Global Polytetramethylene Ether Glycol Market Size, Share, And Business Benefits By Application (Spandex, Thermoplastic Urethane Elastomers, Co-polyester Ether Elastomers, Others), By End Use (Textiles, Coatings, Adhesives and Sealants, Artificial Leather, Automotive, Leisure and Sports, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 164071

- Number of Pages: 390

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

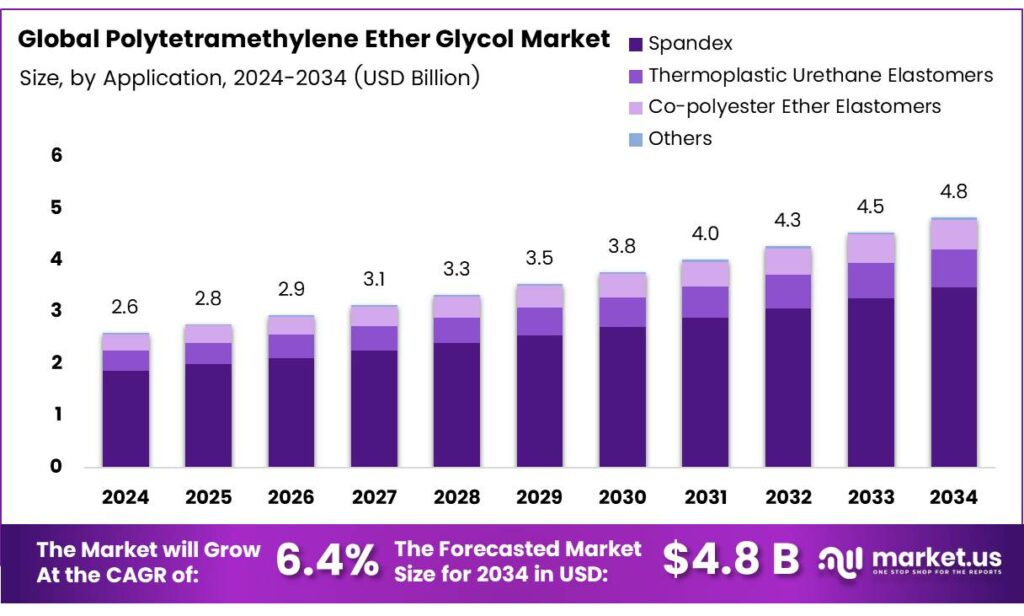

The Global Polytetramethylene Ether Glycol Market size is expected to be worth around USD 4.8 billion by 2034, from USD 2.6 billion in 2024, growing at a CAGR of 6.4% during the forecast period from 2025 to 2034.

Polytetramethylene Ether Glycol (PTMEG) is the premier polyether polyol used worldwide in the manufacture of high-performance polyurethane elastomers. Renowned for its exceptional performance attributes, PTMEG finds applications in polyurethane elastomers, prepolymers, coatings, adhesives, cast polyurethane resins, thermoplastic polyurethanes (TPUs), protective films, spandex fibers, and more.

Processors value PTMEG for its ability to enhance polyurethane elastomers with superior low-temperature flexibility, dynamic properties, resiliency, hydrolytic stability, and abrasion resistance. As a global supplier of specialty chemicals, Gantrade provides a comprehensive range of PTMEG polyols across various molecular weights to suit diverse formulation needs. The standard workhorse grades include PTMEG 1000, 1800, and 2000 molecular weight diols, while PTMEG 220 and 650 offer lower viscosity for easier handling as liquids at room temperature.

PTMEG 1400 delivers intermediate properties between the core grades, and PTMEG 3000 is ideal for applications requiring heightened resiliency, rebound, and abrasion resistance. These grades are available in different physical forms that influence processing. PTMEG 650 has a softening point of 11°C (52°F) and remains liquid at ambient conditions, whereas higher molecular weight options like PTMEG 1000 appear as low-melting waxy solids with softening points around 24°C (75°F).

