Global Polytetrafluoroethylene Market By Form(Granular, Fine Powder, Aqueous Dispersion, Micronized Powder), By Product Type(Virgin PTFE, Modified PTFE, Filled PTFE, Expanded PTFE, Others), By Application(Sheet, Coatings, Pipes, Films, Others), By End-Use(Industrial Processing, Electrical and Electronics, Automotive, Building and Construction, Healthcare, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: June 2024

- Report ID: 121689

- Number of Pages: 297

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

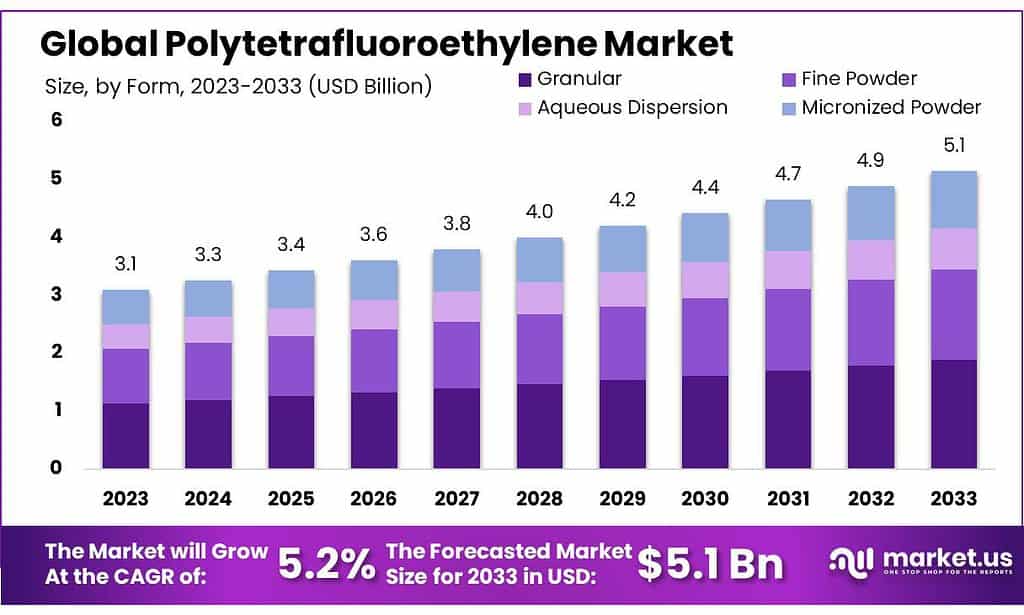

The global Polytetrafluoroethylene Market size is expected to be worth around USD 5.1 billion by 2033, from USD 3.1 billion in 2023, growing at a CAGR of 5.2% during the forecast period from 2023 to 2033.

Polytetrafluoroethylene (PTFE), commonly known by the brand name Teflon, refers to a synthetic fluoropolymer of tetrafluoroethylene with numerous applications due to its unique properties. It is widely recognized for its non-stick qualities, which make it a popular choice for cookware coatings. However, its applications extend far beyond the kitchen. PTFE is also valued in various industries for its high resistance to heat, chemical reactants, and electrical conductivity, making it an ideal material for cable insulation, in gaskets, and industrial coatings.

In the medical field, PTFE is used for its biocompatibility in surgical grafts and implants. Its low friction surface aids in producing catheters and other medical devices that interact with bodily tissues. In the aerospace industry, PTFE’s ability to withstand extreme temperatures and environments makes it suitable for manufacturing parts that experience high thermal stress. The automotive industry uses PTFE to produce seals, hoses, and bushings, where durability and performance under high-stress conditions are required.

The global PTFE market is growing, driven by advancements in various technical applications in industrial processing, electronics, and automotive parts. The versatility and superior properties of PTFE, such as its excellent thermal stability, chemical inertness, and outstanding electrical insulation characteristics, contribute to its widespread use. Economic growth in emerging markets and increased demand from industries such as aerospace, automotive, and electronics are significant contributors to the expansion of the PTFE market.

