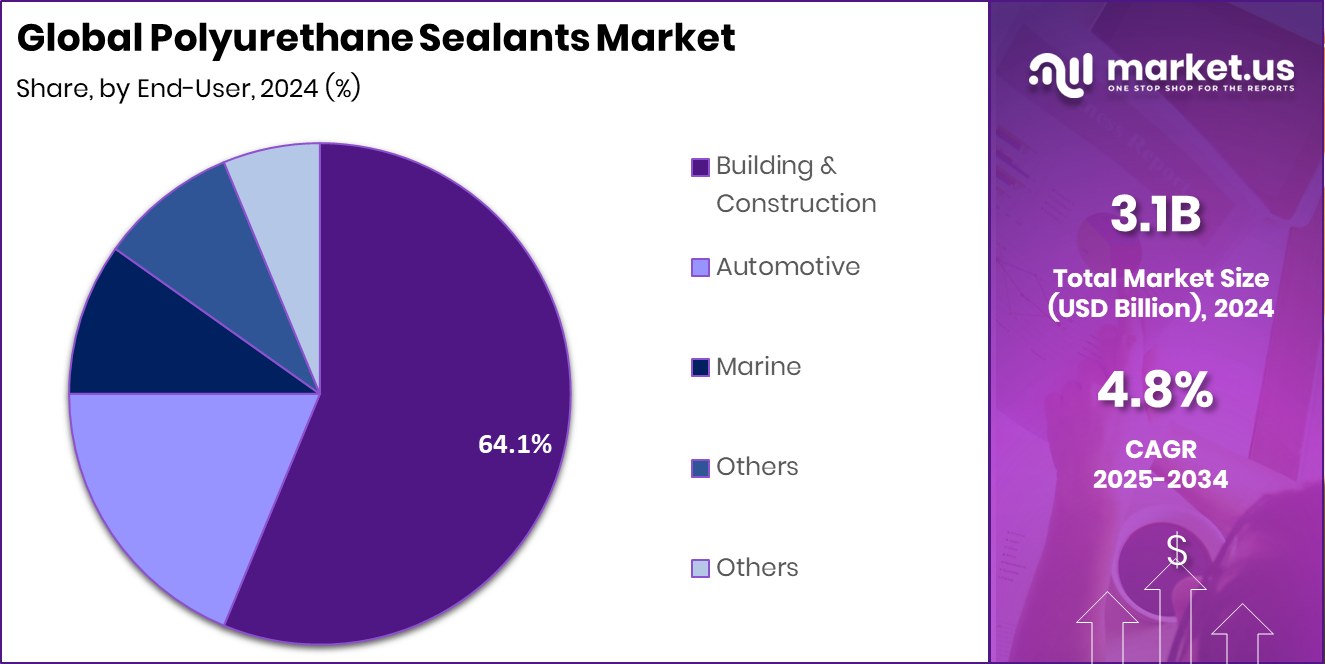

- In 2024, the building and construction sector led with a 64.1% share in global demand.

- The Asia-Pacific market value reached around USD 1.3 Bn, driven by infrastructure growth.

By Type Analysis

In 2024, the Polyurethane Sealants Market’s One-Component type captured 69.3% overall share globally.

In 2024, One-Component held a dominant market position in the By Type segment of the Polyurethane Sealants Market, with a 69.3% share. This segment’s leadership stems from its easy application, requiring no on-site mixing and offering consistent performance across construction and industrial joints. One-component polyurethane sealants are widely used in residential and commercial construction for their high adhesion, elasticity, and moisture resistance.

They provide reliable sealing for concrete expansion joints, curtain walls, and façade systems, ensuring long-term durability. Their compatibility with multiple substrates and reduced labor costs further enhance adoption. The convenience, reduced waste, and faster curing process associated with one-component systems make them the preferred choice among builders, contractors, and infrastructure maintenance professionals worldwide.

By Application Analysis

The Flooring and Joining segment led the Polyurethane Sealants Market with 33.6% share.