Compared to polypropylene glycol (PPG)-based polyether polyols, PTMEG offers distinct advantages in polyurethane elastomers. Both polyether types provide excellent low-temperature performance and hydrolytic stability with very low glass transition temperatures (Tg) in the soft segment PTMEG at approximately -75°C and PPG at around -65°C. PTMEG’s uniform linear structure enables tight packing and stress-induced crystallization within the polyurethane soft segment, dramatically boosting tensile strength.

Key Takeaways

- The Global PTMEG market is projected to grow from USD 2.6 billion in 2024 to USD 4.8 billion by 2034 at a 6.4% CAGR.

- Spandex dominated the application segment in 2024 with a 72.7% share due to PTMEG’s superior elasticity in polyurethane fibers.

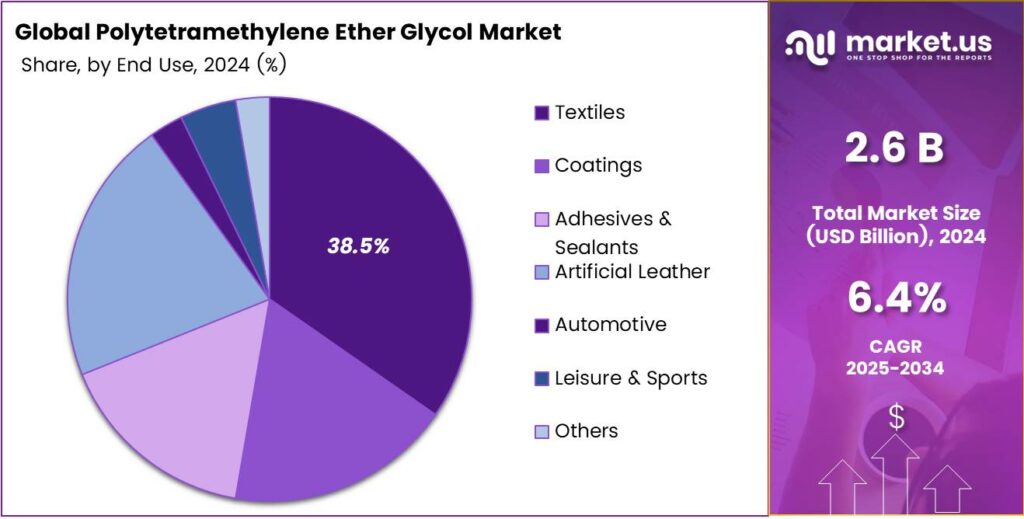

- Textiles led the end-use segment in 2024 with 38.5% share, driven by spandex demand in stretch activewear and apparel.