However, the production of PTFE is not without challenges. Environmental concerns regarding the disposal and the emissions of certain perfluorinated compounds during manufacturing have prompted regulatory scrutiny and demands for more sustainable practices. Despite these hurdles, the PTFE market continues to innovate with developments in recycling processes and the introduction of eco-friendly production techniques, ensuring its relevance and application across various high-tech and industrial sectors.

Key Takeaways

- The PTFE market is projected to grow from USD 3.1 billion in 2023 to USD 5.1 billion by 2033, at a CAGR of 5.2%.

- Granular PTFE led the market in 2023 with a 36.6% share, valued for its high melting point and chemical resistance.

- Virgin PTFE held a dominant 45.3% market share in 2023, known for its purity and performance in high-demand applications.

- Coatings captured over 32.6% of the application market in 2023, driven by PTFE’s non-stick and corrosion-resistant properties.

- Industrial Processing led the end-use segment with a 45.6% share in 2023, utilizing PTFE for its temperature and chemical resistance.

- The Asia-Pacific PTFE market accounted for 44.3% of the global market, valued at USD 1.3733 billion in 2023.

By Form

In 2023, Granular PTFE held a dominant market position, capturing more than a 36.6% share. This form is widely used due to its ease of handling and excellent properties such as high melting point and chemical resistance, making it ideal for industrial applications that require molding into various shapes and sizes.

Fine Powder PTFE is another key segment, appreciated for its ability to produce smooth, thin coatings. This form is particularly valuable in the electronics and automotive industries where precision and durability are critical.

Aqueous Dispersion PTFE offers the advantage of being easy to apply as a coating or additive. It’s utilized in applications ranging from cookware to industrial equipment, providing non-stick properties and resistance to weathering, enhancing the longevity and performance of the products.

Lastly, Micronized Powder PTFE is increasingly popular in applications requiring fine, detailed work, including inks and lubricants. Its small particle size allows for a uniform distribution in applications, leading to consistent performance characteristics.

By Product Type

In 2023, Virgin PTFE held a dominant market position, capturing more than a 45.3% share. This type is highly sought after for its purity and excellent performance in demanding applications such as chemical and heat resistance, making it a staple in industries requiring uncompromised material integrity.

Modified PTFE follows, offering enhanced properties over traditional PTFE, such as better deformation characteristics under load, making it suitable for applications where enhanced performance is essential. This version is particularly valuable in the manufacturing of gaskets and seals used in heavy machinery and aerospace.

Filled PTFE incorporates materials like glass fibers, carbon, and graphite to improve mechanical strength and thermal conductivity. It’s extensively used in applications that require robust material properties, such as automotive components and industrial machines.

Expanded PTFE is known for its exceptional flexibility and is commonly used in applications requiring excellent sealing properties, such as in the pharmaceutical and food processing industries, where contamination prevention is critical.

By Application

In 2023, Coatings held a dominant market position, capturing more than a 32.6% share. This segment benefits from the demand for PTFE’s non-stick and corrosion-resistant properties, making it ideal for cookware, automotive, and industrial applications where durability and performance are critical.

Sheets form another significant application. PTFE sheets are extensively used in chemical processing industries due to their resistance to extreme temperatures and chemicals, proving essential for seals and liners.

Pipes made from PTFE are favored in industries requiring high chemical resistance, such as pharmaceuticals and chemicals. Their ability to withstand corrosive environments without degrading makes them invaluable in these settings.

Films are another important application, utilized for their exceptional strength and clarity in electronics and medical devices. PTFE films are also used in architectural fabrics due to their weather resistance.

