Global Polypropylene Fiber Market Size, Share, And Business Benefits By Type (Staple Fiber, Continuous Fiber, Others), By Application (Healthcare, Automotive, Construction, Textile, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151148

- Number of Pages: 357

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

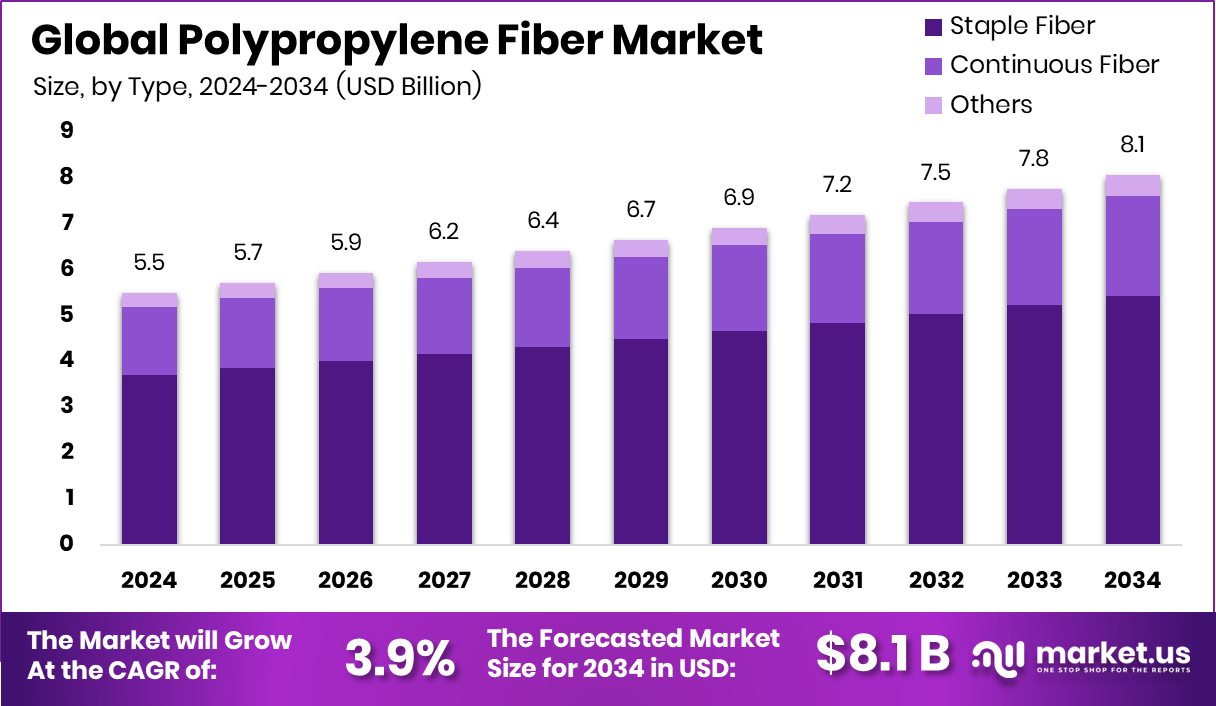

Global Polypropylene Fiber Market is expected to be worth around USD 8.1 billion by 2034, up from USD 5.5 billion in 2024, and grow at a CAGR of 3.9% from 2025 to 2034. Strong demand in Asia-Pacific pushed the polypropylene fiber market growth to USD 2.2 billion.

Polypropylene fiber is a synthetic fiber made from a thermoplastic polymer called polypropylene. Known for its lightweight, moisture-resistant, and durable nature, it is widely used in textiles, geotextiles, carpets, ropes, upholstery, and construction applications. Its resistance to chemicals, mildew, and abrasion makes it ideal for both indoor and outdoor use. Additionally, it offers high tensile strength and is relatively cost-effective compared to other synthetic fibers.

The polypropylene fiber market revolves around the production, demand, and application of these fibers across various sectors. Industries such as automotive, construction, agriculture, and packaging heavily utilize polypropylene fibers due to their versatility and strength. As global industries grow and infrastructure projects expand, the use of polypropylene fiber continues to rise, creating a steady demand in both developed and emerging economies.