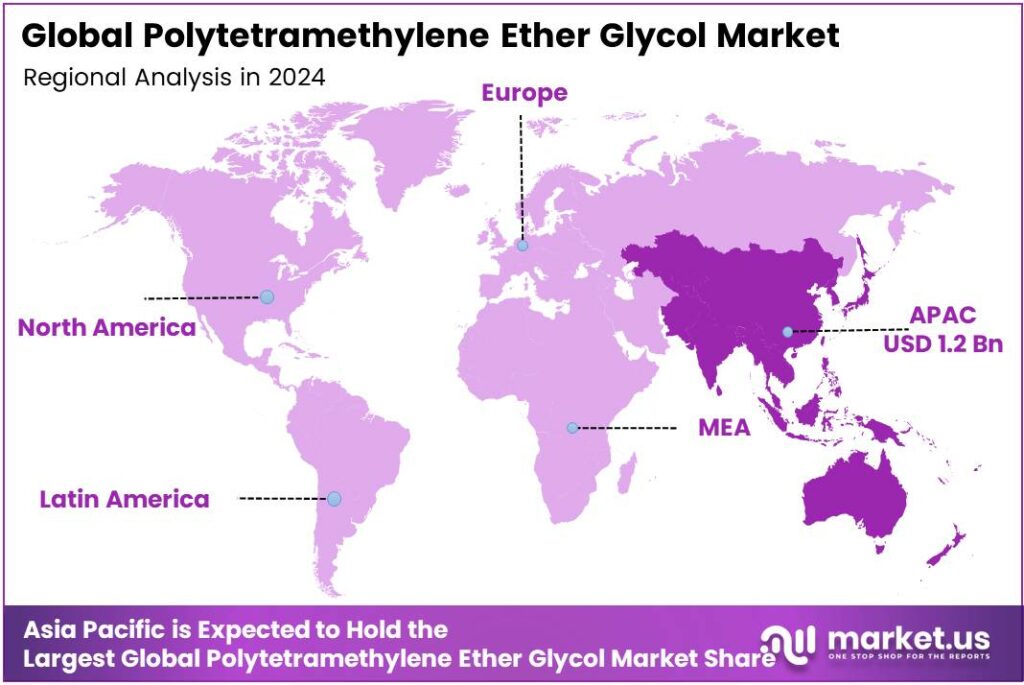

- Asia-Pacific held the largest regional share in 2024 at 48.9%, valued at USD 1.2 billion.

By Application

Spandex dominates with 72.7% due to its widespread use in stretchable textiles and performance fabrics.

In 2024, Spandex held a dominant market position in the By Application Analysis segment of the Polytetramethylene Ether Glycol Market, with a 72.7% share. This sub-segment leads because PTMEG excels as a soft segment in polyurethane fibers, enabling superior elasticity and recovery. Manufacturers favor it for activewear and sportswear.

Thermoplastic Urethane Elastomers follow as a key player, enhancing durability in various products. PTMEG integrates seamlessly here, offering flexibility and strength. Industries adopt it for footwear and hoses, boosting efficiency. This sub-segment grows steadily, supported by automotive innovations that require resilient materials.

Co-polyester Ether Elastomers contribute notably, providing high-performance properties. PTMEG aids in creating tough, flexible polymers for industrial uses. Demand rises in engineering applications, where abrasion resistance matters. This area expands as sectors seek advanced composites for reliability.

By End Use

Textiles dominate with 38.5% due to escalating needs for elastic fabrics in apparel and fashion.

In 2024, Textiles held a dominant market position in the By End Use Analysis segment of the Polytetramethylene Ether Glycol Market, with a 38.5% share. PTMEG powers spandex production, vital for stretch garments. Fashion evolves, favoring comfortable activewear, so this sub-segment thrives. Global apparel demand accelerates its lead position.

Coatings represent an emerging area where PTMEG improves film flexibility and adhesion. It protects surfaces in the construction and automotive fields effectively. Growth stems from eco-friendly formulations, attracting builders. This sub-segment advances as industries prioritize durable, weather-resistant finishes.

Adhesives and Sealants play a crucial role, leveraging PTMEG for strong bonds. It ensures elasticity in joints and seals, ideal for building projects. Demand surges with infrastructure booms, enhancing performance. This area strengthens as applications demand versatile, high-strength solutions.

Key Market Segments

By Application

- Spandex

- Thermoplastic Urethane Elastomers

- Co-polyester Ether Elastomers

- Others

By End Use

- Textiles

- Coatings

- Adhesives and Sealants

- Artificial Leather

- Automotive

- Leisure and Sports

- Others

Emerging Trends

Shift to Bio-Based PTMEG for Sustainable Elastomers

One of the most compelling emerging trends in the Polytetramethylene Ether Glycol (PTMEG) market is the transition toward bio-based PTMEG, that is, using plant-derived feedstocks instead of purely petrochemical raw materials to make polyurethane elastomers, spandex fibres, and related products.