In 2024, Flooring and Joining held a dominant market position in the By Application segment of the Polyurethane Sealants Market, with a 33.6% share. This dominance is attributed to the growing use of polyurethane sealants for creating durable, flexible, and waterproof joints in flooring systems.

Their excellent adhesion to concrete, tiles, and wood makes them ideal for industrial, commercial, and residential floors where movement and vibration resistance are essential. These sealants enhance surface protection against moisture, chemicals, and heavy loads, ensuring long-lasting structural performance.

Easy application, strong bonding, and resistance to wear have positioned polyurethane sealants as the preferred choice for flooring and joining purposes in both new construction and renovation projects.

By End-User Analysis

The Building and Construction sector dominated the Polyurethane Sealants Market with a 64.1% share.

In 2024, Building and Construction held a dominant market position in the By End-User segment of the Polyurethane Sealants Market, with a 64.1% share. This leadership is driven by the extensive use of polyurethane sealants in residential, commercial, and infrastructure projects for sealing joints, facades, and structural components. Their superior adhesion, flexibility, and weather resistance make them ideal for modern construction applications that demand durability and performance.

These sealants are widely applied in flooring, expansion joints, and window installations, ensuring long-term protection against water and air leakage. The sector’s continuous growth and renovation activities further strengthen the demand for polyurethane sealants, making them a preferred choice across diverse construction environments.

Key Market Segments

By Type

- One-Component

- Two-Component

By Application

- Glazing

- Flooring and Joining

- Concrete Joints

- Sanitary

- Submerged

- Others

By End-User

- Building and Construction

- Automotive

- Marine

- Others

Driving Factors

Growing Construction Investments Fuel Market Expansion

One of the key driving factors for the polyurethane sealants market is the continuous rise in global construction investments and flooring developments. In 2024, strong demand for durable and flexible sealing solutions across residential and commercial projects boosted polyurethane sealant usage. Their ability to provide waterproofing, elasticity, and long-term adhesion makes them essential for modern infrastructure.

Recent funding initiatives, such as Direct Flooring, which received £1.5 million from the Bank of Scotland, highlight growing financial support for flooring and construction improvement projects. Such investments encourage product adoption in flooring, wall joints, and structural sealing works. As infrastructure upgrades and renovation activities accelerate, the need for reliable polyurethane sealants continues to rise steadily across global construction markets.

Restraining Factors

Environmental Concerns Limit Market Growth Potential

A major restraining factor for the polyurethane sealants market is the growing environmental concern related to the use of solvent-based and non-recyclable sealant materials. Many polyurethane sealants release volatile organic compounds (VOCs) during application and curing, which can impact air quality and worker safety. Increasing global regulations targeting VOC emissions and hazardous chemicals are pushing manufacturers to reformulate products, raising production costs and slowing market growth.

Additionally, the limited biodegradability of conventional polyurethane materials creates waste management challenges in construction and renovation activities. These environmental issues are encouraging industries to explore more sustainable alternatives, which in turn restricts the expansion of traditional polyurethane sealants across several regions and applications.

Growth Opportunity

Rising Infrastructure Projects Create Expansion Opportunities

A major growth opportunity for the Polyurethane Sealants Market lies in the increasing number of global infrastructure and renovation projects. Governments and private institutions are focusing on improving public buildings, roads, and residential spaces, driving demand for reliable sealing materials. The use of polyurethane sealants is expanding in flooring, roofing, and structural joints due to their strong adhesion, flexibility, and weather resistance.

Recent funding initiatives, such as Mountbatten receiving almost £1 million in government funds, highlight growing public investments in the construction and maintenance sectors. Such financial support enhances large-scale building and refurbishment projects, boosting the adoption of polyurethane sealants as essential materials for achieving energy efficiency, waterproofing, and long-lasting structural integrity.

Latest Trends

Sustainable and Smart Flooring Solutions Gaining Traction

One of the latest trends in the Polyurethane Sealants Market is the rapid shift toward sustainable and smart flooring solutions. Manufacturers are focusing on low-VOC, eco-friendly polyurethane sealants that align with global green building standards and carbon-reduction goals. The demand for high-performance sealants compatible with smart flooring systems is also increasing, especially in commercial and residential construction.