One of the key growth factors for the polypropylene fiber market is the expansion of the construction and infrastructure sector. The use of polypropylene fiber in concrete reinforcement and soil stabilization contributes significantly to structural durability, which is essential for roads, bridges, and buildings. This functionality drives its consistent demand across infrastructure-heavy regions.

Consumer demand is also rising due to increased awareness of sustainability and recycling. Polypropylene fibers are recyclable, aligning with global environmental goals. This makes them a favorable choice for manufacturers seeking sustainable solutions without compromising performance.

Key Takeaways

- Global Polypropylene Fiber Market is expected to be worth around USD 8.1 billion by 2034, up from USD 5.5 billion in 2024, and grow at a CAGR of 3.9% from 2025 to 2034.

- Staple fiber dominates the polypropylene fiber market, accounting for 67.4% of total usage.

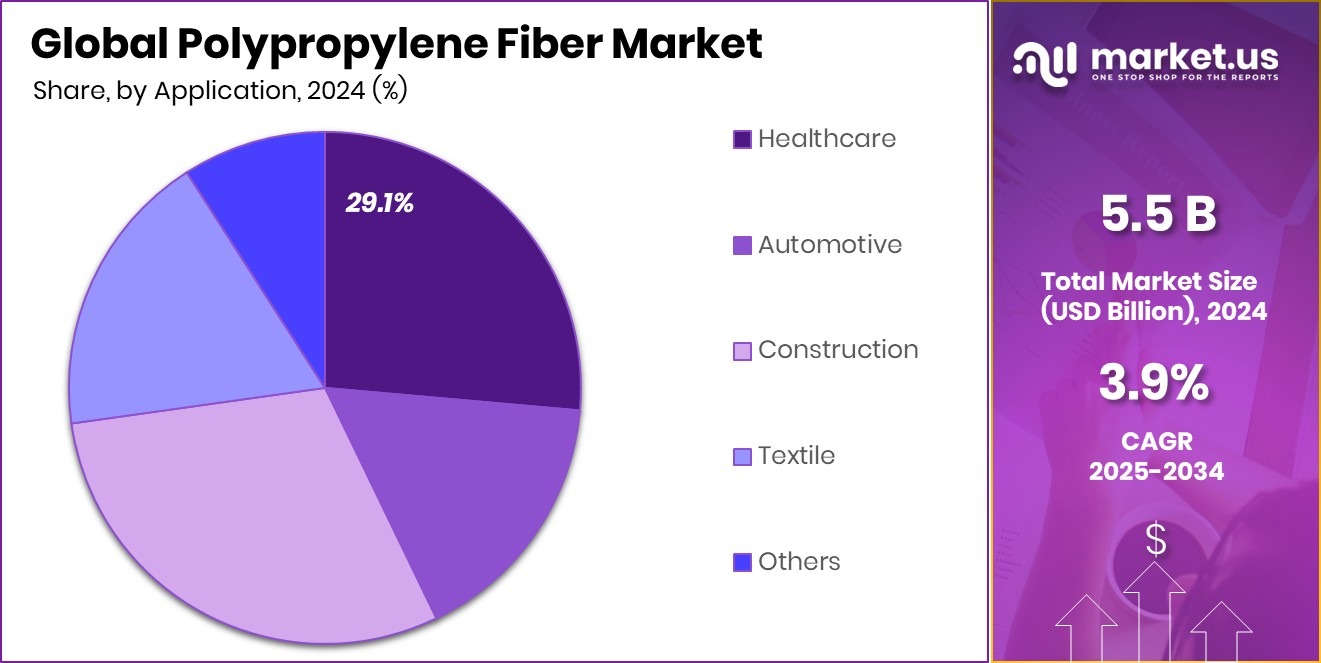

- Healthcare holds a 29.1% share in the polypropylene fiber market due to hygiene and filtration demands.

- Asia-Pacific accounted for 41.2% of the global polypropylene fiber market value.

By Type Analysis

Staple fiber dominates the Polypropylene Fiber Market with a 67.4% share.

In 2024, Staple Fiber held a dominant market position in the “By Type” segment of the Polypropylene Fiber Market, with a 67.4% share. This substantial market share is attributed to its widespread adoption across various end-use industries, particularly in construction, textiles, and automotive sectors.