Manufacturers are responding to increasing pressure from regulators, brands, and end-users to reduce fossil-carbon dependency and lower the embodied carbon of polymeric materials. Mitsubishi Chemical Corporation has developed BioPTMG, a plant-derived PTMEG with a biomass content of over 92%.

The company reports that this product not only matches the performance of conventional PTMEG but also helps reduce greenhouse-gas emissions by approximately 40% over its life cycle compared to the petroleum-based equivalent. It aligns with the broader push for sustainable materials across industries such as textiles, automotive, and construction, where PTMEG and its derivatives see heavy usage.

Drivers

EV Electrification Lifts PTMEG-Based TPU Demand

A clear demand engine for polytetramethylene ether glycol (PTMEG) is the surge in electric-mobility components that rely on PTMEG-based thermoplastic polyurethanes (TPU). PTMEG gives TPU exceptional low-temperature flexibility, abrasion resistance, and durability traits that make charging-cable jackets, wire insulation, connector boots, e-axle seals, and battery-pack gaskets last longer under heat, bending, and outdoor exposure.

Major formulators highlight these performance advantages for energy and electronics applications, including high wear resistance and very good low-temperature flexibility, exactly what EV charging and wiring harnesses need. The scale of the automotive base adds weight to this pull.

- Global motor-vehicle production reached 93.5 million units, restoring volumes and refreshing component pipelines that use flexible elastomers and high-performance seals. That number comes from the International Organization of Motor Vehicle Manufacturers (OICA), the industry’s umbrella body.

Restraints

High Energy & Environmental Burden in PTMEG Production

One major restraint for Polytetramethylene Ether Glycol (PTMEG) is the high energy consumption and associated environmental footprint of its production process. Producing PTMEG typically involves the catalytic polymerisation of Tetrahydrofuran (THF), a process that is energy-intensive and reliant on fossil-derived feedstocks.

- From a regulatory / sustainability viewpoint, this burden is non-trivial. In the European Union, the chemical industry emitted 155,495 kilo-tonnes CO₂ equivalent, representing about 5% of the EU’s total net GHG emissions; 67% of that was from fuel combustion and 33% from industrial processes. While this figure covers the broader chemical industry, it underscores the scale of the challenge.

Efforts to decarbonise the chemical sector are gathering pace, a DECHMA/Cefic study notes the European chemical industry had reduced GHG emissions by 59% since 1990 while production climbed by 78%, but warned that transitioning processes toward low-carbon feedstocks entails huge challenges and economic constraints.

Opportunity

Stretch-Textiles & EV Elastomers Pull PTMEG

Polytetramethylene ether glycol (PTMEG) rides two powerful, real-economy waves: the everyday rise of stretch textiles and the rapid electrification of transport. First, elastane (spandex) keeps spreading from activewear into denim, workwear, and technical fabrics—each kilogram of elastane typically relies on PTMEG as a soft-segment polyol.

- Global fiber output reached 113 million tonnes and could approach 149 million tonnes if business-as-usual continues—an expanding base that indirectly supports elastane usage, and with it PTMEG demand. Even within elastane, recycled elastane accounted for 2.6% of global elastane volume, a small but important foothold that encourages PTMEG producers to offer cleaner grades and bio-/recycled-content routes.

The second tailwind is transport electrification, which lifts polyurethane elastomers and TPU parts—wire and cable jacketing, gaskets, hoses, and soft-touch components where PTMEG-based chemistry is prized for flexibility and low-temperature resilience. The International Energy Agency reports electric-car sales neared 14 million and topped 17 million in 2024, meaning more than one in five cars sold worldwide was electric—clear.

Regional Analysis

Asia-Pacific leads with a 48.9% share and a USD 1.2 Billion market value.

In 2024, Asia-Pacific held a dominant position in the global Polytetramethylene Ether Glycol (PTMEG) market, capturing 48.9% share valued at USD 1.2 billion. The region’s leadership stems from its strong base in textile, automotive, and industrial manufacturing sectors—key consumers of spandex fibers and thermoplastic polyurethanes derived from PTMEG.