By End-Use

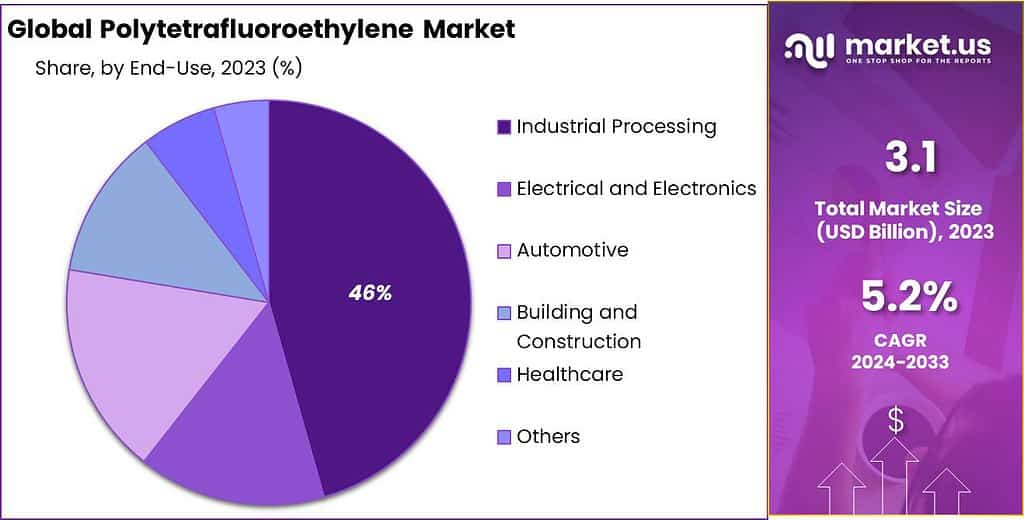

In 2023, Industrial Processing held a dominant market position, capturing more than a 45.6% share. This sector primarily utilizes PTFE for its resistance to high temperatures and chemicals, making it essential in manufacturing processes where durability and reliability are crucial.

The Electrical and Electronics segment also significantly leverages PTFE, especially for its insulation properties in wiring and electronic components. This material is prized for its ability to withstand varying environmental conditions while maintaining integrity and performance.

Automotive uses follow closely, with PTFE components such as seals, gaskets, and hoses being integral to modern vehicle designs. These parts benefit from PTFE’s friction-reducing and heat-resistant qualities, enhancing vehicle efficiency and longevity.

In Building and Construction, PTFE is used in architectural fabrics and as sealants due to its strength and weather resistance. Its application in this sector ensures long-term durability and protection against environmental elements.

Healthcare sees PTFE utilized in a variety of medical devices and implants. Its biocompatibility makes it safe for use in the human body, where its chemical inertness and durability are vital.

Key Market Segments

By Form

- Granular

- Fine Powder

- Aqueous Dispersion

- Micronized Powder

By Product Type

- Virgin PTFE

- Modified PTFE

- Filled PTFE

- Expanded PTFE

- Others

By Application

- Sheet

- Coatings

- Pipes

- Films

- Others

By End-Use

- Industrial Processing

- Electrical and Electronics

- Automotive

- Building and Construction

- Healthcare

- Others

Drivers

Increasing Demand in the Automotive Industry

A significant driver propelling the growth of the polytetrafluoroethylene (PTFE) market is the escalating demand within the automotive industry. PTFE’s unique properties, such as high thermal stability, non-stick nature, low friction, and excellent chemical resistance, make it an indispensable material in automotive manufacturing. This polymer is utilized extensively in the production of components that must withstand harsh environments and require durability and reliability. The application of PTFE in automotive components includes seals, gaskets, hoses, and bearings that are critical for vehicle performance and efficiency.

The automotive industry’s push towards more efficient and reliable vehicles is prompting increased use of materials that enhance longevity and reduce maintenance requirements. PTFE’s ability to operate under high temperatures and its resistance to corrosive substances contribute to extended vehicle lifespans and reduced frequency of repairs. For instance, PTFE is used in fuel and brake systems where high temperature and chemical resistance are paramount. It is also used in piston rings, valve bodies, and in parts of the transmission systems, where its low friction properties reduce wear and tear and improve the overall efficiency of the vehicle.

Additionally, the global shift towards electric vehicles (EVs) is further amplifying the demand for PTFE. As EVs rely heavily on efficiency to maximize battery life and vehicle range, the role of PTFE in reducing energy loss through mechanical parts becomes even more critical. The material’s excellent electrical insulation properties make it suitable for various applications in electric motors and battery modules, safeguarding against electrical hazards and contributing to safer, more reliable vehicles.