Staple fiber’s ease of blending with other materials and its excellent properties, such as high strength, low moisture absorption, and chemical resistance, make it a preferred choice for manufacturers. Its cost-effectiveness further strengthens its appeal in large-scale applications, especially in geotextiles and non-woven fabrics.

The dominance of staple fiber is also driven by its versatility in manufacturing processes, including both mechanical and thermal bonding, which enhances its application in durable goods and consumer products. In construction, staple polypropylene fibers are widely used to reinforce concrete, helping improve structural integrity and reduce cracking.

This practical advantage supports the continued demand for infrastructure and residential projects. Additionally, its recyclability aligns with the rising emphasis on sustainable materials, offering manufacturers an eco-conscious option without sacrificing performance. As demand for durable, lightweight, and affordable synthetic fibers continues, the staple fiber segment is expected to maintain its leading position, reflecting both its functional value and adaptability in key markets.

By Application Analysis

Healthcare leads the Polypropylene Fiber Market, accounting for 29.1% share.

In 2024, Healthcare held a dominant market position in the “By Application” segment of the Polypropylene Fiber Market, with a 29.1% share. This leading position reflects the growing reliance on polypropylene fiber in various healthcare-related products due to its hygienic properties, durability, and resistance to moisture and chemicals. The fiber’s lightweight and non-absorbent nature make it especially suitable for medical textiles such as surgical masks, gowns, disposable bedding, and protective garments.

The healthcare sector’s stringent standards for cleanliness and safety have contributed to the increased adoption of polypropylene fibers. Its compatibility with sterilization processes and ability to create nonwoven fabrics efficiently have made it an essential material in hospitals and clinical settings. The rise in global health awareness and preparedness, along with ongoing investments in healthcare infrastructure, has further supported the strong demand for reliable and cost-effective materials like polypropylene fiber.

Moreover, the disposable nature of many healthcare products has aligned well with the characteristics of polypropylene fiber, reinforcing its dominant share in the segment. The material’s performance under high-use and high-risk environments continues to drive its preference among manufacturers catering to healthcare needs, positioning it as a cornerstone in the medical applications of synthetic fibers.

Key Market Segments

By Type

- Staple Fiber

- Continuous Fiber

- Others

By Application

- Healthcare

- Automotive

- Construction

- Textile

- Others

Driving Factors

Rising Demand from the Construction and Infrastructure Sector

One of the main driving factors for the polypropylene fiber market is its growing use in the construction and infrastructure industry. Polypropylene fiber is widely used in concrete reinforcement because it helps improve the strength and durability of concrete structures. It reduces cracking and enhances the performance of buildings, roads, and bridges. With many countries investing in new infrastructure projects and repairing old ones, the demand for such materials is increasing.

The fiber’s low cost, easy mixing with cement, and resistance to moisture and chemicals make it an ideal choice for construction applications. As urbanization grows and governments spend more on infrastructure, the need for strong and reliable materials like polypropylene fiber will continue to rise steadily.

Restraining Factors

Environmental Concerns Related to Plastic-Based Products

A key restraining factor for the polypropylene fiber market is the growing concern about environmental pollution caused by plastic-based materials. Polypropylene is a synthetic fiber derived from petroleum, and although it is recyclable, a large portion still ends up in landfills or the environment. Its non-biodegradable nature raises issues related to long-term waste management and ecological impact.

As awareness of plastic pollution increases, consumers and governments are pushing for eco-friendly alternatives. This puts pressure on industries using polypropylene fiber to find sustainable solutions or switch to greener options. Stricter regulations and policies around plastic use and disposal may limit the growth of polypropylene fiber in certain regions, affecting its market potential over time.

Growth Opportunity

Expansion into Eco-Friendly and Recycled Fiber Production

The increasing focus on sustainability presents a major growth opportunity for the polypropylene fiber market. Manufacturers can invest in producing recycled or bio-based polypropylene fibers, which appeal to eco-conscious consumers and businesses. By using post-consumer or industrial plastic waste to create new fibers, companies can reduce environmental impact and contribute to a circular economy.