China, Japan, South Korea, and India collectively represent the largest concentration of spandex fiber production capacity worldwide. China alone accounts for nearly the global spandex output, driving robust domestic demand for PTMEG as a core intermediate.

In addition, Asia-Pacific’s fast-evolving automotive industry, led by electric vehicle manufacturing in China and Japan, is boosting the use of PTMEG-based elastomers and coatings that provide flexibility and durability to EV components. Governments in the region are also encouraging investments in high-performance materials through initiatives like India’s Production-Linked Incentive (PLI) for technical textiles.

The shift toward bio-based PTMEG derived from renewable tetrahydrofuran (THF) further aligns with the Asia-Pacific’s sustainability targets and green manufacturing goals. The region’s manufacturing dominance, favorable policies, and strong end-user industries firmly position Asia-Pacific as the global hub for PTMEG production and consumption, ensuring its continued market leadership through the next decade.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF SE is a dominant force in the PTMEG market. Its strength lies in extensive production capacity, advanced technology, and a robust global distribution network. The company’s vertical integration, controlling key raw materials, ensures cost efficiency and supply chain reliability. BASF primarily serves the high-performance spandex (elastane) fiber industry, a major consumer of PTMEG.

Chang Chun Group is a major Asian competitor with a strong and growing presence in the PTMEG sector. The company leverages its integrated petrochemical operations to secure a stable raw material supply. Its strategic focus on the Asia-Pacific region, particularly China’s massive textile market, drives its growth. By catering directly to the booming spandex and polyurethane industries domestically.

Henan Energy Chemical Group, Hebi, benefits from access to fundamental feedstocks like coal, which can be used for production. This positions Hebi as a cost-effective manufacturer, primarily serving the vital Asian market. Its growth is closely tied to regional demand for spandex and polyurethanes, reinforcing China’s self-sufficiency in chemical production.

Top Key Players in the Market

- BASF SE

- Chang Chun Group

- Henan Energy Chemical Group Hebi

- Hyosung Corporation

- INVISTA

- Korea PTG

- LyondellBasell Industries Holdings BV

- Mitsubishi Chemical Corporation

- Sinopec Great Wall Energy and Chemical Co., Ltd

- Shanxi Sanwei Group Co., Ltd

Recent Developments

- In 2024, BASF SE, a major global producer of polytetramethylene ether glycol (PTMEG), has focused on broader chemical sector advancements, with implications for polyether applications in materials like polyurethanes and coatings. Specific PTMEG developments were not detailed in recent announcements.

- In 2024, as a top producer, Chang Chun contributes to PTMEG’s use in co-polyester ether elastomers for automotive components, hoses, seals, airbags, and spandex for textiles and interiors. With Asia-Pacific leading due to textile and automotive expansions.

Report Scope

Report Features Description Market Value (2024) USD 2.6 Billion Forecast Revenue (2034) USD 4.8 Billion CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Application (Spandex, Thermoplastic Urethane Elastomers, Co-polyester Ether Elastomers, Others), By End Use (Textiles, Coatings, Adhesives and Sealants, Artificial Leather, Automotive, Leisure and Sports, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Chang Chun Group, Henan Energy Chemical Group Hebi, Hyosung Corporation, INVISTA, Korea PTG, LyondellBasell Industries Holdings BV, Mitsubishi Chemical Corporation, Sinopec Great Wall Energy and Chemical Co., Ltd, Shanxi Sanwei Group Co., Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Polytetramethylene Ether Glycol MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Polytetramethylene Ether Glycol MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- Chang Chun Group

- Henan Energy Chemical Group Hebi

- Hyosung Corporation

- INVISTA

- Korea PTG

- LyondellBasell Industries Holdings BV

- Mitsubishi Chemical Corporation

- Sinopec Great Wall Energy and Chemical Co., Ltd

- Shanxi Sanwei Group Co. Ltd