Recent funding activities, such as Bertram closing a $260 million extension fund and SVP backing a Swedish flooring company’s expansion, emphasize the industry’s focus on sustainable growth and advanced flooring technologies. These developments are encouraging innovation in polyurethane formulations, driving greater use of environmentally responsible sealants designed for modern, energy-efficient construction projects.

Regional Analysis

In 2024, the Asia-Pacific dominated the Polyurethane Sealants Market with a 43.20% share.

In 2024, the Polyurethane Sealants Market saw varied regional dynamics across North America, Europe, Asia Pacific, the Middle East & Africa (MEA), and Latin America.

In the Asia Pacific region, which is the dominating region with a 43.20% share and a value of USD 1.3 Bn, strong construction and industrial renovation activity has driven demand. In North America, while precise values aren’t disclosed here, demand remains supported by infrastructure upgrades and sealant replacement programmes.

In Europe, moderate growth is sustained by the refurbishment of older buildings and stringent energy-efficiency regulations. The MEA region is influenced by expanding commercial and residential construction in Gulf and African markets, though uptake of high-performance polyurethane sealants is still developing.

Latin America is witnessing gradual adoption, helped by urbanisation and larger commercial projects, but its share remains smaller compared to the Asia Pacific. Together, this regional landscape highlights the Asia Pacific’s dominant position while other markets offer strategic growth avenues.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

3M continued to enhance its polyurethane sealant offerings with a focus on durable bonding and flexible solutions for automotive, aerospace, and construction applications. The company’s emphasis on high-performance adhesives aligned with global trends toward lightweight, energy-efficient, and weather-resistant materials, positioning it as a trusted player in both industrial and consumer segments.

Soudal Group maintained its strong market footprint through diversified polyurethane sealant portfolios tailored for professional and residential construction uses. Its advanced formulations, offering superior adhesion and elasticity, supported the group’s leadership in sealing joints, flooring, and façade systems. The firm’s focus on sustainable, low-VOC sealants aligned with evolving green building standards and global sustainability goals, reinforcing customer trust across Europe and emerging markets.

Pidilite Industries Limited showcased remarkable growth in the Asia-Pacific region, leveraging its expertise in adhesives and sealants to serve regional infrastructure and real estate developments. The company’s emphasis on high-bonding, moisture-resistant polyurethane sealants, suited to tropical and high-humidity conditions, strengthened its construction market position. Collectively, these companies demonstrated strong technological advancement, customer-focused innovation, and sustainable material development, shaping the competitive landscape of the polyurethane sealants industry in 2024.

Top Key Players in the Market

- 3M

- Soudal Group

- Pidilite Industries Limited

- HB Fuller Co

- Henkel AG & Co. KGaA

- BASF SE

- The Dow Chemicals Company

- Arkema

- ASTRAL ADHESIVES

- Sika AG

Recent Developments

- In August 2025, 3M issued a customer letter related to VOC (volatile organic compound) compliance for its polyurethane and related products, indicating adjustments to product portfolios to meet evolving regulations.

- In April 2024, Soudal introduced the Soudal Healthy House® product range, offering a more sustainable option across sealants, foams, and adhesives.

Report Scope

Report Features Description Market Value (2024) USD 3.1 Billion Forecast Revenue (2034) USD 5.0 Billion CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (One-Component, Two-Component), By Application (Glazing, Flooring and Joining, Concrete Joints, Sanitary, Submerged, Others), By End-User (Building and Construction, Automotive, Marine, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape 3M, Soudal Group, Pidilite Industries Limited, HB Fuller Co, Henkel AG & Co. KGaA, BASF SE, The Dow Chemicals Company, Arkema, ASTRAL ADHESIVES, Sika AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Polyurethane Sealants MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Polyurethane Sealants MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- 3M

- Soudal Group

- Pidilite Industries Limited

- HB Fuller Co

- Henkel AG & Co. KGaA

- BASF SE

- The Dow Chemicals Company

- Arkema

- ASTRAL ADHESIVES

- Sika AG