This not only helps meet growing global demands for greener materials, but it also aligns with regulations favoring lower-carbon footprints. Investing in recycling infrastructure or partnering with waste management firms can improve supply chains and reduce raw material costs. As brands and industries seek sustainable alternatives, recycled polypropylene fiber becomes attractive for packaging, textiles, and construction. This shift supports both market growth and responsible manufacturing.

Latest Trends

Integration of Smart Textile Technologies with Polypropylene Fiber

The latest trend in the polypropylene fiber market is its integration with smart textile technologies. Polypropylene fibers are now being used as a base for embedding sensors, conductive threads, and responsive materials. This allows fabrics to monitor body temperature, track movement, or even adjust insulation automatically. Lightweight and durable, polypropylene serves as an ideal carrier for these advanced features.

As wearable tech becomes more common in healthcare, sports, and safety apparel, manufacturers are finding new ways to embed electronics directly into textile fibers without compromising comfort or flexibility. This trend not only adds value to everyday products but also opens doors for innovation across industries, making polypropylene fiber a key player in the future of smart fabrics.

Regional Analysis

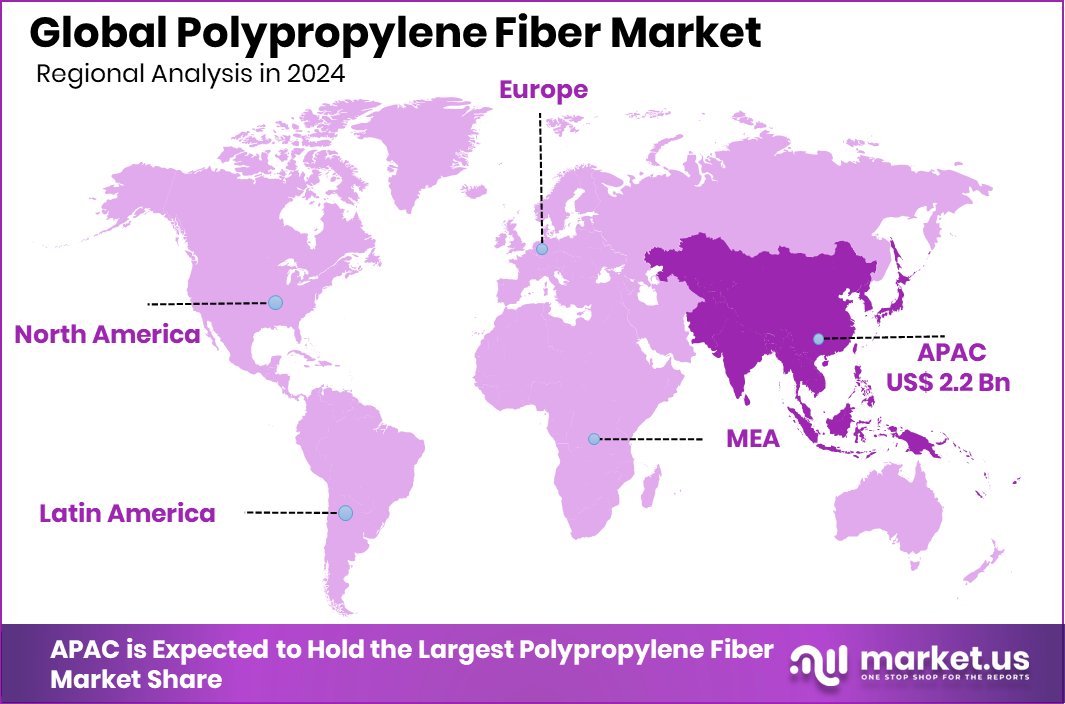

In Asia-Pacific, the Polypropylene Fiber Market reached USD 2.2 billion in 2024.

In 2024, Asia-Pacific emerged as the dominating region in the Polypropylene Fiber Market, holding a significant 41.2% market share, valued at USD 2.2 billion. This dominance is primarily driven by high demand from construction, textiles, and healthcare sectors across key economies such as China, India, and Southeast Asian countries.

The rapid pace of urbanization, infrastructure expansion, and growing population has further supported polypropylene fiber consumption in the region. North America and Europe also represent important markets, driven by advanced healthcare infrastructure, technological adoption, and focus on lightweight, durable materials for industrial use.