Furthermore, environmental regulations and the automotive industry’s focus on reducing emissions have led to the need for better and more reliable pollution control technologies. PTFE is used in components like exhaust gas recirculation systems, which help reduce emissions. Its ability to withstand the corrosive nature of exhaust gases ensures that these systems remain effective over a longer period, thereby supporting the industry’s efforts to meet stringent environmental standards.

The growing automotive industry, especially in emerging economies such as China, India, and Brazil, is expected to continue driving the demand for PTFE. These regions are witnessing significant investments in automotive manufacturing capabilities, spurred by rising vehicle ownership and demand for high-performance vehicles. As automakers strive to differentiate themselves through higher quality and better-performing vehicles, the reliance on advanced materials like PTFE is expected to grow.

Restraints

Environmental and Health Concerns

A major restraint affecting the growth of the polytetrafluoroethylene (PTFE) market is the growing concern over environmental and health issues associated with its production and use. PTFE, commonly known by its brand name Teflon, is part of a group of polyfluoroalkyl substances (PFAS), which are known for their persistence in the environment and potential adverse health effects. These concerns are increasingly influencing regulatory policies and consumer preferences, posing significant challenges to the industry.

The production of PTFE involves the use of perfluorooctanoic acid (PFOA), a chemical that has been linked to various health problems, including cancer, hormone disruption, and immune system harm. Although major manufacturers have largely phased out the use of PFOA, its legacy and the scrutiny over similar chemicals continue to impact the market. Regulatory bodies across the globe, including the Environmental Protection Agency (EPA) in the United States and the European Chemicals Agency (ECHA) in Europe, have been tightening regulations on PFAS chemicals, leading to stricter control measures and higher compliance costs for manufacturers.

Moreover, the disposal and degradation challenges associated with PTFE add to environmental concerns. PTFE does not easily break down in the environment, leading to long-term accumulation and potential entry into the food chain. The environmental persistence of PTFE and its by-products raises concerns about long-term ecological impacts, especially in water bodies and wildlife. These environmental issues are increasingly becoming a point of contention for governments, environmental groups, and the public, prompting calls for more sustainable and environmentally friendly alternatives.

The backlash against PFAS, including PTFE, is also driven by increasing consumer awareness and advocacy for safer and greener products. Consumers are becoming more educated about the ingredients and materials used in the products they purchase, from cookware to clothing, and are often choosing alternatives perceived to be safer and more environmentally responsible. This shift in consumer behavior is prompting companies to explore and invest in alternative materials that do not carry the same environmental and health baggage as PTFE.

The combination of regulatory pressure and changing consumer preferences is not only affecting the demand for PTFE but also altering competitive dynamics within the market. Companies are being pushed to innovate and reformulate their products to reduce or eliminate the use of PTFE, especially in applications directly in contact with consumers, such as in textiles and kitchen products. This transition involves significant research and development efforts and may lead to increased costs and operational challenges for companies transitioning away from PTFE.

Opportunity

Expansion into Emerging Markets

A significant opportunity for the polytetrafluoroethylene (PTFE) market lies in its expansion into emerging markets, particularly in Asia, Africa, and Latin America. These regions are experiencing rapid industrial growth, urbanization, and increased investments in sectors such as automotive, construction, electronics, and healthcare, all of which are substantial end-users of PTFE. This expansion presents a lucrative opportunity for PTFE manufacturers to tap into new customer bases and increase their market presence.

The automotive industry in emerging markets is booming, driven by increasing consumer purchasing power and government initiatives promoting automotive manufacturing. PTFE’s role in enhancing vehicle performance, efficiency, and longevity makes it a critical material for automotive components such as gaskets, seals, and hoses. As the automotive sector grows in these regions, the demand for PTFE in this application is expected to surge, offering substantial growth opportunities for producers.

Similarly, the construction industry in these markets is undergoing significant expansion due to rapid urbanization and the need for modern infrastructure. PTFE’s properties such as resistance to weathering and chemical inertness make it ideal for architectural applications, including coatings and sealants that enhance the longevity and durability of buildings. The rising construction activities provide a steady demand stream for PTFE, positioning it as a key material in building projects.

Furthermore, the electronics sector in emerging markets is expanding at an unprecedented rate, fueled by increasing consumer electronics adoption and local manufacturing pushes by governments aiming to establish themselves as electronic hubs. PTFE is extensively used in electronics for its excellent insulating properties and resistance to high temperatures, essential for ensuring reliability and performance in electronic devices. The growing electronics manufacturing industry in these regions opens new avenues for the usage of PTFE, particularly in wire and cable coatings and circuit boards.

Healthcare is another critical area where emerging markets show considerable promise for PTFE application. As these regions enhance their healthcare infrastructure and increase healthcare spending, the demand for advanced medical devices and technologies rises. PTFE’s biocompatibility makes it suitable for various medical applications, including catheters and surgical implants. The expanding healthcare sector in these markets provides a significant opportunity for the growth of the PTFE market in medical applications.

Trends

Advancements in Recycling and Sustainable Production Techniques

A prominent trend shaping the polytetrafluoroethylene (PTFE) market is the increasing focus on advancements in recycling processes and the development of sustainable production techniques. As environmental concerns and regulations become more stringent globally, the pressure on manufacturers to reduce the ecological footprint of their products, including those made with PTFE, is intensifying. This trend is not only driven by regulatory demands but also by a growing consumer preference for environmentally friendly products.

PTFE is renowned for its exceptional properties such as high heat resistance, chemical inertness, and non-stick capabilities, which make it invaluable across various industries including automotive, aerospace, electronics, and cookware. However, the traditional manufacturing processes of PTFE are resource-intensive and involve chemicals that are harmful to the environment. Additionally, PTFE is not biodegradable, leading to challenges in waste management and recycling. These factors have spurred significant research and innovation aimed at making the production and disposal of PTFE more sustainable.

One of the major developments in this area is the improvement of recycling techniques for PTFE. Traditionally, PTFE waste could only be disposed of in landfills or incinerated, both of which have negative environmental impacts. Modern recycling processes now allow for the recovery and reprocessing of PTFE waste into usable forms, significantly reducing the need for virgin raw materials and minimizing waste. These recycled PTFE products are finding applications in less critical uses where ultra-high performance of virgin PTFE is not necessary, thereby extending the material’s lifecycle and reducing the overall environmental impact.

Furthermore, manufacturers are increasingly investing in new methods of producing PTFE that reduce harmful emissions and energy consumption. These techniques include developing catalysts that lower the required reaction temperatures and pressures, thereby saving energy and reducing the carbon footprint of PTFE production. Some companies are also exploring bio-based routes to synthesize fluoropolymers, an innovative approach that could potentially replace the petrochemical sources currently used in PTFE production.

Another significant trend is the integration of lifecycle assessments in the development of PTFE products, allowing manufacturers to understand and mitigate the environmental impacts associated with their products from cradle to grave. This holistic approach helps in designing products that are not only efficient in their application but also contribute to sustainable practices throughout their lifecycle.

The shift towards sustainable practices is also opening up new markets for PTFE manufacturers. Companies that can offer environmentally friendly solutions are likely to attract customers from sectors that are highly regulated in terms of environmental impact, such as the automotive and construction industries. This competitive edge is crucial in markets where environmental credentials are increasingly influencing purchasing decisions.