Meanwhile, the Middle East & Africa region is gradually witnessing increased usage of polypropylene fiber, particularly in construction and geotextiles, due to rising infrastructure investments. Latin America is experiencing steady growth, supported by developments in agriculture and packaging sectors where polypropylene fiber offers durable and cost-effective solutions.

Though smaller in comparison, these regions show potential for gradual market expansion. With Asia-Pacific maintaining its lead through strong industrial growth and regional demand, other global regions continue to play supporting roles, contributing to the overall balance and gradual expansion of the polypropylene fiber market worldwide.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, key companies such as ABC Polymer Industries LLC, Beaulieu Fibres International (BFI), Belgian Fibers, and Chemosvit Fibrochem SRO played important roles in shaping the global polypropylene fiber market. Each of these players brought unique strengths and specializations, contributing to both market stability and innovation.

ABC Polymer Industries LLC continued to strengthen its position through a focused approach in construction and industrial-grade fiber applications. Its specialization in concrete reinforcement fibers has helped it address the growing demand from infrastructure projects, especially in regions with strong construction activity.

Beaulieu Fibres International (BFI) maintained its presence by offering a diverse range of high-performance fibers tailored for hygiene, geotextile, and automotive sectors. Its emphasis on product development and value-added solutions has enabled it to serve a wide customer base and adapt to changing end-user requirements.

Belgian Fibers has remained a reliable supplier in the polypropylene fiber segment, offering consistency in manufacturing quality. Its focus on delivering fibers suitable for filtration, hygiene, and industrial fabrics has secured its role as a stable regional and global player.

Chemosvit Fibrochem SRO brought in strong technical capabilities and innovation. Known for its high-quality fiber production, the company continued to contribute significantly to the European fiber market with specialized applications and customer-specific developments.

Top Key Players in the Market

- ABC Polymer Industries LLC

- Beaulieu Fibres International (BFI)

- Belgian Fibers

- Chemosvit Fibrochem SRO

- China National Petroleum Corporation

- DuPont

- Fiberpartner Aps

- Freudenberg Group

- Indorama Ventures

- International Fibres Group

- Radici Partecipazioni SpA

- Sika AG

- Huimin Taili Chemical Fiber Products Co. Ltd

- W. Barnet GmbH & Co. KG

- Zenith Fibres Ltd

- Kolon Fiber Inc.

Recent Developments

- In June 2024, ABC Polymer introduced TruBuilt, a new locally owned and operated construction supply company based near Birmingham, Alabama. This expansion beyond fiber products enhances their ability to serve construction markets directly.

- In April 2024, Fiberpartner launched PolyPlant®, a bio-based fiber made from sugarcane-derived PLA. This eco-friendly fiber was showcased at Techtextil Frankfurt, highlighting its move into sustainable alternatives to traditional polypropylene.

Report Scope

Report Features Description Market Value (2024) USD 5.5 Billion Forecast Revenue (2034) USD 8.1 Billion CAGR (2025-2034) 3.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Staple Fiber, Continuous Fiber, Others), By Application (Healthcare, Automotive, Construction, Textile, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ABC Polymer Industries LLC, Beaulieu Fibres International (BFI), Belgian Fibers, Chemosvit Fibrochem SRO, China National Petroleum Corporation, DuPont, Fiberpartner Aps, Freudenberg Group, Indorama Ventures, International Fibres Group, Radici Partecipazioni SpA, Sika AG, Huimin Taili Chemical Fiber Products Co. Ltd, W. Barnet GmbH & Co. KG, Zenith Fibres Ltd, Kolon Fiber Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Polypropylene Fiber MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Polypropylene Fiber MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ABC Polymer Industries LLC

- Beaulieu Fibres International (BFI)

- Belgian Fibers

- Chemosvit Fibrochem SRO

- China National Petroleum Corporation

- DuPont

- Fiberpartner Aps

- Freudenberg Group

- Indorama Ventures

- International Fibres Group

- Radici Partecipazioni SpA

- Sika AG

- Huimin Taili Chemical Fiber Products Co. Ltd

- W. Barnet GmbH & Co. KG

- Zenith Fibres Ltd

- Kolon Fiber Inc.