Regional Analysis

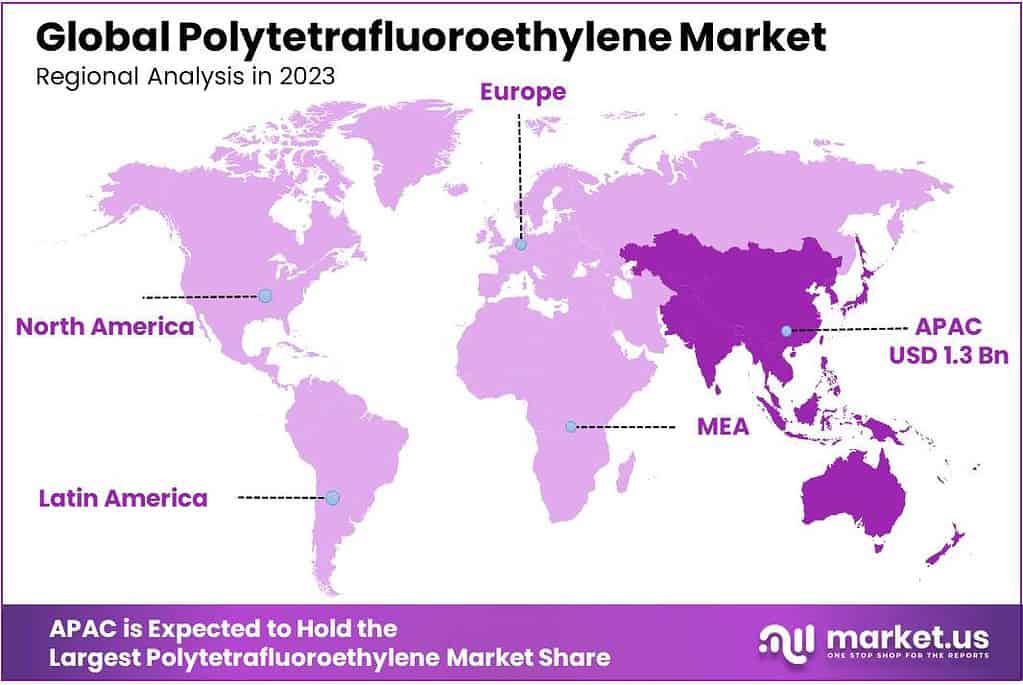

In 2023, the Asia-Pacific Polytetrafluoroethylene (PTFE) Market accounted for 44.3% with a valuation of USD 1.3733 billion.

The Polytetrafluoroethylene Market exhibits distinct dynamics and growth prospects across various global regions, reflecting its wide applications from industrial manufacturing to automotive components.

In North America, the market is driven by a robust manufacturing sector and stringent environmental regulations which increase demand for PTFE in industrial machinery and automotive parts. The presence of leading manufacturers and technological advancements in material science are pivotal growth factors here.

Europe mirrors this trend, with additional impetus from renewable energy projects requiring high-performance materials, where PTFE’s chemical resistance and thermal stability are essential. Moreover, Europe’s focus on advanced manufacturing technologies aligns well with PTFE’s applications in various industrial processes.

Asia-Pacific stands out as the dominating region, holding a significant 44.3% market share, valued at USD 1.3733 billion. This region’s dominance is attributed to rapid industrialization, expanding automotive sectors, and substantial investments in infrastructure development, particularly in China and India. These factors collectively drive the demand for PTFE, used extensively in both automotive components and industrial applications.

The Middle East & Africa and Latin America, although smaller in comparison, are emerging as potential growth areas. These regions are experiencing gradual industrial growth and urbanization, which in turn are expected to increase the adoption of PTFE-based products. The development of local manufacturing capabilities and growing industrial activities are likely to contribute to the market expansion in these regions over the forecast period.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Frequently Asked Questions (FAQ)

What is the Size of Polytetrafluoroethylene Market?Polytetrafluoroethylene Market size is expected to be worth around USD 5.1 billion by 2033, from USD 3.1 billion in 2023

What is the projected CAGR at which the Global Polytetrafluoroethylene Market is expected to grow at?The Global Polytetrafluoroethylene Market is expected to grow at a CAGR of 5.2% (2024-2033).List the key industry players of the Global Polytetrafluoroethylene Market?3M, AGC Chemicals Europe, Daikin Europe, DowDuPont, Saint-Gobain, Solvay, FIBERFLON, Gujarat Fluorochemicals Limited, HaloPolymer, Trelleborg Sealing Solutions, Whitford Worldwide, The Chemours Company, Dongyue Group, OJSC

Polytetrafluoroethylene MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample

Polytetrafluoroethylene MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- 3M

- AGC Chemicals Europe

- Daikin Europe

- DowDuPont

- Saint-Gobain

- Solvay

- FIBERFLON

- Gujarat Fluorochemicals Limited

- HaloPolymer

- Trelleborg Sealing Solutions

- Whitford Worldwide

- The Chemours Company

- Dongyue Group

- OJSC